Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- India-Pakistan relations

The article pitches for the resumption of India-Pakistan relations. But there are obstacles on both the side which come in the way of such resumption.

Pakistan and relations over Kashmir issue

- In July, the Turkish president had assured Pakistan’s parliament of his country’s support for Islamabad’s Kashmir stand.

- More recently, Malaysia’s former Prime Minister, Mahathir Mohamad, has reiterated his backing for that stand.

- Iran’s current negotiations with China do not necessarily mean alignment with the latter’s Kashmir policy.

- Saudi Arabia and the Gulf countries invited official criticism in Pakistan first time for their refusal to back Pakistan in its disputes with New Delhi.

- Pakistan’s foreign minister had made a remark against Saudi Arabia over its reluctance to convene the meeting of IOC.

- Given the long history of Saudi-Pakistani relations, such remarks suggest a high degree of frustration.

India’s vulnerabilities and relations with Pakistan

- An excess of confidence and an unwillingness to think things through may be India’s vulnerabilities.

- Army’s chief of staff made the statement this year, “If Parliament wants that area [PoK] should be ours at some stage, and if we get such orders, we will definitely act on those directions.”

- Prime Minister made the statement regarding time of a week to 10 days to defeat the neighbouring country in case of war.

Picturing resumption of relations with Pakistan

- In case of war, aware of the total devastation to follow, neither side in an India-Pakistan conflict will press the nuclear button.

- On the other hand, it is also possible, before any war, to imagine negotiations that lead, not necessarily in that order, to a resumption of trade, travel and normal relations, the renunciation of terrorism, and the restoration of the democratic rights of the people of Kashmir.

- While no realistic person today expects such talks, it is not a crime to picture them.

Conclusion

Amicable relations with Pakistan may seem remote but they are worth striving for.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: NDHM

Mains level: Paper 2- National Digital Health Mission

The National Digital Health Mission promises to transform the Indian healthcare system with the aid of technology. The article highlights the key aspects of the mission.

Building integrated digital health infrastructure through NDHM

- NDHM is based on the principles of health for all, inclusivity, accessibility, affordability, education, empowerment, wellness, portability, privacy and security by design.

- NDHM will build the backbone necessary to create an integrated digital health infrastructure.

- With its key building blocks HealthID, DigiDoctor, Health Facility Registry, Personal Health Records, Telemedicine, and e-Pharmacy, the mission will bring together disparate stakeholders and radically strengthen and, thus change India’s healthcare delivery landscape.

- NDHM is also a purposeful step towards the achievement of the United Nations’ Sustainable Development Goal of Universal Health Coverage.

Importance of digital intervention in health service

- Digital interventions significantly enhance the outcomes of every health service delivery programme.

- Importance of digital intervention is demonstrated in the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana scheme.

- Under PM-JAY, 1.2 crore cashless secondary and tertiary care treatments have been provided using an indigenously developed state-of-the-art IT platform.

- The Arogya Setu mobile app deploys ICT innovations for contract tracing.

Principal highlight of NDHM

1) Voluntary in nature

- HealthID is entirely voluntary for citizens.

- Its absence will not mean denial of healthcare to a citizen.

- They can choose to generate their Health Account or ID using their Aadhaar card or digitally authenticable mobile number and by using their basic address-related details and email ID.

- The use of Aadhaar, therefore, is not mandatory.

2) Data sharing based on consent

- Providing access to and sharing of personal health records is a prerogative of the HealthID holder.

- The consent of the health data owner is required to access this information or a part of it.The consent can be withdrawn anytime.

- The personal health record will enable citizens to store and access their health data, provide them with more comprehensive information and empower them with control over their private health records.

3) Compliance with laws and fundamental rights

- NDHM has been built within a universe of fundamental rights and legislation such as the Aadhaar Act and the IT Act 2008 as well as the Personal Data Protection Bill 2019.

- This project is also informed by the entire gamut of Supreme Court judgments and core democratic principles of cooperative federalism.

- The Mission gets its strategic and technical foundation from the National Digital Health Blueprint, the architectural framework of which keeps the overall vision of NHP 2017 at its core and ensures security and privacy by design.

4) Reaching out to the unconnected population

- NHDM is a digital mission led by technology powered by the internet.

- So, to reach out to and empower the large number of “unconnected” masses specialised systems are being built and off-line modules that will be designed to reach out to the “unconnected”.

5) Partnership with all key stakeholders

- The design of NDHM has been built on the principle of partnership with all key stakeholders — doctors, health service providers, technology solution providers and above all citizens.

- Without their belief, trust, adoption, and stewardship, this mission will not achieve its desired result.

Consider the question “Examine the key aspects of the National Digital Heath Mission and how it could help transform the Indian healthcare landscape?”

Conclusion

NDHM is a mission whose time has come because health is the first step towards self-reliance and only a healthy nation can become Atma Nirbhar.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Provision of compensation to states under GST

Mains level: Paper 3- Issues of GST compensation to states.

The article analyses the issue of GST compensation to states under GST regime for five years and how this has turned to be contentious issues after the economic disruption caused by Covid-19.

The basis for compensation

- Under Goods and Services Tax (GST) regime the Centre would make good the loss in the first five years if States faced revenue deficits after the GST’s introduction.

- States sacrificed their constitutionally granted powers of taxation in the national interest.

GST compensation cess

- To pay the compensation to states, GST compensation cess was introduced.

- When the GST compensation cess exceeded the amount that had to be paid to States, the Central government absorbed the surplus.

- Now, the economy has slowed down dramatically and the resources raised are insufficient.

- The Centre is raising questions about whether it is legally accountable to pay compensation.

- The constitutional framework that ushered in the GST does not provide an escape clause for ‘Acts of God’.

Way forward

- As stated by the Secretary of the GST Council in the tenth meeting, the central government could raise resources by other means for compensation and this could then be recouped by continuing the cess beyond five years.

- Monetary measures are the monopoly of the central government.

- Even borrowing is more efficient and less expensive if it is undertaken by the Central government.

- As equal representatives of the citizens State governments expected the Centre to demonstrate empathy and provide them relief through the Consolidated Fund of India.

Conclusion

Central government should consider the legal provision in the GST regime and act in the spirit of cooperative federalism.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: GST Compensation

Mains level: Changes in taxation after GST regime

With Centre-State friction over pending compensation payments under the Goods and Services Tax (GST) taking a new turn in the 41st GST Council to meet, the strain on the finances of states is likely to continue in the near term.

Try this question from CSP 2018:

Q.Consider the following items:

- Cereal grains hulled

- Chicken eggs cooked

- Fish processed and canned

- Newspapers containing advertising material

Which of the above items is/are exempt under GST (Goods and Services Tax)?

(a) 1 only

(b) 2 and 3 only

(c) 1, 2 and 4 only

(d) 1, 2, 3 and 4

What is GST?

- GST, being a consumption-based tax, would result in loss of revenue for manufacturing-heavy states.

- GST launched in India on 1 July 2017 is a comprehensive indirect tax for the entire country.

- It is charged at the time of supply and depends on the destination of consumption.

- For instance, if a good is manufactured in state A but consumed in state B, then the revenue generated through GST collection is credited to the state of consumption (state B) and not to the state of production (state A).

Compensation under GST regime

- Due to the consumption-based nature of GST, manufacturing states like Gujarat, Haryana, Karnataka, Maharashtra and Tamil Nadu feared a revenue loss.

- Thus, GST Compensation Cess or GST Cess was introduced by the government to compensate for the possible revenue losses suffered by such manufacturing states.

- However, under existing rules, this compensation cess will be levied only for the first 5 years of the GST regime – from July 1st, 2017 to July 1st, 2022.

- Compensation cess is levied on five products considered to be ‘sin’ or luxury as mentioned in the GST (Compensation to States) Act, 2017 and includes items such as- Pan Masala, Tobacco, and Automobiles etc.

Alternatives to prevent losses

- The input tax credit can help a producer by partially reducing GST liability by only paying the difference between the tax already paid on the raw materials of a particular good and that on the final product.

- In other words, the taxes paid on purchase (input tax) can be subtracted from the taxes paid on the final product (output tax) to reduce the final GST liability.

Distributing GST compensation

- The compensation cess payable to states is calculated based on the methodology specified in the GST (Compensation to States) Act, 2017.

- The compensation fund so collected is released to the states every 2 months.

- Any unused money from the compensation fund at the end of the transition period shall be distributed between the states and the centre as per any applicable formula.

Significance of GST compensation

- States no longer possess taxation rights after most taxes, barring those on petroleum, alcohol, and stamp duty were subsumed under GST.

- GST accounts for almost 42% of states’ own tax revenues, and tax revenues account for around 60% of states’ total revenues.

- Finances of over a dozen states are under severe strain, resulting in delays in salary payments and sharp cuts in capital expenditure outlay amid the pandemic-induced lockdowns and the need to spend on healthcare.

Back2Basics:

Goods and Services Tax

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Land Bank System

Mains level: Digital land records

A prototype of the National GIS-enabled Land Bank System was e-launched by Commerce and Industry Ministry for six States based on which land can be identified for setting up industries.

Try to answer this question in short:

Q.Discuss the benefits of digitizing land records in India.

Land Bank System

- The system has been developed by the Integration of Industrial Information System (IIS) with state GIS (Geographic Information System).

- IIS portal is a GIS-enabled database of industrial clusters/areas across the states.

- On the system, more than 3,300 industrial parks across 31 states/UTs covering about 4,75,000 hectares of land have also been mapped out on the system.

- The information available on the system will include drainage, forest; raw material heat maps (horticulture, agricultural, mineral layers); multilayer of connectivity.

- IIS has adopted a committed approach towards industrial upgrading, resource optimization, and sustainability.

Various stakeholders

- The initiative has been supported by the National e-Governance Division (NeGD), National Centre of Geo-Informatics (NCoG), Invest India, Bhaskaracharya Institute for Space Applications and Geo-Informatics (BISAG), and Ministry of Electronics and Informational Technology.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Dr Kotnis and his legacy

Mains level: NA

A bronze statue of Indian doctor Dwarkanath Kotnis is set to be unveiled in China.

Try this PYQ:

Q.A recent movie titled The Man Who Knew Infinity is based on the biography of

(a) S. Ramanujan

(b) S. Chandrasekhar

(c) S. N. Bose

(d) C. V. Raman

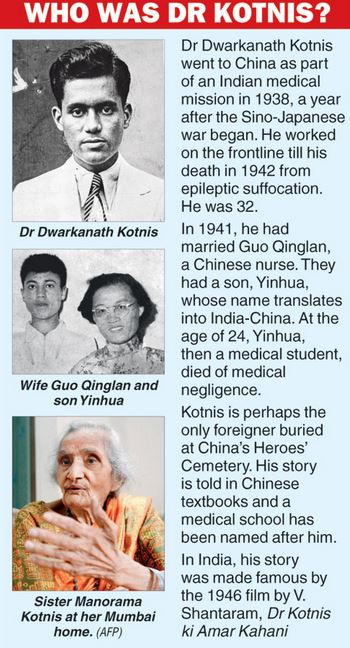

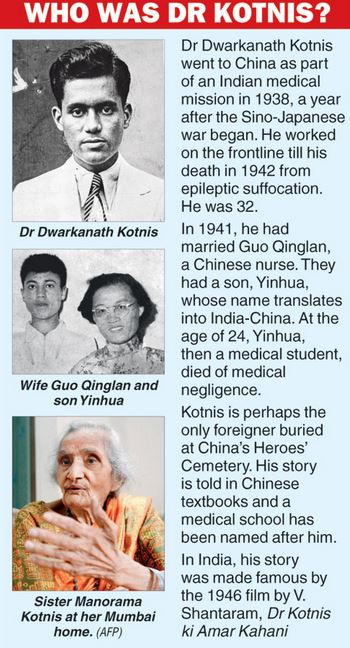

Dr. Dwarkanath Kotnis

- He is revered in China for his contributions during the Chinese revolution headed by its founder Mao Zedong and World War II.

- He hailed from Sholapur in Maharashtra came to China in 1938 as part of a five-member team of doctors sent by the Indian National Congress to help the Chinese during World War II.

- He joined the Communist Party of China (CPC) in 1942 and died the same year at the age of 32.

- Kotnis’ medical assistance during the difficult days of the Chinese revolution was praised by Chinese leader Mao Zedong.

- His statues and memorials were also set in some of the Chinese cities in recognition of his services.

A revered personality in China

- Late Chinese leader Mao Zedong was deeply affected by his death.

- Mao wrote in his eulogy that “the army has lost a helping hand; the nation has lost a friend. Let us always bear in mind his internationalist spirit”.

- Kotnis is remembered not only as a symbol inspiring medical students to work hard, but also an eternal bond between the people of China and India.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Barn Owl

Mains level: Not Much

With a thriving rat population playing havoc with its coconut yield, the UT of Lakshadweep hires barn owls for help.

Try this PYQ:

Q.The Red Data Books published by the International Union for Conservation of Nature and Natural Resources (IUCN) contains lists of:

- Endemic plant and animal species present in the biodiversity hotspots.

- Threatened plant and animal species.

- Protected sites for conservation of nature and natural resources in various countries.

Select the correct answer using the codes given below:

(a) 1 and 3

(b) 2 only

(c) 2 and 3

(d) 3 only

Barn Owl

IUCN status: Least Concerned

- The barn owl is the most widely distributed species of owl in the world and one of the most widespread of all species of birds.

- It is found almost everywhere in the world except for the polar and desert regions, Asia north of the Himalayas, most of Indonesia, and some Pacific islands.

What is Barn?

- A barn is an agricultural building usually on farms and used for various purposes.

- It refers to structures that house livestock, including cattle and horses, as well as equipment and fodder, and often grain.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Eklavya Model Residential Schools

Mains level: Tribal education

An Eklavya Model Residential School (EMRS) teacher was selected for National Award to Teachers 2020.

Note the specific features of EMRS. Each year in the CSP, there is a question related to tribes/tribal development.

Eklavya Model Residential Schools

- EMRS started in the year 1997-98 to impart quality education to ST children in remote areas in order to enable them to avail of opportunities in high and professional education courses and get employment in various sectors.

- Across the country, as per census 2011 figures, there are 564 such sub-districts out of which there is an EMRS in 102 sub-districts.

- As per revised 2018 scheme, every block with more than 50% ST population and at least 20,000 tribal persons, will have an EMRS by the year 2022.

- These schools will be on par with Navodaya Vidyalayas and will have special facilities for preserving local art and culture besides providing training in sports and skill development.

Features of EMRS

- Admission to these schools will be through selection/competition with suitable provision for preference to children belonging to Primitive Tribal Groups, first-generation students, etc.

- Sufficient land would be given by the State Government for the school, playgrounds, hostels, residential quarters, etc., free of cost.

- The number of seats for boys and girls will be equal.

- In these schools, education will be entirely free.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now