Special Category Status and States

Bihar makes fresh demand for Special Category Status

From UPSC perspective, the following things are important :

Prelims level: Special Category Status

Why in the News?

The Nitish Kumar government in Bihar renewed its demand for Special Category Status (SCS) before the 16th Finance Commission, which is currently touring the state.

About Special Category Status (SCS)

- Special Category Status (SCS) is a classification granted to specific states in India facing geographical, socio-economic, and infrastructural challenges.

- It provides special financial assistance for their development.

- Evolution of SCS:

-

- Introduced in 1969 following the recommendations of the Fifth Finance Commission, based on the Gadgil formula for fund allocation.

- Initially granted to Assam, Jammu & Kashmir, and Nagaland, with other states like Himachal Pradesh, Manipur, Uttarakhand, and Telangana added later.

- Eligibility Criteria (Based on the Gadgil Formula): States must meet at least one of the following:

-

- Hilly terrain: Challenging geography impeding development.

- Low population density or a large tribal population.

- Strategic location near international borders.

- Economic and infrastructural backwardness.

- Non-viable state finances: Financial instability due to lack of resources.

- Benefits of SCS:

-

- Financial Assistance: 90% grants for centrally sponsored schemes (vs. 30% for non-SCS states).

- Special Plan Assistance: Additional funds for national importance projects.

- Tax Benefits: Concessions on excise, income, and corporate taxes (many subsumed under GST).

- Carry-Forward of Unspent Funds: Funds are carried forward to the next year.

- Higher Budget Allocation: 30% of the Centre’s budget allocated to SCS states.

Assessment of Bihar’s Demand:

|

About the Finance Commission

- The Finance Commission is created every 5 years to allocate financial resources from the Centre to states, based on Article 280 of the Constitution.

- Composition: Consists of a chairman and four other members appointed by the President.

- Qualifications: Members must have specialized knowledge in finance, economics, accounts, or administration.

- The Fifteenth Finance Commission’s recommendations are valid till 2025-26.

- Terms of Reference for 16th FC: Division of tax proceeds, principles for grants-in-aid, enhancing state funds for local bodies, and evaluation of disaster management financing.

PYQ:[2023] Consider the following:

For the horizontal tax devolution, the Fifteenth Finance Commission used how many of the above as criteria other than population area and income distance? (a) Only two |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Special Category Status and States

Bihar’s call for Special Category Status | Explained

From UPSC perspective, the following things are important :

Prelims level: Specific criteria qualify a State for special category status

Mains level: Special category status benefits to States like Bihar

Why in the News?

Bihar Chief Minister Nitish Kumar has renewed the State’s persistent call for special category status from the Centre, which would boost the State’s share of tax revenues from the Central government.

How does the ‘Special Category’ Status benefit the states like Bihar?

- Increased Central Funds: States with special category status receive a higher share of central funds for government schemes, typically 90% from the Centre, compared to 60%-80% for other states.

- Tax-Related Concessions: These states enjoy various tax concessions that can attract investments and boost economic development.

- Financial Aid for Development: The additional funds can be used to address developmental gaps, improve infrastructure, and support welfare programs.

Criteria for Special Category status:

- Geographic Disadvantages: States with challenging terrains such as hilly or difficult terrain.

- Low Population Density or High Tribal Population: States with a considerable proportion of tribal population or low population density.

- Economic and Social Backwardness: States that are economically and socially disadvantaged.

- Strategic Location: States that share international borders or have strategic significance.

Why has Bihar’s demand been a long-standing issue?

- Economic Backwardness: Bihar has one of the lowest per capita incomes in India and lags behind in several human development indicators.

- Fiscal Challenges: The bifurcation of the state leading to the formation of Jharkhand, frequent natural disasters, and insufficient water resources for irrigation have adversely affected Bihar’s fiscal situation.

- Political Reiteration: Successive Bihar governments have continuously demanded special status to help the state’s development.

What are the political implications of granting ‘Special Status’ to Bihar?

- Increased Bargaining Power: Granting special status could enhance Bihar’s political leverage with the central government, especially in coalition politics.

- Precedent for Other States: Granting special status to Bihar could lead to similar demands from other states, potentially creating financial burdens for the Centre.

- Electoral Promises and Alliances: Political parties may use the promise of special status as an electoral tool to gain or maintain power, as seen with the Congress party’s manifesto promise in 2024.

- Centre-State Relations: The decision could impact the dynamics of center-state financial relations and influence the federal structure of revenue distribution in India.

Conclusion: The Central government should establish a transparent and well-defined framework for granting special category status, taking into account various economic, geographic, and social parameters. This framework should be periodically reviewed to ensure it remains relevant and fair to all states.

Mains PYQ:

Q To what extent is Article 370 of the Indian Constitution, bearing marginal note “Temporary provision with respect to the State of Jammu and Kashmir”, temporary? Discuss the future prospects of this provision in the context of Indian polity. (UPSC IAS/2016)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Special Category Status and States

On Special Category Status for Andhra Pradesh

From UPSC perspective, the following things are important :

Prelims level: Benchmark for the granting of SCS

Mains level: Why is the demand for special status for Andhra Pradesh back in the political limelight?

Why in the News?

With the completion of the 2024 Lok Sabha elections, the demand for Special Category Status to Andhra Pradesh is again gaining attention.

Why is the demand for special status for Andhra Pradesh back in the political limelight?

- Unfulfilled Promise: Despite assurances by the previous Prime Minister and BJP leaders, the Special Category Status (SCS) promised to Andhra Pradesh post bifurcation remained unfulfilled.

- Economic Struggles: Andhra Pradesh faces revenue deficits and escalating debts post-bifurcation, hampering its development projects and infrastructure initiatives.

- Dependency on Central Aid: With the need for funding for critical projects like Amaravati’s development and ongoing revenue deficits, Andhra Pradesh seeks central assistance for its economic stability and growth.

Five factors stood as the qualifying benchmark for the granting of SCS

|

Why did Chandrababu Naidu, back in 2018, settle for a special package?

- Pressure from Opposition: Facing criticism and a strong opposition campaign over the unmet promise of SCS, Naidu, then allied with the NDA, agreed to a Special Package (SP) as an alternative.

- Naidu’s decision to accept the SP was influenced by political considerations that included maintaining stability within the NDA alliance and counter-opposition attacks.

Is the State qualified to be granted Special Status?

- Debatable Qualification: Andhra Pradesh’s eligibility for SCS is contested, with some arguing it doesn’t meet the criteria outlined for special status, including socio-economic and geographical disadvantages.

- Previous Annulment: The 14th Finance Commission equated SCS with general category status and annulled it for new states, citing increased tax devolution and revenue deficit grants as alternatives.

What did the 14th Finance Commission state?

- On Alternative Grants: Instead of SCS, the commission increased tax devolution to states and introduced revenue deficit grants to address fiscal disparities, providing Andhra Pradesh with financial assistance.

- Scope for Review: While the 14th Finance Commission did not explicitly rule out SCS, it left the decision to the Union Government, suggesting a potential review by subsequent finance commissions and policy bodies.

Way forward:

- Comprehensive Economic Reform: Implement structural reforms to boost economic growth, reduce fiscal deficits, and attract investments, ensuring sustainable development beyond dependency on special status or central aid.

- Targeted Development Projects: Prioritize funding for infrastructure projects based on critical needs and potential economic returns, focusing on sectors like agriculture, manufacturing, and technology to drive growth and employment.

Mains PYQ:

Q The political and administrative reorganization of states and territories has been a continuous ongoing process since the mid-nineteenth century. Discuss with examples. (UPSC IAS/2022)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Special Category Status and States

Why are the Marathas mobilising now?

From UPSC perspective, the following things are important :

Prelims level: na

Mains level: Maratha mobilization for reservation

![The Marathas' Demand for Reservation: A Litigation History [2014-21] - Supreme Court Observer](https://www.scobserver.in/wp-content/uploads/2021/10/Maratha-Litigation-History-2640-x-1100-px.png)

Central Idea:

- The Maratha community’s demand for reservation in education and employment stems from a crisis of dominance, influenced by urban and rural challenges.

Urban Crisis:

- Well-paid jobs in urban areas, historically held by Marathas, have rapidly disappeared since the late 1990s.

- Large-scale manufacturing industries and establishments providing such jobs have closed or downsized, leading to increased competition for fewer opportunities.

- Marathas, historically socially superior, used their dominant caste position to secure a significant share of jobs, particularly in the public sector.

- Economic liberalization and the shrinkage of public sector jobs have intensified competition among Marathas for limited opportunities.

Rural Crisis:

- Closure of factories has led to the return of workers to villages, disrupting the pattern of workers retiring in villages and their offspring working in cities.

- Rural youth face challenges migrating to urban areas for better-paying jobs, impacting the financial support they traditionally provided to family members in villages.

- Informal sector jobs become the primary option for rural Maratha youth, diminishing their social standing and pride in rural settings.

- The focus on secure public sector jobs, which have also decreased, becomes crucial for rural Maratha youth.

Education Challenges:

- Increased aspirations for higher education among Marathas face a decline in government institutions and a rise in private unaided colleges with exorbitant fees.

- Marathas, with limited financial resources, compete for a limited number of open-category seats in public institutions.

- Decrease in government-run educational institutions exacerbates the challenges faced by Maratha aspirants.

Crisis of Dominance:

- The combination of urban and rural crises contributes to a crisis of dominance for the Marathas.

- Disturbance of caste hierarchy norms due to Dalit mobility and OBC economic and political assertion adds to Marathas’ anxiety.

- The demand for reservation reflects the need for increased formal sector jobs and the expansion of public educational institutions to address the crisis.

Key Highlights:

- Maratha community demands reservation in education and public employment, intensifying since 2016.

- Historically, Marathas dominated well-paid jobs, but recent urban and rural crises have led to increased competition and challenges.

- Closure of manufacturing industries, decreasing public sector jobs, and rural youth’s struggles contribute to the crisis.

- Educational aspirations face challenges with a decline in government institutions and increased private college fees.

Key Challenges:

- Disappearance of well-paid urban jobs, increased competition, and shrinking public sector employment.

- Rural crisis disrupts the traditional pattern of workers retiring in villages and offspring working in cities.

- Decline in government-run educational institutions, limited open-category seats, and rising private college fees.

Key Terms and Phrases:

- Urban crisis, rural crisis, crisis of dominance, economic liberalization, formal sector jobs.

- Reservation, Maratha mobilization, well-paid jobs, private unaided colleges, public sector employment.

Key Examples and References:

- Maratha protests since 2016, closure of manufacturing industries, decreased public sector jobs.

- Disturbance in traditional caste hierarchies due to Dalit mobility and OBC economic and political assertion.

Key Facts and Data:

- Marathas historically occupied over 29% of open-category jobs in government.

- Jobs in the private formal sector increased from 2% to 3.5%.

- Contractual government jobs increased from 0.7 million to 15.9 million in 2017-18.

- Only 22.2% of colleges are managed by the government as of 2019.

Critical Analysis:

- Maratha crisis stems from economic shifts, urban-rural dynamics, and disturbance in caste hierarchies.

- Limited opportunities, competition, and declining public sector jobs contribute to the community’s mobilization.

- Educational challenges add to the complexity, demanding a comprehensive solution.

Way Forward:

- Address urban and rural crises by creating more formal sector jobs.

- Expand public educational institutions and implement large-scale scholarship programs.

- Focus on inclusive policies to reduce competition and restore traditional patterns of employment.

Conclusion:

- The Maratha mobilization for reservation is rooted in the challenges posed by the disappearance of well-paid jobs, urban-rural dynamics, and the disruption of traditional caste hierarchies. Addressing these challenges requires a focus on creating more opportunities in the formal sector and expanding accessible public education.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Special Category Status and States

Vishakhapatnam is Andhra Pradesh’s new Capital

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: Multi-capital states

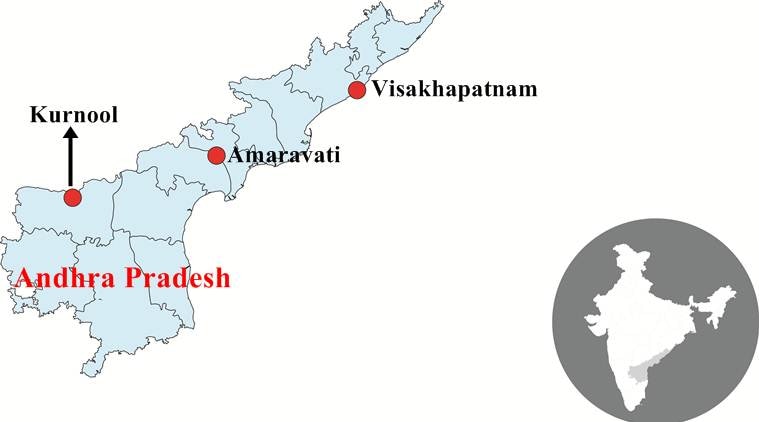

Visakhapatnam will be the new capital of Andhra Pradesh, announced the Chief Minister.

AP’s move for three capitals

- AP had introduced a ‘Three Capitals Act’ titled Andhra Pradesh Decentralisation and Inclusive Development of All Regions Act, 2020.

- Thus, it was decided that:

- Amaravati was to be the Legislative capital

- Visakhapatnam the Executive capital and

- Kurnool the Judicial capital

- However, the Andhra Pradesh High Court repealed this Act citing that the legislature has no competence to enact any law for shifting the three organs of the capital.

Concerns raised by AP government

- AP contended that the judgement was in violation of the basic structure of the Constitution as the HC cannot hold that the State does not have the powers to decide on its capital.

- The judgement was against the doctrine of separation of powers as it sought to preempt the legislature from taking up the issue (of three capitals).

- Further, it is argued that under the federal structure of the Constitution, every State has an inherent right to determine where it should carry out its capital functions from.

Reasons for AP’s consideration

(1) Viable option of Visakhapatnam

- Vizag always had been the biggest city, after Hyderabad, even in the combined State.

- It has all the settings to become a good living space.

(2) Sri Krishna panel recommendations

- The advantages and qualities of Visakhapatnam to become the capital was elaborately deliberated by the Sri Krishna Committee to study the alternatives for a new capital for the State of Andhra Pradesh.

- Coming to suggestion for the alternative capital, the Committee primarily took up three things for consideration — creation of single city or super city in greenfield location, expanding existing cities and distributed development.

(3) Decentralisation

- This idea was elaborately described in the Sri Bagh pact.

- The pact clearly defined decentralisation, for the benefit of all three main regions such as Coastal AP, Godavari and Krishna districts and Rayalaseema.

Major practical problems

- Continuum of work: The government argues that the Assembly meets only after gaps of several months, and government Ministers, officers, and staff can simply go to Amaravati when required.

- Logistics nightmare: coordinating between seats of legislature and executive in separate cities will be easier said than done.

- Time and costs of travel: The distances in Andhra Pradesh are not inconsiderable. Executive capital Visakhapatnam is 700 km from judicial capital Kurnool, and 400 km from legislative capital Amaravati.

Examples of multi-capital states in India

- Among Indian states, Maharashtra has two capitals– Mumbai and Nagpur (which holds the winter session of the state assembly).

- Himachal Pradesh has capitals at Shimla and Dharamshala (winter).

- The former state of Jammu & Kashmir had Srinagar and Jammu (winter) as capitals where Darbar Move is carried out.

Crack Prelims 2023! Talk to our Rankers

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Special Category Status and States

AP approaches SC over Three Capitals Issue

From UPSC perspective, the following things are important :

Prelims level: Read the attached story

Mains level: Three Capitals Issue in AP

After much discontent on the High Court (HC) verdict in the three capitals case, the Andhra Pradesh government has finally challenged it in the Supreme Court through a special leave petition (SLP).

AP’s move for three capitals

- AP had introduced a ‘Three Capitals Act’ titled Andhra Pradesh Decentralisation and Inclusive Development of All Regions Act, 2020.

- Thus, it was decided that:

- Amaravati was to be the Legislative capital

- Visakhapatnam the Executive capital and

- Kurnool the Judicial capital

- However, the Andhra Pradesh High Court repealed this Act citing that the legislature has no competence to enact any law for shifting the three organs of the capital.

Concerns raised by AP government

- AP contended that the judgement was in violation of the basic structure of the Constitution as the HC cannot hold that the State does not have the powers to decide on its capital.

- The judgement was against the doctrine of separation of powers as it sought to preempt the legislature from taking up the issue (of three capitals).

- Further, it is argued that under the federal structure of the Constitution, every State has an inherent right to determine where it should carry out its capital functions from.

Reasons for AP’s consideration

(1) Viable option of Visakhapatnam

- Vizag always had been the biggest city, after Hyderabad, even in the combined State.

- It has all the settings to become a good living space.

(2) Sri Krishna panel recommendations

- The advantages and qualities of Visakhapatnam to become the capital was elaborately deliberated by the Sri Krishna Committee to study the alternatives for a new capital for the State of Andhra Pradesh.

- Coming to suggestion for the alternative capital, the Committee primarily took up three things for consideration — creation of single city or super city in greenfield location, expanding existing cities and distributed development.

(3) Decentralisation

- This idea was elaborately described in the Sri Bagh pact.

- The pact clearly defined decentralisation, for the benefit of all three main regions such as Coastal AP, Godavari and Krishna districts and Rayalaseema.

Major practical problems

- Continuum of work: The government argues that the Assembly meets only after gaps of several months, and government Ministers, officers, and staff can simply go to Amaravati when required.

- Logistics nightmare: coordinating between seats of legislature and executive in separate cities will be easier said than done.

- Time and costs of travel: The distances in Andhra Pradesh are not inconsiderable. Executive capital Visakhapatnam is 700 km from judicial capital Kurnool, and 400 km from legislative capital Amaravati.

Examples of multi-capital states in India

- Among Indian states, Maharashtra has two capitals– Mumbai and Nagpur (which holds the winter session of the state assembly).

- Himachal Pradesh has capitals at Shimla and Dharamshala (winter).

- The former state of Jammu & Kashmir had Srinagar and Jammu (winter) as capitals where Darbar Move is carried out.

Back2Basics: Special Leave Petition

- SLP hold a prime place in the Indian judicial system.

- It provides the aggrieved party a special permission to be heard in Apex court in appeal against any judgment or order of any Court/tribunal in the territory of India.

- It has been provided as a “residual power” in the hands of Supreme Court of India to be exercised only in cases when any substantial question of law is involved, or gross injustice has been done.

- Article 136 vests the Supreme Court of India with a special power to grant special leave, to appeal against any judgment or order or decree.

- It is discretionary power vested in the Supreme Court of India and the court may in its discretion refuse to grant leave to appeal.

- The aggrieved party cannot claim special leave to appeal under Article 136 as a right, but it is privilege vested in the Supreme Court to grant leave to appeal or not.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Special Category Status and States

13 new districts created in Andhra Pradesh

From UPSC perspective, the following things are important :

Prelims level: Creation of new districts

Mains level: Administrative convenience

Andhra Pradesh has got a new map with the creation of 13 new districts, taking the number of total districts in the state to 26.

What are Districts?

- India’s districts are local administrative units inherited from the British Raj.

- They generally form the tier of local government immediately below that of India’s subnational states and territories.

- A district is headed by a Deputy Commissioner/ Collector, who is responsible for the overall administration and the maintenance of law and order.

- The district collector may belong to IAS (Indian Administrative Service).

- Districts are most frequently further sub-divided into smaller administrative units, called either tehsils or talukas or mandals, depending on the region.

How are new districts carved?

- The power to create new districts or alter or abolish existing districts rests with the State governments.

- This can either be done through an executive order or by passing a law in the State Assembly.

- Many States prefer the executive route by simply issuing a notification in the official gazette.

How does it help?

- States argue that smaller districts lead to better administration and governance.

- For example, in 2016, the Assam government issued a notification to upgrade the Majuli sub-division to Majuli district for “administrative expediency”.

Does the Central government have a role to play here?

- The Centre has no role to play in the alteration of districts or creation of new ones. States are free to decide.

- The Home Ministry comes into the picture when a State wants to change the name of a district or a railway station.

- The State government’s request is sent to other departments and agencies such as the Ministry of Earth Sciences, Intelligence Bureau, Department of Posts, Geographical Survey of India Sciences and the Railway Ministry seeking clearance.

- A no-objection certificate may be issued after examining their replies.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Special Category Status and States

Explained: The ‘Chandigarh Question’

From UPSC perspective, the following things are important :

Prelims level: Bifurcation of Punjab

Mains level: Read the attached story

The newly elected Punjab Legislative Assembly passed a resolution, moved by the Chief Minister himself, on April 1 in a special session seeking the transfer of Chandigarh to Punjab.

With this, the ‘Chandigarh question’ has resurfaced, but this time it occupies the national spotlight.

Establishment of Chandigarh

- Chandigarh is described as a ‘planned city’ emblematic of ‘Nehruvian modernity’.

- It is a greenfield city, which was commissioned by the government in independent India to replace Lahore, which went to Pakistan after Partition, as the capital of Punjab.

- Designed by Le Corbusier in association with Pierre Jeanneret, it is located on the foothills of the Shivalik Himalayas on village land acquired from what was then the Kharar tehsil of Ambala district.

- It was the capital of undivided Punjab from its inauguration in 1953 till 1966.

Bifurcation of Punjab and Common Capital

- Under the Punjab Reorganisation Act, 1966 following the Punjabi Suba movement, Haryana was carved out of the Hindi-speaking regions as a separate State.

- The hill regions of Punjab were merged with what was then the Union Territory (UT) of Himachal Pradesh.

- Chandigarh was made a UT and has remained the joint capital of Haryana and Punjab with State assets divided between Punjab and Haryana in a ratio of 60:40.

What is the Chandigarh issue?

- Since 1966, the lack of full rights to its capital has remained a vexed issue in Punjab politics.

- All the governments and most political parties of Punjab have regularly raised the demand for Chandigarh.

- It has featured in all major developments, whether it is the 1973 Anandpur Sahib resolution, Dharam Yudh Morcha (then separatist movement) and the 1985 Rajiv-Longowal Accord.

- Since 1966, the Punjab Assembly has passed at least six such resolutions with the last being in 2014 under the Shiromani Akali Dal-Bharatiya Janata Party (SAD-BJP) government.

- The Centres’ opposition to the latest Assembly resolution is the first time a political party has taken a contrarian stand.

What is different this time?

- The immediate provocation this time has been two recent decisions of the Central government: breaking allies with erstwhile govt and withdrawal of farm laws.

- The Centre also amended the rules governing the functioning of the Bhakra Beas Management Board (BBMB), constituted under the 1966 Act.

- It changed the eligibility criteria for the two full-time members of the Board which have, though technically open to all Indian officials, by convention gone to officials from Punjab and Haryana.

- These moves are widely interpreted as a continuation of the Centre’s contentious relationship with the other political parties.

- It gives an affront blow to Punjab’s claim over Chandigarh.

What has been the position of the Union government on the city?

- At the time of the 1966 Act, the Union government with Indira Gandhi as Prime Minister indicated that the UT status to Chandigarh was temporary and that it would be transferred to Punjab.

- This decision was formalised in 1970 with Mrs Gandhi promising Haryana funds for building its own capital.

- According to the 1985 Rajiv-Longowal Accord, Chandigarh was to be handed over to Punjab on January 26, 1986 but this never fructified after the assassination of Longowal and the long period of militancy.

- The recent developments could thus indicate a shift in the Central government’s position.

What about Haryana?

- As in Punjab, all parties in Haryana present a common position asserting its claim to the city.

- It has objected to any move which associates Chandigarh solely with Punjab.

Is there a distinctive Chandigarh position?

- Employees and unions of the Chandigarh administration have mostly welcomed the change in service rules since the Central provisions carry more benefits and perks.

- After decades of existence as a UT, Chandigarh has developed a distinctive cultural character.

- Given its geographical location it has the presence of many educational institutions, medical establishments and the Army and Air Force.

- It has developed a unique cosmopolitanism and become a magnet for the youth across the north western region.

- They city residents thus favour the status quo.

Way forward

- While this time the issue has attracted more attention than usual.

- Its Punjab mandate indicates massive expectations from the electorate including better service conditions from government employees but it has inherited a debt-ridden government.

- The new govt will have to balance these contending claims in deciding further action.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Special Category Status and States

Andhra Pradesh government repealed laws on 3 capitals

From UPSC perspective, the following things are important :

Prelims level: States with multiple administrative capitals

Mains level: Need for more capital cities

The Andhra Pradesh Assembly unanimously passed a Bill to repeal two laws that were cleared last year to set up three different state capitals.

Three Capitals Act

- The law was titled Andhra Pradesh Decentralisation and Inclusive Development of All Regions Act, 2020.

- The incumbent govt had decided to reverse the previous government’s decision to have an ambitious world-class capital city at Amaravati, which is located between Vijayawada and Guntur.

- Thus, it was decided that Amaravati was to be the Legislative capital, Visakhapatnam the Executive capital, and Kurnool the Judicial capital.

Why was it repealed?

- Over a hundred petitions challenging the government’s move have been filed before the Andhra Pradesh High Court.

- Farmers of Amaravati, who let the government acquire their lands, wanted them to stick to the previous plan and build a world-class capital city in the same location.

Will Andhra Pradesh have only one capital now?

- It is not clear if the government will stick to Amaravati as the sole capital.

- Throughout his address, the CM stressed the need for decentralization for the equitable development of all regions.

What are the other examples of multiple capital cities?

- Among Indian states, Maharashtra has two capitals– Mumbai and Nagpur (which hold the winter session of the state assembly).

- Himachal Pradesh has capitals at Shimla and Dharamshala (winter).

- The former state of Jammu & Kashmir had Srinagar and Jammu (winter) as capitals.

Must read

Three capitals for Andhra Pradesh — its logic and the questions it raises

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Special Category Status and States

Three capitals for Andhra Pradesh — its logic and the questions it raises

From UPSC perspective, the following things are important :

Prelims level: Various committees mentioned in the newscard

Mains level: Three capitals concept

The Andhra Pradesh Assembly passed The Andhra Pradesh Decentralisation and Equal Development of All Regions Bill, 2020, paving the way for three capitals for the state.

Three capitals concept in Andhra Pradesh

- Three cities serve as capitals of the country– Pretoria (executive), Cape Town (legislative), and Bloemfontein (judicial).

- This arrangement was a result of the Second Boer War (1899-1902) in which Britain annexed the two Afrikaner speaking states -– the Orange Free State and the South African Republic (also called Transvaal Republic).

- Cape of Good Hope then remained in the British Empire, becoming self-governing in 1872, and uniting with three other colonies to form the Union of South Africa in 1910.

What are the other examples of multiple capital cities?

- Several countries in the world have implemented the concept.

- In Sri Lanka, Sri Jayawardenepura Kotte is the official capital and seat of national legislature, while Colombo is the de facto seat of national executive and judicial bodies.

- Malaysia has its official and royal capital and seat of national legislature at Kuala Lumpur, and Putrajaya is the administrative centre and seat of national judiciary.

- Among Indian states, Maharashtra has two capitals– Mumbai and Nagpur (which holds the winter session of the state assembly).

- Himachal Pradesh has capitals at Shimla and Dharamshala (winter).

- The former state of Jammu & Kashmir had Srinagar and Jammu (winter) as capitals.

Reasons behind such considerations

- According to the government, decentralisation was the central theme in recommendations of all major committees that were set up to suggest a suitable location for the capital of Andhra Pradesh.

- It had been agreed in the November 16, 1937 Sri Bagh Pact (between leaders of coastal Andhra and Rayalaseema) that two university centres should be established in Waltair (Visakhapatnam) and Anantapur in Rayalaseema, and that the High Court and Metropolis should be in the coastal districts and Rayalaseema respectively.

- In December 2010, the Justice B N Srikrishna Committee, set up to look into the demand for a Telangana state, said Rayalaseema and North Coastal Andhra were economically the most backward, and the “concentration of development efforts in Hyderabad is the key reason for demand of separate states”.

- In August 2014, the K Sivaramakrishnan Committee appointed to identify locations for the new capital of AP said the state should see decentralised development, and that one mega capital city was not desirable.

Major practical problems

- The government argues that the Assembly meets only after gaps of several months, and government Ministers, officers, and staff can simply go to Amaravati when required.

- However, coordinating between seats of legislature and executive in separate cities will be easier said than done, and with the government offering no specifics of a plan, officers and common people alike fear a logistics nightmare.

- The distances in Andhra Pradesh are not inconsiderable. Executive capital Visakhapatnam is 700 km from judicial capital Kurnool, and 400 km from legislative capital Amaravati.

- The Amaravati-Kurnool distance is 370 km. The time and costs of travel will be significant.

- The AP Police are headquartered in Mangalagiri, 14 km from Vijayawada, and senior IPS officers who may be required to visit the Secretariat will have to travel 400 km to Visakhapatnam.

- Likewise, government officers who may have to appear in the High Court will have to travel 700 km to Kurnool, which does not have an airport.

- All officers and Ministerial staff who may have to be at hand to brief Ministers when the Assembly is in session, will probably have to stay put in Amaravati, leaving behind their other responsibilities in Visakhapatnam.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

- What is ‘Special Category’ status?

What benefits do states having ‘Special Category’ status enjoy? - Who accords the category status to state and how?

- Which states held Special category status?

- Lacunas in the working of Special Category status

- Why the status has been removed?

- Way ahead now

What is ‘Special Category’ status?

- ‘Special category’ status is a classification given by Centre to assist in development of those states that face geographical & socio-economic disadvantages like hilly terrains, strategic international borders, economic & infrastructural backwardness and non-viable state finances.

- The classification came into existence in 1969 as per the suggestion given by the Fifth Finance Commission, set up to devise a formula for sharing the funds of Central govt. among all states.

What benefits do states having ‘Special Category’ status enjoy?

- Significant concession in excise & customs duties, income tax and corporate tax

- 30 percent of planned expenditure (central budget) goes to ‘special category’ states

- Special Category states are benefited because of Normal Central Assistance which was skewed in favour of these states. These states get more funds in terms of NCA and most part of these funds was in the form of grants rather than loans.

- Special Central Assistance given to SCS is also an additional amount which can be used by the concerned state for economic development.

- Centre bears 90% of the state expenditure (given as grant) on all centrally-sponsored schemes and external aid while rest 10% is given as loan to state. For general category, the respective grant to loan ratio is 30:70 where as external aid is passed on in the same ratio as received at the centre.

- Unspent money does not lapse and gets carry forward.

Hence, special-category status catalyses the inflow of private investments and generates employment and additional revenue to state. Since centre bears 90% of state expenditure on all centrally-sponsored schemes, state can take more welfare-based schemes from the new savings.

Further, more grants from centre helps in building state infrastructure and social sector projects. As a result, special-category state gets to bridge its development deficit.

Who accords the category status to state and how?

Special Category’ status had been granted in the past by the Union government to States having certain characteristics based on the recommendations of the National Development Council.

These include

i) hilly terrain;

ii) low population density and/or sizeable share of tribal population;

iii) strategic location along borders with neighbouring countries;

iv) economic and infrastructure backwardness; and

v) non-viable nature of State finances.

source

Which states held Special category status?

11 states used to have ‘special category’ status, namely, Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Jammu & Kashmir, Himachal Pradesh, and Uttarakhand.

Lacunas in the working of Special Category status

- Firstly, the way Special Category Status were assigned to a state has been a matter of debate. Various committees used different parameters to classify a state in Special Category status.

- Some states lobby central government to classify them in special category. This was to be corrected and the consent of majority of state must be taken before granting a special category status to any state.

- Moreover there should have been a general consensus among states related to principle used for granting the SCS.

- Secondly, data reveals that even after awarding Special category status not much economic progress has been noticed among states. This may mean that for economic development it’s important to follow sound economic policy. Benefit of SCS may act as a stimulus but rest depends on the individual state policy.

- Third, the amount of proceeds that states receive has increased after 14th finance commission. So the structure does not seem to have any specific relevance in present context.

Why has the status been removed now?

The Finance Ministry’s reasoning for withdrawing the status is that the higher 42% devolution takes into account all needs of states.

Way ahead?

Following the demand for Special Status by Bihar, a committee was appointed under Dr. Raghuram Rajan in 2013. This committee suggested that States classified as ‘Special Category States’ and those seeking inclusion in that category, would find that their need for funds and special attention more than adequately met by a basic allocation to each State and the categorisation of some as ‘least developed’.

Considering special status to any new State will result in demands from other States and dilute the benefits further. It is also not economically beneficial for States to seek special status as the benefits under the current dispensation are minimal. States facing special problems will be better off seeking a special package.

References: