UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Context

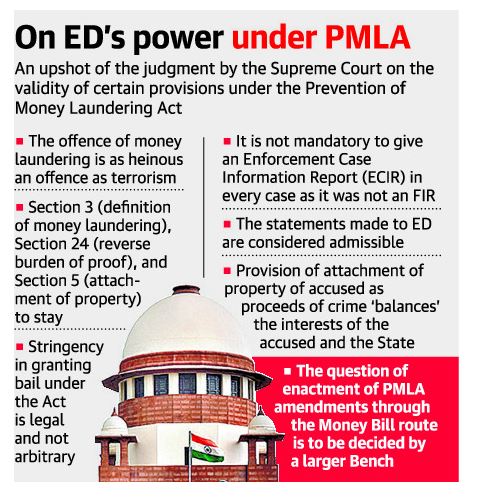

- Delivering its verdict on a batch of petitions concerning the interpretation of certain provisions of the Act, the SC bench opined that money laundering is a “heinous” crime.

- In this article, we will talk about the Supreme Court’s ruling on the Prevention of Money Laundering Act.

Why in news?

- The verdict came on an extensive challenge raised against the amendments introduced in 2002 Act by way of Finance Acts.

- Also bail provisions in PMLA act were contested in the apex court.

Key observations by the Supreme Court

- Possessions of proceeds: Mere possession of proceeds of crime (without any integration, layering etc.) are sufficient to allege money laundering

- Preventing crucial crimes: PMLA not only affects the social and economic fabric of a nation but also tends to promote other serious offenses like terrorism and drug trafficking.

- Curbing illicit financing: The court noted that the law was enacted to address the urgent need for comprehensive legislation to prevent money laundering and prosecute those indulging in activities related to the proceeds of crime.

- Power of arrests are legible: The court also upheld the EDs powers relating to arrest, attachment of property involved in money laundering, search and seizure under the PMLA, which were challenged by multiple petitioners.

- Money laundering is no ordinary offence: It is, therefore, a separate class of offence requiring effective and stringent measures to combat the menace of money laundering,” the Court held.

- Enforcement Case Information Report (ECIR): ECIR cannot be equated with FIR and ECIR is an internal document of the ED. Supply of ECIR to accuse is not mandatory and only disclosure of reasons during arrest is enough.

- Twin bail: On the issue of twin bail conditions under the PMLA, the court ruled that the stringent conditions for bail under the Act are legal and not arbitrary.

- Quantum of Punishment: The punishment provided for the offence is certainly one of the principles in deciding the gravity of the offence. However, it cannot be said that it is the sole factor in deciding the severity of offence as contended by the petitioners.

- Predicate offense: The court made it clear that the offence under Section 3 is dependent on illegal gain of property as a result of criminal activity relating to a scheduled offence. It relates to the process or activity connected with such property that constitutes the offence of money laundering.

What were the petitions?

- Petitions were filed against the amendments, which the challengers claimed would violate personal liberty, procedures of law and the constitutional mandate.

- The petitioners included many veteran politicians who all claimed that the “process itself was the punishment”.

- There were submissions that the accused’s right against self-incrimination suffered when the ED summoned them and made them sign statements on threats of arrest.

- But the court said these statements were recorded as part of an “inquiry” into the proceeds of crime.

- A person cannot claim right against self-incrimination at a summons stage.

What is Money Laundering?

- Section 3 of the Act defines money laundering.

- It initially read that anyone involved in any process or activity connected with the proceeds of crime including its “concealment, possession, acquisition or use” and projecting or claiming it as untainted property shall be guilty of the offense of money-laundering.

- In 2019, the government made a change to Section 3, adding “or” between the words “concealment”, “possession”, and “acquisition”.

- The petitioners before the top court, comprising politicians and industrialists, complained that the 2019 amendment enlarged the ambit of the principal section by including mere concealment or possession.

Explaining beyond legal terms

- Money laundering is the illegal process of making large amounts of money.

- This money is generated by a criminal activity but may appear to come from a legitimate source.

- Criminal activities include drug trafficking, terrorist funding, illegal arms sales, smuggling, prostitution rings, insider trading, bribery, and computer fraud schemes that produce large profits.

What are the different stages involved in money laundering?

Generally, money laundering is a three-stage process:

- Placement: The crime money is injected into the formal financial system.

- Layering: Money injected into the system is layered and spread over various transactions and book-keeping tricks to hide the source of origin.

- Integration: Laundered money is withdrawn from the legitimate account to be used for criminal purposes. Now, money enters the financial system in such a way that the original association with the crime is disassociated. The money now can be used by the offender as legitimate money.

