Why in the News?

The Ministry of Statistics and Programme Implementation (MoSPI) has proposed major revisions in the Consumer Price Index (CPI) methodology, to be implemented in the new retail inflation series from February 2026.

About the Consumer Price Index (CPI):

- Overview: The CPI measures the average change over time in the prices paid by consumers for a fixed basket of goods and services typically consumed by households.

- Purpose: It tracks retail inflation showing how the purchasing power of money changes due to price variations, and how living costs evolve across different population groups.

- Components:

- Food and Beverages: Cereals, pulses, vegetables, milk, meat, fish, sugar, and beverages.

- Housing: Rent paid for rented houses and imputed rent for self-occupied dwellings.

- Clothing and Footwear: Garments, textiles, footwear, and related goods.

- Fuel and Light: LPG, kerosene, electricity, firewood, and other fuels.

- Miscellaneous: Transport, communication, education, health, recreation, personal care, and other services.

- Publishing Authority: The CPI is compiled and released by the Ministry of Statistics and Programme Implementation (MoSPI) through the National Statistical Office (NSO) every month.

- Current Base Year: 2012, which is being revised to 2024 to reflect more recent household consumption patterns captured in the Household Consumption Expenditure Survey (HCES) 2023–24.

- Coverage: Separate indices are compiled for Rural, Urban, and Combined (Rural + Urban) sectors to reflect diverse consumption and price patterns.

- Types of CPI in India:

-

- CPI for Industrial Workers (CPI-IW): Base year 2016; tracks inflation for organized industrial workers; used for Dearness Allowance (DA) revisions.

- CPI for Agricultural Labourers (CPI-AL): Base year 1986–87; measures price changes faced by agricultural labourers.

- CPI for Rural Labourers (CPI-RL): Base year 1986–87; monitors inflation for rural households dependent on wage labour.

- CPI (Urban), CPI (Rural), and CPI (Combined): Base year 2012; represents national-level retail inflation and is the official measure of inflation in India.

- Weightage: The relative importance (weight) of each component reflects its share in total household expenditure, for instance, food and beverages hold over 45%, while housing has 21.67% in urban CPI and 10.07% in all-India CPI.

- Use and Importance:

- Inflation Targeting: The Reserve Bank of India (RBI) uses CPI as the anchor for its Monetary Policy Framework, aiming for 4% ± 2% inflation.

- Wage & Pension Adjustments: CPI is used to revise wages, pensions, and dearness allowances in both government and industrial sectors.

- Policy Planning: It provides essential inputs for economic policy, poverty analysis, and fiscal decisions.

- Economic Indicator: Serves as the primary indicator of cost of living, influencing interest rate decisions, tax indexation, and social welfare adjustments.

Revisions in the CPI:

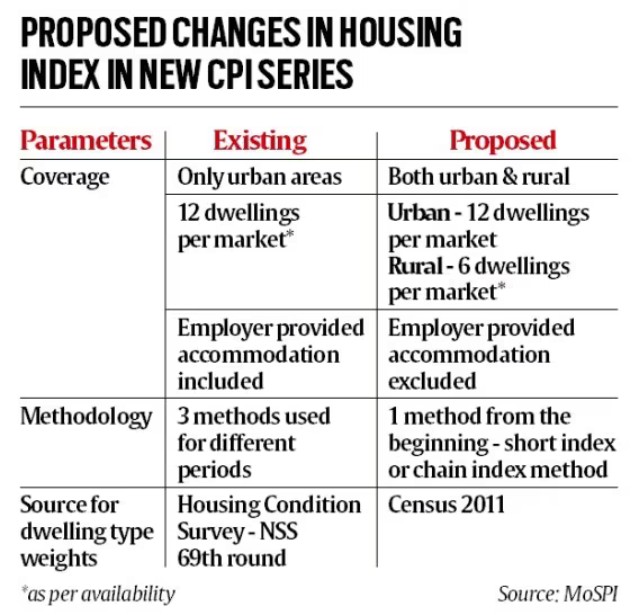

- Monthly Rent Data: Collection every month for both rural & urban areas, replacing earlier six-monthly urban series.

- Inclusion of Rural Housing: Covers imputed rents for owner-occupied rural dwellings.

- Exclusion of Employer Housing: Removes HRA-based distortions from government/PSU quarters.

- Expanded Sampling & IMF Alignment: Broader coverage, discontinuation of panel imputation, adoption of IMF-recommended rent index computation.

- Weight Revision: Recalibrates housing share (currently 21.67 % urban; 10.07 % all-India) using new expenditure data.

- Transparency: MoSPI discussion papers (2024-25) invite feedback on PDS treatment, housing index, and base methodology.

Rationale & Impact:

- Captures Post-Pandemic Rent Surge overlooked by the 2012 base.

- Addresses Rural Under-coverage for two-thirds of India’s population.

- Enhances RBI’s Inflation Targeting through more accurate rent data.

- Aligns with Global Standards, strengthening CPI’s credibility as a comprehensive welfare and policy indicator.

| [UPSC 2020] Consider the following statements: 1. The weightage of food in Consumer Price Index (CPI) is higher than that Wholesale Price Index (WPI). 2. The WPI does not capture changes in the prices of services, which CPI does. 3. Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates. Which of the statements given above is/are correct? Options: (a) 1 and 2 only* (b) 2 only (c) 3 only (d) 1, 2 and 3 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024