From UPSC perspective, the following things are important :

Prelims level: PACS

Mains level: Rural banking in India

The Cabinet Committee on Economic Affairs (CCEA) has approved a proposal to digitise around 63,000 primary agricultural credit societies (PACS).

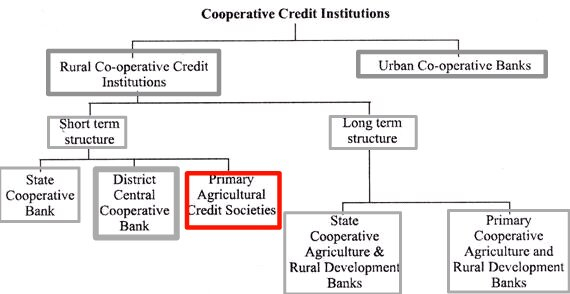

What are the Primary Agricultural Credit Societies (PACS)?

- PACS is a basic unit and smallest co-operative credit institutions in India.

- In 1904 the first Primary Agricultural Credit Society (PACS) was established.

- It works on the grassroots level (gram panchayat and village level).

- PACS is the final link between the ultimate borrowers, i.e., rural people, on the one hand, and the higher agencies, i.e., Central cooperative bank, state cooperative bank, and Reserve Bank of India, on the other.

Who regulates PACS?

- PACS are registered under the Co-operative Societies Act and also regulated by the RBI.

- They are governed by the “Banking regulation Act-1949” and Banking Laws (Co-operative societies) Act 1965.

Various objectives of PACS

- To raise capital for the purpose of making loans and supporting members’ essential activities.

- To collect deposits from members with the goal of improving their savings habit.

- To supply agricultural inputs and services to members at reasonable prices,

- To arrange for the supply and development of improved breeds of livestock for members.

- To make all necessary arrangements for improving irrigation on land owned by members.

- To encourage various income-generating activities through supply of necessary inputs and services.

Functions of PACS

- As registered cooperative societies, PACS have been providing credit and other services to their members.

- PACS typically offer the following services to their members:

- Input facilities in the form of a monetary or in-kind component

- Agriculture implements for hire

- Storage space

Who can form PACS?

- A primary agricultural credit society can be formed by a group of ten or more people from a village. The society’s management is overseen by an elected body.

- The membership fee is low enough that even the poorest agriculturist can join.

- Members of the society have unlimited liability, which means that each member assumes full responsibility for the society’s entire loss in the event of its failure.

What capitalizes PACS?

- The primary credit societies’ working capital is derived from their own funds, deposits, borrowings, and other sources.

- Share capital, membership fees, and reserve funds are all part of the company’s own funds.

- Deposits are made by both members and non-members.

- Borrowings are primarily made from central cooperative banks.

Why need digitization?

- PACS account for 41 % (3.01 Cr. farmers) of the KCC loans given by all entities in the country and 95 % of these KCC loans (2.95 Cr. farmers) through PACS are to the small and marginal farmers.

- The other two tiers viz. State Cooperative Banks (StCBs) and District Central Cooperative Banks (DCCBs) have already been automated by the NABARD and brought on Common Banking Software (CBS).

- Majority of PACS have so far been not computerized and still functioning manually resulting in inefficiency and trust deficit.

Significance of digitization

- Computerization of PACS will increase their transparency, reliability and efficiency, and will also facilitate the accounting of multipurpose PACS.

- Along with this, it will also help PACS to become a nodal centre for providing services such as direct benefit transfer (DBT), Interest subvention scheme (ISS), crop insurance scheme (PMFBY), and inputs like fertilizers and seeds.

Try this PYQ from CSP 1999:

Q.The farmers are provided credit from a number of sources for their short and long term needs. The main sources of credit to the farmers include-

(a) the Primary Agricultural Cooperative Societies, commercial banks, RRBs and private money lenders

(b) the NABARD, RBI, commercial banks and private money lenders

(c) the District Central Cooperative Banks (DCCB), the lead banks, IRDP and JRY

(d) the Large Scale Multi-purpose Adivasis Programme, DCCB, IFFCO and commercial banks

Post your answers here.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Option A

A

A

a

a

A

PACS are outside the purview of Banking Regulation act . Also it is not regulated by RBI

option a

a

A

a

a

PACS are outside the purview of the Banking Regulation Act, 1949 and hence not regulated by the Reserve Bank of India.

RBI Website says that PACS are outside the purview of Banking Regulation Act and hence not regulated by RBI (https://m.rbi.org.in/scripts/FS_Overview.aspx?fn=2755). But here it says the opposite.

a