Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

Employment Linked Incentive (ELI) Scheme

Why in the News?

The Union Cabinet has approved the Employment Linked Incentive (ELI) Scheme to promote job creation, enhance employability, and expand social security—especially in the manufacturing sector.

About Employment Linked Incentive (ELI) Scheme:

- Objective: It aims to promote employment generation, enhance employability, and expand social security across all sectors, with a special focus on the manufacturing sector.

- Inception: The scheme was first announced in the Union Budget 2024–25 as part of the Prime Minister’s ₹2 lakh crore Employment and Skilling Package, which targets 4.1 crore youth.

- Goal: It seeks to create more than 3.5 crore jobs between 1st August 2025 and 31st July 2027.

Key Features of the ELI Scheme:

- It offers direct financial incentives to both first-time employees and employers to promote formalisation and sustained employment. It has 2 major components:

- Part A – Incentives to First-Time Employees:

- One-month EPF wage (up to ₹15,000) in two instalments.

- First instalment after 6 months of continuous service.

- Second instalment after 12 months and completion of a financial literacy programme.

- Eligibility for employees earning up to ₹1 lakh/month.

- Portion of incentive saved in a deposit instrument.

- Benefits to approximately 1.92 crore new employees.

- Part B – Support to Employers:

- Incentives for employers hiring additional employees with salaries up to ₹1 lakh/month.

- Amount ranges from ₹1,000 to ₹3,000 per employee per month, based on wage slabs.

- Employment must be sustained for at least 6 months.

- Manufacturing sector gets incentives for 4 years instead of 2.

- Employers must hire:

- At least 2 additional employees (if workforce < 50).

- At least 5 additional employees (if workforce ≥ 50).

- Payment Mechanism:

- Employees: via Direct Benefit Transfer (DBT) through Aadhaar Bridge Payment System (ABPS).

- Employers: via PAN-linked accounts.

| [UPSC 2024] With reference to the Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM) Yojana, consider the following statements:

1. The entry age group for enrolment in the scheme is 21 to 40 years 2. Age specific contribution shall be made by the beneficiary 3. Each subscriber under the scheme shall receive a minimum pension of ₹ 3,000 per month after attaining the age of 60 years 4. Family pension is applicable to the spouse and unmarried daughters Options: (a) 1 and 4 (b) 2 and 3* (c) 2 only (d) 1,2 and 4 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

Inflation falls but not unemployment

Why in the News?

Despite headlines celebrating India’s less than 3% inflation rate in May 2025, deeper economic indicators tell a more troubling story. The same month saw a rise in unemployment from 5.1% to 5.8%, and GDP growth has slowed sharply from 9.2% in 2023-24 to 6.5% in 2024-25.

What caused the recent fall in inflation despite rising unemployment?

- Faster Agricultural Growth Narrowed Supply-Demand Gap: In 2024-25, agriculture grew faster than non-agricultural sectors, leading to an increased supply of food items. E.g., higher food production reduced scarcity, stabilising prices and easing inflationary pressure.

- Sharp Decline in Food Inflation: Food-price inflation fell from nearly 11% in October 2024 to less than 1% in May 2025. Eg: This drop significantly pulled down the overall Consumer Price Index (CPI).

Why is the RBI’s inflation control strategy being questioned?

- Mismatch Between Interest Rates and Inflation Trends: The RBI’s key tool—repo rate hikes—did not align with the sharp fall in inflation, especially food inflation. Eg: Despite no major repo rate hike since June 2022, inflation fell from ~11% in Oct 2024 to <1% in May 2025.

- Inflation Expectations Remain Unchanged: Household inflation expectations remained high and stable, even as actual inflation dropped, undermining the theory that RBI can anchor inflation through expectations. Eg: RBI’s own surveys (Mar 2024–May 2025) show expectations stayed well above the 4% target.

- Policy Reactivity, Not Proactivity: The RBI’s approach appears reactive, adjusting repo rates after inflation changes instead of steering inflation proactively. Eg: RBI Governor stated repo rates may be reduced if inflation continues to fall—indicating policy follows rather than leads inflation.

How does sectoral growth affect inflation?

- Balanced Sectoral Growth Reduces Supply-Demand Gaps: When agriculture and non-agriculture sectors grow at similar rates, it narrows the supply-demand gap, especially for essentials like food. Eg: In 2024–25, agriculture grew faster than non-agriculture, helping reduce food shortages and lowering food inflation.

- Agricultural Growth Directly Lowers Consumer Prices: A rise in farm output increases food availability, leading to a direct fall in food prices, which are a major part of the Consumer Price Index (CPI). E.g., food inflation fell from nearly 11% in Oct 2024 to under 1% in May 2025 due to a strong agricultural season.

- Wage Effects Spill into Non-Agricultural Prices: Lower food inflation slows down wage growth demands, especially for rural labour, which indirectly eases price pressures in services and manufacturing. Eg: Cheaper food reduces pressure on industrial wages, helping contain broader inflation in non-farm sectors.

What does the data say about interest rates and managing inflation?

- Weak Link Between Interest Rates and Inflation Control: Econometric studies show no conclusive evidence that interest rate hikes directly reduce inflation in India. Eg: Despite a repo rate increase of over 10% in June 2022, food inflation fell in 2025 largely due to improved agricultural supply, not rate changes.

- Sectoral Growth Differences Matter More: Inflation responds more to the relative growth of agriculture and non-agriculture sectors than to interest rate tweaks. Eg: In 2024–25, faster agricultural growth narrowed the supply-demand gap, lowering inflation, independent of any monetary policy shift.

- Inflation Expectations Remain High Despite Rate Hikes: Even with a tighter monetary policy, household inflation expectations remained above the 4% RBI target, questioning the effectiveness of interest rate-driven expectations control. E.g., from March 2024 to May 2025, inflation expectations stayed high despite stable repo rates.

Why should inflation and unemployment be assessed together?

- Inflation Control Alone Doesn’t Reflect Economic Well-being: Focusing only on low inflation can hide deeper problems like joblessness, which directly affects livelihoods. Eg: In May 2025, inflation dropped to 2.8%, but unemployment rose to 5.8%, showing a weak job market despite price stability.

- Policy Trade-offs Require Balanced Assessment: Sometimes policies that lower inflation may slow economic growth and reduce employment opportunities. Eg: Growth fell from 9.2% in 2023–24 to 6.5% in 2024–25, aligning with rising unemployment—highlighting that price stability came at the cost of jobs.

Way forward:

- Adopt a Dual-Mandate Approach: Policymakers, especially the RBI, should consider both inflation and unemployment while framing monetary policy—moving beyond inflation targeting alone.

- Promote Inclusive Growth through Sectoral Investment: Encourage job creation by investing in labour-intensive sectors like manufacturing, MSMEs, and services, while ensuring agricultural support to maintain price stability.

Mains PYQ:

[UPSC 2022] Besides the welfare schemes, India needs deft management of inflation and unemployment to serve the poor and the underprivileged sections of the society. Discuss.

Linkage: This question is highly relevant because it explicitly mentions both “inflation and unemployment” together and the need for their effective management. This article talks about the inflation has fallen, unemployment has risen, and it criticizes the focus on inflation while neglecting unemployment.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

[pib] Changes in Periodic Labour Force Survey (PLFS) from 2025

Why in the News?

The Ministry of Statistics and Programme Implementation (MoSPI) has announced major changes to the Periodic Labour Force Survey (PLFS).

About Periodic Labour Force Survey (PLFS):

- Purpose: To measure employment and unemployment nationwide.

- Conducted by: National Statistical Office (NSO) under the MoSPI, it has been active since 2017.

- Estimate 3 core indicators: Labour Force Participation Rate (LFPR), Worker Population Ratio (WPR), and Unemployment Rate (UR).

- Frequency: It provides Quarterly estimates for Urban areas and Annual estimates for both Rural and Urban areas.

- Methodology: Employment is measured using 2 reference periods — Usual Status (activity in the last 365 days) and Current Weekly Status (activity in the last 7 days).

Note:

|

| [UPSC 2022] In India, which one of the following compiles information on industrial disputes, closures, retrenchments and lay-offs in factories employing workers?

