Why in the News?

In its 56th meeting, the Goods and Services Tax (GST) Council approved a two-rate structure with special category rates, effective 22 September 2025.

What is GST?

About GST Council:

|

New GST Rate Structure:

- Simplification: At the 56th GST Council meeting (Sept 2025), slabs reduced to two rates plus a special rate.

- Main Slabs: 5% and 18% apply on most goods and services.

- Special 40% Rate: Levied on sin goods (tobacco, pan masala, aerated drinks) and super-luxury items (large cars, yachts, private aircraft).

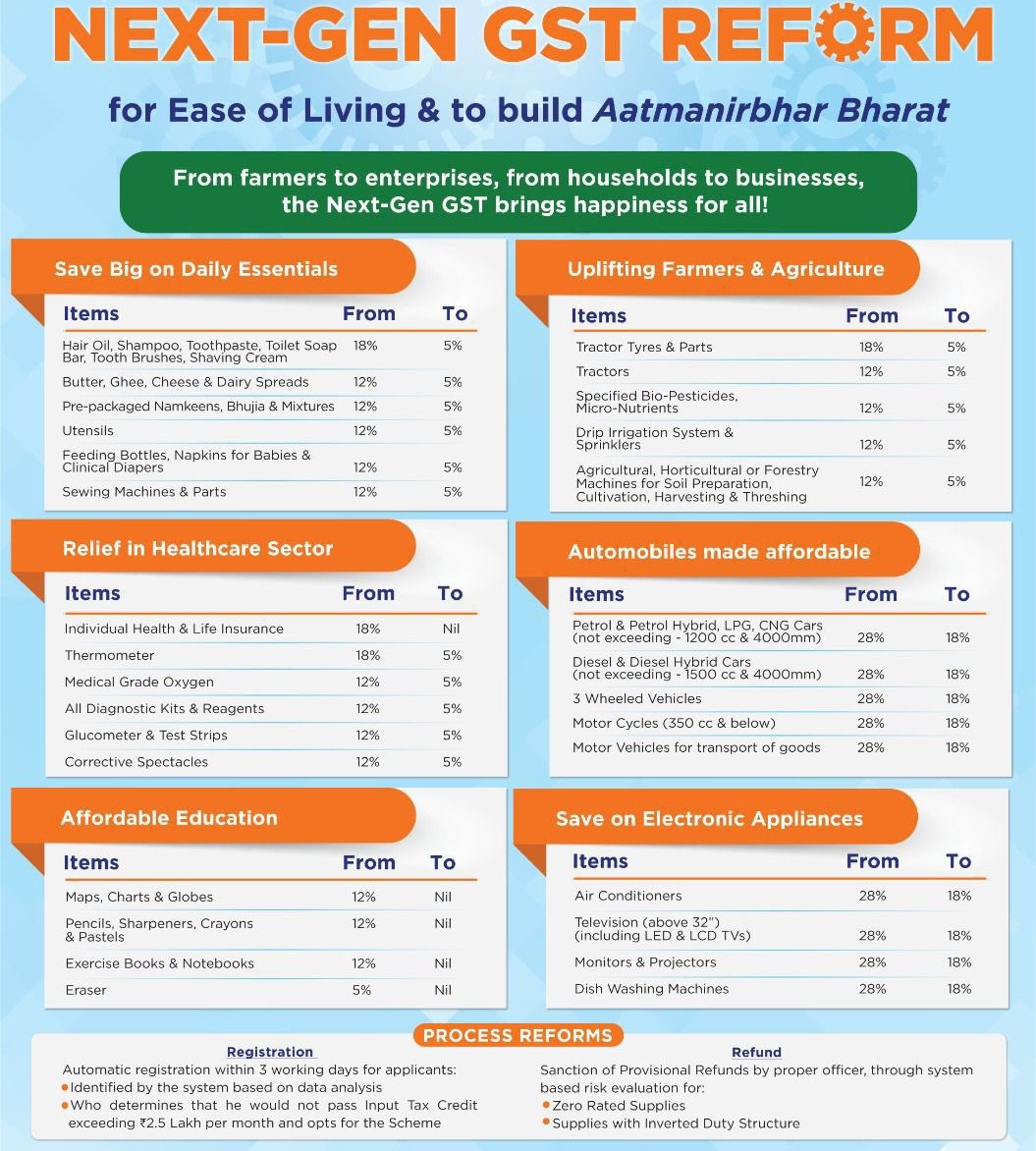

- Rate Reductions:

- Daily-use items (soap, shampoo, toothpaste, bicycles, kitchenware) now at 5%.

- Cement down from 28% to 18%.

- Small cars, motorcycles <350cc, ACs, TVs, dishwashers shifted to 18%.

- Food staples (milk, paneer, rotis, chapatis, parathas) at 0%.

- Life-saving drugs, spectacles corrected to 0–5%.

- Inverted Duty Fix: Man-made fibre, yarn, fertilizers, acids, ammonia cut to 5%.

- Revenue Impact: Estimated loss of ₹48,000 crore, expected to be offset by higher compliance and buoyancy.

| [UPSC 2017] What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’?

1. It will replace multiple taxes collected by multiple authorities and will thus create a single market in India. 2. It will drastically reduce the ‘Current Account Deficit’ of India and will enable it to increase its foreign exchange reserves. 3. It will enormously increase the growth and size of the economy of India and will enable it to overtake China in the near future. Select the correct answer using the code given below: Options: (a) 1 only * (b) 2 and 3 only (c) 1 and 3 only (d) 1, 2 and 3 |