From UPSC perspective, the following things are important :

Prelims level: The 73rd and 74th Constitutional Amendments Acts

Mains level: Ensuring greater devolution of powers and responsibilities to lower tiers of panchayats

Central Idea:

The article discusses the progress and challenges of decentralization in India, focusing on the effectiveness of Panchayati Raj institutions in local governance. It highlights the limited success in revenue generation by these institutions despite constitutional provisions and emphasizes the need for greater efforts towards self-sufficiency.

Key Highlights:

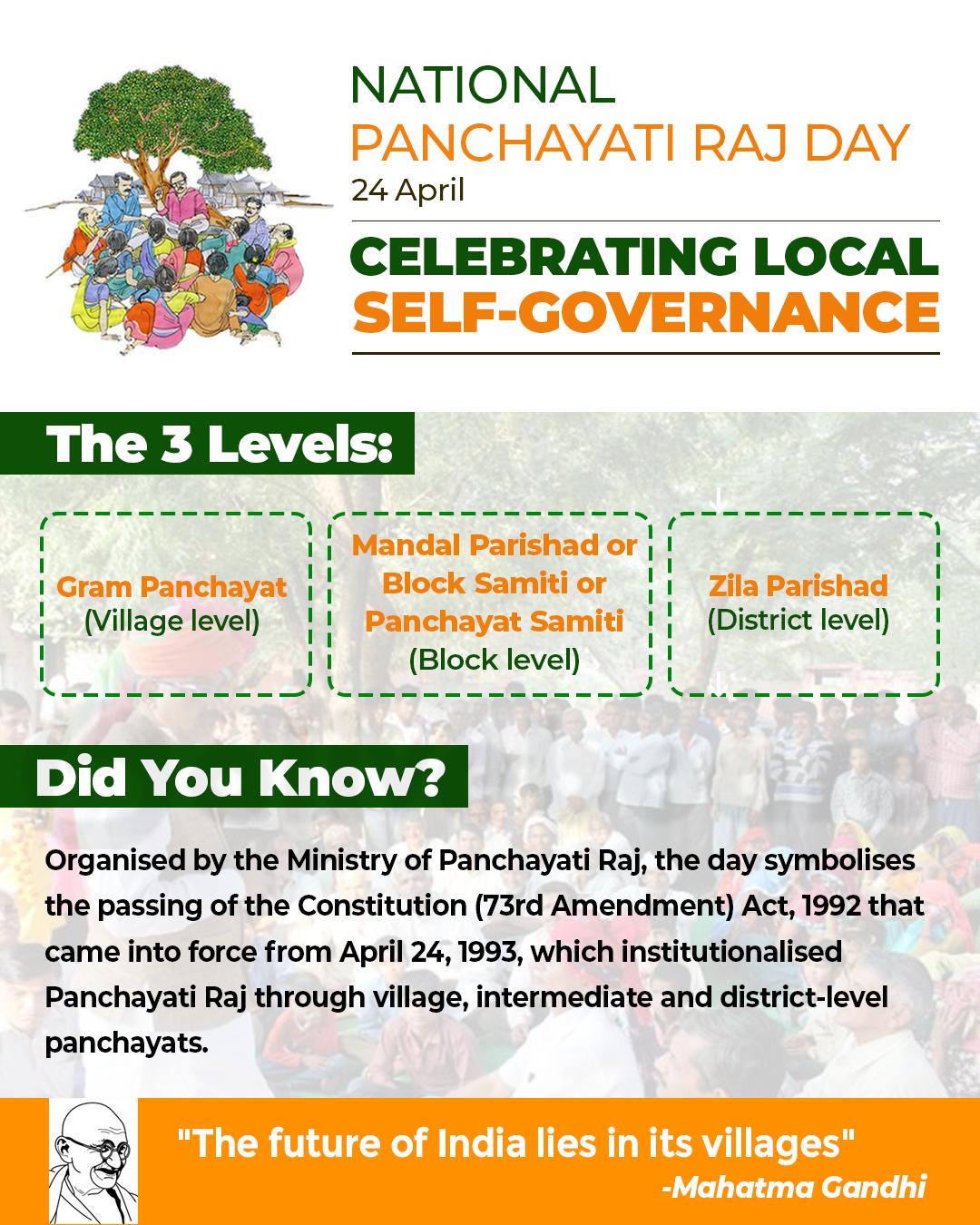

- Background of Decentralization: The 73rd and 74th Constitutional Amendments Acts aimed to empower local bodies for self-governance, leading to the establishment of the Ministry of Panchayati Raj in 2004.

- Fiscal Devolution: The constitutional amendment outlined fiscal devolution details, including own revenue generation by panchayats. However, most revenue still comes from grants, with only 1% generated through taxes.

- Avenues for Revenue: The article lists various avenues for revenue generation by panchayats, including property tax, user charges, and innovative projects like rural business hubs and renewable energy initiatives.

- Role of Gram Sabhas: Gram sabhas play a crucial role in local development and revenue generation by leveraging local resources, engaging in planning, and imposing taxes for community welfare.

- Challenges: Despite potential avenues for revenue, panchayats face challenges such as a culture of dependency on grants, reluctance to impose taxes, and lack of authority in tax collection.

- Dependency Syndrome: The article discusses the prevalent “freebie culture” and the reluctance of elected representatives to impose taxes due to concerns about popularity.

Key Challenges:

- Overreliance on grants from central and state governments.

- Reluctance of elected representatives to impose taxes due to concerns about popularity.

- Lack of authority and capacity in tax collection by panchayats.

- Prevailing “freebie culture” hindering public willingness to pay taxes.

Main Terms:

- Decentralization: Transfer of authority and responsibility from central to local government.

- Panchayati Raj: System of local self-government in rural areas.

- Fiscal Devolution: Transfer of financial powers from central to local governments.

- Own Source of Revenue (OSR): Revenue generated by local bodies through taxes, fees, and other means.

- Gram Sabha: Village assembly responsible for local governance and decision-making.

Important Phrases for answer writing:

- “Decentralization initiatives”

- “Revenue generation efforts”

- “Own source of revenue”

- “Freebie culture”

- “Dependency syndrome”

Quotes for answer quality improvement:

- “Panchayats earn only 1% of the revenue through taxes.”

- “Gram sabhas have a significant role in fostering self-sufficiency and sustainable development.”

- “The dependency syndrome for grants has to be minimized.”

Useful Statements that can be used for essay:

- “Despite efforts towards decentralization, many panchayats still rely heavily on grants for revenue.”

- “Gram sabhas can play a pivotal role in promoting entrepreneurship and local development.”

- “There is a need to educate elected representatives and the public on the significance of revenue generation for panchayat development.”

Examples and References:

- The 73rd and 74th Constitutional Amendments Acts.

- Ministry of Panchayati Raj’s expert committee report on own source of revenue.

- Data highlighting the percentage of revenue generated by panchayats through taxes.

- Examples of successful revenue generation initiatives by panchayats, such as property tax and user charges.

Facts and Data for critical arguments in answer:

- Panchayats earn only 1% of revenue through taxes, with 80% from the Centre and 15% from the States.

- Allocation for rural local bodies increased significantly in recent Finance Commissions, reaching ₹2,80,733 crore in the 15th Finance Commission.

- Tax revenue collected by panchayats decreased from ₹3,12,075 lakh in 2018-19 to ₹2,71,386 lakh in 2021-2022.

Critical Analysis:

While constitutional amendments and expert committee reports have outlined mechanisms for fiscal devolution and revenue generation, there remains a significant gap between policy intent and implementation. Factors such as political reluctance, administrative capacity constraints, and societal attitudes towards taxation pose significant challenges to effective decentralization.

Way Forward:

- Strengthening capacity building initiatives for panchayats in tax administration and financial management.

- Encouraging public awareness campaigns to promote the importance of local revenue generation for sustainable development.

- Ensuring greater devolution of powers and responsibilities to lower tiers of panchayats.

- Exploring innovative revenue generation avenues such as public-private partnerships and leveraging local resources for economic development.

Improve your answer writing with us and crack the mains

Try to attempt following question and write the answer in comment box below

- “What are the various sources available for Panchayats to generate revenue, and how can these sources contribute to enhancing the financial autonomy and sustainability of Panchayati Raj institutions?”

- “What are the main challenges hindering the financial autonomy of Panchayati Raj?”

- “Why is financial autonomy crucial for the effective functioning of local governance?”

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024