Note4Students

From UPSC perspective, the following things are important :

Prelims level: Employees’ Provident Fund Organisation

Mains level: revisiting the pension computation methodology

Central idea

The EPFO’s recent clarification on the 2022 Supreme Court verdict regarding higher PF pension has sparked concerns among pensioners due to ambiguity in pension computation methods. Challenges include discrepancies for pre-2014 and post-2014 retirees, with a demand for increased minimum monthly pension.

Key Highlights:

- The EPFO’s clarification on the 2022 Supreme Court verdict on higher PF pension has raised concerns among pensioners and PF members.

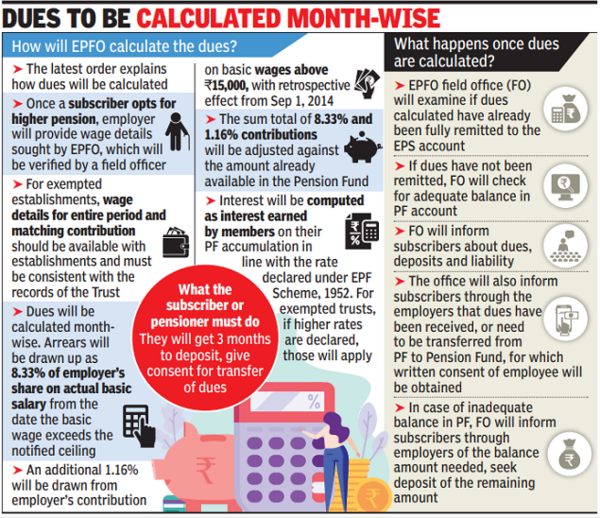

- The Court approved higher pension payments with certain conditions, including amendments to the pensionable salary cap and contribution rules.

- The clarification introduces ambiguity by tying pension computation to the “date of commencement of pension.”

Key Challenges:

- Pre-2014 retirees choosing pension post-amendments receive lower pensions due to the calculation based on the average pay of 60 months.

- Post-2014 retirees face ambiguity and discrepancies in the revised pension amounts, seeking clarity through a worksheet.

- Lack of incorporation of interest rate component in pension calculations.

- Long-standing demand to increase the minimum monthly pension beyond ₹1,000, with calls for linking it to the cost of living index.

Key Terms:

- EPFO: Employees’ Provident Fund Organisation

- EPS: Employees’ Pension Scheme

- Pensionable salary cap: ₹15,000/month

- Amendments (2014): Raised pensionable salary cap, altered contribution rules, and changed computation basis.

- Date of commencement of pension: Controversial factor in pension calculation.

Key Quotes:

- “There is also a demand for incorporating the component of interest rate… the pension amount would at least see a rise of ₹2,300 per month.” – MP M. Shanmugam

- “The government’s contributions should increase… to achieve a durable social security system for contributors to the economy.”

Key Statements:

- The clarification’s reliance on the “date of commencement of pension” has created confusion and dissatisfaction among pensioners.

- Ambiguity in post-2014 retirees’ pension calculations prompts the need for a clearer worksheet.

Way Forward:

- Address concerns by revisiting the pension computation methodology.

- Consider increasing the minimum monthly pension, as demanded by various stakeholders.

- Enhance government contributions to ensure a robust social security system.

- Provide clear guidelines and a comprehensive worksheet for post-2014 retirees to understand and verify their pension calculations.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024