Note4Students

From UPSC perspective, the following things are important :

Prelims level: Short selling of stocks

Mains level: Stock prices volatility: Various causative factors

The stock exchanges have clarified that the Securities and Exchange Board of India (SEBI) was not considering any proposal regarding a ban on short selling to curb the ongoing volatility and equity sell-off.

What is Short Selling?

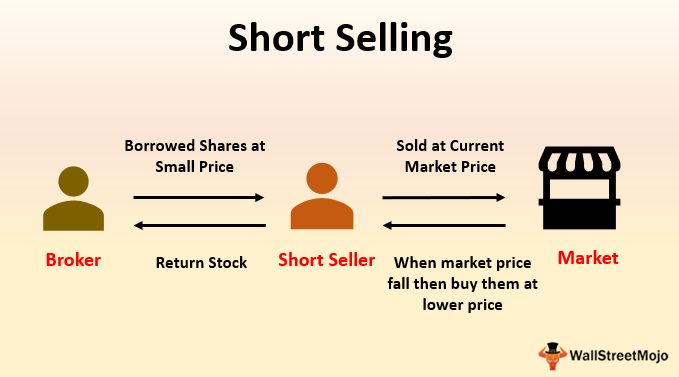

- Short-selling allows investors to profit from stocks or other securities when they go down in value.

- In order to do a short sale, an investor has to borrow the stock or security through their brokerage company from someone who owns it.

- The investor then sells the stock, retaining the cash proceeds.

- The short-seller hopes that the price will fall over time, providing an opportunity to buy back the stock at a lower price than the original sale price.

- Any money left over after buying back the stock is profit to the short-seller.

When does short-selling makes sense?

- Most investors own stocks, funds, and other investments that they want to see rise in value.

- Over time, the stock market has generally gone up, albeit with temporary periods of downward movement along the way.

- For long-term investors, owning stocks has been a much better bet than short-selling the entire stock market.

- Sometimes, though, you’ll find an investment that you’re convinced will drop in the short term (as in case of COVID 19 outbreak).

- In those cases, short-selling can be the easiest way to profit from the misfortunes that a company is experiencing.

- Even though short-selling is more complicated than simply going out and buying a stock, it can allow making money when others are seeing their investment portfolios shrink.

The risks of short-selling

- Short-selling can be profitable when one makes the right call, but it carries greater risks than what ordinary stock investors experience.

- When we buy a stock, the most we can lose is what you pay for it. If the stock goes to zero, we suffer a complete loss, but will never lose more than that.

- By contrast, if the stock soars, there’s no limit to the profits one can enjoy. With a short sale, however, that dynamic is reversed.

Example:

- For instance, say you sell 100 shares short at a price of $10 per share. Your proceeds from the sale will be $1,000.

- If the stock goes to zero, you’ll get to keep the full $1,000. However, if the stock soars to $100 per share, you’ll have to spend $10,000 to buy the 100 shares back.

- That will give you a net loss of $9,000 — nine times as much as the initial proceeds from the short sale.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024