Why in the News?

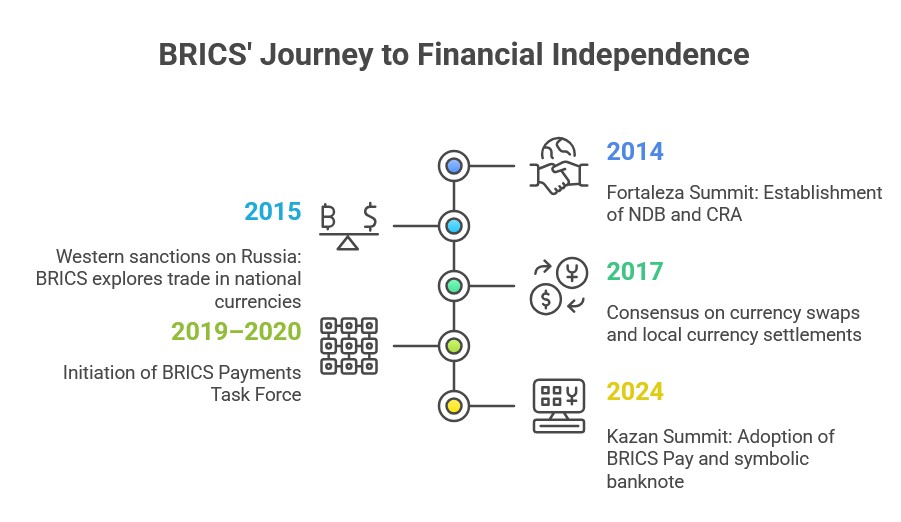

Since 2014, BRICS nations have worked to cut dependence on the U.S. dollar, launching the New Development Bank (NDB), Contingent Reserve Arrangement (CRA), and now BRICS Pay to promote local currency trade and rival the SWIFT system.

About BRICS Pay Initiative:

- Overview: BRICS Pay is a proposed cross-border digital payment and settlement platform developed by the BRICS nations (Brazil, Russia, India, China, South Africa) to facilitate trade in local currencies and reduce reliance on the U.S. dollar and the SWIFT network.

- Origins: The idea emerged after the 2014 Fortaleza Summit, where BRICS established its own financial architecture, the New Development Bank (NDB) and the Contingent Reserve Arrangement (CRA).

- Purpose: To enable direct financial transactions among member nations using local currencies, minimizing the role of Western-controlled financial systems and avoiding U.S.-led sanctions.

- Development Path:

- 2017: BRICS agreed to enhance currency cooperation via swaps, local currency settlements, and direct investments.

- Early 2020s: The BRICS Payments Task Force (BPTF) was created to design interoperable systems.

- 2024 Kazan Summit: Leaders highlighted strengthening of correspondent banking networks and settlements in local currencies under the BRICS Cross-Border Payments Initiative.

- Prototype: A demo of BRICS Pay was unveiled in Moscow (October 2024), marking a concrete step toward implementation.

- Supporting National Systems:

- India: Unified Payments Interface (UPI)

- China: Cross-Border Interbank Payment System (CIPS)

- Russia: System for Transfer of Financial Messages (SPFS)

- Brazil: Pix instant payment system

- Strategic Importance: The initiative seeks to establish a self-reliant financial network, bypass SWIFT, and enhance monetary sovereignty among emerging economies.

Back2Basics: Society for Worldwide Interbank Financial Telecommunication (SWIFT) System

|

| [UPSC 2023] With reference to the Central Bank digital currencies, consider the following statements:

1. It is possible to make payments in a digital currency without using US dollar or SWIFT system. 2. A digital currency can be distributed with a condition programmed into it such as time-frame for spending it. Which of the statements given above is/are correct? Options: (a) 1 only (b) 2 only (c) Both 1 and 2* (d) Neither 1 nor 2 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024