Last week, government approved the hybrid annuity model ( HAM ) as one of the modes for implementing highway development projects. This model was proposed by NHAI as investment dried up in other modes of road development projects such as BOT (Toll) and BOT (annuity).

In this article, we shall understand different modes of PPP projects for highway development.

There are 4 modes under which projects are awarded to private developers –

#1. BOT (toll) – Build Operate Transfer and Toll

As the name suggests, private party is responsible for building the project i.e. acquire land, procure raw material, design and construct the road i.e. private party bears construction risk.

They operate and maintain (O&M) the road during concession period as per agreed specifications i.e. private party bears O&M risk.

During concession period, they collect the toll. They recover their costs via toll collected during concession period i.e. private party bears Traffic or Commercial risk.

If traffic does not materialize as per their projections, they won’t be able to recover their investment or if goons of Shiv Sena assaults toll operators, private players again lose.

Private party has to arrange all the finance to build the project. Government awards contract to the party which is willing to share maximum toll revenue with the govt. Sometimes upfront viability gap funding (VGF) is provided for financially unviable projects.

Clearly private party bears maximum risk in BOT (toll).

#2. BOT (annuity)

What is annuity?

An annuity is a series of equal payments at regular intervals. Eg. pension payments, insurance payments etc.

BOT (annuity) was designed because BOT (toll) entailed too much risk and private developers were not willing to invest in the project.

This model is exactly similar to BOT (toll) except that private party does not bear traffic or commercial risk.

How do they recover their investment then?

NHAI pay them regular annuity during concession period. Obviously developer that demands minimum annuity will be selected.

#3. EPC – Engineering Procurement Construction

Govt policy paralysis, difficulty in land acquisition, high cost of financing etc meant that private interest dried up even in BOT (annuity) and govt. brought EPC mode to award the projects.

As the name suggests, private party only design the project, acquire raw material and construct the road i.e. private party bears only construction risk.

Immediately after the construction, the road is transferred to NHAI. 100 % upfront funding comes from government coffers. Government acquires the land, provides all the regulatory clearances.

In strict terms, EPC is not actually a PPP project. Private player bears virtually zero risk. Private player behaves as a contractor and constructs the road just as contractors build our houses.

As you could imagine, EPC model was putting lot of strain on government finances. Why? Well, one of the main motive of bringing private players is that private players will bring capital and supplement limited public capital. But here private players were bringing ZERO capital. Govt. had to think of an innovative project and along came…

#4. Hybrid Annuity Model (HAM)

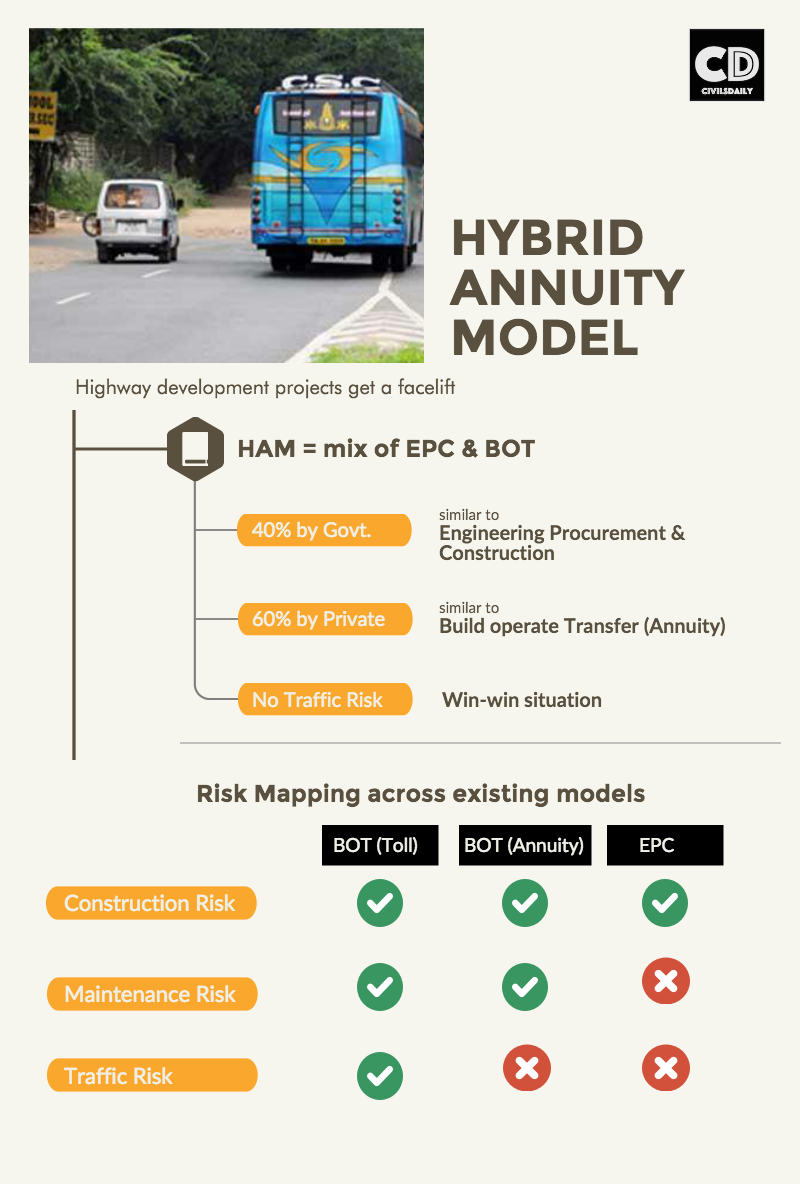

What is hybrid? Simply put, it’s a mix of EPC and BOT (annuity)

- Annuity? Private players don’t collect toll but recover investment via annuities

- EPC? Govt. provide 40% of project cost

BOT (annuity) part – Private player brings 60 % of capital. NHAI will pay annuity over concession period. Private player will be responsible for O&M of the project.

Other features of the project-

- Life cycle cost will be the bidding parameter

- Separate provision for O & M payments

- Provision for inflation adjusted project cost over time

How it is a win – win situation?

- Private player has to arrange for only 60% of project cost. Exposure and risk reduces

- All regulatory clearances risk, compensation risk, commercial risk and traffic risk is borne by government, so risk for private sector is minimal

- Govt. has to cough up only 40 % of initial funding

- Operation and maintenance by private player. Better expertise, better quality of services

- Finally comfort to lenders ( banks ) through assured annuity payments

Hope you got the key differences! If I left out something, feel free to ping back on the comments.

#Q1. What do you mean by the hybrid annuity model? Does this model provide for optimal risk sharing? Suggest some measures to reform overall PPP framework in the country with special reference to reasons for stalled PPP projects in last few years.

#Q2. Funding for infrastructure projects remain weak in India. Discuss various steps taken by govt to provide funding to infrastructure sector. Also suggest measures govt. can take to develop corporate bond market to fund infrastructure projects.

very good content. Thanks

Very help full thank you. Civilsdaily.com