Panchayati Raj Institutions: Issues and Challenges

In news: Mayor’s Election

From UPSC perspective, the following things are important :

Prelims level: Mayor in ULBs, Powers and functions

Mains level: NA

Introduction

- The Supreme Court has nullified the outcome of the mayoral election held on January 30 in Chandigarh.

Who is a Mayor?

- In India, the mayor is the head of an urban local body, which is responsible for providing essential services and infrastructure to the residents of a city or town.

- The mayor is usually elected by the members of the Municipal Corporation or Council.

- He/She serves as the ceremonial head of the local government.

History of Mayor’s elections in India

- Municipal corporation mechanisms in India was introduced during British Rule with formation of municipal corporation in Madras (Chennai) in 1688, later followed by municipal corporations in Bombay (Mumbai) and Calcutta (Kolkata) by 1762.

- However the process of introduction for an elected President in the municipalities was made in Lord Mayo’s Resolution of 1870.

- Since then the current form and structure of municipal bodies followed is similar to Lord Ripon’s Resolution adopted in 1882 on local self-governance.

- The 74th Constitutional Amendment Act of 1992 was introduced providing for the transfer of 18 different powers to urban local bodies, including the election of a mayor and to recognise them which included Municipal Corporations, Nagar Panchayats, and Municipal Councils.

Elections and tenure

- The method of electing mayor and their tenure varies for each city in India.

- In Bengaluru (Karnataka) the election process is indirect with a tenure being for one year.

- In Mumbai (Maharashtra) it follows indirect elections with tenure for 2.5 years and Bhopal (Madhya Pradesh) follows a directly elected mayor with a term for 5 years.

Roles and Responsibilities

- Governs the local civic body.

- Fixed tenure varying in different towns.

- First citizen of city.

- Has two varied roles:

- Representation and upholding of the dignity of the city during ceremonial times and

- Presiding over discussions of the civic house with elected representatives in functional capacity.

- The Mayor’s role is confined to the corporation hall of presiding authority at various meetings relating to corporation.

- The Mayor’s role extends much beyond the local city and country as the presiding authority at corporation meetings during visits of a foreign dignitary to the city as he is invited by the state government to receive and represent the citizens to the guest of honour.

- At government, civic and other social functions he is given prominence.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Having panchayats as self-governing institutions

From UPSC perspective, the following things are important :

Prelims level: The 73rd and 74th Constitutional Amendments Acts

Mains level: Ensuring greater devolution of powers and responsibilities to lower tiers of panchayats

Central Idea:

The article discusses the progress and challenges of decentralization in India, focusing on the effectiveness of Panchayati Raj institutions in local governance. It highlights the limited success in revenue generation by these institutions despite constitutional provisions and emphasizes the need for greater efforts towards self-sufficiency.

Key Highlights:

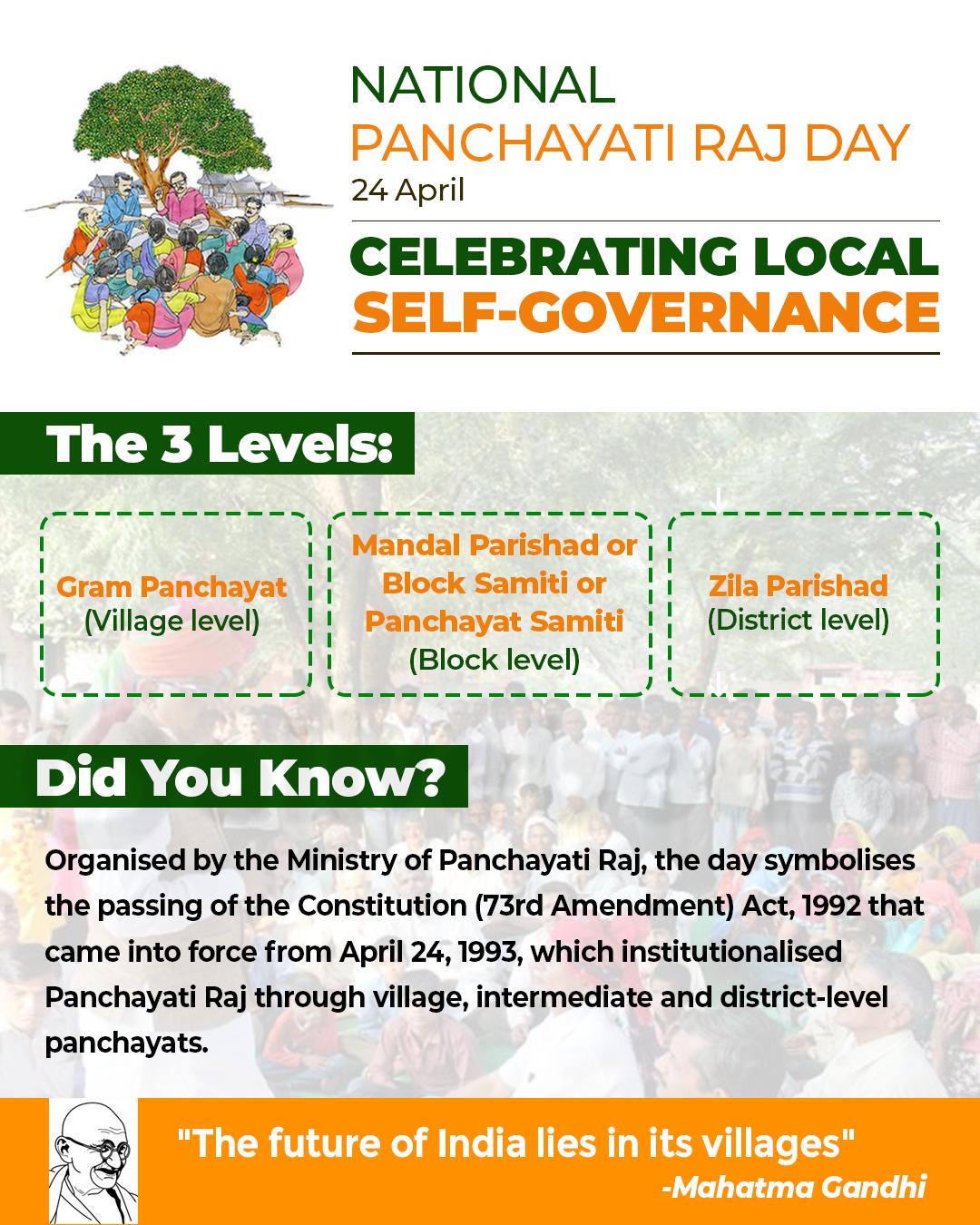

- Background of Decentralization: The 73rd and 74th Constitutional Amendments Acts aimed to empower local bodies for self-governance, leading to the establishment of the Ministry of Panchayati Raj in 2004.

- Fiscal Devolution: The constitutional amendment outlined fiscal devolution details, including own revenue generation by panchayats. However, most revenue still comes from grants, with only 1% generated through taxes.

- Avenues for Revenue: The article lists various avenues for revenue generation by panchayats, including property tax, user charges, and innovative projects like rural business hubs and renewable energy initiatives.

- Role of Gram Sabhas: Gram sabhas play a crucial role in local development and revenue generation by leveraging local resources, engaging in planning, and imposing taxes for community welfare.

- Challenges: Despite potential avenues for revenue, panchayats face challenges such as a culture of dependency on grants, reluctance to impose taxes, and lack of authority in tax collection.

- Dependency Syndrome: The article discusses the prevalent “freebie culture” and the reluctance of elected representatives to impose taxes due to concerns about popularity.

Key Challenges:

- Overreliance on grants from central and state governments.

- Reluctance of elected representatives to impose taxes due to concerns about popularity.

- Lack of authority and capacity in tax collection by panchayats.

- Prevailing “freebie culture” hindering public willingness to pay taxes.

Main Terms:

- Decentralization: Transfer of authority and responsibility from central to local government.

- Panchayati Raj: System of local self-government in rural areas.

- Fiscal Devolution: Transfer of financial powers from central to local governments.

- Own Source of Revenue (OSR): Revenue generated by local bodies through taxes, fees, and other means.