Options: (a) Central Statistics Office (b) Department for Promotion of Industry and Internal Trade (c) Labour Bureau * (d) National Technical Manpower Information System |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

India’s shame — the trap of bonded labour

Why in the News?

On May 1, as people around the world celebrate Labour Day to respect workers and their rights, the lives of millions of bonded labourers in India show a sad and harsh reality.

What are the key factors contributing to bonded labour in India?

- Economic Vulnerability: Poor financial conditions force individuals to take loans or advances from employers or agents, trapping them in bonded labour. Eg: A family in Andhra Pradesh takes an advance of ₹2,000 to work at a brick kiln, leading them into a cycle of forced labour.

- Social Discrimination and Exclusion: Marginalized communities, including lower-caste and ethnic minorities, are more likely to be exploited and trapped in bonded labour due to societal inequalities. Eg: A tribal family from Madhya Pradesh faces exploitation in a sugarcane farm in Karnataka, where they are denied fair wages and basic rights.

- Lack of Education and Awareness: Illiteracy and lack of access to information prevent workers from understanding their rights, making them vulnerable to exploitation. Eg: Migrant workers in India often unknowingly agree to exploitative terms, not realizing they have legal protections, as seen with many labourers working in informal sectors without contracts.

Why has the government’s target of eradicating bonded labour by 2030 been deemed overly optimistic?

- Low Rescue and Rehabilitation Rates: Despite a target of freeing 1.84 crore bonded labourers, only 12,760 were rescued between 2016 and 2021. Eg: To meet the 2030 goal, around 11 lakh people must be rescued every year since 2021, but actual rescues remain far below this mark.

- Lack of Effective Implementation: Government plans and policies exist on paper, but enforcement at the ground level is weak due to administrative apathy and corruption. Eg: Mukesh Adivasi was trafficked and brutalised despite bonded labour being abolished in 1975, showing poor implementation.

- Underestimation of the Scale and Complexity: The issue of bonded and forced labour is deeply rooted in economic, social, and cultural structures, making it hard to resolve with short-term policies. Eg: Millions of unorganised migrant workers face bonded-like conditions across industries, beyond the government’s current rescue capacity.

How does the lack of unionisation among unorganised workers affect their conditions and bargaining power?

- No Collective Bargaining Power: Without unions, unorganised workers cannot negotiate better wages, safety standards, or working hours. Eg: Migrant workers like Mukesh were forced to work 14–16 hours daily without fair compensation or the right to protest.

- Increased Vulnerability to Exploitation: The absence of union support leaves workers exposed to abuse, wage theft, and arbitrary dismissal. Eg: Thenmozhi’s family faced verbal abuse, beatings, and confinement in a brick kiln with no platform to seek redress.

- Lack of Legal Awareness and Representation: Unorganised workers often remain unaware of their rights and have no representation to access justice or government schemes. Eg: Many bonded labourers accept exploitative terms due to illiteracy and isolation, with no union to guide or support them.

What was Dr. B.R. Ambedkar’s contribution to workers’ rights?

How have recent Labour Codes undermined his legacy?

|

Way forward:

- Strengthen Enforcement and Rehabilitation: Ensure strict implementation of anti-bonded labour laws with timely rescue, rehabilitation, and compensation for victims.

- Empower Workers through Unionisation and Awareness: Promote unionisation among informal workers and spread legal awareness to build collective bargaining power and prevent exploitation.

Mains PYQ:

[UPSC 2018] Despite implementation of various programmes for eradication of poverty by the government in India, poverty is still existing.’ Explain by giving reasons.

Linkage: Bonded labour is a manifestation of extreme poverty and the failure of poverty alleviation programmes to reach the most vulnerable, forcing them into debt bondage.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

Urban consumers are worried about their income levels

Why in the News?

In March, while many urban consumers were hopeful about job opportunities, many were still negative about their income levels.

What does the gap between job optimism and income pessimism among urban consumers imply?

- Jobs Are Available, But Income Growth Is Stagnant: In March 2025, 35.5% of urban respondents reported improved job opportunities compared to a year ago, but only 23.8% reported an increase in income.

- Rising Cost of Living Without Corresponding Wage Increases: Over 90% of urban respondents indicated that commodity prices have increased over the past year, but income increases remain minimal.

- Negative Economic Outlook Despite Employment Optimism: Despite optimism regarding job opportunities, only 34.7% of urban respondents believed the overall economic situation improved compared to the previous year, the lowest share in over a year.

Why are rural respondents more pessimistic about income than urban ones?

- Dependence on Agriculture and Seasonal Employment: Rural areas heavily depend on agriculture, which is subject to seasonal fluctuations and external factors like weather conditions. Eg: A farmer in a rural area may experience low income during a poor harvest season, while urban workers with more stable jobs may not face similar income volatility.

- Limited Access to Formal and High-Paying Jobs: Urban areas offer more formal employment opportunities with better wages and benefits, while rural areas often lack access to well-paying jobs and may have higher rates of informal employment. Eg: A rural resident working as a daily wage laborer may earn less compared to an office worker in the city with a regular salary, even if both are employed.

- Lower Economic Diversification: Rural economies are less diversified compared to urban areas, which can lead to fewer job opportunities and economic growth. Eg: A rural worker may be reliant on local industries like agriculture or small-scale manufacturing, while an urban worker has access to a variety of sectors like technology, finance, and services, which tend to offer higher income prospects.

How have rising prices affected urban spending?

- Increased Spending on Essential Goods: With rising commodity prices, urban consumers are spending more on essential goods such as food, transportation, and utilities, leading to higher overall expenditures. Eg: An urban resident may see their grocery bills rise significantly due to inflation, causing them to spend more on basic food items like vegetables and grains, even if their income remains unchanged.

- Shifting Spending Priorities: As prices rise, urban consumers are prioritizing necessary expenses, often cutting back on discretionary spending like entertainment, travel, and luxury goods. Eg: A family in an urban area may reduce spending on dining out or vacations to allocate more money towards rent and daily commuting costs, adjusting their lifestyle to account for increased living expenses.

- Financial Strain Despite Employment Stability: Urban residents may continue to hold jobs, but the combination of stagnant incomes and rising costs puts financial pressure on them, leading to a higher sense of economic uncertainty. Eg: An office worker may retain their job but find it increasingly difficult to cover monthly expenses like rent and school fees for children, as inflation causes prices to rise faster than their salary increases.

What was the main factor behind the decline in positive sentiment about the economy among urban consumers in March 2025?

- Rising Commodity Prices Without Income Growth: In March 2025, over 90% of urban respondents reported that commodity prices had increased over the past year, while only 23.8% saw an increase in their income. Eg: With income levels largely stagnant and prices rising, 80% of urban respondents reported increased spending, leading to a more pessimistic view of the economy.

- Stagnant Income and Higher Spending Pressures: The survey revealed that 34.7% of urban respondents felt the overall economic situation had improved, the lowest share in over a year, indicating dissatisfaction with the broader economic outlook. Eg: An office worker might retain their job but face higher living costs (such as rent, utilities, and groceries), contributing to the sense of financial strain and a decline in positive economic sentiment, despite job availability.

Way forward:

- Focus on Wage Growth and Inflation-Linked Salary Adjustments: To address stagnant incomes, policies should ensure that wage growth keeps up with inflation, potentially through salary adjustments linked to cost-of-living indices, reducing financial strain for urban consumers.

- Boost Rural Economic Diversification and Job Creation: Improve access to diverse, high-paying jobs in rural areas through skill development programs, infrastructure improvements, and incentives for non-agricultural industries, fostering economic resilience and reducing income pessimism.

Mains PYQ:

[UPSC 2022] Economic growth in the recent past has been led by an increase in labour productivity.” Explain this statement. Suggest the growth pattern that will lead to the creation of more jobs without compromising labour productivity.

Linkage: If people in cities are worried that their incomes are not growing even though jobs are available, it shows a gap between growth driven by higher worker productivity and actual rise in people’s earnings. This is an important point discussed in this previous year’s question.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

[pib] Periodic Labour Force Survey (PLFS), 2024

Why in the News?

The latest Annual Report of the Periodic Labour Force Survey (PLFS) for the year 2024, covering the period from January to December, was released on April 8, 2025.

