Panchayati Raj Institutions: Issues and Challenges

Getting the ‘micropicture’ at the panchayat level

Why in the News?

The release of the Panchayat Advancement Index (PAI) Baseline Report 2022–23 in April 2025 marks a major milestone in India’s grassroots governance and data-driven policymaking.

Why does it mark a major milestone?

- Empowers Local Decision-Making: PAI presents complex data in an understandable way for Gram Panchayat leaders, enabling them to identify gaps and take targeted actions. Eg: A sarpanch can use PAI scores to improve health or education outcomes in their village.

- Links Data to Outcomes: It moves beyond raw data by connecting indicators to actual development results, helping stakeholders focus on measurable progress. Eg: PAI scores reveal if a Panchayat is truly “healthy,” guiding specific interventions to improve wellbeing.

What is the Panchayat Advancement Index (PAI)?PAI is a composite index using 435 local indicators (331 mandatory, 104 optional) and 566 data points across nine themes of Localized SDGs (LSDGs). Why is it significant?

|

What are the main limitations in evidence-based decision-making?

- Delayed and Inaccessible Data: Lack of timely and accessible data hinders informed planning and policy formulation. Eg: The delay in conducting the Census and not releasing its data restricts effective resource allocation in sectors like health, education, and welfare schemes.

- Poor Data Usability and Visualization: Data made available is often in complex formats, making it difficult for citizens and policymakers to interpret and act upon. Eg: On data.gov.in, datasets are vast but lack adequate visualization tools, overwhelming even trained researchers.

- Top-Down Data Flow: Data is often generated at the grassroots but is primarily used by officials at the state or national level, not by local decision-makers. Eg: Gram Panchayat data is collected but rarely used by local elected representatives due to lack of access or interpretation tools.

Who are the stakeholders expected to benefit from the PAI?

- Gram Panchayat Representatives: Sarpanches and ward members can understand their Panchayat’s performance and take action to improve local governance.

- State and District Level Officials: Block Development Officers and District Collectors can use PAI data to plan and monitor development programs more effectively.

- Elected Legislators: Members of Parliament (MPs) and Members of Legislative Assemblies (MLAs) can identify local gaps and use funds from MPLADS/MLALADS accordingly.

- Line Departments and Frontline Workers: Departments like health, education, and rural development can coordinate efforts better using specific PAI indicators.

- Civil Society Organizations (CSOs) and Academia: NGOs and Unnat Bharat Abhiyan institutions can support Panchayats by interpreting data and suggesting local interventions.

- Citizens and Local Communities: Residents can be made aware of their Panchayat’s status and engage in participatory planning and accountability.

How can they contribute to achieving the LSDGs (Localisation of Sustainable Development Goals)?

- Targeted Planning and Implementation: Stakeholders can use PAI data to identify local gaps and implement focused interventions aligned with LSDGs. Eg: A Panchayat noticing low scores in sanitation can prioritize toilet construction and awareness drives under Swachh Bharat Abhiyan.

- Resource Optimization and Fund Allocation: Elected representatives and officials can direct funds more effectively to areas needing urgent attention. Eg: An MLA can use MLALAD funds to improve access to clean drinking water in a low-scoring GP on the “Safe Drinking Water” indicator.

- Community Mobilization and Accountability: Civil society and academic institutions can raise awareness and ensure community involvement in achieving development goals. Eg: An NGO working with local residents can organize meetings to explain their PAI score and co-develop action plans to improve education or health indicators.

Where does data submission fall short, and why is it concerning?

- Incomplete data: Undermines the reliability of the Panchayat Advancement Index (PAI). Eg: Without full data from Uttar Pradesh, true development gaps remain hidden.

- Policy gaps: Poor data coverage leads to misinformed decisions, leaving underperforming areas unaddressed. Eg: GPs excluded from PAI may not receive adequate funds or interventions.

- Inequality: Skewed data causes unequal resource allocation and widens regional disparities. Eg: States with full data submissions benefit more from schemes aligned with LSDGs.

What are the steps taken by the Indian government?

|

Way forward:

- Improve Data Accessibility and Visualization: Develop user-friendly dashboards and visualization tools to make data easily understandable for all stakeholders, including elected representatives and citizens.

- Strengthen Data Validation and Coverage: Ensure complete and accurate data submission from all states and Gram Panchayats through rigorous validation and support mechanisms.

Mains PYQ:

[UPSC 2022] “To what extent, in your opinion, has the decentralisation of power in India changed the governance landscape at the grassroots ?

Linkage: The governance landscape at the grassroots and the impact of decentralization. Evaluating this impact necessitates a detailed understanding of the local reality and changes brought about by devolving power – precisely what “getting the micropicture” seeks to achieve.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

[17th February 2025] The Hindu Op-ed: The Panchayati Raj Movement is in Distress

PYQ Relevance:Q) Assess the importance of the Panchayat system in India as a part of local government. Apart from government grants, what sources the Panchayats can look out for financing developmental projects? (UPSC CSE 2018) |

Mentor’s Comment: UPSC mains have always focused on the Panchayat System (2015), and Local Governance (2021).

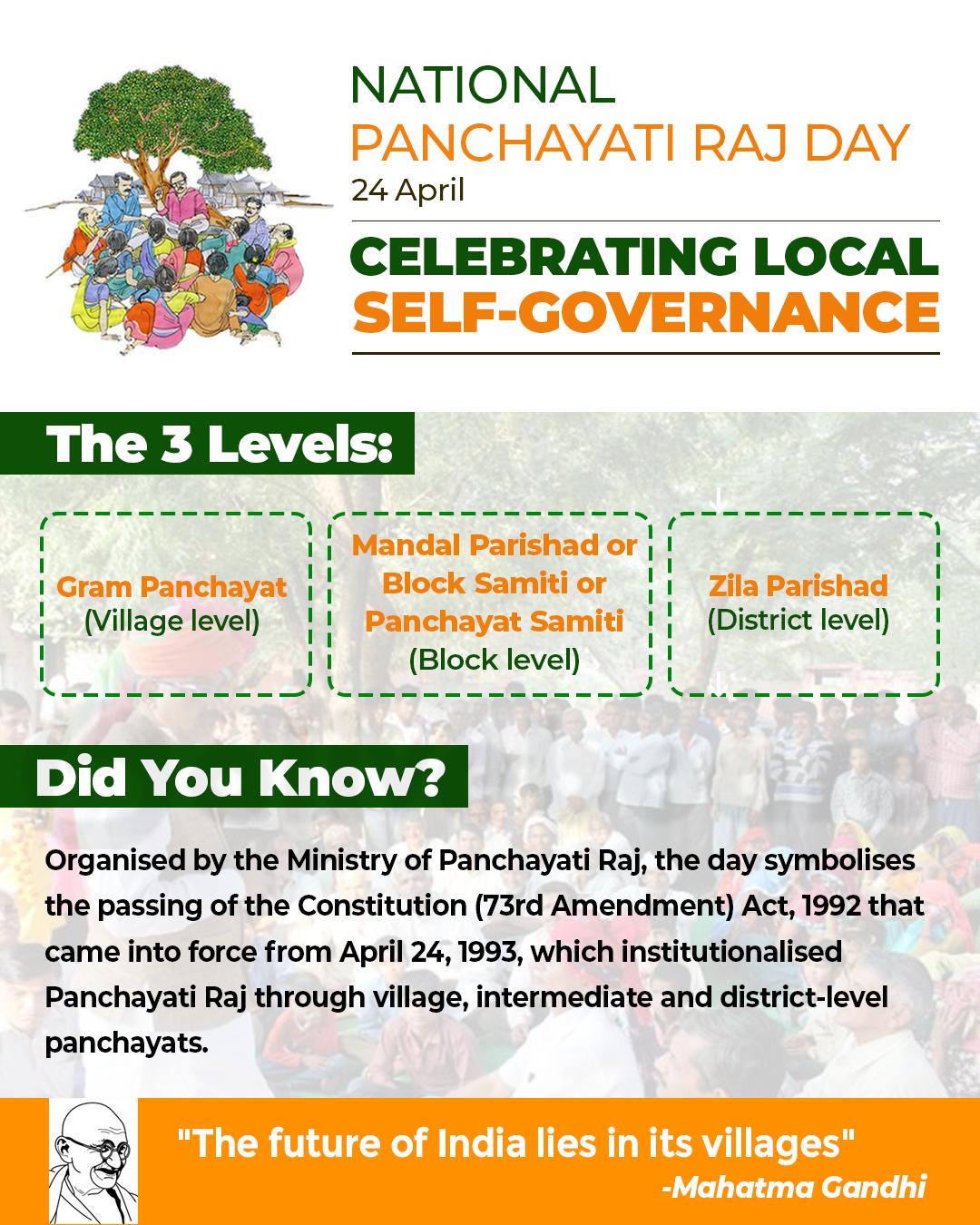

The 73rd Amendment of 1992 was a milestone in India’s democracy, establishing the Panchayati Raj system to decentralize governance. It created a three-tier structure at the village, block, and district levels, ensuring regular local elections and reserving 50% of seats for women, Scheduled Castes, and Scheduled Tribes. This brought democracy to the grassroots, promoting local representation and inclusive leadership. However, progress in strengthening local governance has slowed. Rapid technological and societal changes now risk making Panchayats less relevant. To keep them effective, their role must be reimagined to address modern challenges while preserving their core democratic purpose.

Today’s editorial talks about issues related to local government. This content would help in GS Paper 2 in mains answer writing.

_

Let’s learn!

Why in the News?

The special discussion in Parliament on the 75th anniversary of the Indian Constitution had several salient aspects of the Constitution and policy directions adopted by previous governments but very little on a vital aspect of local governance was highlighted.

Why is the Panchayati Raj movement facing distress?

- Incomplete Devolution of Powers: Many States have not transferred all 29 subjects under the Eleventh Schedule, limiting Panchayats’ decision-making authority. Example: A 2022 Ministry of Panchayati Raj report found that less than 20% of States had fully devolved powers, restricting local governance.

- Declining Fiscal Autonomy: Though direct transfers have increased, untied grants (which Panchayats can use freely) have reduced from 85% (13th Finance Commission) to 60% (15th Finance Commission). Example: Many Gram Panchayats rely on centrally sponsored schemes, leaving little room for independent development planning.

- Marginalization Due to Digital Welfare Schemes: Direct Benefit Transfer (DBT) schemes like PM-KISAN bypass Panchayats, reducing their role in beneficiary selection and grievance redress. Example: Farmers receive ₹6,000 annually under PM-KISAN directly in their accounts, eliminating Panchayats’ role in rural welfare.

- Political and Bureaucratic Interference: State governments and political parties use Panchayats as tools for electoral gains rather than empowering them as self-governing institutions. Example: In states like West Bengal and Kerala, Panchayat elections are highly politicized, often leading to violence and reducing focus on governance.

- Impact of Urbanization: With India’s rural population declining (from ~75% in 1990 to ~60% today), policy focus has shifted towards urban development and municipal governance. Example: Rural development funds have increasingly been diverted towards urban infrastructure projects, weakening Panchayat-led rural initiatives.

What impact does the distress in Panchayati Raj have on rural development?

- Inefficiency in Rural Welfare Implementation: Panchayats have been sidelined in the distribution of welfare benefits, leading to inefficiencies and reduced grievance redressal. Example: Schemes like PM-KISAN and PM Awas Yojana bypass Panchayats, causing delays in identifying genuine beneficiaries and addressing local concerns.

- Neglect of Rural Infrastructure and Public Services: Panchayats’ inability to raise resources has led to poor maintenance of rural roads, sanitation, and drinking water supply. Example: Many village schools and health centres remain understaffed due to a lack of funds and decision-making power at the Panchayat level.

- Increased Rural-Urban Migration: The failure to create employment and sustainable livelihoods in villages forces rural youth to migrate to cities for work. Example: States like Bihar and Uttar Pradesh witness high rural-to-urban migration as Panchayats are unable to promote local skill development and job creation.

- Weakened Local Decision-Making and Planning: Panchayats struggle to implement need-based development projects due to limited autonomy and lack of funds. Example: In many states, Gram Panchayats cannot initiate independent infrastructure projects like rural roads or drinking water facilities without state approval.

- Reduced Grassroots Participation in Governance: Declining public engagement weakens democratic processes, reducing local accountability and effective implementation of schemes. Example: Many village-level meetings (Gram Sabhas) see low attendance, leading to top-down decision-making that may not reflect local priorities.

What steps can be taken to revive and strengthen the Panchayati Raj system?

- Greater Devolution of Powers and Functions: State governments should fully implement the Eleventh Schedule by transferring all 29 subjects to Panchayats. Example: Kerala’s People’s Plan Campaign empowered Panchayats with financial and planning autonomy, leading to better local governance.

- Enhancing Financial Autonomy: Increase untied grants from Finance Commissions to Panchayats and allow them to generate local revenue through taxes and fees. Example: Maharashtra has successfully implemented property tax collection at the Gram Panchayat level to fund local development.

- Strengthening Administrative Capacity: Appoint dedicated local-level bureaucrats and improve digital governance tools for efficient service delivery. Example: Karnataka’s Gram Swaraj Project uses IT-based platforms to improve transparency and monitoring of Panchayat activities.

- Encouraging Citizen Participation and Accountability: Regular and active Gram Sabha meetings should be mandated for community involvement in decision-making. Example: In Rajasthan, social audits of MGNREGA work through Gram Sabhas have improved transparency and reduced corruption.

- Expanding Panchayats’ Role in Emerging Areas: Panchayats should be given new responsibilities in areas like water conservation, renewable energy, and disaster management. Example: Gujarat’s Mission Mangalam engaged Panchayats in women-led SHGs to promote local entrepreneurship and sustainable rural development.

Way forward:

- Comprehensive Devolution and Strengthening Autonomy – Ensure full transfer of subjects under the Eleventh Schedule, increase untied grants, and empower Panchayats with independent revenue-generating mechanisms to enhance self-governance.

- Capacity Building and Community Engagement – Improve Panchayat administration through digital tools, dedicated local bureaucrats, and mandated Gram Sabha participation to enhance transparency, accountability, and grassroots governance.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Panchayat Devolution Index report released

From UPSC perspective, the following things are important :

Mains level: Panchayati Raj-related issues;

Why in the News?

The Ministry of Panchayati Raj released a report in Delhi on Thursday about how powers are given to Panchayats in different states. The report ranks states and UTs based on six key areas.

What are the Key Highlights of the Report?

- Devolution Index: The report ranks states and Union Territories (UTs) based on six dimensions: Framework, Functions, Finances, Functionaries, Capacity Enhancement, and Accountability.

- The overall devolution has increased from 39.9% to 43.9% between 2013-14 and 2021-22.

- Top Performing States: The top five states in the devolution ranking are Karnataka, Kerala, Tamil Nadu, Maharashtra, and Uttar Pradesh. Notably, Uttar Pradesh improved its rank significantly due to enhanced accountability measures.

- Uttar Pradesh made a significant jump from 15th to 5th place, highlighting governance reforms and accountability measures.

- Capacity Building & Infrastructure Growth: The Rashtriya Gram Swaraj Abhiyan (RGSA) played a crucial role in increasing the capacity enhancement index from 44% to 54.6%, along with improved Panchayat infrastructure (office buildings, internet connectivity, etc.).

- Significant Progress in Functionaries: The percentage of functionaries assigned to Panchayats increased from 39.6% to 50.9%, indicating efforts in recruitment and personnel strengthening.

What are the Major concerns in effective Devolution?

- Election Management: State Election Commissions (SECs) sometimes consult with state governments on election dates, leading to potential delays or political manipulation.

- Example: In Maharashtra, Panchayat elections were delayed in 2022 due to the state government’s interference

- Non-centrality of Panchayats: Panchayats operate in subjects designated for them in the eleventh schedule but face challenges that undermine their constitutional mandate.

- Example: In many states, rural development schemes like PMGSY (Pradhan Mantri Gram Sadak Yojana) are implemented by state departments rather than Gram Panchayats.

- Inadequate devolution of functions, funds, and functionaries: The devolution of functions, funds, and functionaries to PRIs has been inadequate, limiting their ability to effectively discharge their responsibilities.

- Example: In Jharkhand and Odisha, despite having legal provisions for devolution, Panchayats have limited control over education, health, and agriculture schemes.

- Lack of financial autonomy: PRIs don’t have enough financial independence since they mostly depend on irregular and inadequate grants from state governments.

- Example: In Uttar Pradesh, Gram Panchayats rely heavily on state grants for executing local projects.

- Lack of Support Staff: There is a severe lack of support staff and personnel in panchayats, such as secretaries, junior engineers, computer operators, and data entry operators, which affects their functioning and delivery of services by them.

- Example: In Bihar, several Gram Panchayats function with just one Panchayat Secretary managing multiple villages.

What are the recommendations in the report?

- Comprehensive Curriculum Development: Implementing a two-year course in Local Public Service Management that covers essential areas such as public systems, financial management, personnel management, law, and e-governance for Panchayat functionaries

- Enhance Capacity Building & Digital Governance: Improve digital infrastructure, training programs, and data-driven governance. Example: Telangana’s success in capacity enhancement highlights the importance of institutional strengthening for effective governance.

- Ensure Greater Transparency & Accountability: Implement real-time financial monitoring, social audits, and grievance redressal systems. Example: Uttar Pradesh’s leap in rankings is attributed to anti-corruption measures and a robust transparency framework.

Way forward:

- Strengthening Institutional Autonomy & Devolution: Ensure full devolution of functions, funds, and functionaries to Panchayati Raj Institutions (PRIs) with legal safeguards to prevent state interference. Example: Karnataka’s success in decentralized governance through direct fund transfers to Gram Panchayats.

- Capacity Building & Technology Integration: Expand digital infrastructure, conduct regular training for PRI members, and adopt real-time monitoring for transparency. Example: Telangana’s effective use of digital governance and capacity-building initiatives under the Rashtriya Gram Swaraj Abhiyan (RGSA).

Mains PYQ:

Q Assess the importance of the Panchayat system in India as a part of local government. Apart from government grants, what sources the Panchayats can look out for financing developmental projects? (UPSC IAS/2018)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Doctrine of Pith and Substance

From UPSC perspective, the following things are important :

Prelims level: Doctrine of Pith and Substance

Why in the News?

In a landmark ruling, the Supreme Court has reaffirmed the Doctrine of Pith and Substance, holding that the Centre cannot impose service tax on lottery distributors as the power to tax lotteries falls exclusively within the jurisdiction of state governments.

Why did the Supreme Court dismiss the Centre’s Plea?

- Lotteries Are Not a Service but Gambling: The court ruled that the relationship between states and lottery distributors is buyer-seller, not principal-agent, making service tax inapplicable.

- Exclusive Taxing Power of States: The Constitution grants state legislatures the authority to tax betting and gambling, including lotteries.

- Parliament cannot override this through residuary powers (Entry 97 – List I) as taxation on lotteries is already covered under Entry 62 – List II.

- Doctrine of Pith and Substance Applied: The court ruled that the dominant nature of lotteries is gambling, even if marketing and promotion involve service elements.

- Since the primary focus remains within the State List, the Centre cannot impose service tax on it.

- Sikkim High Court Ruling Upheld: The SC upheld the 2012 Sikkim HC decision, which declared Section 65(105) of the Finance Act, 1994 (as amended in 2010) unconstitutional, as it attempted to impose service tax on lottery-related activities.

What is Doctrine of Pith and Substance?

- The Doctrine of Pith and Substance helps determine whether a law’s dominant purpose falls within the legislative competence of the enacting government.

- Key Features:

-

- Examines the true nature of a law, rather than incidental overlaps.

- Resolves Centre-State conflicts over legislative powers.

- Allows minor encroachments if the primary subject falls within the legislature’s authority.

- Major Supreme Court Cases Applying the Doctrine:

-

- State of Bombay v. FN Balsara (1951): Upheld a state alcohol prohibition law, despite minor overlaps with Union subjects.

- Prafulla Kumar Mukherjee v. Bank of Commerce (1947): Allowed incidental encroachment as long as the law’s primary focus was within its jurisdiction.

- Application in Lottery Taxation Case:

-

- The Centre’s argument for taxing lotteries under Entry 97 – List I was rejected.

- The dominant purpose of lottery transactions is gambling, which states exclusively regulate and tax.

PYQ:[2016] The Parliament of India acquires the power to legislate on any item in the State List in the national interest if a resolution to that effect is passed by the: (a) Lok Sabha by a simple majority of its total membership (b) Lok Sabha by a majority of not less than two-thirds of its total membership (c) Rajya Sabha by a simple majority of its total membership (d) Rajya Sabha by a majority of not less than two thirds of its members present and voting |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Panchayat Se Parliament 2.0

From UPSC perspective, the following things are important :

Prelims level: Panchayat Se Parliament 2.0

Why in the News?

Lok Sabha Speaker Om Birla inaugurated “Panchayat Se Parliament 2.0” which seeks to give insight into the Constitution and parliamentary procedures to over 500 women representatives from Panchayati Raj institutions from across the country.

About “Panchayat Se Parliament”

- The second edition of the program was organized by the National Commission for Women (NCW) in collaboration with the Lok Sabha Secretariat and the Ministry of Tribal Affairs.

- The program brought together 502 elected women representatives from Scheduled Tribes, hailing from 22 states and Union Territories across India.

- Objectives: The primary objectives of Panchayat Se Parliament 2.0 were to:

- Empower women representatives by enhancing their understanding of constitutional provisions, parliamentary procedures, and governance frameworks.

- Recognize the contributions of women leaders in areas such as education, rural development, and community welfare.

- The first edition of the program, Panchayat Se Parliament 1.0, was held in January 2024.

- It involved over 500 women sarpanches from across India and was organized by the National Commission for Women (NCW) in collaboration with the Lok Sabha Secretariat.

About National Commission for Women (NCW)

|

PYQ:[2017] Is the National Commission for Women able to strategize and tackle the problems that women face at both public and private spheres? Give reasons in support of your answer. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

The missing spotlight on urban local government polls

From UPSC perspective, the following things are important :

Mains level: Challenges related to ULBs;

Why in the News?

The ongoing debate on simultaneous elections, commonly referred to as One Nation One Election (ONOE), presents a valuable opportunity to highlight a fundamental aspect of local democracy: the need for elections to Urban Local Governments (ULGs).

What is the Significance of Urban Local Government elections?

- Decentralized Governance: ULGs are crucial for decentralized self-governance, which is fundamental to democratic functioning at the grassroots level.

- Service Delivery: ULGs are responsible for delivering essential civic services such as water, sanitation, public health, and urban planning, which directly affect citizens’ quality of life.

- Local Democracy: Regular elections to ULGs ensure democratic legitimacy, enabling citizens to participate in the governance process at the local level and hold local representatives accountable.

- Economic and Social Impact: ULGs play a vital role in urban development, economic growth, and social well-being. As cities are responsible for a significant portion of the country’s GDP, well-governed local bodies contribute to national prosperity.

Why is Voter Turnout in Urban Local Elections Typically Lower?

- Lack of Awareness: Voter awareness regarding local elections is often lower than that for state or national elections, leading to reduced participation.

- Perceived Impact: Many voters feel that the impact of urban local elections is less significant compared to state or national elections, resulting in voter apathy.

- Political Disengagement: In many cases, urban residents may feel disconnected from local governance, especially when local issues are not perceived as urgent or when political campaigns do not adequately address them.

- Timing and Scheduling Issues: Elections to ULGs may be held at different times or not synchronized with other elections, causing confusion and disengagement.

- Voter Fatigue: Frequent elections at different levels may contribute to voter fatigue, lowering participation rates in local elections.

What reforms are necessary to enhance the effectiveness of urban local governments?

- Empower State Election Commissions (SECs): Strengthening SECs by granting them autonomy and resources for conducting timely and fair elections is essential. Currently, many SECs lack the authority to carry out ward delimitation effectively, which delays elections.

- Regular Elections: Ensuring that ULGs hold regular elections every five years is crucial. The recent acceptance of recommendations by the High-Level Committee (HLC) for synchronizing local body elections with state and national polls is a positive step in this direction.

- Decentralization of Powers: The 74th Constitutional Amendment aimed at decentralizing powers to ULGs; however, actual implementation has been inconsistent.

- Public Participation: Encouraging greater public involvement in decision-making processes will enhance transparency and accountability within ULGs. This can be achieved through community engagement initiatives and participatory budgeting processes.

Way forward:

- Strengthen Institutional Capacity and Autonomy: Empower State Election Commissions (SECs) with the necessary authority and resources to ensure timely and independent elections.

- Promote Public Engagement and Accountability: Encourage active public participation through initiatives like community engagement, participatory budgeting, and transparency in governance. This will improve the responsiveness of ULGs to citizen needs and foster stronger local democracy.

Mains PYQ:

Q The strength and sustenance of local institutions in India has shifted from their formative phase of ‘Functions, Functionaries and Funds’to the contemporary stage of ‘Functionality’. Highlightthe critical challenges faced by local institutions in terms of their functionality in recent times. (UPSC IAS/2020)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Special Gram Sabhas on Gandhi Jayanti

From UPSC perspective, the following things are important :

Prelims level: Gram Sabha

Why in the News?

The Ministry of Panchayati Raj is organizing special Gram Sabhas across 750 Gram Panchayats on 2nd October 2024, marking Gandhi Jayanti.

Vision to Achieve Gram Swaraj Through People’s Participation

Lal Bahadur Shastri’s Legacy

|

About Gram Sabha

| Details | |

| Role and Significance | • Centerpiece of the Panchayati Raj system • Responsible for village development and local governance |

| Constitutional Provision | • Defined under Article 243(b) of the Indian Constitution • Primary body in the Panchayati Raj system • A permanent body |

| Members | • Individuals above 18 years of age • Must be residing in the village • Listed in the electoral rolls |

| Meetings | • Must meet 2 to 4 times annually as per State Panchayat Raj Acts • Common meeting dates: 1. Republic Day (26th Jan) 2. Labour Day (1st May) 3. Independence Day (15th Aug) 4. Gandhi Jayanti (2nd Oct) • Panchayats may choose other dates for meetings |

| Organizing Body | • Organized by the Panchayat Secretary (Gram Sevak) • Done with approval of the Sarpanch |

| Conditions for Convening | • 10% of members or 50 people (whichever is greater) can request a meeting • A written request must be submitted 5 days prior to the meeting |

| Decision-Making Process | • All decisions of the Panchayat require the approval and validation of the Gram Sabha |

| Purpose | • Discuss local governance and development issues • Make need-based plans for the village |

PYQ:[2012] In the areas covered under the Panchayat (Extension to the Scheduled Areas) Act, 1996, what is the role/power of Gram Sabha?

Which of the statements given above is/are correct? (a) 1 only (b) 1 and 2 only (c) 2 and 3 only (d) 1, 2 and 3 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Moving the spotlight to grassroots democracy

From UPSC perspective, the following things are important :

Prelims level: 73rd and 74th amendments;

Mains level: Issue of Disempowerment of State Election Commissions (SECs);

Why in the News?

The Election Commission of India (ECI) has established itself as one of India’s most credible institutions, known for consistently conducting free, fair, and timely elections to Parliament and State legislatures. However, the 34 State Election Commissions (SECs) still require significant attention and strengthening.

Issue of Disempowerment of State Election Commissions (SECs)

The Constitution (73rd and 74th amendments) vested SECs with the responsibility of conducting elections to panchayats and urban local governments, but in reality, SECs are increasingly disempowered by state governments.

- Legal and Administrative Challenges: SECs sometimes find themselves in litigation with state governments. For instance, the Karnataka SEC has had to file contempt petitions against the state government for failing to fulfill commitments related to the conduct of elections, highlighting a lack of cooperation from state authorities.

- Inadequate Empowerment: Many SECs do not have the power to conduct delimitation of wards or manage the electoral rolls independently. This results in reliance on the Election Commission of India (ECI) and state governments, which can lead to arbitrary decisions that delay elections.

- Only 11 out of 34 states and UTs have empowered SECs to conduct ward delimitation, accounting for just 35% of India’s population.

- Lack of Resources: SECs are legally entitled to request funds and assistance from state governments, but they often do not receive adequate resources, which hampers their ability to conduct elections effectively.

- Public Trust Erosion: The delays and challenges faced by SECs undermine public confidence in local governance and electoral processes, leading to a perception that local elections are not as credible as those conducted by the ECI for national and state elections

- Election not on time: Performance audits by the CAG found that 70% of urban local governments in 18 states did not have elected councils at the time of the audit due to delays caused by disempowered SECs.

Electoral Reforms Needed to Strengthen the Third Tier

- Parity with the Election Commission of India: SECs should be made as transparent and independent as the Election Commission of India.

- This could be achieved by appointing a three-member SEC through a committee comprising the Chief Minister, Leader of Opposition, and Chief Justice of the High Court, rather than by the State government alone.

- Fixed Intervals for Delimitation: The delimitation of ward boundaries and reservations should be conducted at fixed intervals, such as every 10 years, to prevent arbitrary actions by State governments that delay elections.

- Transfer of Powers to SECs: The powers of delimitation and reservation of seats for local governments should be vested in the SECs. SECs should also handle reservations for positions like mayors and presidents to avoid delays caused by State governments.

Conclusion: Strengthening SECs through these reforms is essential to ensure timely, transparent, and credible local elections, thereby reinforcing grassroots democracy and public trust in local governance.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

What is the International Centre for Audit of Local Governance?

From UPSC perspective, the following things are important :

Prelims level: How will iCAL work?

Mains level: How are local bodies audited in India?

Why in the news?

On July 18, CAG Girish Chandra Murmu inaugurated the International Centre for Audit of Local Governance (iCAL) in Rajkot, marking India’s first institute to set global standards for auditing local governance.

How will iCAL work?

- iCAL will serve as a platform for policymakers, administrators, and auditors connected with local governments to enhance collaboration and share best practices.

- Objective: It aims to improve the independence and effectiveness of local government auditors through training, leadership development, and capacity-building initiatives.

- Significance: iCAL will act as a think tank for addressing governance issues at the grassroots level through interactive workshops, knowledge-sharing sessions, and peer exchanges.

How are local bodies audited in India?

- India has a three-tier system consisting of the Union government, state governments, and local bodies (both urban and rural).

- Local bodies like Panchayats and Urban Local Bodies (ULBs) are audited by various entities:

- State-level offices like the Examiner of Local Fund Accounts (ELFA)/Director of Local Fund Accounts (DLFA) audit the utilisation of state funds by local bodies.

- CAG conducts audits of all funds at the central and state levels, including those of local bodies. The CAG also advises and supports ELFA/DLFA.

Why was a need felt for it?

- Increased Funding and Need for Proper Auditing: With significant funds flowing to local bodies, there is a pressing need for improved auditing practices to ensure proper utilisation and financial management.

- Global Practices and Collaboration: There is a need to promote global good practices and institutionalised collaboration among supreme audit institutions (SAIs) to enhance local government audit practices and share best practices.

- Addressing Inefficiencies: Concerns have been raised about inefficiencies in local body financial management and reporting, as highlighted by the Reserve Bank of India’s 2022 report. iCAL aims to address these inefficiencies through better auditing practices and capacity building.

Way forward:

- Expand Capacity Building and Training Programs: Enhance iCAL’s focus on training and capacity-building for auditors and local government officials.

- Foster International Collaboration and Knowledge Sharing: Strengthen partnerships with global audit institutions and engage in knowledge exchange initiatives.

Mains PYQ:

Q In the absence of well – educated and organised local-level government systems, Panchayats and Samitis have remained mainly political institutions and not effective instruments of governance. Critically Discuss. (UPSC IAS/2015)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

How the PESA has boosted Forest Conservation in India?

From UPSC perspective, the following things are important :

Prelims level: PESA Act

Mains level: How PESA ensures Equitable Representation

Why in the News?

Conservation policies in India have long wrestled with dual conflicts: balancing conservation goals against local communities’ resource extraction needs, and reconciling conservation with the imperative of economic development.

Structural Mandate of Panchayat (Extension to Scheduled Areas) Act (PESA):

- PESA was passed in 1996 and it mandates local government councils in Scheduled Areas to reserve all chairperson positions and at least half of the seats for Scheduled Tribes (ST).

- This legislative framework is designed to empower marginalized communities by giving them a direct say in local governance and resource management.

Implementation in India:

- Unlike the 73rd Amendment (which applies to non-Scheduled Areas), PESA ensures mandated representation for STs in decision-making bodies.

- Variations in PESA implementation across states highlight challenges and successes in translating legislative intent into effective governance structures.

How it Ensures Equitable Representation:

- Impact on Forest Conservation: The study employs a “difference-in-differences” methodology to analyze the effect of PESA on forest cover. Findings indicate that areas with mandated ST representation under PESA experience lower rates of deforestation and higher afforestation rates compared to areas without such representation.

- Economic Incentives for Conservation: ST communities, dependent on forest resources for livelihoods, are incentivized to protect forest cover under PESA. This “forest stewardship” mechanism emerges as STs engage in sustainable practices and resist deforestation pressures driven by mining and commercial interests.

On Democratic Decentralization:

- Comparison with Administrative Decentralization: The paper distinguishes between administrative decentralization (focused on efficiency) and democratic decentralization. Democratic decentralization, as exemplified by PESA, emphasizes representative and accountable local governance structures with decision-making autonomy over resource management.

- Single Umbrella Institution: Advocates for consolidating power into a single, empowered institution that integrates both conservation and development objectives. Such an institution would better navigate the complexities of balancing local economic interests with sustainable conservation practices.

Conclusion: PESA serves as a critical example of how legislative mandates for political representation can drive positive environmental outcomes while addressing socio-economic disparities among forest-dwelling communities in India.

Mains PYQ:

Q What are the two major legal initiatives by the state since Independence, addressing discrimination against Scheduled Tribes (ST)? (UPSC IAS/2017)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

In news: Mayor’s Election

From UPSC perspective, the following things are important :

Prelims level: Mayor in ULBs, Powers and functions

Mains level: NA

Introduction

- The Supreme Court has nullified the outcome of the mayoral election held on January 30 in Chandigarh.

Who is a Mayor?

- In India, the mayor is the head of an urban local body, which is responsible for providing essential services and infrastructure to the residents of a city or town.

- The mayor is usually elected by the members of the Municipal Corporation or Council.

- He/She serves as the ceremonial head of the local government.

History of Mayor’s elections in India

- Municipal corporation mechanisms in India was introduced during British Rule with formation of municipal corporation in Madras (Chennai) in 1688, later followed by municipal corporations in Bombay (Mumbai) and Calcutta (Kolkata) by 1762.

- However the process of introduction for an elected President in the municipalities was made in Lord Mayo’s Resolution of 1870.

- Since then the current form and structure of municipal bodies followed is similar to Lord Ripon’s Resolution adopted in 1882 on local self-governance.

- The 74th Constitutional Amendment Act of 1992 was introduced providing for the transfer of 18 different powers to urban local bodies, including the election of a mayor and to recognise them which included Municipal Corporations, Nagar Panchayats, and Municipal Councils.

Elections and tenure

- The method of electing mayor and their tenure varies for each city in India.

- In Bengaluru (Karnataka) the election process is indirect with a tenure being for one year.

- In Mumbai (Maharashtra) it follows indirect elections with tenure for 2.5 years and Bhopal (Madhya Pradesh) follows a directly elected mayor with a term for 5 years.

Roles and Responsibilities

- Governs the local civic body.

- Fixed tenure varying in different towns.

- First citizen of city.

- Has two varied roles:

- Representation and upholding of the dignity of the city during ceremonial times and

- Presiding over discussions of the civic house with elected representatives in functional capacity.

- The Mayor’s role is confined to the corporation hall of presiding authority at various meetings relating to corporation.

- The Mayor’s role extends much beyond the local city and country as the presiding authority at corporation meetings during visits of a foreign dignitary to the city as he is invited by the state government to receive and represent the citizens to the guest of honour.

- At government, civic and other social functions he is given prominence.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Having panchayats as self-governing institutions

From UPSC perspective, the following things are important :

Prelims level: The 73rd and 74th Constitutional Amendments Acts

Mains level: Ensuring greater devolution of powers and responsibilities to lower tiers of panchayats

Central Idea:

The article discusses the progress and challenges of decentralization in India, focusing on the effectiveness of Panchayati Raj institutions in local governance. It highlights the limited success in revenue generation by these institutions despite constitutional provisions and emphasizes the need for greater efforts towards self-sufficiency.

Key Highlights:

- Background of Decentralization: The 73rd and 74th Constitutional Amendments Acts aimed to empower local bodies for self-governance, leading to the establishment of the Ministry of Panchayati Raj in 2004.

- Fiscal Devolution: The constitutional amendment outlined fiscal devolution details, including own revenue generation by panchayats. However, most revenue still comes from grants, with only 1% generated through taxes.

- Avenues for Revenue: The article lists various avenues for revenue generation by panchayats, including property tax, user charges, and innovative projects like rural business hubs and renewable energy initiatives.

- Role of Gram Sabhas: Gram sabhas play a crucial role in local development and revenue generation by leveraging local resources, engaging in planning, and imposing taxes for community welfare.

- Challenges: Despite potential avenues for revenue, panchayats face challenges such as a culture of dependency on grants, reluctance to impose taxes, and lack of authority in tax collection.

- Dependency Syndrome: The article discusses the prevalent “freebie culture” and the reluctance of elected representatives to impose taxes due to concerns about popularity.

Key Challenges:

- Overreliance on grants from central and state governments.

- Reluctance of elected representatives to impose taxes due to concerns about popularity.

- Lack of authority and capacity in tax collection by panchayats.

- Prevailing “freebie culture” hindering public willingness to pay taxes.

Main Terms:

- Decentralization: Transfer of authority and responsibility from central to local government.

- Panchayati Raj: System of local self-government in rural areas.

- Fiscal Devolution: Transfer of financial powers from central to local governments.

- Own Source of Revenue (OSR): Revenue generated by local bodies through taxes, fees, and other means.

- Gram Sabha: Village assembly responsible for local governance and decision-making.

Important Phrases for answer writing:

- “Decentralization initiatives”

- “Revenue generation efforts”

- “Own source of revenue”

- “Freebie culture”

- “Dependency syndrome”

Quotes for answer quality improvement:

- “Panchayats earn only 1% of the revenue through taxes.”

- “Gram sabhas have a significant role in fostering self-sufficiency and sustainable development.”

- “The dependency syndrome for grants has to be minimized.”

Useful Statements that can be used for essay:

- “Despite efforts towards decentralization, many panchayats still rely heavily on grants for revenue.”

- “Gram sabhas can play a pivotal role in promoting entrepreneurship and local development.”

- “There is a need to educate elected representatives and the public on the significance of revenue generation for panchayat development.”

Examples and References:

- The 73rd and 74th Constitutional Amendments Acts.

- Ministry of Panchayati Raj’s expert committee report on own source of revenue.

- Data highlighting the percentage of revenue generated by panchayats through taxes.

- Examples of successful revenue generation initiatives by panchayats, such as property tax and user charges.

Facts and Data for critical arguments in answer:

- Panchayats earn only 1% of revenue through taxes, with 80% from the Centre and 15% from the States.

- Allocation for rural local bodies increased significantly in recent Finance Commissions, reaching ₹2,80,733 crore in the 15th Finance Commission.

- Tax revenue collected by panchayats decreased from ₹3,12,075 lakh in 2018-19 to ₹2,71,386 lakh in 2021-2022.

Critical Analysis:

While constitutional amendments and expert committee reports have outlined mechanisms for fiscal devolution and revenue generation, there remains a significant gap between policy intent and implementation. Factors such as political reluctance, administrative capacity constraints, and societal attitudes towards taxation pose significant challenges to effective decentralization.

Way Forward:

- Strengthening capacity building initiatives for panchayats in tax administration and financial management.

- Encouraging public awareness campaigns to promote the importance of local revenue generation for sustainable development.

- Ensuring greater devolution of powers and responsibilities to lower tiers of panchayats.

- Exploring innovative revenue generation avenues such as public-private partnerships and leveraging local resources for economic development.

Improve your answer writing with us and crack the mains

Try to attempt following question and write the answer in comment box below

- “What are the various sources available for Panchayats to generate revenue, and how can these sources contribute to enhancing the financial autonomy and sustainability of Panchayati Raj institutions?”

- “What are the main challenges hindering the financial autonomy of Panchayati Raj?”

- “Why is financial autonomy crucial for the effective functioning of local governance?”

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

[pib] Panchayat Development Index (PDI)

From UPSC perspective, the following things are important :

Prelims level: Panchayat Development Index (PDI)

Mains level: Not Much

Central Idea

- The Ministry of Panchayati Raj is leading the effort to localize Sustainable Development Goals (SDGs) as part of the 2030 Agenda for Sustainable Development.

- A report on the Panchayat Development Index (PDI) has been released to evaluate the progress of grassroots institutions in achieving Localized SDGs (LSDGs).

About Panchayat Development Index (PDI)

- PDI is a comprehensive, multi-domain, and multi-sectoral index designed to assess the holistic development, performance, and progress of panchayats.

- It incorporates various socio-economic indicators to measure the well-being and development status of local communities under a panchayat’s jurisdiction.

- PDI is crucial for evaluating performance and tracking progress in the localization of Sustainable Development Goals in rural areas.

- The Index is based on a framework of local indicators encompassing nine themes related to sustainable development in villages.

Nine Themes of PDI

- Poverty-Free and Enhanced Livelihood in Village

- Healthy Village

- Child-Friendly Village

- Water-Sufficient Village

- Clean and Green Village

- Village with Self-Sufficient Infrastructure

- Socially Just and Secured Villages

- Village with Good Governance

- Women-Friendly Village

Ranking and Grading System

Panchayats are ranked based on their scores and categorized into four grades:

- Grade A+: Scores above 90%

- Grade A: Scores between 75-90%

- Grade B: Scores between 60-75%

- Grade C: Scores between 40-60%

- Grade D: Scores under 40%

Significance of the Panchayat Development Index

- Insightful Analysis: PDI provides critical insights into areas needing improvement in rural jurisdictions.

- Identifying Disparities: It helps in pinpointing disparities and the achievement of development goals.

- Policy Formulation: The Index aids in creating targeted policies and interventions to enhance the well-being and quality of life in rural communities.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

CAG of India writes: As our democracy matures, my role is becoming more vital

From UPSC perspective, the following things are important :

Prelims level: CAG

Mains level: Social Audit

Central idea

The article highlights the pivotal role of the Comptroller and Auditor General (CAG) in India’s democracy, emphasizing citizen engagement, social audits, and capacity building for local governance. It underscores challenges in finding skilled personnel and the imperative to ensure effective grassroots service delivery. The way forward involves an international center for local governance and online courses to address competency gaps.

Key Highlights:

- Role of CAG in Democracy: Comptroller and Auditor General (CAG) ensures transparency, accountability, and financial integrity. Maintains separation of powers and promotes good governance through audit findings.

- Citizen-Centric Approach: Emphasis on citizen engagement for better audit focus. Use of technology and digital solutions to enhance citizen involvement.

- Social Audit and Local Governance: Introduction of social audit as a tool for citizen oversight. Empowering Panchayati Raj Institutions (PRIs) and urban local bodies for grassroots participation.

- Capacity Building and Online Courses: Collaboration with Institute of Chartered Accountants for online courses. Aiming to create a pool of competent accountants for local governance.

Challenges:

- Competent Accountants Shortage: Difficulty in finding skilled accountants for local governments, especially in remote areas.

- Grassroots Service Delivery: Ensuring effective delivery of devolved functions at the grassroots level.

- Capacity Building Imperatives: The article highlights the necessity for robust capacity-building initiatives to overcome challenges and strengthen local self-governance.

Key Terms:

- Devolved Functions: Functions transferred to local governments for implementation.

- Audit Diwas: Day marking the commencement of registration for online courses on November 16, 2023.

Key Phrases:

- Citizen Oversight: Involving citizens in identifying high-risk areas for audit.

- Social Audit: Facilitating citizen engagement through regular audits and follow-up actions.

- Capacity Building: Strengthening local governance through training and online courses.

Analysis:

The article underscores the critical role of CAG in upholding democratic principles and the evolving strategies to enhance citizen engagement. It highlights challenges in local governance, emphasizing the need for skilled personnel and effective service delivery at the grassroots.

Key Facts/Data:

- The Mahatma Gandhi National Rural Employment Audit of Scheme Rules was notified in 2011 to facilitate social audits.

- The 73rd and 74th Constitutional amendments created a three-tier structure for rural self-governance.

Way Forward:

- International Centre for Local Governance: Establishing a center for excellence to enhance the capacity of local government auditors globally.

- Online Courses: Introducing online courses to address the shortage of competent accountants for local bodies.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

How technology can empower Indian citizens and re-energise local governance

From UPSC perspective, the following things are important :

Prelims level: Models and initiatives of e governance

Mains level: Role of technology in governance and specially for the effective decentralized governance

What is the news?

- Today the relationship between citizens and the state has drastically changed due to extensive penetration and use of technology. Citizens now have concrete channels to directly influence the state and vice versa. It is thus imperative to factor into the debate the three broad ways in which technology has impacted the citizen-state relationship.

Central idea

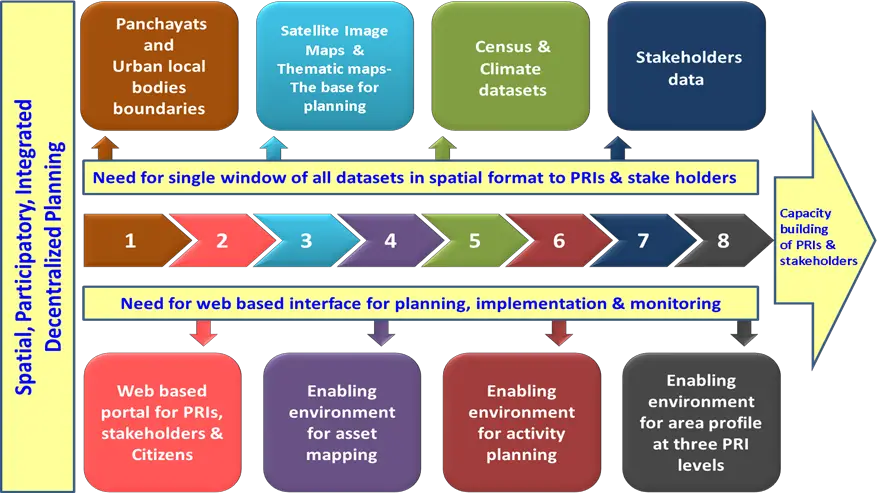

- India’s local governance system boasts an unparalleled scale, reach, and intent, with over 2.5 lakh gram panchayats, and more than 2,000 municipalities and municipal corporations. While some argue that the 73rd and 74th amendments of 1992 hold the key to realizing this potential, others contend that fundamental issues hinder their effective implementation. However, amidst this discussion, one crucial aspect that demands consideration is the rapidly evolving relationship between citizens and the state, primarily driven by technology.

Increasing role of technology in governance in India

- Improved Service Delivery: Technology enhances the delivery of public services through online portals and mobile applications. For example, the Government of India’s Digital India initiative provides services like online payment of utility bills, passport applications, and income tax filing through digital platforms.

- Transparency and Accountability: Technology promotes transparency by enabling the dissemination of information. Open data initiatives, such as India’s Open Government Data (OGD) Platform, provide access to government data on various sectors, promoting transparency and accountability.

- Citizen Engagement: Technology facilitates citizen participation through digital platforms. For instance, platforms like MyGov.in provide opportunities for citizens to engage in policy discussions, share ideas, and provide feedback to the government.

- Data-Driven Decision Making: Technology enables the collection, analysis, and utilization of data for evidence-based policy decisions. The Smart Cities Mission in India leverages data analytics to gather insights and make informed decisions for urban planning and development.

- E-Governance and Digital Transformation: Technology drives e-governance initiatives, streamlining administrative procedures. Examples include the online application and tracking system for services like obtaining a driving license or registering a business.

- Participatory Planning and Smart Cities: Technology supports participatory planning and the development of smart cities. The Pune Smart City initiative utilizes technology to engage citizens in urban planning through online platforms, enabling them to contribute ideas and suggestions.

- Digital Identity and Financial Inclusion: Technology establishes digital identity systems for secure access to financial services and government benefits. Aadhaar, India’s biometric-based digital identity system, enables individuals to avail subsidies and government schemes, promoting financial inclusion.

- Open Government and Collaboration: Technology facilitates open government initiatives and collaboration. Online platforms like India’s e-SamikSha enable government departments to collaborate, share information, and monitor the progress of government projects.

- Crisis Management and Emergency Response: Technology aids in real-time communication and coordination during crises. For instance, during natural disasters, mobile apps like the National Disaster Management Authority’s (NDMA) mobile app provide real-time alerts, emergency helplines, and rescue information.

- Capacity Building and Skill Development: Technology supports capacity building through e-learning platforms and online training programs. Initiatives like the National Digital Literacy Mission (NDLM) provide digital skills training to enable citizens to participate effectively in the digital governance era

Three broad ways in which technology has impacted the citizen-state relationship

- Breaking Communication Barriers through Social Media

- Communication Democratization: Social media platforms have democratized communication by providing accessible and widespread channels for citizens to engage with the state. Platforms like Facebook, Twitter, Instagram, and WhatsApp have enabled individuals from diverse backgrounds to connect, share information, and voice their concerns.

- Organization and Unity: Social media allows like-minded individuals to organize themselves, form communities, and present a united front on governance issues. It simplifies the process of mobilizing support, coordinating protests, and gathering signatures for petitions through platforms like Facebook groups, Twitter campaigns, and WhatsApp groups.

- Amplifying Public Grievances: Citizens can leverage social media platforms to amplify their voices and raise awareness about local issues. By sharing posts, tweets, and other content, individuals can draw attention to problems such as poor infrastructure, corruption, or inefficient services, ensuring a wider audience is reached.

- Structured Grievance Redressal: Recognizing the power of social media, state agencies have established structured systems to address public grievances raised on these platforms. Examples include the IRCTC’s active grievance redressal mechanism, the Chief Minister’s Office of Haryana seeking grievances on social media, and the Ministry of Consumer Affairs using a WhatsApp bot to receive citizen complaints.

- Access to Information: Social media has democratized access to information, empowering citizens with real-time updates, news, and developments related to governance issues. It allows individuals to share information, report on local issues, and hold authorities accountable, fostering transparency in decision-making processes.

- Citizen Engagement through Technological Adoption

- Accessibility and Inclusivity: Technology, particularly digital platforms and apps, has made citizen engagement more accessible and inclusive. Platforms like the MyGov App have allowed millions of citizens to provide inputs and feedback on government policies and programs, irrespective of their geographic location or socioeconomic status.

- Streamlined Communication Channels: Technology has simplified the process of citizen-state interaction. Dedicated channels, such as government apps and digital platforms, enable citizens to provide their inputs, raise concerns, and offer feedback with just a few clicks. This eliminates the need for traditional, time-consuming methods like writing letters or attending physical meetings.

- Improved Participation in Governance: Technology has expanded opportunities for citizen participation in governance processes. The use of video calls on platforms like WhatsApp for parent-teacher meetings in education departments allows parents to engage with teachers without having to take time off from work. This enhances participation and involvement of citizens in decision-making and service delivery.

- Enhanced Transparency and Accountability: By leveraging technology, state actors can gather real-time feedback and inputs from citizens, enabling more transparent and accountable governance. The Supreme Court and district courts conducting hearings through video conferencing and live streaming cases to the public exemplify this use of technology to ensure transparency and accountability.

- Collaboration with Local Entities: Technology has facilitated collaboration between state actors and local entities such as Resident Welfare Associations (RWAs). Startups like MyGate and ApnaComplex have supported RWAs in improving public engagement and facilitating two-way communication between citizens and local authorities. This collaborative approach ensures that citizen inputs are considered in the design and improvement of services.

- Democratization of Feedback: Through technology, citizens have the opportunity to provide feedback on government policies, programs, and service delivery. This direct engagement allows for a more inclusive and comprehensive understanding of citizens’ needs and aspirations, which can inform the decision-making process and lead to more citizen-centric governance.

- Open-Source Technology Empowering Citizens

- Openness and Accessibility: Open-source technology, such as Aadhaar, UPI, and CoWin, is built as publicly-owned digital infrastructure. The source code of these technologies is publicly available, allowing citizens to access and suggest improvements independently.

- Direct Influence on the State: With an active and engaged open-source community, citizens can exercise direct influence on the state through their contributions to digital public infrastructure. By actively participating in the development and improvement of these technologies, citizens can shape the direction and functionality of government systems, increasing their influence on governance.

- Democratization of Technology: Open-source technology democratizes access to technology by making it publicly available. Citizens can access the source code, suggest improvements, and contribute to the development process. This allows for a broader range of individuals, regardless of financial resources or technical expertise, to actively engage with and benefit from these technologies.

- Increasing Ease of Citizen Contribution: With advancements in artificial intelligence (AI) tools, citizen contributions to decentralized public governance systems (DPGs) are becoming easier. The article suggests that AI tools can facilitate citizens’ direct contribution to DPGs, enabling seamless integration of technology in local governance processes.

- Potential for Local Governance: Open-source technology holds the potential to transfer power into the hands of citizens, particularly at the local level. The article mentions how technology can be leveraged by grassroots leaders, such as sarpanchs, for efficient governance of their panchayats. Open-source technology empowers local leaders to utilize technology in decision-making, service delivery, and governance processes.

Conclusion

- Technology, including AI, plays a crucial role in the decentralization. It is essential to explore more effective models of grassroots governance that align with the information age. The time for pondering has passed; now is the time for action. It is imperative for policymakers, state actors, and citizens to harness the potential of technology and work together to realize the true spirit of decentralization.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Supreme Court asks NGO to move govt against Sarpanch-Patism

From UPSC perspective, the following things are important :

Prelims level: Read the attached story

Mains level: Proxy politicians

Central Idea

- The Supreme Court of India has stated that the government, rather than the judiciary, should address the issue of men exerting power behind elected women who remain “faceless wives and daughters-in-law” in grassroots politics.

- The court’s remarks came in response to a petition filed by an NGO which highlighted the phenomenon of unelected male relatives wielding political influence, undermining the spirit of women’s reservation in Panchayati Raj Institutions (PRIs).

Women in PRIs: Legal Aspects

(a) 73rd Constitutional Amendment Act, 1992:

- Mandates 33.3% reservation for women in PRIs across the country.

- Recognizes the Gram Sabha as the foundation of the Panchayat Raj System, empowering it to perform functions and exercise powers entrusted by the State Legislatures.

- Some states have increased the reservation to 50%, including Andhra Pradesh, Chhattisgarh, Gujarat, Himachal Pradesh, Bihar, etc.

- Out of the 30.41 lakh elected representatives in PRIs, 13.74 lakh (45.2%) are women.

(b) Article 15(3) of the Constitution:

- Empowers the State to make special provisions for women.

- Allows the government to introduce measures to ensure gender equality and promote the interests of women.

(c) Article 243D:

- Provides for the reservation of one-third of the total number of seats and offices of Chairpersons in PRIs for women.

- The reserved seats and offices are allocated through rotation to different constituencies within a Panchayat.

- These reservations for women are in addition to the reservations for Scheduled Castes (SCs) and Scheduled Tribes (STs) in all three tiers of PRIs.

(d) Intersectional Reservations:

- The reservation of seats and offices for women in PRIs also falls within the overall reservations for Scheduled Castes (SCs) and Scheduled Tribes (STs) in all three tiers of PRIs.

- This provision aims to address the intersecting disadvantages faced by women from marginalized communities.

(e) Proposed 110th Constitution Amendment Bill:

- Introduced in the Lok Sabha in 2009 to bring about 50% reservation for women in Panchayats across all states.

- The bill aimed to increase the reservation beyond the existing 33.3% mandated by the 73rd Amendment Act.

- Despite multiple tabled attempts, the bill was not passed into law.

Proxy Sarpanchs in India

- It is generally observed where an elected lady Sarpanch (the head of a Panchayat) delegates their powers and responsibilities to someone else, typically a family member or a trusted individual.

- This proxy then acts as a representative or substitute for the Sarpanch in carrying out their duties.

- Quite often, this delegation is forcefully acquired from women.

Reasons behind Panchayat Pati syndrome

- Gender Inequality: Deep-rooted gender inequalities prevalent in Indian society play a significant role in perpetuating the Panchayat Pati syndrome. Patriarchal norms and cultural beliefs that prioritize male authority and decision-making often restrict women’s agency and participation in public affairs.

- Social Norms and Expectations: Traditional gender roles and societal expectations define women’s primary role as homemakers and caretakers. This perception often results in women being considered unfit or inexperienced in matters of governance

- Lack of Awareness and Education: Limited access to education and awareness about women’s rights and the importance of their participation in local governance can contribute to the prevalence of Panchayat Pati. Lack of awareness among women themselves, as well as their families and communities, can lead to the perpetuation of discriminatory practices.

- Male Domination and Resistance to Change: Male dominance in politics and resistance to gender equality can also contribute to the Panchayat Pati syndrome.

- Political Dynamics and Power Struggles: In some cases, male family members or influential community leaders may strategically use the Panchayat Pati practice to retain power and influence. By controlling women’s decision-making, they can ensure their interests are protected and continue to exert control over the local governance processes.

Impact of Panchayat Pati syndrome

1. Economic Impact:

- The practice of Panchayat Pati limits the active participation of women in decision-making processes within the panchayat.

- This exclusion can hinder the effective utilization of resources and allocation of funds, potentially leading to suboptimal economic outcomes for the community.

- Women’s perspectives and needs may not be adequately represented, and projects or initiatives that could benefit women, such as those related to education, healthcare, or livelihood opportunities, may not receive sufficient attention or support.

2. Social Impact:

- Panchayat Pati reinforces gender inequalities and perpetuates traditional gender roles within communities.

- It hampers women’s ability to exercise agency and engage in community development activities. it diminishes their self-esteem and status within the community.

3. Political Impact:

- The practice of Panchayat Pati undermines the principles of democratic representation and participatory governance.

- It restricts the political agency of women and denies them the opportunity to actively contribute to decision-making processes.

- Women’s perspectives and priorities often differ from those of men, and their exclusion diminishes the diversity of voices and perspectives in local governance. This can lead to policy decisions that may not adequately address the needs and concerns of women and other marginalized groups.

Court’s Response

- Not an Executive Authority: The court acknowledged the issue but emphasized that it is not the role of the judiciary to create a spirit of empowerment.

- Focus on women empowerment: The court pointed out that preventing influential individuals’ wives from contesting elections is not feasible, and empowering women requires an evolutionary process.

- Government’s Responsibility: The court highlighted that the Ministry of Panchayati Raj should address the petitioner’s grievance and explore better mechanisms to implement the objectives of women’s reservation.

- Expert Committee and Support Mechanism: The petitioner suggested the formation of an expert committee and the provision of the right support mechanism for women. However, the court deemed this an unrealistic expectation from the judiciary.

Way forward

- Engage Men as Allies: Promote male allies in supporting women’s representation in PRIs. Encourage men to actively advocate for gender equality, challenge patriarchal norms, and work towards creating a more inclusive and equitable political environment.

- Capacity Building and Leadership Development: Provide training and capacity-building programs for women elected representatives in PRIs.

- Political Awareness and Participation: Conduct awareness campaigns to educate women about their rights, the importance of political participation, and the impact of their involvement in PRIs.

- Inter-Gender Dialogues: Organize inter-generational dialogues where older leaders and women can exchange knowledge, experiences, and perspectives. This can help bridge the generation gap, promote inter-generational collaboration, and strengthen the collective power of women in PRIs.

Conclusion

- It is the responsibility of the executive authority to find suitable solutions and ensure the effective implementation of women’s reservations in panchayat governance.

Mains Mark enhancer: Successful Women Sarpanch in India

- Kali Bein Panchayat, Punjab: Kali Bein Panchayat in Punjab gained recognition for its all-women panchayat led by Sarpanch Bibi Jagir Kaur. Under her leadership, the panchayat focused on various development initiatives, including infrastructure development, water conservation, and women empowerment programs.

- Mawlynnong, Meghalaya: Mawlynnong, a village in Meghalaya, is known for its clean and well-maintained environment. The village achieved this feat under the leadership of women panchayat leaders who implemented strict cleanliness and waste management measures, making it one of the cleanest villages in Asia.

- Devdungri, Rajasthan: Devdungri village in Rajasthan is an exemplary case of women’s leadership in panchayats. Women panchayat members successfully implemented initiatives to address issues such as child marriage, female foeticide, and women’s education. Their efforts resulted in significant positive changes in the community.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

What is PESA Act?

From UPSC perspective, the following things are important :

Prelims level: PESA Act

Mains level: Not Much

A Political Party has declared a six-point “guarantee” for tribals in Gujarat’s Chhota Udepur district, including the “strict implementation” of The Panchayats (Extension to the Scheduled Areas) Act (PESA Act).

What is PESA Act?

- The PESA Act was enacted in 1996 to provide for the extension of the provisions of Part IX of the Constitution relating to the Panchayats to the Scheduled Areas.

- Other than Panchayats, Part IX, comprising Articles 243-243ZT of the Constitution, contains provisions relating to Municipalities and Cooperative Societies.

- Under the PESA Act, Scheduled Areas are those referred to in Article 244(1), which says that the provisions of the Fifth Schedule shall apply to the Scheduled Areas and Scheduled Tribes in states other than Assam, Meghalaya, Tripura, and Mizoram.

- The Fifth Schedule provides for a range of special provisions for these areas.

How is the PESA Act, 1996 supposed to work?

- The PESA Act was enacted to ensure self-governance through Gram Sabhas (village assemblies) for people living in the Scheduled Areas.

- It recognises the right of tribal communities to govern themselves through their own systems of self-government, and also acknowledges their traditional rights over natural resources.

- In pursuance of this objective, the Act empowers Gram Sabhas to play a key role in approving development plans and controlling all social sectors.

Special powers accorded by PESA Act includes the:

- Processes and personnel who implement policies

- Exercising control over minor (non-timber) forest resources

- Minor water bodies and minor minerals

- Managing local markets

- Preventing land alienation and

- Regulating intoxicants among other things

States and PESA Act

- State governments are expected to amend their respective Panchayati Raj Acts without making any law that would be inconsistent with the mandate of PESA.

- Ten states — Andhra Pradesh, Chhattisgarh, Gujarat, Himachal Pradesh, Jharkhand, Madhya Pradesh, Maharashtra, Odisha, Rajasthan, and Telangana — have notified Fifth Schedule areas that cover partially or fully several districts in each of these states.

- After the PESA Act was enacted, the central Ministry of Panchayati Raj circulated model PESA Rules.

- So far, six states have notified these Rules, including Gujarat.

What is the issue in Gujarat?

- Gujarat notified the State PESA Rules in January 2017, and made them applicable in 4,503 gram sabhas under 2,584 village panchayats in 50 tribal talukas in eight districts of the state.

- The provisions of the law deem the Gram Sabhas as “most competent”.

- However, the Act has not been enforced in letter and spirit.

- The Act lays down that the state must conduct elections in such a way that the tribal representation is to be dominant in the Gram Sabha Committees.

- Yet again, there has been no attempt to proportionally increase the representation.

Try this PYQ:

Q.The Government enacted the Panchayat Extension to Scheduled Areas (PESA) Act in 1996. Which one of the following is not identified as its objective?

(a) To provide self-governance

(b) To recognize traditional rights

(c) To create autonomous regions in tribal areas

(d) To free tribal people from exploitation

Post your answers here.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Panchayati Raj Institutions: Issues and Challenges

Municipal finances

From UPSC perspective, the following things are important :

Prelims level: 74th Constitutional Amendment Act

Mains level: Paper 2- Municipal finances

Context

Recently, the Indian Institute for Human Settlements (IIHS) analysed data from 80 urban local bodies (ULBs) across 24 States between 2012-13 and 2016-17 to understand ULB finance and spending, and found some key trends.

Health of municipal finances

- The 74th Constitution Amendment Act was passed in 1992 mandating the setting up and devolution of powers to urban local bodies (ULBs) as the lowest unit of governance in cities and towns.

- Constitutional provisions were made for ULBs’ fiscal empowerment.

- Challenges in fiscal empowerment: Three decades since, growing fiscal deficits, constraints in tax base expansion, and weakening of institutional mechanisms that enable resource mobilisation remain challenges.

- Revenue losses after implementation of the Goods and Services Tax (GST) and the pandemic have exacerbated the situation.

Analysing the trends in municipal finances

Recently, the Indian Institute for Human Settlements (IIHS) analysed data from 80 ULBs across 24 States between 2012-13 and 2016-17 to understand ULB finance and spending, and found some key trends.

1] Own sources of revenue less than half of total revenue

- Key sources of revenue: The ULBs’ key revenue sources are taxes, fees, fines and charges, and transfers from Central and State governments, which are known as inter-governmental transfers (IGTs).