Direct Benefits Transfers

Centre extends Ujjwala Subsidy by another Year

From UPSC perspective, the following things are important :

Prelims level: Ujjwala Scheme

Mains level: NA

In the news

- In pretext of the upcoming Lok Sabha elections, the Union Cabinet approved the extension of the subsidy under the Pradhan Mantri Ujjwala Yojana (PMUY) for LPG cylinders, offering a subsidy of ₹300 (earlier ₹200) per cylinder for up to 12 refills per year.

About Ujjwala Scheme

| Details | |

| Launch | 1 May 2016 |

| Introduced By | Ministry of Petroleum and Natural Gas |

| Aim | Provide clean cooking fuel (LPG) to rural and disadvantaged households, reducing reliance on traditional fuels like firewood, coal, and cow dung cakes. |

| Phases |

|

| Financial Support | ₹1600 financial assistance provided for each LPG connection to Below Poverty Line (BPL) households. |

| Deposit-Free Connections | Beneficiaries receive deposit-free LPG connections, including the first refill and a free hotplate. |

| Benefits |

|

Try a similar PYQ from CSE Prelims 2018:

With reference to Pradhan Mantri Kaushal Vikas Yojana, consider the following statements:

- It is the flagship scheme of the Ministry of Labour and Employment.

- It, among other things, will also impart training in soft skills, entrepreneurship, financial and digital literacy.

- It aims to align the competencies of the unregulated workforce of the country to the National Skill Qualification Framework.

Which of the statements given above is/are correct?

(a) 1 and 3 only

(b) 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

Nrega, Nyay and PM-Kisan: Why do politicians rush to give direct benefits?

From UPSC perspective, the following things are important :

Prelims level: NYAY Scheme

Mains level: Read the attached story

Introduction

- Revival of NYAY: A mainstream political party has revived its 2019 manifesto center-piece, the NYAY scheme (Nyuntam Aay Yojana or Minimum Income Scheme), ahead of the 2024 general election.

- Promised Benefits: The party announced that if elected, the party would implement NYAY, providing women with an annual income of Rs 60,000-70,000.

Background of NYAY and PM-KISAN

- NYAY’s 2019 Proposal: Its 2019 manifesto promised NYAY to the poorest 20% of Indian families, guaranteeing Rs 72,000 annually to each eligible family.

- Comparison with PM-KISAN: Around the same time, the incumbent government launched PM-KISAN, providing Rs 6,000 per year to farmer families, showcasing the appeal of direct benefit transfers (DBTs).

Understanding Universal Basic Income (UBI) vs. Targeted Schemes

- UBI Definition: UBI involves providing a basic income to every citizen, from the wealthiest to the poorest, with the simultaneous removal of all subsidies.

- Differences with NYAY/PM-KISAN: These schemes are not UBI as they don’t remove existing subsidies, offer a smaller amount than a basic income, and are targeted rather than universal.

Challenges and Questions Surrounding UBI and DBTs

- Affordability: No country has been able to afford UBI due to its high costs and the population size, especially in countries like India.

- Political Backlash: Removing existing subsidies to fund UBI could lead to significant political backlash.

- Effectiveness of DBTs: Despite criticisms of being mere doles or freebies, DBTs have been seen as effective in alleviating economic distress in various situations.

Rationale behind Direct Benefit Transfers

- Economic Arguments: Direct cash transfers can stimulate local economies and create a virtuous cycle of development.

- Empowerment: Providing cash can empower individuals to make their own decisions and invest in their futures.

A Radical Policy Solution: Direct Cash Transfers

- Provocative Proposition: In their 2010 book, “Just give money to the poor: The Development Revolution from the Global South,” authors Joseph Hanlon, Armando Barrientos, and David Hulme advocate for unconditional cash transfers to the poor.

- Historical Shifts in Welfare Thinking: The book outlines four paradigm shifts in welfare policies:

- 16th-century England’s collective responsibility for subsistence.

- Increased social spending and introduction of pensions in late-19th-century Europe.

- Mid-20th-century recognition of an adequate standard of living as a human right.

- Early 21st-century trend in the Global South of using cash transfers to combat poverty and promote development.

Case for Unconditional Cash Transfers

- Argument for Simplicity and Effectiveness: The authors argue that providing money directly to the poor, without conditions, is a promising approach for reducing poverty and fostering long-term development.

- Global Examples: They cite successful examples from Mexico, South Africa, Namibia, Brazil, Indonesia, and India (NREGA), where governments have implemented such policies.

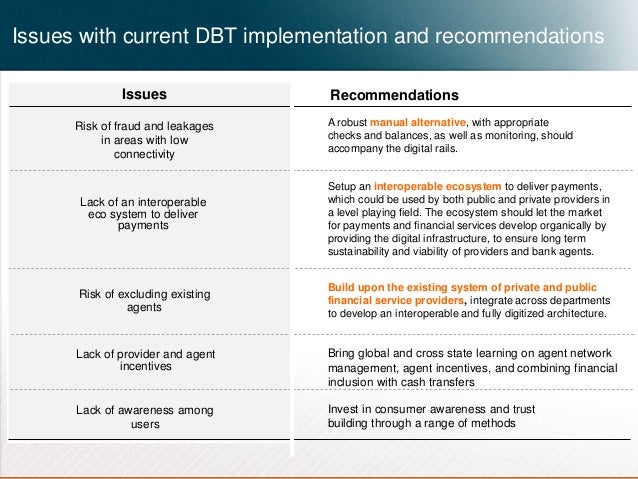

Implementation Challenges and Principles

- Effective Implementation: Successful DBT programs require fairness, assurance, practicality, sufficient payment size, and political acceptability.

- International Examples: Developed countries have implemented various forms of cash transfers, indicating the potential benefits of such policies.

Public Perception and Political Strategy

- Rejection of Higher Cash Transfers: The public’s rejection of 2019 NYAY offer suggests that implementation and trust are as crucial as the policy itself.

- Political Discourse: The debate over DBTs often gets mired in political rhetoric, overshadowing the policy’s potential benefits and challenges.

Conclusion

- Balancing Act: India must balance the immediate relief provided by DBTs with long-term strategies for poverty alleviation and economic empowerment.

- Learning from the Past: The revival of NYAY and the ongoing debate on DBTs provide an opportunity to learn from past experiences and design more effective and inclusive policies.

- Future of Welfare Policies: As India approaches the 2024 general election, the discourse on NYAY, PM-KISAN, and similar schemes will play a crucial role in shaping the country’s welfare policies.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

For government schemes, a path to dignity for the poor

Key Highlights:

- India’s Direct Benefit Transfer (DBT) system lauded globally as a “logistical marvel.”

- DBT utilizes digital infrastructure to directly transfer government scheme benefits, covering 310 schemes across 53 ministries.

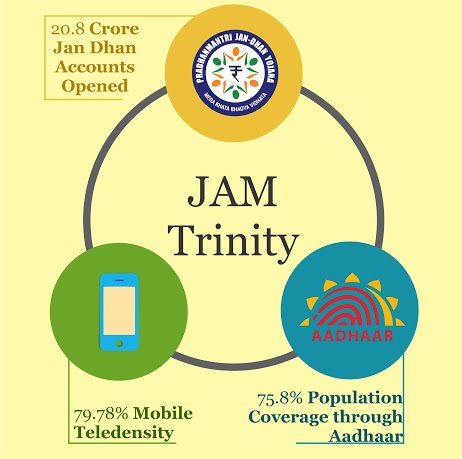

- The JAM Trinity (Jan Dhan, Aadhaar, and Mobile) post-2017-18 maximized DBT’s impact.

Dignity of the Poor:

- DBT’s overlooked benefit is its preservation of the dignity of the poor.

- Without corruption or leakages, DBT eliminates the need for the poor to parade for government benefits.

- Shift in approach—government benefits reaching the poor directly without intermediaries.

Poverty Perspectives and Historical Context:

- Discussion on poverty perspectives, referencing Michael Young’s “The Rise of The Meritocracy.”

- Challenge to the prevailing view that poverty is an individual’s fault, offering an alternative, rights-based approach.

- Advocacy for understanding poverty from an individual rights perspective and addressing historical contexts.

Rights-Based Approach to Poverty:

- Recognition of basic security rights for citizens regarding food, shelter, and health.

- Emphasis on shared societal responsibility for poverty, especially by the rich and elite.

- Contrast with technical solutions, highlighting the need to work with the poor.

Preserving Dignity in Design:

- Importance of not just providing benefits but also considering how they are delivered.

- DBT as a mechanism that ensures rightful benefits reach the poor while preserving their dignity.

- Elimination of the poverty parade with the government reaching the poor.

Replicating DBT Success:

- Suggestion to replicate the DBT design in other areas, with a focus on the judiciary.

- Reference to the judiciary’s challenges and an appeal to ensure justice reaches the poor efficiently.

- Call for collective efforts to address complex problems.

Challenges:

- Unquantifiable nature of preserving dignity makes it challenging to measure its impact.

- The need for broader societal shifts in perspectives on poverty and shared responsibilities.

Key Phrases:

- JAM Trinity (Jan Dhan, Aadhaar, and Mobile)

- Poverty parade

- Rights-based approach

- Shared societal responsibility

- Technical solutions vs. working with the poor

- Veil of ignorance (Rawlsian perspective)

- Dignity preservation in program design

Critical Analysis:

- Emphasis on the overlooked aspect of preserving dignity brings a unique perspective.

- The article challenges prevailing views on poverty, advocating for a rights-based approach.

- DBT is presented as a successful model, but challenges of replicating its success are acknowledged.

- The article connects poverty perspectives with societal responsibilities and justice delivery.

Key Examples and References for value addition:

- Michael Young’s “The Rise of The Meritocracy”

- The Tyranny of Experts by William Easterly

Key Data and Facts:

- 310 government schemes across 53 ministries utilize DBT.

- Estimated savings of 1.14% of GDP attributed to DBT.

Key Terms:

- Direct Benefit Transfer (DBT)

- JAM Trinity

- Rights-based approach

- Poverty parade

- Veil of ignorance

- Shared societal responsibility

Way Forward:

- Advocacy for applying DBT’s success in other sectors, particularly the judiciary.

- Acknowledgment of complexity but a call for collective efforts to address challenges.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

Rythu Bandhu Scheme suspended ahead of Elections

From UPSC perspective, the following things are important :

Prelims level: Rythu Bandhu Scheme

Mains level: Not Much

Central Idea

- The ECI ordered the Telangana government to stop all the disbursements under the state government’s Rythu Bandhu Scheme after a violation of the model codes of conduct.

Rythu Bandhu Scheme: Key Facts

- The Rythu Bandhu scheme is also known as Farmer’s Investment Support Scheme (FISS).

- It is a welfare programme for farmers started in 2018 by the Telangana government.

- Under the scheme, the state government provided the 58 lakh farmers in Telangana with ₹5,000 per acre of their land as a farm investment for two crops.

- There is no ceiling on the number of acres held by a farmer.

- So, a farmer who owns two acres of land would receive Rs 20,000 a year, whereas a farmer who owns 10 acres would receive Rs 1 lakh a year from the government.

- This investment is made twice a year, once for kharif harvest and once for Rabi harvest.

- It is the country’s first direct farmer investment support scheme where cash is paid directly to the beneficiary.

Reasons for suspension

- The election commission had allowed the disbursement of funds for the rabi harvest this season, provided they are not publicised, in accordance with the model code of conduct.

- However, the model code was violated after the state finance minister made a public announcement of the same.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

For government schemes, a path to dignity for the poor

From UPSC perspective, the following things are important :

Prelims level: Direct Benefit Transfer (DBT) JAM Trinity

Mains level: DBT's success

Key Highlights:

- India’s Direct Benefit Transfer (DBT) system lauded globally as a “logistical marvel.”

- DBT utilizes digital infrastructure to directly transfer government scheme benefits, covering 310 schemes across 53 ministries.

- The JAM Trinity (Jan Dhan, Aadhaar, and Mobile) post-2017-18 maximized DBT’s impact.

Dignity of the Poor:

- DBT’s overlooked benefit is its preservation of the dignity of the poor.

- Without corruption or leakages, DBT eliminates the need for the poor to parade for government benefits.

- Shift in approach—government benefits reaching the poor directly without intermediaries.

Poverty Perspectives and Historical Context:

- Discussion on poverty perspectives, referencing Michael Young’s “The Rise of The Meritocracy.”

- Challenge to the prevailing view that poverty is an individual’s fault, offering an alternative, rights-based approach.

