Note4Students

From UPSC perspective, the following things are important :

Prelims level: Key economic concepts

Mains level: Fiscal imbalance and its impact on an economy

Central Idea

- In India, the States play a crucial role in revenue mobilization, government expenditure, and borrowing. Understanding their fiscal situation is essential for drawing evidence-based conclusions about the country’s overall fiscal health.

Relevance of the topic

Despite the decrease in fiscal deficits, it remains important to address the challenges associated with fiscal imbalances, including persistence of revenue deficits in many States

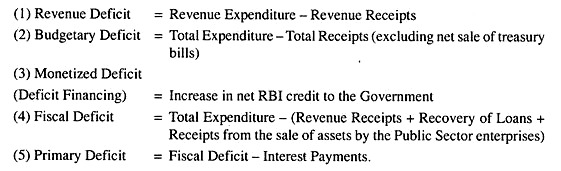

Revise key concepts Fiscal deficit, revenue deficit, Debt-to-GDP ratio etc

Fiscal imbalance and its impact on an economy and thereby social welfare.

The fiscal imbalance at present

- Reduction in Fiscal Deficit:

- There has been a significant reduction in fiscal deficits at both the Union and State levels. The Union’s fiscal deficit decreased from 9.1% of GDP in 2020-21 to 5.9% in 2023-24 (BE).

- The aggregate State fiscal deficit also decreased from 4.1% of GDP in 2020-21 to 3.24% in 2022-23 (RE).

- Major States are expected to achieve a fiscal deficit of 2.9% of GDP in 2023-24 (BE).

- Revenue Deficit Challenge:

- Despite the reduction in fiscal deficits, there is persistence of revenue deficits in many States.

- Out of the 17 major States analyzed, 13 have a deficit in the revenue account for the fiscal year 2023-24 (BE).

- Seven States, namely Andhra Pradesh, Haryana, Kerala, Punjab, Rajasthan, Tamil Nadu, and West Bengal, experience fiscal deficits primarily driven by revenue deficits.

- High Debt-to-GSDP Ratios: Some of the States with revenue deficits also have high debt-to-GSDP ratios. This indicates that these States have accumulated significant levels of debt relative to their Gross State Domestic Product (GSDP).

The Impact of fiscal imbalance on an Economy

- Macroeconomic Instability: Fiscal imbalances, such as high fiscal deficits and revenue deficits, can lead to macroeconomic instability. Large deficits may increase government borrowing, which can put upward pressure on interest rates, crowd out private investment, and potentially lead to inflationary pressures. This instability can hinder economic growth and create uncertainty in the business environment.

- Increased Debt Burden: Persistent fiscal imbalances often result in increased government debt levels. High levels of public debt can have adverse consequences, including increased debt servicing costs, reduced fiscal flexibility, and potential credit rating downgrades. A higher debt burden can also limit the government’s ability to invest in critical areas such as infrastructure, education, and healthcare.

- Reduced Public Investments: Fiscal imbalances may necessitate fiscal consolidation measures, such as expenditure cuts and reduced public investments. This can impact critical areas of public spending, including infrastructure development, social welfare programs, and public services. Reduced investments can hinder long-term economic growth and development.

- Limited Policy Space: Fiscal imbalances can limit the government’s ability to implement countercyclical fiscal policies during economic downturns. A high debt burden or constrained fiscal capacity may prevent the government from effectively using fiscal stimulus measures to boost aggregate demand and support economic recovery.

- Pressure on Social Welfare: Fiscal imbalances may lead to reductions in social welfare programs and public services. Austerity measures implemented to address fiscal imbalances can disproportionately affect vulnerable populations and hinder efforts to address income inequality and social welfare needs.

- Investor Confidence and Credit Ratings: Persistent fiscal imbalances can erode investor confidence and negatively impact the country’s credit ratings. A lower credit rating can increase borrowing costs, discourage foreign investment, and limit access to international capital markets.

- Inter-Generational Equity: Fiscal imbalances, particularly when driven by high levels of public debt, can have inter-generational equity implications. The burden of repaying debt and managing fiscal imbalances may fall on future generations, impacting their ability to invest, save, and achieve sustainable economic growth.

Reducing Revenue deficit: Way forward

- Link Interest-Free Loans to Revenue Deficit Reduction: Implement a mechanism where interest-free loans provided by the Union Government to States are linked to a reduction in revenue deficits. This incentivizes States to prioritize revenue generation and reduce reliance on borrowed funds for revenue expenditure.

- Defined Time Path for Revenue Deficit Reduction: Establish a clear timeline and targets for reducing revenue deficits in States. This includes setting specific goals for revenue deficit reduction and developing a credible fiscal adjustment plan to achieve those targets.

- Performance Incentive Grants: Introduce performance incentive grants to reward States that effectively reduce their revenue deficits. The grants can be designed based on the recommendations of previous Finance Commissions, considering factors such as the extent of deficit reduction, fiscal discipline, and efficient revenue management.

- Fiscal Adjustment and Expenditure Rationalization: Encourage States to undertake fiscal adjustment measures to align revenue and expenditure. This involves conducting a detailed analysis of expenditure patterns, prioritizing essential spending, and identifying areas for rationalization and efficiency gains.

- Strengthen Revenue Mobilization: Enhance efforts to improve revenue mobilization by implementing measures such as broadening the tax base, improving tax administration and compliance, and exploring new revenue sources. This includes ensuring effective collection of Goods and Services Tax (GST) and non-GST revenues.

- Public Financial Management Reforms: Strengthen public financial management systems to enhance transparency, accountability, and efficient utilization of resources. This includes improving budgeting processes, expenditure tracking, and financial reporting mechanisms to monitor and control revenue and expenditure.

- Long-Term Revenue Planning: Develop a comprehensive long-term revenue plan that aligns with the country’s development goals. This involves forecasting revenue trends, identifying potential revenue sources, and implementing policies that support sustainable revenue generation over the long term.

- Capacity Building: Invest in building the capacity of State governments in revenue management, tax administration, and expenditure control. This includes providing training and technical assistance to enhance their skills and capabilities in managing revenue deficits effectively.

- Public Awareness and Participation: Conduct public awareness campaigns to educate citizens about the importance of revenue generation, fiscal discipline, and the impact of revenue deficits on public services. Foster public participation in budgeting processes to promote transparency and accountability.

- Regular Monitoring and Reporting: Establish a robust monitoring and reporting mechanism to track the progress of revenue deficit reduction efforts. Regularly assess and report the performance of States in revenue mobilization and deficit reduction to ensure accountability and facilitate necessary corrective actions.

Prelims mark enhancer

Conclusion

- Effectively managing revenue deficits is crucial for achieving fiscal balance and sustainable economic growth. By adopting a macro view and implementing appropriate measures and incentives, India can consolidate revenue deficits in its States. This would ensure fiscal stability, stimulate State-specific growth, and maintain macroeconomic stability at the national level

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024