- Gram Sabha: Village assembly responsible for local governance and decision-making.

Important Phrases for answer writing:

- “Decentralization initiatives”

- “Revenue generation efforts”

- “Own source of revenue”

- “Freebie culture”

- “Dependency syndrome”

Quotes for answer quality improvement:

- “Panchayats earn only 1% of the revenue through taxes.”

- “Gram sabhas have a significant role in fostering self-sufficiency and sustainable development.”

- “The dependency syndrome for grants has to be minimized.”

Useful Statements that can be used for essay:

- “Despite efforts towards decentralization, many panchayats still rely heavily on grants for revenue.”

- “Gram sabhas can play a pivotal role in promoting entrepreneurship and local development.”

- “There is a need to educate elected representatives and the public on the significance of revenue generation for panchayat development.”

Examples and References:

- The 73rd and 74th Constitutional Amendments Acts.

- Ministry of Panchayati Raj’s expert committee report on own source of revenue.

- Data highlighting the percentage of revenue generated by panchayats through taxes.

- Examples of successful revenue generation initiatives by panchayats, such as property tax and user charges.

Facts and Data for critical arguments in answer:

- Panchayats earn only 1% of revenue through taxes, with 80% from the Centre and 15% from the States.

- Allocation for rural local bodies increased significantly in recent Finance Commissions, reaching ₹2,80,733 crore in the 15th Finance Commission.

- Tax revenue collected by panchayats decreased from ₹3,12,075 lakh in 2018-19 to ₹2,71,386 lakh in 2021-2022.

Critical Analysis:

While constitutional amendments and expert committee reports have outlined mechanisms for fiscal devolution and revenue generation, there remains a significant gap between policy intent and implementation. Factors such as political reluctance, administrative capacity constraints, and societal attitudes towards taxation pose significant challenges to effective decentralization.

Way Forward:

- Strengthening capacity building initiatives for panchayats in tax administration and financial management.

- Encouraging public awareness campaigns to promote the importance of local revenue generation for sustainable development.

- Ensuring greater devolution of powers and responsibilities to lower tiers of panchayats.

- Exploring innovative revenue generation avenues such as public-private partnerships and leveraging local resources for economic development.

Improve your answer writing with us and crack the mains

Try to attempt following question and write the answer in comment box below

- “What are the various sources available for Panchayats to generate revenue, and how can these sources contribute to enhancing the financial autonomy and sustainability of Panchayati Raj institutions?”

- “What are the main challenges hindering the financial autonomy of Panchayati Raj?”

- “Why is financial autonomy crucial for the effective functioning of local governance?”

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

[pib] Panchayat Development Index (PDI)

From UPSC perspective, the following things are important :

Prelims level: Panchayat Development Index (PDI)

Mains level: Not Much

Central Idea

- The Ministry of Panchayati Raj is leading the effort to localize Sustainable Development Goals (SDGs) as part of the 2030 Agenda for Sustainable Development.

- A report on the Panchayat Development Index (PDI) has been released to evaluate the progress of grassroots institutions in achieving Localized SDGs (LSDGs).

About Panchayat Development Index (PDI)

- PDI is a comprehensive, multi-domain, and multi-sectoral index designed to assess the holistic development, performance, and progress of panchayats.

- It incorporates various socio-economic indicators to measure the well-being and development status of local communities under a panchayat’s jurisdiction.

- PDI is crucial for evaluating performance and tracking progress in the localization of Sustainable Development Goals in rural areas.

- The Index is based on a framework of local indicators encompassing nine themes related to sustainable development in villages.

Nine Themes of PDI

- Poverty-Free and Enhanced Livelihood in Village

- Healthy Village

- Child-Friendly Village

- Water-Sufficient Village

- Clean and Green Village

- Village with Self-Sufficient Infrastructure

- Socially Just and Secured Villages

- Village with Good Governance

- Women-Friendly Village

Ranking and Grading System

Panchayats are ranked based on their scores and categorized into four grades:

- Grade A+: Scores above 90%

- Grade A: Scores between 75-90%

- Grade B: Scores between 60-75%

- Grade C: Scores between 40-60%

- Grade D: Scores under 40%

Significance of the Panchayat Development Index

- Insightful Analysis: PDI provides critical insights into areas needing improvement in rural jurisdictions.

- Identifying Disparities: It helps in pinpointing disparities and the achievement of development goals.

- Policy Formulation: The Index aids in creating targeted policies and interventions to enhance the well-being and quality of life in rural communities.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

CAG of India writes: As our democracy matures, my role is becoming more vital

From UPSC perspective, the following things are important :

Prelims level: CAG

Mains level: Social Audit

Central idea

The article highlights the pivotal role of the Comptroller and Auditor General (CAG) in India’s democracy, emphasizing citizen engagement, social audits, and capacity building for local governance. It underscores challenges in finding skilled personnel and the imperative to ensure effective grassroots service delivery. The way forward involves an international center for local governance and online courses to address competency gaps.

Key Highlights:

- Role of CAG in Democracy: Comptroller and Auditor General (CAG) ensures transparency, accountability, and financial integrity. Maintains separation of powers and promotes good governance through audit findings.

- Citizen-Centric Approach: Emphasis on citizen engagement for better audit focus. Use of technology and digital solutions to enhance citizen involvement.

- Social Audit and Local Governance: Introduction of social audit as a tool for citizen oversight. Empowering Panchayati Raj Institutions (PRIs) and urban local bodies for grassroots participation.

- Capacity Building and Online Courses: Collaboration with Institute of Chartered Accountants for online courses. Aiming to create a pool of competent accountants for local governance.

Challenges:

- Competent Accountants Shortage: Difficulty in finding skilled accountants for local governments, especially in remote areas.

- Grassroots Service Delivery: Ensuring effective delivery of devolved functions at the grassroots level.

- Capacity Building Imperatives: The article highlights the necessity for robust capacity-building initiatives to overcome challenges and strengthen local self-governance.

Key Terms:

- Devolved Functions: Functions transferred to local governments for implementation.

- Audit Diwas: Day marking the commencement of registration for online courses on November 16, 2023.

Key Phrases:

- Citizen Oversight: Involving citizens in identifying high-risk areas for audit.

- Social Audit: Facilitating citizen engagement through regular audits and follow-up actions.

- Capacity Building: Strengthening local governance through training and online courses.

Analysis:

The article underscores the critical role of CAG in upholding democratic principles and the evolving strategies to enhance citizen engagement. It highlights challenges in local governance, emphasizing the need for skilled personnel and effective service delivery at the grassroots.

Key Facts/Data:

- The Mahatma Gandhi National Rural Employment Audit of Scheme Rules was notified in 2011 to facilitate social audits.

- The 73rd and 74th Constitutional amendments created a three-tier structure for rural self-governance.

Way Forward:

- International Centre for Local Governance: Establishing a center for excellence to enhance the capacity of local government auditors globally.

- Online Courses: Introducing online courses to address the shortage of competent accountants for local bodies.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

How technology can empower Indian citizens and re-energise local governance

From UPSC perspective, the following things are important :

Prelims level: Models and initiatives of e governance

Mains level: Role of technology in governance and specially for the effective decentralized governance

What is the news?

- Today the relationship between citizens and the state has drastically changed due to extensive penetration and use of technology. Citizens now have concrete channels to directly influence the state and vice versa. It is thus imperative to factor into the debate the three broad ways in which technology has impacted the citizen-state relationship.

Central idea

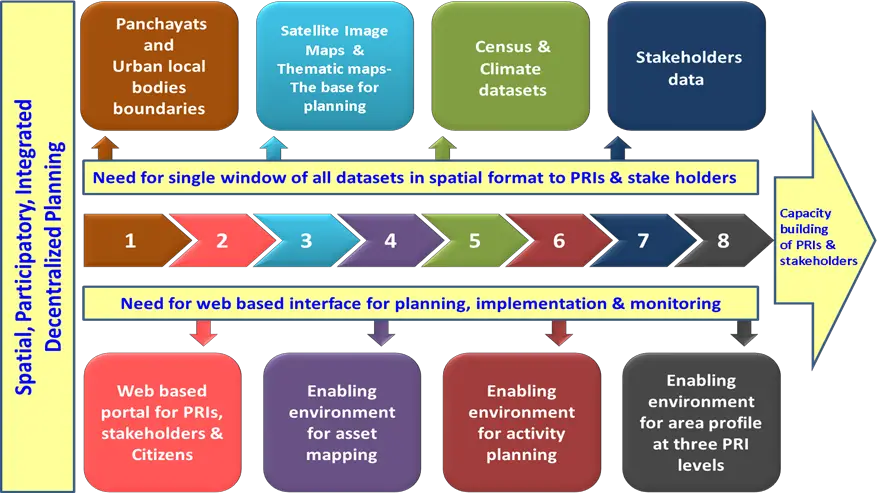

- India’s local governance system boasts an unparalleled scale, reach, and intent, with over 2.5 lakh gram panchayats, and more than 2,000 municipalities and municipal corporations. While some argue that the 73rd and 74th amendments of 1992 hold the key to realizing this potential, others contend that fundamental issues hinder their effective implementation. However, amidst this discussion, one crucial aspect that demands consideration is the rapidly evolving relationship between citizens and the state, primarily driven by technology.

Increasing role of technology in governance in India

- Improved Service Delivery: Technology enhances the delivery of public services through online portals and mobile applications. For example, the Government of India’s Digital India initiative provides services like online payment of utility bills, passport applications, and income tax filing through digital platforms.

- Transparency and Accountability: Technology promotes transparency by enabling the dissemination of information. Open data initiatives, such as India’s Open Government Data (OGD) Platform, provide access to government data on various sectors, promoting transparency and accountability.

- Citizen Engagement: Technology facilitates citizen participation through digital platforms. For instance, platforms like MyGov.in provide opportunities for citizens to engage in policy discussions, share ideas, and provide feedback to the government.

- Data-Driven Decision Making: Technology enables the collection, analysis, and utilization of data for evidence-based policy decisions. The Smart Cities Mission in India leverages data analytics to gather insights and make informed decisions for urban planning and development.

- E-Governance and Digital Transformation: Technology drives e-governance initiatives, streamlining administrative procedures. Examples include the online application and tracking system for services like obtaining a driving license or registering a business.

- Participatory Planning and Smart Cities: Technology supports participatory planning and the development of smart cities. The Pune Smart City initiative utilizes technology to engage citizens in urban planning through online platforms, enabling them to contribute ideas and suggestions.

- Digital Identity and Financial Inclusion: Technology establishes digital identity systems for secure access to financial services and government benefits. Aadhaar, India’s biometric-based digital identity system, enables individuals to avail subsidies and government schemes, promoting financial inclusion.

- Open Government and Collaboration: Technology facilitates open government initiatives and collaboration. Online platforms like India’s e-SamikSha enable government departments to collaborate, share information, and monitor the progress of government projects.

- Crisis Management and Emergency Response: Technology aids in real-time communication and coordination during crises. For instance, during natural disasters, mobile apps like the National Disaster Management Authority’s (NDMA) mobile app provide real-time alerts, emergency helplines, and rescue information.

- Capacity Building and Skill Development: Technology supports capacity building through e-learning platforms and online training programs. Initiatives like the National Digital Literacy Mission (NDLM) provide digital skills training to enable citizens to participate effectively in the digital governance era

Three broad ways in which technology has impacted the citizen-state relationship

- Breaking Communication Barriers through Social Media

- Communication Democratization: Social media platforms have democratized communication by providing accessible and widespread channels for citizens to engage with the state. Platforms like Facebook, Twitter, Instagram, and WhatsApp have enabled individuals from diverse backgrounds to connect, share information, and voice their concerns.

- Organization and Unity: Social media allows like-minded individuals to organize themselves, form communities, and present a united front on governance issues. It simplifies the process of mobilizing support, coordinating protests, and gathering signatures for petitions through platforms like Facebook groups, Twitter campaigns, and WhatsApp groups.

- Amplifying Public Grievances: Citizens can leverage social media platforms to amplify their voices and raise awareness about local issues. By sharing posts, tweets, and other content, individuals can draw attention to problems such as poor infrastructure, corruption, or inefficient services, ensuring a wider audience is reached.

- Structured Grievance Redressal: Recognizing the power of social media, state agencies have established structured systems to address public grievances raised on these platforms. Examples include the IRCTC’s active grievance redressal mechanism, the Chief Minister’s Office of Haryana seeking grievances on social media, and the Ministry of Consumer Affairs using a WhatsApp bot to receive citizen complaints.

- Access to Information: Social media has democratized access to information, empowering citizens with real-time updates, news, and developments related to governance issues. It allows individuals to share information, report on local issues, and hold authorities accountable, fostering transparency in decision-making processes.

- Citizen Engagement through Technological Adoption

- Accessibility and Inclusivity: Technology, particularly digital platforms and apps, has made citizen engagement more accessible and inclusive. Platforms like the MyGov App have allowed millions of citizens to provide inputs and feedback on government policies and programs, irrespective of their geographic location or socioeconomic status.

- Streamlined Communication Channels: Technology has simplified the process of citizen-state interaction. Dedicated channels, such as government apps and digital platforms, enable citizens to provide their inputs, raise concerns, and offer feedback with just a few clicks. This eliminates the need for traditional, time-consuming methods like writing letters or attending physical meetings.

- Improved Participation in Governance: Technology has expanded opportunities for citizen participation in governance processes. The use of video calls on platforms like WhatsApp for parent-teacher meetings in education departments allows parents to engage with teachers without having to take time off from work. This enhances participation and involvement of citizens in decision-making and service delivery.

- Enhanced Transparency and Accountability: By leveraging technology, state actors can gather real-time feedback and inputs from citizens, enabling more transparent and accountable governance. The Supreme Court and district courts conducting hearings through video conferencing and live streaming cases to the public exemplify this use of technology to ensure transparency and accountability.

- Collaboration with Local Entities: Technology has facilitated collaboration between state actors and local entities such as Resident Welfare Associations (RWAs). Startups like MyGate and ApnaComplex have supported RWAs in improving public engagement and facilitating two-way communication between citizens and local authorities. This collaborative approach ensures that citizen inputs are considered in the design and improvement of services.

- Democratization of Feedback: Through technology, citizens have the opportunity to provide feedback on government policies, programs, and service delivery. This direct engagement allows for a more inclusive and comprehensive understanding of citizens’ needs and aspirations, which can inform the decision-making process and lead to more citizen-centric governance.

- Open-Source Technology Empowering Citizens

- Openness and Accessibility: Open-source technology, such as Aadhaar, UPI, and CoWin, is built as publicly-owned digital infrastructure. The source code of these technologies is publicly available, allowing citizens to access and suggest improvements independently.

- Direct Influence on the State: With an active and engaged open-source community, citizens can exercise direct influence on the state through their contributions to digital public infrastructure. By actively participating in the development and improvement of these technologies, citizens can shape the direction and functionality of government systems, increasing their influence on governance.

- Democratization of Technology: Open-source technology democratizes access to technology by making it publicly available. Citizens can access the source code, suggest improvements, and contribute to the development process. This allows for a broader range of individuals, regardless of financial resources or technical expertise, to actively engage with and benefit from these technologies.

- Increasing Ease of Citizen Contribution: With advancements in artificial intelligence (AI) tools, citizen contributions to decentralized public governance systems (DPGs) are becoming easier. The article suggests that AI tools can facilitate citizens’ direct contribution to DPGs, enabling seamless integration of technology in local governance processes.

- Potential for Local Governance: Open-source technology holds the potential to transfer power into the hands of citizens, particularly at the local level. The article mentions how technology can be leveraged by grassroots leaders, such as sarpanchs, for efficient governance of their panchayats. Open-source technology empowers local leaders to utilize technology in decision-making, service delivery, and governance processes.

Conclusion

- Technology, including AI, plays a crucial role in the decentralization. It is essential to explore more effective models of grassroots governance that align with the information age. The time for pondering has passed; now is the time for action. It is imperative for policymakers, state actors, and citizens to harness the potential of technology and work together to realize the true spirit of decentralization.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Supreme Court asks NGO to move govt against Sarpanch-Patism

From UPSC perspective, the following things are important :

Prelims level: Read the attached story

Mains level: Proxy politicians

Central Idea

- The Supreme Court of India has stated that the government, rather than the judiciary, should address the issue of men exerting power behind elected women who remain “faceless wives and daughters-in-law” in grassroots politics.

