Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

India breaks into top 100 of SDG Index for the first time

Why in the News?

In a major milestone, India has ranked 99th out of 167 countries in the 2025 edition of the Sustainable Development Report (SDR), released by the UN Sustainable Development Solutions Network.

What are Sustainable Development Goals (SDGs)?

|

About Global SDG Rankings:

- Report Publisher: The Sustainable Development Report is released annually by the UN Sustainable Development Solutions Network, led by Jeffrey Sachs.

- Methodology: It ranks 167 countries using an SDG Index score out of 100 based on performance across all 17 goals.

- Score Interpretation: A score of 100 means full achievement of all SDGs; lower scores show partial or poor implementation.

- Data Sources: Rankings are based on a mix of social, economic, environmental, and governance indicators.

- Global Patterns: European countries dominate top ranks; countries with conflict or debt rank lower.

| Note: In India, we also have our own SDG India Index released by NITI Aayog. |

Key Highlights of the Rankings:

- India’s Rank 2025: India ranks 99th with a score of 67—its first time in the top 100.

- Major Countries’ Ranking: China ranks 49th (74.4); the US ranks 44th (75.2) but is 193rd in SDG policy support.

- Neighbourhood Comparison: Bhutan ranks 74th (70.5), Nepal 85th (68.6), Bangladesh 114th (63.9), Pakistan 140th (57), Sri Lanka 93rd, and Maldives 53rd.

- Top Performers: Finland, Sweden, and Denmark lead the world in SDG achievement.

- Areas of Progress: Global gains include access to electricity, mobile broadband, internet, and lower child mortality.

- Major Setbacks: Challenges include rising obesity, declining press freedom, biodiversity loss, and growing corruption.

- Target Gaps: Only 17% of SDG targets are on track to be achieved by 2030.

| [UPSC 2016] Consider the following statements:

1. The Sustainable Development Goals were first proposed in 1972 by a global think tank called the ‘Club of Rome’. 2. The Sustainable Development Goals have to be achieved by 2030. Which of the statements given above is/are correct? Options: (a) 1 only (b) 2 only * (c) Both 1 and 2 (d) Neither 1 nor 2 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

[23rd June 2025] The Hindu Op-ed: Steering the Indian economy amidst global troubles

PYQ Relevance:[UPSC 2019] The economy is in a state of crisis due to global inflation. Critically examine whether this crisis and high inflation have left the Indian economy in good shape? Give reasons in support of your arguments. Linkage: This PYQ directly mentions a specific global economic “trouble” – global inflation – and asks about its impact on the Indian economy. This article talks about the “monetary policy should continue to remain accommodative” and that “inflation currently under control and projected to be lower” can help “propel growth,” indicating that managing inflation is a key part of steering the economy amidst global challenges. |

Mentor’s Comment: The global trade order is witnessing a seismic shift amid renewed trade wars, evolving tariff regimes, and accelerating bilateral negotiations. In this flux, India’s exports of nearly one-fifth of its merchandise to the U.S., finds itself vulnerable, especially in sectors dominated by MSMEs like apparel, gems, and electronics. The uncertainty surrounding U.S. reciprocal tariffs, potential dumping threats, and the instability in trade negotiations pose a structural challenge. However, India also faces a rare geopolitical opportunity—to integrate into the reconfigured global supply chains, reduce dependency on traditional partners, and assert itself as a global manufacturing and export hub.

Today’s editorial analyses the impact of new trade rules and ongoing political tensions between countries. This content would help in GS Paper II (International Relations) and GS Paper III (Indian Economy) in the mains Paper.

_

Let’s learn!

Why in the News?

The global economy is changing in a big way, mainly due to new trade rules and ongoing political tensions between countries.

Why are current global trade dynamics creating uncertainty for Indian exporters?

- Rise in protectionism and trade wars: Many countries are reviewing tariffs and adopting protectionist measures. This creates unpredictability in global trade flows, making it harder for Indian exporters to plan pricing and market strategies. Eg: The U.S. imposing or revising tariffs on Indian goods affects sectors like garments and pharmaceuticals.

- Geopolitical tensions: Conflicts like the U.S.-China trade war or the Russia-Ukraine war are disrupting supply chains and altering trade alliances, impacting Indian exporters’ access to global markets and increasing costs. Eg: Indian exporters face delays or higher freight costs due to changes in trade routes.

- Uncertain tariff regimes: Indian exporters face difficulty in decision-making due to fluctuating U.S. trade policies and lack of clarity on future duty structures, impacting pricing and margins. Eg: Sectors such as auto components and gems & jewellery, heavily reliant on the U.S., face profitability issues.

- Losing competitive advantage: Competing countries like Bangladesh and Vietnam may benefit from early trade deals with the U.S., while India’s relative tariff advantage remains unclear. Eg: Indian textile exports could become costlier compared to Bangladesh’s duty-free access.

- Planning uncertainty: Exporters hesitate to invest or plan for the long term in the absence of stable trade rules and policies. This impacts capacity expansion and export contracts, particularly for MSMEs. Eg: Indian MSMEs may cancel new orders or delay shipments due to lack of tariff clarity.

What challenges do Indian MSMEs face due to potential U.S. tariff changes?

- Profit Margin Erosion: Increased U.S. tariffs make Indian goods costlier, reducing profit margins for MSMEs and making their exports uncompetitive. Eg: A carpet-exporting MSME in Uttar Pradesh may struggle to maintain orders if buyers shift to cheaper alternatives from Bangladesh.

- Order Uncertainty and Planning Delays: Fluctuating tariff policies create hesitation among U.S. buyers, affecting long-term contracts and production planning for small businesses. Eg: An MSME manufacturing leather goods may face cancelled or delayed orders due to uncertainty over final landed prices.

- Limited Ability to Absorb Costs: Unlike large firms, MSMEs lack the financial cushion to absorb increased costs from tariffs, logistics, or compliance. Eg: A small pharmaceutical exporter may not afford sudden freight hikes or additional duties, making exports unviable.

How can bilateral and free trade agreements help India navigate global trade disruptions?

- Ensure Preferential Market Access: FTAs allow Indian exporters to access foreign markets with lower or zero tariffs, making their goods more competitiveeven amid global disruptions. Eg: An FTA with the UK can benefit Indian apparel exporters by reducing tariff barriers, boosting exports.

- Diversify Export Destinations: Bilateral trade deals reduce dependency on a single market like the U.S., helping India shift exports to Europe, Australia, or ASEAN during crises. Eg: The India-EU FTA under negotiation could open up multiple markets for Indian electronics and auto components.

- Address Non-Tariff Barriers (NTBs): FTAs help resolve issues like customs delays, quality standards, or licensing hurdles, ensuring smooth trade flowduring uncertain times. Eg: A mutual recognition agreement (MRA) under a BTA with the U.S. could simplify pharmaceutical exports by accepting Indian drug certifications.

What policies can boost India’s economic resilience?

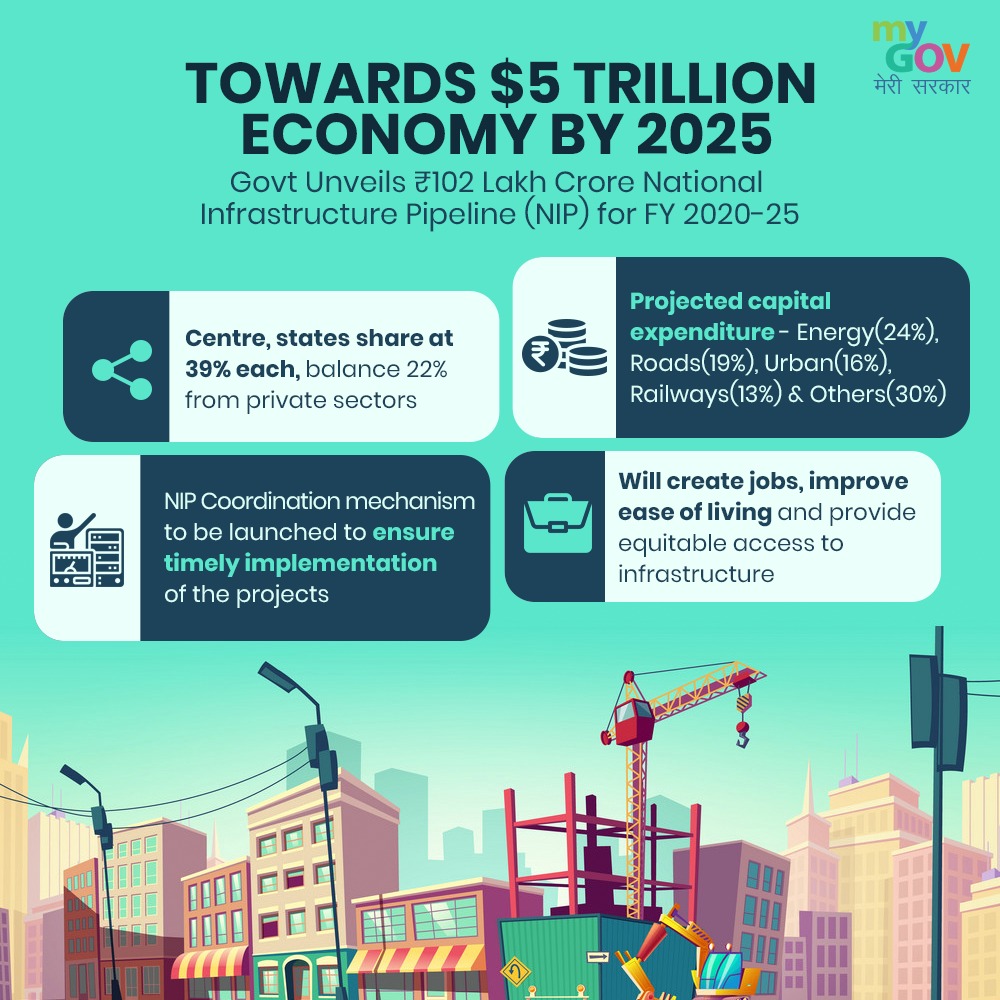

- Strengthening Public Capital Expenditure: Increased government spending on infrastructure boosts domestic demand, generates employment, and crowds in private investment during global slowdowns. Eg: The PM Gati Shakti scheme accelerates infrastructure development, improving logistics and economic stability.

