Monetary Policy Committee Notifications

Repo Rate Hike: Impact Should be Considered Before Making Decisions

From UPSC perspective, the following things are important :

Prelims level: Inflation

Mains level: The role of MPC, Inflation, repo rate and its impact

Central Idea

- In its last meeting, held just a few days after the Union budget, the monetary policy committee (MPC) of the RBI had voted to raise the benchmark repo rate by 25 basis points. The MPC noted that calibrated action was warranted to break the persistence in core inflation. This surprise uptick in inflation is likely to complicate the policy choices before the MPC members when it meets next in the first week of April.

What is Basis points we often hear about?

- A basis point is a unit of measurement used to express changes in interest rates, bond yields, and other financial indicators.

- One basis point is equal to one-hundredth of a percentage point, or 0.01%.

- For example, If the Reserve Bank of India (RBI) raises the repo rate by 25 basis points, it means that the interest rate has increased by 0.25%.

What it indicates?

- If the Reserve Bank of India (RBI) keeps raising the repo rate by basis points, it is an indication that the central bank is tightening its monetary policy stance to manage inflationary pressures in the economy.

Back to basics: Monetary Policy Committee (MPC)

- Committee of RBI to fix the benchmark policy: The Monetary Policy Committee (MPC) is a committee of the RBI, which is entrusted with the task of fixing the benchmark policy interest rate (repo rate) to contain inflation within the specified target level.

- To bring transparency and accountability: The RBI Act, 1934 was amended by Finance Act (India), 2016 to constitute MPC to bring more transparency and accountability in fixing India’s Monetary Policy.

- Policy is published after discussion: The policy is published after every meeting with each member explaining his opinions.

- Answerable to GOI: The committee is answerable to the Government of India if the inflation exceeds the range prescribed for three consecutive months.

What is Inflation?

- Inflation is an increase in the level of prices of the goods and services that households buy. It is measured as the rate of change of those prices.

- Typically, prices rise over time, but prices can also fall (a situation called deflation).

The current trends of Inflation

- Rise in retail inflation: Retail inflation, as measured by the consumer price index, rose to 6.52 per cent in January, up from 5.72 per cent in December, reversing the declining trend seen in the preceding months.

- Much of the surge was driven by food inflation: The consumer food price index rose to 5.94 per cent, up from 4.19 the month before, driven largely by cereals.

- Price pressure remain across the economy: Inflation remained elevated in clothing and footwear, household goods and services, personal care effects and education, signalling that price pressures remain fairly broad-based across the economy.

RBI’s Upper tolerance limit for inflation

- Highest level of inflation that can be tolerated: The upper tolerance limit for inflation set by the Reserve Bank of India (RBI) is the highest level of inflation that the RBI will tolerate before taking action to bring inflation back within its target range.

- RBI’s limit: The target range is defined in terms of the Consumer Price Index (CPI) inflation and the RBI has set an upper tolerance limit of 6% and a lower tolerance limit of 2% with a central target of 4%. This means that the RBI aims to keep CPI inflation within the range of 2-6%, with a target of 4%.

- Tools to contain inflation: If inflation exceeds the upper tolerance limit of 6%, the RBI is required to take steps to bring inflation back within the target range. The RBI uses a variety of monetary policy tools to control inflation, including adjusting the policy interest rate, changing reserve requirements for banks, and using open market operations to manage liquidity in the financial system.

Conclusion

- Monetary policy experts Varma and Goyal suggest pausing to observe the impact of previous tightening before taking further action. Despite a cumulative 250 basis point increase, inflation is still expected to remain above the 6% target. The full impact of previous tightening should be considered before making any decisions.

Mains Question

Q. What is upper threshold of the RBI’s inflation targeting framework? Discuss the impact of policy interest rate hikes on the economy.

Attempt UPSC 2024 Smash Scholarship Test | FLAT* 100% OFF on UPSC Foundation & Mentorship programs

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

High Inflation in India

From UPSC perspective, the following things are important :

Prelims level: types of inflation

Mains level: inflation overview

Context

Context

- It seems that inflation may hover around 7 per cent despite RBI’s tightening of monetary policy in the months to come.

What is a simple definition for inflation?

- Inflation is an increase in the level of prices of the goods and services that households buy. It is measured as the rate of change of those prices. Typically, prices rise over time, but prices can also fall (a situation called deflation).

Inflation Rate

- Inflation Rate is the percentage change in the price level from the previous period. If a normal basket of goods was priced at Rupee 100 last year and the same basket of goods now cost Rupee 120, then the rate of inflation this year is 20%.

- Inflation Rate= {(Price in year 2 – Price in year 1)/ Price in year 1} *100

Types of Inflation

Types of Inflation

Creeping Inflation

- Creeping or mild inflation is when prices rise 3% a year or less. This kind of mild inflation makes consumers expect that prices will keep going up. That boosts demand. Consumers buy now to beat higher future prices. That’s how mild inflation drives economic expansion.

Walking Inflation

- This type of strong, or pernicious, inflation is between 3-10% a year. It is harmful to the economy because it heats up economic growth too fast. People start to buy more than they need, just to avoid tomorrow’s much higher prices. This drives demand even further so that suppliers can’t keep up. More important, neither can wages. As a result, common goods and services are priced out of the reach of most people.

Galloping Inflation

- When inflation rises to 10% or more, it wreaks absolute havoc on the economy. Money loses value so fast that business and employee income can’t keep up with costs and prices. Foreign investors avoid the country, depriving it of needed capital. The economy becomes unstable, and government leaders lose credibility. Galloping inflation must be prevented at all costs.

Hyperinflation

- Hyperinflation is when prices skyrocket more than 50% a month. It is very rare. In fact, most examples of hyperinflation have occurred only when governments printed money to pay for wars. Examples of hyperinflation include Germanyin the 1920s, Zimbabwe in the 2000s, and Venezuela in the 2010s. The last time America experienced hyperinflation was during its civil war.

Core Inflation

- The core inflation rate measures rising prices in everything except food and energy. That’s because gas prices tend to escalate now and then. Higher gas costs increase the price of food and anything else that has large transportation costs.

Consumer Price Index

- CPI is used to monitor changes in the cost of living over time. When the CPI rises, the average Indian family has to spend more on goods and services to maintain the same standard of living. The economic term used to define such a rising prices of goods and services is Inflation.

Whole sale Price Index

- WPI is used to monitor the cost of goods and services bought by producer and firms rather than final consumers. The WPI inflation captures price changes at the factory/wholesale level.

GDP Deflator

- Another important measure of calculating standard of living of people is GDP Deflator. GDP Deflator is the ratio of nominal GDP to real GDP. The nominal GDP is measured at the current prices whereas the real GDP is measured at the base year prices. Therefore, GDP Deflator reflects the current level of prices relative to prices in a base year. Example, In India the base year of calculating deflator is 2011-12.

Factors fuelling inflation in India

Factors fuelling inflation in India

- Falling rupee: Inflation is here to stay because it has much to do with the decline in value of the rupee that has fallen to its lowest, which makes imports of oil and gas more expensive.

- Ukraine crisis: The war in Ukraine has the same effect and pushes the price of some food items upward.

- Poor inflation management: With inflation, as measured by the consumer price index, in August going back to 7 per cent, and the wholesale price index coming in at 12.4 per cent, one thing is clear India is not out of the woods on inflation management.

Rising inflation have these implications

- Impact on the poor: This upsurge of inflation is affecting the poor more because some of the commodities whose prices are increasing the most represent a larger fraction of the budget of the most vulnerable sections of society.

- Rising inequality: As a result, inequalities which were already on the rise are increasing further. Recently, the State of Inequality in India report showed that an Indian making Rs 3 lakh a year belonged to the top 10 per cent of the country’s wage earners.

- Inequality in healthcare: India’s spending on healthcare is among the lowest in the world. Decent level of healthcare is available only to the ones who can afford it because of increasing out-of-pocket expenditure the payment made directly by individuals for the health service, not covered under any financial protection scheme. Overall, these out-of-pocket expenses on healthcare are 60 per cent of the total expenditure on public health in India, which is one of the highest in the world.

Need for bold steps on three fronts to tackle inflation

Need for bold steps on three fronts to tackle inflation

- Unless bold and innovative steps are taken at least on three fronts, GDP growth and inflation both are likely to be in the range of 6.5 to 7.5 per cent in 2022-23.

1] Tightening of loose monetary policy: The Reserve Bank of India (RBI) is mandated to keep inflation at 4 per cent, plus-minus 2 per cent.

- The RBI has already started the process of tightening monetary policy by raising the repo rate, albeit a bit late.

- It is expected that by the end of 2022-3, the repo rate will be at least 5.5 per cent, if not more.

- It will still stay below the likely inflation rate and therefore depositors will still lose the real value of their money in banks with negative real interest rates.

- That only reflects an inbuilt bias in the system — in favour of entrepreneurs in the name of growth and against depositors, which ultimately results in increasing inequality in the system.

2] Prudent fiscal policy: Fiscal policy has been running loose in the wake of Covid-19 that saw the fiscal deficit of the Union government soar to more than 9 per cent in 2020-21 and 6.7 per cent in 2021-22, but now needs to be tightened.

- Government needs to reduce its fiscal deficit to less than 5 per cent, never mind the FRMB Act’s advice to bring it to 3 per cent of GDP.

- However, it is difficult to achieve when enhanced food and fertiliser subsidies, and cuts in duties of petrol and diesel will cost the government at least Rs 3 trillion more than what was provisioned in the budget.

3] Rational trade policy: Export restrictions/bans go beyond agri-commodities, even to iron ore and steel, etc. in the name of taming inflation.

- But abrupt export bans are poor trade policy and reflect only the panic-stricken face of the government.

- A more mature approach to filter exports would be through a gradual process of minimum export prices and transparent export duties for short periods of time, rather than abrupt bans, if at all these are desperately needed to favour consumers.

Conclusion

- Though the government is opting for market-based economics, currently, India needs a mixed solution that comprises price stability via government channels and subsidies.

Mains question

Q.What are the fuelling factors for inflation? Discuss what steps should be taken to tackle inflation.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

India’s Tenfold Path to manage Exchange Rate Volatility

From UPSC perspective, the following things are important :

Prelims level: Rupee-Dollar relation

Mains level: Issues with Rupees depreciation

The RBI is prepared to sell a sixth of its foreign exchange reserves to defend the rupee against a rapid depreciation after it plumbed record lows in recent weeks.

Must read:

Is there a forex crisis underway?

- And the way in which India has tackled foreign exchange crises over the years has been quite profound.

- A forex crisis can be loosely defined as one where the rupee starts depreciating rapidly or when forex reserves slide precipitously.

- Ever since India’s reforms of 1991-92, the external sector has been liberalized, with even full capital account convertibility being considered at one point.

In the rupee’s context, let’s look at options that have been used in the last three decades or so:

(1) Selling dollars

- The first course of action has been selling dollars in the spot forex market.

- This is fairly straightforward, but has limits as all crises are associated with declining reserves.

- While this money is meant for a rainy day, they may just be less than adequate.

- The idea of RBI selling dollars works well in the currency market, which is kept guessing how much the central bank is willing to sell at any point of time.

(2) NRI deposits

- The second tool used is aimed at garnering non-resident Indian (NRI) deposits.

- It was done in 1998 and 2000 through Resurgent India bonds and India Millennium Deposits, when banks reached out asking NRIs to put in money with attractive interest rates.

- The forex risk was borne by Indian banks.

- This is always a useful way for the country to mobilize a good sum of forex, though the challenge is when the debt has to be redeemed.

- At the time of deposits, the rates tend to be attractive, but once the crisis ends, the same rate cannot be offered on deposit renewals.

- Therefore, the idea has limitations.

(3) Let oil importers buy dollars themselves

- The third option exercised often involves getting oil importing companies to buy dollars directly through a facility extended by a public sector bank.

- Its advantage is that these deals are not in the open and so the market does not witness a large demand for dollars on this account.

- It is more of a sentiment cooling exercise.

(4) Let exporters trade in dollars

- Another tool involves a directive issued for all exporters to mandatorily bring in their dollars on receipt that are needed for future imports.

- This acts against an artificial dollar supply reduction due to exporter hold-backs for profit.

(5) Liberalized Exchange Rate

- The other weapon, once used earlier, is to curb the amount of dollars one can take under the Liberalized Exchange Rate Management System.

- This can be for current account purposes like travel, education, healthcare, etc.

- The amounts are not large, but it sends out a strong signal.

(6) Forward-trade marketing

- Another route used by RBI is to deal in the forward-trade market.

- Its advantage is that a strong signal is sent while controlling volatility, as RBI conducts transactions where only the net amount gets transacted finally.

- It has the same power as spot transactions, but without any significant withdrawal of forex from the system.

(7) Currency swaps

- The other tool in India’s armoury is the concept of swaps.

- This became popular post 2013, when banks collected foreign currency non-resident deposits with a simultaneous swap with RBI, which in effect took on the foreign exchange risk.

- Hence, it was different from earlier bond and deposit schemes.

Most preferred options by the RBI

- Above discussed instruments have been largely direct in nature, with the underlying factors behind demand-supply being managed by the central bank.

- Of late, RBI has gone in for more policy-oriented approaches and the last three measures announced are in this realm.

(8) Allowing banks to work in the NDF market

- First was allowing banks to work in the non-deliverable forwards (NDF) market.

- This is a largely overseas speculative market that has a high potential to influence domestic sentiment on our currency.

- Here, forward transactions take place without real inflows or outflows, with only price differences settled in dollars.

- This was a major pain point in the past, as banks did not have access to this segment.

- By permitting Indian banks to operate here, the rates in this market and in domestic markets have gotten equalized.

(9) Capital account for NRI deposits

- More recently, RBI opened up the capital account on NRI deposits (interest rates than can be offered), external commercial borrowings (amounts that can be raised) and foreign portfolio investments (allowed in lower tenure securities), which has the potential to draw in forex over time.

- Interest in these expanded contours may be limited, but the idea is compelling.

(10) Settlement in Rupees

- RBI’s permission for foreign trade deals to be settled in rupees is quite novel; as India is a net importer, gains can be made if we pay in rupees for imports.

- The conditions placed on the use of surpluses could be a dampener for potential transactions.

- But the idea is innovative and could also be a step towards taking the rupee international in such a delicate situation.

- Clearly, RBI has constantly been exploring ways to address our forex troubles and even newer measures shouldn’t surprise us.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

Communication gap between the MPC and RBI

From UPSC perspective, the following things are important :

Prelims level: GSAP

Mains level: Paper 3- Communication gap between MPC and RBI

Context

Communication is a critical element of monetary policy. Yet there seems to be a gap between what the MPC says and what the RBI does.

About MPC

- The Reserve Bank of India Act, 1934 (RBI Act) has been amended by the Finance Act, 2016, to provide for a statutory and institutionalised framework for a Monetary Policy Committee, for maintaining price stability, while keeping in mind the objective of growth.

- Highest monetary policy-making body: By law, the Monetary Policy Committee is the highest monetary policy-making body in the land, tasked with deciding monetary policy changes at regular intervals.

- Composition: The MPC will have six members – the RBI Governor (Chairperson), the RBI Deputy Governor in charge of monetary policy, one official nominated by the RBI Board and the remaining three members would represent the Government of India.

- The MPC will be chaired by the Governor.

- Under the inflation targeting regime, the most important role in communication belongs to the MPC.

Communication with public

- Monetary policy changes are communicated through formal statements, with the discussions underlying these decisions also being published, so that the public can understand why the MPC decided the way that they did.

- Communication gap: Over the past few years, a communication gap seems to have opened up between what the MPC has been saying and what the RBI has been doing, thereby potentially eroding the credibility of the IT framework.

- Influencing inflation expectations: Communication is an important part of the ability of the central bank to influence inflation expectations.

Following are the ways which indicate the communication gap between the RBI and the MPC, with several implications for the credibility of the MPC.

1] Separate statements

- During the first few years of the inflation-targeting regime from 2016 to 2018, the process of communication worked quite well.

- On the days of policy announcements, the governor and his deputies would participate in a press conference.

- From 2019 onwards, however, things began to change.

- Governor’s separate statement: The RBI began to release a separate governor’s statement on the day of the monetary policy meeting, presenting an inflation outlook and even explaining the decision taken by the MPC.

- MPC statement: It has overlapped with the MPC statement; at times, it has seemed somewhat different.

- For example, following the June 8 Monetary Policy Review the MPC highlighted inflation concerns, and voted in favour of raising the policy repo rate.

- On the same day, a governor’s statement mentioned that the central bank will also remain focussed on the orderly completion of the government’s borrowing programme.

- Confusion: The issuance of two such different statements can lead to confusion, especially as lowering inflation and lowering government bond yields are contradictory policy objectives.

Why is communication so crucial? To influence inflation expectations!

- If the public believes the central bank is committed to keeping inflation under control, then it will act accordingly.

- Firms will moderate their price increases, fearing that large price rises will make them uncompetitive.

- Meanwhile, workers will accept moderate wage increases, while investors will accept low interest rates on their bond purchases.

- With everyone acting in this way, it will be easier for the central bank to ensure that inflation indeed remains low.

- Anchored inflation expectations: If inflation expectations are well anchored, then it becomes relatively easy for the central bank to ensure that inflation returns to the target level before too long.

2] Change in the Monetary Policy Corridor width during pandemic

- Deciding the repo rate: The most important task of the MPC, enshrined in the RBI Act (Amended), 2016 that introduced IT, is to decide the repo rate, since this has long been the lynchpin of India’s monetary policy framework.

- Ever since the early 2000s, policy had aimed to keep overnight money market rates in a corridor, with the lower bound established by the reverse repo rate and the upper bound by the repo rate.

- Since the width of this corridor was fixed, once the repo rate was decided, the reverse repo rate was automatically determined, and market overnight rates adjusted accordingly.

- During the Covid-19 pandemic, the RBI constantly adjusted the reverse repo rate even as the MPC kept the repo rate unchanged.

- As a result, the fixed width of the corridor was lost, and the MPC lost any role in determining interest rates.

3] Introduction of policy instruments outside the remit of MPC

- During pandemic, the RBI introduced a number of new policy instruments, again outside the remit of the MPC.

- GSAP: It brought in the GSAP programme through which it pre-commited to buying a certain amount of dated government bonds in order to control their yields.

- Variable reverse repo auctions: It then introduced variable reverse repo auctions, and more recently, replaced the reverse repo rate with the long-dormant standing deposit facility rate.

- The rationale for this was not explained in the MPC statement.

- All unconventional monetary policy announcements were kept outside the MPC statement.

- This raised the questions about the role of the committee in deciding monetary policy actions at a crucial time like the pandemic.

4] Intervention in the foreign exchange market

- The RBI has been intervening in the foreign exchange market to manage the rupee.

- Forex interventions by definition influence the domestic monetary base and inflation.

- Yet the MPC in its monetary policy statements does not discuss either the exchange rate dynamics or the forex interventions.

- Just as it does not discuss the RBI’s interventions in the bond market to lower the yields.

Way forward

- In its latest two statements, the MPC indicated that policy would now be focusing on bringing India’s inflation rate under control.

- Clear policy framework: If the RBI is going to be successful in this endeavour, the first step must be to close the communication gap, by reintroducing a simple and clear policy framework and restoring the central role of the MPC.

Conclusion

The net result of all these actions is a potential loss of both clarity and credibility. The communication gap will need to be closed in order for the RBI to become successful in bringing inflation back to its 4 per cent target level.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: Monetary Policy Corridor

- The Corridor in the monetary policy of the RBI refers to the area between the reverse repo rate and the MSF rate.

- Reverse repo rate will be the lowest of the policy rates whereas Marginal Standing Facility is something like an upper ceiling with a higher rate than the repo rate.

- The MSF rate and reverse repo rate determine the corridor for the daily movement in the weighted average call money rate.

- As per the monetary policy of the RBI, ideally, the call rate should travel within the corridor showing a comfortable liquidity situation in the financial system and economy.

What is GSAP?

- The G-Sec Acquisition Programme (G-SAP) is basically an unconditional and a structured Open Market Operation (OMO), of a much larger scale and size.

- G-SAP is an OMO with a ‘distinct character’.

- The word ‘unconditional’ here connotes that RBI has committed upfront that it will buy G-Secs irrespective of the market sentiment.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

Explained: Repo Rate in India

From UPSC perspective, the following things are important :

Prelims level: Repo Rate

Mains level: Inflation targetting by MPC

Earlier this month, the RBI, in a surprise move decided unanimously to raise the “policy repo rate by 40 basis points to 4.40%, with immediate effect”.

What is the Repo Rate?

- The repo rate is one of several direct and indirect instruments that are used by the RBI for implementing monetary policy.

- Specifically, the RBI defines the repo rate as the fixed interest rate at which it provides overnight liquidity to banks against the collateral of government and other approved securities under the liquidity adjustment facility (LAF).

- In other words, when banks have short-term requirements for funds, they can place government securities that they hold with the central bank and borrow money against these securities at the repo rate.

- Since this is the rate of interest that the RBI charges commercial banks such as SBI and ICICI Bank when it lends them money, it serves as a key benchmark for the lenders to in turn price the loans they offer to their borrowers.

Why is the repo rate such a crucial monetary tool?

- According to Investopedia, when government central banks repurchase securities from commercial lenders, they do so at a discounted rate that is known as the repo rate.

- The repo rate system allows central banks to control the money supply within economies by increasing or decreasing the availability of funds.

How does the repo rate work?

- Besides the direct loan pricing relationship, the repo rate also functions as a monetary tool by helping to regulate the availability of liquidity or funds in the banking system.

- For instance, when the repo rate is decreased, banks may find an incentive to sell securities back to the government in return for cash.

- This increases the money supply available to the general economy.

- Conversely, when the repo rate is increased, lenders would end up thinking twice before borrowing from the central bank at the repo window thus, reducing the availability of money supply in the economy.

- Since inflation is caused by more money chasing the same quantity of goods and services available in an economy, central banks tend to target regulation of money supply as a means to slow inflation.

What impact can a repo rate change have on inflation?

- Inflation can broadly be: mainly demand driven price gains, or a result of supply side factors.

- This in turn push up the costs of inputs used by producers of goods and providers of services.

- It is thus spurring inflation, or most often caused by a combination of both demand and supply side pressures.

- Changes to the repo rate to influence interest rates and the availability of money supply primarily work only on the demand side.

- It makes credit more expensive and savings more attractive and therefore dissuading consumption.

- However, they do little to address the supply side factors, be it the high price of commodities such as crude oil or metals or imported food items such as edible oils.

Try this PYQ:

Q.If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do?

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Post your answers here.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

Control inflation by acting on liquidity

From UPSC perspective, the following things are important :

Prelims level: CRR

Mains level: Paper 3- Dealing with inflation challenge through liquidity measures

Context

The recent action of the Reserve Bank of India (RBI) to raise the repo rate by 40 basis points and cash reserve ratio (CRR) by 50 basis points is a recognition of the serious situation with respect to inflation in our country and the resolve to tackle inflation.

Inflation in India and role of government expenditure

- India’s CPI inflation has been fluctuating around a high level.

- As early as October 2020, it had hit a peak of 7.61%.

- It had remained at a high level of over 6% since April 2020.

- It did come down after December 2020 but has started rising significantly from January 2022.

- On the other hand, the Wholesale Price Index (WPI) inflation had remained in double digits since April 2021. The GDP implicit price deflator-based inflation rate for 2021-22 is 9.6%.

- Even though the RBI’s mandate is with respect to CPI inflation, policymakers cannot ignore the behaviour of other price indices.

- After the advent of COVID-19, the major concern of policymakers all over the world was to revive demand.

- Keynesian prescription: This was sought to be achieved by raising government expenditure.

- Thus, the expansion in government expenditure did not immediately result in increased production in countries where the lockdown was taken seriously.

- However, the Keynesian multiplier does not work when there are supply constraints as in developing countries.

- That is why the multiplier operates in nominal terms rather than in real terms in such countries.

- Something similar has happened in the present case where the supply constraint came from a non-mobility of factors of production.

- Nevertheless, the prescription of enhanced government expenditure is still valid under the present circumstances.

- Perhaps the increase in output could happen with a lag and also with the relaxation of restrictions.

Role of monetary policy

- Why lover money multiplier rate? Initially, the focus of monetary policy in India has been to keep the interest rate low and increase the availability of liquidity through various channels, some of which have been newly introduced.

- However, the growth rate of money was below the growth rate in reserve money.

- This is because of lower credit growth which also depends on business sentiment and investment climate.

- Thus the money multiplier is lower than usual.

- The Government’s borrowing programme which was larger went through smoothly, thanks to abundant liquidity.

- Even as the economy picked up steam in 2021-22, inflation also became an issue, this is a worldwide phenomenon.

- In India too there is a shift in monetary policy.

Analysing the cause of inflation

- While discussing inflation, analysts focus almost exclusively on the increases in the prices of individual commodities such as crude oil as the primary cause of inflation.

- General price level: Supply disruptions due to domestic or external factors may explain the behaviour of individual prices but not the general price level which is what inflation is about.

- Given a budget constraint, there will only be an adjustment of relative prices.

- Besides the fact that any cost-push increase in one commodity may get generalised, it is the adjustment that happens at the macro level which becomes critical.

- It is the adjustment in the macro level of liquidity that sustains inflation.

Inflation and growth

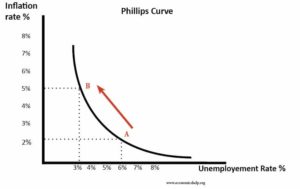

- The possible trade-off between inflation and growth has a long history in economic literature.

- The Phillip’s curve has been analysed theoretically and empirically.

- Tobin called the Phillip’s curve a ‘cruel dilemma’ because it suggested that full employment was not compatible with price stability.

- The critical question flowing from these discussions on trade-off is whether cost-push factors can by themselves generate inflation.

- In the current situation, it is sometimes argued that inflation will come down, if some part of the increase in crude prices is absorbed by the government.

- If the additional burden borne by the government (through loss of revenue) is not offset by expenditures, the overall deficit will widen.

- The borrowing programme will increase and additional liquidity support may be required.

Concomitant decisions on CRR and repo rate

- These are concomitant decisions. Central banks cannot order interest rates.

- For a rise in the interest rate to stick, appropriate actions must be taken to contract liquidity.

- That is what the rise in CRR will do.

- In the absence of a rise in CRR, liquidity will have to be sucked by open market operations.

Conclusion

Beyond a point, inflation itself can hinder growth. Negative real rates of interest on savings are not conducive to growth. If we want to control inflation, action on liquidity is very much needed with a concomitant rise in the interest rate on deposits and loans.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

Inflation control needs another model

From UPSC perspective, the following things are important :

Prelims level: CPI and WPI

Mains level: Paper 3- Need for the review of inflation targeting model

Context

At the conclusion of the April meeting, the Monetary Policy Committee had already warned that the focus will henceforth be on inflation. Yesterday it raised the repo rate somewhat sooner than was expected by the market.

Discourse on inflation engaged in by the western central banks

- Inflation reflects an excess of output over its ‘natural’ level.

- Inflation targeting refers to the policy of controlling inflation by raising the interest rate over which the central bank has control, i.e. the rate at which it lends to commercial banks, the ‘repo rate’.

- This, it is argued, will induce firms to stay their investment plans and reduce inventories, lowering production.

- As economy-wide output declines, becoming equal to the natural level of output, inflation will cease.

- This story does not just legitimise a policy of output contraction for inflation but sees it as optimal.

- The natural level of output itself is the productive counterpart of the natural level of employment, the level that obtains in a freely functioning labour market.

- So, at the natural level of output, the economy is deemed to be at full employment.

- Salient in the context is the fact that the natural level of output is unobservable.

- Hence inflation as a reflection of an “overheating” economy is something that must be taken on trust.

Inflation control in India

- Not surprisingly for a theory based on an unobservable variable, the proposition that inflation is due to an overheating economy fares poorly when put to a statistical test for India.

- There is not a single demonstration of the empirical validity of the model of inflation presented in the RBI report of 2014, which recommended a move to inflation targeting.

- On the other hand inflation in India can be explained in terms of the movement of the prices of agricultural goods and, to a lesser extent, imported oil.

- How effective is monetary policy in controlling inflation: The implication of this finding is damaging for the claim that monetary policy can control inflation, for neither the price of agricultural goods nor that of imported oil is under the central bank’s control.

- The only route by which monetary policy can, in principle, control inflation is by curbing the growth of non-agricultural output, which would in turn lower the growth of demand for agricultural goods.

- As the demand for agricultural goods slows, so will inflation, but this comes at the cost of output and employment.

- At least, this is the theory.

- Whether this takes place in practice depends upon the extent to which changes in the repo rate are transmitted to commercial bank lending rates.

Way forward

- Focus on supply of agricultural goods: The implication for the policymaker that inflation is driven by agricultural goods prices, as is the case in India presently, is that the focus should be on increasing the supply of these goods.

- Growing per capita income in India has shifted the average consumption basket towards foods rich in minerals, such as fruits and vegetables, and protein, such as milk and meat.

- But the expansion of the supply of these foods has been lower than the growth in demand for them.

- So a concerted drive to increase the supply of food other than rice and wheat holds the key.

- Costly food threatens the health of the population, as people economise on their food intake, and holds back the economy, as only a small part of a household’s budget can be spent on non-agricultural goods.

Conclusion

Monetary policy manoeuvres, typified by the RBI’s raising of the repo rate is not an efficient solution for agricultural price-driven inflation. Any lasting inflation control would require placing agricultural production on a steady footing, with continuously rising productivity.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

RBI surprises with 40 bps rate increase in Repo Rate

From UPSC perspective, the following things are important :

Prelims level: Repo Rate

Mains level: Inflation targetting by MPC

The Reserve Bank of India (RBI), in a sudden move, raised the repo rate by 40 basis points (bps) to 4.4% citing inflation that was globally rising alarmingly and spreading fast.

Why in news?

- The repo rate increase was the first since August 2018.

- The MPC retained its ‘accommodative’ policy stance even as it focuses on withdrawal of accommodation to keep inflation within the target range while supporting growth.

- Due to Ukraine War, persistent and spreading inflationary pressures are becoming more acute with every passing day.

Hues over the REPO spike

- The move — to have such a meeting and to raise the interest rates — is, at two different levels, both surprising and obvious.

- It is surprising because the RBI’s MPC meets once every two months — and the meeting this week was not scheduled.

What is Repo Rate?

- Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds.

- It is used by monetary authorities to control inflation.

- In the event of inflation, central banks increase repo rate as this acts as a disincentive for banks to borrow from the central bank.

- This ultimately reduces the money supply in the economy and thus helps in arresting inflation.

How does the repo dynamics work?

- When there is a shortage of funds, commercial banks borrow money from the central bank which is repaid according to the repo rate applicable.

- The central bank provides these short terms loans against securities such as treasury bills or government bonds.

- This monetary policy is used by the central bank to control inflation or increase the liquidity of banks.

- The government increases the repo rate when they need to control prices and restrict borrowings.

- An increase in repo rate means commercial banks have to pay more interest for the money lent to them and therefore, a change in repo rate eventually affects public borrowings such as home loan, EMIs, etc.

- From interest charged by commercial banks on loans to the returns from deposits, various financial and investment instruments are indirectly dependent on the repo rate.

What is accommodative stance of policy?

- Accommodative monetary policy is when central banks expand the money supply to boost the economy. Monetary policies that are considered accommodative include lowering the Federal funds rate.

- These measures are meant to make money less expensive to borrow and encourage more spending.

What triggered the RBI to take sudden decision?

- Inflation has been rising for over two years: By law, the RBI is supposed to target retail inflation at 4%. Inflation constantly above 4% since last year.

- Inflation has not been “transitory”: The reasons for high inflation have tended to change over the months due to wide range of reasons like war, crude oil prices rise, taxes on fuels etc.

- Spike in crude oil prices is not new: The RBI has pointed to high crude oil prices in the wake of the Ukraine war, as one of the key reasons for high inflation in India.

- High core inflation: The core inflation which is essentially the inflation rate stripped of the effect of fuel and food prices has been rising up. This is more worrisome for RBI since it cannot be altered overnight.

- Monetary policy has lags. RBI waited too long: If the RBI wanted to contain inflation in May, it should have acted in February or at least in April. Raising rates right now may not bring down the inflation rate immediately.

Try this PYQ from CSP 2020:

Q.If the RBI decides to adopt an expansionist monetary policy, which of the following it would NOT do?

- Cut and optimize the statutory liquidity ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Post your answers here:

Back2Basics: Monetary Policy Committee (MPC)

- The Monetary Policy Committee (MPC) is a committee of the RBI, which is entrusted with the task of fixing the benchmark policy interest rate (repo rate) to contain inflation within the specified target level.

- The RBI Act, 1934 was amended by Finance Act (India), 2016 to constitute MPC to bring more transparency and accountability in fixing India’s Monetary Policy.

- The policy is published after every meeting with each member explaining his opinions.

- The committee is answerable to the Government of India if the inflation exceeds the range prescribed for three consecutive months.

- Suggestions for setting up a MPC is not new and goes back to 2002 when YV Reddy committee proposed to establish an MPC, then Tarapore committee in 2006, Percy Mistry committee in 2007, Raghuram Rajan committee in 2009 and then Urjit Patel Committee in 2013.

Composition and Working

- The committee comprises six members – three officials of the RBI and three external members nominated by the Government of India.

- The meetings of the Monetary Policy Committee are held at least 4 times a year and it publishes its decisions after each such meeting.

- The Governor of RBI is the chairperson ex officio of the committee.

- Decisions are taken by a majority with the Governor having the casting vote in case of a tie.

- They need to observe a “silent period” seven days before and after the rate decision for “utmost confidentiality”.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

Challenges in RBI’s inflation management

From UPSC perspective, the following things are important :

Prelims level: Liquidity Adjustment Framework

Mains level: Paper 3- Standing Deposit Facility

Context

The first bi-monthly meeting of the Reserve Bank of India’s Monetary Policy Committee (MPC) for the current financial year reaffirmed its focus on inflation management.

Towards the normalisation of monetary policy

- The MPC voted to keep the policy rate unchanged at 4 per cent and retained its accommodative stance.

- However, the wording was changed to “remain accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.”

- This statement sets the stage for a shift to a neutral stance in the next meeting and policy rate hikes in subsequent meetings.

- RBI has announced the withdrawal of some of the steps taken during the pandemic to support the economy.

- These will foster the normalisation of monetary policy.

Inflation challenge

- The central bank has acknowledged that the disruptions caused by the Russia-Ukraine crisis have upended their growth and inflation outlook.

- It has steeply revised its inflation projection from 4.5 per cent earlier to 5.7 per cent now for the current financial year.

- The projection is based on an average global crude oil price of $100 per barrel.

- The Food and Agriculture Organisation’s (FAO’s) Food Price Index, a gauge of global food prices, posted a record growth of 12.6 per cent from February.

Formalisation of Liquidity Adjustment Framework (LAF)

- The RBI has been managing liquidity infused into the system during the pandemic through the Variable Rate Reverse Repo Auctions (VRRR) to withdraw liquidity and Variable Rate Repo auctions to inject liquidity.

- RBI has now formalised the Liquidity Adjustment Framework (LAF).

- The LAF is a framework to absorb and inject liquidity into the banking system.

- The LAF is now a symmetric corridor with a width of 50 basis points.

- The policy repo rate is at the centre of the corridor, with the MSF 25 basis points above the policy rate and the SDF 25 basis points below the policy rate.

What is a Standing Deposit Facility

- The RBI has introduced the Standing Deposit Facility (SDF) as the lower bound of the LAF corridor to absorb liquidity.

- The idea of the SDF was first mooted by the Urjit Patel Committee report on the monetary policy framework.

- The RBI Act was amended through the Finance Act of 2018 to allow RBI to use this instrument.

- The SDF will be a facility available to banks to park their funds.

- The SDF will serve as the standing liquidity absorption facility at the lower end of the LAF corridor.

- At the upper end of the corridor is the Marginal Standing Facility (MSF) to inject liquidity.

- Through the SDF, the RBI can absorb liquidity without placing government securities as collateral, hence it will give greater flexibility to the central bank.

- The change also marks a shift away from reverse repo being the effective policy rate.

Key takeaways

- While on the face of it, there are no rate hikes, the shift from the reverse repo rate to the SDF signals a tightening of monetary policy.

- There is a 40 basis points increase in the floor rate.

- In the medium run, the call money rate would move towards the new LAF corridor, thus bringing orderly conditions in the money market.

- As RBI begins to normalise liquidity in a calibrated manner, its ability to manage bond yields will likely be limited.

- Yields on bonds are likely to inch up and remain above the 7 per cent mark.

- Going forward, the trade-off between managing inflation and the borrowing programme of the government will become challenging.

Conclusion

For now the RBI has rightly decided to place top priority on inflation management. This will help in maintaining the credibility of the inflation targeting framework.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

RBI shift on monetary policy

From UPSC perspective, the following things are important :

Prelims level: LAF corridor

Mains level: Paper 3- Monetary policy normalisation

Context

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Friday gave a surprise, with a formal start to policy normalisation. This was contrary to the predominant market expectations of a hold.

RBI on the path of policy normalisation

- Focus on target of 4% +/- 2%: While the MPC voted unanimously to remain accommodative, in a change of language, the focus would now be on “withdrawal of accommodation to ensure that (CPI) inflation remains within the target (of 4 per cent +/- 2 per cent) going forward”.

- Remember, the RBI had become a (flexible) inflation-targeting central bank since FY17, whose primary objective is price stability, that is, inflation management.

- The Liquidity Adjustment Facility (LAF) corridor was narrowed back to the conventional 0.25 percentage points from the earlier extraordinary pandemic widening in late March 2020.

- The cap of the erstwhile corridor was the repo rate and the floor was the reverse repo.

- Now, while the repo rate was held at 4.0 per cent and the latter at 3.35 per cent, the floor of the corridor was increased by 0.4 percentage points from 3.35 per cent.

- There was also a change in the monetary policy orientation, of which the stance is one component.

- The priority for monetary policy now is inflation, growth and financial stability, in that order.

Reasons for unexpected tightening of policy

- Inflation concerns: Despite uncertainty over growth impulses and demand concentrated at the upper-income level households, inflation has increasingly emerged as a big concern.

- Given that inflation is likely to average 6.1 per cent in Q4 of FY22, this increases the risk of inflation remaining above the 6 per cent upper target for three consecutive quarters, necessitating an explanation to the government by the MPC.

- One comforting aspect of this scenario is that household inflation expectations remain anchored, with the median of three months to one year ahead expectations (as of March ’22) rising by only 0.1 percentage points from the earlier January readings.

- Stabilisation of demand: On demand conditions, the RBI scaled-down the FY23 real GDP growth projection to 7.2 per cent (from 7.8 per cent), indicating that a combination of continuing supply dislocations, slowing global economy and trade, high prices and financial markets volatility are likely to take a toll.

- One possible reconciliation with modest GDP growth is continuing weakness in services, which is also borne out by channel checks.

- Certainly, continuing high inflation is likely to lead to some demand destruction, which will act as an automatic stabiliser.

- A relatively loose fiscal policy is likely to offset some of this reduced demand, particularly with continuing subsidies to lower-income households.

- Financial stability: This has multiple dimensions – interest and foreign exchange rates, market volatility, banking sector asset stress, and so on.

- An important objective for the RBI is the management of money supply and system liquidity.

- In a rising rate cycle, with a large borrowing programme of the Centre and state governments, interest rates on sovereign bonds are likely to increase without a measure of support from the RBI through Open Market Operations (OMOs).

- This will entail injecting more liquidity into an already large surplus, which might add to inflationary pressures.

- The introduction of the overnight Standing Deposit Facility (SDF) was a significant measure in this context.

- Unlike the reverse repo facility, the RBI will not need to give banks government bonds as collateral against the funds they deposit.

- This is thus a more flexible instrument should a shortage of government bonds in RBI holdings actually transpire under some eventuality, say the need to absorb large capital inflows post a bond index inclusion.

What are the implications?

- Interest rates will begin to increase but, for bank borrowers, this is likely to be a very gradual process.

- For corporates and other wholesale borrowers, who also borrow from bond markets, this increase is likely to be faster as the surplus system liquidity is gradually drained.

- How this is likely to affect demand for credit is uncertain, given the capex push of the government, some revival of private sector investment and likely continuing demand for housing.

Conclusion

This cycle of policy tightening will present a particularly difficult mix of economic and financial trade-offs, but RBI has demonstrated the ability to innovatively use the multiple instruments at its disposal to ensure an orderly transition.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: Liquidity Adjustment Facility corridor

- Liquidity adjustment facility (LAF) is a monetary policy tool which allows banks to borrow money through repurchase agreements or repos.

- LAF is used to aid banks in adjusting the day to day mismatches in liquidity (frictional liquidity deficit/surplus).

- The liquidity adjustment facility corridor is the excess of repo rate over reverse repo.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

What is Reverse Repo Normalization?

From UPSC perspective, the following things are important :

Prelims level: Repo , Reverse Repo, Normalization

Mains level: Normalization of Monetary Policy

In a recent report, the State Bank of India, which is the largest public sector bank in the country, has stated that the stage is set for a reverse repo normalization.

What is Monetary Policy Normalisation?

The RBI keeps tweaking the total amount of money in the economy to ensure smooth functioning by two types of policies:

(I) Loose Monetary Policy

When the RBI wants to boost economic activity it adopts a so-called “loose monetary policy”.

There are two parts to such a policy:

- RBI injects more money (liquidity) into the economy: It does so by buying government bonds from the market. As the RBI buys these bonds, it pays back money to the bondholders, thus injecting more money into the economy.

- RBI also lowers the interest rate: it charges banks when it lends money to them; this rate is called the repo rate. Lower interest rates and more liquidity, together, are expected to boost both consumption and production in the economy.

(II) Tight Monetary Policy

- It involves the RBI raising interest rates and sucking liquidity out of the economy by selling bonds (and taking money out of the system).

- When any central bank finds that a loose monetary policy has started becoming counterproductive in reducing inflation, the central bank “normalizes the policy” by tightening the monetary policy stance.

What is Reverse Repo?

- An interest rate that the RBI pays to the commercial banks when they park their excess “liquidity” (money) with the RBI.

- The reverse repo, thus, is the exact opposite of the repo rate.

- Under normal a circumstance, that is when the economy is growing at a healthy pace, the repo rate becomes the benchmark interest rate in the economy.

- That’s because it is the lowest rate of interest at which funds can be borrowed.

- As such, the repo rate forms the floor interest rate for all other interest rates in the economy — be it the rate you pay for a car loan or a home loan or the interest you earn on your fixed deposit, etc.

How does Reverse Repo fit into policy normalization?

- Imagine a scenario where the RBI pumps more and more liquidity into the market but there are no takers of fresh loans.

- This is because the banks are unwilling to lend or because there is no genuine demand for new loans in the economy.

- In such a scenario, the action shifts from repo rate to reverse repo rate because banks are no longer interested in borrowing money from the RBI.

- Rather they are more interested in parking their excess liquidity with the RBI. And that is how the reverse repo becomes the actual benchmark interest rate in the economy.

What does reverse repo normalization mean?

- Simply put, it means the reverse repo rates will go up.

- Over the past few months, in the face of rising inflation, several central banks across the world have either increased interest rates or signaled that they would do so soon.

- In India, too, it is expected that the RBI will raise the repo rate.

- But before that, it is expected that the RBI will raise the reverse repo rate and reduce the gap between the two rates.

- In the immediate aftermath of Covid, RBI had increased this gap.

Implications of such policy

- Incentivize commercial banks to park excess funds with RBI, thus sucking some liquidity out of the system.

- The next step would be raising the repo rate.

- This process of normalization, which is aimed at curbing inflation, will not only reduce excess liquidity but also result in higher interest rates across the board in the Indian economy.

- This will help reduce the demand for money among consumers (since it would make more sense to just keep the money in the bank) and make it costlier for businesses to borrow fresh loans.

Try this PYQ from CSP 2020:

Q.If the RBI decides to adopt an expansionist monetary policy, which of the following it would NOT do?

- Cut and optimize the statutory liquidity ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Post your answers here:

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

What is the Regression Theorem?

From UPSC perspective, the following things are important :

Prelims level: Regression Theorem

Mains level: Not Much

This newscard is an excerpt from the original article published in the TH e-paper edition.

Regression Theorem

- The regression theorem refers to a theory of the origin of money.

- It states that money must have originated as a commodity with intrinsic value in the marketplace.

- The idea was first proposed by Austrian economist Carl Menger in his 1892 work “On the Origins of Money.”

- This theory is offered as an alternative to the state theory of money which states that money (fiat money) can come into existence only when it is backed by the government.

Evolution of Money

- The regression theory argues that money comes into existence through a gradual process of evolution in the marketplace, without the need for any government sanction.

- Economists who try to explain the regression theory generally start with the question of why money, particularly fiat money which is simply just a piece of paper, has any value at all in the marketplace.

- The most common answer to this question is that fiat money can be used to buy other useful goods such as houses, cars etc.

- But this answer is insufficient —it tries to tackle the question of why fiat money can buy other useful goods by simply saying that it can buy other useful goods.

Why is fiat money, which has little intrinsic value, considered valuable?

- In real life, people accept money in exchange for goods in the present because they are aware that money was accepted as a medium in exchange for other goods in the past.

- For example, people accept wages in the US dollar today because they are aware that the dollar was used to buy cars, groceries and other goods in the market yesterday.

- This gives them confidence in the value of their money.

What made people accept money in exchange for other useful goods in the past?

Ans. Intrinsic Value

- Economists who advocate the regression theory of money argue that money must have originated as a useful commodity like gold or silver or the barter system.

- This is the only way, they argue, it could have possibly been accepted by people in exchange for other useful goods at some point in the past.

- If a thing did not possess any intrinsic value, it is unlikely that people in the marketplace would have accepted it in exchange for other goods and services.

- So, commodities like gold and silver must have been traded in exchange for other goods and services at some point in history purely because they offered some kind of personal utility to people.

- For example, these precious metals could have been used to make ornaments, to fill teeth, etc., which gives them intrinsic value.

- They maintain value over time because their supply cannot be easily ramped up as mining gold involves significant production costs.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

Why policymakers prefer targeting of Retail Inflation over Wholesale Inflation?

From UPSC perspective, the following things are important :

Prelims level: Wholesale and Retail (Consumer) Inflation

Mains level: Inflation control in India

The wholesale inflation in India has grown by double digits. This is the highest year-on-year increase recorded in any month since the start of the 2011-12 data series.

Context

- It is surprising policymakers are not looking as concerned as the inflation figures show.

- The Finance Ministry has largely focused on the trend in retail inflation — or the inflation rate at the level of retail consumers.

- It is not just the policymakers within the government who prefer to focus on retail inflation but also the RBI.

Wholesale and Retail (Consumer) Inflation

- The wholesale and retail (consumer) inflation rates are based on the wholesale price index (WPI) and the consumer price index (CPI), respectively.

- In other words, we make two separate indices — one each for wholesale prices and retail prices — and see how the index values have gone up in a particular month as against the same month last year.

- The percentage change is the rate of inflation.

- The CPI-based inflation data is compiled by the Ministry of Statistics and Programme Implementation (or MoSPI) and the WPI-based inflation data is put together by DPIIT.

The tables alongside detail how the two indices — WPI and CPI — differ in their composition. There are two key differences.

[A] Wholesale Price Index

| Component | Weight (in %) | Inflation rate (in %);

Nov 2021 |

| All Commodities | 100.00 | 14.23 |

| Primary Articles | 22.62 | 10.34 |

| Fuel & Power | 13.15 | 39.81 |

| Manufactured Products | 64.23 | 11.92 |

[B] Consumer Price Index

| Component | Weight (in %) | Inflation rate (in %);

Nov 2021 |

| General Index | 100.00 | 4.91 |

| Food and beverages | 45.86 | 2.60 |

| Pan, tobacco and intoxicants | 2.38 | 4.05 |

| Clothing and footwear | 6.53 | 7.94 |

| Housing | 10.07 | 3.66 |

| Fuel and light | 6.84 | 13.35 |

| Miscellaneous (services) | 28.32 | 6.75 |

A Comparison

(1) Manufactured Goods Vs. Food Items

- WPI is dominated by the prices of manufactured goods while CPI is dominated by the prices of food articles.

- As such, if the year-on-year increase in the prices of food articles is subdued, as is the case at present, chances are that the overall (also called headline) retail inflation will be within reasonable bounds.

- In WPI, if manufactured products are getting costlier at the wholesale level then that would likely spike wholesale inflation regardless of how food prices are doing at the wholesale level.

(2) Accounting Service

- Two, WPI does not take into account the change in prices of services. But CPI does.

- If services such as transport, education, recreation and amusement, personal care etc. get significantly costlier, then retail inflation will rise but there will be no impact on wholesale price inflation.

Why do policymakers prefer targeting retail inflation instead of wholesale inflation rate?

- RBI’s limitations: RBI is the monetary authority that has little ability to control food and fuel prices. Ex: raising the repo rate (rate at which RBI lends money to banks) is unlikely to contain the price of vegetables if any disruptions have led to a sudden spike.

- Non-commodity Inflation: Wholesale inflation does not capture price movements in non-commodity-producing sectors like services, which constitute close to two-thirds of economic activity in India.

- Large revisions in WPI: Movements in WPI often reflect large external shocks and as such, the wholesale inflation rate is often subject to large revisions.

Arguments in favour of CPI-based inflation targeting

- Commodity basket: A crucial reason why CPI-based inflation could not be ignored is the fact that it has almost 57% dominance of food and fuel prices.

- Affecting general public: Since most people use retail inflation as a way to arrive at their real earnings, and use it for wage negotiations etc., it makes more sense for policymakers,

- Public faith: The choice of CPI establishes ‘trust’ viz., economic agents note that the monetary policy maker is targeting an index that is relevant for households and businesses.

- Inflation affecting people: True inflation that consumers face is in the retail market. It is for this reason that almost all central banks in big economies use CPI as their primary price indicator.

Impact of Wholesale inflation on Retail

- The Urjit Patel committee analysed the relationship between WPI and CPI based on monthly data from January 2000 to December 2013 — a total of 14 years.

- When they looked at the impact of an increase in WPI-food inflation on CPI food inflation, they found it to be “significant”.

- It stated that higher food inflation in wholesale markets leads to an increase in retail food inflation “till two months”.

- An increase in retail food inflation leads to a corresponding increase in WPI-food inflation.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

RBI must tackle surplus liquidity on way to policy normalisation

From UPSC perspective, the following things are important :

Prelims level: Monetary policy corridor

Mains level: Paper 3- Monetary policy normalisation and challenges involved in it

Context

Monetary Policy Committee (MPC) voted to maintain status quo on policy rates, with one member continuing to dissent on the “accommodative” stance of policy.

What is accommodative stance of policy?

Accommodative monetary policy is when central banks expand the money supply to boost the economy. Monetary policies that are considered accommodative include lowering the Federal funds rate. These measures are meant to make money less expensive to borrow and encourage more spending.

Overview of RBI policy measures during Covid-related lockdown

- Cut in policy rates and injection of liquidity: The RBI had moved proactively to cut the repo and reverse repo rate and inject unprecedented amounts of funds into banks and other intermediaries.

- The short-term interest rate at reverse repo level: a combination of the lower reverse repo rate and the large liquidity injection had resulted in a drop in various short-term rates down to (and occasionally below) the reverse repo rate, making it the effective operating rate of monetary policy.

- Gap between repo and reverse repo increased to 65 bps: In addition, both the repo and reverse repo rates had been cut to 4.0 and 3.35 per cent, respectively, with the gap – the “corridor” – between the rates widening from the usual 25 basis points to 65 bps.

Central bank’s role in modern monetary policy

- Determining basic overnight interest rate: A central bank’s main role in modern monetary policy operating procedures is to determine the basic overnight interest rate, deemed to be consistent with prevailing macroeconomic conditions and their economic policy objectives, in balancing the ecosystem for sustained growth together with moderate inflation.

- This is achieved through buying and selling very short-term (predominantly overnight) funds (mainly) from banks to keep a specified operating rate (the weighted average call rate in our case) very close to the policy rate.

Liquidity management: Key pillar of monetary policy normalisation

- Liquidity management: Liquidity management in the extended banking and financial system (which includes non-banking intermediaries like NBFCs, mutual funds and others) will now be the key pillar of normalisation.

- This process is the domain of RBI and not MPC.

- These operations will be conducted within RBI’s liquidity management framework.

- There are two sources of liquidity additions:

- (i) Exogenous: which are largely due to inflows of foreign currency funds and outflows of currency in circulation (cash) from the banking sector.

- (ii) Voluntary or endogenous: which is the result of the creation of base money by RBI through buying and selling of bonds, thereby injecting or extracting rupee funds.

How RBI is managing liquidity surplus?

- Stopped GSAP and OMOs: Post the October review, RBI had stopped buying bonds under the Govt Securities Asset Purchase (GSAP) and done negligible Open Market Operations (OMOs), thereby stopping addition of voluntary liquidity injection into the system, our own version of “tapering”.

- Union government balances with RBI, arising from cash flow mismatches between receipts and expenditures, has hybrid characteristics and also impacts liquidity.

- Use of reverse repo window: RBI has used the reverse repo window to absorb almost all this liquidity surplus from banks.

- Allowed repaying TLRTOs: It has again allowed banks the option to prepay the outstanding borrowings from the Targeted Long Term Repo Operations (TLTROs), thereby potentially extracting another Rs 70,000 crores.

How RBI is managing interest rate in the policy normalisation process

- Increased rates and closed the gap between repo and reverse repo: RBI – post the October review – has gradually guided short-term rates up with a sure hand from near the reverse repo rate to close to the repo rate.

- It has shifted its liquidity absorption operations from the predominant use of fixed rate reverse repos (FRRR) into (largely) 14-day variable rate reverse repo (VRRR) auctions to guide a rise in interest rates.

- Since early October, these rates had steadily moved up in a smooth and orderly fashion up to 3.75-3.9 per cent.

- The VRRR rates moving up have also resulted in various short-term funding interest rates like 90-day Treasury Bills, Commercial Papers (CP) and banks’ Certificates of Deposits (CD) moving up from the reverse repo rate or below in September to 3.5 per cent and higher since December.

- The OMO and GSAP operations have also helped in managing medium- and longer-term interest rates in the yield curve.

Way forward

- There is a likelihood of further additions to exogenous system liquidity.

- Other instruments to absorb surpluses: There might consequently be a need for other instruments to absorb these surpluses apart from VRRR auctions.

- Liquidity surplus of non-banking intermediaries: Managing liquidity surpluses of the non-banking intermediaries, especially mutual funds, will be another challenge since they do not have direct access to VRRR operations.

Consider the question “Since the onset of the Covid-related lockdowns, RBI had moved proactively to cut the repo and reverse repo rate and inject unprecedented amounts of funds into banks and other intermediaries. In this context, what are the challenges in monetary policy normalisation as RBI plans to absorb the excess liquidity and increase the interest rates ?”

Conclusion

The shift to the tightening phase, with hikes in the repo rate, is likely towards the late months of FY23, with shifts “if warranted by changes in the economic outlook”.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: Monetary Policy Corridor

- The Corridor in monetary policy of the RBI refers to the area between the reverse repo rate and the MSF rate.

- Reverse repo rate will be the lowest of the policy rates whereas Marginal Standing Facility is something like an upper ceiling with a higher rate than the repo rate.

- The MSF rate and reverse repo rate determine the corridor for the daily movement in the weighted average call money rate.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Monetary Policy Committee Notifications

RBI’s monetary policy statement

From UPSC perspective, the following things are important :

Prelims level: Taper tantrum

Mains level: Paper 3- MPC decision on interest rates

Context

The Monetary Policy Committee of the RBI kept the benchmark policy rates unchanged, and retained the accommodative stance in its October review.

Factors playing part in monetary policy decisions

- It’s important to remember that monetary policy these days is influenced by both local macroeconomic developments and the global monetary policy direction, with the former playing a dominant role.

- Locally, after the second wave of the pandemic, a variety of indicators such as the Purchasing Managers Index (manufacturing and services), mobility indicators, government tax collections, exports and imports are pointing at an improvement in economic activity.

- Then there is the good news on the monsoon front. With a late pick-up in rains, the cumulative deficiency in this monsoon season has come down to just 1 per cent of the long-period average (LPA).

- Since the MPC’s August 2021 policy review, Covid-19 cases have trended down and there has been admirable progress on the vaccination front.

- Also, despite high year-on-year growth numbers, the level of economic activity this fiscal will only be 1.5 per cent above 2019-2020.

Trends emerging from the economic recovery

- Role of government: Capital expenditure of both the Centre and states is on track to meet the budgetary commitment, supported by healthy tax collections.

- Large companies on recovery path: Large companies in industrial sectors such as steel, cement, non-ferrous metals are operating at healthy utilisation levels, and have deleveraged their balance sheets.

- Policy support for smaller companies: The going is not so good for the smaller ones.

- Clearly, smaller companies need policy support. The extension of the Emergency Credit Line Guarantee Scheme is a recognition of that.

- Private consumption is not broad-based either.

- Even in goods consumption, which is faring better than services, the nature of demand seems skewed towards relatively higher-value items such as cars and utility vehicles.

- This probably reflects the income dichotomy spawned by the pandemic.

- Inflation: Its fall to 5.3 per cent in August offers only limited comfort for two reasons.

- One, core and fuel inflation, which have 54 per cent weightage in CPI, remain stubbornly high.

- Second, food prices have nudged down overall inflation.