- The court’s remarks came in response to a petition filed by an NGO which highlighted the phenomenon of unelected male relatives wielding political influence, undermining the spirit of women’s reservation in Panchayati Raj Institutions (PRIs).

Women in PRIs: Legal Aspects

(a) 73rd Constitutional Amendment Act, 1992:

- Mandates 33.3% reservation for women in PRIs across the country.

- Recognizes the Gram Sabha as the foundation of the Panchayat Raj System, empowering it to perform functions and exercise powers entrusted by the State Legislatures.

- Some states have increased the reservation to 50%, including Andhra Pradesh, Chhattisgarh, Gujarat, Himachal Pradesh, Bihar, etc.

- Out of the 30.41 lakh elected representatives in PRIs, 13.74 lakh (45.2%) are women.

(b) Article 15(3) of the Constitution:

- Empowers the State to make special provisions for women.

- Allows the government to introduce measures to ensure gender equality and promote the interests of women.

(c) Article 243D:

- Provides for the reservation of one-third of the total number of seats and offices of Chairpersons in PRIs for women.

- The reserved seats and offices are allocated through rotation to different constituencies within a Panchayat.

- These reservations for women are in addition to the reservations for Scheduled Castes (SCs) and Scheduled Tribes (STs) in all three tiers of PRIs.

(d) Intersectional Reservations:

- The reservation of seats and offices for women in PRIs also falls within the overall reservations for Scheduled Castes (SCs) and Scheduled Tribes (STs) in all three tiers of PRIs.

- This provision aims to address the intersecting disadvantages faced by women from marginalized communities.

(e) Proposed 110th Constitution Amendment Bill:

- Introduced in the Lok Sabha in 2009 to bring about 50% reservation for women in Panchayats across all states.

- The bill aimed to increase the reservation beyond the existing 33.3% mandated by the 73rd Amendment Act.

- Despite multiple tabled attempts, the bill was not passed into law.

Proxy Sarpanchs in India

- It is generally observed where an elected lady Sarpanch (the head of a Panchayat) delegates their powers and responsibilities to someone else, typically a family member or a trusted individual.

- This proxy then acts as a representative or substitute for the Sarpanch in carrying out their duties.

- Quite often, this delegation is forcefully acquired from women.

Reasons behind Panchayat Pati syndrome

- Gender Inequality: Deep-rooted gender inequalities prevalent in Indian society play a significant role in perpetuating the Panchayat Pati syndrome. Patriarchal norms and cultural beliefs that prioritize male authority and decision-making often restrict women’s agency and participation in public affairs.

- Social Norms and Expectations: Traditional gender roles and societal expectations define women’s primary role as homemakers and caretakers. This perception often results in women being considered unfit or inexperienced in matters of governance

- Lack of Awareness and Education: Limited access to education and awareness about women’s rights and the importance of their participation in local governance can contribute to the prevalence of Panchayat Pati. Lack of awareness among women themselves, as well as their families and communities, can lead to the perpetuation of discriminatory practices.

- Male Domination and Resistance to Change: Male dominance in politics and resistance to gender equality can also contribute to the Panchayat Pati syndrome.

- Political Dynamics and Power Struggles: In some cases, male family members or influential community leaders may strategically use the Panchayat Pati practice to retain power and influence. By controlling women’s decision-making, they can ensure their interests are protected and continue to exert control over the local governance processes.

Impact of Panchayat Pati syndrome

1. Economic Impact:

- The practice of Panchayat Pati limits the active participation of women in decision-making processes within the panchayat.

- This exclusion can hinder the effective utilization of resources and allocation of funds, potentially leading to suboptimal economic outcomes for the community.

- Women’s perspectives and needs may not be adequately represented, and projects or initiatives that could benefit women, such as those related to education, healthcare, or livelihood opportunities, may not receive sufficient attention or support.

2. Social Impact:

- Panchayat Pati reinforces gender inequalities and perpetuates traditional gender roles within communities.

- It hampers women’s ability to exercise agency and engage in community development activities. it diminishes their self-esteem and status within the community.

3. Political Impact:

- The practice of Panchayat Pati undermines the principles of democratic representation and participatory governance.

- It restricts the political agency of women and denies them the opportunity to actively contribute to decision-making processes.

- Women’s perspectives and priorities often differ from those of men, and their exclusion diminishes the diversity of voices and perspectives in local governance. This can lead to policy decisions that may not adequately address the needs and concerns of women and other marginalized groups.

Court’s Response

- Not an Executive Authority: The court acknowledged the issue but emphasized that it is not the role of the judiciary to create a spirit of empowerment.

- Focus on women empowerment: The court pointed out that preventing influential individuals’ wives from contesting elections is not feasible, and empowering women requires an evolutionary process.

- Government’s Responsibility: The court highlighted that the Ministry of Panchayati Raj should address the petitioner’s grievance and explore better mechanisms to implement the objectives of women’s reservation.

- Expert Committee and Support Mechanism: The petitioner suggested the formation of an expert committee and the provision of the right support mechanism for women. However, the court deemed this an unrealistic expectation from the judiciary.

Way forward

- Engage Men as Allies: Promote male allies in supporting women’s representation in PRIs. Encourage men to actively advocate for gender equality, challenge patriarchal norms, and work towards creating a more inclusive and equitable political environment.

- Capacity Building and Leadership Development: Provide training and capacity-building programs for women elected representatives in PRIs.

- Political Awareness and Participation: Conduct awareness campaigns to educate women about their rights, the importance of political participation, and the impact of their involvement in PRIs.

- Inter-Gender Dialogues: Organize inter-generational dialogues where older leaders and women can exchange knowledge, experiences, and perspectives. This can help bridge the generation gap, promote inter-generational collaboration, and strengthen the collective power of women in PRIs.

Conclusion

- It is the responsibility of the executive authority to find suitable solutions and ensure the effective implementation of women’s reservations in panchayat governance.

Mains Mark enhancer: Successful Women Sarpanch in India

- Kali Bein Panchayat, Punjab: Kali Bein Panchayat in Punjab gained recognition for its all-women panchayat led by Sarpanch Bibi Jagir Kaur. Under her leadership, the panchayat focused on various development initiatives, including infrastructure development, water conservation, and women empowerment programs.

- Mawlynnong, Meghalaya: Mawlynnong, a village in Meghalaya, is known for its clean and well-maintained environment. The village achieved this feat under the leadership of women panchayat leaders who implemented strict cleanliness and waste management measures, making it one of the cleanest villages in Asia.

- Devdungri, Rajasthan: Devdungri village in Rajasthan is an exemplary case of women’s leadership in panchayats. Women panchayat members successfully implemented initiatives to address issues such as child marriage, female foeticide, and women’s education. Their efforts resulted in significant positive changes in the community.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

What is PESA Act?

From UPSC perspective, the following things are important :

Prelims level: PESA Act

Mains level: Not Much

A Political Party has declared a six-point “guarantee” for tribals in Gujarat’s Chhota Udepur district, including the “strict implementation” of The Panchayats (Extension to the Scheduled Areas) Act (PESA Act).

What is PESA Act?

- The PESA Act was enacted in 1996 to provide for the extension of the provisions of Part IX of the Constitution relating to the Panchayats to the Scheduled Areas.

- Other than Panchayats, Part IX, comprising Articles 243-243ZT of the Constitution, contains provisions relating to Municipalities and Cooperative Societies.

- Under the PESA Act, Scheduled Areas are those referred to in Article 244(1), which says that the provisions of the Fifth Schedule shall apply to the Scheduled Areas and Scheduled Tribes in states other than Assam, Meghalaya, Tripura, and Mizoram.

- The Fifth Schedule provides for a range of special provisions for these areas.

How is the PESA Act, 1996 supposed to work?

- The PESA Act was enacted to ensure self-governance through Gram Sabhas (village assemblies) for people living in the Scheduled Areas.