- Expanding Production-Linked Incentive (PLI) Schemes: Enhancing PLI coverage to include more sectors like IoT devices or battery raw materials promotes domestic manufacturing, attracts FDI, and reduces import dependency. Eg: PLI in electronics has boosted mobile phone exports and created supply chain resilience.

- Maintaining Accommodative Monetary Policy: Ensuring low interest rates and easy liquidity through monetary support helps businesses manage costs and stimulate investment during global headwinds. Eg: RBI’s repo rate cuts post-COVID helped MSMEs access cheaper credit, aiding recovery.

Why should India focus on foreign investment and PLI expansion?

- Diversify Global Supply Chains: Global companies are looking to reduce dependency on China and Southeast Asia. India can attract them by offering stable policies and incentives. Eg: Apple has shifted part of its iPhone manufacturing to India due to the PLI scheme and policy support.

- Boost Manufacturing and Employment: Expanding PLI coverage to sectors like wearables, batteries, and semiconductors can enhance local production, reduce imports, and generate jobs. Eg: The PLI for electronics has helped create thousands of direct jobs and increased exports.

- Strengthen Export Competitiveness: Foreign investments bring technology transfer, better quality standards, and improved productivity, which are crucial for export growth. Eg: Investments in the automobile and pharma sectors under PLI have enhanced India’s global competitiveness.

Way forward:

- Accelerate FTA Negotiations and Ensure Tariff Stability: India should fast-track bilateral and multilateral trade agreements (e.g., with the EU, Australia) to ensure stable market access and reduce uncertainty for exporters.

- Expand and Streamline PLI Schemes: Broaden the Production-Linked Incentive (PLI) schemes to include high-potential sectors (e.g., semiconductors, IoT), and simplify procedures to attract more foreign investment and boost domestic manufacturing.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Why govts revise GDP base year and methodology, why the proposed 2026 revision matters for India’s global standing

Why in the News?

India will update the base year for calculating GDP to 2022–23, and the new data is expected by February 2026. This change, confirmed by Saurabh Garg from the Ministry of Statistics, is an important step to improve the accuracy and trust in India’s economic data both in the country and around the world.

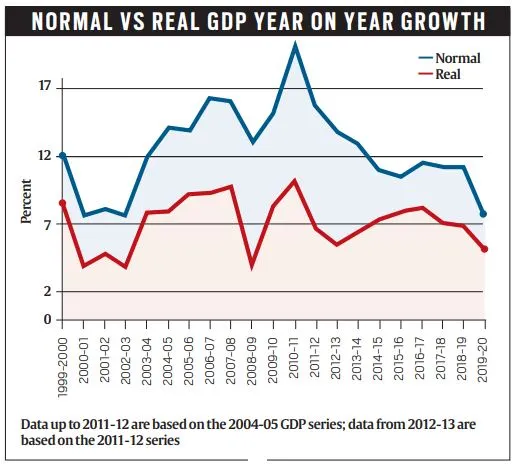

Why is the base year for GDP being revised to 2022-23?

- To Reflect Structural Changes in the Economy: India’s economy has shifted significantly from agriculture to services and digital sectors. Revising the base year captures these structural shifts more accurately. Eg: The rise of digital platforms, fintech, and gig economy post-2015 needs to be incorporated into GDP estimates.

- To Incorporate Improved and Updated Data Sources: New datasets such as the Periodic Labour Force Survey (PLFS) and administrative records like MCA-21 provide more comprehensive and timely data for accurate GDP computation. Eg: PLFS helps capture employment trends better than the older Employment-Unemployment surveys.

- To Ensure Compatibility with International Standards and Better Inflation Adjustment

Regular base year revisions align with UN and IMF guidelines and help in more precise estimation of real GDPby adjusting for price changes. Eg: Without a revision, outdated price structures (like 2011-12) may overstate or understate real growthdue to inflation distortions.

What challenges delayed the previous GDP base year revision in 2017-18?

- Data Quality Concerns in Key Surveys: The government raised concerns about the credibility of the Consumer Expenditure Survey (CES) and Periodic Labour Force Survey (PLFS) conducted in 2017-18. Eg: CES showed a decline in consumer spending, suggesting rising poverty — a politically sensitive finding that was never officially released.

- Economic Disruptions during the Reference Year: Major policy shocks such as demonetisation (2016) and the introduction of Goods and Services Tax (GST) in 2017 led to economic volatility, making 2017-18 an unsuitable “normal” year for baseline calculations. Eg: GDP growth fell from 8.3% in 2016-17 to below 4% by 2019-20, reflecting prolonged economic slowdown post these disruptions.

- Delayed Acceptance and Use of Survey Results: While the PLFS findings were eventually accepted after the 2019 elections, the CES was rejected, causing a gap in key inputs required for GDP revision. Eg: Without reliable consumption and employment data, the GDP estimation would lack accuracy, forcing the government to drop 2017-18 as the base year.

Which other economic indicators are also undergoing base year revisions?

|

How does base year revision affect the credibility of India’s economic data globally?

- Improves Accuracy and International Comparability: A timely base year revision ensures that GDP estimates reflect current economic structures, making India’s data more credible and aligned with international standards (like those of IMF and UN). Eg: Including digital economy or renewable energy sectors helps match the metrics used by other G20 nations.

- Builds Investor Confidence: Transparent and methodologically sound revisions enhance global investor trust, which is crucial for foreign direct investment (FDI) and sovereign credit ratings. Eg: A credible GDP estimate influences decisions by agencies like Moody’s or Fitch, and reassures multinational corporations evaluating India’s market.

- Reduces Skepticism from Global Analysts: Past controversies—like the 2015 revision which some experts claimed overstated growth—have raised doubts on India’s data integrity. A robust 2022-23 revision can restore credibility. Eg: Even former Chief Economic Advisor Arvind Subramanian questioned past data quality; accurate revisions now can counteract such reputational damage.

Way forward:

- Institutionalise Regular Data Revisions: Establish a fixed 5-year cycle for revising base years of GDP and other macroeconomic indicators, in line with National Statistical Commission recommendations, to ensure timeliness, consistency, and credibility.

- Enhance Data Transparency and Accessibility: Improve the quality, frequency, and public availability of key datasets like Consumer Expenditure Survey (CES), PLFS, and Census, to build trust among researchers, investors, and global institutions.

Mains PYQ:

[UPSC 2021] What are the main features of the estimation of India’s Gross Domestic Product(GDP) before the year 2015 and after the year 2015.

Linkage: The changes in GDP estimation around the 2015 revision, which is a prime example of the process of revising the base year and methodology. The “India’s GDP: Revising the Economic Base” source provides extensive details on this very topic, explaining the rationale and significance of such revisions, including the upcoming 2026 revision and its importance for India’s global standing.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Growing pains: On economic performance, Viksit Bharat

Why in the News?

India’s economic data for 2024–25 shows a mixed picture: the economy grew strongly by 7.4% in the last quarter, which was better than expected, but the overall yearly growth dropped to 6.5% — the lowest in four years since the pandemic.

What led to the higher-than-expected GDP growth in Q4 2024-25?

- Robust Growth in Construction and Agriculture Sectors: The construction sector returned to double-digit growth, and agriculture performed strongly, both of which are key employment generators. Eg: Infrastructure expansion and favourable harvests boosted rural incomes and demand.

- Strong Performance of Services Sector: The services sector maintained steady and strong growth, contributing significantly to the GDP rise. Eg: IT, finance, and hospitality services saw sustained recovery post-pandemic.

- Statistical Boost from Higher Net Taxes: A 12.7% increase in net tax collections inflated the GDP figure, even though underlying economic activity was slower. Eg: Higher indirect tax revenues during the quarter pushed headline growth from ~6.8% to 7.4%.

Why is 6.5% annual GDP growth seen as inadequate despite being the highest globally?

- Below the Required Rate for ‘Viksit Bharat 2047’ Vision: To achieve the developed nation goal by 2047, India needs sustained annual growth of around 8% or more. Eg: The Economic Survey states that consistent 8% growth is essential to meet infrastructure, employment, and welfare needs by 2047.