Note: All three sources may not be involved in money laundering. Some stages could be combined or repeated many times.

What are different methods of money laundering?

- Smurfing (the criminal breaks up large chunks of cash into multiple small deposits, often spreading them over many different accounts, to avoid detection.)

- Use of currency exchanges

- “Mules” (cash smugglers, who sneak large amounts of cash across borders and deposit them in foreign accounts, where money-laundering enforcement is less strict.)

- Investing in commodities such as gems and gold that can be moved easily to other jurisdictions

- Discreetly investing in and selling valuable assets such as real estate, cars, and boats;

- Gambling and laundering money at casinos;

- Counterfeiting

- Using shell companies (inactive companies or corporations that essentially exist on paper only).

- Hawala transactions

What are some of the national and global efforts to combat money laundering?

[A] Some of the national efforts are:

- Smugglers and Foreign Exchange Manipulators (Forfeiture of Property) Act, 1976,

- Narcotic Drugs and Psychotropic Substances Act, 1985, and

- Prevention of Money-Laundering Act, 2002 (PMLA), PMLA (Amendment) Act, 2012

Other than these efforts two important agencies/ units involved are-

- Financial Intelligence Unit-IND: It is an independent body reporting directly to the Economic Intelligence Council (EIC) headed by the Finance Minister.

- Enforcement Directorate (ED): It is a law enforcement agency and economic intelligence agency responsible for enforcing economic laws and fighting economic crime in India. Main function of ED is to Investigate offenses of money laundering under the provisions of the Prevention of Money Laundering Act, 2002(PMLA).

Note: India is a full-fledged member of the FATF and follows its guidelines.

[B] Some of the global efforts are

- Vienna Convention,

- 1990 Council of Europe Convention

- International Organization of Securities Commissions (IOSCO)

- Financial Action Task Force (It has been set up by the governments of the G-7 countries),

- IMF

- United Nations office on Drugs and Crime

Why prevent money laundering?

- Corruption in high offices: This is a major facilitator of money laundering.

- Worldwide nexus: Three “supra-national or transnational” crimes which have brought together the global community are narcotics, money laundering and terrorism.

- Existence of safe homes: People accused of money laundering run to small nations with no extradition treaty with India where they can buy citizenship.

- Preventing terrorism: Money laundering and terrorism financing activity in one country can have serious cross-border and even global adverse effects.

- Huge social costs: This include allowing drug traffickers, smugglers, and other criminals to expand operations and the transfer of economic power from the market, government, and citizens to criminals.

Critical view of the Judgment

- Lack of judicial standards: It is argued that the judgment falls short of judicial standards of reviewing legislative action.

- Downplay of FRs: It invokes legal framework for combating money-laundering so inviolable that possible violation of fundamental rights can be downplayed.

- Overemphasis on global pledge: The judgment repeatedly invokes the “international commitment” behind Parliament’s enactment of the law to curb the menace of laundering.

- Selective targeting is justified: The ED has also been manifestly selective in opening money-laundering probes, rendering any citizen vulnerable to search, seizure, and arrest at the whim of the executive.

- Self-incrimination and reverse burden of proof: This was violative of Article 20(3), which provided protection against self-incrimination.

- Obsolete arguments: The Court relied on Article 39 of the Constitution, part of the DPSP that mandates the State to prevent concentration of wealth, to uphold the stringent bail conditions under PMLA.

- Free hand to ED: The constitutionality of several provisions of the PMLA has been considered in the latest judgment and all of them have been upheld, the Court should have at least placed some additional safeguards on exercise of powers by the ED.

Is further Constitutional Challenge possible?

- The judgment may be reviewed further by a five or seven-judge bench but the likelihood of the same immediately is not high.

- As we have seen in the past, judgments of constitutional significance tend to be revisited (if at all) after several years when a situation arises which renders such interference absolutely necessary.

- But yes a larger bench is already considering the issue of whether amendments can be passed to PMLA under Finance Act like a money bill.

- It may be worth pointing out, however, that it can sometimes take years for a Constitution Bench (a five, seven or nine-judge bench of the top court) to arrive at a conclusion.

Way ahead

- The evolving threats of money laundering supported by the emerging technologies need to be addressed with the equally advanced Anti-Money Laundering mechanisms like big data and artificial intelligence.

- Both international and domestic stakeholders need to come together by strengthening data sharing mechanisms amongst them to effectively eliminate the problem of money laundering.

- Similarly, FRs do exist everywhere. And they cannot be used as brackets to prevent investigation agencies since the FRs of large section of population matters than any individual.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)