About the Periodic Labour Force Survey (PLFS):

- Launched by the National Statistics Office (NSO) in April 2017, the PLFS provides frequent data on labour force indicators to track employment trends.

- It estimates employment and unemployment indicators in rural and urban areas quarterly and annually, using Current Weekly Status (CWS) and Usual Status (ps+ss).

- The PLFS Annual Reports offer national estimates on employment and unemployment, broken down by rural and urban areas.

- The survey tracks indicators like Labour Force Participation Rate (LFPR), Worker Population Ratio (WPR), and Unemployment Rate (UR), helping policymakers understand employment dynamics.

Key Terminologies Used:

|

Key Highlights of the Recent Report (2024):

Details |

|

| Sample Size and Survey Coverage | Surveyed 12,749 Field Survey Units (FSUs) across 6,982 villages and 5,767 urban blocks with 1,01,957 households and 4,15,549 individuals. |

Labour Force Indicators (CWS) |

|

| LFPR (Urban) |

|

| WPR (Urban) |

|

| Unemployment Rate (UR) |

|

| Decline in Unpaid Helpers |

|

Labour Force Indicators (PS+SS) |

|

| LFPR (National) |

|

| WPR (National) |

|

| Unemployment Rate (UR) |

|

| [UPSC 2013] Disguised unemployment generally means:

(a) large number of people remain unemployed (b) alternative employment is not available (c) marginal productivity of labour is zero (d) productivity of workers is low |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

A regional divide in blue-collar worker migration from India

From UPSC perspective, the following things are important :

Mains level: Migration; Remittances;

Why in the News?

Recent data show a decline in remittances from Gulf countries to India, while contributions from advanced economies have grown.

Why has the share of remittances from Gulf countries to India declined while contributions from advanced economies have increased?

- Wage Stagnation and Cost of Living in the Gulf: Wages in Gulf countries have remained relatively stagnant, while the cost of living has increased, reducing the savings and ability to send money home of Indian workers. Example: The UAE introduced a Value Added Tax (VAT) in 2018, increasing living costs for migrant workers.

- Shift in Migration Patterns Toward High-Income Countries: More Indian professionals and skilled workers are migrating to advanced economies like the U.S., Canada, and the U.K., where salaries are higher. Example: The number of Indian students and skilled workers in Canada has surged, contributing to rising remittances from the country.

- Stringent Localization Policies in the Gulf: Gulf nations have implemented employment nationalization policies that push for localization in jobs (e.g., Saudization in Saudi Arabia, Nitaqat in UAE), shrinking opportunities for foreign workers, including Indians.

- Depreciation of Gulf Currencies Against the U.S. Dollar: The exchange rates of Gulf currencies, which are tied to U.S. dollar, have not appreciated significantly, while the Indian rupee has remained relatively stable. Example: A stronger U.S. dollar means remittances from the U.S. convert to more Indian rupees compared to Gulf remittances.

- Expansion of India’s IT and Healthcare Workforce Abroad: Skilled professionals in IT, healthcare, and finance are securing jobs in developed countries, leading to increased remittances from these sectors. Example: Indian tech workers in the U.S. under the H-1B visa program send substantial remittances back home, contributing to the U.S.’s growing share.

| Global Migration & Remittance Shifts: How India Compares with Other Nations | Traditional Remittance Sources | New Migration Trends | Key Drivers of Change |

| India | Gulf countries (UAE, Saudi Arabia, Qatar) | U.S., Canada, U.K., Germany | Wage stagnation in the Gulf, rise in high-skilled migration, better job opportunities in advanced economies |

| Philippines | Middle East, Southeast Asia | U.S., Canada, Australia | Strong demand for healthcare workers, education-driven migration, better worker rights in Western nations |

| Vietnam | Japan, South Korea, Taiwan | U.S., Europe, Australia | Economic ties with Western economies, investment in skilled workforce |

| Mexico | U.S. | Europe, South America | Stricter U.S. immigration policies, expansion of trade ties with Spain and Latin America |

| Bangladesh | Gulf countries, Malaysia | Limited shift; still Gulf-dependent | Fewer high-skilled migration pathways, reliance on traditional labor jobs |

| Pakistan | Saudi Arabia, UAE | Minimal change; remains Gulf-dependent | Economic constraints, limited alternative migration routes |

What are the reasons behind the decline in the number of blue-collar workers emigrating from the Southern States to the Gulf?

- Improved Employment Opportunities in India: Economic growth and industrial expansion in southern states have created more local job opportunities, reducing the need for migration. Example: Tamil Nadu and Telangana have seen growth in manufacturing (automobiles, electronics) and IT sectors, offering better wages compared to low-paying Gulf jobs.

- Stringent Gulf Employment Policies & Localization Programs: Gulf nations have implemented policies like Saudization and Emiratization, prioritizing local workers over foreign laborers, reducing demand for Indian blue-collar workers. Example: Saudi Arabia’s Nitaqat system has restricted Indian employment in sectors like retail and construction.

- Higher Migration Costs and Reduced Financial Returns: The cost of migration, including visa fees, recruitment charges, and living expenses, has risen, while wages in the Gulf have remained stagnant, making migration less attractive. Example: In Kerala, many workers are opting for European destinations (e.g., Italy, Germany) instead of the Gulf due to better wages and worker rights.

How has the shift in migration patterns impacted States like Bihar, Uttar Pradesh, Rajasthan, and West Bengal in terms of remittance inflows?

- Slower Growth in Remittance Inflows: These states still send large numbers of workers to the Gulf, where wages and remittances are lower compared to advanced economies. Example: Despite high migration from Uttar Pradesh and Bihar, their share in India’s total remittances remains low (around 3%), while Kerala and Maharashtra, with migrants in high-income countries, receive a higher share.

- Limited Economic Upliftment Due to Lower Earnings: Since Gulf remittances have lower financial returns, households in these states see limited improvements in savings and investments. Example: While Tamil Nadu and Kerala benefit from higher wages in the U.S. and the U.K., families in Rajasthan and West Bengal largely rely on low-wage Gulf jobs, leading to slower economic mobility.

- Higher Economic Vulnerability and Migration Dependency: With fewer alternative employment opportunities, many continue to migrate to the Gulf despite lower wages, reinforcing economic dependence on remittances. Example: Unlike Punjab, where migration to Canada has increased financial stability, states like Bihar still rely on remittances from Gulf labor, leaving them more vulnerable to economic downturns in the region.

Which factors contribute to the continued high migration from northern and eastern States to the Gulf despite lower financial returns?

- Skill Development and Certification Programs: Initiatives like the Pravasi Kaushal Vikas Yojana (PKVY) aim to enhance the skills of Indian workers, making them eligible for higher-paying jobs abroad. Example: The program aligns skill training with international standards, increasing employment prospects in advanced economies.

- Bilateral Agreements and Labour Welfare Measures: India has signed labor agreements with Gulf countries to ensure better working conditions, fair wages, and legal protection for migrant workers. Example: The India-UAE MoU on Labor Cooperation provides safeguards against exploitation and ensures wage protection.

Way forward:

- Enhancing High-Skilled Migration Pathways: The government should strengthen bilateral agreements with high-income countries to facilitate the migration of skilled professionals, particularly in IT, healthcare, and engineering.

- Expanding initiatives like the India-Germany Skilled Workers Pact and negotiating better visa policies with the U.S., Canada, and the U.K. will ensure higher remittance inflows.

- Skill Development and Certification for Diversified Destinations: To reduce dependence on Gulf remittances, India should invest in internationally recognized skill training through programs like Pravasi Kaushal Vikas Yojana (PKVY) and collaborate with European and East Asian countries for labor mobility agreements.

Mains PYQ:

Q Discuss the changes in the trends of labour migration within and outside India in the last four decades. (2015)

Reason: This PYQ asks for a discussion of changes in labour migration trends over a significant historical period (the last four decades) and across both internal and external migration.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

[pib] Time Use Survey (TUS), 2024

From UPSC perspective, the following things are important :

Prelims level: Time Use Survey (TUS), 2024

Why in the News?

The National Statistics Office (NSO), under the Ministry of Statistics and Programme Implementation (MoSPI), has released the Time Use Survey (TUS) 2024, marking the second nationwide survey of its kind after 2019.

What is the Time Use Survey (TUS) 2024?