- Mismatch with India’s Domestic Demands and Aspirations: India’s population growth and development needs demand faster economic expansion, regardless of how the rest of the world is performing. Eg: Even though India outpaces global peers, a 6.5% rate may not create enough jobs or uplift per capita incomes sufficiently.

- Limited Acceleration Potential Under Stable Growth Phase: While 6.5% reflects stability, it also signals a plateau, with low inflation but no signs of rapid acceleration in the near future. Eg: Chief Economic Adviser V. Anantha Nageswaran indicated India may not see major growth spurts soon, making it harder to catch up with long-term development targets.

How do net taxes affect the true picture of GDP growth?

- Artificial Boost to Headline GDP: A significant rise in net taxes (taxes minus subsidies) can inflate GDP figures without a corresponding increase in real economic activity. Eg: In Q4 2024–25, GDP growth was 7.4%, but without the 12.7% surge in net taxes, real growth would have been around 6.8%.

- Distorts Sector-Wise Contribution Assessment: High net tax contributions may overshadow sluggish performance in core sectors like manufacturing or consumption, giving a misleading impression of overall health. Eg: Despite weak private consumption, GDP looked robust due to the statistical impact of increased tax revenue.

Is stable growth enough for India’s transition?

- Stability Reduces Risk but Limits Acceleration: While stable growth ensures low inflation and reduced economic volatility, it may not generate the momentum needed to transform India into a developed economy. Eg: As per the Chief Economic Adviser, India has entered a phase of low inflation and stable growth, but such stability might cap faster economic acceleration.

- Inadequate for Meeting Rising Aspirations: India’s growing population and developmental needs require higher employment, infrastructure, and productivity, which stable but slow growth may not adequately support. Eg: A 6.5% GDP growth may not create enough jobs or income levels to match the goals of schemes like ‘Viksit Bharat 2047’.

- Missed Opportunity in a Global Slowdown: In a “growth-scarce” global environment, India has the chance to become a key economic engine. Relying on stable growth without pushing for higher gains may lead to missed strategic opportunities. Eg: Despite outperforming other major economies, India’s slow capital investment pace until late FY25 indicates underutilization of its potential.

Way forward:

- Accelerate Structural Reforms and Investments: India must boost productivity by investing in infrastructure, manufacturing, skilling, and digitalisation, while simplifying regulations to attract both domestic and foreign investment. Eg: Fast-tracking initiatives like Gati Shakti and PLI schemes can unlock higher economic momentum.

- Enhance Domestic Demand and Job Creation: Policies should focus on reviving rural consumption, supporting MSMEs, and expanding labour-intensive sectors to ensure inclusive growth. Eg: Increasing public expenditure on health, education, and affordable housing can stimulate demand and generate employment.

Mains PYQ:

[UPSC 2024] Examine the pattern and trend of public expenditure on social services in the post-reforms period in India. To what extent this has been in consonance with achieving the objective of inclusive growth?

Linkage: Inclusive growth is a core objective for a “transitioning economy” like India aiming for goals such as ‘Viksit Bharat’, and challenges in achieving it represent “growing pains”.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Govt. releases Provisional GDP Estimates

Why in the News?

The Ministry of Statistics and Programme Implementation (MoSPI) released two important data sets on May 30, 2025 — one for India’s GDP growth in Q4 (January–March) FY25, and another for the provisional estimates for the entire FY25 (2024–25).

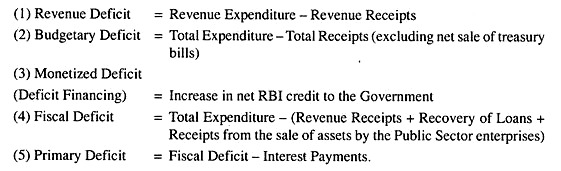

How is Economic Growth measured?

- Gross Domestic Product (GDP) measures economic growth by adding all expenditures in the economy — including private, government, and business spending. It shows demand-side performance.

- Gross Value Added (GVA) measures the supply-side. It calculates how much value is added by each sector of the economy.

- GDP and GVA are related:

GDP = GVA + (Taxes) – (Subsidies) - MoSPI reports both in:

- Nominal terms: Includes current prices.

- Real terms: Adjusted for inflation to reflect true growth.

Why are these Estimates called “Provisional”?

|

Key Takeaways from FY25 Data

- India’s Economy Size:

-

- India’s economy is now worth ₹330.7 lakh crore or $3.87 trillion.

- GDP grew by 9.8%, which is slower than in previous years.

- Real GDP Growth:

-

- After removing inflation, real GDP grew by 6.5%.

- This is slower than the 9.2% growth seen last year (as mentioned in the Provisional Estimates). (Disputed: India’s real GDP growth rate was 8.2% in FY 2023-24 as per Economic Survey.)

- Sector Performance:

-

- Agriculture grew well at 4.6%.

- Manufacturing grew only 4.5%, which is a concern.

- Construction was strong with 9.4% growth.

- Services grew by 7.2%.

- Manufacturing Worry:

-

- Manufacturing is growing slower than agriculture.

- This is affecting urban jobs, especially for youth.

- Best Growth in Jan–Mar 2025 (Q4):

-

- GDP growth was 7.4% in Q4 — the highest for the year.

- Construction grew fastest at 10.8%.

- Agriculture and Services also did well.

- Spending Trends:

-

- People spent more — household spending rose 7.2%.

- Investment in assets grew 7.1%, slower than last year.

| [UPSC 2015] With reference to Indian economy, consider the following statements:

(1) The rate of growth of Real Gross Domestic product has steadily increased in the last decade. (2) The Gross Domestic product at market prices (in rupees) has steadily increased in the last decade. Which of the statements given above is/are correct? Options: (a) 1 only (b) 2 only* (c) Both 1 and 2 (d) Neither 1 nor 2 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Why India is the 3rd-largest Economy, NOT 4th or 5th?

Why in the News?

Recently, the CEO of NITI Aayog announced that India has moved ahead of Japan to become the world’s fourth-largest economy.

What is the key difference between nominal GDP and PPP-based GDP?

- Nominal GDP: Measured using current market exchange rates in US dollars. Eg: If India’s GDP is ₹270 lakh crore and $1 = ₹75, then nominal GDP = ₹270 lakh crore ÷ 75 = $3.6 trillion.

- PPP-Based GDP: Adjusted for differences in the cost of living and price levels between countries. Eg: If goods and services are cheaper in India, PPP adjusts the GDP upward to reflect greater actual consumption — India’s GDP could be $12 trillion in PPP terms, even though nominal GDP is lower.

When did India become the third-largest economy by PPP estimates?In 2009, India overtook Japan in PPP-based GDP. This milestone occurred during the tenure of the Manmohan Singh-led UPA government. India has retained the 3rd position ever since, behind only China and the United States. The PPP-based ranking reflects India’s large population and lower cost of living, which boosts its effective domestic consumption. |

How do exchange rates affect nominal GDP rankings?

- Conversion Dependency: Nominal GDP is calculated in US dollars, so a country’s GDP in local currency must be converted using the exchange rate. Eg: If India’s GDP is ₹300 lakh crore and $1 = ₹75, its dollar GDP would be $4 trillion; but if $1 = ₹85, the same GDP becomes $3.5 trillion.

- Exchange Rate Fluctuations Can Distort Rankings: A country’s global GDP rank can change without any real economic growth or decline, simply due to currency appreciation or depreciation. Eg: If the Japanese yen strengthens against the dollar, Japan’s nominal GDP in dollars rises—even if its actual output hasn’t changed.

- Unfair Comparison Across Countries: Countries with volatile or weakening currencies may appear smaller in nominal terms than they are in real domestic terms. Eg: India’s GDP may seem lower than the UK’s in nominal terms due to a weaker rupee, even if India produces more goods and services overall.

Why is per capita GDP more reflective of individual prosperity?

- Accounts for Population Size: Per capita GDP divides total GDP by the population, showing the average income per person, unlike aggregate GDP which may hide disparities. Eg: India’s GDP is higher than the UK’s in total, but because India has over 20 times the population, its per capita GDP is much lower.

- Better Indicator of Living Standards: It reflects the average economic well-being and purchasing power of citizens, making it more relevant for assessing prosperity. Eg: A country with $50,000 per capita GDP (like the UK) offers far better public services, infrastructure, and living conditions than one with $2,800 (like India), even if total GDPs are comparable.

- Highlights Income Distribution and Development Needs: Low per capita GDP suggests widespread poverty or unequal wealth distribution, even if overall GDP is growing. Eg: Despite being the world’s 5th largest economy, India’s low per capita GDP shows most individuals have limited incomes and access to economic benefits.

What does India’s per capita GDP reveal compared to the UK’s?

| Aspect | India | UK | Example |

| Per Capita GDP (2025) | 10,020 PPP dollars | 58,140 PPP dollars | UK’s per capita income is ~6 times higher than India’s. |

| Living Standards & Services | Lower access to quality services | Higher standard of living, social welfare | Indians have limited access to healthcare, education, and housing |

| Economic Inequality & Prosperity | Aggregate GDP is growing, but benefits are not evenly distributed | Prosperity is more widely shared | Despite India’s growth, individual prosperity remains low on average. |

Way forward:

- Invest in Human Capital and Social Infrastructure: India must enhance spending on education, healthcare, and skill development to improve productivity and raise per capita incomes. Improved human capital directly boosts innovation, employability, and long-term economic growth.

- Focus on Inclusive and Equitable Growth: Policies should ensure that economic gains are widely distributed, especially through rural development, MSME support, and targeted welfare schemes. This will reduce income disparities and lift more people into the formal, productive economy, improving per capita prosperity.

Mains PYQ:

[UPSC 2022] Is inclusive growth possible under market economy? State the significance of financial inclusion in achieving economic growth in India.

Linkage: India’s high aggregate economic rank alongside low per capita income, raises questions about how India’s economic growth model is translating into shared prosperity, a central theme of inclusive growth. This question explicitly asks about the possibility and mechanisms (like financial inclusion) of achieving “inclusive growth” within a market economy.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Under control: On the latest inflation data

Why in the News?

Retail inflation dropped to 3.16% in April, marking its lowest level in nearly six years. This shows that prices are rising more slowly, bringing relief to consumers and policymakers.

What caused the recent fall in retail and wholesale inflation in April?

- Sharp Drop in Vegetable Prices: Retail inflation was driven down by a nearly 11% drop in vegetable prices. Eg: Wholesale potato prices fell by 24.3% compared to April last year.

- Falling Crude Oil and Fuel Prices: Crude oil and natural gas inflation hit a 22-month low of -15.55%. Eg: Petrol prices contracted by 7.7%, and diesel by 5.04% at the wholesale level.

- Government Measures to Control Prices: Actions like open market foodgrain releases, buffer stock management, and eased imports helped stabilize supply. Eg: These steps helped prevent food shortages and kept overall food inflation at 2.55%, a 22-month low.

Why is the contraction in vegetable prices considered partly due to the base effect?

- High Inflation Last Year (Base Effect): In April last year, vegetable inflation was very high, in the range of 27%-30%. Eg: A sharp rise last year creates a high base, making even stable or slightly falling prices this year appear like a large drop.

- Statistical Comparison Distortion: Inflation is measured year-on-year, so a high base can exaggerate the percentage fall in the current period.Eg: If tomato prices were ₹100 last year and are ₹90 now, it shows a 10% fall—but last year’s ₹100 was unusually high.

- Not Solely Due to Supply Improvement: The large fall in prices this year is not only because of better supply or government action but also due to last year’s spike. Eg: Last year’s shortages due to unseasonal rains had led to higher prices, inflating the base.

How have government actions helped in easing inflation?

- Strengthening Buffer Stocks: The government has maintained adequate buffer stocks of food items like rice, wheat, and pulses to manage supply shocks. Eg: Releasing pulses from buffer stocks during price spikes helped stabilise market supply and reduce inflationary pressure.

- Open Market Sales to Regulate Prices: Through open market operations, the government released surplus food items into the market to control prices. Eg: Open sale of onions and tomatoes by agencies like NAFED helped bring down retail prices during seasonal spikes.

- Relaxation of Import Restrictions: The government eased import norms and reduced import duties on key commodities during shortages. Eg: Reduction in import duties on edible oils and pulses led to higher supply and reduced food inflation.

What policy actions are expected from the RBI and the government based on the latest inflation data? (Way forward)

- Likely Cut in Interest Rates by RBI: With inflation easing, especially retail inflation falling for six consecutive months, the RBI’s Monetary Policy Committee (MPC) may cut policy rates to support growth. Eg: The RBI might reduce the repo rate in the upcoming June review to boost borrowing and investment.

- Reduction in Fuel Prices by Oil Marketing Companies: With crude oil inflation hitting a 22-month low, the government is expected to direct public sector oil companies to cut petrol, diesel, and LPG prices. Eg: Despite a 42% fall in global crude prices over three years, retail fuel prices remained almost unchanged; a correction is now anticipated.

Mains PYQ:

[UPSC 2024] What are the causes of persistent high food inflation in India? Comment on the effectiveness of the monetary policy of the RBI to control this type of inflation.

Linkage: “India’s Easing Inflation and Policy Implications” discusses the latest inflation data, noting the easing of both retail and wholesale inflation, largely driven by a contraction in vegetable and pulse prices.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

India’s retail inflation slips to over 5-year low, opens door to more rate cuts

Why in the News?

The decline in food prices is seen as a major reason for the drop in inflation. After two rate cuts by the RBI, inflation is expected to stay below 4% in the coming months, which might lead to another rate cut of 50 basis points.

What was India’s retail inflation rate in March?

|

Why have food prices been a major factor in the decline of retail inflation?

- Sharp Decline in Vegetable Prices: Vegetable prices saw a significant drop of 7.04% year-on-year in March 2025, compared to a small increase of 1.07% in February. This sharp fall in vegetable prices helped lower overall food inflation.

- Lower Pulses Prices: Pulses prices fell by 2.73% in March, after a smaller 0.35% decrease in February, contributing to reduced food inflation.

- Moderation in Overall Food Inflation: Food inflation in March 2025 decreased to 2.69% from 3.75% in February. This marked the lowest food inflation since November 2021, indicating a significant reduction in food price pressures.

- Improved Farm Output: The moderation in food prices is partly due to better farm output, which led to a more stable supply of food items, especially vegetables and pulses, easing inflationary pressures.

- Government and Central Bank Support: The government’s expectations for above-average monsoon rains in 2025 are likely to boost farm output further, maintaining lower food prices, which will continue to moderate overall inflation.

How did the Reserve Bank of India respond to the easing inflation trend?

- Second Consecutive Rate Cut: On April 9, 2025, the RBI reduced the key policy repo rate by 25 basis points to 6.00%, marking its second consecutive rate cut aimed at stimulating economic growth amid moderating inflation.

- Shift to Accommodative Stance: The RBI changed its monetary policy stance from “neutral” to “accommodative,” signaling a more supportive approach to economic growth while maintaining vigilance over inflation.

- Revised Inflation Forecast: The central bank projected the Consumer Price Index (CPI) inflation to average 4% for the fiscal year 2025–26, down from the previous forecast of 4.2%, reflecting improved inflation dynamics.

- Lowered GDP Growth Estimate: The RBI revised its GDP growth forecast for the fiscal year to 6.5%, down from 6.7%, acknowledging the challenges posed by global uncertainties and trade tensions.

What risks did the RBI highlight that could impact the inflation outlook?

- Global Market Uncertainties: The RBI noted that ongoing global uncertainties, such as trade tensions (like the U.S.-China trade war), could disrupt supply chains and impact inflationary pressures in India. Eg, any further escalation in global trade disputes could lead to higher import costs.

- Adverse Weather Conditions: The RBI pointed out that unpredictable weather events, such as unseasonal rains or droughts, could lead to food supply disruptions and push up food prices, affecting overall inflation. Eg, a poor monsoon could lead to shortages in key agricultural products.

- Rising Global Commodity Prices: The central bank warned that fluctuations in global commodity prices, including oil and metals, could lead to higher domestic prices, contributing to inflation. Eg, a rise in global crude oil prices could increase transportation and fuel costs in India.

- Supply Chain Disruptions: The RBI highlighted the risk of supply-side bottlenecks, especially due to external factors like geopolitical conflicts or supply chain disruptions caused by the COVID-19 pandemic. These could raise prices for imported goods and affect domestic inflation. Eg, disruptions in global electronics supply chains could lead to higher prices for tech products.

- Core Inflation Pressures: The RBI also noted that core inflation, which excludes volatile items like food and fuel, remained persistently high at 4.1%, signaling that inflationary pressures could be more entrenched in the economy, which poses a risk to the inflation outlook. Eg, rising demand for services could contribute to sustained core inflation.

Way forward:

- Strengthen Supply Chain Resilience: The government and RBI should work together to improve supply chain infrastructure and reduce vulnerabilities to global disruptions. This includes addressing logistical bottlenecks, improving domestic production capabilities, and diversifying import sources to mitigate the impact of geopolitical tensions and climate events.

- Focus on Sustainable Agricultural Practices: To ensure stable food prices, long-term investments in sustainable farming techniques, irrigation systems, and better farm management practices are crucial. This will not only help stabilize food prices but also contribute to higher farm output and lower volatility in food inflation.

Mains PYQ:

[UPSC 2024] What are the causes of persistent high food inflation in India? Comment on the effectiveness of the monetary policy of the RBI to control this type of inflation.

Linkage: Food inflation and the RBI’s role in controlling it, which is a key aspect of the scenario described in the article.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Growth in most Southern States is concentrated in a few districts

Why in the News?

Economic growth in southern states lagged behind India’s overall growth in 2023-24. Despite a large working population, unemployment rates in these states remain a major concern, as seen in their Budget and Economic Surveys.

What are the key reasons behind the economic growth of southern states lagging behind India’s overall growth in 2023-24?

- Lower Growth Rates Compared to National Average – While India’s economy grew at 9.2%, southern states like Tamil Nadu (8.2%) and Telangana (7.4%) recorded slower growth, with Karnataka, Kerala, and Andhra Pradesh growing at over 6%.

