Why in the News?

- The Group of Ministers (GoM) on Rate Rationalisation has accepted the Centre’s proposal to simplify GST into a two-rate structure.

- The recommendation will now be placed before the GST Council for final approval.

About Goods and Services Tax (GST):

- Nature: Comprehensive, multi-stage, destination-based indirect tax on goods and services.

- Introduction: Launched July 1, 2017, via the 101st Constitutional Amendment Act, 2016.

- Replaced Taxes: Subsumed excise duty, value-added tax (VAT), service tax, etc.

- Objectives: One Nation–One Tax, reduce cascading taxation, simplify compliance, expand tax base.

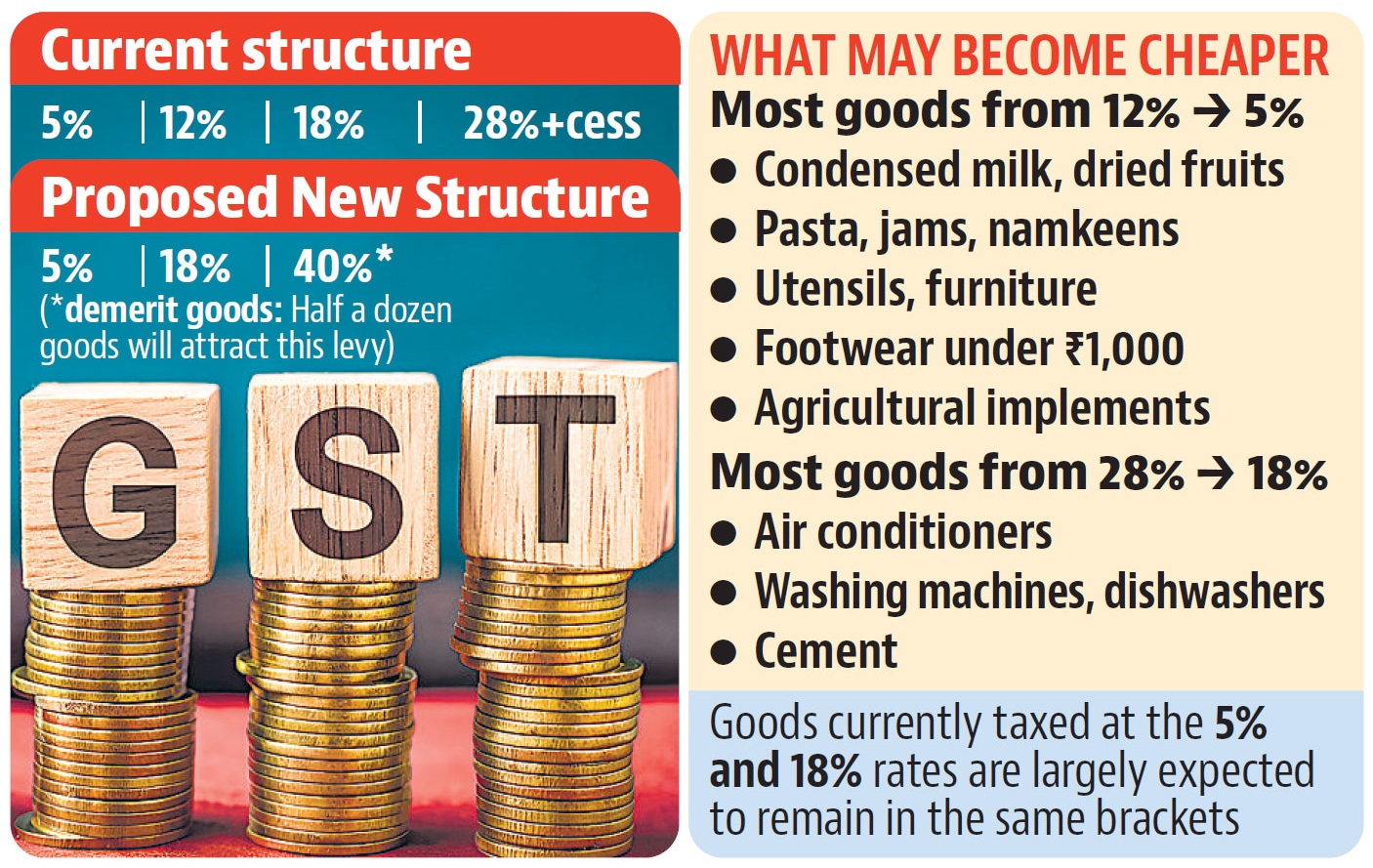

- Structure: Five slabs – 0%, 5%, 12%, 18%, 28%, with cess on luxury/sin goods (tobacco, cars, online gaming).

- Exemptions: Essential goods (food, medicines, education items) in 0% slab. Petroleum, alcohol, and electricity remain outside GST.

Proposed Two-Rate GST Structure:

- Reforms: Removal of 12% and 28% slabs; only 5% and 18% to remain.

- Reclassification: 99% of 12% items → 5% slab; 90% of 28% items → 18% slab.

- New Slab: 40% rate for demerit goods (tobacco, luxury cars, real-money gaming).

- Cess: Compensation cess on 28% items to end.

- Timeline: Implementation expected October 2025 (Diwali).

Policy Rationale & Concerns:

- Simplification: From four slabs to two, easing compliance and transparency.

- Consumption Boost: Lower rates on daily goods to benefit households and Micro, Small and Medium Enterprises (MSMEs).

- Compliance Gains: Less scope for disputes, litigation, and evasion.

- Economic Signal: Projects confidence in domestic consumption as growth driver.

- State Concerns: States, including Kerala, warn of revenue loss; call for compensation mechanism.

| [UPSC 2018] Consider the following items:

1. Cereal grains hulled 2. Chicken eggs cooked 3. Fish processed and canned 4. Newspapers containing advertising material Which of the above items is/are exempted under GST (Goods and Services Tax)? Options: (a) 1 only (b) 2 and 3 only (c) 1, 2 and 4 only *(d) 1, 2, 3 and 4 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024