Dear Aspirants,

This Spotlight is a part of our Mission Nikaalo Prelims-2023.

You can check the broad timetable of Nikaalo Prelims here

Session Details

YouTube LIVE with Parth sir – 7 PM – Prelims Spotlight Session

Evening 04 PM – Daily Mini Tests

Join our Official telegram channel for Study material and Daily Sessions Here

1st May 2023

Inflation

Understanding Inflation

Inflation: Inflation is when the overall general price level of goods and services in an economy is increasing. As a consequence, the purchasing power of the people are falling.

Inflation Rate: Inflation Rate is the percentage change in the price level from the previous period.

Inflation Rate= {(Price in year 2 – Price in year 1)/ Price in year 1} *100

Whole sale Price Index: WPI is used to monitor the cost of goods and services bought by producer and firms rather than final consumers. The WPI inflation captures price changes at the factory/wholesale level.

GDP Deflator: GDP Deflator is the ratio of nominal GDP to real GDP. The nominal GDP is measured at the current prices whereas the real GDP is measured at the base year prices.

The Difference

| Consumer Price Index | GDP Deflator |

| CPI reflects the price of goods and services bought by the final consumers. | GDP deflator reflects the price of all the goods and services produced domestically. |

| Example: Suppose the price of a satellite to be launch by ISRO increases. Even though the satellite is part of the GDP of India, but it is not a part of normal CPI index, since we don’t consume satellite. | The price rise of the ISRO satellite will be reflected in GDP deflator. |

| Similarly, India produces some crude oil, but most of the oil/petroleum is imported from the West Asia, as a result, when the price of oil/petroleum product changes, it is reflected in CPI basket as petroleum products constitute a larger share in CPI. | The price change of oil products is not reflected much in the GDP deflator since we do not produce much crude oil. |

| The CPI compares the price of a fixed basket of goods and services to the price of the basket in the base year. | The GDP deflator compares the price of currently produced goods and services to the price of the same goods and services in the base year. Thus, the group of goods and services used to compute the GDP deflator changes automatically over time. |

Producer Price Index

PPI measures the average change in the sale price of goods and services either as they leave the place of production or as they enter the place of production. Moreover, PPI includes services also.

The PPI measure the price changes from the perspective of the seller and differs from CPI which measures price changes from buyer perspective.

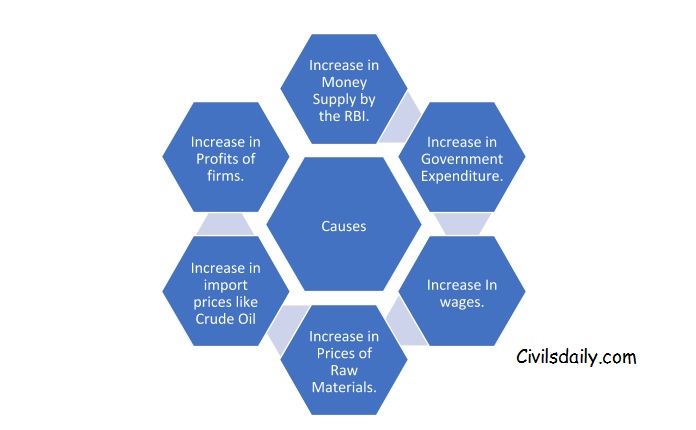

Causes of Inflation

Inflation is mainly caused either by demand Pull factors or Cost Push factors. Apart from demand and supply factors, Inflation sometimes is also caused by structural bottlenecks and policies of the government and the central banks. Therefore, the major causes of Inflation are:

- Demand Pull Factors (when Aggregate Demand exceeds Aggregate Supply at Full employment level).

- Cost Push Factors (when Aggregate supply increases due to increase in the cost of production while Aggregate demand remains the same).

- Structural Bottlenecks (Agriculture Prices fluctuations, Weak Infrastructure etc.)

- Monetary Policy Intervention by the Central Banks.

- Expansionary Fiscal Policy by the Government.

Demand and Supply factors can be further sub divided into the following:

Inflationary Gap: the Inflationary gap is a situation which arises when Aggregate demand in an economy exceeds the Aggregate supply at the full employment level.

Deflationary Gap: Deflationary Gap is a situation which arises when Aggregate demand in the economy falls short of Aggregate Supply at the full employment level.

Stagflation: The falling growth along with rising prices makes cost push inflation more dangerous than the demand-pull inflation. The situation of rising prices along with falling growth and employment is called as stagflation.

Hyperinflation: Hyperinflation is a situation when inflation rises at an extremely faster rate. The rate of inflation can increase from 50 times to 300 times. The major causes of the hyperinflation are; government issuing too much currency to finance its deficits; wars and political instabilities and unexpected increase in people’s anticipation of future inflation.

Structural Inflation

- Structuralist Inflation is another form of Inflation mostly prevalent in the Developing and Low-Income Countries.

- The Structural school argues that inflation in the developing countries are mainly due to the weak structure of their economies.

Deflation: Deflation is when the overall price level in the economy falls for a period of time.Deflation is when, for instance, the price of a basket of goods has fallen from Rs 100 to Rs 80. It’s the reduction in overall prices of goods.

Disinflation: Disinflation is a situation in which the rate of inflation falls over a period of time. Remember the difference; disinflation is when the inflation rate is falling from say 5% to 3%.

Headline versus Core Inflation

The headline inflation measure demonstrates overall inflation in the economy. Conversely, the core inflation measures exclude the prices of highly volatile food and fuel components from the inflation index.

Core inflation excludes the highly volatile food and fuel components and therefore represents the underlying trend inflation.

Banking and Monetary Policy

What is monetary policy?

As the name suggests it is policy formulated by monetary authority i.e. central bank which happens to be RBI in case of India.

It deals with monetary i.e money matters i.e. affects money supply in the economy.

Eg. CRR,SLR,OMO,REPO etc

What is fiscal policy then?

It is formulated by finance ministry i.e. government. It deals with fiscal matters i.e. matters related to government revenues and expenditure.

Revenue matters- tax policies, non tax matters such as divestment, raising of loans, service charge etc

Expenditure matters– subsidies, salaries, pensions, money spent on creation of capital assets such as roads, bridges etc.

Monetary policy and fiscal policy together deal with inflation.

Let us now understand how RBI formulates monetary policy to control inflation

It’s clear from what we have learnt so far that to control inflation, RBI will have to decrease money supply or increase cost of fund so that people do not demand goods and services.

Tools available with RBI

- Quantitative tools or general tools- they affect money supply in entire economy- housing, automobile, manufacturing, agriculture- everything.

They are of two types

- Cash Reserve Ratio (CRR)– as the name suggests, banks have to keep this proportion as cash with the RBI. Bank cannot lend it to anyone. Bank earns no interest rate or profit on this.Bank cannot lend it to anyone.

- Statutory Liquidity Ratio (SLR)- As the name indicates banks have to set aside this much money into liquid assets such as gold or RBI approved securities mostly government securities. Banks earn interest on securities but as yield on govt securities is much lower banks earn that much less interest.

RBI Tools for Controlling Credit/Money Supply

Broadly speaking, there are two types of methods of controlling credit.

Measure of Money Supply in India

| M1 | M2 | M3 | M4 |

| It is also known as Narrow Money. | It is a broader concept of the money supply. | It is also known as Broad Money. | M4 includes all items of M3 along with total deposits of post office saving accounts. |

| M1= C+DD+OD

C= Currency with Public. DD= Demand Deposit with the public in the Banks. OD= Other Deposits held by the public with RBI. |

M2= M1 + Saving deposits with the post office saving banks.

M1 is distinguished from M2 because the post office saving deposits are not as liquid as Bank deposits. |

M3 = M1+ Time Deposits with the Bank.

Time deposits serve as a store of wealth and represent a saving of the people and are not as liquid as they cannot be withdrawn through cheques or ATMs as compared to money deposited in Demand deposits. |

M4= M3+Total Deposits with Post Office Saving Organisations.

M4 however, excludes National Saving Certificates of Post Offices. |

| It is the most liquid form of the money supply. | M3 is the most popular and essential measure of the money supply. The monetary committee headed by late Prof Sukhamoy Chakravarty recommended its use for monetary planning in the economy. M3 is also called Aggregate Monetary Resource |

FINANCIAL MARKETS

- Financial Markets refers to the system consisting of financial institutions, financial instruments, regulatory bodies and organisations

- It facilitates flow of debt and equity capital.

