PYQ Relevance:

[UPSC 2015] To what factors can be the recent dramatic fall in equipment cost and tariff of solar energy be attributed? What implications does the trend have for thermal power producers and related industry?

Linkage: The articles talks about the how China has effectively led and transformed the global green energy market, particularly through cost reduction and market control. This question directly addresses the factors behind the fall in solar energy costs, which is directly related to article. |

Mentor’s Comment: In 2024, China installed more wind turbines and solar panels than the rest of the world combined, demonstrating its dominance in renewable energy manufacturing and supply chains. With a $940 billion investment in renewables in a single year, China has strategically leveraged state-owned enterprises (SOEs), policy backing, and supply chain control to become a clean-energy superpower.

Today’s editorial analyses China’s dominance in Green Energy. This topic is important for GS Paper II (International Relations) and GS Paper III (Energy Sector) in the UPSC mains exam.

_

Let’s learn!

Why in the News?

Recently, China has gained attention for investing a huge amount of money and taking the lead in the global green energy sector.

Why is China a global leader in renewable energy?

- Installed Capacity: China has the largest installed base of solar and wind energy in the world. Eg: By 2024, China added 300 GW of solar power, more than the rest of the world combined.

- Supply Chain Control: China dominates the entire renewable energy supply chain, from raw materials to finished products. Eg: It produces over 80% of global solar panels and a major share of battery components like lithium and cobalt.

- Massive Green Investments: China leads in clean energy investments, supported by government incentives and green bonds. Eg: In 2024, China invested $940 billion in clean energy, nearly triple that of the U.S.

- State-Led Policies: The government uses State-Owned Enterprises (SOEs) and policy mandates to drive green growth. Eg: SOEs like Huaneng and State Grid built large-scale wind and solar farms across the country.

- Export of Green Technology: Through the Belt and Road Initiative, China exports renewable energy infrastructure globally. Eg: Chinese firms are setting up solar projects in Africa and wind parks in Latin America.

How did domestic issues drive China’s green strategy?

- Severe Air Pollution: China faced toxic air quality, especially in industrial cities like Beijing, causing public health crises and unrest. Eg: The 2013 “Airpocalypse” led to mass protests, pushing the government to launch the Air Pollution Action Plan.

- Energy Insecurity: Heavy dependence on coal and imported oil created vulnerability in energy supply and pricing. Eg: China increased solar and wind deployment to reduce reliance on fossil fuel imports and enhance energy self-sufficiency.

- Economic Rebalancing Needs: China needed to shift from heavy industry to innovation-driven growth and green jobs. Eg: The government promoted green industries under the 13th and 14th Five-Year Plans to support sustainable development and tech leadership.

What role do SOEs play in China’s energy transition?

- Leading Renewable Deployment: State-Owned Enterprises (SOEs) are the primary drivers of solar, wind, and hydro projects, benefiting from state financing and land access. Eg: China Three Gorges Corporation built massive hydropower plants, including the Three Gorges Dam, aiding low-carbon electricity supply.

- R&D and Technology Innovation: SOEs invest in clean energy R&D, fostering breakthroughs in battery storage, grid tech, and EVs. Eg: State Grid Corporation of China has led innovations in ultra-high-voltage transmission to integrate renewables across vast regions.

- Policy Implementation and Scaling: SOEs act as instruments of the central government’s green policy, enabling fast scaling of infrastructure and meeting national climate goals. Eg: China Energy Investment Corporation rapidly expanded wind farms under the 14th Five-Year Plan.

What can India learn from China?

- Scale and Speed of Deployment: India can emulate China’s rapid infrastructure development in renewables by simplifying land acquisition and faster clearances.Eg: China added over 230 GW of renewable capacity in 2023, nearly 3 times India’s total renewable addition.

- Strong Role of Public Sector: India should empower its public sector undertakings (PSUs) to take a leadership role in clean energy, similar to China’s state-owned enterprises (SOEs). Eg: China’s SOEs like State Power Investment Corporation lead massive solar and wind projects, while India can enhance NTPC and SECI’s role.

- Domestic Manufacturing Push: China’s dominance is rooted in its robust clean tech manufacturing ecosystem. India should focus on R&D, incentives, and supply chains.

What are the steps taken by the Indian government?

- National Solar Mission: Launched under the National Action Plan on Climate Change (NAPCC), this mission promotes solar power generation with a target of 280 GW by 2030. Eg: India has already crossed 81 GW of solar capacity as of 2024.

- Green Hydrogen Mission: The government launched the National Green Hydrogen Mission to make India a global hub for green hydrogen production and export. Eg: Target of 5 MMT green hydrogen production annually by 2030.

- PLI Scheme for Renewable Manufacturing: To reduce import dependence, the government introduced Production Linked Incentive (PLI) schemes for solar PV modules, batteries, and wind components. Eg: Over ₹24,000 crore allocated to boost domestic solar manufacturing.

What are the challenges in India?

- Intermittent Energy Supply: Renewable energy like solar and wind is non-continuous, making it hard to meet demand consistently. Eg: In 2022–23, India’s solar power capacity was ~70 GW, but actual generation was only ~110 billion units, implying an average capacity utilization of ~18%.

- Inadequate Energy Storage: India lacks robust battery storage infrastructure to balance supply-demand fluctuations. Eg: As of 2023, India had only ~4.6 GW of battery storage, while the estimated need by 2030 is over 40 GW(CEA).

- Low Private Investment in Renewables: High risks and policy uncertainty reduce private sector participation. Eg: In FY 2022–23, investment in India’s renewable sector fell by 25%, from $14.5 billion in 2021 to $10.9 billion (IEEFA).

Way forward:

- Strengthen Public-Private Partnerships (PPPs): Encourage collaboration between government, industry, and startups to accelerate clean energy innovation and deployment.

- Invest in Skill Development and R&D: Promote training in green technologies and boost research in storage, hydrogen, and grid integration to build long-term capacity.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

PYQ Relevance:

[UPSC 2015] Earthquakes along the plate margins are still a cause of concern. India’s preparedness for mitigating their impact has significant gaps. Discuss various aspects.

Linkage: The article emphasizes that India’s seismic risk is rooted in the northward drift of the Indian Plate colliding with the Eurasian Plate, which shaped the Himalayas and makes the region “overdue for a ‘Great Himalayan Earthquake’. The question specifically mentions “earthquakes along the plate margins” and critically highlights “India’s preparedness for mitigating their impact has significant gaps. |

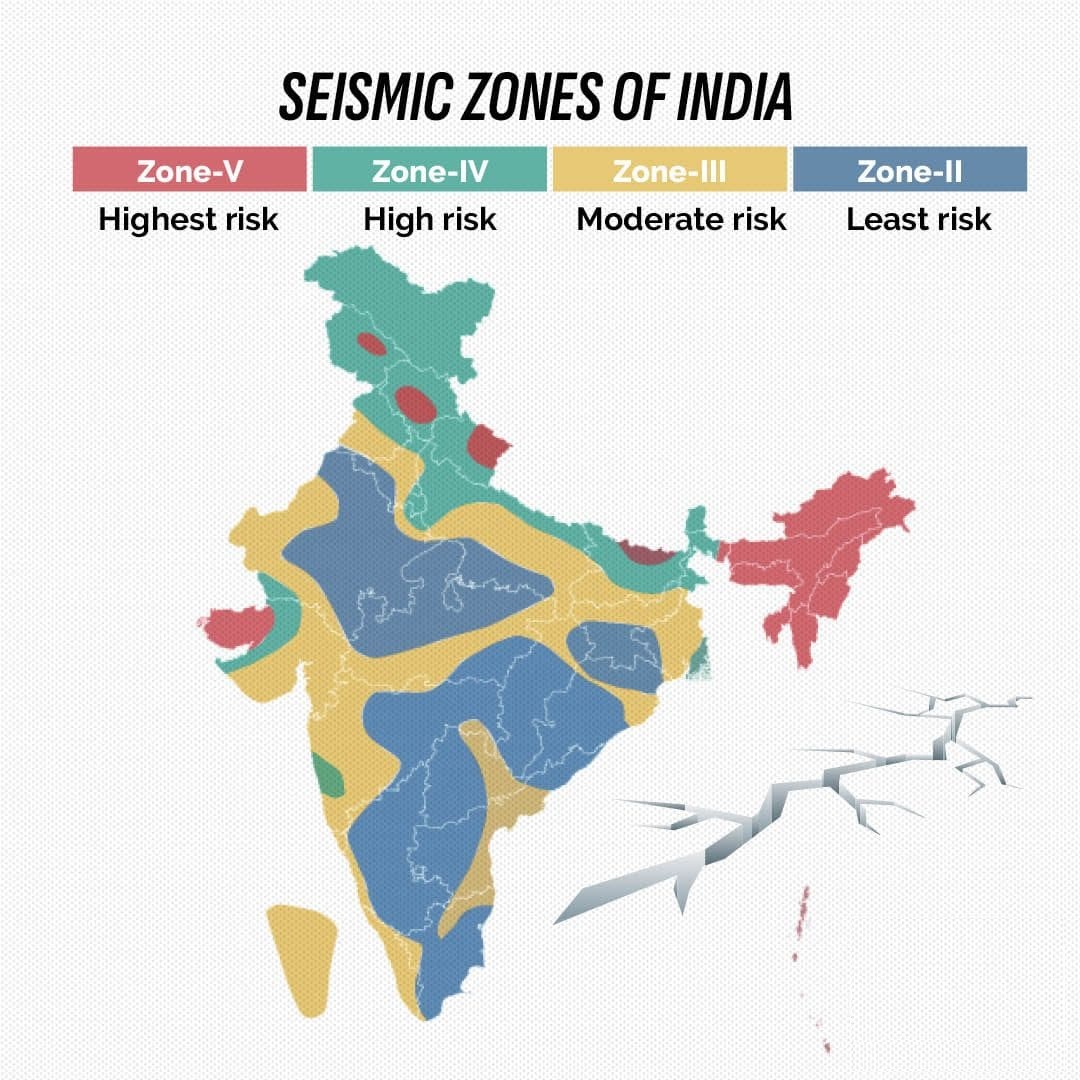

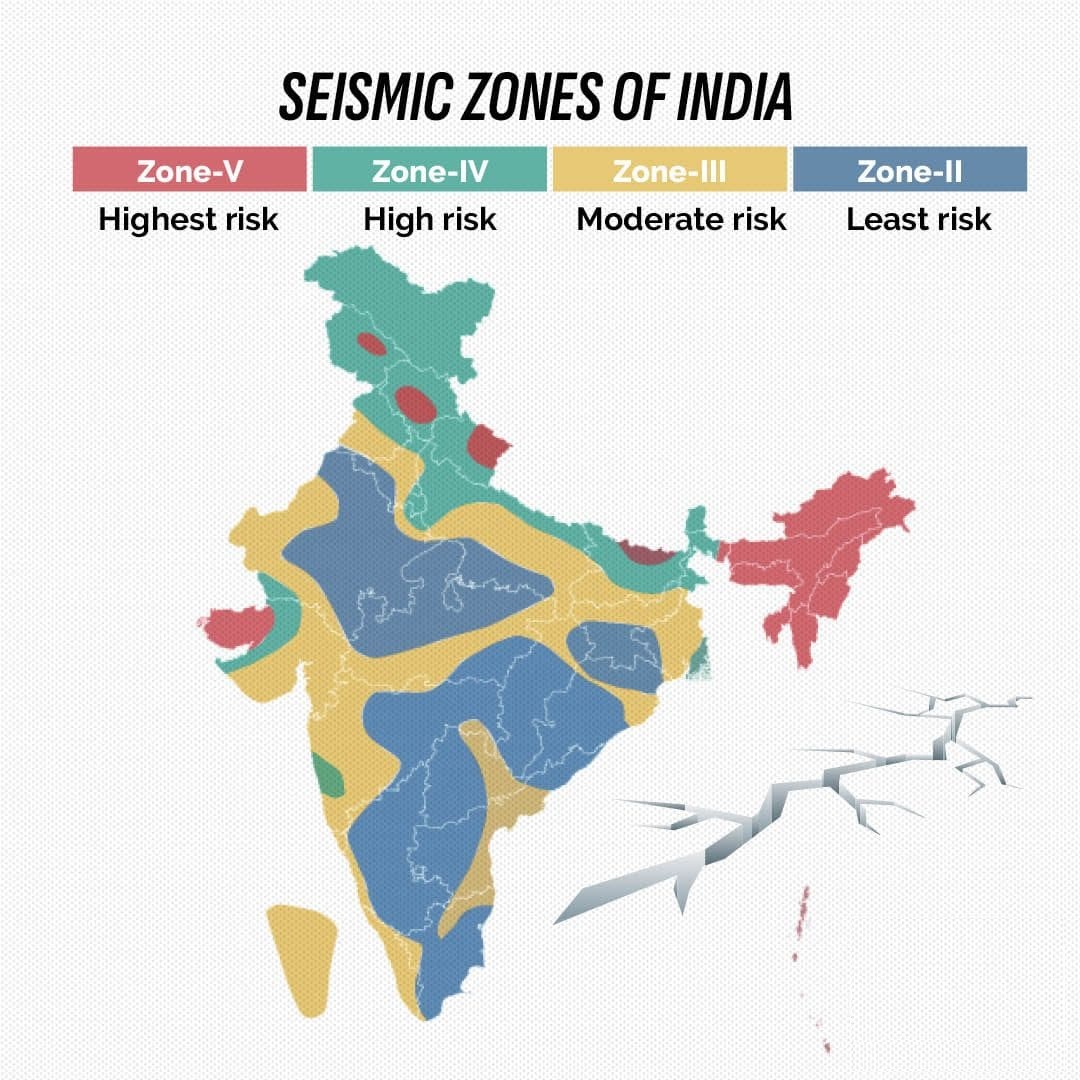

Mentor’s Comment: The 4.4 magnitude tremor in Delhi on July 10, 2025, though moderate, exposed the critical fragility of India’s infrastructure, especially in Delhi, where over 80% of buildings violate seismic safety norms. This event is part of a wider pattern of seismic activity across Asia, underlining the urgent need for earthquake preparedness. India, particularly northern and northeastern regions, lies in high-risk seismic zones (IV & V) due to the collision of tectonic plates, making a massive quake imminent. Urbanisation, outdated construction, and poor enforcement of seismic codes like IS 1893:2016 worsen the risk.

Today’s editorial analyses the vulnerability to earthquakes in India. This topic is important for GS Paper I (Geography) and GS Paper III (Disaster Management) in the UPSC mains exam.

_

Let’s learn!

Why in the News?

On July 10, 2025, a 4.4 magnitude earthquake struck near Delhi, exposing the fragile state of infrastructure.

Why is Delhi vulnerable to earthquakes?

- High Seismic Risk Zone: Delhi lies in Seismic Zone IV, indicating a severe seismic hazard with a peak ground acceleration (PGA) of around 0.24g. Eg: Similar Zone IV cities like Srinagar and Patna have experienced strong tremors in the past.

- Poor Structural Compliance: Over 80% of buildings in Delhi, especially those constructed before 2000, do not comply with seismic safety codes. Eg: Unregulated high-rise apartments in East Delhi lack ductile detailing or shear walls, making them prone to collapse.

- Liquefaction-Prone Areas: Areas like East Delhi and Yamuna floodplains are built on soft alluvial soils, which are susceptible to liquefaction during earthquakes. Eg: In the 2001 Bhuj earthquake, structures on soft soil experienced severe tilting and collapse.

- Rapid Urbanisation Without Planning: Delhi’s urban sprawl and dense population (over 33 million) have led to haphazard construction, often violating zoning and structural norms. Eg: Many illegal colonies like those in outer Delhi lack any seismic design considerations.

What are the vulnerable areas in India?

- Himalayan Region: The Himalayan belt is highly prone to earthquakes due to the collision of the Indian and Eurasian tectonic plates. Eg: Regions like Jammu & Kashmir, Himachal Pradesh, Uttarakhand, and parts of Northeast India fall under Seismic Zone V.

- Indo-Gangetic Plain: This region experiences significant seismic activity due to the tectonic stress transfer from the Himalayan region. Eg: Parts of Bihar, Uttar Pradesh, Delhi, and West Bengal lie in Seismic Zones III and IV.

- Peninsular India Fault Zones: Though considered geologically stable, intraplate faults in Peninsular India can still trigger strong earthquakes. Eg: Areas like Latur (Maharashtra), Koyna (Maharashtra), and Bhuj (Gujarat) have witnessed major quakes in the past.

|

What are the steps taken by the Indian Government?

- Building Code Reforms: The government enforces Earthquake-Resistant Building Codes to ensure structural safety in seismic zones. Eg: The Bureau of Indian Standards (BIS) revised IS 1893 and IS 4326 to include updated seismic design norms across construction sectors.

- National Seismic Zoning: India has been zoned into seismic risk areas to guide planning and construction based on earthquake vulnerability. Eg: The country is divided into Zone II to Zone V, with Zone V (like parts of Uttarakhand, Kashmir) being most earthquake-prone.

- Disaster Management Framework: The government has established a dedicated institutional framework to coordinate disaster preparedness and response. Eg: The National Disaster Management Authority (NDMA) issues guidelines for earthquake risk mitigation and conducts regular mock drills and capacity-building programs.

What are the steps taken at the international level?

- Sendai Framework for Disaster Risk Reduction (2015–2030): The United Nations adopted this global framework to strengthen disaster preparedness, promote resilient infrastructure, and reduce disaster losses. Eg: Countries like Japan and Chile have aligned their national disaster policies with Sendai priorities, emphasizing risk governance and early warning.

- Global Seismic Hazard Assessment Program (GSHAP): Led by the International Lithosphere Program, this initiative provides seismic hazard maps to help countries plan safer infrastructure. Eg: Italy and other European nations use GSHAP data to revise building codes and zoning laws in earthquake-prone zones.