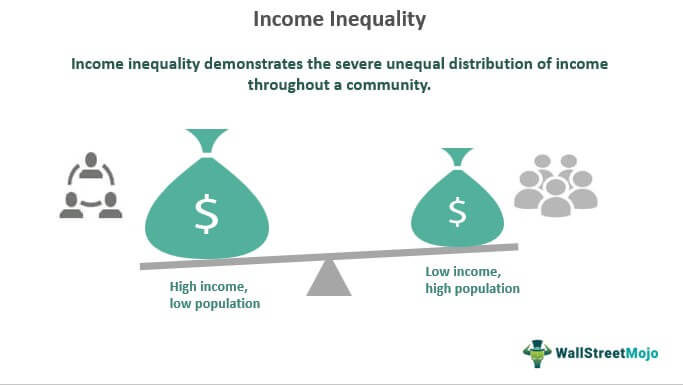

- Regional Income Disparities – Economic advantages are concentrated in select districts, limiting broad-based growth. For example, only 8 of 38 districts in Tamil Nadu and 3 of 33 in Telangana had higher per capita income than their state averages.

- Unemployment and Labour Force Challenges – Despite a significant working population, labour force participation rates (LFPR) in Tamil Nadu (58.8%), Karnataka (56.8%), and Kerala (56.2%) were below the national average of 60.1%, affecting economic output.

- Shift Towards Self-Employment – There is a decline in casual labour and an increase in self-employment, often in household enterprises, leading to a lack of stable wage employment. Example: In Telangana, self-employment rose by 8% to 55.9%, while casual labour fell by 5.7% to 18.7%.

- Slower Industrial and Manufacturing Growth – Despite industrial pushes, manufacturing contributes less than 20% of southern states’ economies, limiting their overall economic expansion.

Which southern state has the most equitable distribution of per capita income across its districts?

- More Even Income Spread: Kerala has 7 out of 14 districts with a per capita income above the state average, making it the most balanced among southern states. In contrast, Tamil Nadu (8 out of 38), Telangana (3 out of 33), and Karnataka (4 out of 31) show higher income concentration in a few districts.

- Unlike Telangana, where Rangareddy district’s per capita income is more than three times the state average, Kerala’s income distribution is less skewed, ensuring better regional development and social welfare across the state.

Why is this significant?

- Reduced Regional Disparities: A more balanced income distribution ensures that economic benefits are spread across districts, preventing excessive wealth concentration in urban centers. Example: Unlike Telangana, where Rangareddy dominates income levels, Kerala’s development is more uniform, reducing economic inequalities.

- Better Social and Human Development Indicators: Equitable income distribution translates into better education, healthcare, and infrastructure across all districts, improving overall quality of life. Example: Kerala consistently ranks high in Human Development Index (HDI) due to its statewide access to education and healthcare.

- Sustainable and Inclusive Growth: A well-distributed economy supports long-term stability by ensuring that no district lags significantly behind, leading to lower migration pressures and balanced urbanization. Example: Unlike Tamil Nadu, where Chengalpattu’s income is double the state average, Kerala’s economy avoids overburdening specific urban hubs, leading to sustainable development.

Why is unemployment still a pressing concern in southern states?

- Higher Labour Force Participation but Fewer Job Opportunities – While more people are seeking work, the availability of stable, well-paying jobs remains limited. Example: In 2023-24, Tamil Nadu (58.8%), Karnataka (56.8%), and Kerala (56.2%) had labour force participation rates lower than the national average (60.1%), indicating fewer employment opportunities relative to job seekers.

- Shift from Casual Labour to Self-Employment Without Formal Jobs Growth – More people are moving away from casual labour towards self-employment, but the growth of regular salaried jobs remains stagnant. Example: In Telangana, the self-employed workforce increased by 8% (to 55.9%), while casual labour declined by 5.7%, reflecting a lack of structured employment.

- Dominance of the Services Sector with Limited Manufacturing Growth – The services sector contributes over 50% of economic output, but it often lacks the capacity to absorb large numbers of workers, especially in lower-income groups. Example: In Tamil Nadu, despite an industrial push, manufacturing has not significantly increased its share in the state economy, limiting job creation in this sector.

What role does the services sector play in the economies of southern states?

- Primary Driver of Economic Growth – The services sector contributes over 50% of economic output in most southern states, making it the main engine of economic expansion. Example: In Karnataka and Telangana, the IT and software services industry significantly boosts state GDP, with Bengaluru and Hyderabad being major global tech hubs.

- Uneven Job Creation Across Skill Levels – While the services sector creates high-value jobs in IT, finance, and healthcare, it does not generate enough employment for lower-skilled workers, contributing to persisting unemployment. Example: Kerala, despite its strong service-driven economy (tourism, healthcare, remittances), struggles with high unemployment rates due to a lack of blue-collar service jobs.

Way forward:

- Diversify Economic Growth Beyond Services – Strengthen manufacturing and industrial sectors to create stable, large-scale employment opportunities, especially for lower-skilled workers. Example: Expanding MSMEs and industrial corridors in Tamil Nadu and Karnataka can boost job creation.

- Enhance Skill Development and Labour Market Reforms – Improve vocational training and upskilling programs to align with industry demands, ensuring better job-market absorption. Example: Kerala can integrate its educated workforce into high-value sectors like healthcare and renewable energy.

Mains PYQ:

Question: What is regional disparity? How does it differ from diversity? How serious is the issue of regional disparity in India? (UPSC 2024)

Reason: This question’s demand is directly linked with the regional inequality, which explains why economic growth is concentrated in certain parts of a state. Understanding this helps us see why some districts develop faster than others.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

What the recent GDP data revisions reveal

From UPSC perspective, the following things are important :

Mains level: GDP Growth;

Why in the News?

The rise in real and nominal growth rates is expected to impact future economic growth plans and long-term strategies.

Recently, the National Statistical Office (NSO) has provided two types of data.

|

Why have the real and nominal growth rates been revised upwards?

- Improved Sectoral Performance: Significant upward revisions in key sectors like manufacturing (by 2.4 percentage points) and financial, real estate, and related services (by 1.9 percentage points) contributed to higher GDP estimates.

- Higher Investment Contributions: Increased gross capital formation (GCF) in 2023-24 (10.5% growth) led to stronger economic activity, positively impacting overall GDP figures. Example: Real investment rate (Gross Fixed Capital Formation to GDP ratio) reached 33.4% in 2024-25.

- Stronger Consumption Demand: A rebound in Private Final Consumption Expenditure (PFCE) contributed to the upward revision, especially in sectors like trade and hospitality. Example: PFCE contribution to GDP increased to 5.3 percentage points in Q4, reflecting stronger consumer spending.

Which sectors experienced the maximum upward revision in growth?

- Manufacturing Sector: Revised upward by 2.4 percentage points, reflecting improved industrial production and better capacity utilization. Example: Manufacturing growth increased from 2.1% in Q2 to 3.5% in Q3 of 2024-25, indicating a gradual recovery.

- Financial, Real Estate, and Related Services: Revised upward by 1.9 percentage points, driven by increased financial activities and a stronger real estate market. Example: The growth in these services contributed significantly to the overall 9.2% GDP growth in 2023-24, up from the previous estimate of 8.2%.

What are the key challenges in achieving the implied fourth-quarter GDP growth of 7.6% for 2024-25?

- Weak Private Final Consumption Expenditure (PFCE) Growth: The required PFCE growth for achieving 7.6% GDP growth is 9.9%, which is historically high and challenging to sustain. Example: PFCE contribution fell from 4.3 percentage points in Q1 to 3.3 percentage points in Q2, leading to slower GDP growth of 5.6%.

- Insufficient Government Capital Expenditure: The government needs to spend ₹2.61 lakh crore in the last two months to meet the revised target of ₹10.18 lakh crore, which is significantly higher than the recent trend. Example: Average government capital expenditure during February-March (2021-24) was ₹1.81 lakh crore, making the target difficult to achieve.

- Slow Recovery in Manufacturing Sector: Despite some improvement, manufacturing growth remains sluggish at 3.5% in Q3, limiting its contribution to overall GDP. Example: Manufacturing growth in Q2 was only 2.1%, indicating continued structural weaknesses and reduced industrial output.

- Decline in Investment Contribution: The contribution of investment to GDP growth fell from 2.3 percentage points in Q1 to 1.8 percentage points in Q3, reducing overall economic momentum. Example: Gross capital formation growth dropped from 10.5% in 2023-24 to 5.8% in 2024-25, reflecting lower private sector investments.

- Global Economic Uncertainty: External factors like geopolitical tensions and fluctuating global demand can negatively impact exports and foreign investments. Example: Persistent global uncertainties in energy markets and supply chains may hinder India’s export-led growth in Q4.

What are the present policies of the Government in this regard?

|

Way forward:

- Enhance Private Sector Participation: Implement targeted incentives and streamline regulatory processes to boost private investments in critical sectors like manufacturing and infrastructure. Example: Expanding the Production-Linked Incentive (PLI) scheme to emerging industries can drive long-term growth.

- Strengthen Consumption and Export Demand: Promote domestic consumption through targeted tax relief and social welfare programs while enhancing export competitiveness by supporting value-added manufacturing and reducing trade barriers. Example: Implementing sector-specific export promotion schemes can mitigate global uncertainties.

Mains PYQ:

Q Investment in infrastructure is essential for more rapid and inclusive economic growth.”Discuss in the light of India’s experience. (2021)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Income levels of salaried class have stagnated in recent years

From UPSC perspective, the following things are important :

Mains level: Issues related to employment;

Why in the News?

According to PLFS reports, employment in India is increasing, but the real wages of salaried workers have remained unchanged since 2019.

What are the key reasons behind the stagnation of real wages for salaried workers in India since 2019?

- Inflation Outpacing Wage Growth: Rising consumer prices (CPI) have eroded the purchasing power of salaries despite nominal wage increases. For example, Real wages for salaried workers in India were 1.7% lower in the June 2024 quarter compared to the June 2019 quarter (PLFS data).

- Excess Labour Supply and Declining Returns to Education: An oversupply of qualified workers has reduced the premium for higher education, limiting salary growth. For example, the share of self-employed workers increased from 53.5% in 2019-20 to 58.4% in 2023-24, indicating a shift from salaried roles due to a lack of opportunities.

- Depressed Private Sector Investment: Reduced corporate investment leads to slower job creation and wage stagnation. For example, India’s private sector investment-to-GDP ratio declined from 28% in 2011-12 to 21.1% in 2022-23 (Reserve Bank of India).

- Policy Shocks (Demonetisation and GST Impact): Economic disruptions from demonetisation (2016) and GST (2017) weakened small and medium enterprises (SMEs), affecting formal employment. For example, Formal employment fell, and salaried employment as a share of total workers dropped from 22.9% in 2019-20 to 21.7% in 2023-24 (PLFS data).

- Shift Toward Informal and Contractual Work: Companies increasingly rely on temporary and gig workers, offering lower pay and fewer benefits. For example, Casual labour wages increased by 12.3% (real terms) between 2019 and 2024, while salaried wages stagnated, reflecting a rise in informal work.

Why is the increase in wages for casual labour not considered a net positive for the economy?

- Lower Productivity Contribution: Casual labour typically involves low-skilled, irregular work with limited productivity gains. While wages may rise, the overall economic output does not grow proportionately.

- For example, the agriculture sector, which employs a large share of casual labour, contributed only 16% to India’s GDP in 2023-24 despite employing over 45% of the workforce (Economic Survey 2023-24).

- Informal Nature of Work: Casual jobs lack social security, health benefits, and job stability, leading to long-term economic insecurity despite wage increases.

- In India, 93% of the workforce remains in the informal sector with minimal social protection, contributing to economic vulnerability (ILO report, 2023).

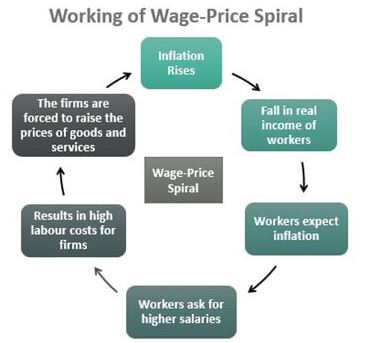

- Wage-Price Spiral Risk: Rising wages in low-skilled sectors can increase the cost of goods and services, driving inflation without improving living standards.

- For instance, wage increases for casual farm labour contribute to higher food prices, intensifying retail inflation (CPI rose by 7.44% in July 2024, RBI).

- Limited Skill Development and Upward Mobility: Casual work offers fewer opportunities for training or career advancement, trapping workers in low-wage cycles despite nominal wage growth.

- The Periodic Labour Force Survey (2023-24) shows that only 2.4% of India’s workforce received formal vocational training, limiting skill-based upward mobility.

- Depressed Consumption and Savings Rates: Casual labourers typically earn subsistence-level wages, leaving little room for savings or significant consumption, which hampers long-term economic growth.

- Household savings as a share of GDP declined from 23.6% in 2011-12 to 18.1% in 2022-23, reflecting weak wage-driven consumption (RBI report).

When did real wages for self-employed workers begin to recover after the pandemic?Real wages for self-employed workers in India began to recover after the pandemic in the quarters. Despite this recovery, as of the June 2024 quarter, real wages remained 1.5% lower than in the June 2019 quarter.

|

How have policy decisions like demonetization and the implementation of GST affected wage growth and employment patterns?

- Disruption of Informal and Small-Scale Enterprises: Both demonetisation and GST disrupted cash-dependent small and medium enterprises (SMEs), leading to job losses and reduced wage growth in the informal sector. Example: The share of salaried workers declined from 22.9% in 2019-20 to 21.7% in 2023-24 (PLFS data), indicating a shift away from formal employment.

- Shift Toward Informal and Gig Work: Policy shocks accelerated the transition from stable salaried jobs to informal, gig-based, and self-employed work, which generally offers lower pay and fewer benefits. Example: The share of self-employed workers increased from 53.5% in 2019-20 to 58.4% in 2023-24, reflecting a rise in informal employment (PLFS data).

- Slower Wage Growth and Employment Stagnation: Compliance burdens from GST and cash shortages from demonetisation constrained business operations, leading to slower wage increases across sectors. Example: Real wages for salaried workers were 1.7% lower in June 2024 compared to June 2019 (PLFS data), indicating stagnant wage growth despite economic recovery.

Way forward:

- Enhance Formal Employment and Skill Development: Promote labour-intensive sectors and incentivize formal job creation through targeted tax benefits and reduced compliance burdens.

- Strengthen Social Security and Wage Policies: Implement comprehensive social protection schemes for informal workers to ensure income stability and healthcare benefits.

Mains PYQ:

Q Besides the welfare schemes, India needs deft management of inflation and unemployment to serve the poor and the underprivileged sections of the society. Discuss. (UPSC IAS/2022)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

[21st February 2025] The Hindu Op-ed: Is consumption enough to drive growth?

PYQ Relevance:Q) Explain the difference between the computing methodology of India’s Gross Domestic Product (GDP) before the year 2015 and after the year 2015. (UPSC CSE 2021) |

Mentor’s Comment: UPSC mains have always focused on India’s Gross Domestic Product (2021), and India from realizing its potential GDP (2020).

An economy grows through two key factors: supply (production of goods and services) and demand (spending on these goods and services). Among demand sources, investment is crucial as it creates a multiplier effect, boosting jobs and income. Consumption follows growth but cannot drive it alone, as sustainable expansion requires strong investment and production.

Today’s editorial talks about India’s GDP growth factors based on demand and supply. This content would help in GS Paper 3 mains Paper.

_

Let’s learn!

Why in the News?

An economy’s growth is like navigating two interconnected boats—one representing the supply or production of goods and services.

Is consumption enough to drive growth?Consumption plays a crucial role in driving economic growth, but it is not sufficient on its own for sustainable long-term growth.

|

Why is economic growth dependent on two factors?

- Balanced Growth Requires Both Supply & Demand: Economic growth happens when goods and services are produced (supply) and purchased (demand) in a balanced manner.

- Example: A country increasing factory production (supply) must also have enough consumers to buy the products (demand), ensuring sustainable growth.

- Mismatch Leads to Economic Problems

-

- If demand > supply, inflation rises due to excessive spending with limited goods.

- If supply > demand, businesses suffer from unsold stock, leading to job losses.

- Example: Post-pandemic, supply chain disruptions led to high demand but low supply, causing inflation.

- Investment Drives Long-Term Growth: Investment in infrastructure, industries, and technology increases production capacity (supply) while also creating jobs, which boosts spending power (demand).

- Example: China’s high investment in infrastructure and manufacturing led to rapid economic growth by expanding both supply and demand.

- Government Policies Impact Both Sides: Fiscal and monetary policies help balance supply-side growth (e.g., industrial incentives) and demand-side expansion (e.g., tax cuts or subsidies).

- Example: India’s Production-Linked Incentive (PLI) scheme boosts manufacturing (supply), while government social schemes increase purchasing power (demand).

- Exports and Imports Affect Domestic Growth: A strong export sector increases supply, bringing foreign exchange, while controlled imports ensure domestic industries remain competitive.

- Example: India’s IT exports generate revenue (supply), while consumer imports like electronics influence domestic demand.

What role does investment play in economic growth?

- Boosts Production Capacity: Investment in factories, infrastructure, and technology increases the ability to produce goods and services, leading to higher GDP. Example: China’s heavy investment in manufacturing and infrastructure helped it become the world’s largest exporter.

- Creates Employment Opportunities: New industries and infrastructure projects generate jobs, increasing income and overall demand in the economy. Example: India’s road and metro projects have created millions of direct and indirect jobs, boosting economic activity.

- Multiplier Effect on Demand & GDP: Investment leads to increased income, which in turn increases consumption and demand, further driving growth. Example: A ₹100 investment in building highways can create ₹125 in overall economic output due to increased business activities along the route.

- Encourages Private Sector Confidence: When the government invests in key sectors, it builds confidence among private businesses to invest further. Example: India’s Production-Linked Incentive (PLI) scheme for electronics manufacturing has attracted global tech firms to set up production units.

- Leads to Technological and Industrial Development: Investments in research, innovation, and new industries enhance productivity and global competitiveness. Example: South Korea’s investment in R&D and technology made it a leader in electronics and automobile industries.

How have India and China experienced changes in per capita income?

- Similar Per Capita Incomes in the Early 1990s: In the early 1990s, India and China had nearly equal per capita incomes, with both countries being 1.5% of the U.S. average. Example: In 1992, both nations were considered low-income economies with similar economic structures.

- China’s Investment-Led Growth Model: China prioritized high investment rates, focusing on infrastructure, state-owned enterprises, and manufacturing. Example: In 1992, China’s investment rate was 39.1% of GDP, much higher than India’s 27.4%.

- Diverging Growth Post-2000s: India’s investment rate rose to 35.8% in 2007, almost matching China’s, but declined after 2012 due to policy uncertainty and global economic slowdown.Example: By 2013, China’s investment rate increased to 44.5%, while India’s fell to 31.3%.

- China’s Faster Rise in Per Capita Income: By 2023, China’s per capita income was 5 times India’s in nominal terms and 2.4 times higher in purchasing power parity (PPP). Example: As a percentage of U.S. per capita income in 2023: China: 15%, India: 3%.

- India’s Consumption-Driven Growth Model: India’s economic growth has been mainly driven by domestic consumption, while China maintained higher investment levels. Example: In 2023, consumption was 60.3% of India’s GDP, compared to 39.1% in China.

- Long-Term Impact on Growth and Inequality: India’s lower investment and trade deficits have led to slower per capita income growth, affecting job creation and economic equality. Example: China’s investment rate in 2023 was 41.3%, whereas India’s was only 30.8%, limiting economic expansion.

What measures has the Indian government taken to promote investment in India?

|

Way forward:

- Enhancing Investment-Led Growth: India should focus on increasing capital formation by boosting infrastructure, industrial productivity, and R&D investments. Strengthening public-private partnerships (PPPs) and expanding the PLI scheme to emerging sectors can accelerate long-term economic growth.

- Balancing Consumption and Supply-Side Expansion: While consumption remains a key driver, policies should encourage domestic manufacturing and export competitiveness to reduce reliance on imports. Strengthening skill development and labour market reforms will enhance productivity and job creation.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

India to be part of UN’s 63rd session of Commission for Social Development 2025

From UPSC perspective, the following things are important :

Mains level: Social Cohesion; Solidarity;

Why in the News?

India participated in the 63rd session of the Commission for Social Development (CSoCD) from February 10 to 14, 2025, in New York, USA. The Indian delegation was led by Smt. Savitri Thakur, Minister of State for Women and Child Development.

What is Social cohesion?

|

What are the Dimensions of the Social Cohesion?

- Social Inclusion & Equity: Ensures equal access to opportunities, resources, and rights for all individuals, reducing discrimination and marginalization. Example: India’s JAM Trinity (Jan Dhan, Aadhaar, Mobile) has enabled financial inclusion for disadvantaged communities, particularly women and rural populations.

- Trust in Institutions & Social Capital: Building confidence in governance, law enforcement, and civic institutions to enhance cooperation and stability. Example: Sweden’s transparent governance and welfare policies result in high public trust in government institutions.

- Participation & Civic Engagement: Encouraging individuals and communities to actively engage in decision-making and democratic processes. Example: Rwanda’s high female political representation (over 60% in Parliament) fosters inclusive and equitable policymaking.

- Solidarity & Shared Identity: Promoting unity while respecting cultural diversity and fostering a common sense of belonging. Example: Canada’s multicultural policies encourage immigrant integration while maintaining cultural heritage.

- Economic Inclusion & Opportunity: Providing equal access to economic resources, employment, and skill development to ensure upward mobility. Example: Germany’s dual vocational education system equips young people with job-ready skills, reducing unemployment and income inequality.

What is the virtuous cycle?

|

What are the roles of Social Cohesion in the Virtuous cycle?

- Promotes Inclusive Economic Growth: Social cohesion ensures equal access to economic opportunities, reducing disparities and fostering shared prosperity. Example: In Germany, strong social policies and labor rights have contributed to stable economic growth and low unemployment rates.

- Enhances Trust in Institutions and Governance: When citizens feel included and represented, they trust public institutions, leading to political stability and effective governance. Example: Scandinavian countries like Sweden and Norway have high levels of trust in governance due to inclusive decision-making and welfare policies.

- Encourages Social Mobility and Equal Opportunities: A cohesive society provides fair access to education, healthcare, and social protection, enabling upward mobility for all. Example: Singapore’s education system focuses on meritocracy, ensuring students from all backgrounds have access to quality education and career opportunities.

- Strengthens Community Participation and Civic Engagement: Social cohesion encourages people to engage in local governance, volunteerism, and community development initiatives. Example: Japan’s neighborhood associations play a crucial role in disaster response, fostering collective responsibility and mutual support.

- Reduces Social Conflicts and Crime: By addressing inequalities and fostering a sense of belonging, social cohesion minimizes tensions and crime rates. Example: New Zealand’s restorative justice programs emphasize reconciliation and community involvement, reducing recidivism rates.

What are the Key Recommendations to promote Social Cohesion? (Way forward)

- Inclusive Policies and Equal Opportunities: Ensure access to quality education, healthcare, and employment for all, reducing social and economic disparities. Example: Finland’s education system provides free, high-quality education, ensuring equal opportunities for all children, regardless of socioeconomic background.

- Community Engagement and Trust Building: Promote civic participation, intergroup dialogue, and local governance to strengthen social bonds and mutual respect. Example: South Africa’s Truth and Reconciliation Commission (TRC) helped heal racial divides by addressing historical injustices through public dialogue.

- Economic and Social Safety Nets: Implement strong social protection systems like universal healthcare, unemployment benefits, and targeted welfare programs. Example: Brazil’s Bolsa Família program reduced poverty and inequality by providing conditional cash transfers to low-income families, improving education and health outcomes.

Mains PYQ:

Q An independent and empowered social audit mechanism is an absolute must in every sphere of public service, including judiciary, to ensure performance, accountability and ethical conduct. Elaborate. (UPSC IAS/2021)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

A pragmatic picture: Economic Survey

Why in the News?

The Budget session of Parliament has started at a time when India’s economic situation is shifting. After four years of strong growth following the pandemic, the economy is slowing down.

What are the key projections for India’s economic growth in FY 2024-25?

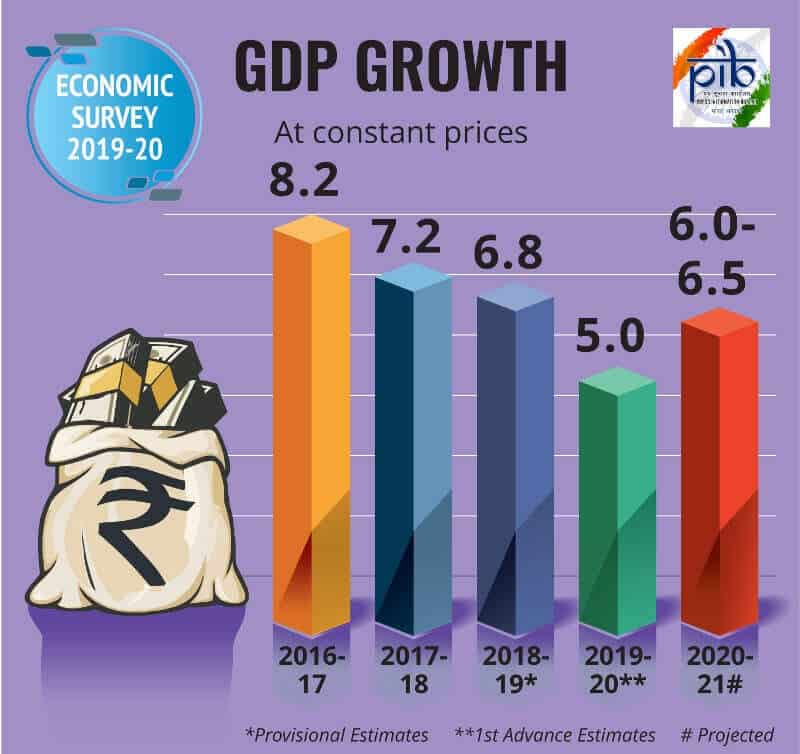

- Projected GDP Growth: The National Statistical Office (NSO) has estimated that India’s GDP will grow by 6.4% in FY 2024-25. This figure marks a decline from the 8.2% growth recorded in FY 2023-24 and is lower than earlier forecasts which ranged from 6.5% to 7%.

- Sectoral Performance: The slowdown is attributed to weaker performance in sectors such as manufacturing and services. The first half of FY 2024-25 is expected to see a growth rate of around 6%, necessitating a stronger performance of 6.8% in the second half to meet the annual target.

- Comparative Estimates: While the NSO’s estimate stands at 6.4%, other organizations like the International Monetary Fund (IMF) have projected a slightly higher growth rate of 7%, reflecting differing outlooks on economic recovery and consumer demand.

How does the Economic Survey address challenges such as inflation and global uncertainties?

