Context

- Finance Ministry has recently announced a reduction in the base corporate tax rate to 22% from 30% as part of stimulus measures to reverse slowing economic growth.

- The effective tax rate for domestic corporates, inclusive of surcharges, will fall from 34.94% to 25.17% if they stop availing any other tax sops.

- For new manufacturing firms set up after October 1, 2019 and commencing operations by March 31, 2023, the effective tax rate will fall from 29.1% to 17%.

Corporate Tax: Background

- Indian taxation system is divided into two types: One is Direct Taxes and other is Indirect Taxes.

- Talking about direct taxes, it is levied on the income that different types of business entities earn in a financial year.

- There are different types of taxpayers registered with Income tax department and they pay taxes at different rates.

- An individual and a company being a taxpayer are not taxed at the same rate. Therefore, Direct Taxes are again subdivided as:

Income Tax

- This tax is paid by the taxpayers other than companies registered under company law in India on the income earned by them.

- They are taxed on the basis of slabs at different rates.

Corporate Tax

- This tax is paid by the companies registered under company law in India on the net profit that it makes from businesses.

- It is taxed at a specific rate as prescribed by the income tax act subject to the changes in the rates every year by the IT department.

Corporate Tax in India

- Domestic as well as foreign companies are liable to pay corporate tax under the Income-tax Act.

- While a domestic company is taxed on its universal income, a foreign company is only taxed on the income earned within India i.e. is being accrued or received in India.

- For the purpose of calculation of taxes under Income tax act, the types of companies can be defined as under:

- Domestic Company is one which is registered under the Companies Act of India and also includes the company registered in the foreign countries having control and management wholly situated in India. A domestic company includes private as well as public companies.

- Foreign Company is one which is not registered under the companies act of India and has control & management located outside India.

Why has the government slashed Corporate Tax?

- The corporate tax cut is part of a series of steps taken by the government to tackle the slowdown in economic growth, which has dropped for five consecutive quarters to 5% in the June quarter.

- The most immediate reason behind the tax cut may be the displeasure that various corporate houses have shown against the government’s policies.

- Many investors, for instance, were spooked by the additional taxes on them that were announced by the government during the budget in July and began pulling money out of the country.

- The government hopes that the new, lower tax rates will attract more investments into the country and help revive the domestic manufacturing sector which has seen lackluster growth.

Why Corporate Tax?

- The corporate tax rate is a major determinant of how investors allocate capital across various economies.

- So there is constant pressure on governments across the world to offer the lowest tax rates in order to attract investors.

- Tax cuts, by putting more money in the hands of the private sector, can offer people more incentive to produce and contribute to the economy.

Impact of the rate cut

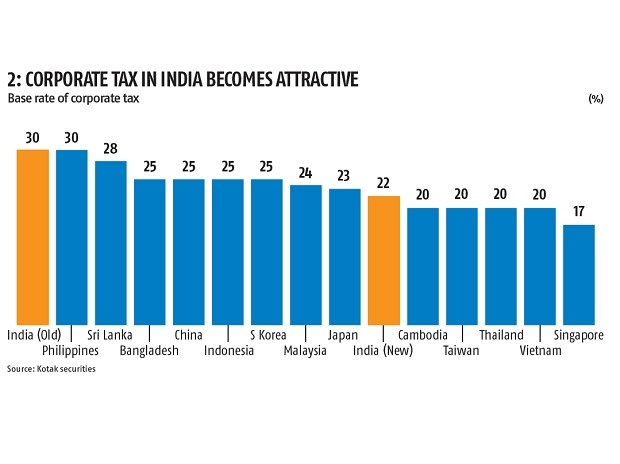

- The present cut in taxes can make India more competitive on the global stage by making Indian corporate tax rates comparable to that of rates in East Asia.

- The tax cut, however, is expected to cause a yearly revenue loss of ₹1.45 lakh crore to the government which is struggling to meet its fiscal deficit target.

- At the same time, if it manages to sufficiently revive the economy, the present tax cut can help boost tax collections and compensate for the loss of revenue.

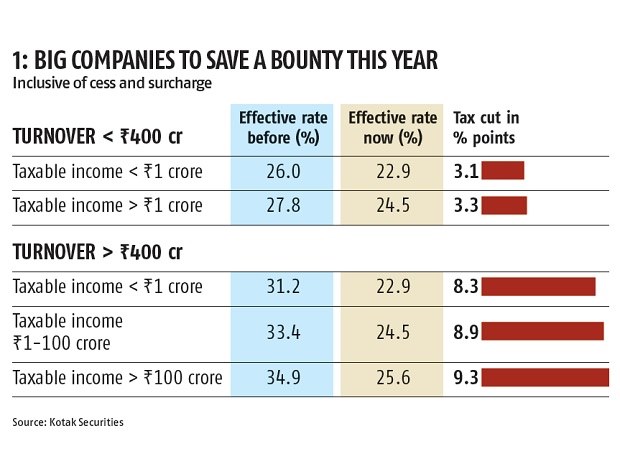

I. Relief to big companies

- Big companies got a relief of close to 10 percentage points in the effective tax rate including cess and surcharge.

II. Enhanced competitiveness

- India was earlier at disadvantage because of a couple of factors and on top of it was the high corporate tax rate.

- After this cut, base corporate tax rate in India has become competitive and should help boost investment.

- This reduction was a long-pending demand of Indian firms. India is likely to attract investors looking to move out of China.

III. Enhanced EoDB

- Singapore with 17 per cent tax rate, and Vietnam, Thailand, Cambodia and Taiwan with 20 per cent base tax rates are the only countries offering lower rates than India

- India is now much better than China in terms of rate, transparency, and tax administration so companies can now look at India for setting up new units.

Criticisms of the move

- Some see the present tax cut simply as a concession to corporate houses rather than as a structural reform that could boost the wider economy.

- They believe that the current economic slowdown is due to the problem of insufficient demand which cannot be addressed just through tax cuts and instead advocate greater government spending to boost the economy.

- Others, however, argue that lackluster demand faced by sectors like automobiles is merely a symptom of supply-side shocks such as the GST that have affected various businesses and caused job losses.

- If so, tax cuts and other supply-side reforms can indeed help the economy recover from its slump.

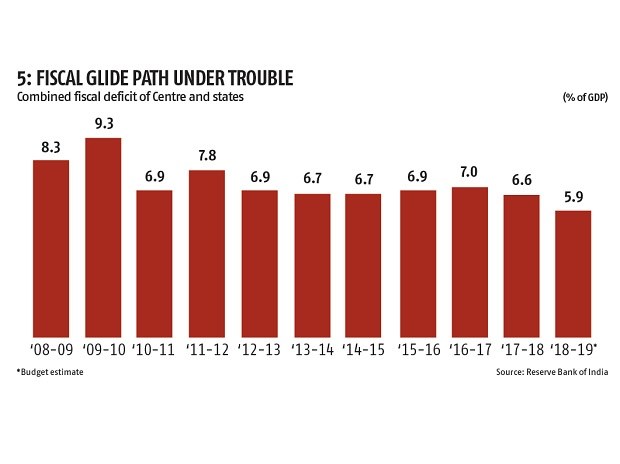

- Towards deficit

- The lower tax collection could affect the government’s fiscal glide path.

- With a minor blip in 2016-17, combined fiscal deficit of Centre and states was nearing the 6 per cent of GDP target.

- A hole of 0.7 per cent of GDP due to tax cuts could compel them to borrow more, and disturb the bond market.

Way Ahead

- Investor confidence in the past, it is worth noting, has been affected by retrospective changes to the law made by governments in the past.

- The government will need to enact along with these tax cuts other structural reforms that reduce entry barriers in the economy and make the marketplace more competitive.

- The government could, for instance, extend the tax cuts to smaller businesses.

- The benefits of the present tax cut will also depend on whether the government sticks to its promises in the long run.

References

https://cleartax.in/s/corporate-tax

https://economictimes.indiatimes.com/definition/corporation-tax

Easy to use Income Tax Calculator – Estimate Income Tax Return

Free Income Tax Calculator: Use online Tax Calculator to estimate your payable Income Tax and compute your income tax return

https://fintra.co.in/english/calculator/44