Issues related to Economic growth

Why India should invest in mining

From UPSC perspective, the following things are important :

Prelims level: Hindu Kush region

Mains level: mineral wealth

Central idea

The article highlights India’s opportunity in the emerging critical minerals market in Afghanistan’s Hindu Kush, emphasizing responsible mining amidst environmental considerations. It connects this opportunity to the global shift towards electric mobility, with the potential for job creation.

Key Highlights:

- Afghanistan’s Riches: The Hindu Kush region in Afghanistan holds minerals worth a trillion dollars, a potential game-changer.

- Mobility Shift: Global movement from oil to electric vehicles is escalating demand for critical minerals.

- Indian Opportunity: Geological hints suggest the possibility of similar mineral wealth in the northern Indian side of the Hindu Kush range.

- Untapped Potential: India, with vast unexplored land and advancements in deep-sea mining, may have undiscovered mineral riches.

Challenges:

- Governance and Environmental Concerns: Past issues highlight the need for robust laws to balance environmental concerns with job creation.

- Political Tensions: Historical discord between the central government and Congress on mining needs resolution for cohesive policies.

- Legislative Balance: Striking a balance between ecological conservation and job creation requires nuanced legislation.

- Private Sector Role: Private sector involvement is crucial for capital-intensive mining, demanding careful governance.

Key Phrases for value addition:

- “Afghanistan: Saudi Arabia of lithium” emphasizes the potential of the Hindu Kush region.

- “Transition from oil to electric mobility” underlines the global shift and increasing demand for critical minerals.

- “New Middle East: Hindu Kush mountain range” positions the region as a significant player in the emerging critical minerals market.

- “Global critical minerals race” highlights the competitive dynamics in securing these resources worldwide.

Analysis:

- Global Shift: The global transition to electric mobility is a key driver behind the soaring demand for critical minerals.

- Indian Potential: India, with its untapped resources, is poised to benefit from the increasing global demand for minerals.

- Balancing Act: Striking a balance between environmental conservation and job creation is essential for sustainable mining practices.

- Private Sector Significance: In the capital-intensive mining sector, the private sector’s involvement is crucial for efficiency and technological advancements.

Key Data:

- Trillion-Dollar Potential: Afghanistan’s Hindu Kush region is estimated to hold minerals worth a trillion dollars.

- Geological Reports: Reports suggest the possibility of untapped mineral deposits in the northern Indian side of the Hindu Kush range.

- Exploration Status: Less than 10% of India’s landmass has been explored, with only 2% mined.

Way Forward:

- Legislation: Enforcing robust environmental, labor, and land laws is crucial for responsible and sustainable mining.

- Private Exploration: Encouraging large-scale private exploration for critical minerals is vital for efficiency and technological advancements.

- Deep-Sea Prospects: Leveraging emerging deep-sea mining technologies can open new avenues for resource exploration.

- Balance Priority: Striking a balance between environmental conservation and job creation should be a priority in future mining policies.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Issues related to Economic growth

Propelling India’s development the right way

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: India’s development strategies, misses, challenges and way forward

What’s the news?

- The op-ed acknowledges India’s technological achievements, emphasizing the need to revive state support, particularly in emerging sectors. It underscores the urgency of addressing persistent inequalities and promoting inclusive economic growth for a more prosperous future.

Central idea

- Aim for the moon is often synonymous with bold ambition, verging on recklessness. India’s foray into space research in the 1960s was initially met with skepticism, given its status as a young and struggling nation. Today, India boasts remarkable achievements in space exploration. However, these accomplishments raise a pertinent question: How do these feats align with the persistent poverty and destitution afflicting millions of Indians?

Historical Foundations of India’s Scientific and Technological Capabilities

- Indian Institutes of Technology (IITs): Between 1951 and 1961, India founded five Indian Institutes of Technology. These institutions rapidly gained global recognition as centers of academic excellence. They played a critical role in nurturing a talent pool of engineers and scientists who would later contribute to India’s technological advancements.

- Indian Institutes of Management (IIMs): In 1961, India inaugurated the first two Indian Institutes of Management. These institutions aimed to foster managerial talent, aligning with India’s broader goals of building expertise and human capital in various fields.

- Public Sector Units (PSUs): Throughout the 1950s and 1960s, India established numerous public sector units across diverse industrial sectors. These sectors included steel production, fertilizer manufacturing, machine tools, electric machinery, drug production, and petrochemicals. These PSUs not only bolstered industrialization but also served as vital testing grounds for emerging technologies.

India’s Moonshot Development Strategy

- The moonshot development strategy aimed to leverage modern industrialization to address developmental challenges.

- Early visionaries like Vikram Sarabhai envisioned satellite technology for nationwide communication, agricultural improvements, and healthcare education.

- Nevertheless, this approach faced criticism for its heavy reliance on public investment and the alleged misdirection of resources toward capital- and technology-intensive industries instead of labor-intensive sectors.

How have inequalities posed significant hurdles to India’s progress and development?

- Lack of Effective Government Intervention:

- India’s development strategy’s lackluster record was not due to excessive government emphasis on technology but rather because the government could not effectively address inequalities and ensure social development.

- One of the missed opportunities was the failure to implement a successful program of land redistribution.

- Ownership Disparities: Ownership of assets remains significantly low among socially oppressed communities, including Dalits and the Scheduled Caste (SC) population. This lack of asset ownership creates barriers to accessing education and economic opportunities.

- Education Underinvestment: India has consistently underinvested in basic education for the masses. This educational deficit further exacerbates inequalities and limits opportunities for those who are socioeconomically disadvantaged.

- Replicated Inequalities in the Labor Market: The historical inequalities in social and economic spheres translate into labor market disparities. Better-paying jobs tend to be concentrated among privileged groups with greater access to higher education, further deepening the divide.

- Employment Disparities: The data from the Periodic Labour Force Survey highlights significant disparities in employment. In 2021–22, a higher percentage of SC workers (38.2%) were engaged in casual employment, which often involves manual labor, compared to workers from other general category castes (11.2%).

- Contrast with East Asian Countries: East Asian countries like Japan and China implemented land reforms and other measures in the 1950s that created a relatively egalitarian social structure. This laid the foundation for progressive economic and social changes in the subsequent years.

- Impact on Industrial and Economic Growth: Inequalities have negatively impacted industrial and economic growth in India. The skewed domestic demand, driven by the upper-income classes, has hindered the growth of manufacturing sectors producing high-quality, mass-consumption goods like food products and garments.

- Narrow Social Base for Entrepreneurship: Entrepreneurship in India has emerged from a narrow social base, limiting the diversity and inclusivity of the entrepreneurial ecosystem.

Way forward

- Reinstate state support:

- India should recognize the strengths and weaknesses of its post-independence development strategy.

- The audacious attempt to build technological and industrial capabilities with generous state support was the right approach.

- India must reinstate such efforts, especially in rapidly growing economic sectors like semiconductors and biotechnology.

- Abandoning industrial policy in a globalized economy, as done after 1991, is a mistake, especially when countries like the United States and China actively support their industries.

- Make Economic Growth Inclusive:

- India needs to redouble efforts to ensure that economic growth is inclusive and broad-based.

- Access to education, particularly higher education, should be made accessible to all, including marginalized communities.

- Strengthen human and social capabilities:

- While technology has played a significant role in India’s development, it’s equally important to focus on building human and social capabilities.

- Empowering the billion-strong population with the skills and capabilities required for upward mobility is crucial.

- Achieving this would be equivalent to a significant leap in economic progress.

Conclusion

- India’s journey toward technological prowess should coexist with a commitment to alleviate inequality and ensure inclusive growth. A moonshot approach to development, grounded in state support for technological advancement, is imperative. By reconciling these objectives, India can pave the way for a prosperous and equitable future.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Issues related to Economic growth

How India can leverage its biggest strength?

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: India's demography: opportunity or disaster, challenges and priorities

Central Idea

- India’s greatest strength lies in its vast manpower. In the coming 25 years, the country has the potential to experience a golden era, provided it effectively utilizes its favorable demographic composition.

Relevance of the topic

The current population of India is 1,420,681,800, based on Worldometer elaboration of the latest United Nations data.

The growth is driven by India’s large, dynamic and young population, with 65% of Indians being under 35 years old.

However, one of the greatest challenges facing young India’s is unemployment. This raises core question is this an opportunity or demographic disaster

There is a need to create opportunities for the existing labour force and the new entrants into the labour market by improving their productivity.

India’s Demographic Advantage

- Young Workforce: India’s average age of 29 years, compared to countries like the US (38), China (38), France (42), Germany (45), and Japan (48), highlights its advantage of having a younger population, which can contribute to economic growth and productivity.

- Favorable Dependency Ratio: The projected old-age dependency ratios indicate India’s advantage in terms of a smaller proportion of the population requiring support from the working-age population. For instance, while India’s projected old-age dependency ratio is 37% in 2075, France is projected to have 55.8%, Japan 75.3%, the US 49.3%, the UK 53%, and Germany 63.1%.

- Rising Working-Age Population: India is currently in a phase where its working-age population is increasing, presenting a potential workforce that can drive economic growth and development for several decades.

- Potential for Labor Supply: With its large population and a growing workforce, India has the potential to become a significant source of labor supply for the rest of the world. This can attract investment and outsourcing opportunities, further boosting economic growth.

- Abundant Human Capital: India possesses a vast pool of educated and skilled individuals, which contributes to its human capital advantage. This workforce can drive innovation, productivity, and economic competitiveness across various sectors.

- Consumer Market: India’s large population provides a substantial domestic consumer market, offering significant opportunities for businesses to cater to the needs and demands of a vast consumer base, driving economic activity.

- Innovation and Entrepreneurship: The young and dynamic population in India fosters a culture of innovation and entrepreneurship, contributing to the development of new industries, technologies, and solutions, creating employment opportunities and driving economic progress.

- Potential for Economic Growth: By effectively utilizing its demographic advantage, India has the potential to achieve higher rates of economic growth and improve its standard of living.

- Global Competitiveness: A young and skilled labor force enhances India’s competitiveness in the global market, attracting foreign investment, promoting export-oriented industries, and positioning India as a preferred business and investment destination.

- Demographic Dividend: India’s favorable demographic composition presents the opportunity to unlock the demographic dividend, leading to accelerated economic growth and development through investments in education, skill development, healthcare, and employment opportunities.

Lessons learned from Asian success stories accordingly

- Harnessing the Demographic Dividend: Asian countries like China, Japan, South Korea, Malaysia, and Singapore have effectively utilized their favorable demographics to drive economic growth and development. India, with its young workforce, can learn from these examples and focus on maximizing the potential of its demographic dividend.

- Focus on Labor-Intensive Manufacturing: Asian success stories have demonstrated the importance of capitalizing on labor-intensive manufacturing sectors to create employment opportunities. India can prioritize these sectors, such as textiles, toys, footwear, auto components, and agricultural processing, to leverage its abundant labor force.

- Structural Transformations: Asian nations have undergone structural transformations by transitioning from labor-intensive industries to more advanced sectors. India can learn from these examples and emphasize technological advancements, innovation, and high-value manufacturing to sustain economic growth and enhance competitiveness.

- Investment in Infrastructure: Developing robust infrastructure is crucial for economic growth. Asian countries have recognized the significance of infrastructure development in reducing trade and transaction costs, improving connectivity, and attracting investments. India should focus on infrastructure development to support its economic growth objectives.

- Trade and Investment Facilitation: Asian success stories have implemented trade facilitation measures and pursued policies to attract foreign direct investment. India can learn from these experiences by adopting measures to facilitate trade, improve ease of doing business, and create a favorable investment climate.

- Support for MSMEs: Micro, Small, and Medium Enterprises (MSMEs) play a pivotal role in the manufacturing sector. Asian countries have provided support to MSMEs to enhance their competitiveness, scale, and integration into global supply chains. India can prioritize support for MSMEs to drive manufacturing growth and job creation.

- Emphasis on Skill Development: Asian success stories have recognized the importance of skill development in enhancing labor force productivity. India should invest in skilling initiatives, re-skilling, and up-skilling programs to improve employability and align the workforce with evolving industry demands.

- Quality Education and Healthcare: Asian nations have prioritized investments in quality education and healthcare. India can learn from these examples by focusing on improving access to quality education and healthcare services, which will contribute to a skilled workforce and a healthy labor force.

- Government Reforms and Policies: Asian success stories have been supported by proactive government reforms and policies. India should implement favorable policies related to labor laws, taxation, ease of doing business, and intellectual property rights to create an enabling environment for economic growth and entrepreneurship.

- Long-term Vision and Implementation: Asian countries that have achieved sustained success have demonstrated long-term vision and commitment to implementing policies and reforms. India should adopt a similar approach by formulating long-term strategies and ensuring consistent implementation to drive sustainable economic growth.

What India needs to capitalize on its demographic dividend?

- Skilling and Education: India needs to focus on skill development programs such as the Jan Shikshan Sansthan, the Pradhan Mantri Kaushal Vikas Yojana, and the National Apprenticeship Promotion Scheme. These programs have shown success in increasing human resource supply in various sectors. However, efforts should be made to upscale and improve the skills of the labor force, especially in the unorganized sector where underpaid jobs prevail.

- Job Creation and Employment Opportunities: India should prioritize sectors with high labor intensity, such as textiles, toys, footwear, auto components, sports goods, agricultural processing, restaurants, hotels, mining, construction, healthcare, and caregiving services. These sectors have significant potential for employment generation. Additionally, the focus should be on infrastructure development to reduce trade and transaction costs and create an environment conducive to doing business.

- Industry and Infrastructure Development: India should accelerate infrastructure development to support economic growth and enhance competitiveness. This includes investment in transportation, energy, digital connectivity, and other critical infrastructure sectors.

- Ease of Doing Business: To attract investments and promote entrepreneurship, India should continue its efforts to improve the ease of doing business by simplifying regulatory processes, reducing bureaucratic hurdles, and enhancing transparency.

- Social Security and Healthcare: India should work towards improving access to quality healthcare services and implementing robust social security programs. Measures like the Ayushman Bharat and Pradhan Mantri Bhartiya Janaushadhi Pariyojana mentioned in the article can help in achieving these goals.

- Government Reforms and Policies: Implementing favorable labor laws, rationalizing taxation systems, and providing policy stability are essential for creating an enabling environment for economic growth. There is importance of reforms such as the National Education Policy 2020, which aims to update knowledge and ensure productive employment opportunities.

Way Forward: Priority areas

- Improving Education Quality:

- India should prioritize the implementation of the National Education Policy 2020, which emphasizes knowledge updating and aims to provide inclusive, equitable, and quality education at all levels.

- Steps should be taken to address challenges such as non-functional schools, resistance to change, and inadequate resources.

- Providing access to quality education up to higher secondary levels for all is essential to create a productive labor force.

- Ensuring Quality Healthcare:

- The government should continue implementing initiatives like Ayushman Bharat and the Pradhan Mantri Bhartiya Janaushadhi Pariyojana to improve healthcare equity.

- Efforts should be made to make drug prices affordable and accessible, and steps should be taken to ensure financial medical protection, such as universal insurance and adequate medical infrastructure.

- Quality health infrastructure for all will contribute to a healthy and productive labor force.

- Accelerating Reforms for Future Success:

- India should accelerate the implementation of reforms and flagship programs to unlock its demographic dividend and drive economic growth.

- Streamlining bureaucratic processes, improving ease of doing business, and creating an investor-friendly environment are essential to attract investments and foster entrepreneurship.

- Additionally, continued infrastructure development, trade facilitation measures, and reforms in labor laws and taxation systems will support the growth of industries and enhance India’s competitiveness in the global market.

Conclusion

- India’s demographic dividend offers a unique opportunity for growth and development in the coming years. By prioritizing skill development, creating employment opportunities, enhancing productivity, ensuring access to quality healthcare and education, and implementing crucial reforms, India can fully harness its demographic advantage. The nation has the potential to become a global labor force supplier and secure a prosperous future.

Also read:

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Issues related to Economic growth

India’s Population Growth: Dividend or a Disaster?

From UPSC perspective, the following things are important :

Prelims level: India's population trends

Mains level: India's population growth analysis and a way ahead

Central Idea

- India’s projected transition as the most populous country from China by mid-2023 presents opportunities for demographic advantage, but also requires focusing on the available demographic dividend. The population growth, size, and composition must be viewed from an empirical and scientific perspective to understand whether it is a dividend or a disaster.

India’s Population Projection

- A UN report released on recently has provided the first official confirmation that India’s population is expected to surpass that of China by the middle of this year at the latest.

- The annual State of World Population report by the UN Population Fund (UNFPA) has pegged India’s mid-2023 population at 142.86 crore, marginally ahead of China’s 142.57 crore, which is 2.9 million higher than China’s population

What is State of World Population Report?

- The report is an annual report published by the United Nations Population Fund (UNFPA), which provides a global overview of population trends and issues.

- The report covers a wide range of topics related to the population, such as fertility, mortality, migration, family planning, and gender equality.

- It also includes analysis and recommendations for policymakers and governments to address population challenges and promote sustainable development.

- The report is widely regarded as a key reference for researchers, policymakers, and international organizations working on population and development issues.

How India’s Population growth can be a resource?

- A larger workforce: A growing population means a larger workforce, which, if trained and employed, can contribute to economic growth and development.

- Domestic market: A larger population can create a larger domestic market, which can drive economic growth by increasing demand for goods and services.

- Innovation and technological advancements: A larger population can provide a greater pool of knowledge and expertise, and a more diverse range of perspectives and ideas, which can lead to innovation and technological advancements.

- Investment in infrastructure: Population growth can create opportunities for investment in infrastructure, education, and health, which can further stimulate economic development.

- Cultural richness: A larger population can lead to cultural richness and diversity. With a diverse population comes a range of languages, traditions, and cultural practices, which can contribute to a vibrant and dynamic society.

- Diplomatic influence: A larger population can give a country greater diplomatic influence on the world stage. As one of the world’s most populous countries, India has significant diplomatic influence and can use its demographic size as a bargaining tool in international negotiations.

How India’s Population growth can be a Burden?

- Strain on resources: A growing population can put a strain on natural resources, such as water, food, and energy. This can lead to environmental degradation, scarcity, and conflict.

- Unemployment: A larger population can create a mismatch between the supply and demand of jobs, leading to high unemployment rates, particularly among young people

- Poverty: Population growth can exacerbate poverty, particularly in rural areas and among marginalized communities. This can create social and economic inequality and limit access to education, healthcare, and other basic needs.

- Overcrowding: A larger population can lead to overcrowding, particularly in urban areas. This can create poor living conditions, increased pollution, and health hazards.

- Infrastructure: A growing population can put a strain on infrastructure, such as transportation, housing, and sanitation. This can lead to inadequate services and poor living conditions.

- Health: A larger population can increase the spread of disease and illness, particularly in areas with poor healthcare infrastructure. This can lead to public health crises and decreased life expectancy.

- Education: Population growth can put a strain on education systems, particularly in terms of providing quality education to all. This can limit social and economic mobility and contribute to inequality.

- Migration: A larger population can lead to migration, particularly to urban areas, which can create social and economic challenges, such as increased crime rates and inequality.

Deeper outlook: Trends of population growth, size and composition

- Replacement level fertility: With total fertility rate of 2.0 in 2023, India is already at replacement level fertility, meaning two children replacing their parents. This indicates that the population is on a path toward stabilisation.

- Negative growth: India continues to experience positive growth, but in a decelerated mode until 2064, from which point it will become negative growth. The peak of India’s population size will be around 169.6 crore in 2063.

- Working age population: Looking at the population composition of India, there are greater prospects for demographic dividend than a disaster. With 68% of the working age population in 2023, the country continues to have a demographic window of opportunity for the next 35 years to reap an economic dividend

Facts for prelims

Fertility Decline

|

Mechanism to translate a demographic bonus to economic dividend

- There are four key mechanisms that translate a demographic bonus to economic dividend:

- Employment, 2. Education and skills, 3. Health conditions, and 4. Governance.

- Job creation, education, skills generation, and ensuring a healthy lifespan are important channels that translate demographic opportunity into economic gains.

- Good governance, reflected through conscientious policies, is another essential aspect for reaping demographic dividend.

Way ahead: India’s Demographic opportunity

- India’s relatively younger population provides higher support ratios, with lesser disease, disability, and caring burden.

- India has the potential to become a worldwide market for both production and consumption, with lower manufacturing costs due to a relatively cheaper workforce.

- Available demographic opportunity in the form of a greater share of the working age population has the potential to boost per capita GDP by an additional 43% by 2061.

- However, a total fertility rate of less than 1.8 may not be economically beneficial for India, and population control methods run the risk of inducing forced population aging.

Conclusion

- While India’s demographic transition presents opportunities for demographic advantage, it must focus on reaping the available demographic dividend. The composition of India’s population presents prospects for demographic dividends, but certain mechanisms must be employed to translate demographic opportunity into economic gains. Policies that support an enabling environment that can provide high-quality education, good healthcare, respectable employment opportunities, good infrastructure, and gender empowerment are essential.

Mains Question

Q. India is set to surpass China as the most populous country in the mid 2023. This presents India an opportunity and a challenge of population growth. Analyze and suggest a way ahead to harness the potential of its working age population.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Issues related to Economic growth

China plus one (C+1) strategy and advantage for India

From UPSC perspective, the following things are important :

Prelims level: C+1 strategy

Mains level: C+1 strategy and India's adavtages

Context

- In January 2023, India surpassed China to become the world’s most populous country with a population count of approximately 1.417 billion as against China’s 1.412 billion, as estimated by the World Population Review (WPR). This creates both opportunities and challenges for India.

Crack Prelims 2023! Talk to our Rankers

The global turmoil and China as enablers of the Indian growth story

- There are three factors that have enabled the Indian growth story.

- Overdependence on specific economies: If the pandemic had had one crucial lesson for the global economy, it must be reducing the overdependence on China-specific Global Value Chains (GVCs). As is evident from the pandemic, the subsequent Ukraine-Russia war or the recent disastrous COVID-19 surge in China the overdependence on specific economies is bound to have cascading effects on the world economy because of the macroeconomic shocks they produce.

- Glocalised models of economic partnerships: Countries now strive to strike the right balance between globalisation and localisation, through bilateral and multilateral platforms characterised by leveraging sub-regional comparative advantages. To a large extent, these emerging forms of glocalised models are also based on controlling Beijing’s political and economic prowess in the Indo-Pacific and beyond, where India plays an active role.

- Use of technology: There is no doubt that the pandemic has provided an uptick in the use of technology ranging from the provision of social security payments at the grassroots to government-level conferences.

China plus one (C+1) strategy

- The US-China trade war and the pandemic-induced supply chain disruptions emanating from China have indeed paved the way for many western corporates to consider a China Plus One (C+1) strategy.

- The strategy would entail diversifying investments from China to other countries, to mitigate the economic and geopolitical risks associated with the former.

- While many also hail Vietnam as another economy to be in the race of attracting investments fleeing China, India could be the potential frontrunner in the C+1 game.

Why makes India to surge ahead in C+1?

- India’s economic advancement: India has a demographic advantage over China, with a larger percentage of its population under 30. This young population is expected to drive consumption, savings, and investments, leading to India’s goal of a multi-trillion dollar economy.

- Low cost of labour is an advantage: India has a low cost of labor and other forms of capital, making production costs lower and increasing competitiveness in international markets. India’s labor cost is also half that of Vietnam, making it a strong player in electronics and semiconductor manufacturing.

- India’s heavy infrastructure investment: A heavy investment in physical infrastructure through the National Infrastructure Pipeline (NIP) is expected to reduce costs in manufacturing sectors and cut transportation time and costs by 20%. This is in contrast to China, where multiple companies handle different parts of the transportation process, increasing costs

- India’s conducive business environment: Recent policy interventions in India such as the Production Linked Incentive (PLI) scheme, tax reforms, liberalization of FDI policies, setting up of land pools and organizing business summits have helped attract investments to the domestic economy. These efforts, driven by the Make in India initiative, have also been supported by efforts to promote competitive federalism and reduce transaction costs of doing business.

- India’s digital advantage: India’s high internet penetration at 43% allows for digital skilling initiatives to bring returns across various economic sectors, particularly services. A combination of home-grown technologies and greater access to Google and Facebook, which are banned in China, gives Indian youth a digital edge.

- As English is the second language provides ease of communication: the prevalence of the English language skill set in the young Indian populace undoubtedly puts India ahead of China. As English is the second official language in the Indian states, it provides business executives with ease of communication in conducting business with North American and European clients.

- Well balanced economic partnerships: India’s economic partnerships are characterized by utilizing sub-regional comparative advantages and controlling Beijing’s political and economic power in the Indo-Pacific. India’s decision to not join the RCEP in 2020 to protect its domestic market and curb trade deficits sends a strong signal of its disassociation with Beijing in trade partnerships. The CEPA signed with the UAE in 2022 is expected to increase two-way trade to $100 billion in five years by opening access for Indian exporters to Arab and African markets.

- Dynamic Indian diplomacy: India has strengthened its economy through diplomatic partnerships and trade agreements, such as the QUAD, I2U2, and agreements with Australia, Canada, the European Union, and African countries. These partnerships have provided Indian businesses with greater access to finance, technology, and new markets. As India assumes the presidency of the G20 and the Shanghai Cooperation Organization this year, it is well-positioned to navigate changing globalisation trends and be a strong voice for the Global South.

- Most important is the large domestic market: India’s large domestic market with a population of 1.3 billion and increasing incomes at 6.9 percent per annum offers a competitive alternative to China’s massive domestic market. With a population base of 98 million, Vietnam’s market is much smaller in comparison.

Conclusion

- Indian economy that has risen from the ashes like a phoenix after a year of negative growth caused by the pandemic-led lockdown. India’s 74th Republic Day, therefore, should not merely mark a remembrance of the past or a celebration of adoption of the world’s largest and most comprehensive constitution, but should also be a celebration of the dazzling future of a roaring economy that will show light to a dreary world.

Mains question

Q. What is China plus one (C+1) strategy? Discuss why it is said that India will surge ahead in C+1?

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Issues related to Economic growth

Key takeaways form the World Economic Forum’s annual meeting

From UPSC perspective, the following things are important :

Prelims level: World Economic Forum

Mains level: World Economic Forum annual meeting and key takeaways and new initiatives

Context

- The World Economic Forum’s Annual Meeting 2023, held in the Swiss town of Davos, ended Friday a conference that started in a world possibly fundamentally altered, but whose processes and outcomes remained pretty much business as usual.

The theme this year was ‘Cooperation in a Fragmented World’.

World Economic Forum (WEF)

- Headquartered in Geneva, Switzerland, WEF is an international not-for-profit organization, focused on bringing the public and private sectors together to address the global political, social, and economic issues.

- It was founded in 1971 by Swiss-German economist and Professor Klaus Schwab in a bid to promote the global cooperation on these most pressing problems.

- The first meeting of WEF was held more than five decades ago in Davos, which has been the home of the annual gathering almost ever since, also becoming the shorthand for the event.

Crack Prelims 2023! Talk to our Rankers

key takeaways from WEF on the economy

- Positive outlook for economy: Most business leaders were upbeat about the economy, with US and the European Union (EU) seemingly beyond the risk of a recession now. China ending its zero Covid curbs and opening shop again added to the positive outlook.

- Caution from central banks: Central banks of the major economies cautioned that concerns still remained, and said they would keep interest rates high to ensure inflation is under check. For example, Stay the course is my mantra, European Central Bank President quoted. The US Federal Reserve Vice Chair Lael Brainard was quoted as reminding investors that “inflation remains high, and policy will need to be sufficiently restrictive for some time.

- Potential impact on energy prices: Many also pointed out that China opening up could mean a rise in its energy consumption, thereby driving up energy prices.

- Concerns for developing economies: As the richer nations look to focus inwards, protecting their own workers, energy sufficiency, supply lines, etc., concerns were raised that this policy direction would hit developing economies.

Climate change and green energy discussions at World Economic Forum

- The need for green energy and financing: Everyone agreed upon the need for green energy and the need for more money to flight climate change.

- GAEA initiative to unlock $3 trillion financing: According to the WEF’s website, The World Economic Forum, supported by more than 45 partners launched the Giving to Amplify Earth Action (GAEA), a global initiative to fund and grow new and existing public, private and philanthropic partnerships (PPPPs) to help unlock the $3 trillion of financing needed each year to reach net zero, reverse nature loss and restore biodiversity by 2050.

- International Concerns and Reactions: The EU raised concerns over a US green energy law that benefits products, such as electric vehicles, made in America.

- New Initiatives and Partnerships: The Press Trust of India (PTI) reported that more than 50 high-impact initiatives were launched at the event. 1.Maharashtra Institution for Transformation (MITRA) signed a partnership with the forum on urban transformation to give the state government strategic and technical direction. 2. A thematic centre on healthcare and life sciences is to be set up in Telangana. 3. The Coalition for Epidemic Preparedness and Innovations (CEPI) aims to develop new vaccines for future pandemics.

Ukraine demands more military and financial aid

- Military Aid and Financial Aid for Reconstruction: Ukraine kept up its demand for more military aid to fight its war against Russia, and more financial aid to rebuild after the war, saying the reconstruction fund commitments should start coming in now and not after the war ends.

- President Zelenskyy’s Address and Criticism of US and Germany: While Ukraine President Volodymyr Zelenskyy gave a video address. In his address, Zelenskyy made an indirect criticism of the US and Germany dithering over sending tanks to his country.

Criticism and defence of the Davos Event

- Spectacle of Rich and Powerful Talking about Poverty and Climate: The jarring spectacle of the Davos event where the uber-rich and powerful fly in on private jets to talk about poverty alleviation and climate action came in for criticism yet again.

- Opportunity for Decision-Makers to Meet and Interact: However, others pointed out that despite its flaws, the conference is an opportunity for many decision-makers to meet and interact with each other.

- The Economist’s View on the Importance of Communication and Conversation: As the Economist editor-in-chief Zanny Minton Beddoes put it, while the talks at Davos can be described as “highly-caffeinated speed dating”, more conversation and communication is better than less contact and less communication.

Conclusion

- The World Economic Forum highlighted the pressing need for green energy and financing to combat climate change. Though the event remained focused on business as usual, we can see that the WEF provided an opportunity for decision-makers to meet and interact, and more than 50 high-impact initiatives were launched at the event.

Mains Question

Q. Discuss some of the key takeaways from the WEF’s annual meeting 2023, with a specific focus on the discussions and initiatives related to the economy and climate change.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Issues related to Economic growth

New India: The world’s next engine of growth

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: Global slowdown and India' economic growth

“The mantle of the G20 presidency has come at the right time, allowing India to influence the global agenda based on its own priority of accelerated, inclusive and resilient growth”

Context

- The pandemic has proven to be the breakout moment in India’s long overdue emergence as the world’s next engine of growth. New India is bearing fruit at a time when one-third of the world’s economy is facing a slowdown. Speaking at FICCI’s 95th annual general meeting, Finance Minister said that the upcoming budget will set the template for the next 25 years, which is India’s Amrit Kaal.

Crack Prelims 2023! Talk to our Rankers

A gloomy global outlook

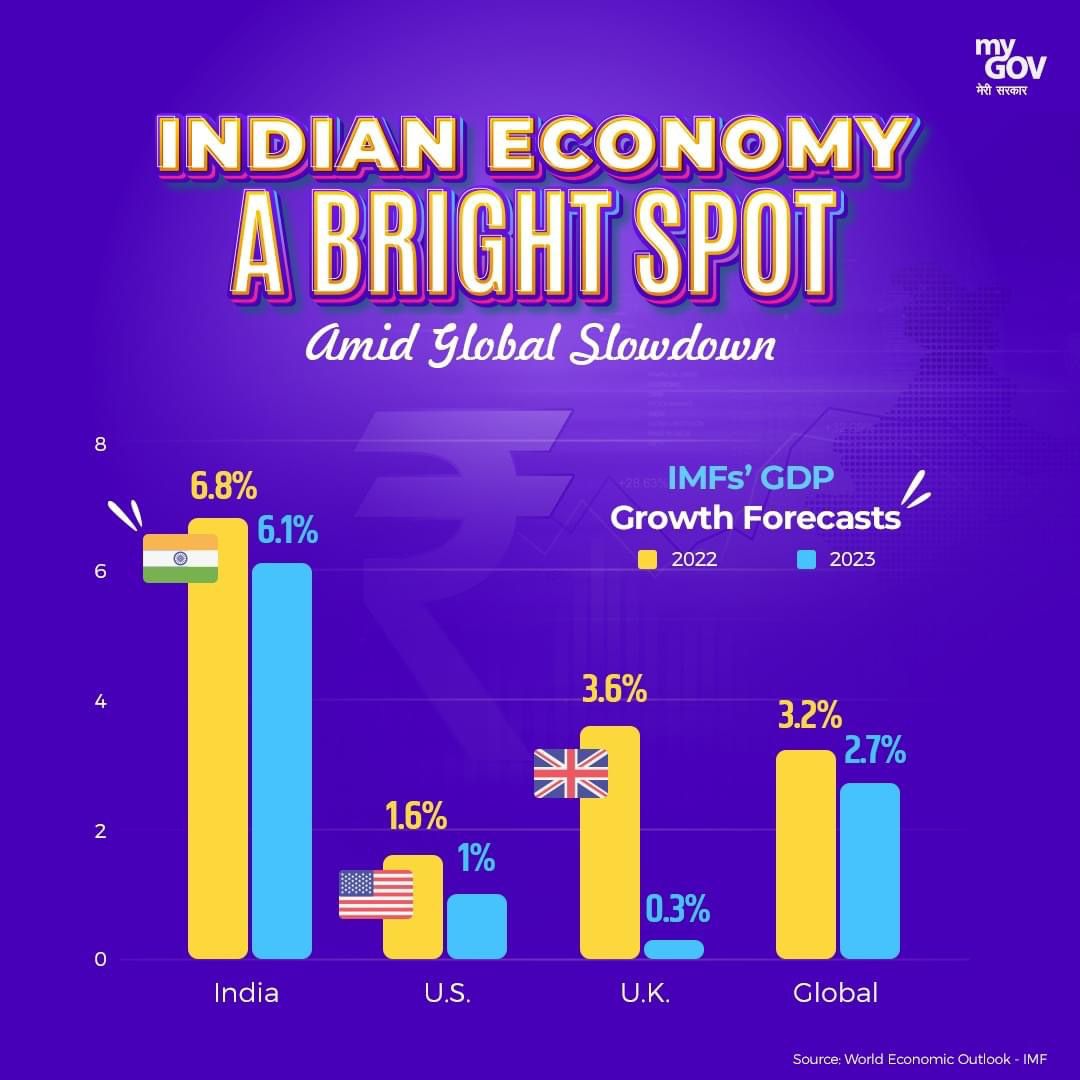

- Prospectus of global growth: According to the International Monetary Fund (IMF), global growth will nearly halve to 3.2 per cent in 2022 and fall further to 2.7 per cent in 2023, reflecting stalling growth in the US, China and the Euro Zone.

- Global inflation: Higher food and energy prices have led to global inflation peaking at 8.8 per cent in 2022 which is, however, expected to decline to 6.5 per cent in 2023 and 4.1 per cent in 2024.

- Developed nations are struggling to tame inflation: Developed nations have adopted excessive stimulus measures. According to a report by the McKinsey Global Institute, in 2020 and 2021, households globally added $100 trillion to global wealth on paper as asset prices soared and $39 trillion in new currency and deposits were minted and debt and equity liabilities increased by about $50 trillion and $75 trillion, respectively, as governments and central banks stimulated economies.

- Russia- Ukraine conflict inflicting fiscal pain: Meanwhile, the continuing Russia-Ukraine conflict is inflicting fiscal pain beyond the immediate region

- Disrupted supply chain by China’s covid policy: While China’s Covid policy has disrupted supply chains, which are now once again threatened by a potential fallout of an abrupt reversal.

- India’s inflation is largely imported: India’s own fight against inflation, which is largely imported, has been aided by fiscal and monetary policy working in tandem with a little help from easing commodity prices.

India stands at a bright spot amidst significant challenges

- Fastest-growing large economy in the world: However, India stands out as a rare bright spot with the economy estimated to grow around 7 per cent in FY23 and a growth forecast of 6.1-6.5 per cent in FY24, thus retaining the tag of the fastest-growing large economy in the world.

- Inflation coming down within RBI’s tolerance level: In an encouraging sign, retail inflation eased to 5.88 per cent in November, thus coming within the RBI’s tolerance band after 11 months. While it is too early to declare victory in terms of taming inflation, policymakers must now chart out a path that prioritises growth

- India likely to overtake Japan and Germany to become 3rd largest economy: Having recently surpassed the UK to become the world’s fifth-largest economy, India is likely to overtake Japan and Germany before the end of the decade to become the third-largest economy in the world.

- What made this possible: Reforms aimed at enhancing ease of doing business and reducing the cost of doing business in a large, unified domestic market along with a focus on boosting the manufacturing sector through the Production Linked Incentive (PLI) schemes, which are helping attract large investments including in critical areas like semiconductors.

What India has to share with the world?

- G20 leadership to bring about structural transformation: Its priority as G20 president is to focus on areas, which have the potential to bring about structural transformation leading to accelerated, inclusive and resilient growth.

- Concept of LiFE for a sustainable lifestyle: Similarly, the concept of LiFE (Lifestyle for the Environment) draws upon ancient sustainable traditions to reinforce modern-day environmentally conscious practices.

- Knowledge sharing: Finally, knowledge sharing in areas like digital public infrastructure and financial inclusion will enable the wider adoption of disruptive technologies.

Conclusion

- Investors both domestic and global must now come forward and participate in the India growth story which, in turn, will give a much-needed boost to global growth going ahead. Speaking at the World Economic Forum last year, PM Modi said “Make in India, Make for the World”. There has never been a better time to invest in India and reap the benefits of what it has to offer.

Mains question

Q. At a time when one-third of the world’s economy is facing a slowdown India stands at a brighter spot Discuss. Highlight what India has to share with the world?

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Issues related to Economic growth

India’s Economic Growth story and the future roadmap

From UPSC perspective, the following things are important :

Prelims level: Economic indicators

Mains level: India's economic growth story, current challenges and the future roadmap

Context

- By 2047, India will complete 100 years after Independence. By that time, India strives to achieve the status of a developed economy, which means achieving a minimum per capita income equivalent to $13,000.

Economic growth during the British period

- Poor state of economy: It is not realized often that India’s economic progress in the first half of the 20th century under British rule was dismal. According to one estimate, during the five decades, India’s annual growth rate was just 0.89%.

- Negligible growth in per capita: With the population growing at 0.83%, per capita income grew at 0.06%. It is not surprising that immediately after Independence, growth became the most urgent concern for policymakers.

Economic growth after Independence

- In the early period, India’s strategy of development comprised four elements:

- Raising the savings and investment rate;

- Dominance of state intervention;

- Import substitution, and

- Domestic manufacture of capital goods.

- Modest growth till 1970: India’s average growth till the end of the 1970s remained modest, with the average growth rate being 3.6%. With a population growth of 2.2%, the per capita income growth rate was extremely modest at 1.4%.

- Improvement in social indicators: On certain health and social parameters, such as the literacy rate and life expectancy, there were noticeable improvements.

- The success of green revolution: While India had to rely on the heavy imports of food grains on a concessional basis, initially, there was a breakthrough in agriculture after the Green Revolution.

- Industrial base widened: The industrial base expanded with time. India became capable of producing a wide variety of goods including steel and machinery.

- Unsustainable fiscal policy: Plan after plan, actual growth was less than what was projected. The Indian economy did grow at 5.6% in the 1980s. But it was accompanied by a sharp deterioration in the fiscal and current account deficits, and the economy faced its worst crisis in 1991-92.

Statistics of economic growth after 1991

- Rapid economic growth: Between 1992-93 and 2000-01, GDP at factor cost grew annually by 6.20%. Between 2001-02 and 2012-13, it grew by 7.4% and the growth rate between 2013-14 and 2019-20 was 6.7%.

- Sustained period of high growth rate: The best performance was between 2005-06 and 2010-11 when GDP grew by 8.8%, showing clearly what the potential growth rate of India was. This is the highest growth experienced by India over a sustained period of five to six years. This was despite the fact that this period included the global crisis year of 2008-09.

- Rising investment rate: There was a corresponding increase in the savings rate. The current account deficit in the Balance of Payments (BOP) remained low at an average of 1.9%.

- Setback to growth after 2011-12: However, the growth story suffered a setback after 2011-12. The growth rate fell to 4.5% in 2012-13 according to the 2004-05 series. The growth rate since then has seen ups and downs. The growth rate touched the 3.7% level in 2019-20.

Roadmap for Future Growth

- Keeping the sustained growth rate: The first and foremost task is to raise the growth rate. Calculations show that if India achieves a 7% rate of growth continuously over the next two decades and more, it will make a substantial change to the level of the economy. India may almost touch the status of a developed economy.

- Maintaining the incremental capital output ratio: If India maintains the incremental capital output ratio at 4, which is a reflection of the efficiency with which we use capital, India can comfortably achieve a 7% rate of growth.

- Investment must be increased: Raising the investment rate depends on a number of factors. A proper investment climate must be created and sustained.

- Private investment is crucial: While public investment should also rise, the major component of investment is private investment, both corporate and non-corporate. It is this which depends on a stable financial and fiscal system. The importance of price stability in this context cannot be ignored.

- New technologies must be embraced: India needs to absorb the new technologies that have emerged, and that will emerge. Its development strategy must be multidimensional.

- Strong Export and manufacturing: India need a strong export sector. It is a test of efficiency. At the same time, India needs a strong manufacturing sector. The organized segment of this sector must also increase.

- Strengthened the social safety nets: As output and income increase, India must also strengthen the system of social safety nets. Growth without equity is not sustainable.

Challenges for India’s growth

- Low per capita income: India today is the fifth largest economy. This is an impressive achievement. However, in relation to per capita income, it is a different story. In 2020, India’s rank was 142 out of 197 countries. This only shows the distance we have to travel.

- Declining growth in developing countries: The external environment is not going to be conducive. The Organization for Economic Co-operation and Development reports a secular decline in growth in developed countries.

- Climate change may affect the growth: Environmental considerations may also act as a damper on growth. Some adjustment on the composition of growth may become necessary.

Conclusion

- Considering the India’s population, India has no option but to grow continuously. Government has undertaken major structural reform and policy initiatives like GATI-SHAKTI to give fillip to growth of economy. These are the steps in the right directions and more such liberalizing initiatives need to be encouraged.

Mains Question

Q. Briefly describe the history of economic growth of India after independence. What could be the roadmap for future growth of India till 2047?

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Issues related to Economic growth

Retail Inflation and the new trends

From UPSC perspective, the following things are important :

Prelims level: Inflation

Mains level: Inflation and the concerns

Context

- The recent data seems to indicate that retail inflation has possibly peaked and is now likely to trend downwards. But, it would be wise to exercise caution. The latest data, while providing useful nuggets of information about price trends in the economy, challenges some of the widely held conceptions about inflation, and gives mixed signals about its trajectory.

What is a simple definition for inflation?

- Inflation is an increase in the level of prices of the goods and services that households buy. It is measured as the rate of change of those prices. Typically, prices rise over time, but prices can also fall (a situation called deflation).

Click and get your FREE Copy of CURRENT AFFAIRS Micro Notes

Inflation Rate

- Inflation Rate is the percentage change in the price level from the previous period. If a normal basket of goods was priced at Rupee 100 last year and the same basket of goods now cost Rupee 120, then the rate of inflation this year is 20%.

- Inflation Rate= {(Price in year 2 – Price in year 1)/ Price in year 1} *100

Five broad trends emerge to consider as reasons behind high inflation.

- Russia- Ukraine war:

- The sharp rise in commodity prices as a consequence of the war is considered to have been largely responsible for the spurt in inflation this year, pushing it beyond the upper threshold of the RBI’s inflation-targeting framework.

- For instance, India’s crude oil import price rose from $84.67 per barrel in January to $112.87 in March, and further to $116.01 in June. The ripple effects of higher commodity prices have been felt across the economy.

- Inflation generalized in formal and informal sectors:

- There are indications that inflation is getting more generalized across both the formal and informal segments of the economy.

- One indication of this comes from the clothing and footwear category, a highly fragmented industry with the presence of both formal and informal segments. Another possible indication comes from rentals.

- Rental inflation in India had tended to remain largely range-bound over much of the past few years. But as this category has the highest individual item-wise weight in the inflation index, any movement in either direction, however small, would have a large impact on core inflation.

- Supply side disruptions during the pandemic: During the pandemic, supply-side disruptions had caused goods inflation to rise, even as services inflation remained relatively muted owing to risk-averse behaviour by consumers and restrictions on high-contact intensive sectors.

- Competition and the pricing mechanism in the economy:

- Prices are rigid on the downside will depend not only on how demand fares now with monetary conditions having been tightened, but also on the extent of competition in the economy, among others.

- After all, greater market concentration creates conditions for greater pricing power. A badly damaged non-corporate sector (MSMEs) would have led to ruptures in the low-cost economy, increasing the pricing power of the corporate sector during this period.

- Wage- price spiral:

- Inflation in India is not a consequence of a strong economy. Wage growth in the large informal rural economy has been lower than inflation.

- While some skill-intensive segments of the urban formal labour force may be able to exercise some bargaining power, the labour force participation rates suggest continuing slack in urban labour markets.

What are the concerns?

- Commodity should have come down over the period: If high core inflation in the months after the beginning of hostilities was an outcome of the passthrough, either in part or completely, of the Ukrainewar, then the decline in commodity prices since then should have led to a moderation in core inflation

- Services inflation vs goods inflation: But as activities normalised, there was an expectation that services inflation would see a strong pick-up. The recent data indicates that this has not been the case. While services inflation has risen, it remains considerably lower than goods inflation, perhaps owing to a combination of lower cost-push pressures, more slack and less demand.

Conclusion

- While inflation may have peaked, it is far from being quashed. The RBI expects inflation to edge downwards from 6.5 per to 5 per cent in the first quarter of the next financial year (2023-24). But RBI ca not afford to underestimate the price pressures in the economy.

Mains Question

Q. What is inflation? Some of the new emerging trends are considered while measuring rising inflation in the current scenario. Discuss.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Issues related to Economic growth

One must know India’s Economic Growth Story

From UPSC perspective, the following things are important :

Prelims level: Economic indicators and related facts

Mains level: Indias Growth story, Status of Growth drivers amidst the challenge of slowing economies

Context

- As the COVID-19 pandemic fades and hopes to rise for nations and societies to return to some kind of normalcy, there is effort all around to take stock of where we stand and what our prospects look like. A look back over the last few years at how India performed in terms of its economy.

Present situation of India’s economic growth

- Mixed growth story: One group of experts argues, India’s growth story is more mixed. In 2021-22, its GDP growth was 8.7%, which was among the highest in the world. This is good but, against this, we must offset the fact that much of this is the growth of climbing out of the pit into which we had fallen the previous year.

- IMF reduced the growth forecast: In 2020-21, India’s growth was minus 6.6%, which placed the country in the bottom half of the global growth chart. For 2022-23, the International Monetary Fund has cut India’s growth forecast to 6.1%.

Structural assessment of India’s growth

- Rising inequality and high unemployment: Most of India’s growth is occurring at the top end, with a few corporations raking in a disproportionate share of profits, and unemployment is so high, it is likely that large segments of the population are actually witnessing negative growth.

- Slowdown in previous years: What makes India’s growth story worrying is that the slowdown began much before the COVID19 pandemic. It began in 2016, after which, for four consecutive years, the growth rate each year was lower than in the previous year. Growth in 2016-17 was 8.3%. After that it was, respectively, 6.9%, 6.6%, 4.8%, and minus 6.6%.

- Status of unemployment: India’s unemployment rate is high. In October, it stood at 7.8%. However, what is really worrying is youth unemployment. According to International Labour Organization (ILO) data, collated and presented by the World Bank, India’s youth unemployment, that is, from among people aged 15 to 24 years who are looking for work, the percent that does not find any, stands at 28.3%.

Know the basics-What is Unemployment?

- Definition: Unemployment is a phenomenon that occurs when a person who is capable of working and is actively searching for the work is unable to find work.

- Those who are excluded: People who are either unfit for work due to physical reason or do not want to work are excluded from the category of unemployed.

- Unemployment rate: The most frequent measure of unemployment is unemployment rate. The unemployment rate is defined as a number of unemployed people divided by the number of people in the labour force.

- Labour Force: Persons who are either working (or employed) or seeking or available for work (or unemployed) during the reference period together constitute the labour force.

Other perspectives on Indian economy

- The latest GDP numbers suggest: For Q1 FY2022–23 suggest that economic growth is on a healthy track. Consumers, after a long lull, have started to step out confidently and spend private consumption spending went up 25.9% in Q1.

- On the production side: the contact-intensive services sector also witnessed a strong rebound of 17.7%, thanks to improving consumer confidence.

- Healthy agriculture sector: The only sector that consistently performed well throughout the pandemic, remained buoyant.

- Industrial growth: Industrial growth boosted from accelerating growth in construction and electricity, gas, water supply and other utility services sectors.

- Manufacturing is not doing well: A sector that has not yet taken off sustainably is manufacturing, which witnessed modest growth of 4.5% in Q1. Higher input costs, supply disruptions, and labor shortages due to reverse migration have weighed on the sector’s growth. According to the Reserve Bank of India’s (RBI’s) data on nonfinancial firms, surging raw material costs have stressed the profitability and margins of companies.

What are the Challenges for the growth of economy?

- High inflation: The biggest worry is that of high inflation (which has persisted for way too long) and all the challenges that come along with it. Inflationary environments increase the costs of doing business, impact profitability and margins, and reduce purchasing power. In short, inflation thwarts both supply and demand. Central banks’ monetary policy actions, in response to rising inflation, can impede credit growth and economic activity, thereby intensifying the probability of a recession in a few advanced nations.

- Rising current account deficit: The other challenge is the rising current-account deficit and currency depreciation against the dollar. While a rebounding domestic economy is resulting in higher imports, moderating global demand is causing exports to slow. The US dollar’s unrelenting rise and global inflation are further causing India’s import bills to rise.

- Declining forex: The RBI had to intervene to contain volatility and ensure an orderly movement of the rupee. The RBI’s intervention is leading to a drawdown in foreign exchange reserves. Consequently, the import cover from reserves has reduced to nine months from a high of 19 months at the start of 2021 (although, it remains above the benchmark of three months).

The economy’s growth drivers are improving

- Exports: Exports, the first growth driver are slowing down and are likely to moderate along with the probable global economic slowdown.

- Government spending: Government spending, the second driver, is already at an elevated level, thanks to the pandemic, and the government will likely focus on its prudence in utilizing limited resources. The good news is the share of capital expenses is going up even as the government is reducing revenue expenses. Multiplier effects of this spending will aid in growth in income, assets, and employment for years to come. Strong tax revenues may support further capital spending in the future.

- Capital expenditure: According to experts, prospects for capex investments the third growth driver by companies are brighter. Sustained demand growth may be the most-awaited cue for a sustained push for investment.

- Consumer demand: Consumer Demand, the fourth, and perhaps the most important, growth driver has improved significantly in recent quarters. However, spending has not grown sustainable despite improving consumer confidence. For instance, retail sales are growing but the pace is patchy, and auto registrations have remained muted. We expect that receding pandemic fears and the upcoming festive season could give a much-needed boost to the consumer sector.

Conclusion

- Indian economy should not be looked from isolation. It is very much integrated in global economy. Pandemic, Ukraine war, US- China trade war have given a successive shock to global and Indian economy. Despite that Indian has done well than rest of the world. Our focus should be on curbing inequality, not to allow people to descend into extreme poverty and employment generation.

Mains Question

Q. Analyse the present economic macro-indicators of Indian economy. What are the challenges for growth story of India in the context of global uncertainty?

Click and Get your FREE copy of Current Affairs Micro notes

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Issues related to Economic growth

Road to Net Zero Goes Via Green Financing

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: Green Financing, India's Net Zero 2070 objective

Context

- Climate finance, or Green Money, remains a critical bottleneck for India in its journey towards the Net Zero 2070 objective and to create a resilient system through climate adaptation and mitigation. The challenge is daunting to make a climate transition for a nation of 1.4 billion people with increasing aggregate national income and individual wealth inequality.

What is the Present arrangement of external financing for climate change

- Estimated cost: Finances for climate change were to be channelized through multi-tiered systems in the form of national, regional, and international bodies. It has been estimated that India will need $15 trillion to finance its Net Zero journey.

- Concessional loans: In most cases, small amounts flowing now into the developing component of the G20 nations are actually in the form of concessional loans rather than grants.

- Technological support from developed countries: There is no doubt that India will need international financial commitments and technological support from developed countries, who have been erratic with their promised deliveries so far.

What is green financing?

- Green finance is a phenomenon that combines the world of finance and business with environment friendly behavior. It may be led by financial incentives, a desire to preserve the planet, or a combination of both.

- In addition to demonstrating proactive, environment friendly behavior, such as promoting of any business or activity that could be damaging to the environment now or for future generations.

Green financing through domestic market

- Status of Green Bonds: As for domestic financial sources, according to an RBI Bulletin from January 2021, green finance in India is still at the nascent stage. Green bonds constituted only 0.7% of all the bonds issued in India since 2018, and bank lending to the non-conventional energy constituted about 7.9% of outstanding bank credit to the power sector as of March 2020.

- Provision of Green loans: The report also mentioned that the development of green financing and funding of environment-friendly sustainable development is not without challenges, which may include false compliance claims, misuse of green loans, and, most importantly, maturity mismatches between long-term green investments and relatively short-term interests of investors.

What are the challenges to green financing?

- No assessment of climate finance risk: Research report indicates that banks in India, like in many parts of the world, are not prepared to adapt to climate change; and have not yet factored in any climate-related financial risks into their day-to-day decision-making. Some of the criteria used to assess the banks include a commitment to phase out investments in coal, disclosing and verifying direct and indirect emissions, issuing green loans, financing climate mitigation, and Net Zero targets for different types of emissions and their implementation plans.

- Lack of enthusiasm among bankers: The report is also critical that none of the 34 banks have tested the resilience of their portfolios in the face of climate change. Yet, the bankers’ noise around the green finance topic is euphorically loud, without action.

- No standard definition of green financing: These banks and financial institutions are also not geared up for financing green transition. India faces the big challenge of “how to define green”, as there is no uniform green definition and green taxonomy.

- Poor debt market for green finance: The green money is generated through largely debt-based products (green bonds, climate policy performance bonds, debt for climate swaps, etc.), while the fund deployment occurs through debt-based, equity-based, and often, insurance-based instruments, apart from grants and loans. However, the Indian market lacks the depth of its debt markets or the heft of the bond markets.

- Lack of green data governance: There is an inherent problem with “green data governance” that entails tracking the entire data-chain of a green financing initiative.

- Unviable green projects: Like many other private sectors funding, the banks look at rates of return that do not really often make financing “public goods” as viable investments. They are even apprehensive about financing projects with long gestation periods with uncertain returns.

What is way forward for green financing?

- Considering social cost of carbon: An economic return alone might not be sufficient to induce green financing. A more holistic rate of return, considering the social cost of carbon, will be appropriate.

- Return on green investment should include social returns: A longer time horizon will be needed for the cost-benefit analysis and the estimation of the return on investment. This is because, for climate-related projects, the returns increase over time. The extent to which the particular project could result in CO2 reduction and, eventually reduction in the social cost of carbon need to be assessed. As an example, India intends to reduce 1 billion Tonnes of CO2. The present social cost of CO2 (SCC) is $86/tonne. Therefore, the sheer economic gain is to the tune of $86 billion, or 2.1% of the current Indian GDP. Social cost saving is a public good and is enjoyed by all businesses, including the financial institutions.

- Applying the green taxation: Hence, for a stronger business case for climate finance, experts propose to include in its Return-on-investment calculations the cost-benefit returns of the project through NPVSCC20 the Net Present Value of Social Cost of Carbon over 25 years of the project, a time period that compares well with tenor of infra and sovereign bonds. As an incentive, the government could introduce taxation sops for using NPVSCC25.

You may want to know about Net Zero

- Net zero means cutting greenhouse gas emissions to as close to zero as possible, with remaining emissions re-absorbed by oceans/ forests.

- China, US, EU and India contribute 75% of total GHG emissions

- However, per capita GHG emissions for US, EU and China are7,3 and 3 times of India

- India has set target to achieve net zero emissions by 2070.

Conclusion

- The way India finances its journey to Net Zero 2070 could very well be a framework for other nations, for it would need to have contours of social inclusion, economic flexibility, and sustainable financing, while keeping in mind the political compulsions, as well as serving the demographic requirements of creating and sustaining livelihood in decades to come.

Mains Question

Q. Green financing is the most crucial part of achieving Net zero target. Comment. What are the India’s efforts to finance its climate action goals?

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Issues related to Economic growth

Why Private Investment is Lagging in India?

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: private investment in manufacturing and economic growth

Context

- Last month, Finance Minister asked captains of industry what was holding them back from investing in manufacturing. She likened industry to Lord Hanuman from the Ramayana by stating that industry did not realize its own strength and that it should forge ahead with confidence. She said, “This is the time for India, we cannot miss the bus”.

What is present situation of private investment?

- Tax cut rate of domestic companies: In the hope of revitalizing private investment, the government had in September 2019 cut the tax rate for domestic companies from 30% to 22% if they stopped availing of any other tax SOP (standard operating procedure).

- Weak private investment: Expert says that Indian private sector investment has been weak for almost a decade now. If we look at drivers of economic growth right now, there are amber lights flashing. The export story will be under threat because of the global slowdown, the government’s ability to support domestic demand would also be limited as the fiscal deficit comes down.

- Impact of k-shaped recovery: Because of the K-shaped recovery, private consumption is only concentrated in some parts of the income pyramid.

Analyzing the investment scenario

- Investment to GDP ratio: As in the June edition of the Ministry of Finance’s Monthly Economic Review, the fixed investment to GDP ratio was 32% in 2021-22. However, there is need for caution in reading the most recent data, as they are subject to revision.

- The National Accounts Statistics: It provides disaggregation of gross capital formation (GCF) by sectors, type of assets and modes of financing; over 90% of GCF consists of fixed investments.

- No change in investment distribution: The investment distribution has hardly changed over the last decade, with the public sector’s share remaining 20%.

- Fall in share of agriculture and industry: Between 2014-15 and 2019-20, the shares of agriculture and industry in fixed capital formation/GDP fell from 7.7% and 33.7% to 6.4% and 32.5%, respectively.

- Rise in service sectors: Services’ share rose to 52.3% in 2019-20 compared to 49% in 2014-15.The rise in the services sector is almost entirely on transport and communications. The share of transport has doubled from 6.1% to 12.9% during the same period. Within transportation, it is mostly roads.

- Decline in the share of investment: Its share in the investment ratio (column 2.1) fell from 19.2% in 2011-12 to 16.5% in 2019-20. This indicates that ‘Make in India’ failed to take off, import dependence went up, and India became deindustrialised. Import dependence on China is alarming for critical materials such as fertilizers, bulk drugs (active pharmaceutical ingredients or APIs) and capital goods. Instead of boosting investment and domestic technological capabilities, the ‘Make in India’ campaign frittered away time and resources to raise India’s rank in the World Bank’s Ease of Doing Business Index.

- Decline in foreign capital in GFC: The contribution of foreign capital to financing GCF fell to 2.5% in 2019-20 from 3.8% in 2014-15 (or 11.1% in 2011-12). With declining investment share, industrial output growth rate fell from 13.1% in 2015-16 to a negative 2.4% in 2019-20, as per the National Accounts Statistics.

What is Consumer’s demand situation?

- Average Consumer sentiment index: Private companies invest when they are able to estimate profits, and that comes from demand. The Centre for Monitoring Indian Economy’s (CMIE) consumer sentiment index is still below pre-pandemic levels but is far higher than what was seen 12-18 months ago.

- Buoyant Aggregate demand: RBI’s Monetary policy report dated September 30 says, Data for Q2 (ended Sept) indicate that aggregate demand remained buoyant, supported by the ongoing recovery in private consumption and investment demand. It shows that seasonally adjusted capacity utilization rose to 74.3% in Q1 the highest in the last three years.

- High household savings: Along with household savings intentions remaining high, might hold the key to the investment cycle kicking in.

Conclusion

- Both public and private investment is necessary for sustainable growth trajectory of any economy. Global uncertainty, Ukraine war, oil prices have added to the skepticism of private investors. However, India’s macroeconomic performance is much better than those of developed and developing economies. Private investors must take these into account before holding back their investment.

Mains Question

Q. What role private investment plays in Indian economy? Analyse the post-pandemic private investment situation in India?

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Issues related to Economic growth

Thin line between freebies and public welfare

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: Social security,Populist measures.

Context

Context

- ‘Revdi Culture’ (sweet) or Govt’s Basic Responsibility? What Prioritising Welfare Is Really About

- While hearing a petition demanding the de-recognition of political parties that promise “irrational freebies” to voters, the Supreme Court recently drew attention to the substantial fiscal cost of freebies.

What are freebies?