- Food Inflation Concerns: Despite the overall decline in inflation, food inflation remains a challenge, rising from 7.5% in FY24 to 8.4% in the same period due to supply chain disruptions and adverse weather conditions.

- The survey emphasizes the need for improved agricultural practices and climate-resilient crops to manage these risks effectively.

- Inflation Trends: The survey reports a reduction in retail inflation from 5.4% in FY24 to 4.9% during April-December 2024, indicating a positive trend towards achieving the RBI’s target of around 4% by FY26, contingent on stable global commodity prices and favorable domestic agricultural output.

- Global Economic Uncertainties: The survey highlights that ongoing geopolitical tensions and global trade risks pose significant challenges to inflation management, necessitating careful policy interventions to mitigate potential impacts on the domestic economy.

- Policy Recommendations: To address these challenges, the Economic Survey advocates for strategic policy measures, including enhancing supply chain resilience, improving data collection for better price monitoring, and fostering an environment conducive to investment and growth.

What structural reforms are recommended to enhance long-term economic stability?

- Deregulation and Ease of Doing Business: The Economic Survey advocates for significant deregulation to foster a more conducive business environment. It stresses that the government should “get out of the way” of businesses by minimizing micro-management and enhancing accountability among regulators.

- Empowering Small Firms: Recommendations include empowering small enterprises, enhancing economic freedom, and ensuring a level playing field across sectors to stimulate growth and investment.

- Focus on Domestic Demand: The budget is expected to prioritize boosting domestic demand through increased government spending, particularly in infrastructure and capital projects, as a countermeasure against global uncertainties and inflationary pressures.

Way forward:

- Strengthen Domestic Resilience – Focus on boosting domestic consumption and investment through targeted fiscal measures, infrastructure expansion, and support for MSMEs to counter global uncertainties.

- Enhance Inflation Management – Implement climate-resilient agricultural policies, improve supply chain efficiency, and strengthen monetary-fiscal coordination to maintain stable inflation and ensure sustainable growth.

Mains PYQ:

Q Is inclusive growth possible under market economy? State the significance of financial inclusion in achieving economic growth in India.(UPSC IAS/2022)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

India is heading into a middle income trap

From UPSC perspective, the following things are important :

Mains level: Middle-income trap;

Why in the News?

Ahead of the Union Budget, the Congress released a report on January 30, 2025, saying that India is at risk of getting stuck in the middle-income trap.

What is the classification of Countries given by the World Bank?The World Bank classifies countries into four income groups based on their Gross National Income (GNI) per capita.

|

What factors contribute to India being at risk of falling into a middle-income trap?

- Low GDP Growth: India’s projected GDP growth rate for 2024-25 is around 6.4%, significantly lower than the 8% needed to leverage its demographic dividend effectively, indicating a slowdown in economic momentum.

- Food Inflation Concerns: Despite the overall decline in inflation, food inflation remains a challenge, rising from 7.5% in FY24 to 8.4% in the same period due to supply chain disruptions and adverse weather conditions.

- Private Sector Investment: Despite corporate tax cuts, private sector investment has not significantly increased. The Economic Survey 2024-25 indicates that Gross Fixed Capital Formation (GFCF), a crucial indicator of investment activity, slowed to 5.4% in the recent quarter, reflecting a decline in private capital expenditure.

- Government Capital Expenditure: The survey notes that government capital expenditure utilization was only 37.3% in the first half of FY25, down from 49% the previous year, which has contributed to the overall slowdown in investments.

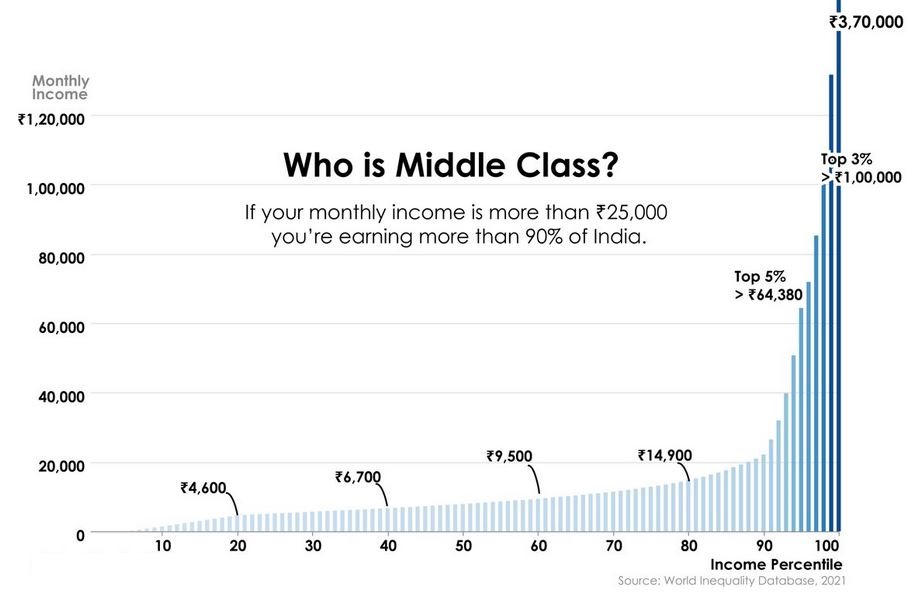

- Low Incomes: A significant portion of India’s population lives on extremely low incomes, with estimates suggesting that about 50% of the population earns between ₹100 and ₹150 per day. This level of income severely limits consumer spending capacity and economic growth potential.

How does the current economic policy framework address the challenges? (Way forward)

- Next-Generation Reforms: The Union Budget 2024-25 emphasizes “Next Generation Reforms” aimed at enhancing productivity and market efficiency across various sectors.

- This includes a comprehensive Economic Policy Framework that focuses on improving factors of production land, labour, capital, and entrepreneurship while leveraging technology to reduce inequality and boost economic growth.

- Deregulation and Economic Freedom: The Economic Survey highlights the need for deregulation and grassroots reforms to enhance the competitiveness of the economy. It advocates for greater economic freedom, allowing individuals and organizations to pursue legitimate economic activities without excessive regulatory burdens.

- Public-Private Partnerships and Infrastructure Investment: The framework encourages public-private partnerships (PPPs) in infrastructure projects, facilitating greater collaboration between the government and private sector.

- By removing policy hurdles and providing upfront support for long-term projects, the government aims to attract patient capital necessary for sustainable development, which is critical for addressing current economic challenges

Mains PYQ:

Q Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. (UPSC IAS/2019)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

McKinsey released Report on Demographic Transition and Depopulation

From UPSC perspective, the following things are important :

Prelims level: Demographic Transition Theory

Why in the News?

The report, ‘Dependency and Depopulation? Confronting the Consequences of a New Demographic Reality’, released by McKinsey Global Institute, provides a detailed comparative analysis of demographic dynamics in developed (first wave) and developing (later wave) countries.

IMPORTANT: What is Demographic Transition Theory?

Demographic transition describes changes in birth and death rates and population age structure as societies develop economically and technologically.

|

Key Highlights of the McKinsey Report

- Two-thirds of humanity now live in countries with fertility rates below the replacement level of 2.1 children per family.

- Age structures are shifting from pyramids to obelisks, with a growing elderly population and a shrinking youth demographic.

- Populations in some major economies are projected to decline by 20%-50% by 2100 (UN).

- The global support ratio (working-age individuals per senior aged 65 or older) is projected to decline from 6.5 today to 3.9 by 2050.

- In India, the ratio will fall from 10 workers per senior in 1997 to 4.6 in 2050 and just 1.9 by 2100, similar to Japan’s current levels..

- Consumption Patterns in India:

- India’s share in global consumption is projected to rise from 9% today to 16% by 2050, while shares of advanced economies are expected to remain flat or decline.

- By 2050, the share of consumption by seniors aged 65 and older will rise from 8% to 15%, reflecting changing consumer demographics.

- The percentage of hours worked by seniors is projected to increase from 2.9% to 5.4% by 2050 under current trends.

About India’s Diminishing Demographic Dividend

- India has 33 years to fully capitalize on its demographic dividend before its support ratios align with those of advanced economies.

- From 1997 to 2023, India’s favorable demographics added 0.7 percentage points per year to its GDP per capita growth.

- This contribution is expected to shrink to 0.2 percentage points per year through 2050 as the population ages.

- India’s support ratio (working-age individuals per senior) is projected to decline significantly, creating greater dependency on fewer workers to support older populations.

- By 2050, there will be only 4.6 workers per senior, down from 10 workers per senior in 1997.

- India’s GDP per capita is currently 18% of the World Bank’s high-income threshold, emphasizing the need for faster economic progress to “get rich before it gets old.”

- Increasing labor force participation, particularly among women, and improving worker productivity are critical to sustaining economic growth.

- Despite rapid progress, India’s worker productivity remains at $9 per hour, significantly lower than the $60 per hour average in high-income countries.

PYQ:[2012] Consider the following specific stages of demographic transition associated with economic development:

Select the correct order of the above stages using the codes given below: (a) 1, 2, 3 (b) 2, 1, 3 (c) 2, 3, 1 (d) 3, 2, 1 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Why is rupee weakening against dollar?

From UPSC perspective, the following things are important :

Mains level: Rupee depreciation;

Why in the News?