- The TUS, 2024 is a nationwide survey conducted by the National Statistics Office (NSO) under the Ministry of Statistics and Programme Implementation (MoSPI).

- It is the second edition of the survey, following the first TUS conducted in 2019.

- Purpose: TUS measures how individuals allocate their time across paid work, unpaid domestic work, caregiving, learning, leisure, and other daily activities.

- India is among a few countries, including Australia, Japan, Korea, the US, and China, that conduct National Time Use Surveys.

- Unlike traditional surveys that focus solely on employment, TUS captures both economic and non-economic activities, highlighting gender roles, social structures, and lifestyle changes.

Key Highlights of TUS 2024:

- 75% of males and 25% of females (aged 15-59 years) participated in employment-related activities in 2024.

- In 2019, the participation rate was 70.9% for males and 21.8% for females, reflecting a 3.2% increase in female workforce participation.

- Decline in unpaid domestic work for women from 315 minutes/day (2019) to 305 minutes/day (2024), indicating a shift towards paid employment.

- 41% of women and 21.4% of men in the 15-59 age group engaged in caregiving.

- Women spent 140 minutes/day, while men spent 74 minutes/day on caregiving.

- Male involvement in child-rearing and elder care is rising, signaling changing gender roles.

- 89.3% of children (6-14 years) participated in learning activities, dedicating an average of 413 minutes/day.

- Leisure time has increased – People aged 6 years and above spent 11% of their daily time on cultural, leisure, mass media, and sports activities, compared to 9.9% in 2019.

- 16.8% of people engaged in producing goods for personal use, spending 121 minutes/day.

- In rural areas, 24.6% of individuals (15-59 years) participated in household production.

- Unpaid domestic services participation: 81.5% of women, 27.1% of men.

PYQ:[2013] Disguised unemployment generally means: (a) large number of people remain unemployed [2023] Most of the unemployment in India is structural in nature. Examine the methodology adopted to compute unemployment in the country and suggest improvements. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

Indian industry needs innovation, not mindless toil

From UPSC perspective, the following things are important :

Mains level: Challenges to Indian Industries;

Why in the News?

Indian industry leaders are hurting their future by depending too much on cheap labour for growth.

What are the issues related to cheap labour in India?

- Long Working Hours: Migrant industrial workers often work 11-12 hours a day without breaks during peak demand, compromising their physical and mental well-being.

- Informal Employment: As per the 2023-24 Periodic Labour Force Survey, only 21.7% of workers hold regular jobs with salaries. Even within this group, nearly half face informal conditions (no contracts, paid leave, or social security).

- Exploitation via Contract Work: 56% of workers joining the factory sector since 2011-12 are contract workers, lacking legal protection and receiving lower wages.

- Migrant Worker Vulnerability: Migrant workers face multiple disadvantages due to social position, lack of assets, and inadequate access to social security.

- Profit Maximization: Industries prioritize profit over worker welfare, with profit shares rising from 31.6% in 2019-20 to 46.4% in 2021-22 in the factory sector.

What is the current situation of the garment industry in India?

- Stagnant Share in Global Exports: India’s share in global garment exports has remained stagnant at 3.1% over the past two decades. Example: In contrast, Bangladesh (7.9%) and Vietnam (6.4%) have increased their market share by investing in modern technologies and efficient supply chains (Economic and Political Weekly, August 2024).

- Over-Reliance on Cheap Labour: The industry depends heavily on low-cost, unorganized labour rather than technology and automation, limiting productivity. Example: Over 70% of the workforce in garment manufacturing operates in small, unregistered enterprises with poor working conditions and low wages (PLFS 2023-24).

- Declining Competitiveness: Rising competition from China, Vietnam, and Bangladesh has reduced India’s competitiveness in both mass-market and premium garment segments. Example: India’s textile and garment exports dropped by 13.3% to $32 billion in 2023-24, while Vietnam’s exports rose to $44 billion (Ministry of Commerce data, 2024).

- Lack of Innovation and Modernization: Indian firms lag in adopting advanced production technologies, affecting product diversity and design innovation. Example: While countries like Vietnam invest in smart textiles and sustainable practices, Indian firms focus primarily on basic, low-margin garments.

- Impact of Policy and Infrastructure Gaps: Inadequate government support, high logistics costs, and delayed payments to small firms hinder sectoral growth. Example: The Textile PLI Scheme launched in 2021 aimed to boost manufacturing but has had limited uptake, particularly among smaller manufacturers due to complex compliance issues.

How can India benefit from its cheap labour?

- Investing in Skill Development and Training: Enhancing workers’ skills can increase productivity while maintaining cost advantages. Example: The Skill India Mission has trained over 50 million workers since its launch in 2015, improving output quality in sectors like textiles, automotive, and electronics.

- Promoting Labour-Intensive Industries: Expanding labour-intensive sectors (e.g., textiles, leather, and electronics assembly) can maximize employment and exports. Example: The Apparel Park Scheme in Tamil Nadu supports garment clusters, increasing job opportunities while improving global competitiveness.

- Strengthening MSMEs and Local Supply Chains: Supporting Micro, Small, and Medium Enterprises (MSMEs) through policy incentives and better access to credit can utilize cheap labour efficiently. Example: The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme has provided ₹3.7 lakh crore in credit to over 65 lakh MSMEs (as of 2024).

- Encouraging Export-Oriented Production: Facilitating exports through simplified regulations and logistical improvements can enhance global market access. Example: The Remission of Duties and Taxes on Exported Products (RoDTEP) scheme helps Indian exporters by reimbursing embedded taxes, making Indian goods more competitive.

- Adopting a Hybrid Model of Labour and Technology: Combining low-cost manual labour with affordable automation can balance efficiency with cost advantages. Example: Maruti Suzuki uses a man-machine hybrid system for auto production, reducing costs while maintaining high output, making it India’s largest car exporter.

Why are industries falling behind in innovation?

|

Way forward:

- Enhance Technology Adoption and Innovation: Encourage investment in advanced manufacturing technologies and R&D through better policy incentives and stronger industry-academia collaboration to improve productivity and global competitiveness.

- Support Labour Welfare and Formalization: Implement policies to improve working conditions, ensure social security for informal workers, and promote skill development programs to balance cost efficiency with worker well-being.

Mains PYQ:

Q Can the strategy of regional-resource based manufacturing help in promoting employment in India? (UPSC IAS/2019)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

[pib] Periodic Labour Force Survey (PLFS) Quarterly Bulletin

From UPSC perspective, the following things are important :

Prelims level: Periodic Labour Force Survey (PLFS)

Why in the News?

The latest edition of PLFS report (October-December 2024) has highlighted key labour market indicators.

About Periodic Labour Force Survey (PLFS)

- The PLFS is conducted by the National Statistical Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI) to assess employment and unemployment trends in India.

- Launched in April 2017, PLFS provides quarterly estimates for urban areas and annual estimates for both rural and urban areas.

- Key Indicators:

- Labour Force Participation Rate (LFPR): Percentage of people working or seeking jobs.

- Worker Population Ratio (WPR): Percentage of people employed.

- Unemployment Rate (UR): Percentage of job seekers unable to find employment.

- Current Weekly Status (CWS): Employment status based on work done in the last 7 days.

- Survey Methodology:

- Urban Areas: Rotational Panel Sampling (each household surveyed four times).

- Data Collected (Oct-Dec 2024): 5,742 urban units surveyed, covering 1,70,487 individuals across 45,074 households.

- Publication: Quarterly Bulletins for urban areas, Annual Reports for rural and urban regions.

Key Highlights of PLFS (Oct-Dec 2024)

- Labour Force Participation Rate (LFPR): 50.4% (↑ from 49.9% in 2023).

- Male LFPR: 75.4% (↑ from 74.1% in 2023).

- Female LFPR: 25.2% (↑ from 25.0% in 2023).

- Worker Population Ratio (WPR): 47.2% (↑ from 46.6% in 2023).

- Male WPR: 70.9% (↑ from 69.8% in 2023).

- Female WPR: 23.2% (↑ from 22.9% in 2023).

- Unemployment Rate (UR): 6.4% (↓ from 6.5% in 2023).

- Male UR: 5.8% (unchanged).

- Female UR: 8.1% (↓ from 8.6% in 2023).

PYQ:[2023] Most of the unemployment in India is structural in nature. Examine the methodology adopted to compute unemployment in the country and suggest improvements. [2013] Disguised unemployment generally means: (a) large number of people remain unemployed (b) alternative employment is not available (c) marginal productivity of labour is zero (d) productivity of workers is low |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

The kind of jobs needed for the ‘Viksit Bharat’ goal

From UPSC perspective, the following things are important :

Mains level: Issues related to employment;

Why in the News?

With the Union Budget now presented, this is the right time to focus on three important types of jobs India needs: climate-friendly jobs, jobs that can adapt to AI, and jobs that match people’s aspirations.

Why must long-term structural reforms in India focus on creating climate-resilient, AI-resilient, and aspiration-centric jobs?

- Economic Stability & Climate Adaptation: Climate change threatens agriculture, infrastructure, and livelihoods. Structural reforms must promote green jobs in renewable energy (e.g., solar panel manufacturing, e-rickshaw deployment) and climate adaptation (e.g., afforestation, water conservation projects) to ensure sustainable economic growth.

- Future-Proofing Against Automation: With AI disrupting traditional jobs, reforms should focus on AI-resilient employment by upskilling workers for roles in healthcare, education, and creative industries (e.g., AI-assisted medical diagnostics, digital marketing). This will help maintain workforce relevance and prevent large-scale job losses.

- Inclusive & Aspirational Workforce: Youth and marginalized groups need jobs that match their ambitions. So, reforms should enhance opportunities in high-growth sectors like tourism, food processing, and local manufacturing (e.g., PM Vishwakarma Yojana for artisans, National Manufacturing Mission in textiles and electronics) to drive social mobility and economic dynamism.

What are the recent allocation of the budget for Jobs creation?

|

What types of jobs are necessary for achieving Viksit Bharat?

- Manufacturing Jobs: Increasing the contribution of manufacturing to GDP from approximately 16% to 25% by 2030 is crucial. This requires creating jobs in various manufacturing industries, enhancing productivity, and reducing operational costs.

- MSMEs are vital for employment generation. Policies aimed at supporting these enterprises can create millions of jobs by fostering entrepreneurship and innovation within local communities.

- Boosting Rural Demand and Agricultural Reforms: Jobs that focus on modernizing agriculture through technology and sustainable practices can enhance productivity and create employment in rural areas. This includes initiatives that support local farmers and agricultural workers.

- Skill Development Initiatives: With a strong emphasis on skilling the workforce, there is a need for jobs that require specialized training in sectors like technology, healthcare, and renewable energy.

- Climate-Resilient Employment: As India faces significant challenges due to climate change, creating jobs focused on sustainability—such as in renewable energy sectors (solar, wind) and environmental conservation—will be critical for long-term resilience.

- AI and Digital Economy Roles: With the rise of artificial intelligence and digital transformation, there is a growing demand for jobs that leverage technology. This includes roles in IT services, software development, data analysis, and digital marketing.

- Service Sector Jobs: The service sector continues to be a significant contributor to employment in India. Focused efforts on improving service delivery in healthcare, education, and hospitality can create numerous job opportunities.

How can structural reforms in the economy facilitate job creation?

- Enhancing Government Investment: Increased funding in infrastructure, education, and healthcare sectors directly correlates with job creation.

- For instance, investments in rural infrastructure can stimulate local economies and create jobs in construction and services.

- Promoting Industry Participation: Collaborating with industries for training programs ensures that the skills developed align with market needs, thereby improving employability. This approach can help bridge the gap between educational outcomes and industry requirements.

- Supporting MSMEs: Strengthening micro, small, and medium enterprises (MSMEs) through financial incentives and easier access to credit can drive job creation. MSMEs are crucial for employment as they account for a significant portion of India’s workforce.

What role does government policy play in bridging the gap between formal and informal economies? (Way Forward)

- Implementing Employment Schemes: Programs such as the Employment Linked Incentives (ELI) aim to create jobs through targeted financial support for employers who hire new employees.

- This encourages formal employment while providing a safety net for workers transitioning from informal sectors.

- Facilitating Skill Development: Policies focused on skill development ensure that workers are equipped with relevant skills for emerging sectors like technology and renewable energy.

- This not only helps integrate informal workers into the formal economy but also enhances overall productivity.

- Encouraging Entrepreneurship: By fostering an environment conducive to startups and small businesses through grants, tax incentives, and simplified regulations, the government can stimulate job creation across various sectors, particularly in rural areas where traditional job opportunities may be limited.

Mains PYQ:

Q The nature of economic growth in India in recent times is often described as a jobless growth. Do you agree with this view? Give arguments in favour of your answer. (UPSC IAS/2015)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

[pib] E-Shram Microsites & Occupational Shortage Index (OSI)

From UPSC perspective, the following things are important :

Prelims level: E-Shram Microsites & Occupational Shortage Index (OSI)

Why in the News?

Union Minister for Labour & Employment has launched State and Union Territory Microsites under the e-Shram initiative and the Occupational Shortage Index (OSI).

About E-Shram Microsites

- E-Shram Microsites are state-specific digital platforms integrated with the national e-Shram database.

- It is aimed at providing unorganised workers seamless access to both Central and State government welfare programs.

- These platforms ensure real-time integration between State portals and the e-Shram database, allowing simplified registration of unorganised workers.

Key benefits includes:

(1) For Workers:

- One-stop access to employment opportunities, skilling programs, and social security benefits.

- Multilingual accessibility, ensuring workers from different regions can navigate the platform in their preferred language.

- Two-way integration with the e-Shram database, allowing workers to receive real-time updates on welfare schemes and job opportunities.

(2) For States/UTs:

- Cost-effective digital infrastructure, reducing the need for separate State-level portals.

- Real-time analytics dashboards for better policy decision-making and customized tools for specific labour market requirements.

What is Occupational Shortage Index (OSI)?

- The OSI is a data-driven tool designed to identify job roles and industries facing labour shortages, improving workforce planning and employment outcomes.

- It is based on ILO methodology and quarterly Periodic Labour Force Survey (PLFS) data, ensuring an accurate and updated analysis of the job market.

- It comprise of following 4 sub-indicators:

- Hourly Wage Growth

- Employment Growth

- Growth in Hours Worked

- Share of Under-qualified Workers

- High OSI indicates Shortage/higher demand of workers within a particular occupation, which may result in higher wages, more job opportunities.

- Low OSI indicates Surplus/less demand of workers, which may lead to lower wages, fewer job opportunities, and increased competition for available positions.

PYQ:[2015] Discuss the changes in the trends of labour migration within and outside India in the last four decades. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

WEF released Future of Jobs Report, 2025

From UPSC perspective, the following things are important :

Prelims level: Future of Jobs Report, 2025; Other reports by WEF

Why in the News?

According to the World Economic Forum’s (WEF) Future of Jobs Report 2025, global macro trends, including technological advancements, demographic shifts, and the green transition, will create 170 million new jobs by 2030.

About the Future of Jobs Report, 2025

- It is based on insights gathered from over 1,000 leading global companies, collectively representing 14 million workers across 22 industry sectors and 55 economies worldwide.

- It provides critical insights into emerging and declining job roles, skills trends, and the overall impact of global changes on the labour market.

What are the key findings of the report?

- The report projects 170 million new jobs globally by 2030, with a net increase of 78 million jobs after accounting for 92 million displaced roles.

- Fast-growing roles include AI and machine learning specialists, big data experts, FinTech engineers, and farmworkers, driven by technological advancements and the green transition.

- Clerical jobs like data entry clerks and cashiers are declining due to automation.

- Employers anticipate 39% of skills will change by 2030, with growing demand for AI proficiency, creative thinking, and resilience.

- Businesses are focusing on reskilling, with 85% investing in upskilling programs.

- Collaboration among governments, academia, and industries is vital to bridge the skills gap and align with future job demands.

About World Economic Forum (WEF):

|

PYQ:[2019] The Global Competitiveness Report is published by the: (a) International Monetary Fund (b) United Nations Conference on Trade and Development (c) World Economic Forum (d) World Bank |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

India’s wage challenge has shifted from chronic to immediate

From UPSC perspective, the following things are important :

Mains level: Challenges related to employment;

Why in the news?

India’s Rural low wages pose a significant challenge, but adopting a ground-level perspective on employers’ daily realities highlights policy measures to increase the number of high-productivity employers.

What are the root causes of the current wage stagnation in India?

- Economic Structure: The shift from agriculture to non-farm jobs has not been accompanied by a corresponding increase in productivity. Despite significant government spending, the flow of jobs since 1991 has not reduced farm employment, leading to wage stagnation in rural areas.

- Skill Mismatch: There is a disparity between the skills available in the labour market and those demanded by employers. Many workers remain under-skilled for the higher-paying jobs that are available, perpetuating low wages.

- Economic growth vs wage stagnation: Despite India’s GDP growing at a strong rate, averaging 7.8% in recent years, this growth has not led to substantial wage increases for rural workers. In fact, real wages, when adjusted for inflation, have either remained stagnant or decreased. This disparity underscores a crucial issue: the underlying nature of economic growth.

- Shift to Capital-Intensive Growth: India’s recent economic growth is driven by capital-intensive sectors, which create fewer jobs, limiting the demand for rural labour and keeping wages low.

- Inflation vs. Wage Growth: While nominal wages have risen, inflation has outpaced wage growth, reducing the real purchasing power of rural workers. For example, rural wages grew by 5.2% nominally, but real wage growth was negative at -0.4%.

- Increased Labour Supply: Government schemes like Ujjwala and Har Ghar Jal have increased rural women’s workforce participation, intensifying competition for jobs and putting downward pressure on wages.

- Agricultural Wage Stagnation: Despite steady agricultural growth (4.2% and 3.6% in recent years), wages in agriculture have not increased proportionally, limiting overall wage growth in rural areas.

How can India effectively implement a living wage system?

A living wage system ensures workers earn enough to meet basic needs like food, housing, healthcare, and education, enabling a decent standard of living beyond mere subsistence wages.

- Policy Framework: Establishing a clear definition of what constitutes a living wage based on local cost of living metrics is essential. This framework should be adaptable to different regions and sectors.

- Incentives for Employers: Providing tax breaks or subsidies for businesses that pay living wages can encourage compliance and support workers’ livelihoods.

- Strengthening Labor Rights: Ensuring robust enforcement of labor laws that protect workers’ rights to fair wages and safe working conditions is crucial for implementing a living wage system effectively.

- Public Awareness Campaigns: Educating both employers and employees about the benefits of a living wage can help shift perceptions and practices within the workforce.

What are the wage disparities in India?

Note: The D9/D1 wage ratio is a measure of income inequality that compares the earnings of the top 10% of wage earners (D9) to the earnings of the bottom 10% (D1) within a given population |

What policy measures can be taken to address wage disparities and ensure fair compensation? (Way forward)

- Rationalisation of Regulations: Streamlining regulatory frameworks to reduce bureaucratic hurdles can encourage entrepreneurship and job creation. This includes removing unnecessary jail provisions that deter business operations.

- Investing in Human Capital: Prioritizing skill development programs aligned with market demands can boost employability and empower workers to secure higher-paying jobs.

- Encouraging Non-Farm Employment: Policies should focus on fostering private, productive non-farm jobs through digitisation and formalization, paving the way for better wages.

- Strengthening Redistribution Mechanisms: Adopting progressive taxation on higher profits can fund social programs designed to uplift wage levels across different sectors.

- Fostering Long-Term Economic Planning: Crafting a comprehensive economic strategy aligned with labour market needs is essential for ensuring sustainable wage growth and effectively addressing disparities.

Mains PYQ:

Q Can the strategy of regional-resource-based manufacturing help in promoting employment in India? (UPSC IAS/2019)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

The right to work deleted

From UPSC perspective, the following things are important :

Mains level: DPSP; Right to work; Labour Laws; MGNREGA;

Why in the News?

The implementation guidelines for MGNREGA are outlined in Master Circulars issued by the Ministry of Rural Development (MoRD) annually or biennially.

Mahatma Gandhi NREGA provides a number of legal entitlements to the job seekers through a series of provisions in the Act. While the Act makes provision for at least 100 days work per rural household in a year, it is the strong legal framework of rights and entitlements that come together to make the hundred days of work per year possible.

|

What were the reasons behind the decision to delete references to the ‘Right to work’ in recent legislation or policy?

- Administrative Efficiency: Governments may argue that streamlining policies and removing cumbersome regulations can enhance efficiency in employment programs.

- Aadhaar-Based Payment Systems (ABPS): The push for ABPS has led to increased deletions of job cards, as officials focus on compliance metrics rather than ensuring workers’ rights are upheld.

- Political and Economic Pressures: There may be external pressures to reduce welfare spending or adjust labour policies in response to economic conditions, leading to a perception that the ‘right to work’ is less critical.

What does the term ‘right to work’ entail, and why is it significant in the context of labor laws?

|

How might the deletion of the ‘right to work’ impact workers, unions, and the broader labour market?

- Workers’ Rights: It undermines the legal protections afforded to workers, making it easier for authorities to arbitrarily delete job cards without proper verification or due process.

- Unions and Collective Bargaining: Unions may find it challenging to advocate for workers’ rights when legal entitlements are diminished, weakening their bargaining power.

- Labour Market Dynamics: A reduction in guaranteed employment can lead to increased unemployment and underemployment, exacerbating poverty and economic inequality among rural populations.

Way forward:

- Strengthen Oversight and Accountability: Implement independent audits, regular reviews, and grievance redress mechanisms to ensure adherence to due process in job card deletions, with active involvement of Gram Sabhas and worker representatives.

- Enhance Worker Protections: Reinforce legal safeguards for the ‘right to work’ by improving transparency in employment programs, ensuring compliance with MGNREGA mandates, and addressing systemic issues like ABPS-linked exclusions through inclusive digital solutions.

Mains PYQ:

Q An essential condition to eradicate poverty is to liberate the poor from the process of deprivation.” Substantiate this statement with suitable examples. (UPSC IAS/2016)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

Calling out exploitative labour dynamics on platforms

From UPSC perspective, the following things are important :

Mains level: Issues related to Gig workers;

Why in the News?

Amid the ongoing evolution of the “gig worker” concept, India recently witnessed a groundbreaking movement a nationwide digital strike organized by women gig workers this Deepavali.

What are the specific exploitative practices faced by gig workers?

- Wage Theft and High Commissions: Many gig workers receive only a fraction of their earnings after substantial deductions for company commissions, which can range from 10% to 35% of their total income. This often leaves them with minimal take-home pay, insufficient to meet basic living expenses.

- Forced Purchases and Costs: Workers are often required to buy product kits at full retail prices from their employers, which further erodes their earnings. This practice restricts their ability to purchase necessary supplies at more affordable wholesale rates.

- Job Insecurity and Rating Systems: Gig workers are subjected to biased rating systems that can lead to job insecurity. If they refuse “auto-assigned” jobs or fail to meet performance metrics, they risk being blocked from the platform or terminated without recourse.

- Lack of Social Security: Gig workers are excluded from essential benefits such as minimum wages, health protections, and social security rights, leaving them vulnerable in times of need.

How do platform dynamics contribute to labour exploitation?

- Misclassification of Workers: Gig workers are often classified as independent contractors rather than employees, which denies them access to fundamental labour rights and protections. This legal loophole allows companies to evade responsibilities related to wages and benefits.

- Algorithmic Control: Companies utilize complex algorithms to manage worker assignments and ratings, creating a system where workers are constantly monitored and evaluated based on performance metrics that may not accurately reflect their work quality.

- Patriarchal Structures: The gig economy perpetuates existing patriarchal norms by relegating women to traditionally female roles such as beauticians and housekeepers, limiting their job options and negotiating power within the labour market.

What measures can address and combat labour exploitation in this sector? (Way forward)

- Legal Recognition as Employees: Governments should legislate the recognition of gig workers as employees rather than independent contractors, thereby extending labour rights such as minimum wage laws and social security benefits.

- Regulatory Frameworks: Establishing comprehensive labour laws specific to the gig economy would help protect workers’ rights. This includes mechanisms for grievance redressal, ensuring fair treatment and accountability from platform companies.

- Collective Bargaining Rights: Supporting unionization efforts like those of the Gig and Platform Services Workers Union (GIPSWU) can empower workers to negotiate better wages and working conditions collectively. This grassroots organizing is crucial for achieving meaningful change in labour practices within the sector

Mains PYQ:

Q Examine the role of ‘Gig Economy’ in the process of empowerment of women in India. (UPSC IAS/2021)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

Indian Council of Social Science Research (ICSSR)

From UPSC perspective, the following things are important :

Prelims level: Indian Council of Social Science Research (ICSSR)

Why in the news?

Employees of the Indian Council of Social Science Research (ICSSR) institutions have expressed concerns over the delay in revising their pay scales.

About the Indian Council of Social Science Research (ICSSR):

| Details | |

| Establishment | It was established as an Autonomous organization, in 1969 on the recommendation of Prof. V. K. R. V. Rao Committee (National Income Committee). |

| Nodal Ministry | Operates under the Ministry of Education. |

| Function | Promote, fund, and support social science research in India. |

| Objectives | • Encourage social science research • Fund and coordinate research in various branches • Collaborate with international research organizations • Provide policy recommendations based on research |

| Organizational Structure | It is governed by a Council of eminent scholars and policymakers, supported by 24 research institutes and 6 regional centers. |

| Research Institutes | Funds institutes such as: • Centre for Development Studies (CDS), Thiruvananthapuram • Institute for Social and Economic Change (ISEC), Bengaluru • Centre for Studies in Social Sciences (CSSS), Kolkata • Gokhale Institute of Politics and Economics (GIPE), Pune |

| Key Programs and Initiatives | • ICSSR Data Service: National repository for social science data • NASSDOC: Documentation and library services • Workshops and conferences to enhance research capabilities |

| International Collaboration | Collaborates with organizations like UNESCO and the Indian Council of World Affairs for joint projects and scholar exchanges. |

PYQ:[2013] Which of the following bodies is/are not mentioned in the Indian Constitution? 1. National Development Council 2. Planning Commission 3. Zonal Councils Select the correct answer using the codes given below: (a) 1 and 2 only (b) 2 only (c) 1 and 3 only (d) 1, 2 and 3 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

Workplace carcinogens are increasingly a global problem

From UPSC perspective, the following things are important :

Mains level: Issues in the Workplace;

Why in the News?

Data indicates that Central Europe and the wealthiest nations in Asia are approaching the cancer rates from workplace exposure to carcinogens seen in Western Europe, Australia, and New Zealand.

Carcinogens are associated with Occupational Cancer:

- Asbestos: A major contributor to lung cancer and mesothelioma, responsible for the highest number of deaths is related to occupational exposure.

- Benzene: Associated with leukemia and bladder cancer; prevalent in chemical industries.

- Silica: Linked to lung cancer; significant exposure occurs in construction and mining.

- Diesel Engine Exhaust: Contributes to lung cancer and other respiratory issues.

- Secondhand Smoke: Increases risk of lung cancer among workers in smoke-exposed environments.

- Arsenic, Beryllium, Cadmium, Chromium: Various cancers are associated with these substances, including kidney and lung cancers.

Data Trends on Cancer from Workplace Exposure:

- Western Europe and Australasia historically had the highest rates of death from cancers attributed to workplace carcinogens. These regions have maintained the highest mortality rates for over three decades.

- Southeast Asia countries like Singapore, Japan, Brunei, and South Korea have seen their cancer death rates from occupational exposure triple since 1990. This increase correlates with their growing manufacturing sectors.

- In Central Europe and East Asia, death rates have doubled in Central Europe and increased by 2.5 times in East Asia since 1990. The rise is attributed to a large manufacturing economy that often lacks stringent safety regulations.

International guidelines:

|

Way forward:

- Strengthen Regulations and Enforcement: Implement and enforce stricter occupational health and safety regulations, including banning or limiting the use of known carcinogens, such as asbestos and benzene, and promoting safer alternatives in industries.

- Enhance Awareness and Training: Develop comprehensive training programs for workers and employers on the risks of carcinogens, safe handling practices, and the importance of regular health monitoring to prevent occupational cancers.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

What is the Samsung worker’s strike in Chennai about?

From UPSC perspective, the following things are important :

Mains level: Wage issues in India;

Why in the News?

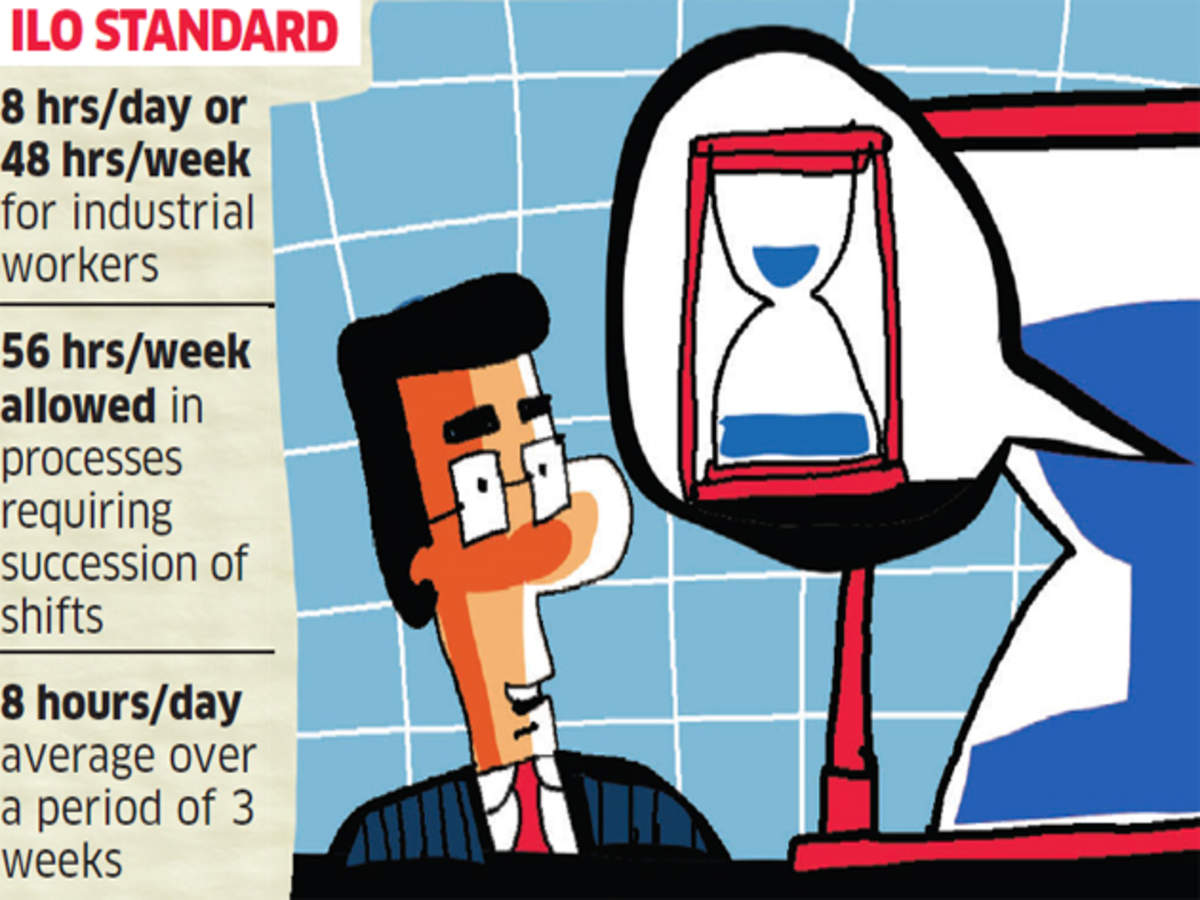

Approximately two-thirds of workers at Samsung’s flagship factory in Chennai have been on strike for a month, demanding higher wages, an eight-hour workday, improved conditions, and union recognition.

What are the main demands of the striking workers?

- Higher Wages: Workers are demanding increased salaries to improve their financial conditions.

- Eight-Hour Work Day: The employees seek the implementation of an eight-hour workday to ensure better work-life balance.

- Better Working Conditions: Strikers are advocating for improved health and safety standards in the workplace.

