Differentiated Banks – Payment Banks, Small Finance Banks, etc.

What is Merchant Discount Rate (MDR)?

Why in the News?

The Finance Ministry has firmly denied recent online rumours suggesting that the government is planning to impose Merchant Discount Rate (MDR) charges on UPI transactions.

About Merchant Discount Rate (MDR):

- Overview: MDR refers to the fee charged to merchants by banks or payment service providers for processing digital payments made via credit cards, debit cards or other digital modes.

- Purpose: It serves to compensate multiple stakeholders involved in a digital transaction, including the issuing bank, acquiring bank, payment gateway, and network operator.

- Fee Structure: MDR is typically calculated as a percentage of the total transaction amount, usually ranging from 1% to 3%, depending on the transaction and merchant type.

- RBI Regulation: The Reserve Bank of India (RBI) regulates MDR, and merchants are NOT permitted to pass this fee onto customers.

- Discontinuation: To promote cashless payments, the government waived MDR on UPI and RuPay card transactions in 2020, benefiting small merchants and consumers.

How does it work?

- Transaction Flow: When a customer pays digitally, the payment amount is credited to the merchant’s account after deducting the MDR fee.

- Example: If a customer pays ₹1,000 and the MDR is 2%, the merchant receives ₹980, while the remaining ₹20 is distributed among the banks and service providers.

- Automatic Deduction: The MDR amount is automatically deducted by the settlement system at the time of transaction processing.

- Variable Rates: The MDR rate may vary depending on factors such as the type of card used, nature of business, monthly transaction volume, and average transaction value.

- Merchant Agreements: Merchants are required to sign MDR agreements with their payment service providers before they begin accepting digital payments.

- Operational Cost: MDR is treated as a part of the merchant’s operational costs when offering customers the convenience of digital payment options.

| [UPSC 2017] Which one of the following best describes the term “Merchant Discount Rate” sometimes seen in news?

Options: (a) The incentive given by a bank to a merchant for accepting payments through debit cards pertaining to that bank. (b) The amount paid back by banks to their customers when they use debit cards for financial transactions for purchasing goods or services. (c) The charge to a merchant by a bank for accepting payments from his customers through the bank’s debit cards. * (d) The incentive given by the Government to merchants for promoting digital payments by their customers through Point of Sale (PoS) machines and debit cards. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Differentiated Banks – Payment Banks, Small Finance Banks, etc.

What are Digital Banking Units (DBU)?

Why in the News?

In October 2022, 75 Digital Banking Units were launched across remote districts to commemorate India’s 75th Independence Day, but their momentum has declined from past 2 years.

About Digital Banking Units (DBUs):

- DBUs are specialized, fixed-location banking hubs designed to deliver a wide range of digital financial services using modern infrastructure.

- They operate in both self-service and assisted modes, offering customers 24/7 access to banking in a paperless, secure, and cost-effective environment.

- The RBI permits commercial banks with digital banking experience to establish DBUs in Tier I to Tier VI cities, without prior approval unless restricted.

- RRBs, payment banks, and local area banks are not eligible.

- In October 2022, as part of India’s 75th independence anniversary, 75 DBUs were launched across 75 remote districts to promote financial inclusion and bring banking services closer to citizens in semi-urban and rural areas.

Services and Features:

- DBUs offer digital services such as account opening, internet and mobile banking kits, debit and credit card applications, and UPI QR-based merchant solutions.

- Customers can apply online for retail loans, MSME loans, and government-sponsored schemes, with the entire process—from application to disbursal—handled digitally.

- Each DBU operates independently from existing branches and must follow RBI guidelines, including housing in separate premises with automated-only cash services.

- They are equipped with interactive teller machines, cash recyclers, document upload systems, and video KYC facilities.

- A senior bank executive is appointed as Chief Operating Officer (COO) to manage each unit.

Benefits Offered:

- DBUs offer a convenient, paperless banking experience, reducing the need to visit traditional branches.

- They support inclusive banking by expanding access to financial services in underserved regions.

- Customers in remote areas benefit from both automated and assisted service options.

- For banks, DBUs help optimize costs while improving service delivery and outreach.

| [UPSC 2024] Consider the following statements in respect of the digital rupee:

1. It is a sovereign currency issued by the Reserve Bank of India (RBI) in alignment with its monetary policy. 2. It appears as a liability on the RBI’s balance sheet. 3. It is insured against inflation by its very design. 4. It is freely convertible against commercial bank money and cash. Which of the statements given above are correct? Options: (a) 1 and 2 only (b) 1 and 3 only (c) 2 and 4 only (d) 1, 2 and 4* |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Differentiated Banks – Payment Banks, Small Finance Banks, etc.

NPCI Launches BHIM 3.0 with Enhanced Features

From UPSC perspective, the following things are important :

Prelims level: BHIM 3.0

Why in the News?

NPCI BHIM Services Ltd. (NBSL), a subsidiary of the National Payments Corporation of India (NPCI), launched BHIM 3.0 with new features aimed at enhancing the user experience and providing new offerings for businesses and banks.

About BHIM (Bharat Interface for Money):

- BHIM is a mobile payment app developed by NPCI, based on the Unified Payments Interface (UPI), aimed at promoting cashless transactions and digital payments directly through banks.

- Launched on December 30, 2016, BHIM facilitates instant money transfers between over 170 member banks using IMPS infrastructure.

- Unlike mobile wallets, BHIM transfers money directly between bank accounts, ensuring quick transactions at any time, including holidays.

- BHIM now supports Aadhaar-based authentication for easier digital payments.

- BHIM is available in more than 20 Indian languages and is designed to work effectively in areas with low or unstable internet connectivity.

- BHIM employs a robust three-factor authentication (3FA) process to ensure the security of transactions:

-

- Device ID and Mobile Number: The app binds with the user’s device ID and mobile number to verify the device.

- Bank Account Link: Users must sync their bank account (UPI-enabled or non-UPI-enabled) to the app for transactions.

- UPI PIN: A unique UPI PIN is required for completing transactions, which adds an extra layer of security.

- NPCI does not charge any fee for transactions between ₹1 and ₹100,000.

- Banks may charge fees for UPI or IMPS transfers, but there is no official information on BHIM-specific charges.

Key Features of BHIM 3.0

- Split Expenses: Users can now divide bills for shared expenses (e.g., rent, dining, group purchases) and settle payments instantly.

- Family Mode: Users can onboard family members, track shared expenses, and assign specific payments for better financial management.

- Spends Analytics: A new dashboard provides a detailed breakdown of monthly expenses, automatically categorizing them for easier budgeting.

- Action Needed Alerts: BHIM 3.0 includes reminders for pending bills, activation of UPI Lite, and low Lite balance alerts to help users stay updated.

- BHIM Vega: This feature allows merchants to accept in-app payments directly within the BHIM app, streamlining transactions without needing third-party apps.

| [UPSC 2018] With reference to digital payments, consider the following statements:

1.BHIM app allows the user to transfer money to anyone with a UPI-enabled bank account. 2. While a chip-pin debit card has four factors of authentication, BHIM app has only two factors of authentication. Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Payment Banks are the new stripped-down type of banks, which are expected to reach customers mainly through their mobile phones rather than traditional bank branches. They are expected to increase the financial inclusion in the country by providing banking services to the people who are currently out of the reach of banking services.

source

- Features of Payment Banks

- Why these Banks were set up?

- Requirements for payment banks

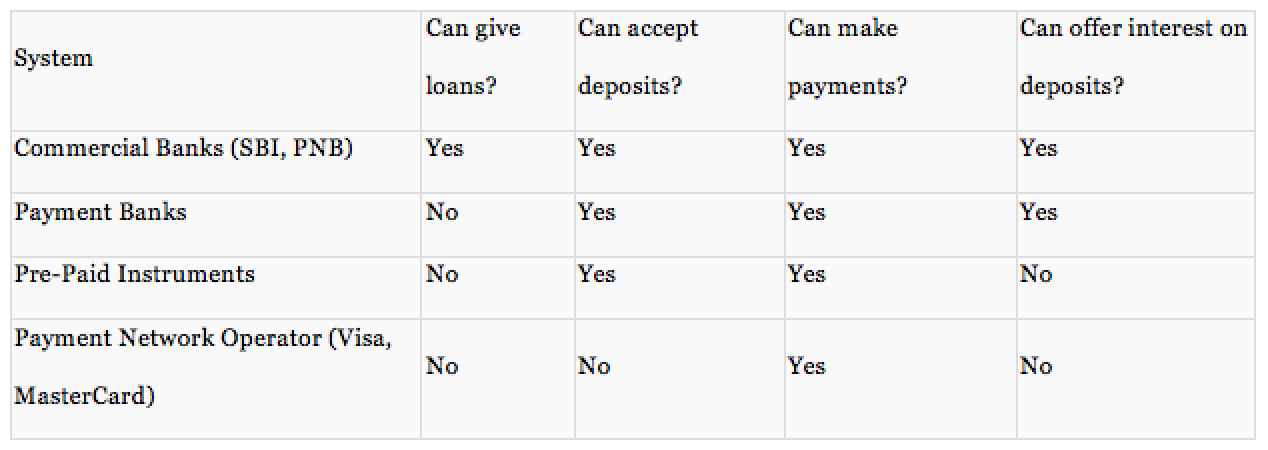

- Major difference between the payment banks, PPI and Commercial banks

- Approved payment banks in India

- Why does India need payment banks when we already have so many PSB?

- How these Payment Banks Will Survive, when they cannot lend?

- How can we make Payment Banks Viable?

- Way ahead

Features of Payment Banks

- Payments Banks can accept demand deposits (only current account and savings accounts) with a ceiling limit of Rs.1 lakh per customer.

- Payment Banks will pay interest at the rate notified by the RBI.

- Payment Banks can issue Debit Cards but not credit cards.

- Payment Banks cannot engage in lending services i.e. they cannot give loans, thus phasing out the fear of NPA.

- The Deposit up to Rs.1 lakh is insured by the DICGC (Deposit Insurance and Credit Guarantee Corporation), same as in bank accounts.

- Payment banks cannot involve in any credit risk and can only invest in less than one year G-Secs or treasury bills.

- Payment Banks will charge a fee as commission. This will be the sole earning for the banks.

- Payment bank will also have to maintain CRR (Cash reserve ratio) just like other Scheduled commercial banks (SBI, PNB, BoB, Dena, ICICI etc)

source

What’s the need for Payment banking in India?

- The goal behind creating these payment banks is to bring about financial inclusion, by making it easier for anyone to get a bank account. That’s also why the cash limit in the accounts is set to just Rs. 1 lakh.

- The Reserve Bank expects payment banks to target India’s migrant labourers, low-income households and small businesses, offering savings accounts and remittance services with a low transaction cost.

- These banks will enable poorer citizens who transact only in cash to take their first step into formal banking. The innovation is also expected to accelerate India’s journey into a cashless economy.

Approved payment banks in India

source

How will these banks will survive, when they cannot lend?

The questions are being raised as to how these new banks will be able to survive in absence of income from lending.

- The payments banks are expected to bring in to their fold millions of customers who are currently not within the fold of the formal financial system. This would lead to large volumes of transactions fetching the payments banks fees – a charge of even 1 or 2 per cent on a large volume can be lucrative on normal cash transfers, which will include government’s direct benefits transfer programmes.

- Moreover, new payments banks can also earn 7.0% or so on their investments in government securities.

- With no need for any provisions or losses on NPAs for these payment banks, they may become fitter banks than existing banks.

How can we make Payment Banks viable?

- Payment Banks will need to be more like these innovative consumer products businesses (particularly digital businesses).

- Digital technology, coupled with a rigorous approach to user interface/user experience and an asset-light strategy, making good use of cloud-based services, will play an important role in enabling Payment Banks to develop simple solutions and acquire customers at low marginal cost.

- The success of payment banks will depend on low-cost technology and high volume of transactions so that charges are reasonable and yet, profits are made.

- If the model is to be a success, a payment bank should neither offer fixed-deposit products nor savings bank accounts.

- Payment banks should offer small-ticket loan products because these products are required in rural areas, as these will discourage borrowers from approaching local moneylenders.

- If payments banks aren’t mandated to have a capital adequacy ratio, it will provide them relief.

- RBI should also reconsider an entry capital of Rs 100 crore for smaller banks, since such low entry-capital requirement may let non-serious players to throw their hat in the ring. This will also help weed out non-serious players from the bank licence fray.

Way ahead

The concept of new payments bank is compelling as it opens another route for inclusive banking. While time will tell how successful this model will be in incremental terms, the RBI on its part has given permission to probably the best players who are capable of making this a reality.

References: