WORLD BANK GROUP

source

- The World Bank Group (WBG) is a family of five international organizations that make leveraged loans to developing countries. It is the largest and most famous development bank in the world and is an observer at the United Nations Development Group. Its five organizations are the International Bank for Reconstruction and Development (IBRD), the International Development Association (IDA), the International Finance Corporation (IFC), the Multilateral Investment Guarantee Agency (MIGA) and the International Centre for Settlement of Investment Disputes (ICSID).

The World Bank

- The International Bank for Reconstruction and Development (IBRD), better known as the World Bank, was established at the same time as the International Monetary Fund to tackle the problem of international investment.

- Since the IMF was designed to provide temporary assistance in correcting the balance of payments difficulties, an institution was also needed to assist long-term investment purposes. Thus, IBRD was established for promoting long-term investment loans on reasonable terms.

- The World Bank (IBRD) is an inter-governmental institution, corporate in form, whose capital stock is entirely owned by its member-governments. Initially, only nations that were members of the IMF could be members of the World Bank; this restriction on membership was subsequently relaxed.

Functions:

The principal functions of the IBRD are set forth in Article I of the agreement as follows:

- To assist in the reconstruction and development of the territories of its members by facilitating the investment of capital for productive purposes.

- To promote private foreign investment by means of guarantee of participation in loans and other investments made by private investors and when private capital is not available on reasonable terms, to make loans for productive purposes out of its own resources or from funds borrowed by it.

- To promote the long-term balanced growth of international trade and the maintenance of equilibrium in balance of payments by encouraging international investment for the development of the productive resources of members.

- To arrange loans made or guaranteed by it in relation to international loans through other channels so that more useful and urgent projects, large and small alike, will be dealt with first. It appears that the World Bank was created to promote and not to replace private foreign investment. The Bank considers its role to be a marginal one, to supplement and assist foreign investment in the member countries.

A little consideration will show that the objectives of the IMF and IBRD are complementary. Both aim at increasing the level of national income and standard of living of the member nations. Both serve as lending institutions, the IMF for short-term and the IBRD for long-term capital. Both aim at promoting the balanced growth of international trade.

Organisation:

- Like the Fund, the Bank’s structure is organised on a three-tier basis; a Board of Governors, Executive Directors and a President. The Board of Governors is the supreme governing authority. It consists of one governor (usually the Finance Minister) and one alternate governor (usually the governor of a central bank), appointed for five years by each member.

- The Board is required to meet once every year. It reserves to itself the power to decide important matters such as new admissions, changes in the bank’s stock of capital, ways and means of distributing the net income, its ultimate liquidation, etc. For all technical purposes, however, the Board delegates its powers to the Executive Directors in the day-to-day administration.

- At present, the Executive Directors are 19 in number, of which five are nominated by the five largest shareholders — the USA, the UK, Germany, France and India. The rest are elected by the other members.

- The Executive Directors elect the President who becomes their Ex-officio Chairman holding office during their presence. He is the chief of the operating staff of the Bank and is subject to the direction of the Executive Directors on questions of policy and is responsible for the conduct of the ordinary business of the Bank and its organisation.

Criticism:

The modus operandi of the Bank has been criticised on various counts from different quarters:

- It is alleged that the Bank charges a very high rate of interest on loans. For example, some of the loans which India has received in recent years bear an interest of 53.4 per cent including the commission at 1 per cent which is credited to the Bank’s special reserves.

- The Bank’s insistence, prior to the actual grant of loan, on the country having the capacity to transfer or repay, is open to criticism. The Bank should not apply orthodox standards to judge the transfer capacity of any borrowing country. Transfer capacity follows rather than precedes the loan.

- The financial help given by the Bank does not amount to more than a drop in the big ocean of financial requirement so essential for various development projects.

- It is dominated by USA which is the dominant shareholder of the bank. Till now all World Bank President have been from USA.

- With the World Bank, there are concerns about the types of development projects funded. Many infrastructure projects financed by the World Bank Group have social and environmental implications for the populations in the affected areas and criticism has centred on the ethical issues of funding such projects. For example, World Bank-funded construction of hydroelectric dams in various countries has resulted in the displacement of indigenous peoples of the area.

- The Bank’s undemocratic governance structure – which is dominated by industrialised countries – its privileging of the private sector and the controversy over the performance of World Bank-housed Climate Investment Funds have also been subject to criticism in debates around this issue.

- There are also concerns that the World Bank working in partnership with the private sector may undermine the role of the state as the primary provider of essential goods and services, such as healthcare and education, resulting in the shortfall of such services in countries badly in need of them.

Conclusion:

- It may be said that the World Bank has not come up to the expectations of many nations. Nevertheless, it has been instrumental to a very large extent in initiating and accelerating the work of economic reconstruction and development in different countries. No doubt, India has derived immense benefit from the World Bank.

- The Bank may have failed to finance most of the development projects, but it should be remembered that it has financed quite a large number of them which have proved a notable success.

- The Bank has also played a significant role outside financial matters by serving as a mediator between different countries on major economic and political issues. For instance, its help in the solution of the Indus Waters between India and Pakistan and the Suez Canal dispute between the U.K. and the U.A.R. has been invaluable.

International Development Association

- The International Development Association (IDA) is the part of the World Bank group that helps the world’s poorest countries. Overseen by 173 shareholder nations, IDA aims to reduce poverty by providing loans (called “credits”) and grants for programs that boost economic growth, reduce inequalities, and improve people’s living conditions.

- IDA complements the World Bank’s original lending arm—the International Bank for Reconstruction and Development (IBRD). IBRD was established to function as a self-sustaining business and provides loans and advice to middle-income and credit-worthy poor countries. IBRD and IDA share the same staff and headquarters and evaluate projects with the same rigorous standards.

- IDA is one of the largest sources of assistance for the world’s 771 poorest countries, 39 of which are in Africa, and is the single largest source of donor funds for basic social services in these countries.

- IDA lends money on concessional terms. This means that IDA credits have a zero or very low interest charge and repayments are stretched over 25 to 40 years, including a 5- to 10-year grace period. IDA also provides grants to countries at risk of debt distress.

- In addition to concessional loans and grants, IDA provides significant levels of debt relief through the Heavily Indebted Poor Countries (HIPC) Initiative and the Multilateral Debt Relief initiative (MDRI).

- In the fiscal year ending June 30, 2015, IDA commitments totaled $19 billion, of which 13 percent was provided on grant terms. New commitments in FY15 comprised 191 new operations. Since 1960, IDA has provided $312 billion for investments in 112 countries. Annual commitments have increased steadily and averaged about $19 billion over the last three years.

- IDA is a multi-issue institution, supporting a range of development activities that pave the way toward equality, economic growth, job creation, higher incomes, and better living conditions. IDA’s work covers primary education, basic health services, clean water and sanitation, agriculture, business climate improvements, infrastructure, and institutional reforms.

IFC

- The IFC was established in 1956 to support the growth of the private sector in the developing world. The IFC’s stated mission is “to promote sustainable private sector investment in developing countries, helping to reduce poverty and improve people’s lives.”

- While the World Bank (IBRD and IDA) provides credit and non-lending assistance to governments, the IFC provides loans and equity financing, advice, and technical services to the private sector. The IFC also plays a catalytic role, by mobilizing additional capital through loan syndication and by lessening the political risk for investors, enabling their participation in a given project. The IFC has worked with more than 3319 companies in 140 countries since its inception in 1956.

- It is a public entity, although its clientele consists of transnational, national, and local private sector companies, operating in a competitive and fast-moving business environment.

The Multilateral Investment Guarantee Agency (MIGA)

- It is an international financial institution which offers political risk insurance and credit enhancement guarantees. Such guarantees help investors protect foreign direct investments against political and non-commercial risks in developing countries. MIGA is a member of the World Bank Group and is headquartered in Washington, D.C., United States. It was established in 1988 as an investment insurance facility to encourage confident investment in developing countries. MIGA’s stated mission is “to promote foreign direct investment into developing countries to support economic growth, reduce poverty, and improve people’s lives”. It targets projects that endeavor to create new jobs, develop infrastructure, generate new tax revenues, and take advantage of natural resources through sustainable policies and programs.

- MIGA is owned and governed by its member states, but has its own executive leadership and staff which carry out its daily operations. Its shareholders are member governments which provide paid-in capital and have the right to vote on its matters. It insures long-term debt and equity investments as well as other assets and contracts with long-term periods. The agency is assessed by the World Bank’s Independent Evaluation Group each year.

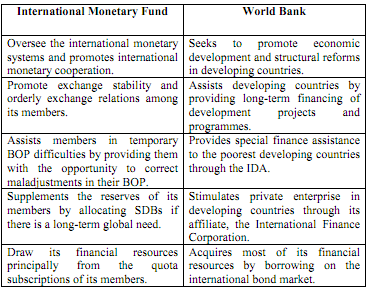

INTERNATIONAL MONETARY FUND

The World Bank and the IMF performs different functions, but they are often confused with each other either with reference to their functions or with their operation. We are therefore, trying to clearly mark the points of difference between these two. You must remember that the name World Bank does not refers to a bank in conventional sense (this is because it performs development function). And International Monetary Fund or IMF performs the lending function(which we associate with banks).

source

History of IMF and World Bank:

- The Great Depression of 1930s led to failure of several economies as a result the gold standard for valuation of currencies(where currencies were back by gold) dissipated.

- Nations raised trade barriers, and devalued their currencies to compete against each other, in the export markets.

- These factors led to a decline in world trade, which caused high unemployment, and sharp drop in living standards across many countries.

- The Bretton Woods Conference after World War II in 1944, established a new international monetary system.C.D. Deshmukh was an Indian civil servant who represented India at the Bretton Woods Conference in 1944. Also remember that he was the first Indian Governor of Reserve Bank of India(RBI).[/box]

- The international Bank for Reconstruction and Development( now called the World Bank) and the International Monetary Fund (IMF) were established with different mandates.

- Both these IMF and World Bank are also known as ‘Bretton Woods Twins’.

Let us study the details of both on a comparative basis. This will clear the air about confusion regarding both these institutions.

Structure and Size of IMF:

The International Monetary Fund:

- 188 countries member.

- Headquarters: Washington, D.C.

- It has 2,300 staff members.

Functions of IMF

The International Monetary Fund functions :

- The IMF is basically a lending institution which gives advances to members in need.

- It is the mentor of its members’ monetary and exchange rate policies.

- To maintain the stability in Exchange rate system around the World.

Operations of IMF and World Bank :

source

The International Monetary Fund operations :

- It primarily urges its members to allow their currencies to be exchanged without any restriction for the currencies of other member countries of IMF.

- The IMF supervises economic policies that influence the balance of payments in member’s’ economies. This provides an opportunity for early warning of any exchange rate or balance of payments problem in its member nations.

- It provides short- and medium-term financial assistance to its member nations which run into any temporary balance of payments difficulties. This financial assistance involves the option of convertible currencies to alter the affected member’s troubled foreign exchange reserves. It is done only in return for that government’s promise to reform their economic policies that have caused the said balance of payments problem.

Criticism in the working of IMF

- Critics of the World Bank and the IMF are concerned about the ‘conditionalities’ imposed on borrower countries. The World Bank and the IMF often attach loan conditionalities based on what is termed the ‘Washington Consensus’, focusing on liberalisation—of trade, investment and the financial sector—, deregulation and privatisation of nationalised industries. Often the conditionalities are attached without due regard for the borrower countries’ individual circumstances and the prescriptive recommendations by the World Bank and IMF fail to resolve the economic problems within the countries.

- IMF conditionality’s may additionally result in the loss of a state’s authority to govern its own economy as national economic policies are predetermined under IMF packages. Issues of representation are raised as a consequence of the shift in the regulation of national economies from state governments to a Washington-based financial institution in which most developing countries hold little voting power. IMF packages have also been associated with negative social outcomes such as reduced investment in public health and education.

- There are also criticisms against the World Bank and IMF governance structures which are dominated by industrialised countries. Decisions are made and policies implemented by leading industrialised countries—the G7—because they represent the largest donors without much consultation with poor and developing countries.

Recent reforms in IMF

- Recently The emerging economies gained more influence in the governance architecture of the International Monetary Fund (IMF).

- The reforms were agreed upon by the 188 members of the IMF in 2010, in the aftermath of the global financial meltdown.

- More than six per cent of the quota shares will shift to emerging and developing countries from the U.S. and European countries.

Which countries gained?

- India’s voting rights increase to 2.6 per cent from the current 2.3 per cent, and China’s to six per cent from 3.8. Russia and Brazil are the other two countries that gain from the reforms.

Significance

- For the first time, the Executive Board will consist entirely of elected executive directors, ending the category of appointed executive directors. Currently, the members with the five largest quotas appoint an executive director, a position that will cease to exist.

- The significant resource enhancement will fortify the IMF’s ability to respond to crises more effectively.

- These reforms will reinforce the credibility, effectiveness, and legitimacy of the IMF.

ADB

Asian Development Bank (ADB) was set up to fight poverty in Asia and the Pacific. ADB is a multilateral development finance institution dedicated to reducing poverty in Asia and the Pacific. Established in 1966, ADB is now owned by 63 members, mostly from the region. The headquarters is in Manila with 24 other offices around the world.

Functions of The Asian Development Bank:

- extends loans and equity investments to its developing member countries (DMCs) for their economic and social development

- provides technical assistance for the planning and execution of development projects and for advisory services

- promotes and facilitates investment of public and private capital for development

- responds to requests for assistance in coordinating development policies and plans of its developing member countries

AIIB & NDB

- The New Development Bank (NDB) is established by The BRICS states (Brazil, Russia, India, China and South Africa). According to the Agreement on the NDB, “the Bank shall support public or private projects through loans, guarantees, equity participation and other financial instruments.” Moreover, the NDB “shall cooperate with international organizations and other financial entities, and provide technical assistance for projects to be supported by the Bank.

- The initial authorized capital of the bank is $100 billion divided into 1 million shares having a par value of $100,000 each. The initial subscribed capital of the NDB is $50 billion divided into paid-in shares ($10 bln) and callable shares ($40 bln). The initial subscribed capital of the bank was equally distributed among the founding members. The Agreement on the NDB specifies that the voting power of each member will be equal to the number of its subscribed shares in the capital stock of the bank.

- The bank is headquartered in Shanghai, China. The first regional office of the NDB will be opened in Johannesburg, South Africa.

Why There was need for NDB?

- Need for the creation of NDB was felt because of the discriminatory attitude of the West towards the developing countries. The BRICS member countries accounting for almost half of the world’s population and about one-fifth of global economic output have only 11 per cent of the votes at international financial institution like the IMF. Both the WB and the IMF are based on weighted voting system, which provide the rich countries a big say in the management. There are informal arrangements whereby the American is always at the top in the WB; while the European is in top position in IMF. In those monetary institutions, the developing countries don’t have enough voting rights.

- Expectation is that the NDB with its total capital of $100 billion would meet short term liquidity requirement of the member countries. An effort has been made to avoid China’s dominance on the bank; for which India is made president of the bank for the first six years and after this Brazil and Russia would have turns with five years each.

Significance of the NDB

- (1)The New Development Bank is not just about setting up yet another bank. It represents a new political will among new and emerging power in the world to challenge the old architecture of growth.

2) Over the last 20 years, it has been obvious that the growth impetus has shifted to Asia and also Africa. The World Bank and the IMF, dominated by the US and Europe, cannot function with limited voting powers for the new tigers. BRICS seeks to challenge their power structure.

3) The setting up of the New Development Bank and the $100 billion currency stabilization fund will signal the emergence of new international currencies to challenge the US dollar’s hegemony. In the initial years, the Chinese yuan will get internationalized first, followed by the Indian rupee after about a decade of strong growth in India’s economic and trade shares. Even though the dollar will continue to remain the biggest international currency for the foreseeable future,its share will start falling as the yuan rises. The world will have the dollar, euro, the yen and the yuan as it main currencies over the next decade. The dollar will not remain the only option for the settlement of global trades, especially when intra-Asian, African and Latin American shares of global trade start picking up in the decades ahead.

4) With $100 billion contingency reserves pool ,it will help any of its members if they are hit by a sudden exodus of foreign capital

Challenges NDB will face

- Critical details as the cost of borrowing and to whom the NDB will lend are still not clear, and much will hinge on the new institution’s credibility in terms of lending and governance standards as these will in turn affect its credit ratings.

- More important of all, the CRA is likely to be too small to be useful to any of the BRICS countries at the time of a crisis.

- Each of the five BRICS has a different strategic imperative for creating the bank, while China, Russia and India have a greater stake in it than Brazil and South Africa. For China, the NDB along with the Asian Infrastructure Development Bank that it is also promoting, it’s all about challenging the dominance in Asia of the Japanese. Russia is keen to participate in the NDB as a way of shoring up its falling credibility thanks to its war games in Ukraine.

- The Political tensions which the BRICS countries have with each other will likely to be carried into the NDB as well, so even if the technical architecture of the NDB works out well, these strategic interplays could constrain the NDB from fulfilling its potential.

AIIB

source

Why Has India joined the AIIB?

There are many reasons for it:

- India is preparing start a large number of infrastructure projects, but they’re short of money, so they need help from China. Of course they can get money from ADB or WB, but they also need to find a balance between China and USA.

- It’s a great chance to develop economy links between India and China. These two countries both has huge market, and they also keep a rapid growth of economy.

- Though AIIB is a Chinese-lead financial institution, India is welcomed to play a important role in it. It’s the reason why the UK, Germany and France all want to be a member of AIIB.

WTO

Introduction

World Trade Organization, as an institution was established in 1995. It replaced General Agreement on Trade and Tariffs (GATT) which was in place since 1946. In pursuance of World War II, western countries came out with their version of development, which is moored in promotion of free trade and homogenization of world economy on western lines. This version claims that development will take place only if there is seamless trade among all the countries and there are minimal tariff and non- tariff barriers. That time along with two Bretton wood institutions – IMF and World Bank, an International Trade Organization (ITO) was conceived. ITO was successfully negotiated and agreed upon by almost all countries. It was supposed to work as a specialized arm of United Nation, towards promotion of free trade. However, United States along with many other major countries failed to get this treaty ratified in their respective legislatures and hence it became a dead letter.

Consequently, GATT became de-facto platform for issues related to international trade. It has to its credit some major successes in reduction of tariffs (custom duty) among the member countries. Measures against dumping of goods like imposition of Anti-Dumping Duty in victim countries, had also been agreed upon. It was signed in Geneva by only 23 countries and by 1986, when Uruguay round started (which was concluded in 1995 and led to creation of WTO in Marrakesh, Morocco), 123 countries were already its member. India has been member of GATT since 1948; hence it was party to Uruguay Round and a founding member of WTO. China joined WTO only in 2001 and Russia had to wait till 2012.

Why WTO replaced GATT?

While WTO came in existence in 1995, GATT didn’t cease to exist. It continues as WTO’s umbrella treaty for trade in goods.

There were certain limitations of GATT. Like –

- It lacked institutional structure. GATT by itself was only the set of rules and multilateral agreements.

- It didn’t cover trade in services, Intellectual Property Rights etc. It’s main focus was on Textiles and agriculture sector.

- A strong Dispute Resolution Mechanism was absent.

- By developing countries it was seen as a body meant for promoting interests of wests. This was because Geneva Treaty of 1946, where GATT was signed had no representation from newly independent states and socialist states.

- Under GATT countries failed to curb quantitative restrictions on trade. (Non-Tariff barriers)

Accordingly WTO seeks to give more weightage to interests of global south in framing of multilateral treaties. Here, a number of other aspects have been brought into, such as Intellectual property under Trade related aspects of Intellectual Property (TRIPS), Services by General Agreement on Trade in Service (GATS), Investments under Trade related Investment Measures (TRIMS).

Uruguay Round and its Outcomes

This (8th round of multilateral negotiations) round begun in 1986 and went on till 1994. Uruguay Round of negotiations covered more issues and involved more countries than any previous round. It prescribes, among other things, that tariffs on industrial products be reduced by an average of more than one-third, that trade in agricultural goods be progressively liberalized, and that a new body, the World Trade Organization, be established both to facilitate the implementation of multilateral trade agreements and to serve as a forum for future negotiations.

Agreements to liberalize trade in industrial products include reductions in tariffs and removal of quantitative restrictions. The advanced countries agreed to reduce tariffs on industrial imports amounting to 64 percent of the total value of their imports of such products; 18 percent of their industrial imports were already duty-free under commitments made prior to the Round. By comparison, the developing countries agreed to lower their tariffs on about one-third of their industrial imports, and the participating transition countries on three-quarters of theirs. Tariff reductions are to be completed by the year 2000 except for certain sensitive sectors such as textiles, for which the reductions must be completed by 2005. Further, outcome of this round mandated reduction of import duty on Tropical Products, which are mainly exported by developing and least developed countries.

The most important of them were a fixed timetable for dismantling the multi-fibre agreement (MFA) governing trade in textiles enshrined in the agreement on textiles and clothing (ATC) and the agreement on agriculture (AOA). Consider each in turn.

As per the ATC, developed countries would progressively bring greater volumes of textile trade under the normal Gatt tariff disciplines. It was recognised that the developed countries (like any other country) also needed time for ‘structural adjustment’. The time was mainly required for achieving domestic political acceptance of structural change in these economies. Accordingly, it was decided that by January 1, 2005 all textile trade would be off quotas. What was the actual experience?

While countries like Norway did follow the time table, both the US and the EU used simple arithmetic to postpone the end of quotas on exports of developing countries till the end of the period. This was done by the simple expedient of initially bringing out of quotas only those textile and clothing items where exports of developing countries were minimal. When 2005 approached, an attempt was made to scuttle the ATC by arguing that it would be harmful for exports of less competitive developing countries!

it was decided to bring the textile trade under the jurisdiction of the World Trade Organization. The Agreement on Textiles and Clothing provided for the gradual dismantling of the quotas that existed under the MFA. This process was completed on 1 January 2005. However, large tariffs remain in place on many textile products.

Principle of the Trading System – WTO

1) Non Discrimination

- a) Most Favored Nation

Treating other nations equally- Under the WTO agreements, countries cannot normally discriminate between their trading partners. If they grant some country a special favor (such as a lower customs duty rate for one of their products), then they’ll have to do the same for all other WTO members.

Some exceptions are allowed. For example,

- Countries can set up a free trade agreement that applies only to goods traded within the group — discriminating against goods from outside.

- Or they can give developing countries special access to their markets.

- Or a country can raise barriers against products that are considered to be traded unfairly from specific countries. And in services, countries are allowed, in limited circumstances, to discriminate.

- b) National Treatment: Treating foreigners and locals equally

This principle of “national treatment” (giving others the same treatment as one’s own nationals) is also found in all the three main WTO agreements (Article 3 of GATT, Article 17 of GATS and Article 3 of TRIPS)

National treatment only applies once a product, service or item of intellectual property has entered the market. Therefore, charging customs duty on an import is not a violation of national treatment even if locally-produced products are not charged an equivalent tax.(as this happens before entry into domestic market)

2) Freer Trade : Gradually through negotiation

Lowering trade barriers is one of the most obvious means of encouraging trade. The barriers concerned include customs duties (or tariffs) and measures such as import bans or quotas that restrict quantities selectively. From time to time other issues such as red tape and exchange rate policies have also been discussed

3) Predictability : Through binding and Transparency

With stability and predictability, investment is encouraged, jobs are created and consumers can fully enjoy the benefits of competition — choice and lower prices. The multilateral trading system is an attempt by governments to make the business environment stable and predictable.

The Uruguay Round increased bindings

Percentages of tariffs bound before and after the 1986-94 talks

| Before | After | |

| Developed countries | 78 | 99 |

| Developing countries | 21 | 73 |

| Transition economies | 73 | 98 |

(These are tariff lines, so percentages are not weighted according to trade volume or value)

In the WTO, when countries agree to open their markets for goods or services, they “bind” their commitments. For goods, these bindings amount to ceilings on customs tariff rates. Sometimes countries tax imports at rates that are lower than the bound rates. Frequently this is the case in developing countries. In developed countries the rates actually charged and the bound rates tend to be the same.

4) Promoting fair competition

The WTO is sometimes described as a “free trade” institution, but that is not entirely accurate. The system does allow tariffs and, in limited circumstances, other forms of protection. More accurately, it is a system of rules dedicated to open, fair and undistorted competition.

The rules on non-discrimination — MFN and national treatment — are designed to secure fair conditions of trade. So too are those on dumping (exporting at below cost to gain market share) and subsidies.

The issues are complex, and the rules try to establish what is fair or unfair, and how governments can respond, in particular by charging additional import duties calculated to compensate for damage caused by unfair trade.

Many of the other WTO agreements aim to support fair competition: in agriculture, intellectual property, services, for example. The agreement on government procurement (a “plurilateral” agreement because it is signed by only a few WTO members) extends competition rules to purchases by thousands of government entities in many countries. And so on.

5) Encouraging Development and Economic Reforms

The WTO system contributes to development. On the other hand, developing countries need flexibility in the time they take to implement the system’s agreements. And the agreements themselves inherit the earlier provisions of GATT that allow for special assistance and trade concessions for developing countries.

Over three quarters of WTO members are developing countries and countries in transition to market economies.

During the seven and a half years of the Uruguay Round, over 60 of these countries implemented trade liberalization programmes autonomously. At the same time, developing countries and transition economies were much more active and influential in the Uruguay Round negotiations than in any previous round, and they are even more so in the current Doha Development Agenda.

Major agreements of WTO

All these agreements were concluded during negotiations of Uruguay round i.e. in or before 1995. In most agreements new proposals have been brought in by different countries, which we will discuss later.

- Agreement on subsidies and countervailing measures – SCM

The WTO SCM Agreement contains a definition of the term “subsidy”. The definition contains three basic elements: (i) a financial contribution (ii) by a government or any public body within the territory of a Member (iii) which confers a benefit. All three of these elements must be satisfied in order for a subsidy to exist.

In order for a financial contribution to be a subsidy, it must be made by or at the direction of a government or any public body within the territory of a Member. Thus, the SCM Agreement applies not only to measures of national governments, but also to measures of sub-national governments and of such public bodies as state-owned companies.

Further, Such Financial contribution must also confer benefit to the industry. Now, in cash grants, benefit will be straightforward to identify, but in cases where there is loan or capital infusion from government/ Public body, it will not be that easy. Such issues are resolved by appellate body of WTO.

Only “specific” subsidies are subject to the SCM Agreement disciplines. There are four types of “specificity” within the meaning of the SCM Agreement:

- Enterprise-specificity. A government targets a particular company or companies for subsidization;

- Industry-specificity. A government targets a particular sector or sectors for subsidization.

- Regional specificity. A government targets producers in specified parts of its territory for subsidization.

- Prohibited subsidies. A government targets export goods or goods using domestic inputs for subsidization.

Hence there are two types of prohibited subsidies –

- Subsidies contingent upon export performance.

- Subsidies contingent upon use of domestic content over imported goods.

Further, there is separate category of ‘Actionable subsidies’. These are not prohibited but countries can take ‘Countervailing measures’ against these subsidies or they can be challenged in ‘dispute resolution body’ of WTO.

For a subsidy to be actionable, 3 conditions should be present –

- Injury to domestic industry due to subsidized imports of other country.

- There is serious prejudice: Serious prejudice usually arises as a result of adverse effects (e.g., export displacement) in the market of the subsidizing Member or in a third country market. For e.g. If India starts subsidizing its textile sector heavily, then China can claim that this subsidy is causing serious prejudice to its textile industry.

- Nullification or impairment of benefits accruing under the GATT 1994. It means when benefit to be accrued from reduction of tariffs (under GATT) are nullified by increase in subsidies.

Against such subsidies members can take Countervailing Measures, such as imposing countervailing duties or antidumping duty. These can only be done in a transparent manner and a sunset period should be specified. Recently, India imposed Anti- Dumping duty on imports of stainless steel from China.

Countervailing Duty – It is imposed on imported goods to counterbalance subsidy provided by the exporter country.

Anti-Dumping Duty – At times countries resort to subsidize production or exports so heavily that exporters are able to sell goods below domestic price or even cost of production in foreign markets. It is aimed at wiping out target country’s industry. Anti-Dumping Duty is aimed at counterbalancing such subsidization.

General Agreement on Trade in Services – GATS

The GATS was inspired by essentially the same objectives as its counterpart in merchandise trade, GATT: creating a credible and reliable system of international trade rules; ensuring fair and equitable treatment of all participants (principle of non-discrimination); stimulating economic activity through guaranteed policy bindings; and promoting trade and development through progressive liberalization.

While services currently account for over 60 percent of global production and employment, they represent no more than 20 per cent of total trade (BOP basis). This — seemingly modest — share should not be underestimated, however. Many services, which have long been considered genuine domestic activities, have increasingly become internationally mobile.

This trend is likely to continue, owing to the introduction of new transmission technologies (e.g. electronic banking, tele-health or tele-education services), the opening up in many countries of long-entrenched monopolies (e.g. voice telephony and postal services), and regulatory reforms in hitherto tightly regulated sectors such as transport. Combined with changing consumer preferences, such technical and regulatory innovations have enhanced the “tradability” of services and, thus, created a need for multilateral disciplines.

Services negotiations in the WTO follow the so-called positive list approach, whereby members’ schedules of specific commitments list all of the services sectors and sub-sectors where they undertake to bind the market opening and the granting of national treatment to foreign service suppliers, apart the listed barriers that remain. Sectors and sub-sectors not included in the schedule are exempt from any obligations as regards market access and national treatment.

West is pushing hard to move from positive list approach to negative list approach. In negative list approach, services where GATS is not applicable will have to be negotiated, agreed upon and specified. India is against this concept as it will throw open almost whole Indian services sector to western multinational giants.

Negotiations is services under GATS are classified in 4 modes, interests of different countries depend upon this classification –

Mode 1 – It includes cross border supply of services without movement of natural persons. For eg. Business Process Outsourcing, KPO or LPO services. Here, it’s in India’s interest to push for liberalization given its large human resource pool and competitive IT industry.

Mode 2 – This mode covers supply of a service of one country to the service consumer of any other country. E.g. telecommunication

Mode 3 – Commercial presence – which covers services provided by a service supplier of one country in the territory of any other country. This opens door of relevant sector in one country to investments from another country. Accordingly, it is in west’s interest to push for liberalization here. There has been sustained pressure to open up higher education sector, insurance sector, Medical sector etc through this mode.

Mode 4 – Presence of natural persons – which covers services provided by a service supplier of one country through the presence of natural persons in the territory of any other country. E.g. Infosys or TCS sending its engineers for onsite work in US/Europe or Australia. Here again it’s in India’s interest to push for liberalization. In 2012, India dragged the US to the World Trade Organization’s (WTO’s) dispute settlement body (DSB) over an increase in the professional visa fee (H1B/L1).

- TRIPS

The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) is an international agreement administered by the World Trade Organization (WTO) that sets down minimum standards for many forms of intellectual property (IP) regulation as applied to nationals of other WTO Members. It was negotiated at the end of the Uruguay Round of the General Agreement on Tariffs and Trade (GATT) in 1994.

It remains an issue between Developed and developing countries. TRIPS was fine tuned in favor of developing countries in 2003, as part of Doha development agenda, when all members agreed to compulsory licensing in certain cases. However, now U.S. and Europe remain unhappy about current strict terms of patent allowed by TRIPS

2. TRIMS

The Agreement on Trade-Related Investment Measures (TRIMS) recognizes that certain investment measures can restrict and distort trade. It states that WTO members may not apply any measure that discriminates against foreign products or that leads to quantitative restrictions, both of which violate basic WTO principles. A list of prohibited TRIMS, such as local content requirements, is part of the Agreement. Recently India was dragged to WTO by U.S. over former’s specification of Domestic Content Requirement in relation to procurement of Solar Energy cells and equipments.

AOA

WTO’s agreement on agriculture was concluded in 1994, and was aimed to remove trade barriers and to promote transparent market access and integration of global markets. Agreement is highly complicated and controversial; it is often criticized as a tool in hands of developed countries to exploit weak countries. Negotiations are still going on for some of its aspects.

Agreement on agriculture stands on 3 pillars viz. Domestic Support, Market Access, and Export Subsidies.

- Domestic Support – It refers to subsidies such guaranteed Minimum Price or Input subsidies which are direct and product specific. Under this, Subsidies are categorized into 3 boxes –

- a) Green Box – Subsidies which are no or least market distorting includes measures decoupled from outputsuch as income-support payments (decoupled income support), safety – net programs, payments under environmental programs, and agricultural research and-development subsidies.

Such as Income Support which is not product specific. Like in India farmer is supported for specific products and separate support prices are there for rice, wheat etc. On the other hand income support is uniformly available to farmers and crop doesn’t matter.

US has exploited this opportunity to fullest by decoupling subsidies from outputs and as of now green box subsidies are about 90% of its total subsidies. It was easy for USA because it doesn’t have concern for food security. Further, it has prosperous agro economy, and farmers can better respond to markets and shift to other crops. But in India, domestic support regime provides livelihood guarantee to farmers and also ensures food security and sufficiency. For this MSP regime tries to promote production of particular crop in demand. And this makes decoupling Support with output very complicated.

USA was also in position to subsidies R&D expenditure in agriculture as almost all the farming in US is capitalist and commercial. Big agriculturists spend substantial amount on technology upgradations and R&D. But in India about 80% of farming is subsistence and hence, India & other developing countries can use this opportunity.

- b) Blue Box – Only ‘Production limiting Subsidies’ under this are allowed. They cover payments based on acreage, yield, or number of livestock in a base year.

‘Targets price’ are allowed to be fixed by government and if ‘market prices’ are lower, then farmer will be compensated with difference between target prices and market prices in cash. This cash shall not be invested by farmer in expansion of production.

Loophole here is that there no limit on target prices that can be set and those are often set far above market prices deliberately. USA currently isn’t using this method, instead here EU is active.

- c) Amber Box – Those subsidies which are trade distorting and need to be curbed.

The Amber Box contains category of domestic support that is scheduled for reduction based on a formula called the “Aggregate Measure of Support” (AMS).

The AMS is the amount of money spent by governments on agricultural production, except for those contained in the Blue Box, Green Box and ‘de minimis’.

It required member countries to report their total AMS for the period between 1986 and 1988, bind it, and reduce it according to an agreed upon schedule. Developed countries agreed to reduce these figures by 20% over six years starting in 1995. Developing countries agreed to make 13% cuts over 10 years. Least – developed countries do not need to make any cuts.

As we can note that Subsidies were bind to levels of 1986-1988, there was inequality at very beginning of the agreement. At that time subsidies which latter came under ‘Amber Box’ were historically high in western countries.

In developing countries, including India these subsidies were very limited. It is only now under pressure of Inflation in prices of agricultural Inputs, and wide differences between market prices and Minimum support Price, subsidies have grown to this level. In effect developed countries are allowed to maintain substantially higher amount of trade distorting subsidies.

De-Minimis provision

Under this provision developed countries are allowed to maintain trade distorting subsidies or ‘Amber box’ subsidies to level of 5% of total value of agricultural output. For developing countries this figure was 10%.

So far India’s subsidies are below this limit, but it is growing consistently. This is because MSP are always revised upward whereas Market Prices have fluctuating trends. In recent times when crash in international market prices of many crops is seen, government doesn’t have much option to reduce MSP drastically. By this analogy India’s amber box subsidies are likely to cross 10% level allowed by de Minimis provision.

- Market Access: The market access requires that tariffs fixed (like custom duties) by individual countries be cut progressively to allow free trade. It also required countries to remove non-tariff barriers and convert them to Tariff duties.

Earlier there were quotas for Imports under which only certain quantities of particular commodities were allowed to Import. This is an example of Non-tariff Barrier.

India has agreed to this agreement and substantially reduced tariffs. Only goods which are exempted by the agreement are kept under control.

Maximum tariff has been bonded as required by WTO, under which a higher side of tariffs is fixed in percentage that should never be surpassed. Generally actual tariffs are far below this high limit. This makes custom policy transparent and tariffs can’t be fixed arbitrarily.

If India is able to diversify its production and add value by food processing, then this is a win-win deal for India. A number of commodities are exported to West and low tariffs in west will benefit Indian suppliers.

- Export Subsidy: These can be in form of subsidy on inputs of agriculture, making export cheaper or can be other incentives for exports such as import duty remission etc. These can result in dumping of highly subsidized (and cheap) products in other country. This can damage domestic agriculture sector of other country.

These subsidies are also aligned to 1986-1990 levels, when export subsidies by developed countries was substantially higher and Developing countries almost had no export subsidies that time.

But USA is dodging this provision by its Export credit guarantee program. In this, USA gov. gives subsidized credit to purchaser of US agricultural products, which are to be paid back in long periods. This is generally done for Food Aid programs, such as (Public Law-480) under which food aid is send massively to under developed countries.

India also received this Aid in 1960’s. But this is only at concessional rates and credit options. But this results in perpetual dependence on foreign grain in recipient countries and destroys their domestic agriculture. So this is equally trade distorting subsidy, which is not currently under ambit of WTO’s AOA.

There is little doubt that subsidies and support to agriculture should be controlled and better targeted. WTO negotiations also claim to work towards this direction, but inherent conflicting and vested interest of few countries are too influential in WTO. Every country has different requirements and different product mix, so enough flexibility is must in any agreement.

Further, right to food is a global movement and is guaranteed by numerous UN conventions. So, ensuring food security is a domestic concern of a nation, international community can just advice but can’t coerce other sovereign country. Thus, India has to made its expenditure much more effective, with dynamic policy and resist any outside pressure which is misdirected towards negative results for Indian people.

Special Safeguard Mechanism

A Special Safeguard Mechanism (SSM) would allow developing countries to impose additional (temporary) safeguard duties in the event of an abnormal surge in imports or the entry of unusually cheap imports.

Debates have arisen around this question, some negotiating parties claiming that SSM could be repeatedly and excessively invoked, distorting trade. In turn, the G33 bloc of developing countries, a major SSM proponent, has argued that breaches of bound tariffs should not be ruled out if the SSM is to be an effective remedy. SSM is quite important in a scenario in which west has significant powers to subsidize their production and in turn, exports.

Special Products

At the 2005 WTO Ministerial Conference in Hong Kong, members agreed to allow developing countries to “designate an appropriate number of tariff lines as Special Products” (SPs) based on “food security, livelihood security and rural development”

Multifibre Arrangement and Agreement on Textiles and Clothing

The MFA was introduced in 1974 as a short-term measure intended to allow developed countries to adjust to imports from the developing world. Developing countries and countries without a welfare state] have an absolute advantage in textile production because it is labor-intensive and they have low labor costs.

The Arrangement was not negative for all developing countries. For example, the European Union (EU) imposed no restrictions or duties on imports from the emerging countries, such as Bangladesh, leading to a massive expansion of the industry there.

It was decided to bring the textile trade under the jurisdiction of the World Trade Organization. The Agreement on Textiles and Clothing provided for the gradual dismantling of the quotas that existed under the MFA. This process was completed on 1 January 2005. However, large tariffs remain in place on many textile products.

Sanitary and Phyto- Sanitary Measures

This agreement was one of the results of Uruguay Round of negotiation entered into force with the establishment of the World Trade Organization on 1 January 1995. The Agreement sets out the basic rules for food safety and animal and plant health standards. It allows countries to set their own standards. But it also says regulations must be based on science. They should be applied only to the extent necessary to protect human, animal or plant life or health. And they should not arbitrarily or unjustifiably discriminate between countries where identical or similar conditions prevail.

Doha Development Round

For the next ministerial (Seattle) meet developed countries tried to push a lopsided agreement on Singapore Issues down the throat of developing countries, but latter successfully resisted. All this while, allegations were hurled on developed countries for ignoring developmental challenges of developing and least developed countries.

This made developed countries to agree to a ‘developmental agenda’ and new round of negotiations – Doha Development Round begun at 4th ministerial meet in Doha. It is said that this was agreed to by developed countries in expectation that contents of ‘Singapore Issues’ will be agreed by dissidents.

Main issues of Doha Development Round:

- Agriculture – First proposal in Qatar, in 2001, called for the end agreement to commit to substantial improvements in market access; reductions (and ultimate elimination) of all forms of export subsidies (including under Green and blue box); and substantial reductions in trade-distorting support.

The United States is being asked by the EU and the developing countries, led by Brazil and India, to make a more generous offer for reducing trade-distorting domestic support for agriculture. The United States is insisting that the EU and the developing countries agree to make more substantial reductions in tariffs and to limit the number of import-sensitive and ‘special products’ (aoa) that would be exempt from cuts.

Import-sensitive products are of most concern to developed countries like the European Union, while developing countries are concerned with special products – those exempt from both tariff cuts and subsidy reductions because of development, food security, or livelihood considerations.

Brazil has emphasized reductions in trade-distorting domestic subsidies, especially by the United States (some of which it successfully challenged in the WTO U.S.-Brazil cotton dispute), while India has insisted on a large number of special products that would not be exposed to wider market opening.

Access to patented medicines –

- A major topic at the Doha ministerial regarded the WTO Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS). The issue involves the balance of interests between the pharmaceutical companies in developed countries that held patents on medicines and the public health needs in developing countries. Before the Doha meeting, the United States claimed that the current language in TRIPS was flexible enough to address health emergencies, but other countries insisted on new language.

On 30 August 2003, WTO members reached agreement on the TRIPS and medicines issue. Voting in the General Council, member governments approved a decision that offered an interim waiver under the TRIPS Agreement allowing a member country to export pharmaceutical products made under compulsory licenses to least-developed and certain other members. It also allows members to not to allow evergreening of Patents.

- Special and differential treatment (SDT) – SDT as a principle has been there since 1970’s in multilateral negotiations under GATT. In Doha round, members agreed that Developing and Least developed countries will continue to be eligible for a favorable treatment.

- However, of late developed countries are dragging their feet here too. They now claim that big developing countries like India, China, Brazil and South Africa are unreasonable in their demand and only least developed countries are rightful claimant of differential treatment. Here it is inconceivable that poor countries like India are to be treated at par with western developed world. At the December 2005 Hong Kong ministerial, members agreed to five S&D provisions for least developed countries(LDCs), including the duty-free and quota-free access.

- Implementation issue: Developing countries claim that they have had problems with the implementation of the agreements reached in the earlier Uruguay Round because of limited capacity or lack of technical assistance. They also claim that they have not realized certain benefits that they expected from the Round, such as increased access for their textiles and apparel in developed-country markets. They seek a clarification of language relating to their interests in existing agreements.

Apart from this, there was agreement on prevention of appropriation of Traditional Knowledge of developing world by Corporations in west Latest – Nairobi Ministerial Meet – 2015:

Recently concluded Nairobi meet was a huge disappointment for the developing and under developed world. Here, U.S. trade Representative unabashedly called Doha Development Agenda a dead, outdated and undesirable course. West is desperately trying to set aside development aspect of negotiations, to which it had agreed in Doha. Its focus is now on Trade Facilitation Agreement which was agreed to in Bali meet. Further, they are trying to introduce new issues (including some Singapore issues) such as Government Procurement, E-commerce, Investment, Competition policy. To this India and other developing countries took strong objection.

In the run-up to the Nairobi meeting, a large majority of developing countries led by India, China, South Africa, Indonesia, Ecuador, and Venezuela prepared the ground to ensure that the Doha Round of negotiations are not closed by the two trans-Atlantic trade elephants. They also tabled detailed proposals for a permanent solution for public stockholding programmes for food security and a special safeguard mechanism (SSM) to protect millions of resource-poor and low-income farmers from the import surges from industrialized countries.

Again, the two proposals were actively opposed by the US, which led a sustained campaign to ensure that there was neither an outcome on continuing DDA negotiations nor a deal on SSM and public stockholdings for food security.

Highlights of Nairobi outcomes:

- There was a commitment to completely eliminate subsidies for farm exports

Under the decision, developed members have committed to remove export subsidies immediately, except for a handful of agriculture products, and developing countries will do so by 2018. Developing members will keep the flexibility to cover marketing and transport costs for agriculture exports until the end of 2023, and the poorest and food-importing countries would enjoy additional time to cut export subsidies.

- Ministers also adopted a Ministerial Decision on Public Stockholding for Food Security Purposes. The decision commits members to engage constructively in finding a permanent solution to this issue. Under the Bali Ministerial Decision of 2013, developing countries are allowed to continue food stockpile programmes, which are otherwise in risk of breaching the WTO’s domestic subsidy cap, until a permanent solution is found by the 11th Ministerial Conference in 2017.

- A Ministerial Decision on a Special Safeguard Mechanism (SSM) for Developing Countries recognizes that developing members will have the right to temporarily increase tariffs in face of import surges by using an SSM. Members will continue to negotiate the mechanism in dedicated sessions of the Agriculture Committee. (This means issue is not closed and still under negotiation).

- There were other decisions of particular interests of least developing Countries. One of them is Preferential Rules of Origin. It entails that ‘Made in LDC’ products will get unrestricted access to markets of non-LDCs.

- There was affirmation that Regional Trade Agreements (RTAs) remain complementary to, not a substitute for, the multilateral trading system (WTO).

- Ministers acknowledged that members “have different views” on how to address the future of the Doha Round negotiations but noted the “strong commitment of all Members to advance negotiations on the remaining Doha issues.

Is WTO a friend or foe of India?

India is one of the prominent members of WTO and is largely seen as leader of developing and under developed world. At WTO, decisions are taken by consensus. So there is bleak possibility that anything severely unfavorable to India’s interest can be unilaterally imposed. India stands to gain from different issues being negotiated in the forum provided it engages with different interest groups constructively, while safeguarding its developmental concerns.

In absence of such a body we stand to lose a platform through which we can mobilize opinion of likeminded countries against selfish designs of west. Thanks to vast resources of developed countries they can easily win smaller countries to their side.

WTO provides a forum for such developing countries to unite and pressurize developed countries to make trade sweeter for poor countries. Accordingly, India remains committed to various developmental issues such as Doha Development Agenda, Special Safeguard Mechanism, Permanent solution of issue of public stock holding etc.

Apart from this, Dispute Resolution Mechanism of WTO is highly efficient. Chronological list of cases in WTO can be accessed here. Countries drag their trading partner to this body when action of one country is perceived to be unfair and violative of any WTO agreement, by other country.

Cases of Complaints against India

- India — Certain Measures Relating to Solar Cells and Solar Modules (Complainant: United States)

- India —Anti-Dumping Duties on USB Flash Drives from the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu(Complainant: Chinese Taipei)

- India —Measures Concerning the Importation of Certain Agricultural Products(Complainant: United States)

- India —Certain Taxes and Other Measures on Imported Wines and Spirits(Complainant: European Communities)

Cases of Complaints by India

- United States —Countervailing Measures on Certain Hot-Rolled Carbon Steel Flat Products from India (Complainant: India)

- Turkey —Safeguard measures on imports of cotton yarn (other than sewing thread)(Complainant: India)

- European Union and a Member State —Seizure of Generic Drugs in Transit(Complainant: India)

Hence, WTO is a body which provides opportunity to aggrieved country to bring unfair trade practices to notice of Dispute Settlement body and to bring an end to such unfair practice. This dimension of WTO makes it a desirable and neutral body as it seeks to create a just global trading system.

What is Indo – US’s WTO problem?

Since end of cold war both countries have witnessed a spectacular improvement in bilateral relations in almost all spheres. However, at WTO platform two countries remain arch rival and leaders of opposite camps. U.S. has severe disliking for India’s position in atleast two spheres – Agriculture and Intellectual Property.

Agriculture

We have already seen that Agreement on Agriculture which was hatched in Uruguay round negotiations is heavily tilted in favor of developed world. For balancing this India as part of Group of developing and least developed nations (G-33) proposed amendment to AOA in 2008.

Current quest of G-33, toward achieving permanent solution is follow up story of this proposal only. As of now, Peace Clause agreed to in 2013, allows us perpetually to continue our food stocking program at administered prices, without being dragged into WTO for violation of AOA.

Intellectual Property

Further, as part of Doha Development Agenda, developing countries managed to tweak ‘Agreement on Trade related aspects of Intellectual Property’ (TRIPS) in favor of developing countries by allowing compulsory licensing in certain circumstances. First compulsory license was granted by Indian Patent Office to NATCO for ‘nexavar’ drug produced originally by German firm Bayer AG.

Since then US pharma industry has been apprehensive of frequent evocation of this principle in developing world. US not only want this concept to be done away with, it also wants a liberal IPR regime which allows evergreening of patents.

Indian Patent Act as amended in 2005 allows protection of both product and process, but it allows patent only when there is enhanced efficacy of the substance. If a company re-invents a previously known substance in to new form e.g. from Solid to Liquid, then protection can’t be granted. India due to its promising pharmaceutical industry exploits these powers religiously. Since India’s course is not violative of TRIPS, question of India being challenged in WTO doesn’t arise

Domestic Content Requirement in Solar Panel

Recently, India lost this case to US in WTO’s dispute resolution body. India has prescribed ‘domestic content requirement’ for procurement of Solar cells/panels for its target of installing 100 GW of solar power by 2022. Under this some (about 5%) procurement was reserved to be bought from Indian vendors, to promote indigenous industry. US alleged that this is against principles of Non Discrimination and National Treatment.

India now has appealed against this decision and can get 2 year reprieve from rolling back of scheme.

Earlier this year, WTO had ruled against the Indian ban on import of poultry meat, eggs and live pigs from the US, stating that it was not consistent with international norms.

Visa problem

Recently, U.S. has double the fees for certain categories of H1B and L1 visas to $4,000 and $4,500 respectively. H1B and L1 visas are temporary work visas for skilled professionals. India is the largest user of H1B visas (67.4 per cent of the total 161,369 H1B visas issued in FY14 went to Indians) and is also among the largest users of L1 visas (Indians received 28.2 per cent of the 71,513 L1 visas issued in FY14). India is likely to pursue bilateral discussions over the issue, but as last resort it may head to WTO if nothing comes out.

Important Contemporary Issues

Currency War

- China has devalued its currency twice in last 1 year, many economist believe that it is in response to Quantitative easing programme of the USA which has led to depreciation of US dollar against YUAN and hurted Chinese exports. This devaluation is termed as maturation of currency war which is prevailing in world economy since last few years.

What is currency war?

- A currency war refers to a situation where a number of nations seek to deliberately depreciate the value of their domestic currencies in order to stimulate their economies. Although currency depreciation or devaluation is a common occurrence in the foreign exchange market, the hallmark of a currency war is the significant number of nations that may be simultaneously engaged in attempts to devalue their currency at the same time.

- More than 20 countries having reduced interest rates or implemented measures to ease monetary policy from January 2015 and January 2016 , the trillion-dollar question is – are we already in the midst of a currency war

Why do countries indulge in currency war?

- It may seem counter-intuitive, but a strong currency is not necessarily in a nation’s best interests. A weak domestic currency makes a nation’s exports more competitive in global markets, and simultaneously makes imports more expensive.

- Higher export volumes spur economic growth, while pricey imports also have a similar effect because consumers opt for local alternatives to imported products. This improvement in terms of trade generally translates into a lower current account deficit (or a greater current account surplus), higher employment, and faster GDP growth.

- The stimulative monetary policies that usually result in a weak currency also have a positive impact on the nation’s capital and housing markets, which in turn boosts domestic consumption through the wealth effect.

Negative Effects of a Currency War

- Currency depreciation is not the panacea for all economic problems. Brazil is a case in point. The Brazilian real has plunged 48% since 2011, but the steep currency devaluation has been unable to offset other problems such as plunging crude oil and commodity prices, and a widening corruption scandal. As a result, the Brazilian economy is forecast by the IMF to contract 1% in 2015, after barely growing in 2014.

So what are the negative effects of a currency war?

- Currency devaluation may lower productivity in the long-term, since imports of capital equipment and machinery become too expensive for local businesses. If currency depreciation is not accompanied by genuine structural reforms, productivity will eventually suffer.

- The degree of currency depreciation may be greater than what is desired, which may eventually cause rising inflation and capital outflows.

- A currency war may lead to greater protectionism and the erecting of trade barriers, which would impede global trade.

- Competitive devaluation may cause an increase in currency volatility, which in turn would lead to higher hedging costs for companies and possibly deter foreign investment.

Are countries today indulging in currency war?

- The Yuan has lost 5.8 per cent since August 10 when the Chinese central bank devalued the currency. The European Central Bank’s (ECB) has promised to further its quantitative easing programme, While recently Japanese central bank has brought negative interest rate in Japan which is likely to make YEN weaker. Even central bank of many emerging economies like Turkey, Brazil and South Africa are also following easy monetary policy in order to make their currency weak. This has proved that countries are indulging in currency war currently.

Should India indulge in currency war?

- In 2015 the rupee has depreciated just about five per cent against the dollar, compared with a 20-35 per cent loss in currencies of Brazil, Argentina and Turkey. At the same time, the rupee’s peers in Asia have fallen about seven to nine per cent over the past year. Many experts believe that our lack of indulgence in currency war has led to fall in India’s exports and therefore India should indulge in currency war in order to protect our turf. However if we closely analyze we find that Currency war is not a solution for India for number of reasons.

- Currency depreciation is not the panacea for all economic problems. Brazil is a case in point. The Brazilian real has plunged 48% since 2011, but the steep currency devaluation has been unable to offset other problems such as plunging crude oil and commodity prices, and a widening corruption scandal.

- At a time when India is starved of domestic capital, foreign capital has been a savior. In fact, India has been making all efforts to attract foreign capital. A weak rupee impacts their return on capital and would starve India of foreign capital

- Thirdly India’s imports are inelastic and therefore a weak currency could lead to Balance of payment crisis.

- We have also seen other negative effects of currency war above, Therefore India not rely on weak currency to boost its growth and exports instead it should focus on doing real reforms including improving infrastructure, labour reforms, passing GST to have a long term stable and sustainable positive effect on growth and trade.

UNO

The United Nations is an international organization founded in 1945 after the Second World War by 51 countries committed to maintaining international peace and security, developing friendly relations among nations and promoting social progress, better living standards and human rights.

The United Nations was the second multipurpose international organization established in the 20th century that was worldwide in scope and membership. Its predecessor, the League of Nations, was created by the Treaty of Versailles in 1919 and disbanded in 1946.

Due to its unique international character, and the powers vested in its founding Charter, the Organization can take action on a wide range of issues, and provide a forum for its 193 Member States to express their views, through the General Assembly, the Security Council, the Economic and Social Council and other bodies and committees.

UN TIMELINE:

The UN has 4 main purposes :

- To keep peace throughout the world;

- To develop friendly relations among nations;

- To help nations work together to improve the lives of poor people, to conquer hunger, disease and illiteracy, and to encourage respect for each other’s rights and freedoms;

- To be a centre for harmonizing the actions of nations to achieve these goals.

How UN gets Funded

The United Nations (UN) is funded by its member states through compulsory and voluntary contributions. The size of each state’s compulsory contribution depends mainly on its economic strength, though its state of development and debt situation are also taken into account.

Over and above their compulsory contributions, member states also make voluntary contributions to:

- The Specialized Agencies of the UN System such as the UN Educational, Scientific and Cultural Organization (UNESCO) and the World Health Organization (WHO)

- UN Programmes and Funds such as the Office of the UN High Commissioner for Refugees (UNHCR) and the UN Children’s Fund (UNICEF).

Organisation Structure of UN :

The Charter of United Nations established six main bodies of the United Nations Organisation: the General Assembly, the Security Council, the Economic and Social Council, the Trusteeship Council, The International Court of Justice and the Secretariat. Sixth principal organ, the Trusteeship Council, suspended operations in 1994, upon the independence of Palau, the last remaining UN trustee territory and now it has five Principal Organs.

Four of the five principal organs are located at the main UN Headquarters in New York City. The International Court of Justice is located in The Hague. The six official languages of the United Nations, used in intergovernmental meetings and documents, are Arabic, Chinese, English, French, Russian, and Spanish. On the basis of the Convention on the Privileges and Immunities of the United Nations, the UN and its agencies are immune from the laws of the countries where they operate, safeguarding the UN’s impartiality with regard to the host and member countries.

General Assembly:

- The General Assembly is the main deliberative, policymaking and representative organ of the United Nations.

- It is Comprise of all 193 Members of the United Nations.

- It provides a unique forum for multilateral discussion of the full spectrum of international issues covered by the Charter.

- Decisions on important questions, such as those on peace and security, admission of new members and budgetary matters, require a two-thirds majority. Decisions on other questions are by simple majority.

- Each country has one vote in General Assembly.

- It also plays a significant role in the process of standard-setting and the codification of international law.

- The assembly is led by a president, elected from among the member states on a rotating regional basis.

Function & Powers of Assembly:

- Consider and approve the United Nations budget and establish the financial assessments of Member States;

- Elect the non-permanent members of the Security Council and the members of other United Nations councils and organs and, on the recommendation of the Security Council, appoint the Secretary-General;

- Consider and make recommendations on the general principles of cooperation for maintaining international peace and security, including disarmament;

- Discuss any question relating to international peace and security and, except where a dispute or situation is currently being discussed by the Security Council, make recommendations on it;

- Discuss, with the same exception, and make recommendations on any questions within the scope of the Charter or affecting the powers and functions of any organ of the United Nations;

- Initiate studies and make recommendations to promote international political cooperation, the development and codification of international law, the realization of human rights and fundamental freedoms, and international collaboration in the economic, social, humanitarian, cultural, educational and health fields;

- Make recommendations for the peaceful settlement of any situation that might impair friendly relations among nations;

- Consider reports from the Security Council and other United Nations organs.

Security Council:

- IT has primary responsibility for the maintenance of international peace and security.

- It has 15 Members, consisting of 5 permanent members—China, France, Russia, the United Kingdom, and the United States—and 10 non-permanent members.

- Non Permanent seats are held for two-year terms, with member states voted in by the General Assembly on a regional basis

- Five permanent members hold veto power over UN resolutions, allowing a permanent member to block adoption of a resolution, though not debate.

- The presidency of the Security Council rotates alphabetically each month

- The Security Council also recommends to the General Assembly the appointment of the Secretary-General and the admission of new Members to the United Nations.

- Together with the General Assembly, it elects the judges of the International Court of Justice.

Economic and Social Council (ECOSOC) :