From UPSC perspective, the following things are important :

Prelims level: Cost Inflation Index (CII); Long Term Capital Gains

Why in the News?

- The Income Tax Department has notified the cost inflation index (CII) for the current fiscal to calculate long-term capital gains arising from the sale of immovable property, securities and jewellery.

- The CII is used by a taxpayer to compute gains arising out of the sale of capital assets after adjusting for inflation.

CII Values:

|

What is Cost Inflation Index (CII)?

- CII is a measure used by the Income Tax Department of India to account for inflation when calculating the capital gains on the sale of long-term capital assets.

- It helps to adjust the purchase price of assets to reflect the effect of inflation.

- CII adjusts the cost of acquisition of assets to the price level inflation at the time of sale.

- This ensures that taxpayers pay taxes on the real gains rather than on the inflationary component of the price rise.

- It is defined under Section 48 of the Income-tax Act, 1961.

- The index is revised annually to keep up with inflation, with the base year being periodically reset (currently the base year is 2001-02 in India).

Application of CII

- CII is used to compute the indexed cost of acquisition of a capital asset that has been held for more than 36 months (considered as long-term capital assets).

- Different holding periods apply for certain types of assets like immovable property and listed securities.

Tax Calculation:

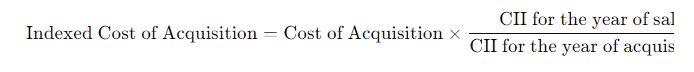

- The formula used is:

- This formula helps determine the adjusted cost basis from which any sale proceeds are subtracted to calculate capital gains.

Back2Basics: Long Term Capital Gains

Definition of Long-Term Capital Assets

Taxation of Long-Term Capital Gains

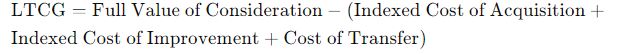

Calculation of Long-Term Capital GainsThe general formula for calculating LTCG is:

Full Value of Consideration is the sale price of the asset. Indexed Cost of Acquisition is the purchase price adjusted by the CII. Indexed Cost of Improvement refers to the cost of any improvements made to the asset, adjusted by the CII. Cost of Transfer includes expenses directly related to the sale or transfer of the asset. Exemptions and Deductions

|

PYQ:[2015] Which reference to inflation in India, which of the following statements is correct? (a) Controlling the inflation in India is the responsibility of the Government of India only (b) The Reserve Bank of India has no role in controlling the inflation (c) Decreased money circulation helps in controlling the inflation (d) Increased money circulation helps in controlling the inflation |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024