- Recognition of Labour Union: The workers want formal acknowledgment of their recently formed union, the Samsung India Workers Union (SIWU).

What is Samsung’s union policy?

- Historically, Samsung has maintained a strict no-union policy for over 80 years, resisting any collective bargaining efforts by employees.

- In July 2021, the company began to recognize unions after successful negotiations at Samsung Display and Samsung Electronics, allowing for some degree of collective bargaining.

- Samsung now has various unions representing its workforce globally, with significant representation in South Korea.

Why was SIWU unrecognised?

- Registration Challenges: SIWU’s registration has been opposed by Samsung management, citing trademark violations due to the use of the name “Samsung” in the union’s title.

- Legal Precedents: SIWU argues that trademark issues should not apply, as their activities do not involve commercial undertakings that could infringe on the trademark.

- Pending Legal Review: The case regarding SIWU’s registration is pending further court hearings, with the government examining objections raised by the management.

What has been the govt.’s response?

- Indifferent Stance: SIWU and the Centre of Indian Trade Unions (CITU) have accused the Tamil Nadu government of being indifferent and supportive of Samsung management, which the government denies.

- Support for Workers’ Rights: The government claims it considers the registration application in light of Samsung’s objections and aims to ensure fair treatment of both workers and management.

- CITU’s Position: Union leaders assert that government intervention in favor of management undermines the rights of workers and can deter unionization efforts, despite evidence showing that unions can benefit both employees and companies.

Present Legislation in India:

|

Way forward:

- Facilitate Dialogue and Mediation: Establish a formal dialogue between the workers, Samsung management, and government representatives to address grievances, negotiate demands, and work towards a mutually beneficial agreement.

- Strengthen Legal Framework for Union Recognition: Amend or clarify existing labor laws to ensure timely and transparent registration processes for unions, protecting their rights and enabling effective collective bargaining.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

Fairwork India report highlights the absence of local living wage for gig workers, aggregators turning their back to collectivization

From UPSC perspective, the following things are important :

Mains level: Issues related to gig workers;

Why in the News?

The ‘Fairwork India Ratings 2024’ highlights that platform aggregators in India fail to ensure local living wages and resist recognizing the collective rights of workers.

Who are the Gig Workers?

|

Key highlights as per the report:

- No Platform Scored Perfectly: No digital labor platform scored more than 6 out of 10 points, and none met all criteria across the five principles — Fair Pay, Fair Conditions, Fair Contracts, Fair Management, and Fair Representation.

- Fair Pay: Only BigBasket and Urban Company ensured a minimum wage, but no platform met the criteria for guaranteeing a living wage after work-related costs.

- Fair Conditions: Several platforms (e.g., Amazon Flex, Swiggy, Zepto) provided safety equipment and training, but only a few offered comprehensive accident insurance and income loss compensation.

- Fair Contracts: BigBasket, Swiggy, and others made contracts accessible and comprehensible, and provided data protection for workers.

- Fair Management: Platforms like BluSmart and Zomato implemented processes for addressing grievances and preventing discrimination.

Present Status of Gig Economy in India:

- Growth of the Gig Economy: India is witnessing rapid growth in the gig economy, with millions of workers depending on digital platforms for their livelihoods.

- The rise of app-based platforms such as Uber, Zomato, and Urban Company has driven the expansion of gig work across urban areas.

- Government Focus: Recent years have seen increasing political and legislative attention to gig worker welfare. Karnataka and Jharkhand are examples of states that have proposed new legislation to regulate platform work and protect gig workers’ rights.

- Worker Conditions: Despite the expansion of gig work, platforms in India still lag in ensuring fair pay, safety, and management of gig workers.

- The Fairwork India Ratings 2024 reveal that no platform scored above 6 out of 10, signaling considerable gaps in adhering to key labor standards.

Challenges faced by the Gig Economy

- Low Wages and Unstable Earnings: Many platforms fail to ensure a local living wage for workers after accounting for work-related costs. Only a few platforms like Bigbasket and Urban Company guarantee the local minimum wage, but none meet the standard of ensuring a living wage.

- Lack of Social Security and Benefits: Most gig workers lack access to benefits such as healthcare, insurance, and paid leave. While a few platforms provide accident insurance, broader social security protections remain elusive.

- Poor Working Conditions: Platforms often do not ensure adequate safety training or measures. While some like Swiggy, Zomato, and Zepto offer basic safety equipment and training, broader protections, especially in terms of income loss and sick leave, are limited.

- Inflexible Contracts: Contracts on platforms are frequently unclear, lengthy, and not always comprehensible for workers, making it difficult for them to fully understand their rights and obligations.

- Management Issues and Bias: Workers face arbitrary decisions and discipline without proper recourse. Though some platforms have mechanisms for workers to appeal decisions, few have adopted policies to ensure fairness in work allocation.

- Collectivization Challenges: Platforms resist recognizing gig workers’ right to form unions or collective bodies. Despite the growing movement for gig worker collectivization, no platform showed evidence of supporting or acknowledging these efforts.

Way forward:

- Strengthen Legal Protections and Social Security: Introduce comprehensive legislation ensuring gig workers receive fair wages, social security benefits like healthcare and insurance, and clear, comprehensible contracts.

- Promote Worker Representation and Fair Management: Encourage platforms to recognize collective bodies of gig workers, ensuring their right to unionize. Implement transparent and bias-free management practices, along with grievance redressal mechanisms, to improve working conditions and fairness.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

Investing in persons with disabilities

From UPSC perspective, the following things are important :

Mains level: Challenges Faced by Persons with Disabilities

Why in the News?

The recent film Srikanth depicts industrialist Srikanth Bolla’s triumph over visual impairment. It highlights societal stigma, marginalization, and the lack of support for Persons with Disabilities (PwDs).

Status of Education and Jobs for PwD’s in India:

- Limited Employment Opportunities: A 2023 report indicates that only five out of 50 Nifty 50 companies employ more than 1% of persons with disabilities (PwDs), with most being public sector firms.

- Gap in Accessibility and Supply: Less than 1% of educational institutions in India are disabled-friendly, highlighting a significant gap in accessibility and support for PwDs in both education and employment sectors.

- Inadequate Infrastructure: Data shows that fewer than 40% of school buildings have ramps, and only about 17% have accessible restrooms.

- Lack of effective implementation: Despite legislative provisions for reservations in government jobs under the Rights of Persons with Disabilities Act, 2016, there is a lack of effective implementation, resulting in low participation of PwDs in the workforce.

Challenges Faced by Persons with Disabilities (PwD)

- Social Stigma and Marginalization: PwDs face deep-rooted social stigma, which leads to discrimination and exclusion from various sectors, including education and employment.

- Inaccessible Infrastructure: Many public and private spaces lack the necessary infrastructure to accommodate PwDs, such as ramps and accessible restrooms, which severely limits their mobility and independence. For example, Less than 40% of school buildings have ramps, and only about 17% have accessible restrooms.

- Educational Barriers: Despite the Right to Education Act, many PwDs encounter barriers such as a lack of inclusive schools, trained teachers, and assistive technologies, leading to high illiteracy rates among disabled individuals.

- Workplace Discrimination: PwDs often face discrimination in the workplace, including a lack of reasonable accommodations and societal prejudices that create a “glass ceiling” for their employment opportunities.

Erosion of Identity for PwDs

|

Way forward:

- Enhance Accessibility: Ensure that educational institutions and workplaces are fully accessible by upgrading infrastructure and implementing inclusive design standards.

- Combat Stigma and Promote Inclusion: Launch targeted awareness campaigns to challenge negative perceptions of PwDs and promote their positive contributions.

Mains PYQ:

Q The Rights of Persons with Disabilities Act, 2016 remains only a legal document without intense sensitisation of government functionaries and citizens regarding disability. Comment. (2022)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Labour, Jobs and Employment – Harmonization of labour laws, gender gap, unemployment, etc.

A ground plan for sustainable mass employment

From UPSC perspective, the following things are important :

Mains level: Challenges due to Low wages and short-term skill programs;

Why in the News?

The ambitious ₹2 lakh crore employment package aims to create 4.1 crore jobs, but evidence shows low wages and short-term skill programs hinder long-term sustainability.

Low wages and short-term skill programs hinder long-term sustainability: