Privatisation of Public Sector Enterprises in India

Privatisation is a process by which the government transfers the productive activity from the public sector to the private sector.

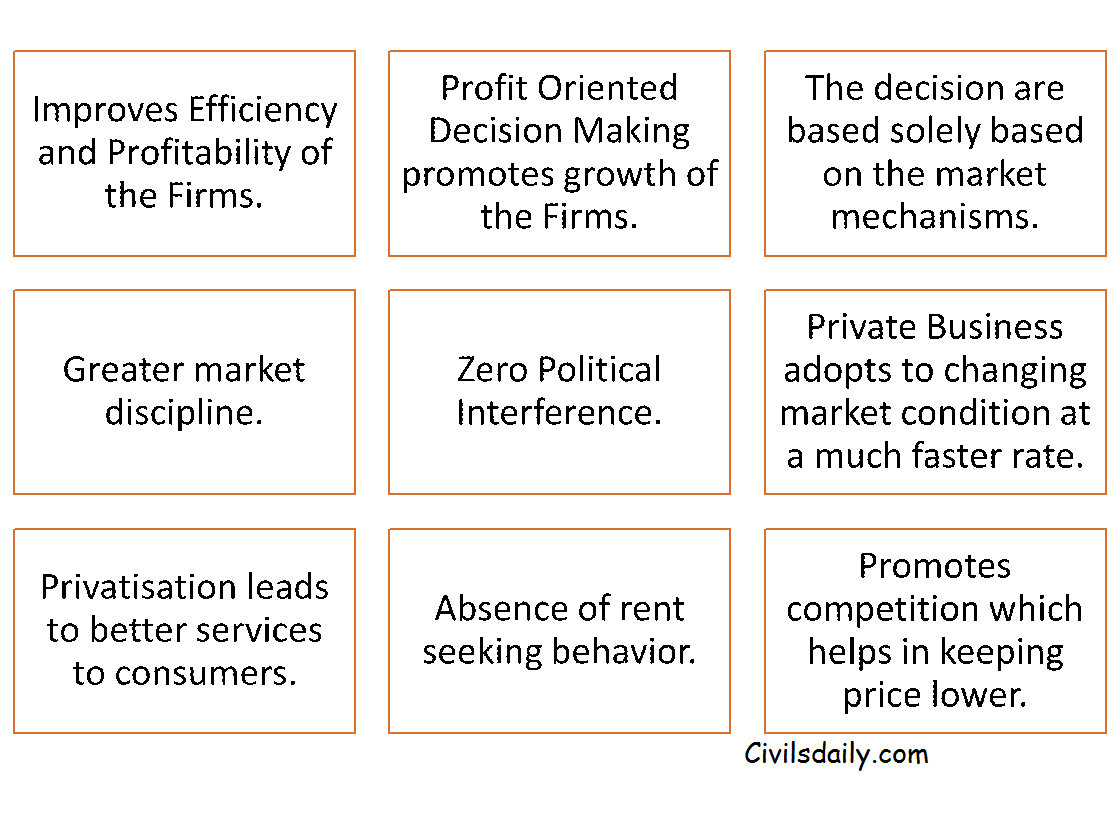

Privatisation offers many advantages.

Methods of Privatisation adopted in India.

Methods of Privatisation adopted in India.

Initial Public Offers (IPO).

IPOs are the most favoured method of privatisation followed in the developed countries of Europe and OECD. Under this method, the shares/equity holdings of the PSUs are sold to the private retail investors and institutions like Mutual Fund houses, Pension Funds and Insurance Companies etc.

The prerequisite for the IPOs to be successful is that a country must have a well-developed and well-functioning Capital Market.

The main advantages of the IPO method are:

- It ensures wide participation of retail investors.

- It is likely to face less resistance from the PSUs stakeholders like employees, as the method involves only selling of PSUs shares without any change in the management and policies.

- It can be used to offer shares to the employees.

- The method is best suited when the government wanted to raise financial resources without losing on the management and control of the PSU.

Strategic Sale.

Strategic Sale is a method in which the government decides to sell PSU shares to a strategic partner. The management in all such cases passes to the strategic buyer.

The various advantages of the method are:

- The performance of the PSU is expected to improve as the private player selected will already have an expertise in the management and operation of the PSU.

- The strategic partner will be willing to pay a better price for the PSU as his business interest lies in combining his own business with that of PSU.

- The method helps in infusion of capital and modernisation of the PSUs.

- The method also helps the government in transferring the loss making PSU which could not have been attractive to retail buyers otherwise. The strategic partner will acquire such business as he has the prerequisite skills to turnaround the PSU.

- The method is very important for countries having less developed capital market.

Disadvantages:

Sale to Foreign Firms.

The method is a variant of the strategic sales method where the government decides to sell the PSUs to the foreign firms.

Management and Employees Buy outs.

In this route, management and employees come forward to but the shares and equities of the PSUs.

Disinvestment.

The method is followed in India from time to time. The method involves the sale of the Public sector equity to the private sector and the public at large.

Methods of Disinvestment

There are primarily three different approaches to disinvestments (from the sellers’ i.e. Government’s perspective)

- Minority Disinvestment

- Majority Disinvestment

- Complete Privatisation