- Advocacy for understanding poverty from an individual rights perspective and addressing historical contexts.

Rights-Based Approach to Poverty:

- Recognition of basic security rights for citizens regarding food, shelter, and health.

- Emphasis on shared societal responsibility for poverty, especially by the rich and elite.

- Contrast with technical solutions, highlighting the need to work with the poor.

Preserving Dignity in Design:

- Importance of not just providing benefits but also considering how they are delivered.

- DBT as a mechanism that ensures rightful benefits reach the poor while preserving their dignity.

- Elimination of the poverty parade with the government reaching the poor.

Replicating DBT Success:

- Suggestion to replicate the DBT design in other areas, with a focus on the judiciary.

- Reference to the judiciary’s challenges and an appeal to ensure justice reaches the poor efficiently.

- Call for collective efforts to address complex problems.

Challenges:

- Unquantifiable nature of preserving dignity makes it challenging to measure its impact.

- The need for broader societal shifts in perspectives on poverty and shared responsibilities.

Key Phrases:

- JAM Trinity (Jan Dhan, Aadhaar, and Mobile)

- Poverty parade

- Rights-based approach

- Shared societal responsibility

- Technical solutions vs. working with the poor

- Veil of ignorance (Rawlsian perspective)

- Dignity preservation in program design

Critical Analysis:

- Emphasis on the overlooked aspect of preserving dignity brings a unique perspective.

- The article challenges prevailing views on poverty, advocating for a rights-based approach.

- DBT is presented as a successful model, but challenges of replicating its success are acknowledged.

- The article connects poverty perspectives with societal responsibilities and justice delivery.

Key Examples and References for quality enrichment of mains answers:

- Michael Young’s “The Rise of The Meritocracy”

- The Tyranny of Experts by William Easterly

- Reference to the judiciary’s challenges and the appeal of the first woman tribal President.

Key Data and Facts:

- 310 government schemes across 53 ministries utilize DBT.

- Estimated savings of 1.14% of GDP attributed to DBT.

- 79,813 cases pending before 34 judges in the judiciary.

Key Terms:

- Direct Benefit Transfer (DBT)

- JAM Trinity

- Rights-based approach

- Poverty parade

- Veil of ignorance

- Shared societal responsibility

Way Forward:

- Advocacy for applying DBT’s success in other sectors, particularly the judiciary.

- Acknowledgment of complexity but a call for collective efforts to address challenges.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

What is Public Financial Management System (PFMS)?

From UPSC perspective, the following things are important :

Prelims level: PFMS, PAC

Mains level: Read the attached story

The Public Accounts Committee (PAC), in its report found that the tasks related to the implementation of the PFMS appeared to have been dealt with a casual approach and there was no proper financial planning.

Public Finance Management System (PFMS)

- PFMS is an online platform developed and implemented by the office of the Controller General of Accounts (CGA) under the Union Ministry of Finance.

- The PFMS portal is used to make direct payments to beneficiaries of government schemes.

- PFMS initially started as a Plan scheme named CPSMS of the Planning Commission in 2008-09 as a pilot in four States of Madhya Pradesh, Bihar, Punjab and Mizoram.

- It was for four Flagship schemes e.g. MGNREGS, NRHM, SSA and PMGSY.

- In December, 2013 the Union Cabinet approved the national roll out of PFMS for all States.

Mandate of PFMS

PFMS has been mandated the following:

- It acts as a financial management platform for all plan schemes and allows for efficient and effective tracking of fund flow to the lowest level of implementation for the planning scheme of the Government.

- It is mandated to provide information on fund utilization leading to better monitoring, review, and decision support system to enhance public accountability in the implementation of plan schemes.

- To result in effectiveness and economy in Public Finance Management through better cash management for Government transparency in public expenditure and real-time information on resource availability and utilization across schemes.

Achievements of PFMS

- PFMS can be credited to the transformation of Direct Beneficiary Transfers space in financial governance in India.

- An estimated 102 crore DBT transactions were done through PFMS in FY 19-20 amounting to about ₹2.67 lakh crore.

- Through efficient use of technology, PFMS is estimated to have saved about ₹1 lakh crore in direct beneficiary transfers.

Factors that could determine the successful evolution of PFMS in future

- Agility in terms of Onboarding/Integrating all Govt. accounts: Only after ensuring significant coverage, the true execution of the concept will take place.

- Effective data management capabilities: PFMS will have to add significant data management capabilities in order to ensure better monitoring/review to deliver on the idea of a decision support system for effective cash management or management of idle float in the system.

- Constantly upgrading: Adaption to rapid changes in technology is another key area that would call for a considerable amount of focus both in terms of gradation and monitoring.

- Collaboration with the banking system: Lastly, one of the most critical factors for the successful execution of PFMS is its integration with the banking systems.

What did PAC observe now?

- PAC is concerned over data security of PFMS.

- It observed that in the absence of a dedicated workforce, a key strategic system like the PFMS could possibly encounter new threats every now and then owing to the advancements in technology.

- It stressed the need for a thorough assessment of physical and technical infrastructure along with back-up arrangements required in the PFMS scheme.

Conclusion

- The PFMS has revolutionized the ways public finances are managed in the country.

- With constant improvement and increasing coverage, the scope of PFMS is ever-increasing.

Back2Basics: Public Accounts Committee

- The PAC is a committee of selected members of parliament constituted for the purpose of auditing the revenue and the expenditure of the Government of India.

- It was established in 1921 after its first mention in the Government of India Act, 1919.

- PAC is one of the parliamentary committees that examine the annual audit reports of CAG, which the President lays before the Parliament of India.

- It seeks to examines public expenditure.

- Those three reports submitted by CAG are:

- Audit report on appropriation accounts

- Audit report on finance accounts

- Audit report on public undertakings

Its members-

- It consists of not more than twenty-two members, fifteen elected by Lok Sabha and not more than seven members of Rajya Sabha, the upper house of the Parliament.

- The members are elected every year from amongst its members of respective houses according to the principle of proportional representation by means of single transferable vote.

- None of its members are allowed to be ministers in the government.

Click and get your FREE Copy of CURRENT AFFAIRS Micro Notes

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

67% drop in PM-KISAN pay-out in 3 years

From UPSC perspective, the following things are important :

Prelims level: PM KISAN

Mains level: Success of the DBT schemes

The number of farmers who received the 11th installment of funds from the Prime Minister’s Kisan Samman Nidhi (PM-KISAN) had fallen by 67%.

What is PM-KISAN?

- The PM-KISAN Yojana is a government scheme through which, all small and marginal farmers will get up to Rs 6,000 per year as minimum income support.

- It is a Central Sector scheme with 100% funding from GoI. It has become operational since 1st December 2018.

- Under the PM-KISAN scheme, all landholding farmers’ families shall be provided with the financial benefit of Rs. 6000 per annum per family payable in three equal instalments of Rs. 2000 each, every four months.

- The definition of the family for the scheme is husband, wife, and minor children.

- State Government and UT administration will identify the farmer families which are eligible for support as per scheme guidelines.

- The fund will be directly transferred to the bank accounts of the beneficiaries.

Note: Aadhaar was made optional for availing the first instalment (December 2018 – March 2019). But now it is mandatory.

Who are NOT eligible for PM-KISAN?

The following categories of beneficiaries of higher economic status shall not be eligible for benefit under the scheme.

- All Institutional Landholders

Farmer families that belong to one or more of the following categories:

- Former and present holders of constitutional posts

- Former and present Ministers/ State Ministers and former/present Members of Lok Sabha/ Rajya Sabha/ State Legislative Assemblies/ State Legislative Councils, former and present Mayors of Municipal Corporations, former and present Chairpersons of District Panchayats.

- All serving or retired officers and employees of Central/ State Government Ministries

- All superannuated/retired pensioners whose monthly pension is Rs.10,000/-or more. (Excluding Multi-Tasking Staff / Class IV/Group D employees) of the above category

- All Persons who paid Income Tax in the last assessment year

- Professionals like Doctors, Engineers, Lawyers, Chartered Accountants, and Architects registered with Professional bodies and carrying out the profession by undertaking practices.

Note: It is not so easy to remember all such exclusions. But one must be able to recognize them by applying pure logic and thumb rule. This can be well understood from the PYQ given.

Plus, West Bengal is yet to implement the PM-KISAN scheme while the farmers have completed their registrations!

Why in news?

Ans. Fall in number of beneficiaries

- PM Kisan was one of the largest Director Benefits Transfer schemes in the world and certain higher income categories of farmer families were excluded from the benefits.

- But 67% reduction in overall beneficiaries clearly points to exclusion of eligible beneficiaries too.

- Only about three crore farmers in India had received all the 11 instalments.

How are states responsible?

- The responsibility of maintaining the data of beneficiaries, remained with the States.

- The Scheme extensively uses digital technologies to verify eligibility of farmers.

- States/ UTs upload the data of eligible farmers after verification of the farmers, in terms of eligibility and exclusion criterion prescribed under the scheme.

- The data of farmers so uploaded by States goes through several validations, through the portals of UIDAI, PFMS, Income Tax Portal and NPCI.

Try this PYQ:

Q.Under the Kisan Credit Card Scheme, short-term credit support is given to farmers for which of the following purposes? (CSP 2020)

- Working capital for maintenance of farm assets

- Purchase of combine harvesters, tractors and mini trucks

- Consumption requirements of farm households

- Construction of family house and setting up of village cold storage facility

- Construction of family house and setting up of village cold storage facility

Select the correct answer using the code given below:

(a) 1,2 and 5 only

(b) 1,3 and 4 only

(c) 2,3,4 and 5 only

(d) 1, 2, 3 and 4

Post your answers here.

Click and get your FREE Copy of CURRENT AFFAIRS Micro Notes

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

India’s Direct Benefit Transfer Schemes

From UPSC perspective, the following things are important :

Prelims level: JAM trinity

Mains level: JAM trinity, financial inclusion and Direct Benefit Transfer

Context

- Last week, the International Monetary Fund (IMF) lauded India’s Direct Benefit Transfer (DBT) Scheme as a “logistical marvel” that has reached hundreds of millions of people and specifically benefitted women, the elderly and farmers. Paolo Mauro, Deputy Director in the IMF’s Fiscal Affairs Department, praised the role of technological innovation in achieving this feat.

What is Direct Benefit Transfer(DBT)?

- With the aim of reforming Government delivery system by re-engineering the existing process in welfare schemes for simpler and faster flow of information/funds and to ensure accurate targeting of the beneficiaries, de-duplication and reduction of fraud Direct Benefit Transfer (DBT) was started on 1st January, 2013.

- DBT Mission was created in the Planning Commission to act as the nodal point for the implementation of the DBT programmes. The Mission was transferred to the Department of Expenditure in July, 2013 and continued to function till 14.9.2015. To give more impetus, DBT Mission and matters related thereto has been placed in Cabinet Secretariat under Secretary (Co-ordination & PG).

Efforts behind the efficient DBT

- Mission-mode approach for financial inclusion: Government endeavoured to open bank accounts for all households, expanded Aadhaar to all, and scaled up the coverage of banking and telecom services.

- Public Finance Management System through Aadhar: It evolved the Public Finance Management System and created the Aadhaar Payment Bridge to enable instant money transfers from the government to people’s bank accounts.

- Participation of various stakeholders for extensive UPI: The Aadhaar-enabled Payment System and Unified Payment Interface further expanded interoperability and private-sector participation.

- Directly receiving of subsidies: This approach not only allowed all rural and urban households to be uniquely linked under varied government schemes for receiving subsidies directly into their bank accounts but also transferred money with ease.

What is the Present status of DBT?

- The status of JAM trinity (Jan Dhan Aadhar Mobile)

- By 2022, more than 135 crore Aadhaar’s have been generated,

- There are 47 crore beneficiaries under Pradhan Mantri Jan Dhan Yojana,

- Mobile subscribers number more than 120 crores.

- Riding on this network, the DBT programme has reached commanding heights towards achieving the government’s vision of “sabka vikas”.

- Last mile banking through Bank Mitras: 5 lakh Bank Mitras delivering branchless banking services.

- DBT applicable to government schemes: Becoming the major plank of the government’s agenda of inclusive growth, it has 318 schemes of 53 central ministries spanning across sectors, welfare goals and the vast geography of the country.

How benefits are delivered through DBT?

- DBT in rural areas: In rural Bharat, DBT has allowed the government to provide financial assistance effectively and transparently to farmers with lower transaction costs be it for fertilisers or any of the other schemes including the PM Kisan Samman Nidhi, PM Fasal Bima Yojana, and PM Krishi Sinchayi Yojana thus becoming the backbone for supporting the growth of the agricultural economy.

- DBT in urban area: In urban India, the PM Awas Yojana and LPG Pahal scheme successfully use DBT to transfer funds to eligible beneficiaries.

- Benefits under MGNAREGA: The benefits received under the Mahatma Gandhi National Rural Employment Guarantee Act and Public Distribution System drive the rural demand-supply chain.

- Various assistance programmes: Various scholarship schemes and the National Social Assistance Programme use the DBT architecture to provide social security.

- Scheme for rehabilitation: DBT under rehabilitation programmes such as the Self Employment Scheme for Rehabilitation of Manual Scavengers opens new frontiers that enable social mobility of all sections of society.

- DBT as last mile support in Pandemic: The efficacy and robustness of the DBT network were witnessed during the pandemic. It aided the government to reach the last mile and support the most deprived in bearing the brunt of the lockdown. From free rations to nearly 80 crore people under the Pradhan Mantri Garib Kalyan Yojana, fund transfers to all women Jan Dhan account holders and support to small vendors under PM-SVANidhi, DBT helped the vulnerable to withstand the shock of the pandemic.

What are the reasons for successful DBT schemes?

- An enabling policy regime: Proactive government initiatives and supportive regulatory administration allowed the private and public sector entities in the financial sector to overcome longstanding challenges of exclusion of a large part of the population.

- Creation of a dedicated ecosystem: These are essential elements of the pioneering ecosystem created by the government for the aggressive rollout of the ambitious DBT programme, achieving impressive scale in a short span of six years.

Conclusion

- Direct Benefit Transfer has transformed the welfare aspect of the governance. Going forward digital and financial literacy, robust grievance redressal, enhancing awareness and an empowering innovation system are some of the aspects that would require continued focus. This would play a vital role for India in meeting the diverse needs of its population and ensuring balanced, equitable and inclusive growth.

Mains Question

Q.Enlist the schemes that comes under DBT. How DBT has changed the lives of needy people in urban and rural India?

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

Universal basic income

From UPSC perspective, the following things are important :

Prelims level: various schemes for vulnerable section

Mains level: social security, universal basic income

Context

Context

- New evidence from two Kenyan counties shows that universal basic income and other income supplements reduce hunger, illness, and risk exposure during crises.

- Countries should consider building universal basic income that can be activated at short notice to help people weather unanticipated shocks.

Why in news?

- When the COVID-19 pandemic and the resulting recession pushed 120 million people worldwide into extreme poverty in 2020, many countries relied on social-protection measures to cushion the blow.

What is social protection?

- Social protection is concerned with preventing, managing, and overcoming situations that adversely affect people’s well-being.

- Social protection programs that assist low-income families, insure against shocks, and break poverty traps offer a potential solution.

Universal basic income meaning

Universal basic income meaning

- Universal basic income (UBI) is a model for providing all citizens of a country or other geographic area with a given sum of money, regardless of their income, resources or employment status.

- The purpose of UBI is to prevent or reduce poverty and increase equality among citizens.

What is social security?

- Social securityin India includes a variety of statutory insurances and social grant schemes bundled into a formerly complex and fragmented system run by the Indian government.

- These are retirement, healthcare, disability, childcare, gratuity and provident fund and insurance programs.

What is insurance simple words?

- An agreement by which a person pays a company and the company promises to pay money if the person becomes injured or dies or to pay for the value of property lost or damaged.

Constitutional mandate

- The Directive Principles of State Policy, enshrined in Part IV of the Indian Constitution reflects that India is a welfare state.

Interesting fact

India operates the widest spectrum of social security schemes which cater to the largest number of people than any other country.

What are the benefits of Universal Basic Income?

- Ending poverty: Advocates for UBI say that it could help bring everyone’s income above the poverty line.

- Discouraging low wages: UBI would give employees enough security to have bargaining power.

- Redistributing wealth: The economic growth of high-income countries is making the rich richer, but having very little effect on the working classes.

Case study / value addition

Namibia

Namibia had a basic income pilot program between 2008 and 2009. Every resident of Otjivero-Omitara was entitled to 100 Namibian dollars ($6.75) every month. The program was funded by donors from around the world.

Findings from the pilot program showed that cases of child malnutrition had dropped significantly while school enrollment went up. Also, social crimes such as theft had significantly dropped.

Negative implications of UBI

Negative implications of UBI

- Induce lethargy: UBI removes the incentive to work, adversely affecting the economy and leading to a labour and skills shortage.

- Inequity: Universal basic income would be just that: universal. That means that everyone, regardless of how poor, or rich, they were would get the same amount of money.

- Huge Cost: The cost of implementing UBI could be huge. In the United States it’s estimated to be about $3.9 trillion per year.

- Motivation to work: One concern is that UBI would incite millions of workers to stop working. If people aren’t working, there is less taxable income.

Some government initiatives

- National Pension Scheme for Traders and Self Employed Persons.

- Pradhan Mantri Suraksha Bima Yojana.

- Employees’ State Insurance Scheme.

- Minimum Wages for various employment roles.

- National Pension System.

Conclusion

- One of the major criticisms of poverty alleviation programs is significant leakages. UBI is seen as a more efficient alternative. Though UBI has many advantages, there are many practical challenges too. The idea should be to save costs with better targeting. This will help create the necessary conditions for higher growth which will decisively lift people out of poverty.

Mains question

Q. India operates the widest spectrum of social security schemes which cater to the largest number of people than any other country. Do you think they are enough? Discuss in context of rising demand for universal basic income and its pros and cons for ensuring social security.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

Rythu Bandhu: Telangana DBT scheme for farmers’ assistance

From UPSC perspective, the following things are important :

Prelims level: Rythu Bandhu Scheme

Mains level: DBT schemes for farmers

The total funds disbursed under Rythu Bandhu, Telangana government’s direct benefit transfer scheme for farmers, will soon touch Rs 50,000 crore in the coming days.

What is Rythu Bandhu?

- Rythu Bandhu is a scheme under which the state government extends financial support to land-owning farmers at the beginning of the crop season through direct benefit transfer.

- The scheme aims to take care of the initial investment needs and do not fall into a debt trap.

- This in turn instills confidence in farmers, enhances productivity and income, and breaks the cycle of rural indebtedness.

DBT under the Scheme

- Each farmer gets Rs 5,000 per acre per crop season without any ceiling on the number of acres held.

- So, a farmer who owns two acres of land would receive Rs 20,000 a year, whereas a farmer who owns 10 acres would receive Rs 1 lakh a year from the government.

- The grant helps them cover the expenses on input requirements such as seeds, fertilizers, pesticides, and labour.

How much does it cost the state exchequer?

- Since the Kharif season of 2018, the state government has been crediting Rythu Bandhu assistance to farmers.

- As of date, it has credited Rs 43,036.64 crore into the bank accounts of beneficiaries.

- This season, the state government will disburse another Rs 7638.99 crore, taking the total sum disbursed so far to over Rs 50,000 crore.

Comparing with the PM-KISAN scheme

- The state government has often said that the Centre’s PM-KISAN (Pradhan Mantri Kisan Samman Nidhi) scheme is a “copy” of Rythu Bandhu.

- Under PM-KISAN, a land-holding family receives an income support of 6,000 per year in three equal installments.

- Rythu Bandhu is based on anticipated input expenditure for each acre of land and there is no restriction on the number of acres owned by a farmer.

- PM-KISAN only provides support to the family and not to the farm units.

Criticisms of the Rythu Bandhu Scheme

- The scheme does not cover the landless or tenant farmers.

- Farmer bodies have been demanding that the state government should extend the agriculture assistance to tenant farmers as well.

- They have pointed out that those who work on lands taken on lease from landowners also need government assistance at the beginning of a crop season.

- It is difficult to bring tenant farmers under the ambit of the scheme because of the informal nature of the agreements they enter into.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

How e-RUPI can transform government’s welfare schemes

From UPSC perspective, the following things are important :

Prelims level: e-RUPI

Mains level: Paper 3- e-RUPI and its advantages

Context

Recently e-RUPI was launched by the Prime Minister.

About e-RUPI

- It is a digital prepaid, purpose, and person-specific payment utility.

- Built on the UPI platform, e-RUPI is easy to scale by the issuer.

- At the point of presence, the verification code received by the beneficiary is shared with the service provider to authenticate and authorize the transaction: Contactless, real-time payment, and online settlement of funds into the service provider’s bank account.

- Fourteen leading banks have already integrated it with their systems.

- e-RUPI is almost custom-designed for school voucher programs.

- The efficacy of these programs is well established in many countries.

Advantages

The adoption of e-RUPI in various government programs will enhance business efficiency, simplicity, transparency, and accountability in these programs.

1) e-RUPI can make cash transfer purpose and person-specific

- Policymakers have debated whether direct cash transfers deliver benefits more efficiently than in-kind transfers like the Public Distribution System (PDS) and fertilizers.

- e-RUPI could break the policy logjam with the following advantages:

- 1) It will make cash transfers purpose- and person-specific.

- 2) Freeing them from dependence on bank accounts.

- 3) Providing visibility from the time of issue until redemption.

2) e-RUPI can make PDS more efficient

- The inefficiency of PDS is rooted in high overhead costs, leakages, exclusion, and inefficiencies.

- A food-specific e-RUPI voucher will allow beneficiaries to buy rations from an outlet of their choice.

- It will also help promote the One Nation, One Ration Card.

- The move will also help in removing price distortion and the redemption of the voucher at market price by merchants within and outside the PDS network.

3) Streamline fertilizer subsidy

- e-RUPI will enable farmers to buy fertilizer at nominal prices with direct credit of the subsidy amount into the account of the authorised dealers.

- As far back as 2011, a task force on direct transfer of subsidies on kerosene, LPG and fertilisers headed by Nandan Nilekani had suggested a roadmap for direct cash transfer of fertiliser subsidies in a phased manner.

- The e-RUPI will allay apprehensions about creating an IT infrastructure, managing nearly 3,00,000 fertilizer sale points, the collapse of dealer network due to liquidity squeeze in the event of subsidy payments getting delayed, and a complex system of timely credit of subsidy into an estimated 129 million Aadhaar-linked bank accounts of farm households.

4) Basic income support

- The Covid-19 pandemic has revived interest in Universal Basic Income (UBI).

- The lockdowns to contain the pandemic exposed the poor to acute distress, due to loss of means of livelihood.

- e-RUPI can mitigate their stress by rapidly distributing food and cash vouchers at scale.

5) Ayushman Bharat

- In the Ayushman Bharat healthcare initiative beneficiaries can be given e-RUPI vouchers of designated value tenable at empanelled healthcare facilities, providing them portability and facility choice.

- The service provider will benefit from the immediate payment.

Way forward

- Ownership agency: The Aadhaar experience suggests ownership must vest with a specific agency.

- Make distribution and acceptance compatible: Making the distribution and acceptance of e-RUPI incentive-compatible is recommended, as demonstrated by the popularisation of prepaid telephony by the telecom industry.

- Light regulation and competition promotion: Light regulation and the opening of e-RUPI to the competition will spur innovation and adoption.

- All banks, small and big, NBFCs, non-bank PPI issuers, and telcos may be allowed to issue it later.

Conclusion

e-RUPI opens up a world of opportunities to the government, people, and businesses to provide, avail, and pay for services seamlessly.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

[pib] PM-KISAN Scheme Completes Two Years

From UPSC perspective, the following things are important :

Prelims level: PM-KISAN

Mains level: Cash support schemes for farmers

The PM-Kisan scheme, launched with an aim to ensure a life of dignity and prosperity for farmers has completed two years of successful implementation.

PM-KISAN

- Under this programme, vulnerable landholding farmer families, having cultivable land upto 2 hectares, will be provided direct income support at the rate of Rs. 6,000 per year.

- This income support will be transferred directly into the bank accounts of beneficiary farmers, in three equal instalments of Rs. 2,000 each.

- This programme will be entirely funded by the Government of India.

Note: Aadhaar was made optional for availing the first instalment (December 2018 – March 2019). But now it is mandatory.

Exclusion categories

The following categories of beneficiaries of higher economic status shall not be eligible for benefit under the scheme.

- All Institutional Landholders

- Farmer families in which one or more of its members belong to the following categories

- Former and present holders of constitutional posts

- Former and present Ministers/ MP/MLAs/Mayors /Chairpersons of District Panchayats

- All serving or retired officers and employees of Central/ State Government Ministries (Excluding Multi Tasking Staff /Class IV/Group D employees)

- All superannuated/retired pensioners whose monthly pension is ₹10,000/-or more (Excluding Multi Tasking Staff / Class IV/Group D employees) of the above category

- All Persons who paid Income Tax in the last assessment year

- Professionals like Doctors, Engineers, Lawyers, Chartered Accountants, and Architects registered with Professional bodies and carrying out the profession by undertaking practices.

Do you know?

West Bengal is yet to implement the PM-KISAN scheme while the farmers have completed their registrations!

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

Linking Aadhaar to residence for targeted aid

From UPSC perspective, the following things are important :

Prelims level: PM-Kisan

Mains level: Paper 2- Geo-targeted aid during disasters

The article suggests the provision for a safety net with geographic targeting in case of disasters as most disasters are location specific.

Safety net in the U.S.

- The US Congress enacted in March a Coronavirus Aid, Relief and Economic Security (CARES) Act to sends $1,200 to each individual below the income threshold of $75,000.

- Nonetheless, as The Washington Post reported, even in October, millions of households were yet to receive their stimulus payments.

- The tax authorities who were charged with disbursing the funds had no way of knowing how to send the cheques.

- But the poor had to cross several hurdles to get this money and the computer system did not make it easy for them to register their claim.

Safety net in India and issues with it

- In contrast to U.S., 23 per cent of Indians living in Delhi-NCR received a payment of Rs 500 in their Jan Dhan accounts within three weeks of the lockdown being declared.

- Farmers registered for PM-KISAN also received Rs 2,000 in their accounts immediately.

- However, there were some issues for example, recipients of PM-KISAN were not amongst the poorest households, nor were these the households that were most affected by the COVID-related lockdown.

- The PM-Kisan Yojana applies to landowners, thereby excluding agricultural labourers as well as the urban informal sector workers who were most affected by the lockdown.

- Similarly, for the PMJDY payment, BPL and non-BPL households record similar receipt transfers.

Twin challenges in designing social safety nets

- Unless a registry containing data about individuals and their bank accounts exists, money cannot be transferred expeditiously.

- 1) Registries based on specific criteria (for example, identified BPL households) may not identify individuals most vulnerable to crises.

- 2) Factors that contribute towards alleviating poverty may differ from the ones that push people into it — indicating the challenge of targeting welfare beneficiaries in response to shocks.

- About 40 per cent of the poor in 2012 were pushed into poverty by special circumstances and would not have been classified as being poor based on their 2005 conditions.

- Such exclusion errors can get magnified in the event of large-scale disasters when using pre-existing databases, since many people are likely to fall into poverty from an economy-wide negative shock, leading to coverage errors.

Way forward

- Recent estimates from the World Bank suggest that 88 to 115 million people could slide into poverty in 2020.

- These observations suggest that in a disaster response situation, we cannot rely on registries based on individual characteristics to identify beneficiaries.

- Most disasters are geographically clustered.

- If there is a way for us to set up social registries that identify individuals, their place of residence, and their bank accounts, these linkages can be used to transfer funds to everyone living in the affected area quickly.

- Aadhaar linkages of individuals and bank accounts already exist.

- If residential information in the Aadhaar database can be efficiently structured, this would allow for geographic targeting.

- Issue of violation of individual privacy can be addressed by providing that such social registries store only basic information such as location, instead of more sensitive identifiers.

Consider the question “Disasters underscores the importance of social safety nets. However, designing a social safety net that identifies and reach the vulnerable suffers from several challenges. What are these challenes. Suggest ways to address these challenges.”

Conclusion

As we try to disaster-proof future welfare programmes, these are some of the considerations that deserve attention.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Direct Benefits Transfers

How would Direct Benefit Transfer (DBT) of power subsidy work?

From UPSC perspective, the following things are important :

Prelims level: Not Much

Mains level: Read the attached story

Context

- Punjab has been providing free power to the agriculture sector.

- The new Electricity Amendment Bill 2020 has proposed providing subsidy on power to farmers through DBT, which is contrary to the prevailing ‘free power’ system in Punjab.

Free or subsidised power is being provided to millions of consumers in almost every state. Punjab is no exception but its free power scheme is. Other states can learn from the example of Punjab, here.

Practice questions for mains:

Q. Discuss the efficacy of Direct Benefit Transfer in power subsidy for farmers.

Punjab on knees

- Before it submits suggestions regarding the Electricity Amendment Bill 2020, recently drafted by the Union Power Ministry to amend the Electricity Act 2003, a big challenge lies ahead for the Punjab government.

- Under the garb of DBT, it is a move to stop the free power supply to them.

What is the current system of power subsidy for farmers in Punjab?

- At present, Punjab is supplying free power to 14.16 lakh electricity-run tubewells of the agriculture sector which are getting power through 5,900 Agricultural Pumpset Feeders (APFs).

- These APFs are metered and the Punjab Power Corporation charges the state government for consumed units recorded in metered APFs.

The Free Power Scheme

- Farmers are getting power supply for their Kharif and Rabi crops from these feeders as per the recommendations of the Punjab Agriculture University (PAU), Ludhiana.

- It is supplied for around eight hours every day in Kharif season and four hours on alternate days during Rabi crop season.

- The state government pays around Rs 6,000 crore power subsidy bill to Power Corporation every year under the scheme to the farming sector.

What would change under the DBT allowed under the new Electricity Bill 2020?

- Under DBT, farmers will have to pay the bill for the power consumed for agriculture purposes.

- After that, they will get the subsidy in their bank accounts through DBT.

- A meter would be installed on every individual tubewell.

Issues with Punjab farmer

- Approximately the annual power bill will come to around Rs 46,000 to Rs 48,000, and farmers are required to pay a bill of Rs 4,000 per month.

- In Punjab, 67 per cent of farmers come under the small and marginal categories with 1-2 hectares land.

- Paying bills in advance is not possible for them due to debt.

- If farmers don’t pay their bills, the department will disconnect their connection, which could lead to farmers’ agitation.

Can it work like DBT on LPG gas cylinders?

- The bill suggests the subsidy be paid directly to consumers in cash on the pattern of LPG subsidy.

- This proposal should be tried in a pilot project and if results are encouraging, only then it should be included in the amendment bill.

- It is not feasible to provide meters on every pump set up across the country and then give cash subsidy every month after the consumer has paid the bill.

Punjab government’s own DBT scheme titled ‘Paani Bachao Paisa Kamao’ is also working here. How it is different from DBT under the new Bill?

- The Punjab government’s scheme is a voluntary one.

- The farmers who have adopted it need to get install a power meter on their tubewell but are not required to pay any power bill.

- The main purpose of PBPK is to save groundwater by using it judiciously because, under the traditional system, several farmers are misusing the water by over-irrigating the crops due to free power available to them.

What do farmers’ organisations think of this?

- Farmers’ organisations say that if the Punjab government agrees to this bill, they will fight it tooth and nail.

- From where will poor farmers pay such heavy bills when they get an income after six months following the sale of their crop, they ask.

- Anywhere in the world, the agrarian sector cannot run without the support of the government as it is the base of every human being who is dependent on farmers’ produce from his/her morning tea to dinner.

Back2Basics

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

The government’s DBT plan involves transferring the subsidy amount directly to the beneficiaries’ bank accounts.

- Here, the government does not have to fiddle around with differential pricing for the underprivileged.

- This method can effectively address the issue of leakages and go a long way in solving the mis-targeting problem.

The government has also linked DBT to Aadhaar. Efficient targeting, using Aadhaar-linked data, ensures that the intended beneficiary receives the money in his account, thus helping him as well as reducing the government’s subsidy burden. This has resulted in effectively solving the leakage and mis-targeting problems in some schemes.

- DBT in India

- Pre requisite of successful DBT

- Merits of DBT

- Demerits of DBT

- DBT in fertilizers

- Is India ready to implement DBT in all programmes?

- Suggestions for improvement

- Conclusion

DBT in India

Direct Benefit Transfer is a mechanism to transfer the subsidy amount directly to the bank account of beneficiaries. Main agendas for DBT is to prevent and address following

- Leakages

- Delays

- Reducing structural expenses in distributing the subsidies in hand

- Encouraging everyone to have bank account and achieve financial inclusion.

Right now it is applied to only 4 areas that too in selected districts:

- LPG subsidies

- Jnani Suraksha Yojana

- Old age pension

- Scholarships

Pre requisite of successful DBT

source

Merits of DBT (Direct Benefit Transfer)

- Leakage and delays are prevented.

- Reduces Corruptions and black money issue.

- Reduces economical inequalities in rural areas as everyone gets theire share rightfully.

- Reducing the government expense on PDS, Cooperative society, bureaucracy to distribute scholarships etc.

- Reduces time, energy and money of people to get their money/commodity.

- Encourage free and fair market structure. Earlier subsidised grains entering market through backdoor used to distort the price in market.

- More circulation of money in economy which will lead to at least 0.5% growth in GDP.

- Government can better focus on other issues and not engaging in distribution.

- Transportation charge for FCI and NABARD subsidies for warehouses will be reduced.

- Slowly importance of MSP will reduce while price a farmer would fetch will increase which is win-win situation for farmers, also non-food crops will get importance which is issue right now in India.

- Financial institutions will pay attention in rural area once people have cash in their hand.

- Health facility will get better with private hospital giving facilities once people will have money to get treatment.

Demerits of DBT

- Money in the hand of poor may get spent in something other than what is needed, a scholarship needed to be spent in education only, but how government can ensure that, once she has sent it to account

- Most accounts holder are males who have accessibility to banks, hence it will lead to usage by them only. Females may not get their share if they are the intended beneficiaries

- With lesser banks in rural parts of India, it will be another overhead for people to get their withdrawal

- Delay in transfer may create more turbulence as many will flock to banks to check on their balances

DBT in fertilisers

Government is embarked on rationalizing subsidies as has been seen in LPG subsidy which saved thousands of crores of government exchequer. Now it has proposed for rolling out DBT for fertilizers as has been mentioned in recent economic survey.

Pros of DBT in fertilizer –

- It would be beneficial for minimizing the use of fertilizer which would check degradation of soil nutrients and would prevent water contamination.

- Farmers would be free from moneylender’s debt trap as now they would have secure money in their bank accounts. It would be helpful for inculcating saving habits also in farmers.

- Released government control on the fertilization market would drive competition and would enhance productivity.

- Enhanced financial inclusion and financial literacy will give boost to digital India and skill India.

- No middlemen > no leakage > benefits to the needy > correct use of tax payer’s money (redistribution of wealth).

- Less burden on government exchequer > fiscal consolidation target >money transferred in job creation and infrastructure development

However there are some cons which need to be factored –

- More money in hand may lead to misuse like in drug, alcohol, unnecessary shopping or gambling etc.

- May further widen the gap between big farmers and small farmers.

- Bio-identification can be detrimental for the personal information of farmers if not properly handled.

Operational challenges –

- Management of data whether it may be of land, of status of farmer (landholder, tiller or tenant etc) or pertaining to agriculture practice is not up to the level in our country.

- Though crores of accounts are opened but still there is a good number of people who are unbanked.

- Some farmers have little knowledge about banking system so they can fall prey of undue interference.

Is India ready to implement DBT across all programmes?

The debate of implementing DBT in all subsidy programmes is discussed below. A proper implementation would helpful in following ways –

- Filling leakages: DBT will help in reducing malpractices like leakages, ultimately giving the beneficiary what he is entitled. Example: LPG subsidy.

- Increasing incomes: with large number of schemes which are implemented with an intention to increase incomes of the poor, but due to delay and other factors most of the time poor gets subsidy after a long time (like in wages of MNREGA). DBT can reduce these cases.

- Financial inclusion: with the provision of DBT, poor will get themselves included in financial system of the country, which will help them to get other benefits and will boost their saving.

Some of the downsides of the implementation –

- People may use money for other purposes rather than using it for what it is meant for like in case of PDS.

- Due to lack of education and financial literacy, poor will keep themselves outside the purview of banks.

- Inadequate development of the banking channel in rural areas is also a challenge.

- Lack of adequate documents also leads to exclusion of many poor from banking sector.

source

Conclusion

DBT revolutionized the banking sector by connecting low income segments of society with banks. There is no doubt that DBT has created a firm base for financial inclusion, which will include poor sections to the growth and development processes.

National Payment Corporation of India (NPCI) has successfully opened 150 million DBT accounts with Adhaar numbers and around 125 million accounts under Jan Dhan Yojana.

The government is fully relying on this scheme to plug leakages and save costs. It is estimated that over the time it could save up to 1.2% of GDP, which is currently lost in transit.

References: