Note4Students

From UPSC perspective, the following things are important :

Prelims level: Small Finance Bank

Mains level: Not Much

The Reserve Bank of India has issued a small finance bank (SFB) license to a consortium of fintech companies BharatPe and Centrum Financial Services Ltd.

What is a SFB?

- Small finance banks (SFBs) are a type of niche banks in India.

- They can be promoted either by individuals, corporate, trusts or societies.

- They are governed by the provisions of Reserve Bank of India Act, 1934, Banking Regulation Act, 1949 and other relevant statutes.

- They are established as public limited companies in the private sector under the Companies Act, 2013.

- Banks with a SFB license can provide basic banking service of acceptance of deposits and lending.

Objectives of setting-up an SFB

- To provide financial inclusion to sections of the economy not being served by other banks, such as small business units, small and marginal farmers, micro and small industries and unorganized sector entities

Key features of SFBs

- Existing non-banking financial companies (NBFC), microfinance institutions (MFI) and local area banks (LAB) can apply to become small finance banks.

- The banks will not be restricted to any region.

- 75% of its net credits should be in priority sector lending and 50% of the loans in its portfolio must in ₹25 lakh.

- The firms must have a capital of at least ₹200 crore.

- The promoters should have 10 years’ experience in banking and finance.

- Foreign shareholding will be allowed in these banks as per the rules for FDI in private banks in India.

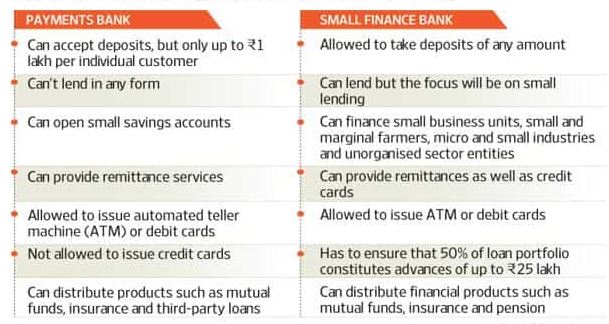

Back2Basics: Small Payments Bank Vs. Payment Bank

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024