In this section, we will deal with the issue which is of critical importance to the growth of every economy – Financial Sector Reforms.

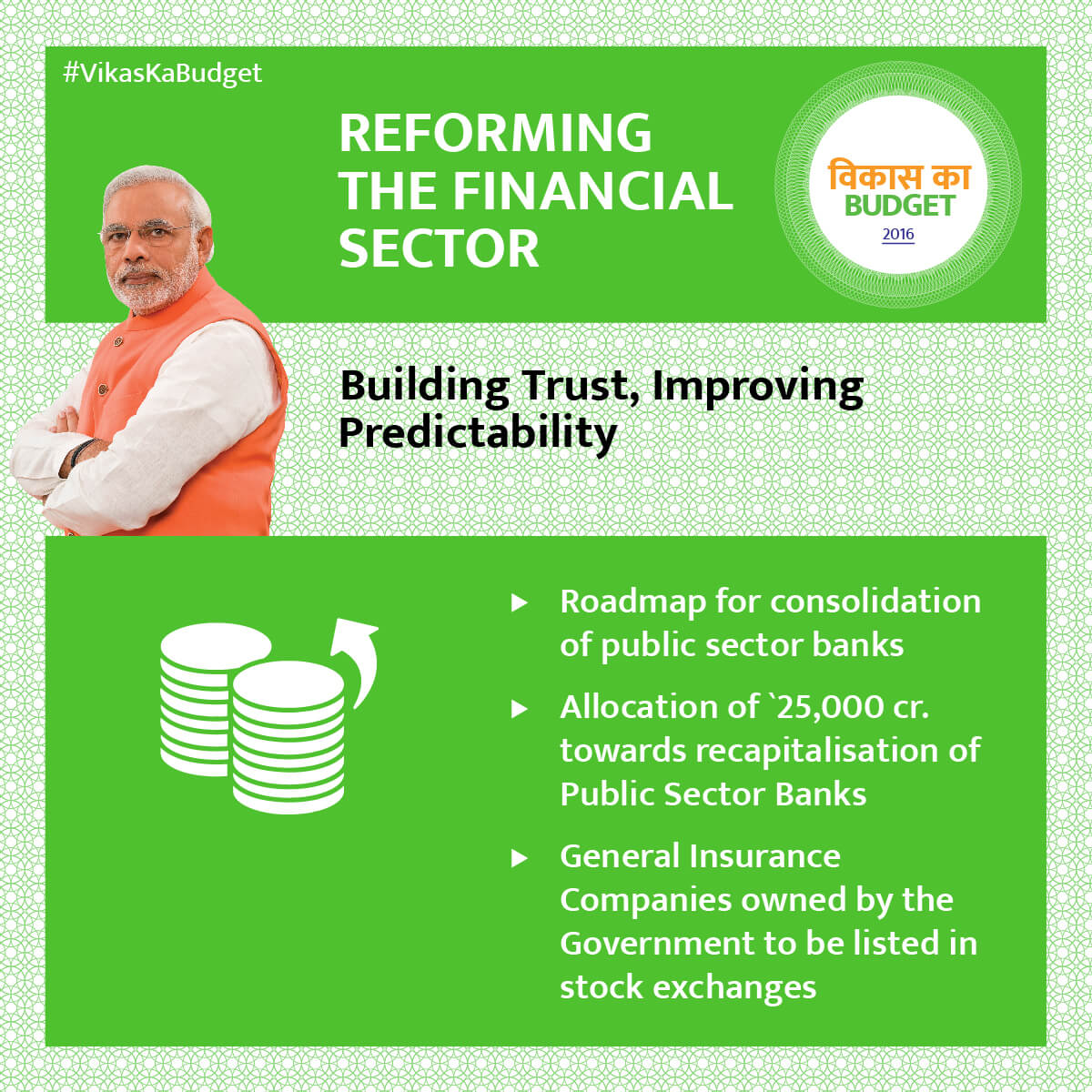

Take a look at overall approach of govt. towards financial sector reforms:

- Rs 25,000 crore towards recapitalisation of public sector banks

- Target of disbursement under MUDRA increased to 1,80,000 crore

- Banking Board Bureau to be operationalised

- General Insurance companies will be listed in the stock exchange

Focus Areas

Monetary Policy Committee

Govt. will amend RBI Act 1934, to provide statutory basis for a Monetary Policy Framework and a Monetary Policy Committee through the Finance Bill 2016.

Capital Market

- RBI will improve greater retail participation in govt securities

- SEBI will develop new derivative products in the commodity derivatives market

Revamping Public Sector Banks

- Govt. to allocate Rs. 25000 crore towards recapitalization of public sector banks

- The Bank Board Bureau will be operationalized during 2016-17

- The Debt Recovery Tribunals will be strengthened with focus on improving the existing infrastructure for speedier resolution of stressed assets

- Efforts are made to address structural issues in various sectors like Power, Coal, Highways, Sugar and Steel, with a focus on reviving stalled projects

Read more about Indradhanush and PJ Nayak committee on bank reforms and do watch our video explainer on NPAs.

Pradhan Mantri Mudra Yojana

Govt. had launched this scheme for the benefit of bottom of the pyramid entrepreneurs. Banks and NBFC-MFIs have sanctioned about Rs. 1 lakh crore to over 2.5 crore borrowers under PMMY. Govt. has increased the target next year to Rs. 1,80,000 crore.

Read more about Mudra bank and follow our story on Micro-finance.

New Initiatives

Bankruptcy code for Financial Sector Insolvency

Govt. will introduce a comprehensive Code on Resolution of Financial Firms as a Bill, in order to provide a specialised resolution mechanism to deal with bankruptcy situations in banks, insurance companies and financial sector entities

This code along with the Insolvency and Bankruptcy Code 2015, will provide a comprehensive resolution mechanism for our economy.

Bill on Illicit Deposit Schemes

Govt. will bring in a comprehensive central legislation to deal with the menace of illicit deposit taking schemes as poor and the financially illiterate are the worst-victims.

Amendments in SARFAESI Act, 2002

Govt. will bring necessary amendments in the SARFAESI Act 2002, tackle the problem of stressed assets in the banking sector. It will enable the sponsor of an Asset Reconstruction Companies to hold up to 100% stake in it and permit non-institutional investors to invest in Securitization Receipts.

Financial Data Management Centre

The centre will be set up under the aegis of the Financial Stability Development Council to facilitate integrated data aggregation and analysis in the financial sector.

What’s Financial Stability Development Council?

The idea to create such a super regulatory body was first mooted by the Raghuram Rajan Committee in 2008. Finally in 2010, the then Finance Minister of India, Pranab Mukherjee, decided to set up such an autonomous body dealing with macro prudential and financial regularities in the entire financial sector of India.

Chairperson: The Union Finance Minister of India

Post Office ATMs

To provide better access to financial services, especially in rural areas, we will undertake a massive nationwide rollout of ATMs and Micro ATMs in Post Offices over the next three years.

Read more about Payment Banks’ revolution.

Listing of General Insurance companies

The general insurance companies owned by the govt will be listed in the stock exchanges, in order to promote public shareholding in govt-owned companies as a means of ensuring higher levels of transparency and accountability.

Read more about Reforms in Banking Sector.

PS: Please click on the green hyperlinked text to read more about the concepts. Revise and revise & feel free to ask pertinent questions.

Published with inputs from Pushpendra | Image: Finmin