- Early Warning Systems and Technology Sharing: Countries are collaborating to develop earthquake early warning systems and share real-time seismic data across borders. Eg: The Pacific Tsunami Warning Center and Japan’s Earthquake Early Warning System help neighbouring nations prepare faster for seismic events.

What global lessons can India adopt from other countries? (Way forward)

- Building Code Enforcement: Strong and regularly updated building codes ensure that infrastructure can withstand seismic shocks, reducing casualties and damage. Eg: After the 1995 Kobe earthquake, Japan revised its seismic building codes, which helped limit destruction during the 2011 Tōhoku earthquake.

- Early Warning Systems: Timely alerts enable people to take quick protective actions, such as evacuation or shutting down utilities, before the shaking begins. Eg: In 2017, Mexico City’s SASMEX system gave a 20-second alert before the quake struck, allowing residents to prepare.

- Retrofitting Incentives: Providing financial support for retrofitting older buildings motivates citizens to strengthen structures against earthquakes. Eg: The Earthquake Brace + Bolt program in California offers funds to homeowners, promoting structural safety in vulnerable areas.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

PYQ Relevance:

[UPSC 2022] Discuss global warming and mention its effects on the global climate. Explain the control measures to bring down the level of greenhouse gases which cause global warming, in the light of the Kyoto Protocol, 1997.

Linkage: The fundamental objective behind global shipping’s decarbonization efforts is to reduce the level of greenhouse gases (GHGs) to combat global warming. The shift to green fuels like green ammonia and e-methanol by the shipping industry represents a crucial “control measure” aimed at achieving this objective. |

Mentor’s Comment: India is positioning itself as a global hub for green marine fuels like green methanol and green ammonia, aligning with global shipping’s decarbonisation goals by 2040–2050. With strong policy support, India is accelerating electrolyser manufacturing, advancing carbon capture technologies, and reviving its shipbuilding sector. By promoting green fuel exports, the country aims to seize a strategic opportunity in the global transition to clean energy and assert its maritime leadership in the emerging green shipping economy.

Today’s editorial analyses the green fuels in shipping decarbonisation. This topic is important for GS Paper III (Environment) in the UPSC mains exam.

_

Let’s learn!

Why in the News?

Recently, Global shipping is moving towards reducing carbon emissions by 2040–2050, which offers a major opportunity for India. Currently, most merchant ships run on fuels like Very Low Sulphur Fuel Oil (VLSFO), diesel, and liquefied methane gas.

What are green fuels?

- Green fuels are derived from green hydrogen, which is produced by electrolysis of water using renewable energy (e.g., solar, wind). Green ammonia is created by combining green hydrogen and nitrogen.

- Green methanol is produced from green hydrogen and CO₂ (captured from industrial sources). These fuels are carbon-neutral or low-carbon alternatives to conventional shipping fuels like VLSFO or LNG.

|

How do green fuels aid in shipping decarbonisation?

- Reduction of Greenhouse Gas Emissions: Green fuels like green methanol and green ammonia significantly reduce or eliminate CO₂ and GHG emissions compared to traditional fossil fuels such as VLSFO and LNG. Eg: Green methanol emits about 10% of CO₂ compared to VLSFO, while green ammonia emits virtually zero greenhouse gases.

- Compatibility with Existing Systems (for Transition): Green methanol is a suitable transitional fuel requiring minimal retrofitting of existing ship engines, supporting a smooth shift from fossil fuels. Eg: Over 360 methanol-capable ships are already in service or on order, including by global giants like Maersk and CMA CGM.

- Enables Compliance with Future Emission Norms: Adoption of green fuels ensures alignment with global decarbonisation goals and helps meet emission standards set for 2040–2050 by international maritime bodies. Eg: India’s initiative to build green fuel hubs at Tuticorin and Kandla supports compliance with IMO’s emission targets.

How can India become a global hub for marine green fuel production?

- Utilising Coastal Industrial Clusters for Integrated Green Fuel Zones: India can leverage existing coastal industrial zones to integrate green fuel production with port logistics, reducing supply chain costs and boosting efficiency. Eg: The Mumbai–Pune industrial corridor near the Jawaharlal Nehru Port can be developed into a green methanol hub with co-located renewable energy, CO₂ sources, and export terminals.

- Exporting Green Fuels Through Strategic Trade Partnerships: By forging long-term green energy export agreements with fuel-deficit countries, India can secure demand and scale up production. Eg: A partnership with the European Union’s FuelEU Maritime initiative could enable India to export green methanol to European ports aiming for carbon-neutral shipping.

- Establishing Research and Innovation Centers in Maritime States: Setting up marine green fuel R&D centres in states like Tamil Nadu, Andhra Pradesh, or Odisha can drive innovation in fuel production, storage, and engine retrofits. Eg: A dedicated Marine Energy Innovation Park in Visakhapatnam could support pilot projects for green ammonia engines and advanced electrolyser technology.

What are the challenges?

- High Capital Costs and Infrastructure Requirements: Transitioning to green fuels requires significant investments in retrofitting ships, building new vessels, and developing bunkering infrastructure. Eg: Installing methanol-compatible systems or ammonia handling setups onboard involves major design changes and safety adaptations, slowing adoption.

- Limited Availability and High Price of Green Fuels: Green fuels like e-methanol and green ammonia are still expensive and scarce due to high renewable electricity costsand limited production capacity. Eg: In February, e-methanol cost $1,950/tonne in Singapore, compared to $560/tonne for VLSFO, making the shift economically difficult.

What are the policy and financial tools that are key to scaling green methanol in India?

- Sovereign Guarantees and Off-take Assurance: Government-backed sovereign guarantees reduce investment risks and enable access to low-cost international finance, while off-take agreements ensure steady demand, improving project bankability.

- Production-Linked Incentives (PLI) and Domestic Manufacturing Support: PLI schemes for electrolyser manufacturing help reduce import dependence, lower production costs, and localise the green fuel value chain.

- Carbon Capture and CCUS Incentives: Policy incentives for Carbon Capture, Utilisation, and Storage (CCUS) make it viable to obtain CO₂ from industrial sources, which is essential for green methanol production using green hydrogen.

In what ways can green fuel shipbuilding boost India’s maritime sector?

- Revival of Domestic Shipyards through High-Value Orders: Building green fuel-compatible ships can generate consistent demand for Indian shipyards, modernising infrastructure and creating skilled employment. Eg: Reviving the Hindustan Shipyard Limited (HSL) in Andhra Pradesh with contracts for green ferries and coastal cargo vessels can reinvigorate domestic shipbuilding.

- Enhancing India’s Global Ship Export Potential: Developing expertise in green shipbuilding can position India as an exporter of eco-friendly vessels to emerging markets transitioning to low-emission fleets. Eg: India can export hybrid-electric and green methanol-compatible vessels to island nations in the Indian Ocean and Africa implementing IMO emission norms.

- Strengthening India’s Role in the Green Maritime Supply Chain: Green shipbuilding can attract global OEMs and technology partners, integrating India into the international green maritime supply chain. Eg: Setting up a Green Marine Innovation Cluster in Kochi with global collaboration could turn the region into a hub for next-gen ship components and propulsion systems.

Case study:

- Denmark – Green Methanol Leadership: Denmark, through Maersk, is leading the global shift to green methanol-powered shipping, with multiple vessels ordered and partnerships for fuel production. Government support and private sector collaboration have positioned Denmark as a model for green shipping innovation and sustainable maritime infrastructure.

- Japan – Advancing Green Ammonia Shipping: Japan is pioneering green ammonia as a marine fuel with state-backed funding, R&D, and prototype vessels under companies like NYK Line. Its investments in ammonia bunkering infrastructure and domestic shipbuilding are helping build a complete green maritime ecosystem.

|

Way forward:

- Develop Integrated Green Maritime Ecosystems: India should establish green fuel production, bunkering, and shipbuilding hubs along key coastal regions by combining policy incentives, infrastructure investment, and private sector participation.

- Leverage Financial Tools and Global Partnerships: Use sovereign guarantees, PLI schemes, and international green financing to scale up green methanol projects, while forging strategic trade and technology alliances with global maritime leaders.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

PYQ Relevance:

[UPSC 2022] “Economic growth in the recent past has been led by increase in labour productivity.” Explain this statement. Suggest the growth pattern that will lead to creation of more jobs without compromising labour productivity.

Linkage: The article talks about the corporate investment in India has been lagging, with industrial production slowing down. This question touches on the nature of economic growth and job creation, which is directly linked to investment patterns and their ability to generate sufficient employment. |

Mentor’s Comment: India’s Index of Industrial Production (IIP) growth slowed to a nine-month low of 1.2%, raising concerns over sluggish corporate investment despite tax cuts, public capital expenditure, and monetary easing. This has reignited debate on the causes of low investment, drawing from Marxist economic theories by Luxemburg and Baranovsky, and highlighting the need for demand revival and effective government stimulus to reboot the economy.

Today’s editorial analyses the slow corporate investment in India. This topic is important for GS Paper III (Indian Economy) in the UPSC mains exam.

_

Let’s learn!

Why in the News?

Recently, India’s industrial output growth dropped to a nine-month low of 1.2%, raising worries about slow corporate investment.

Why has corporate investment remained low despite tax cuts, capex, and rate cuts?

- Weak Consumer Demand: Despite tax cuts and improved corporate profits, investment remains low due to insufficient consumer demand in the economy. Eg: Even after the 2019 corporate tax cut (from 30% to 22%), private sector investment in machinery and intellectual property grew only 35% over four years (FY20–FY23), as noted in the 2024-25 Economic Survey.

- Excess Industrial Capacity: Many industries are operating at suboptimal capacity, making firms hesitant to invest in new production facilities. Eg: With underutilised factories post-COVID, private players see no incentive to expand despite low interest rates and high liquidity.

- Misreading of Profit-Investment Link: The assumption that higher profits lead to more investment is flawed. As per Michał Kalecki, investment determines profits, not the other way around. Eg: Without a revival in demand, businesses avoid investment regardless of profitability, due to uncertainty about returns.

About Rosa Luxemburg and Mikhail Tugan-Baranovsky:

- Rosa Luxemburg (1871–1919): A Polish-German Marxist economist and revolutionary, Luxemburg was known for her critique of capitalist accumulation.

- Mikhail Tugan-Baranovsky (1865–1919): A Russian economist and early Marxist thinker, Baranovsky challenged traditional Marxist views with his theories on industrial cycles.

What do Luxembourg and Baranovsky argue about investment in capitalism?

- Baranovsky’s View – Investment Generates Its Own Market: He argued that in capitalism, investment can sustain itself as long as there is a balanced ratio between the consumption and investment sectors. He believed that machines can produce more machines, and investment can occur even without final consumption demand.

- Luxemburg’s Counter–Investment Depends on Demand: Luxembourg disagreed, stating that individual capitalists base investment decisions on anticipated demand. If demand is weak and existing capacity underused, capitalists avoid new investments, making demand revival essential for capital accumulation.

|

What limits the effectiveness of government capex in crowding in private investment?

Note: Government capex refers to the expenditure on creating long-term assets such as infrastructure (roads, railways, ports), schools, hospitals, and defence equipment.

- Gestation lags of infrastructure projects: Large public investments in infrastructure (like ports, highways, railways) take years to become operational. Until completed, they do not immediately enhance productivity or reduce logistics costs, thus delaying private sector response.

- High import content in capex: A significant portion of government capex may be spent on imported machinery or inputs, which leaks demandout of the domestic economy. This reduces the multiplier effect and fails to generate sufficient local demand for private sector goods and services.

- Low employment intensity of capex projects: Many infrastructure projects are capital-intensive but not labour-intensive, meaning they create few jobs. This limits income generation and consumer demand, reducing the incentive for private firms to expand production capacity.

Why is demand revival essential for boosting investment?

- Drives Capacity Utilisation: When consumer demand rises, existing production units approach their full capacity. This encourages private firms to invest in expanding their capacity to meet growing market needs.

- Reduces Investment Risk: Strong and predictable demand provides confidence to investors that they will earn returns on capital. Without sufficient demand, firms fear underutilisation of new assets and avoid fresh investments.

- Stimulates a Virtuous Economic Cycle: Higher demand leads to higher sales, which increases profits, employment, and further consumer spending. This self-reinforcing cycle sustains investment momentum and boosts overall economic growth.

What is the state’s role?

- Stimulating Demand through Public Spending: The state plays a counter-cyclical role by increasing government expenditure, especially during economic slowdowns. Eg: Large-scale infrastructure investments in roads, railways, and housing under PM Gati Shakti generate demand, jobs, and confidence in the private sector.

- Providing Exogenous Stimuli for Investment: The state acts as a catalyst by injecting external demand and resources into the economy when private demand is weak. Eg: PLI (Production-Linked Incentive) schemes offer incentives for capital expenditure in key sectors like electronics and pharma, attracting private investment.

- Ensuring Access to Affordable Finance: The state, through monetary and fiscal institutions, helps ensure easy credit availability and interest rate stability. Eg: The Reserve Bank of India’s rate cuts and liquidity measures during COVID-19 were aimed at making credit cheaper for industries to invest.

|

Way forward:

- Focus on Demand Revival: The government must prioritize income support, especially for lower-income households, through targeted welfare schemes and employment guarantees. This will boost consumption, which is essential for stimulating private sector investment.

- Enhance the Multiplier Effect of Capex: Public capital expenditure should be labour-intensive, locally sourced, and designed to reduce import leakages. This will maximize domestic demand generation and strengthen the crowd-in effect on private investment.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

PYQ Relevance:

[UPSC 2024] Discuss India as a secular state and compare with the secular principles of the US Constitution.

Linkage: The article talks about the concept of secularism was deeply embedded in India’s foundational principles long before the word was explicitly added to the Constitution. The question directly asks for a discussion of India as a secular state and a comparison with the secular principles of the US Constitution. This necessitates an understanding of the fundamental nature and historical evolution of Indian secularism, which aligns perfectly with the theme of “implicit from day one, explicit in 1976.” |

Mentor’s Comment: Indian secularism is a core constitutional and civilizational value, not a foreign imposition. Secularism was always embedded in India’s political philosophy—rooted in Ashoka’s Dhamma, the freedom struggle, and Nehruvian ideals—long before the term was explicitly added to the Preamble in 1976.

Today’s editorial analyses the ongoing national debate on secularism in India. This topic is important for GS Paper II (Indian Polity) in the UPSC mains exam.

_

Let’s learn!

Why in the News?

Recently, the ongoing national debate on secularism in India, especially in light of rising Hindutva narratives, political calls to re-examine or delete the word “secular” from the Constitution, and broader questions about the role of religion in Indian politics and governance.

What is the Indian model of secularism?

- Equal respect for all religions: Unlike strict separation models (like in France), Indian secularism does not oppose religion but ensures that the state maintains a principled distance and treats all religions equally.

- Religious autonomy with state neutrality: It protects religious communities from state interference, while also allowing the state to intervene in religious practices that violate fundamental rights (e.g., banning untouchability, regulating temple entry).

- Rooted in pluralism and history: It draws from India’s civilizational ethos, including Ashoka’s Dhamma, and the ideals of the freedom struggle, ensuring a harmonious coexistence of diverse faiths within a democratic framework.

Why did the Constitution’s framers reject a state religion for India?

- Commitment to Equality and Non-Discrimination: The framers believed the state must treat all religions equally to ensure religious freedom and equal citizenship, irrespective of faith. Eg: The 1928 Motilal Nehru Report and 1931 Karachi Resolution explicitly advocated for state neutrality in religious matters.

- Historical Legacy of Tolerance: India’s long tradition of religious pluralism, influenced by Ashokan edicts, emphasised coexistence and respect for all faiths, not state endorsement of one. Eg: Ashoka’s Rock Edict 7 promoted the idea that all religions should coexist peacefully.

- Avoidance of Theocracy and Communal Division: After witnessing Partition and its communal violence, the framers feared that endorsing a state religion would deepen sectarian divides and weaken national unity. Eg: Even Syama Prasad Mookerjee and the Hindu Mahasabha’s 1944 draft constitution did not support declaring Hinduism as the state religion.

What are the risks of redefining secularism in India’s current context?

- Erosion of Religious Neutrality of the State: Redefining secularism could weaken the state’s impartial stance in religious matters, leading to preferential treatment for the majority religion and marginalisation of minorities. Eg: The growing demand to formally declare India a Hindu Rashtra could alienate religious minorities and threaten inclusive governance.

- Undermining Constitutional Morality and Democratic Ideals: Secularism is part of the basic structure doctrine upheld by the Supreme Court. Altering it could compromise constitutional values like liberty, equality, and fraternity. Eg: The Kesavananda Bharati case (1973) affirmed secularism as an inviolable part of the Constitution.

- Increase in Communal Polarisation and Social Instability: Shifting away from secularism may embolden majoritarian narratives, intensify hate speech, and provoke inter-religious conflicts, disrupting national unity. Eg: The Ram Temple consecration in 2024, influenced more by political decisions than theological consensus, reflects state intrusion into religious space.

What can India learn from global models of religion–state relations?

- Balance between Symbolism and Equality: Countries like England and Greece recognize a dominant religion symbolically (e.g., Anglican Church or Greek Orthodox Church), yet uphold equal rights and religious freedom for all citizens through constitutional guarantees. India can maintain its spiritual heritage while ensuring non-discrimination and equality in law.

- Institutional Autonomy with Legal Safeguards: Ireland and Sri Lanka offer models where religion is acknowledged culturally, but the state cannot endow or control religious institutions, preserving religious autonomy and legal protection for minority practices. India can reinforce legal safeguards for all religions while maintaining a non-theocratic state.

- Flexible Jurisdictional Models: In Western Thrace (Greece) and Sri Lanka, minority religious communities have the option to resolve disputes through personal or religious laws, within constitutional limits. India can explore plural legal frameworks that respect cultural autonomy without compromising constitutional supremacy.

What are the steps taken by the Indian Government?

- Equal Treatment of All Religions: The state maintains neutrality in religious affairs — it does not promote or adopt any state religion, ensuring equal respect for all communities (e.g., no public funding for religious instruction in state-funded educational institutions).

- Minority Rights Protection: Through Articles 29 and 30, the government protects cultural and educational rights of religious and linguistic minorities, allowing them to establish and manage educational institutions of their choice.

- Personal Law Autonomy: The state allows different religious communities to follow their own personal laws in matters like marriage, divorce, and inheritance, reinforcing religious autonomy while also subjecting them to judicial review.

- Legal Actions Against Communalism: The government has enacted laws like the Religious Institutions (Prevention of Misuse) Act, Places of Worship Act, 1991, and anti-hate speech provisions to prevent communal violence, hate speech, and religious polarization.

- Representation and Inclusion: Reservation in educational institutions and government jobs for socially and educationally backward classes, including religious minorities, promotes inclusive development.

|

Way forward:

- Strengthen Constitutional Literacy: Promote public awareness about secular values enshrined in the Constitution through education and civic outreach to counter misinformation and foster interfaith harmony.

- Ensure Political Neutrality in Religious Matters: Enforce strict separation between religion and politics, preventing the misuse of religion for electoral gains and ensuring the State remains neutral in matters of faith.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

| PYQ Relevance:

[UPSC 2023] Why did human development fail to keep pace with economic development in India?

Linkage: The report says that India’s low scores in areas like women’s jobs and health show a deep problem that is slowing down the country’s progress. Even though the economy is growing, women are still left behind in key areas. That’s why the report’s low ranking is a strong warning. |

Mentor’s Comment: The World Economic Forum’s Global Gender Gap Report 2025 has brought renewed attention to India’s poor performance in gender equality, ranking it 131 out of 148 countries. Despite being a global economic and digital power, the report highlights serious structural deficits in India, especially in women’s health, economic participation, and decision-making roles.

Today’s editorial analyses the World Economic Forum’s Global Gender Gap Report 2025 for India. This topic is important for GS Paper II (Social Justice) in the UPSC mains exam.

_

Let’s learn!

Why in the News?

Recently, India was ranked very low in the World Economic Forum’s Global Gender Gap Report 2025, showing that there are serious and long-standing inequalities between men and women, especially in jobs and economic roles.

Why is India’s low gender gap ranking seen as a structural failure?

- Low Global Ranking in Gender Gap: According to the Global Gender Gap Report 2025, India ranks 131 out of 148 countries, reflecting persistent inequality in key areas such as economic participation and health. This ranking indicates a structural issue beyond isolated policy failures.

- Poor Female Labour Force Participation: India ranks 143rd in economic participation and opportunity, with women earning less than one-third of what men do. Female labour force participation remains below 25%, revealing systemic barriers to employment despite rising educational levels.

|

What health barriers limit women’s economic participation in India?

- High Anaemia Prevalence: Nearly 57% of women aged 15–49 suffer from anaemia (NFHS-5), which weakens physical capacity, affects cognitive ability, and reduces safe maternal outcomes, ultimately restricting their ability to work or study.

- Gendered Gaps in Healthcare Access: Women, especially in rural and low-income groups, face inadequate access to reproductive health, preventive care, and nutrition, leading to poor health outcomes and lower life expectancy than men.

- Neglect of Women’s Health in Policy: Public health systems often fail to prioritise women’s specific needs, with underfunded primary care, weak maternal services, and poor sanitation, resulting in chronic health issues that hinder long-term workforce participation.

How does unpaid care work hinder gender equality and growth?

- Limits Women’s Workforce Participation: Indian women perform nearly seven times more unpaid domestic work than men (Time Use Survey), leaving little time for formal employment or skill development.

For instance, many women drop out of jobs after childbirth due to lack of childcare support.

- Undervalued in National Economy: Despite its economic value, unpaid care work is invisible in GDP calculations and often excluded from policy priorities. Countries like Uruguay have tried to measure and integrate care work into development plans to promote inclusive growth.

- Worsens Gender Inequality in Decision-Making: The burden of care responsibilities keeps women out of leadership roles and policy spaces, reinforcing their marginalisation in public and private institutions. Low representation of women in budget committees leads to underfunding of women-centric welfare schemes.

| Note: The Time Use Survey, conducted by the National Statistical Office (NSO) in India (latest available: 2019), provides valuable data on how individuals allocate time to various activities over a 24-hour period. |

Which global models can India adopt for care economy reforms?

- Uruguay’s Approach: The National Integrated Care System ensures universal access to services like childcare, eldercare, and disability assistance, aiming to reduce the unpaid care burden and promote professionalisation of care work.

- South Korea’s Model: Through expansive public investment in care services, including care vouchers and subsidised facilities, South Korea has enhanced female workforce participation and addressed the care gap in ageing and young populations.

- Nordic Countries’ Example: Nations like Sweden and Norway offer state-supported childcare, generous parental leave, and policies that promote shared caregiving roles, fostering strong welfare systems and improving gender equity.

What are the demographic risks of excluding women from the workforce?

- Rising Dependency Ratio: When women are excluded, fewer people contribute economically while more depend on them, especially as India’s population ages. Eg: By 2050, nearly 20% of Indians will be senior citizens, increasing the burden on a shrinking working population.

- Shrinking Labour Force: Low female participation limits the potential of India’s large youth base, reducing the nation’s demographic dividend. Eg: India’s female labour force participation was just 24% in 2023, compared to over 60% in many developing nations.

- Stagnant Economic Growth: Without women’s inclusion, GDP growth slows, and the country may miss massive income gains. Eg: McKinsey Global Institute estimated India could add $770 billion to its GDP by 2025 by closing gender gaps.

What are the demographic risks of excluding women from the workforce?

- Beti Bachao Beti Padhao (BBBP): Launched in 2015, this scheme aims to improve the child sex ratio, ensure education for girls, and raise awareness against gender discrimination.

- Pradhan Mantri Matru Vandana Yojana (PMMVY): This maternity benefit scheme provides financial support to pregnant and lactating women for their first childbirth, promoting nutrition and health.

- Mahila Shakti Kendra (MSK): MSKs offer support services at the grassroots level, including skill training, employment guidance, legal aid, and digital literacy to empower rural women.

|

Way forward:

- Invest in Women-Centric Infrastructure: Enhance public spending on healthcare, childcare, and eldercare services, especially at the primary level, to support women’s well-being and free up time for economic participation.

- Institutionalize Gender-Responsive Policies: Implement gender budgeting, time-use surveys, and inclusive labour reforms to recognize unpaid care work and promote women’s entry into the formal workforce.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

PYQ Relevance:

[UPSC 2019] Empowering women is the key to control population growth”. Discuss

Linkage: The PYQ’s focus on “Empowering women” directly reflects this crucial aspect of granting individuals, particularly young women, the choice and control over their bodies and lives. The article further elaborates that true empowerment means equipping adolescents, especially girls, with the skills, education, and opportunities. |

Mentor’s Comment: The World Population Day 2025 has reignited global and national discussions on youth empowerment, reproductive rights, and falling fertility rates. With the theme “Empowering young people to create the families they want in a fair and hopeful world”, the UN highlights the need for informed reproductive choices and access to health, education, and economic opportunities, especially for India’s large youth population. The day also coincides with the release of the UNFPA’s State of World Population Report 2025, which warns that the real fertility crisis lies not in declining birth rates, but in the unmet reproductive goals due to financial, social, and infrastructural constraints.

Today’s editorial analyses the youth empowerment, reproductive rights, and falling fertility rates. This topic is important for GS Paper I (Indian Society) in the UPSC mains exam.

_

Let’s learn!

Why in the News?

Recently, World Population Day 2025 has brought renewed attention to global and national debates on empowering youth, ensuring reproductive rights, and addressing the challenges of declining fertility rates.

Why is youth empowerment essential for harnessing India’s demographic dividend?

- India’s youth population is a major economic asset: With over 371 million people aged 15–29, India has the world’s largest youth population. If equipped with quality education, skills, health, and family planning services, this segment can become a powerful engine of economic growth and innovation.

- Youth empowerment boosts national productivity and employment: Empowered youth can significantly reduce unemployment and enhance social outcomes. According to the World Bank and NITI Aayog, unlocking youth potential could increase India’s GDP by up to $1 trillion by 2030.

- Empowerment ensures participation in nation-building: By promoting reproductive autonomy, gender equality, and economic independence, youth, especially young women, can participate in decision-making and shape their futures, contributing meaningfully to sustainable development.

What barriers hinder reproductive autonomy and fertility choices in India?

- Limited access to family planning services and information: A significant share of the population lacks access to modern contraceptives, comprehensive sexual and reproductive health education, and counselling. Eg: According to the UNFPA State of World Population Report 2025, 36% of Indian adults faced unintended pregnancies, while 30% had unmet reproductive goals, reflecting systemic gaps in reproductive healthcare access.

- Socio-cultural norms and gender inequality: Patriarchal attitudes, early marriages, and taboos around women’s reproductive rights often prevent young women from making independent fertility decisions. Eg: Though child marriage rates have declined, they remain high at 23.3% (NFHS-5, 2019–21), indicating how cultural practices continue to limit women’s reproductive autonomy.

- Economic insecurity and structural barriers: Financial constraints, lack of housing, quality childcare, and secure employment inhibit couples from achieving their desired family size. Eg: A UNFPA survey found that 38% of Indian respondents cited financial limitations and 22% housing constraintsas major reasons for not fulfilling fertility aspirations.

How have schemes tackled child marriage and women’s empowerment?

- Promoting girls’ education to delay early marriages: Schemes like Project Udaan in Rajasthan focused on keeping girls in secondary school using government scholarships, reducing the incidence of child marriage and teenage pregnancy.

- Enhancing reproductive health awareness and services: Programmes such as Udaan and Advika improved access to modern contraceptives and sexual and reproductive health education, thereby strengthening reproductive agency among young women.

- Empowering adolescents through life skills and leadership training: The Advika programme in Odisha helped prevent child marriage by providing life-skills training, leadership development, and child protection awareness across thousands of villages.

- Fostering economic independence and employment: Project Manzil, implemented in Rajasthan, aligned skill training with young women’s aspirations and connected them to gender-sensitive workplaces, empowering over 16,000 women with employment and negotiation power.

- Engaging communities to shift social norms: Behaviour change strategies under projects like Manzil worked to challenge harmful gender norms and involved families and communities, leading to reduced resistance against girls’ education and work.

Why should population discourse focus on rights and gender equity over fertility panic?

- Respecting reproductive autonomy prevents coercion: Framing falling fertility as a “crisis” can lead to target-driven pronatalist policies that pressure women to reproduce, threatening their right to bodily autonomy. Eg: In countries like Hungary and Iran, such policies have led to restrictions on abortion and contraception, undermining women’s freedom.

- Empowering women yields long-term social gains: Promoting gender equality, economic participation, and education for women improves both fertility decisions and broader development outcomes. Eg: Nordic countries like Sweden focus on workplace equality and parental leave, ensuring women can choose when and whether to have children.

- Inclusive policy design avoids harmful stereotyping: Fertility panic often ignores the needs of those who want children but face barriers, while blaming those who are voluntarily childfree. Eg: The UNFPA’s 2025 report shows that 40% of respondents globally had to forgo childbearing due to financial and structural obstacles, not personal choice.

What can India learn from global responses to fertility decline?

- Focus on enabling choices, not coercion: Countries like South Korea have spent billions on pronatalist incentives, but results remained limited until recent societal support systems (e.g., childcare, housing, and financial aid) improved. India must prioritize voluntary reproductive agency over target-driven incentives.

- Promote gender equity in workforce and caregiving: Fertility policies that reinforce traditional gender roles have backfired. Instead of pressuring women to bear more children, countries like Sweden have boosted fertility by promoting gender-equal parenting, paternal leave, and women’s employment, which India can emulate.

Way forward:

- Invest in rights-based reproductive health systems: Ensure universal access to quality contraceptives, safe abortion, maternal care, and infertility services, while safeguarding individuals’ reproductive autonomy through accurate health education and gender-sensitive policies.

- Shift from fertility targets to gender equity: Focus on empowering women through education, economic independence, and childcare support, instead of promoting pronatalist incentives that risk reinforcing patriarchal norms and limiting personal choices.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

PYQ Relevance:

[UPSC 2024] What is disaster resilience? How is it determined? Describe various elements of a resilience framework. Also mention the global targets of the Sendai Framework for Disaster Risk Reduction (2015-2030).

Linkage: This PYQ, focusing on “disaster resilience” and “Disaster Risk Reduction (DRR),” provides an excellent framework to discuss how catastrophe bonds (cat bonds) function as a financial planning tool for natural disasters. The article “Catastrophe Bonds: Insuring India’s Future Against Disasters” directly addresses the need for such instruments in India’s disaster management strategy. |

Mentor’s Comment: Catastrophe bonds (cat bonds) are in the spotlight as India explores innovative disaster risk financing amid rising climate-related calamities. With low disaster insurance penetration, India is considering cat bonds to strengthen post-disaster response, reduce fiscal shocks, and lead a regional South Asian initiative. Global success stories and India’s proactive mitigation funding have revived interest in adopting this financial tool.

Today’s editorial analyses the Catastrophe bonds (cat bonds). This topic is important for GS Paper III (Disaster Management) in the UPSC mains exam.

_

Let’s learn!

Why in the News?

As climate change causes more frequent disasters, countries and insurers are using cat bonds to manage risk. These bonds help raise funds from markets for recovery and rebuilding after disasters.

What are catastrophe bonds?

- Catastrophe bonds are risk-linked securities that transfer disaster risk from issuers (usually governments or insurers) to investors. They are triggered when a predefined catastrophic event (like an earthquake, cyclone, or flood) occurs.

- Eg: The World Bank issued cat bonds for Mexico and Pacific Island countries to cover tropical cyclone and earthquake risks.

How do they function as instruments for disaster risk financing?

- Governments (sponsors) pay premiums, and the principal becomes the insured sum; if a disaster hits, investors lose their principal, which goes to recovery. Intermediaries like the World Bank issue the bond, ensuring reliability and reduced counter-party risk.

- They ensure quicker payouts, reduce dependency on budget allocations, and transfer risk away from insurers to global markets.

Why is disaster risk insurance penetration low in India?

- Lack of Awareness and Financial Literacy: Many individuals, especially in rural and hazard-prone areas, are unaware of the importance or availability of disaster insurance. Eg: Farmers vulnerable to floods or droughts often rely on government relief instead of purchasing crop insurance.

- High Premium Costs and Perceived Low Returns: Insurance premiums are often considered unaffordable or unnecessary, especially when disasters seem unlikely in the short term. Eg: Urban households in seismic zones like Delhi-NCR rarely insure homes against earthquakes.

- Limited Private Sector Participation and Poor Outreach: The insurance market remains underdeveloped, with few disaster-specific products and limited last-mile delivery mechanisms. Eg: MSMEs in coastal Odisha remain uninsured despite repeated cyclone exposure due to poor insurer penetration.

How can cat bonds address this gap?

- Access to Global Capital Markets: Cat bonds transfer disaster risk from governments to global investors, increasing the funding pool for post-disaster recovery. Eg: After Hurricane Maria (2017), Mexico accessed $150 million via a World Bank-backed cat bond, enabling rapid relief.

- Ensure Quick Payouts for Emergencies: Cat bonds use trigger-based mechanisms (e.g. earthquake magnitude, wind speed) to enable fast disbursement of funds. Eg: In 2021, the Philippines received $52.5 million within weeks after Typhoon Rai, due to pre-agreed cat bond triggers.

- Reduce Fiscal Pressure on Governments: Pre-disaster financing through cat bonds helps avoid budget shocks and reduce dependency on ad-hoc aid or borrowing. Eg: A cyclone-risk cat bond for Bay of Bengal can pre-finance relief for Odisha and Andhra Pradesh.

How can India benefit from a regional South Asian cat bond?

- Shared Risk Pooling for Cost Efficiency: By joining a regional cat bond with countries like Nepal, Bangladesh, and Sri Lanka, India can pool disaster risks, reducing the premium burden and increasing affordability. Eg: The Pacific Catastrophe Risk Insurance Company (PCRIC) pools risk for Pacific island nations, lowering overall costs.

- Boosts Regional Cooperation and Preparedness: A shared bond encourages joint early warning systems, emergency planning, and data sharing, improving collective disaster readiness. Eg: SAARC Disaster Management Centre can coordinate common triggers and payout parameters across South Asia.

- Access to Larger and Diverse Capital Markets: A regional bond can attract more global investors by offering diversified risk, improving fund availability post-disaster for quick response and recovery. Eg: The World Bank’s Southeast Asia Disaster Risk Insurance Facility (SEADRIF) supports countries like Laos and Myanmar through pooled financing.

What are the key risks in designing and implementing cat bonds?

- Basis Risk (Mismatch Between Trigger and Actual Loss): There’s a risk that the bond may not pay out even when severe losses occur, if the predefined trigger (e.g., earthquake magnitude or rainfall level) is not met, undermining trust and utility.

- High Setup and Transaction Costs: Cat bonds require specialized modeling, legal structuring, and investor engagement, which may be too complex or expensive for lower-income or disaster-prone regions without external support.

Why should India diversify its disaster financing amid climate risks?

- Rising Frequency and Intensity of Disasters: Climate change is increasing the number of extreme weather events like floods, cyclones, and droughts. Sole reliance on budgetary support and relief funds is unsustainable, making diversified financing (like cat bonds, parametric insurance) essential.

- Reducing Fiscal Burden and Ensuring Faster Relief: A diversified disaster financing system helps minimize delays in post-disaster response and lessens pressure on state and central budgets, allowing for quick payouts and resilient recovery.

Way forward:

- Promote Risk-Based Financing Instruments: Encourage the use of catastrophe bonds, parametric insurance, and public-private partnerships to diversify disaster risk funding and ensure timely payouts.

- Strengthen Institutional Capacity and Data Systems: Develop robust disaster risk assessment tools, improve climate modelling, and integrate early warning systems to design effective and credible financial instruments.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

PYQ Relevance:

[UPSC 2024] Examine the need for electoral reforms as suggest ed by various committees with particular reference to “one na tion-one election” principle.

Linkage: The article talks about the “Special Intensive Revision (SIR) of electoral rolls in Bihar,” initiated on June 24, 2025, after a gap of over 20 years. This SIR is described as a “complete reconstruction of the electoral rolls” based on document submission which is directly related electoral reforms given in question. |

Mentor’s Comment: The Election Commission of India (ECI) has launched a Special Intensive Revision (SIR) of the electoral rolls in Bihar, just months before the upcoming State Assembly elections in 2025. The process has drawn widespread criticism for being sudden, opaque, and document-heavy, potentially disenfranchising lakhs of eligible voters, particularly migrants, Muslims, and the poor. It is now being challenged in the Supreme Court for violating fundamental rights such as the right to vote, equality, and dignity. The issue has national implications, as similar exercises are reportedly planned in other states.

Today’s editorial analyses the issues related to Special Intensive Revision (SIR) of the electoral rolls in Bihar. This topic is important for GS Paper II (Polity and Governance) in the UPSC mains exam.

_

Let’s learn!

Why in the News?

Recently, the Election Commission of India (ECI) started a Special Intensive Revision (SIR) of the voter list in Bihar, just a few months before the 2025 State Assembly elections.

What is Special Intensive Revision (SIR)?

Special Intensive Revision (SIR) is a process carried out by the Election Commission of India (ECI) to update and verify the electoral rolls (voter lists) more thoroughly than usual.

Key Features of SIR:

- Not a routine update: Unlike regular annual revisions, SIR involves a more detailed and document-heavy verification process.

- Document verification: Voters are required to submit proof of citizenship (like birth certificates, land documents, or school records), especially if they are not listed in older rolls (e.g., from 2003).

- Purpose: Officially, it aims to: Remove duplicate or deceased voters, Identify ineligible entries, and Add newly eligible voters.

|

Why is the Bihar Special Intensive Revision (SIR) seen as a threat to electoral democracy?

- Sudden and Opaque Implementation: The SIR was launched abruptly in June 2025 with minimal public awareness and a tight deadline of July 31, offering little time for a state with high migration and low documentation. Eg: Migrants working outside Bihar during monsoon may be excluded due to inability to submit documents on time.

- Document-Heavy Verification Process: Common documents like Aadhaar or voter ID are not accepted. Instead, hard-to-obtain papers like birth certificates, land records, or matriculation certificates are required, placing a disproportionate burden on poor, rural populations.

- Creation of a Two-Tier Citizenship: The process presumes voters not on the 2003 rolls are “suspect” citizens until proven otherwise, undermining the principle of universal adult franchise and equal voting rights. Eg: Like in Assam’s NRC, the burden of proof shifts to individuals, potentially creating a permanent class of disenfranchised citizens.

- Violation of Natural Justice: Requiring voters to prove citizenship reverses the principle of “innocent until proven guilty” and treats individuals as suspect citizens unless they can prove otherwise. Eg: In the Bihar SIR process, those not on the 2003 voter list must submit rarely available documents like birth certificates or land records, making many vulnerable to arbitrary exclusion.

How does the Bihar SIR compare with Assam’s NRC exercise?

| Aspect |

Bihar SIR (2025) |

Assam NRC (2013–2019) |

| 1. Suddenness vs. Supervised Process |

Launched suddenly with only one-month deadline, causing logistical challenges. |

Conducted over six years, supervised by Supreme Court, with phased rollout. |

| 2. Legal Oversight |

No direct judicial monitoring; raises concerns about transparency and accountability. |

Directly monitored by the Supreme Court, ensuring legal safeguards. |

| 3. Scale and Timeframe |

Targets 50 million voters in just one monsoon month, with floods and migration. |

Covered 33 million applicants in multiple phases over years. |

| 4. Document Requirements |

Demands rare documents (birth/matriculation/land records); common IDs not accepted. |

Required legacy documents, but provided assistance centres and lists. |

| 5. Purpose and Outcome |

Ostensibly for voter list update, but risks becoming a citizenship test, causing mass disenfranchisement. |

Explicitly aimed at identifying illegal immigrants; excluded 19 lakh people. |

What constitutional principles are at stake in the current voter verification drive?

- Universal Adult Franchise: Article 326 guarantees every Indian citizen above 18 the right to vote without discrimination. The demand for rare documents like land titles or educational certificates risks excluding poor and illiterate citizens.

- Equality Before Law (Article 14): The selective burden of proof imposed on new or undocumented voters violates the principle of equal treatment. It creates two classes of citizens — one presumed to be voters and another forced to prove eligibility.

- Presumption of Innocence (Principle of Natural Justice): The shift of burden from the state to the citizen undermines the principle that individuals are “innocent until proven guilty.”

Who are the vulnerable groups most affected by the SIR process?

- Migrant Workers: The Special Intensive Revision (SIR) disproportionately affects migrant workers who are often away from their home constituencies during the verification period, especially in July, a peak seasonal migration month.

- Poor and Illiterate Citizens: Those from economically weaker sections, particularly in rural areas, often lack the official documents such as birth certificates, matriculation degrees, or land records now required for voter verification. Their reliance on documents like Aadhaar, ration cards, or job cards, which the ECI currently does not accept, puts them at risk of disenfranchisement.

- Women (especially Elderly or Homemakers): Many women, especially widows, elderly, or those confined to domestic roles, are not listed on ownership documents and may lack the required identity proofs.

- Scheduled Castes and Scheduled Tribes (SCs/STs): Historically marginalised communities such as SCs and STs face greater hurdles due to their geographic isolation, poor access to services, and lower literacy levels, making it harder to furnish the required documentation to prove citizenship or residence.

- Urban Slum Dwellers and Informal Settlers: Migrants living in slums or unauthorised colonies in cities often lack registered addresses, utility bills, or tenancy documents. This makes it difficult to verify their voter eligibility either in their native village or in the urban location, risking double exclusion from electoral rolls.

Way forward:

- Ensure Inclusive and Transparent Voter Verification Process: Extend the verification timeline, especially in high-migration and flood-prone regions like Bihar. Accept commonly held identity documents such as Aadhaar, voter ID, and ration cards as valid proof. This would reduce arbitrary exclusions and uphold the principle of universal franchise.

- Protect Vulnerable Groups through Targeted Support: Launch doorstep assistance, mobile camps, and helplines in rural, tribal, and urban slum areas to help citizens gather documents and complete verification. Special provisions should be made for migrants, women, SC/STs, and informal workers, ensuring no one is disenfranchised due to procedural hurdles.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

PYQ Relevance:

[UPSC 2018] The China-Pakistan Economic Corridor (CPEC) is viewed as a cardinal subset of China’s larger ‘One Belt One Road’ initiative. Give a brief description of CPEC and enumerate the reasons why India has distanced itself from the same.

Linkage: The Article state that China’s traditional strategy involves “building up Pakistan’s strategic and conventional capabilities through overt and covert help to counter India and keep it off-balance”. This question directly relates to the “China-Pakistan nexus” by focusing on the China-Pakistan Economic Corridor (CPEC). |

Mentor’s Comment: The Indian Army has officially confirmed what experts had long suspected, China directly helped Pakistan during Operation Sindoor (May 7–10), marking a major change in their military relationship. For the first time, China supported Pakistan in battle by sharing real-time surveillance data, using advanced weapons together, and spreading information online — all without openly escalating the conflict. This has turned the idea of a “two-front war” into a “one-front reinforced” war, where China backs Pakistan more closely in a real conflict. China’s support included high-tech weapons, cyber tools, and diplomatic moves at the UN, while avoiding any clear criticism of the Pahalgam terror attack. The use of Chinese-made fighter jets, drones, and air defence systems by Pakistan during the fighting is a game-changer and means India needs to rethink its defence strategy.

Today’s editorial analyses the China-Pakistan military collusion and its impact. This topic is important for GS Paper II (International Relations) in the UPSC mains exam.

_

Let’s learn!

Why in the News?

The new “one-front reinforced” threat is now real, not just an idea. India must now rethink how it defends itself, update its military equipment, and clearly show its strength to others.

What are the strategic implications of China-Pakistan military collusion for India’s security?

- Increased Security Threat from a “One-Front Reinforced War”: A conflict with Pakistan now includes covert Chinese support, transforming it into a hybrid front rather than a standalone battle. India must prepare for simultaneous pressure on both borders, diluting its strategic flexibility. Eg: During Operation Sindoor (May 2025), China provided real-time ISR support and surveillance data to Pakistan.

- Enhanced Pakistani Military Capabilities via Chinese Technology: Pakistan’s use of advanced Chinese weapons systems improves its operational effectiveness and battlefield confidence. This deepens strategic asymmetry and reduces India’s military advantage. Eg: Pakistan deployed Chinese J-10C fighters and HQ-9 air defence systems, guided by China’s BeiDou satellites, during active operations.

- Erosion of India’s Strategic Autonomy and Deterrence: Collusion undermines India’s ability to execute punitive strikes without risking escalation or Chinese interference. India must now calibrate its response to avoid wider regional destabilisation. Eg: China blocked India’s diplomatic push at the UNSC post-Pahalgam attack and echoed Pakistan’s narrative, limiting India’s international manoeuvring space.

How has China’s role in India-Pakistan conflicts evolved over time?

- From Passive Diplomatic Support to Active Collusion: In earlier conflicts (1965, 1971, Kargil 1999), China offered only diplomatic or symbolic support to Pakistan without direct involvement. Now, China is actively enhancing Pakistan’s battlefield capabilities through technology and real-time support. Eg: In Operation Sindoor (2025).

- Use of Advanced Defence and ISR Systems: China has moved from supplying basic military hardware to enabling operational interoperability and network-centric warfare. Chinese platforms are now tactically integrated into Pakistan’s military exercises and combat. Eg: Deployment of Chinese J-10C fighters, PL-15 missiles, and BeiDou navigation for missile guidance shows deeper integration.

- Strategic Messaging and Digital Warfare Support: China now also supports Pakistan via propaganda, perception warfare, and digital influence operations. It helps shape global narratives and reduces diplomatic pressure on Pakistan. Eg: Chinese media amplified Pakistan’s ISPR propaganda during Operation Sindoor and resisted India’s push at the UNSC, aligning with Pakistan’s narrative.

What is a “One-Front Reinforced War”?

A “one-front reinforced war” refers to a conflict scenario where India fights on one primary front (e.g., against Pakistan), but this front is reinforced by active support from another adversary (e.g., China) without that second adversary being officially at war.

Why is the “one-front reinforced war” concept critical for India’s defence strategy?

- Unified Threat Vector: The China-Pakistan collusion has created a combined strategic front, making it harder for India to manage threats separately.

- Reduced Response Window: India faces a compressed decision-making timeline and resource overstretch, requiring faster and more coordinated defence responses. Eg: Despite the 2024 Ladakh disengagement, large Indian deployments are still needed on both the LAC and LoC.

- Need for Capability Boost: The “one-front” scenario highlights the urgency to upgrade conventional deterrence, invest in modern warfare tech, and adapt military doctrine. Eg: Pakistan acquiring Chinese J-35 stealth jets, KJ-500 AEW&C, and HQ-19 missile defence systems intensifies pressure on India to respond.

|

How should India respond to rising two-front challenges amid declining defence spending?

- Increase Defence Allocation and Modernise Capabilities: India must reverse the decline in defence expenditure (from 17.1% of central spending in 2014-15 to 13% in 2025-26) and invest in next-generation warfare capabilities. This includes drones, AI-enabled surveillance, cyber defence, and network-centric warfare systems.

- Adopt Asymmetric and Unpredictable Response Strategies: India should avoid predictable retaliation and adopt multi-domain deterrence, including economic, cyber, and covert measures. Eg: Strategic reconsideration of agreements like the Indus Waters Treaty, economic sanctions on critical Chinese firms, or calibrated cyber operations.

- Institutional and Diplomatic Realignment: India needs to bolster its international alliances and ensure seamless coordination between the armed forces, intelligence agencies, and foreign policy apparatus. Eg: Deepening defence ties with the Quad members, France, and Israel for intelligence sharing, joint exercises, and technology transfer.

Way forward:

- Strengthen Integrated Defence Capabilities: India must invest in network-centric warfare, ISR systems, drone technologies, and joint-force interoperability to counter a reinforced adversary. Enhancing real-time battlefield awareness and communication across services is key.

- Recalibrate Strategic and Diplomatic Posture: India should link China’s strategic collusion with Pakistan to its bilateral ties, signalling consequences for such behaviour. Simultaneously, boost alliances like QUAD, and explore unpublicised retaliatory options (e.g., Indus Waters Treaty leverage) to deter future collusion.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

PYQ Relevance:

[UPSC 2024] What changes has the Union Government recently introduced in the domain of Centre-State relations? Suggest measures to be adopted to build the trust between the Centre and the States and for strengthening federalism.

Linkage: The articles discusses how India’s democratic backsliding occurred partly due to the exploitation of constitutional weaknesses and how “the deeper damage to political culture, to institutions, to the idea that constitutionalism alone can protect democracy remains” after the Emergency. |

Mentor’s Comment: On U.S. Independence Day, reflections by Judge J. Michael Luttig and a look back at India’s 1975 Emergency give a strong warning about how democracy can be weakened from within. It compares how Indira Gandhi misused the Constitution in India to how leaders like Donald Trump show signs of authoritarianism in America. It highlights that freedom and rights can be lost not by war, but by twisting laws and failing institutions. The Emergency period still feels relevant today, as many democracies around the world face similar dangers. It’s a reminder that constant vigilance is the price of liberty.

Today’s editorial analyses the 1975 Emergency and its impact in India. This topic is important for GS Paper II (Indian Polity) in the UPSC mains exam.

_

Let’s learn!

Why in the News?

The same problems that caused the Emergency in India are now putting the U.S. at risk. The lesson is that tyranny grows when important institutions stop doing their job.

What Constitutional gaps enabled the 1975 Emergency’s misuse?

- Vague Grounds for Proclaiming Emergency (Article 352): The term “internal disturbance” (before it was amended to “armed rebellion” by the 44th Amendment) was undefined, allowing the government to declare an Emergency without sufficient justification.

- Lack of Judicial Safeguards: The judiciary, including the Supreme Court, failed to protect fundamental rights. In the ADM Jabalpur case (1976), the Court ruled that even the right to life could be suspended, revealing a serious weakness in judicial independence and constitutional checks.

- Absence of Parliamentary Oversight Mechanisms: There was no mandatory review or time limit for an Emergency once proclaimed. Parliament was not empowered to effectively question or revoke the declaration, enabling prolonged executive overreach.

- Preventive Detention Laws without Safeguards: Laws like the Maintenance of Internal Security Act (MISA) allowed for the detention of individuals without trial, and the suspension of habeas corpus, giving the executive near-total control over personal freedoms.

How did the Emergency weaken democratic institutions in India?

- Suppressing the Free Press: The government imposed pre-censorship on newspapers like The Indian Express and The Statesman, curbing freedom of the press. Journalists were jailed, and dissenting voices silenced, eroding media independence.

- Paralysing the Legislature and Bureaucracy: Parliament became a rubber stamp, passing ordinances and amendments without real debate. Civil servants and ministers followed orders unquestioningly, prioritising loyalty over legality, thereby hollowing out institutional integrity.

Why is India’s Emergency relevant to the current global democratic decline?

- Authoritarianism through Legal Means: The 1975 Emergency showed how laws can be manipulated to suspend rights and suppress dissent without military coups. Today, similar tactics are used globally — leaders use legal loopholes and executive decrees to weaken democratic norms (e.g., Hungary’s rule-by-decree during the COVID-19 pandemic).

- Erosion of Institutional Independence: During the Emergency, judiciary, media, and civil services failed to resist executive overreach. This institutional submission mirrors current trends in several democracies where checks and balances are compromised under pressure (e.g., judiciary weakening in Turkey and political pressure on U.S. law enforcement).

- Cult of Personality and Centralised Power: Indira Gandhi’s consolidation of power and her son’s parallel command structure resemble modern populist leadershipsthat centralise authority, undermine opposition, and control narratives (e.g., executive overreach in Brazil, Philippines, or even Russia).

What ethical duties do institutions hold in resisting authoritarianism?

- Upholding Constitutional Values: Institutions like the judiciary, legislature, and civil services must prioritise the Constitution over political loyalty, ensuring that democratic principles, civil liberties, and rule of law are never compromised.

- Maintaining Institutional Independence: Institutions have a duty to remain independent and impartial, resisting pressure from the executive or ruling parties. This includes protecting dissent, enabling checks and balances, and avoiding complicity in authoritarian overreach.

- Defending Public Trust and Accountability: Ethical responsibility requires institutions to serve the public interest, not individual leaders. They must ensure transparency, fairness, and accountability, especially during crises when democratic norms are most vulnerable.

How can citizens safeguard democracy from internal threats?

- Active Civic Participation: Citizens must engage in democratic processes such as voting, peaceful protest, and public discourse to hold leaders accountable. Eg: Mass movements like India’s JP Movement in the 1970s or the U.S. Civil Rights Movement helped restore democratic accountability.

- Demanding Transparency and Accountability: Citizens should question government actions, demand answers through RTI, media, and civil society platforms, and resist normalisation of unconstitutional acts. Eg: Public pressure during India’s anti-corruption movement (2011) led to the Lokpal Act.

- Promoting Constitutional Literacy and Vigilance: A well-informed public is less likely to fall for authoritarian rhetoric. Citizens must educate themselves about constitutional rights and duties, enabling them to recognize and resist erosion of democratic norms.