Why in the News?

The Supreme Court of India has agreed to examine a petition challenging the constitutional validity of the Securities Transaction Tax (STT) imposed under the Finance Act, 2004.

Legal Context of this Case:Petitioner: Aseem Juneja – contends that STT violates fundamental and economic rights. Bench: Headed by Justice J.B. Pardiwala; formal notice issued to Union Ministry of Finance.

|

What is the Securities Transaction Tax (STT)?

- About: A direct tax levied on purchase and sale of securities through recognised stock exchanges.

- Introduction: Under the Finance Act, 2004, to ensure transparency and curb tax evasion in capital markets.

- Objective: Replace complex capital-gains tracking with a small, upfront levy to counter under-reporting and increase tax buoyancy.

- Administered by: Central Board of Direct Taxes (CBDT), Ministry of Finance.

- Scope: Applies to-

-

- Equity shares of listed companies

- Derivatives (futures & options)

- Equity-oriented mutual funds and ETFs.

- Purpose:

- Simplify tax collection from capital market participants.

- Create a traceable, automated tax mechanism.

- Generate steady revenue while discouraging speculative trading.

- Nature: A transaction-based tax (TBT) collected automatically at the time of trade, irrespective of overall profit or loss.

- Distinctive features:

-

-

- Applies even on loss-making trades payable merely for conducting a transaction.

- Non-refundable and non-adjustable, unlike TDS.

- Raises transaction costs for high-frequency traders.

-

- Imposition of STT:

-

- Mode of collection: Automatically deducted by stock exchanges on every taxable trade and deposited into the government account; Ensures near-universal compliance and minimal evasion.

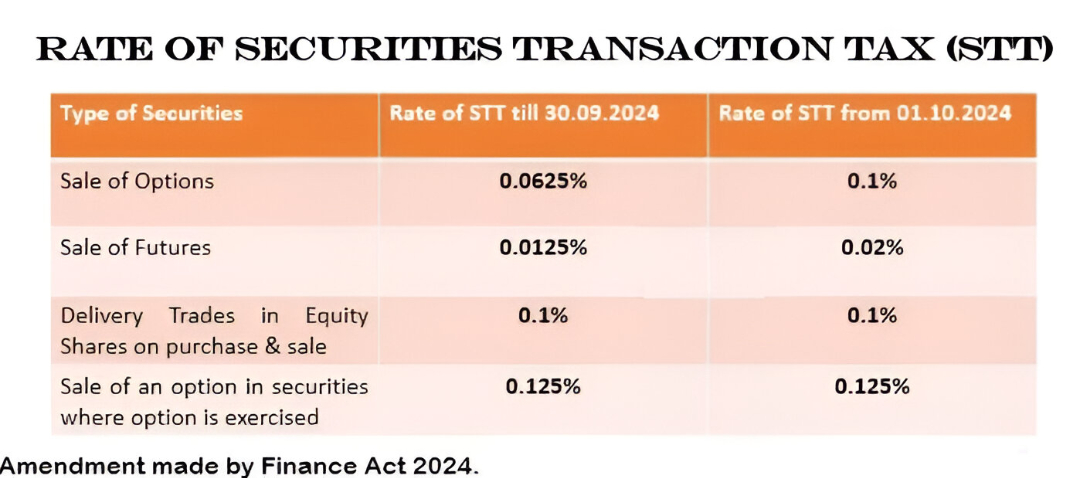

- Rate & coverage: Varies across instruments and between buy/sell transactions; Periodically revised through Union Budgets.

Key Grounds of Challenge:

- Violation of Fundamental Rights:

-

- Article 14 (Equality): Unequal treatment; tax imposed irrespective of gain or loss.

- Article 19(1)(g) (Right to Trade): Penalises the act of trading itself.

- Article 21 (Livelihood & Dignity): Non-refundable levy burdens small traders.

- Double Taxation: Traders already pay Capital Gains Tax on profits; STT adds a second layer on the same transaction.

- Arbitrariness / Lack of Proportionality: Taxing even unprofitable transactions violates the principle of reasonable classification and fiscal fairness.

- No Refund or Adjustment Mechanism: Absence of provision similar to TDS refunds; creates permanent loss even when income is negative.

- Changed Circumstances: With digital audit trails, PAN-linked demat accounts, and near-complete transparency, the original rationale (to curb evasion) may no longer hold.

| [UPSC 2009] Consider the following:

1. Fringe Benefit Tax 2. Interest Tax 3. Securities Transaction Tax Which of the above is/are Direct Tax/Taxes? Options: (a) 1 only (b) 1 and 3 only (c) 2 and 3 only (d) 1,2 and 3* |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024