- Financial Institutions (Banks), Development financial Institutions (NABARD, SIDBI, IDBI etc.) and Non-Banking Financial Institutions form Financial Institutions. Ø Financial Instruments are shares, bonds, debentures etc.

Financial markets consist of two major segments:

(l) Money Market: the market for short term funds;

(2) Capital Market: the market for long and medium term funds.

MONEY MARKET

According to the RBI, “The money market is the centre for dealing mainly of short character, in monetary assets; it meets the short term requirements of borrowers and provides liquidity or cash to the lenders.

It is a place where short term surplus investible funds at the disposal of financial and other institutions and individuals are bid by borrowers, again comprising institutions and individuals and also by the government.

Functions of Money Market

- To maintain monetary equilibrium: It means to keep a balance between the demand for and supply of money for short term monetary transactions.

- To promote economic growth: Money market can do this by making funds available to various units in the economy such as agriculture, small scale industries, etc.

- To provide help to Trade and Industry: Money market provides adequate finance to trade and industry. Similarly it also provides facility of discounting bills of exchange for trade and industry.

- To help in implementing Monetary Policy: It provides a mechanism for an effective implementation of the monetary policy.

- To help in Capital Formation: Money market makes available investment avenues for short term period. It helps in generating savings and investments in the economy.

- Money market provides non-inflationary sources of finance to government.

Instruments of money market

Treasury Bills: They are promissory notes issued by the RBI on behalf of the government as a short term liability and sold to banks and to the public. The maturity period ranges from 14 to 364 days. They are the negotiable instruments, i.e. they are freely transferable. No interest is paid on such bills but they are issued at a discount on their face value.

Commercial Bills: They are also called Trade Bills or Bills of Exchange. Commercial bills are drawn by one business firm to another in lieu of credit transaction. It is a written acknowledgement of debt by the maker directing to pay a specified sum of money to a particular person. They are short-term instruments generally issued for a period of 90 days. These are freely marketable. Banks provide working capital finance to firms by purchasing the commercial bills at a discount; this is called ‘discounting of bills’.

Commercial Paper (CP): The CP was introduced in 1990 on the recommendation of the Vaghul Committee. A commercial paper is an unsecured promissory note issued by corporate with net worth of atleast Rs 5 crore to the banks for short term loans. These are issued at discount on face value for a period of 14 days to 12 months. These are issued in multiples of Rs 1 lakh subject to a minimum of Rs 25 lakh.

Certificate of Deposit (CD): The CD was introduced in 1989 on the recommendation of the Vaghul Committee. These are issued by banks against deposits kept by individuals and institutions for a period of 15 days to 3 years. These are similar to Fixed Deposits but are negotiable and tradable. These are issued in multiples of Rs. 1 lakh subject to a minimum of Rs25 lakh.

CAPITAL MARKET

The capital market is the market, for medium and long term funds. It consists of all the financial institutions, organizations and instruments which deal in lending and borrowing transaction of over one year maturity.

It is of following two types:

|

Primary Market |

Secondary Market |

|

It issues security for the first time. Example- Initial public offer and follow on public offer. |

Existing securities are bought and sold. |

|

Firms issue shares to public. |

One investor sells it to another investor. |

|

Price is fixed by the firms. |

Price is fixed on the basis of demand and supply. |

|

Firms raise money for long-term investment. |

Companies benefit from the secondary markets. |

|

There is no specific geographical location. |

There is no specific geographical location. |

|

SEBI is the regulator for this market. |

SEBI is the regulator for this market as well. |

GILT-EDGED MARKET

The Gilt-edged market refers to the market for government and semi government securities, backed by the RBI.

It is known so because the government securities do not suffer from the risk of default and are highly liquid.

The RBI is the sole supplier of such securities. These are demanded by commercial banks, insurance companies, provident funds and mutual funds.

The gilt-edged market may be divided into two parts- the Treasury bill market and the government bond market. Treasury bills are issued to meet short-term needs for funds of the government, while government bonds are issued to finance long-term developmental expenditure.