- It recognises the right of tribal communities to govern themselves through their own systems of self-government, and also acknowledges their traditional rights over natural resources.

- In pursuance of this objective, the Act empowers Gram Sabhas to play a key role in approving development plans and controlling all social sectors.

Special powers accorded by PESA Act includes the:

- Processes and personnel who implement policies

- Exercising control over minor (non-timber) forest resources

- Minor water bodies and minor minerals

- Managing local markets

- Preventing land alienation and

- Regulating intoxicants among other things

States and PESA Act

- State governments are expected to amend their respective Panchayati Raj Acts without making any law that would be inconsistent with the mandate of PESA.

- Ten states — Andhra Pradesh, Chhattisgarh, Gujarat, Himachal Pradesh, Jharkhand, Madhya Pradesh, Maharashtra, Odisha, Rajasthan, and Telangana — have notified Fifth Schedule areas that cover partially or fully several districts in each of these states.

- After the PESA Act was enacted, the central Ministry of Panchayati Raj circulated model PESA Rules.

- So far, six states have notified these Rules, including Gujarat.

What is the issue in Gujarat?

- Gujarat notified the State PESA Rules in January 2017, and made them applicable in 4,503 gram sabhas under 2,584 village panchayats in 50 tribal talukas in eight districts of the state.

- The provisions of the law deem the Gram Sabhas as “most competent”.

- However, the Act has not been enforced in letter and spirit.

- The Act lays down that the state must conduct elections in such a way that the tribal representation is to be dominant in the Gram Sabha Committees.

- Yet again, there has been no attempt to proportionally increase the representation.

Try this PYQ:

Q.The Government enacted the Panchayat Extension to Scheduled Areas (PESA) Act in 1996. Which one of the following is not identified as its objective?

(a) To provide self-governance

(b) To recognize traditional rights

(c) To create autonomous regions in tribal areas

(d) To free tribal people from exploitation

Post your answers here.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Municipal finances

From UPSC perspective, the following things are important :

Prelims level: 74th Constitutional Amendment Act

Mains level: Paper 2- Municipal finances

Context

Recently, the Indian Institute for Human Settlements (IIHS) analysed data from 80 urban local bodies (ULBs) across 24 States between 2012-13 and 2016-17 to understand ULB finance and spending, and found some key trends.

Health of municipal finances

- The 74th Constitution Amendment Act was passed in 1992 mandating the setting up and devolution of powers to urban local bodies (ULBs) as the lowest unit of governance in cities and towns.

- Constitutional provisions were made for ULBs’ fiscal empowerment.

- Challenges in fiscal empowerment: Three decades since, growing fiscal deficits, constraints in tax base expansion, and weakening of institutional mechanisms that enable resource mobilisation remain challenges.

- Revenue losses after implementation of the Goods and Services Tax (GST) and the pandemic have exacerbated the situation.

Analysing the trends in municipal finances

Recently, the Indian Institute for Human Settlements (IIHS) analysed data from 80 ULBs across 24 States between 2012-13 and 2016-17 to understand ULB finance and spending, and found some key trends.

1] Own sources of revenue less than half of total revenue

- Key sources of revenue: The ULBs’ key revenue sources are taxes, fees, fines and charges, and transfers from Central and State governments, which are known as inter-governmental transfers (IGTs).

- Important indicator of financial health: The share of own revenue (including revenue from taxes on property and advertisements, and non-tax revenue from user charges and fees from building permissions and trade licencing) to total revenue is an important indicator of ULBs’ fiscal health and autonomy.

- The study found that the ULBs’s own revenue was 47% of their total revenue.

- Of this, tax revenue was the largest component: around 29% of the total.

- Property tax, the single largest contributor to ULBs’ own revenue, accounted for only about 0.15% of the GDP.

- Figures for developing countries: The corresponding figures for developing and developed countries were significantly higher (about 0.6% and 1%, respectively) indicating that this is not being harnessed to potential in India.

2] High dependence on IGTs

- Most ULBs were highly dependent on external grants — between 2012-13 and 2016-17, IGTs accounted for about 40% of the ULBs’ total revenue.

- Transfers from the Central government are as stipulated by the Central Finance Commissions and through grants towards specific reforms, while State government transfers are as grants-in-aid and devolution of State’s collection of local taxes.

3] Tax revenue is largest revenue for larger cities, while smaller cities are more dependent on grants

- here are considerable differences in the composition of revenue sources across cities of different sizes.

- Class I-A cities (population of over 50 lakh) primarily depend on their own tax revenue, while Class I-B cities and Class I-C cities (population of 10 lakh-50 lakh and 1 lakh-10 lakh, respectively) rely more on IGTs.

- Own revenue mobilisation in Class I-A cities increased substantially.

- It was primarily driven by increases in non-tax revenue

4] Increasing operations and maintenance (O&M) expenses

- Operations and maintenance (O&M) expenses are on the increase but still inadequate.

- While the expenses were on the rise, studies (such as ICRIER, 2019 and Bandyopadhyay, 2014) indicate that they remained inadequate.

- For instance, O&M expenses incurred in 2016-17 covered only around a fifth of the requirement forecast by the High-Powered Expert Committee for estimating the investment requirements for urban infrastructure services.

- O&M expenses should ideally be covered through user charges, but total non-tax revenues, of which user charges are a part, are insufficient to meet current O&M expenses.

- The non-tax revenues were short of the O&M expenditure by around 20%, and this shortfall contributed to the increasing revenue deficit in ULBs.

Way forward

- Improving own revenue: It is essential that ULBs leverage their own revenue-raising powers to be fiscally sustainable and empowered and have better amenities and quality of service delivery.

- Stability in IGT: Stable and predictable IGTs are particularly important since ULBs’ own revenue collection is inadequate.

- O&M expenses: Increasing cost recovery levels through improved user charge regimes would not only improve services but also contribute to the financial vitality of ULBs.

- Measures need to be made to also cover O&M expenses of a ULB for better infrastructure and service.

- Tapping into property taxes, other land-based resources and user charges are all ways to improve the revenue of a ULB.

Conclusion

The health of municipal finances is a critical element of municipal governance which will determine whether India realises her economic and developmental promise.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Structural interventions by state governments that can create higher-wage jobs

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Structural interventions by State for creating high wage jobs

Context

The recent decision to deduct off-budget borrowings from state borrowing limits reminds chief ministers to be good policy ancestors.

Financing welfare state

- In A Brief History of Equality, economist Thomas Piketty suggests that “the world of the early 2020s, no matter how unjust it may seem, is more egalitarian than that of 1950 or 1900, which were… more egalitarian than those of 1850 or 1780”.

- But how the welfare state is financed matters.

- Changes in state borrowing limits: Adjusting state borrowing limits for their off-budget borrowings leads to transparency because they are routinely breached through vehicles for schemes whose bill comes due far in the future.

- The confiscation of future spending — interest payments crowd out expenditure and revenue expenditure crowd out capex — matters because our prosperity problem is productivity, wages, not jobs.

5 Structural interventions that can create high wage jobs

1] Reduce regulatory hurdles

- States control 80 per cent of India’s employers’ compliance ecosystem of 67,000+ compliances, 6,500+ filings and 26,000+ criminal provisions.

- State governments that rationalise, decriminalise, and digitise their compliance ecosystem will reap lower corruption and higher formality.

2] Fix government schools

- The most powerful tool for social mobility and employability is free and quality school education.

- State governments that undertake a significant overhaul of school performance management (the fear of falling and hope of rising for teachers) and governance (the allocation of decision rights around resources and hiring) will create an unfair advantage in human capital.

3] Converge education and employability

- States should set up skill universities that create qualification modularity (between certificates, diplomas, advanced diplomas, and degrees), delivery flexibility (equate online, apprenticeships, on-site and on-campus classrooms), and pray to the one god of employers.

- Degree apprentices innovate at the intersection of employment, employability and education.

- State governments that remove barriers in their path will see their population of employed learners exceed full-time learners.

4] Devolution of money and power

- Cities drive productive job creation — New York City’s GDP is higher than Russia’s.

- It took 70 years after 1947 for the budget of 28 states to cross the central government’s budget.

- The combined budget of state governments now exceeds Rs 45 lakh crore, but 2.5 lakh municipalities and panchayats have a budget of only Rs 3.7 lakh crore.

- Governments that devolve money and power from state capitals to their towns will avoid the curse of megacities and create the competition that drove China’s growth (they have 375 cities with more than a million people versus our 52).

5] Civil service reforms

- State governments must sell their 1,500+ loss-making public sector units, cut civil service compensation to less than 40 per cent of budget spending, and replace expenditure with capex.

- Moving from outlays to outcomes needs a new human capital regime for civil servants via seven interventions; structure, staffing, training, performance management, compensation, culture, and HR capabilities.

Shifting resources to protective and productive version of states

- Nobel Laureate James Buchanan said any state had three versions — the protective state (police, rule of law, defence, courts), the productive state (common goods like roads, power, health, education, etc.), and the redistributive state.

- Too many state governments accept the status quo in the first two and “innovate” in the third version.

- It’s time to shift resources to the first two.

Conclusion

Chief Ministers ought to create high wage jobs, and not borrow money future generations will have to repay.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Nod to extend Gram Swaraj Scheme

From UPSC perspective, the following things are important :

Prelims level: Gram Swaraj Scheme

Mains level: Read the attached story

The Cabinet Committee on Economic Affairs (CCEA) approved a proposal to continue the Rashtriya Gram Swaraj Abhiyan (RGSA), a scheme for improving the governance capabilities of Panchayati Raj institutions, till 2025-26.

What is RGSA?

- The RGSA, a centrally sponsored scheme, was first approved by the Union Cabinet in 2018 for implementation from 2018-19 to 2021-22.

- It is a unique scheme proposed to develop and strengthen the Panchayati Raj System across India in rural areas.

- The objective of the campaign is to promote social harmony, spread awareness about pro-poor initiatives of the government, and reach out to poor households to enroll them as also to obtain their feedback on various welfare programs.

- The main central components of the scheme included incentivization of panchayats and mission mode project on e-Panchayat including other activities at central level.

Scope of the scheme

- RGSA is extend to all States and Union Territories (UTs) of the country. It includes institutions of rural local government in non-Part IX areas.

- Part IX provides for a 3 tier Panchayat system, which would be constituted in every state at the village level, intermediate level and district level.

- This provision brought uniformity in the Panchayati Raj structure in India.

Areas where Part IX is not applicable:As per Article 243M of the Constitution, provisions of Part IX of the Constitution are not applicable to:

|

Purpose of extension

The scheme would work towards:

- Poverty-free and enhanced livelihood in villages

- Healthy villages, child-friendly villages

- Water-sufficient villages

- Clean and green villages

- Self-sufficient infrastructure in villages

- Socially-secure villages with good governance and engendered development

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

[pib] Mysuru Declaration on Service Delivery by Panchayats

From UPSC perspective, the following things are important :

Prelims level: Myusur Declaration

Mains level: Not Much

The Participants from 16 States signed the Mysuru Declaration and resolved to roll out the Common Minimum Service delivery by Panchayats across the country from April 1, 2022.

Mysuru Declaration

- The Mysuru declaration is aimed at recognising Citizen Centric Services as the “Heart of Governance”.

- It provides key inputs on various aspects of service delivery that are either provided by the panchayats directly or services of other departments that are facilitated by panchayats.

Highlights of the Declaration

WE, the Representatives and Officials recognise the efforts to promote inclusive and accountable Local Self Governments in delivery of services, in consonance with the priorities and the aspirations of our citizens.

We accept responsibility for seizing this moment to strengthen our commitments to promote transparency, empower citizens, and harness the power of new technologies towards timely and quality delivery of services; enhancing citizen service experiences

We uphold the value of openness in our engagement with citizens to improve services, incorporating diverse views when designing and delivering services. We embrace principles of transparency and open government with a view towards achieving greater prosperity, well-being, and human dignity for sustainable development of local communities.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

25 years of Panchayats (Extension to the Scheduled Areas) Act, 1996 (PESA)

From UPSC perspective, the following things are important :

Prelims level: PESA, FIfth Schedule

Mains level: Tribal autonomy and self-government issues

The Ministry of Tribal Affairs has celebrated the 25th year of the inauguration of the Panchayats (Extension to Scheduled Areas) Act 1996 (PESA)’ as a part of Azadi Ka Amrit Mahotsav.

What is PESA?

- The PESA is a law enacted by the govt. for ensuring self-governance through traditional Gram Sabhas for people living in the Scheduled Areas of India.

- Scheduled Areas are areas identified by the Fifth Schedule of the Constitution of India.

What are Scheduled Areas?

- “Scheduled Areas” mean the Scheduled Areas as referred to in Clause (1) of Article 244 of the Constitution.

- They are found in ten states of India which have predominant population of tribal communities.

- At present, Scheduled Areas have been declared in the States of AP (including Telangana), Chhattisgarh, Gujarat, Himachal Pradesh, Jharkhand, MP, Maharashtra, Odisha and Rajasthan.

Powers granted to Gram Sabha/Panchayats

- Land acquisition: To be consulted on matters of land acquisition and resettlement.

- Mining licencing: Grant prospecting license for mining lease for minor minerals and concessions for such activities.

- Water Bodies: Planning and management of minor water bodies.

- Regulation of Liquor: The power to enforce prohibition or to regulate or restrict the sale and consumption of any intoxicant.

- Minor Forest Produces: The ownership of MFPs

- Land reforms: The power to prevent alienation of land and to restore any unlawfully alienated land of a scheduled tribe.

- Village Markets: The power to manage village markets.

- Money Lending: The power to exercise control over money lending to scheduled tribes.

Role of Governor in Implementation of PESA

(1) Report as sought by the President:

- As per para 3 of the Fifth Schedule, the Governor therein is required to make a report to the President regarding the administration of the Scheduled Areas.

- The Attorney General had advised the Home Ministry that the role of the governor in sending this report is discretionary.

(2) Applicability of certain laws:

- An even more significant role of the Governor in scheduled areas arises out of the powers inherent in sub-para (1) of Para 5 of the Fifth Schedule.

- Governor may direct that any particular Act of Parliament or of the Legislature of the State shall not apply to a Scheduled Area or any part thereof in the State or shall apply to a Scheduled Area.

(3) Modification of laws:

- The regulation-making powers of the Area is bound neither by the advice of the Tribes Advisory Council or the assent of the President.

- The provision lays down the responsibility on the Governor to ensure that laws that are contrary to the interests of Scheduled Areas may be suitably modified.

Why was PESA enacted?

- Filling the constitutional vacuum: These Areas were not covered by the 73rd Constitutional Amendment or Panchayati Raj Act of the Indian Constitution as provided in Part IX of the Constitution.

- Self-governance: PESA sought to enable the Panchayats at appropriate levels and Gram Sabhas to implement a system of self-governance.

- Customary regulation: It includes a number of issues such as customary resources, minor forest produce, minor minerals, minor water bodies, selection of beneficiaries, sanction of projects, and control over local institutions.

Significance of PESA

- Tribal autonomy: PESA was seen as a panacea for many of these vulnerabilities where the tribal communities in such Scheduled Areas were to decide by themselves the pace and priorities of their development.

- Tribal way of development: PESA was viewed as a positive development for tribal communities in Scheduled Areas that had earlier suffered tremendously from engagement with modern development processes.

- Sustainable access to forests: The loss of access to forest, land, and other community resources had increased their vulnerability.

- Easing of tribal distress: Rampant land acquisition and displacement due to development projects had led to large-scale distress in tribal communities living in Scheduled Areas.

Issues with PESA

- Dilution of the role of Tribal Advisory Councils: PESA mandates Tribal Advisory Councils to oversee tribal affairs and also gives extrajudicial, extra-constitutional powers to the Governors.

- Politicization: The councils, with the CM as their chairperson, have evolved into a non-assertive institution amid the machinations of upper-class politics.

- Non-involvement: The Governors, in order to have friendly relations with the Chief Ministers, have desisted from getting involved in tribal matters.

- Lack of coordination at Centre: Two different ministries, the Ministry of Panchayati Raj and the Ministry of Tribal Affairs, have an overlapping influence and they function almost without any coordination.

- Lack of operationalization: In most of the state the enabling rules are not in place more than eight years after the adoption of the Act suggests the reluctance to operationalize the PESA mandate.

- Ignoring the spirit of PESA: The state legislations have omitted some of the fundamental principles without which the spirit of PESA can never be realised.

- Ambiguous definitions: No legal definition of the terms like minor water bodies, minor minerals etc. exist in the statute books.

Related question in CS Mains:

Q. What are the two major legal initiatives by the State since Independence addressing discrimination against Scheduled Tribes (STs)? (2017, 150W)

—

Also try answering this PYQ:

In the areas covered under the Panchayat (Extension to the Scheduled Areas) Act, 1996, what is the role/power of Gram Sabha?

- Gram Sabha has the power to prevent alienation of land in the Scheduled Areas.

- Gram Sabha has the ownership of minor forest produce.

- Recommendation of Gram Sabha is required for granting prospecting license or mining lease for any mineral in the Scheduled Areas.

Which of the statements given above is/are correct?

(a) Only 1

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Post your answers here:

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

[pib] Saansad Adarsh Gram Yojana

From UPSC perspective, the following things are important :

Prelims level: Saansad Adarsh Gram Yojana

Mains level: Not Much

The Ministry of Rural Development has taken several measures for the successful implementation of the Sansad Adarsh Gram Yojana (SAGY) Gram Panchayats.

Saansad Adarsh Gram Yojana (SAGY)

- SAGY is a village development project launched in October 2014, under which each Member of Parliament will take the responsibility of developing physical and institutional infrastructure in three villages by 2019.

- SAGY aims at instilling certain values in the villages and their people so that they get transformed into models for others.

These values include:

- Adopting people’s participation as an end in itself – ensuring the involvement of all sections of society in all aspects related to the life of village, especially in decision- making related to governance

- Adhering to Antyodaya – enabling the “poorest and the weakest person” in the village to achieve well being

- Affirming gender equality and ensuring respect for women

- Guaranteeing social justice

- Instilling dignity of labour and the spirit of community service and voluntarism

- Promoting a culture of cleanliness

- Living in consonance with nature – ensuring a balance between development and ecology

- Preserving and promoting local cultural heritage

- Inculcating mutual cooperation, self-help and self-reliance

- Fostering peace and harmony in the village community

- Bringing about transparency, accountability and probity in public life

- Nurturing local self-governance

- Adhering to the values enshrined in the Fundamental Rights and Fundamental Duties of the Indian Constitution

Identification of an Adarsh Gram

- A Gram Panchayat would be the basic unit.

- It will have a population of 3000-5000 in plain areas and 1000-3000 in hilly, tribal and difficult areas.

- In districts where this unit size is not available, Gram Panchayats approximating the desirable population size may be chosen.

- The MP would be free to identify a suitable Gram Panchayat for being developed as Adarsh Gram, other than his/her own village or that of his/her spouse.

- Lok Sabha MP has to choose a Gram Panchayat from within his/her constituency and Rajya Sabha MP a from the rural area of a district of his/her choice in the State from which he/she is elected.

- Nominated MPs may choose a Gram Panchayat from the rural area of any district in the country.

- In the case of urban constituencies, (where there are no Gram Panchayats), the MP will identify a Gram Panchayat from a nearby rural constituency.

- The newly elected MPs will have the option to select the GP of their choice.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

[pib] Sabki Yojna Sabka Vikas Campaign

From UPSC perspective, the following things are important :

Prelims level: Sabki Yojna Sabka Vikas

Mains level: Not Much

The Government has launched ‘Sabki Yojna Sabka Vikas’ campaign for inclusive and holistic preparation of the Gram Panchayat Development Plan (GPDP).

Sabki Yojna Sabka Vikas

- Under Article 243 G of the Constitution, Panchayats have been mandated for the preparation and implementation of plans for economic development and social justice.

- Thus, Panchayats have a significant role to play in the effective and efficient implementation of flagship schemes/programs on subjects of national importance for transforming rural India.

- The objectives of the campaign broadly include strengthening of elected representatives and Self-Help Groups, evidence-based assessment of progress made.

- The campaign aimed to help Gram Panchayats (GPs) in preparation of convergent and holistic GPDP through the identification of sectoral infrastructural gaps in respective areas.

Back2Basics: Gram Panchayat Development Plan (GPDP)

- The Gram Panchayats are constitutionally mandated for the preparation of GPDP for economic development and social justice utilizing resources available with them.

- The GPDP should be comprehensive and based on a participatory process involving the community particularly Gram Sabha.

- It will be in convergence with schemes of all related Central Ministries / Line Departments related to 29 subjects listed in the Eleventh Schedule of the Constitution.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Federalism and India’s human capital

From UPSC perspective, the following things are important :

Prelims level: 73rd and 74th Amendments

Mains level: Paper 3- Decentralisation and its relationship with human capital

The article argues for recognising the correlation between human capital and decentralisation in India.

Low human capital indicators

- In the World Bank’s Human Capital Index, the country ranked 116th.

- The National Family Health Survey-5 for 2019-20 shows that malnutrition indicators stagnated or declined in most States.

- The National Achievement Survey 2017 and the Annual Status of Education Report 2018 show poor learning outcomes.

- In addition, there is little convergence across States.

- India spends just 4% of its GDP as public expenditure on human capital:1% and 3% on health and education respectively— one of the lowest among its peers.

Initiatives to address these issues

- Investing in human capital through interventions in nutrition, health, and education is critical for sustainable growth.

- The National Health Policy of 2017 highlighted the need for interventions to address malnutrition.

- On the basis of NITI Aayog’s National Nutrition Strategy, the Poshan Abhiyaan was launched, as part of the Umbrella Integrated Child Development Scheme.

- The latest Union Budget has announced a ‘Mission Poshan 2.0’ and the Samagra Shiksha Abhiyan has been the Centre’s flagship education scheme since 2018.

Relation between decentralisation and human capital

- International experience suggests that one reason why these interventions are not leading to better outcomes may be India’s record with decentralisation.

- Globally, there has been a gradual shift in the distribution of expenditures and revenue towards sub-national governments.

- These trends are backed by studies demonstrating a positive correlation between decentralisation and human capital.

Issues with decentralisation in India

1) Letting states decide the way of empowerment

- The 73rd and 74th Amendments bolstered decentralisation by constitutionally recognising panchayats and municipalities as the third tier.

- The Amendment also added the Eleventh and Twelfth schedules containing the functions of panchayats and municipalities.

- These include education, health and sanitation, and social welfare for panchayats, and public health and socio-economic development planning for municipalities.

- However, the Constitution lets States determine how they are empowered.

- In effect, three tiers of government are envisaged in the Constitution it divides powers between the first two tiers — the Centre and the States

- This has resulted in vast disparities in the roles played by third-tier governments.

2) Centralised nature of fiscal architecture

- While the Constitution assigns the bulk of expenditure responsibilities to States, the Centre has major revenue sources.

- To address this vertical imbalance, the Constitution provides for fiscal transfers through tax devolution and grants-in-aid.

- In addition, the Centre can make ‘grants for any public purpose’ under Article 282 of the Constitution.

- While fiscal transfers that are part of tax devolution are unconditional, transfers under grants-in-aid or Centrally Sponsored Schemes (CSSs) can be conditional.

- Therefore, the increase in the States’ share of tax devolution represents more meaningful decentralisation.

- Despite some shifts towards greater State autonomy in many spheres, the centralised nature of India’s fiscal architecture has persisted.

- Centrally Sponsored Schemes (CSS) have formed a sizeable chunk of intergovernmental fiscal transfers over the years, comprising almost 23% of transfers to States in 2021-22.

- But its outsized role strays from the intentions of the Constitution.

- There are issues in the design of CSSs as well, with the conditions being overly prescriptive and, typically, input-based.

- Against this, international experience reveals that schemes with output-based conditions are more effective.

- Moreover, CSSs typically have a cost-sharing model, thereby pre-empting the States’ fiscal space.

3) Lack of fiscal empowerment

- Third-tier governments are not fiscally empowered.

- The collection of property tax, a major source of revenue for third-tier governments, is under 0.2% of GDP in India, compared to 3% of GDP in some other nations.

- The Constitution envisages State Finance Commissions (SFCs) to make recommendations for matters such as tax devolution and grants-in-aid to the third tier.

- However, many States have not constituted or completed these commissions on time.

Solution

- The Centre should play an enabling role, for instance, encouraging knowledge-sharing between States.

- For States to play a bigger role in human capital interventions, they need adequate fiscal resources.

- To this end, States should rationalise their priorities to focus on human capital development.

- The Centre should refrain from offsetting tax devolution by altering cost-sharing ratios of CSSs and increasing cesses.

- Concomitantly, the heavy reliance on CSSs should be reduced, and tax devolution and grants-in-aid should be the primary sources of vertical fiscal transfers.

- Panchayats and municipalities need to be vested with the functions listed in the Eleventh and Twelfth Schedules.

Consider the question “There is a positive correlation between decentralisation and human capital. This in part explains India’s low human capital indicators. In light of this, examine the issues with the decentralisation in India and suggest the measures to deal with it.”

Conclusion

Leveraging the true potential of our multi-level federal system represents the best way forward towards developing human capital.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Issues related to Urban local bodies

From UPSC perspective, the following things are important :

Prelims level: Article 243X

Mains level: Paper 2- Making urban local bodies financially strong

The inability of ULBs’ to raise revenue

- Although it is envisaged that municipal revenue should be 1% of GDP, between 2010 and 2018 revenues declined from 0.48% to 0.43%.

- As against the municipal revenue of Rs 4,624 per capita, own-source revenue was only Rs 1,975 in 2018 (ICRIER, 2019).

- This affects the low-levels of municipal services and translates into salary delays for employees.

8-way strategy to increase the revenue of ULBs

1) Increasing the property tax base

- In India, property taxes only account for 0.15% of GDP, whereas in developing economies they account for 0.6% and the global average is 1.04%.

- To double the property tax collection the property tax base needs to be expanded using GIS mapping, cross-checking with building licenses, ration cards, mutations, electricity/gas accounts, and review of exemptions.

- This also needs to cover government properties as per GoI circular 2009 and the SC judgment in Rajkot Corporation vs Railways.

- Similarly, rates need revision in the guiding value for rent or unit area; for instance, in Delhi, rates are fairly low.

- The collection process needs to be automated too.

- ABC (Always best Control) analysis should be done to target the top 10-20% properties, and measures such as attaching bank accounts must be implemented.

2) Upward revision of various fees

- The value capture taxes need to include upward revision of building license fee and new sources like impact fee, as imposed in Telangana, exactions, and betterment levy like the one imposed in Gujarat.

3) Levy advertisement fee

- An advertisement fee needs to be levied.

- Thiruvananthapuram listed the sites and plugged leakages for 33,170 unauthorized boards to double its income from 2018 to 2019.

- South Delhi MC has achieved a three-time increase with revision of rates in a ratio of 1:8 as per location and by dividing the city into clusters.

4) Local fee

- Local fee/charges also have immense potential such as (i) recovery on user charges (water, etc) which is only 20% (ii) right of way from gas/electricity and fiber optic lines, (ii) cell tower, (iii) leasing electricity poles, etc.

5) Participatory funding

- The potential of participatory funding (private sector, CSR, and local community) needs to be tapped.

- This has been done by Bengaluru, Ahmedabad, Mathura (Hybrid Annuity project), Indore, and Pune.

6) Special attention for assigning and activating the fiscal instrument

- Sixth, small and medium-sized municipal bodies need special attention for assigning and activating fiscal instruments.

- Better mobilization of own sources may also lead to revenue account surplus.

- This has been achieved in Ahmedabad, Pune, etc and it also enables access to the capital market.

7) Revision of Article 243X

- Article 243X needs suitable revision to allow larger inclusion of fiscal instruments above within the scope of a municipality’s own sources.

8) Creating ULBs as per MoHUA’s advisory

- Over 3,000 census towns not having city government need special attention to create ULBs in line with MoHUA’s advisory in 2016.

- It will create an innovative and effective financing framework for sustainable urban development.

Conclusion

Financially strong local bodies hold the key to the development of the country. The steps mentioned here needs to be implemented effectively to make the ULBs financially strong.

Source:-

https://www.financialexpress.com/opinion/bolster-ulbs-capacity-to-raise-revenue/2157171/

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

[pib] E-Gram Swaraj Portal

From UPSC perspective, the following things are important :

Prelims level: e-Gram SWARAJ

Mains level: E-governance of PRIs

A unified tool e-Gram SWARAJ portal has been developed by the Ministry of Panchayati Raj for effective monitoring and evaluation of works taken up in the Gram Panchayats.

e-Gram SWARAJ

- It unifies the planning, accounting and monitoring functions of Gram Panchayats.

- Its combination with the Area Profiler application, Local Government Directory (LGD) and the Public Financial Management System (PFMS) renders easier reporting and tracking of Gram Panchayat’s activities.

- It provides a single-window for capturing Panchayat information with the complete Profile of the Panchayat, details of Panchayat finances, asset details, activities taken up through Gram Panchayat Development Plan (GPDP) etc.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Enabling people to govern themselves

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Issues with the governance, importance of decentralisation.

The article examines the issues exposed by the pandemic with the current system of governance in India as well as the global level. Strengthening the local governments is suggested as the need of the hour.

How pandemic exposed the limits of systems

- Governance systems at all levels, i.e. global, national, and local, have experienced stress as a fallout of the COVID-19 pandemic.

- There was a breakdown in many subsystems in health care, logistics, business, finance, and administration.

- Solutions for one subsystem backfired on other subsystems.

- For example, lockdowns to make it easier to manage the health crisis have made but it was disastrous for the economy.

Following 3 are the problems exposed in the governance

1) Mismatch in abilities and functions

- Human civilisation advances with the evolution of better institutions to manage public affairs.

- Institutions of parliamentary democracy did not exist 400 years ago.

- Institutions of global governance, such as the United Nations and the World Trade Organization, did not exist even 100 years ago.

- These institutions were invented to enable human societies to produce better outcomes for their citizens.

- The pandemic has revealed a fundamental flaw in their design.

- There is a mismatch in the design of governance institutions at the global level with the challenges they are required to manage.

2) Interconnected issues

- All 17 Sustainable Development Goal are interconnected with each other.

- Environmental, economic, and social issues cannot be separated from each other.

- Experts working in silos or by agencies focused only on their own problems cannot solve these problems.

- As government responses to the novel coronavirus pandemic have revealed, a good solution to one can create more problems for others.

3) Local solution requires local problems

- Even if experts in different discipline arrives at silo-ed solutions at the global level, they will not be able to solve the systemic problems of the SDGs.

- Because, their solutions must fit the specific conditions of each country, and of each locality within countries too, to fit the shape of the environment and the condition of society there.

- Solutions for environmental sustainability along with sustainable livelihoods cannot be the same in Kerala and Ladakh.

- Solutions must be local.

- For the local people to support the implementation of solutions, they must believe the solution is the right one for them.

Decentralisation of governance

- Governance of the people must be not only for the people. It must be by the people too.

- There are scientific explanations for why local systems solutions are the best.

- Elinor Ostrom, the first woman to win the Nobel Prize in Economics, had developed the principles for self-governing communities from research on the ground in many countries, including India.

- Indian Constitution requires devolution of powers to local government too.

- During pandemic States in India, such as Kerala, have weathered the storm better than others.

- A hypothesis is that those States and countries in which local governance was stronger have done much better than others.

Consider the question “Examine the issues with the current system of governance which were exposed by the pandemic. Also explain why decentralisation could improve many problems the governance faces.

Conclusion

The government has to support and enable people to govern themselves, to realise the vision of ‘government of the people, for the people, by the people’. Which is also the only way humanity will be able to meet the ecological and humanitarian challenges looming over it in the 21st century.

Original article:

https://www.thehindu.com/opinion/lead/enabling-people-to-govern-themselves/article32071943.ece

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Taking care of finances of local governments