One Rank One Pension Issue

Andhra Pradesh’s Guaranteed Pension System

From UPSC perspective, the following things are important :

Prelims level: Guaranteed Pension System

Mains level: Not Much

Central Idea

- Andhra Pradesh’s Guaranteed Pension System (GPS) blends elements from both old and new pension schemes, offering the advantages of a guaranteed pension while not overly straining the state’s finances.

- This innovative system holds the potential to preserve India’s hard-won pension reforms.

What is the Andhra Pension System?

- A Hybrid Approach: The Andhra Pradesh Guaranteed Pension System Bill, 2023, recently approved by the state assembly, introduces a unique blend of the Old Pension Scheme (OPS) and the New Pension Scheme (NPS) implemented in 2004.

- Contributory Guarantee: This system ensures government employees a monthly pension equivalent to 50% of their last-drawn salary, including dearness allowance relief.

- Reason for Introduction: Andhra Pradesh introduced GPS as a response to resistance against NPS, which was viewed by many as inferior to the earlier scheme. The return to OPS was considered fiscally unsustainable, with the potential to drive the state’s fiscal deficit to 8% by 2050.

Breakthrough created

- Long-standing Pension Reforms: India struggled for over a decade to implement pension reforms that led to the introduction of NPS in 2004.

- Growing Discontent: Over time, public sentiment favored those receiving pensions under the old scheme, leading to discontent.

- Political Promises: Political parties capitalized on this discontent, pledging to return to the old scheme if elected.

- Andhra’s Middle Path: Andhra Pradesh’s GPS offers a middle ground, preventing a regressive return to the old scheme while addressing concerns about NPS.

How does the Andhra System work?

- Enhancing Attractiveness: The contributory system guarantees a pension equivalent to 50% of the last drawn salary.

- Balancing Financial Burden: Any shortfall in NPS returns is covered by the government.

- Current NPS Pensions: Presently, NPS pensions amount to around 40% of an employee’s last drawn salary. Therefore, the government only has to fund the remaining balance.

Alternative to NPS

- Contributory Nature: NPS is a contributory scheme, with both employees and employers contributing to a corpus invested for returns.

- Uncertainty: In NPS, the pension amount is not guaranteed, as it depends on corpus returns influenced by market conditions.

- Ignoring Inflation: NPS does not consider inflation or pay commission recommendations.

- Market Dependency: Opposition to NPS is fueled by fears of further reductions in pension due to adverse market conditions.

Why not revert to the Old Pension Scheme?

- Budgetary Constraints: Under OPS, pensions were financed through the budget.

- Unsustainable Growth: Pension liabilities for all states saw a compound annual growth rate of 34% for a 12-year period ending in 2021-22.

- Budgetary Impact: In 2020-21, pension outgo accounted for 29.7% of states’ revenues.

- Development Challenges: A return to OPS would strain government funds, hindering development efforts and operational financing.

- Competitiveness Concerns: Such a shift could negatively impact India’s ease of doing business and overall competitiveness.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

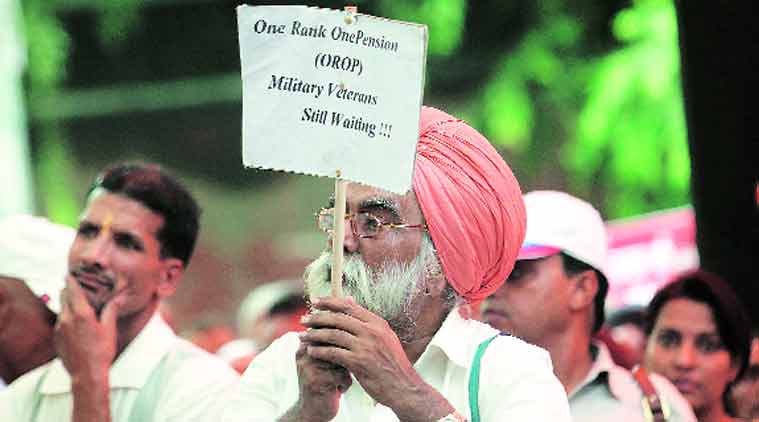

One Rank One Pension Issue

SC backs Centre’s OROP scheme

From UPSC perspective, the following things are important :

Prelims level: One rank one pension Scheme

Mains level: OROP Policy

The Supreme Court has upheld the Centre’s one rank, one pension (OROP) scheme for the armed forces.

What is the news?

- The Supreme Court has ruled that there was “no constitutional infirmity” in the way the government had introduced ‘one rank, one pension’ (OROP) among ex-service personnel.

- The scheme, notified by the Defence Ministry on November 7, 2015, was challenged by Indian Ex-Service Movement, an association of retired defence personnel.

What is OROP Scheme?

- OROP means that any two military personnel retiring at the same rank, with the same years of service, must get an equal pension.

- While this might appear almost obvious, there are several reasons why two military personnel who may have retired at the same rank with the same years of service, may get different pensions.

Need for the scheme

Military personnel across the three services fall under two categories, the officers and the other ranks.

- Early age of retirement: The other ranks, which are soldiers, usually retire at age 35.

- No benefits from pay commissions: Unlike government employees who retire close to 60, soldiers can thus miss out on the benefits from subsequent pay commissions.

- Salary based pension: And since pensions are based on the last drawn salary, pensions too are impacted adversely.

- Ranks based discrimination: The age when officers in the military retire depends upon their ranks. The lower the rank, the earlier they superannuate.

- Liability against the sacrifice: It was argued that early retirement should not become an adverse element for what a soldier earns as pension, compared with those who retire later.

Earlier pension mechanism

- From 1950 to 1973, there was a concept known as the Standard Rate of Pension, which was similar to OROP.

- In 1974, when the 3rd Pay Commission came into force, certain changes were effected in terms of weightage, additional years of notion service, etc., with regard to pensions.

- In 1986, the 4th Pay Commission’s report brought further changes.

- What ultimately happened was that the benefits of the successive pay commissions were not passed to servicemen who had retired earlier.

- Pensions differed for those who had retired at the same rank, with the same years of service, but years apart.

Demand for OROP

- Ex-servicemen demanded OROP to correct the discrepancy.

- Over the decades, several committees looked into it.

- The Brig K P Singh Deo committee in 1983 recommended a system similar to Standard Rate of Pension, as did Parliament’s standing committees on defence.

- The Narendra Modi government notified the current OROP scheme in November 2015, and it was made applicable from July 1, 2014.

Issues with OROP

- During the OROP protests of 2013-15, it was argued repeatedly that meeting the demand would be financially unsustainable.

- Because soldiers retire early and remain eligible for pension for much longer than other employees, the Defence Ministry’s pension budget is very large, impacting capital expenditure.

- The total defence pensioners are 32.9 lakh, but that includes 6.14 lakh defence civilian pensioners.

- The actual expenditure of the Defence Ministry on pensions was Rs 1.18 lakh crore in 2019-2020.

- The Defence Ministry’s pension-to-budget ratio is the highest among all ministries, and pensions are more than one-fifth of the total defence budget.

- When the late Manohar Parrikar was Defence Minister, it was estimated that a one-time payout of Rs 83,000 crore would be needed to clear all past issues.

Challenge to OROP

- The petitioners contended that the principle of OROP had been replaced by ‘one rank multiple pensions’ for persons with the same length of service.

- They submitted that the government had altered the initial definition of OROP and, instead of an automatic revision of the rates of pension.

- Under this, any future raising of pension rates would be passed on to past pensioners — the revision would now take place at periodic intervals.

- According to the petitioners, this was arbitrary and unconstitutional under Articles 14 and 21.

What has the SC ruled now?

- The court did not agree with the argument that the government’s 2015 policy communication contradicted the original decision to implement OROP.

- It said that “while a decision to implement OROP was taken in principle, the modalities for implementation were yet to be chalked out.

- The court also said that while the Koshyari Committee report furnishes the historical background of the demand, and its own view on it, it cannot be construed as embodying a statement of governmental policy.

- It held that the OROP policy “may only be challenged on the ground that it is manifestly arbitrary or capricious”.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

One Rank One Pension Issue

One Rank One Pension (OROP) Policy

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: OROP Policy

The Supreme Court has said that the Centre’s hyperbole on the One Rank One Pension (OROP) policy presented a much “rosier picture” than what is actually given to the pensioners of the armed forces.

What is OROP Policy?

- OROP means the same pension, for the same rank, for the same length of service, irrespective of the date of retirement.

- The concept was provoked by the then decision by Indira Gandhi-led government, in 1973, two years after the historic victory in the 1971 Bangladesh war.

How did the issue escalate?

- The Rank pay was a scheme implemented by the Rajiv Gandhi-led govt in 1986, in the wake of the 4th Central Pay Commission.

- It reduced the basic pay of seven armed officers’ ranks of 2nd Lieutenant, Lieutenant, Captain, Majors, Lt. Colonel, Colonels, Brigadiers, and their equivalent by fixed amounts designated as rank pay.

How was it reviewed?

- In 2008, Manmohan Singh led Government in the wake of the Sixth Central Pay Commission (6CPC), which discarded the concept of rank-pay.

- Instead, it introduced Grade pay, and Pay bands, which instead of addressing the rank, pay, and pension asymmetries caused by ‘rank pay’ dispensation, reinforced existing asymmetries.

Issues with this pension policy

- The causes that inform the OROP protest movement are not pension alone, as armed forces veterans have often tried to make clear, and the parliamentary committee recorded.

- The issues, veterans emphasize, are of justice, equity, honor, and national security.

- The failure to address the issue of pay-pension equity, and the underlying issue of honor, is not only an important cause for the OROP protest movement but its escalation.

Present status

- PM Modi-led government has accepted the OROP.

- It has already released Rs. 5500 crores to serve the purpose, but still, there are some grievances from the veterans’ side.

- It refined Pensions for all pensioners retiring in the same rank as the average of the minimum and maximum pensions in 2013.

- The veterans noted governments’ proposal as one rank many pensions since the review of 5 years would lead to differences in pension between senior and a junior.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Everything That You Need to Know on OROP

- It is a pension scheme for the armed forces personnel which was in existence till 1973.

- This scheme provided same pension for same rank and for the same length of service irrespective of the date of retirement which was the basis for determining the pension and benefits of the Indian Armed Forces till 1973.

- OROP was terminated by the government in 1973.

Which government was in power at that time and who was the PM of India?

Then came the Koshiyari committee –

Bhagat Singh Koshiyari headed a committee which comprised 10 members (an all party parliamentary panel). It was formed in 2011.

What were the recommendations of the committee?

- OROP should be implemented in the defence forces at the earliest and a separate commission should be formed to take decisions on pay allowances, pension, family pension etc. in respect of the defence personnel should be taken into the account by that committee.

- The committee recommended to absorb the Armed Forces personnel after their military engagement into other services of government which is a custom in countries like U.S. and China.

What would be the financial Implications?

- Early estimates were around 3000crores for OROP.( by Ministry of Defence)

- Revised estimates vary between 8000 to 9000 crores.

- According to the Koshiyari committee the estimates for implementation of OROP were around 12000 crores.

Is OROP expensive for the government?

- OROP is affordable by the government as it is a small fraction of the military pension budget.

- It includes about 4,00,000 defence civilians.

- Defence civilians, which includes the entire civilian bureaucracy in the ministry of defence ,retire at the age of 60 are mostly based permanently in Delhi and they are not covered by OROP.

- It is alleged that they oppose the OROP due to their exclusion from the scheme.

Government of India on OROP

- The government does not subscribe to the definition of Koshiyari committee, but states that there is a need for a new definition of OROP which should be acceptable to all the other ‘stakeholders’.

- The stakeholders were neither defined nor identified by the government.

- The government stand on the OROP prompted widespread dismay, disappointment and outrage amongst Armed Forces pensioners.

- The ministry of defence recommended the proposal for implementation after the approval of the Defence minister.

- Now it is with the of the Finance ministry which should make a call on the scheme.