UDAY Scheme for Discoms

Basics of Electric Power Transmission

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: Power transmission

Central Idea

- In 1954, India’s first Prime Minister, Jawaharlal Nehru, referred to dams as “the temples of modern India” during a visit to the Bhakra Nangal Dam site.

- This statement emphasized the critical role of electricity in the nation’s development and its transmission as the cornerstone of economic progress.

This article offers a simplified introduction to the world of electric power transmission.

Three Components of Power Supply

- Generation: Electricity is generated at power plants, including renewable energy installations.

- Transmission: It involves the distribution of electricity through a network comprising substations, switches, overhead and underground cables, transformers, and more.

- Distribution: The final step is delivering electricity to consumers, tailored to the requirements of various machines and applications.

Key Principles of Electric Power Transmission

- Efficiency and Voltage: Lower current and higher voltage enhance transmission efficiency. Transformers play a crucial role in voltage manipulation, stepping it up before transmission and reducing it for consumers.

- Resistance and Cable Thickness: Transmission cables exhibit resistance, leading to energy loss. Thicker cables minimize losses but also increase costs.

- Distance and Transmission Cost: Longer transmission distances result in lower costs.

- Alternating Current (AC): AC power transmission is predominant due to its adaptability and higher efficiency compared to direct current (DC). However, higher AC frequencies result in increased resistance.

Understanding AC Power

- Three-Phase AC: AC power transmission commonly utilizes three-phase AC, where voltage periodically changes polarity.

- Phases in AC: In a three-phase AC circuit, three wires carry AC current in different phases, typically at 120°, 240°, and 360°.

- AC in Household Appliances: Consumers receive three-phase AC power, which is used in household appliances for ease of control.

Transmission Process

- Voltage Stepping: Voltage is stepped up at power plants using transformers before being transmitted.

- Transmission Lines: Suspended from transmission towers, transmission lines carry the electricity across long distances.

- Safety Measures: Insulators, circuit-breakers, grounding, arresters, and dampers ensure safe and stable transmission.

- Switches: Used to control current availability and to redirect currents between lines.

- Substations: Different types of substations perform tasks like power collection, frequency modification, voltage reduction for distribution, and diagnostics.

Operation of Power Grids

- National Grids: A national grid encompasses generation, transmission, and distribution. It must accommodate various power sources, production locations, and consumption patterns.

- Storage Facilities: Grids include storage systems to manage surplus and deficit power supply.

- Flexible Sources: Gas turbines and automated systems respond to fluctuating consumer demand or emergencies.

- Grid Management: Grids maintain synchronized frequencies, manage demand, control voltage, and improve power factor.

- Wide-Area Synchronous Grids: Such grids, where all generators produce AC at the same frequency, result in lower costs but require measures to prevent cascading failures.

Key agencies in Power Transmission

India’s power transmission sector relies on key agencies to manage and enhance the electricity grid. These include:

- State Transmission Utilities (STUs): Managing intrastate power transmission within each state.

- National Load Despatch Centre (NLDC): Maintaining national power balance and grid security.

- Regional Load Despatch Centres (RLDCs): Overseeing regional power operations and grid stability.

- Central Electricity Regulatory Commission (CERC): Regulating tariffs and power transmission at the national level.

- State Electricity Regulatory Commissions (SERCs): Regulating power transmission within individual states.

- Private Transmission Companies: Collaborating with government agencies for grid expansion and modernization.

Conclusion

- Electric power transmission is a complex but vital aspect of modern civilization, serving as the backbone of economic development.

- Understanding its basic principles sheds light on the intricate network that powers our lives and fuels progress.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

UDAY Scheme for Discoms

What is Time-of-Day Tariff?

From UPSC perspective, the following things are important :

Prelims level: Time-of-Day Tariff

Mains level: Not Much

Central Idea

- The Ministry of Power has recently introduced Time-of-Day (ToD) tariff for electricity, which will be implemented next year for commercial users and in 2025 for home users.

- This article aims to explain what ToD tariff is, how it impacts consumers, and why it is important for the power sector.

What is Time-of-Day Tariff?

- Amendments: The government has made amendments to the Electricity (Rights of Consumers) Rules 2020, introducing ToD tariff and rationalizing smart meters.

- Tariff structure: Under ToD tariff, electricity charges will vary based on the time of day. The current flat rate system will be replaced. During daytime, the tariff may decrease by up to 20%, benefiting consumers. Conversely, during night-time, the tariff will increase by the same amount.

- Benefits for consumers: ToD tariff allows consumers to regulate and manage their electricity consumption and control their bills. It gives them the flexibility to take advantage of lower tariffs during off-peak hours.

Impact on electricity bills

- Impact on different households: For small working couples who primarily use electricity at night, their bills are likely to increase. However, other households can offset the nighttime spike by shifting some of their electricity usage to daytime hours.

- Power consumption patterns: Power consumption typically peaks in the morning when schools and offices open, in the late afternoon when children return home, and in the early evening when air conditioners and heaters are in high demand. ToD tariff aims to discourage excessive power consumption during these peak hours.

Power guzzling appliances

- Identifying power-consuming appliances: Appliances such as air conditioners, coolers, refrigerators, heaters, and geysers are the major contributors to electricity consumption in households. Other significant power-consuming appliances include washing machines, dishwashers, and microwaves.

- Energy-efficient alternatives: It is worth noting that energy-efficient versions of most electrical appliances are available in the market, which can help reduce overall electricity consumption.

Readiness of infrastructure

- Requirement of smart meters: To implement ToD tariff, smart meters are necessary. These meters automate the meter-reading process and provide accurate cost estimation, minimizing wastage. They send consumption information to power distribution companies every 15 minutes, which is crucial for calculating ToD charges.

- Status of smart meter installation: Currently, over 6.5 million smart meters have been installed in the country, with a target of reaching 250 million by 2026. Approximately 230 million smart meters have been sanctioned so far.

Benefits for the power sector

- Improved billing efficiency: ToD tariff and smart metering can enhance billing efficiency and reduce transmission and distribution losses.

- Differential tariff for renewable power: As the share of renewable power increases, it needs to be blended with coal-based power, requiring differential tariff structures. ToD tariff can facilitate this blending effectively.

- Electric vehicles (EVs) and ToD tariff: With the expected surge in EV adoption, ToD tariff can encourage consumers to charge their vehicles during off-peak hours, reducing the strain on the power grid.

- Flexibility for discoms: ToD tariff provides flexibility for loss-making distribution companies (discoms) to revise tariffs, addressing their financial challenges.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

UDAY Scheme for Discoms

Energy Conservation (Amendment) Bill, 2022 introduced in RS

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: Read the attached story

The Ministry of New and Renewable Energy has introduced the Energy Conservation (Amendment) Bill in Rajya Sabha.

Highlights of the Bill

- The Bill amends the Energy Conservation Act, 2001 to empower the central government to specify a carbon credit trading scheme.

- Designated consumers may be required to meet a proportion of their energy needs from non-fossil sources.

Why was this Bill introduced?

- During the COP-26 summit in 2021, India made commitments relevant for energy efficiency efforts.

- Against this backdrop, the Energy Conservation (Amendment) Bill, 2022 was introduced in Lok Sabha in August 2022.

Key features of the bill

- Carbon credit trading:The Bill empowers the central government to specify a carbon credit trading scheme. Carbon credit implies a tradable permit to produce a specified amount of carbon dioxide or other greenhouse emissions.

- Obligation to use non-fossil sources of energy:The Act empowers the central government to specify energy consumption standards for designated consumers to meet a minimum share of energy consumption from non-fossil sources. Designated consumers include: (i) industries such as mining, steel, cement, textile, chemicals, and petrochemicals, (ii) transport sector including Railways, and (iii) commercial buildings, as specified in the schedule.

- Energy conservation code for buildings: The bill empowers the central government to specify norms for energy efficiency and conservation, use of renewable energy, and other requirements for green buildings. Under the Act, the energy conservation code applies to commercial buildings: (i) erected after the notification of the Code, and (ii) having a minimum connected load of 100 kilowatt (kW) or contract load of 120 kilo volt ampere (kVA).

- Standards for vehicles and vessels: Under the bill, the energy consumption standards may be specified for equipment and appliances which consume, generate, transmit, or supply energy. The Bill expands the scope to include vehicles (as defined under the Motor Vehicles Act, 1988), and vessels (includes ships and boats).

- Composition of the governing council of BEE: The Act provides for the setting up of the Bureau of Energy Efficiency (BEE). The Bureau has a governing council with members between 20 and 26 in number.

Concerns raised

- Carbon credit trading aims to reduce carbon emissions, and hence, address climate change. The question is whether the Ministry of Power is the appropriate Ministry to regulate this scheme.

- A further question is whether the market regulator for carbon credit trading should be specified in the Act.

- Same activity may be eligible for renewable energy, energy savings, and carbon credit certificates.

- The Bill does not specify whether these certificates will be interchangeable.

- Designated consumers must meet certain non-fossil energy use obligation. Given the limited competition among discoms in any area, consumers may not have a choice in the energy mix.

Click and get your FREE Copy of CURRENT AFFAIRS Micro Notes

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

UDAY Scheme for Discoms

[pib] National Open Access Registry (NOAR)

From UPSC perspective, the following things are important :

Prelims level: National Open Access Registry (NOAR)

Mains level: Not Much

National Open Access Registry (NOAR) has successfully gone live from 1st May 2022.

What is NOAR?

- NOAR is a centralized online platform through which the short-term open access to the inter-state transmission system is being managed in India.

- It is an integrated platform accessible to all stakeholders in the power sector, including open access customers (both sellers and buyers), power traders, power exchanges, National/Regional/State LDCs and others.

- The platform provides automation in the workflow to achieve shorter turnaround time for the transactions.

- NOAR platform also has a payment gateway integrated for making payments related to interstate short-term open access transactions.

- NOAR platform provides transparency and seamless flow of information among stakeholders of open access.

Key features

- Centralized System: Single point electronic platform for all the stakeholders

- Automated Process: Automated administration process of the short-term open access

- Common Interface: Interface with the RLDCs scheduling applications and Power Exchanges (s)

- Payment Gateway: Make payments related to STOA transactions

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

UDAY Scheme for Discoms

Why central government schemes for discoms have not worked

From UPSC perspective, the following things are important :

Prelims level: UDAY

Mains level: Paper 3- Schemes for discoms and issues with them

Context

A recent report of Niti Aayog has assessed the losses of discoms to be about Rs 90,000 crore in 2020-21.

Central government schemes for discoms

- In 2001, the Accelerated Power Development Scheme was initiated.

- This was followed by various other schemes with some differences between them.

- The government had launched the UDAY scheme in 2015.

- UDAY did not involve any monetary assistance to the states, but only promised to help the states in reducing the cost of power through coal linkage rationalization, etc.

- Recently, the government launched a new scheme with a total outlay of around Rs 3.03 lakh crore.

- It seeks to improve the distribution infrastructure of the distribution companies (discoms) with the primary intention of improving their financial health.

- The objective of the scheme is to bring down commercial losses in the range of 12-15 percent and also reduce the difference between the average cost of supply (ACS) and average revenue realized (ARR) to zero by 2024-25.

- The problem with all these schemes (including UDAY) is that they have not been delivered and the financial position of the discoms has only worsened.

Why did schemes fail to improve the financial health of discoms?

- Reduction of loss is a managerial issue: Reduction of commercial losses is not really about improving infrastructure, it is more of a managerial issue.

- The average loss (inclusive of technical and commercial) is about 22 percent today.

- But several discoms have losses in excess of 40 percent.

- It is possible to bring down losses from 40 percent to about 15 percent without any significant investments in infrastructure.

- Investments, however, would be required to bring down losses further to a single-digit level.

- The governance issues of the scheme is a complex issue.

- The two most popular parameters which are monitored are the loss levels and the difference between the ACS and ARR.

- There are inherent problems with these parameters since they keep fluctuating and it is very difficult to fathom their trend on a quarter-wise basis, rendering the release of funds to be tricky and cumbersome.

- In the scheme now announced by the government, about 26 parameters will be taken into consideration and assigned a score.

- For some of the parameters, it may be difficult to assign a score across discoms which may lead to some amount of subjectivity.

Way forward: Alternate approach

- Provide transitional financial support: An alternate approach that could be considered by the Centre (in lieu of such assistance schemes) is providing only transitional financial support to all discoms, which are privatized under the private-public partnership mode.

- A transitional support of Rs 3,450 crore spread over five years proved to be exceedingly beneficial in the case of discoms in Delhi.

- Promote privatization: Since in an earlier policy statement the government had mentioned that privatization of discoms is to be promoted, it would make sense to consider this transitional support as a catalyst.

Conclusion

Adopting this approach will ensure that the central government moves away from the micro-management of discoms, which inevitably happens if the release of funds is linked to reform-linked parameters on a quarter-wise basis.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

UDAY Scheme for Discoms

Electricity (Amendment) Bill, 2021

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Electricity (Amendment) Bill, 2021

The Electricity (Amendment) Bill, 2021 will be introduced and is likely to be pushed for passage in the ongoing monsoon session of Parliament.

Need for this bill

- Electricity distribution is at the cutting edge of the power sector.

- Despite the last 25 years of power sector reforms, the electricity distribution companies are unable to pay the generation and transmission companies as well as banks / financial institutions due to poor financial health.

- In this situation, patchwork may not turn around the power sector and a holistic approach is the need of the hour.

- The provisions of the proposed amendment bill have to be seen in this context.

Key features of Electricity (Amendment) Bill, 2021

De-licensing: Electricity distribution is delicensed, at least in the letter, giving consumers a choice to choose a distribution company in their area.

Universal service obligation: There is the provision of a universal service obligation fund, which shall be managed by a government company. This fund shall be utilized to meet any deficits in cross-subsidy. In case of supply through pre-paid meters, security deposit will not be required.

Appellate Tribunal for Electricity (APTEL): It is being strengthened by an increasing number of members. The domains from where the chairperson and members of Central Electricity Regulatory Commission (CERC) and State Electricity Regulatory Commissions (SERC) will come have been described.

Renewable Power Obligation: Keeping in view the national climate change goals, the responsibility of fixing renewable power obligations (RPO) is shifted from state commissions to the central government.

Penalty: Penalty for contravention of the provisions of the Act has been increased up to Rs 1 crore. Non-fulfillment of RPO will attract stringent penalties as per the proposed amendments.

Important issues not addressed

- Recovery of dues: Discoms collect revenue from the consumers and feed the supply chain upstream. They are, however, unable to recover their costs, out of which nearly 75-80 percent are power purchase costs.

- Tariff: A broad guideline to reduce tariffs could have been part of the proposed amendment bill. Recently, the Forum of Regulators came out with a report on cost elements of tariff and suggested measures to reduce the same.

- AT&C losses: The Aggregate Technical & Commercial (AT&C) losses of 12 states were more than 25 percent and of six states between 15 and 25 percent, according to a report released by the distribution utility forum based on Uday dashboard in 2020.

Some provisions may backfire

- Power distribution is proposed to be delicensed. However, the eligibility criteria shall be prescribed by the central government and the conditions for registration by the SERC.

- There is a provision for amendment and cancellation of registration as well. In case these provisions are implemented similar to a license, the purpose shall be defeated.

- The newly registered companies are given the facility to use the power allocation as well as the network of existing discom, which may be dilapidated in many cases due to paucity of funds.

- With such a network, the quality of supply to the electricity consumers will be seriously affected.

- Financial penalty on discom may not fully compensate and satisfy the consumers in such cased.

Some of the issues that may be considered for holistic power sector reforms:

- The provision of coal and railway freight regulators

- Linkage of AT&C losses as key performance indicator for release of central funds to states by any ministry

- Provision of a risk management committee and corporate governance within discoms, irrespective of being listed company

Way forward

- Fourteen years after the last amendment to the Electricity Act, currently, the focus of the amendment is on competition and compliance.

- Electricity regulatory commissions hold the key to take this forward.

- The commissions should be built as strong institutions and their autonomy should be respected and maintained.

- After providing a robust framework for fair competition, the government should minimize its frequent interventions in the sector.

- The government interventions often distort the market and maybe resorted to only in case of market failure.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

UDAY Scheme for Discoms

Reforms-Linked, Result-Based Scheme for Distribution’ (RLRBSD)

From UPSC perspective, the following things are important :

Prelims level: RLRBSD

Mains level: Paper 3- Issues with the RLRBSD scheme for discoms

The debt burden of discoms is estimated to touch 4.5 lakh crore by the end of 2020-21. This high level of debt underscores the need for reforms in the discoms. With this in view, RLRBSD has been launched by the Centre. The article highlights the issues with this scheme.

Reforms-Linked, Result-Based Scheme for Distribution’ (RLRBSD)

- In her FY22 Budget speech, Finance Minister proposed Electricity (Amendment) Bill, 2021, which intends to delicence the distribution business, bring in competition, and give the consumer power to choose her supplier.

- She also unveiled the Rs 3 lakh crore electricity distribution reform programme to reduce losses and improve the efficiency of discoms.

- Against this background, the RLRBSD aims at helping discoms trim their electricity losses to 12-15% from the present level.

- The aggregate technical and commercial (AT&C) losses and shortfall in the average revenue realisation from the sale of electricity vis-a-vis the average cost of supply or the ACS-ARR gap, are major causes for losses of discoms.

- Accordingly, the scheme sets the target for both to be achieved by 2025.

- It also aims to gradually narrow the deficit between the cost of electricity and the price at which it is supplied to ‘zero’ by March 2025.

- It will also have a compulsory pre-paid and smart metering component to be implemented across the power supply chain, including in about 250 million households.

Funding for RLRBSD

- The Centre is expected to contribute around Rs 60,000 crore to the scheme’s corpus.

- The rest may be raised from multilateral funding agencies such as ADB and World Bank (WB).

- The Centre’s contribution will be met through the previous commitment of the ongoing schemes, viz. the Integrated Power Development Scheme (IPDS) and the Deen Dayal Upadhyaya Gram Jyoti Yojna (DDUGJY).

- The funds will be released subject to discoms meeting reform-related milestones.

Analysing RLRBSD against the context of UDAY

- Under UDAY, discoms were required to reduce AT&C losses from 20.7% during 2015-16 to 15% by 2018-19.

- During 2019-20, their AT&C losses were 18.9% against the 15% target for 2018-19.

- Further, they were to reduce the ACS-ARR gap from Rs 0.59 per unit during 2015-16 to ‘zero’ by 2018-19.

- The ACS-ARR gap during 2019-20, stood at Rs 0.42 per unit against target of ‘zero’ for 2018-19.

- Simultaneously, the government gave them a financial restructuring package (FRP).

- The FRP was nothing but a condoning of discoms’ staggering debt of about Rs 4 lakh crore.

- Against this backdrop, aims of achieving those targets by 2025 under RLRBSD, which should have been achieved by 2018-19 under UDAY seems difficult.

3 factors that contribute to debt of discoms

- 1) At the root of persistent and increasing losses of discoms is the orders issued by state governments to sell electricity to some preferred consumers, viz. poor households and farmers.

- Electricity is supplied to these customers either at a fraction of the cost of purchase, transmission and distribution, or even free.

- On the units sold to these groups, discoms incur colossal under-recovery.

- 2) This is aggravated by AT&C losses—most of it plain theft.

- 3) Inflated tariff allowed to independent power plants (IPPs) under purchase agreements adds to the revenue shortfall.

Consider the question “Why the discoms in India require frequent bail-outs? How far will the Reforms-Linked, Reforms-Based Scheme for Distribution be successful in addressing the woes of discoms?”

Conclusion

The problem is entirely political. In a bid to win elections almost every political party promises sops which include, among others, power supply to farmers and poor households at a throwaway price or even free. As long as this effect of populist politics persists, the discoms will continue to be in the red, needing a bailout at frequent intervals.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

UDAY Scheme for Discoms

[pib] Rights to the Electricity Consumers

From UPSC perspective, the following things are important :

Prelims level: Not Much

Mains level: Rights to the Electricity Consumers

The Ministry of Power has for the first time laid down Rights to the Electricity Consumers through “Electricity (Rights of Consumers) Rules, 2020”.

Q.What are the new Rights to the Electricity Consumers as envisaged under Electricity (Rights of Consumers) Rules, 2020?

Rights to the Electricity Consumers: A highlight

Following key areas are covered in the Electricity (Rights of consumers) Rules:

- Rights of consumers and Obligations of Distribution licensees

- Release of new connection and modification in an existing connection

- Metering arrangement

- Billing and Payment

- Disconnection and Reconnection

- Reliability of supply

- Consumer as Prosumer

- Standards of Performance of licensee

- Compensation Mechanism

- Call Centre for Consumer Services

- Grievance redressal mechanism

(1) Rights and Obligations

- It is the duty of every distribution licensee to supply electricity on request made by an owner or occupier of any premises in line with the provisions of the Act.

- It is the right of the consumer to have minimum standards of service for the supply of electricity from the distribution licensee.

(2) Release of new connection and modification in an existing connection

- Transparent, simple, and time-bound processes,

- The applicant has an option for online application,

- The maximum time period of 7 days in metro cities and 15 days in other municipal areas and 30 days in rural areas identified to provide new connections and modify existing connections.

(3) Metering

- No connection shall be given without a meter;

- Meter shall be the smart pre-payment meter or pre-payment meter;

- Provision of Testing of meters;

- Provisions for replacement of defective or burnt or stolen meters specified.

(4) Billing and payment

- Transparency in applicable consumer tariff and bills;

- A consumer shall have the option to pay bills online or offline;

- Provision for advance payment of bills.

(5) Reliability of supply

- The distribution licensee shall supply 24×7 powers to all consumers. However, the Commission may specify lower hours of supply for some categories of consumers like agriculture;

- The distribution licensee shall put in place a mechanism, preferably with automated tools to the extent possible, for monitoring and restoring outages.

(6) Consumer as prosumer

- The prosumers will maintain consumer status and have the same rights as the general consumer.

- They will also have the right to set up RE generation units including rooftop solar photovoltaic (PV) systems – either by themselves or through a service provider.

- Net metering for loads up to ten kW and for gross metering for loads above ten kW.

(7) Standards of Performance

- The Commission shall notify the standards of performance for the distribution licensees;

- Compensation amount to be paid to the consumers by the distribution licensees for violation of standards of performance.

(8) Compensation mechanism

- Automatic compensation shall be paid to consumers for which parameters on standards of performance can be monitored remotely;

- The standards of performance for which the compensation is required to be paid by the distribution licensee.

(9) Call Centre for Consumer Services

- Distribution licensee shall establish a centralized 24×7 toll-free call center;

- Licensees shall endeavor to provide all services through a common Customer Relation Manager (CRM) System to get a unified view.

(10) Grievance redressal mechanism

- Consumer Grievance Redressal Forum (CGRF) to include consumer and prosumer representatives;

- The consumer grievance redressal has been made easy by making it multi-layered and the number of consumer’s representatives has been increased from one to four.

- The licensee shall specify the time within which various types of grievances by the different levels of the forums are to be resolved. Maximum timeline of 45 days specified for grievance redressal.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

UDAY Scheme for Discoms

Fiscal support to the power sector

From UPSC perspective, the following things are important :

Prelims level: UDAY scheme

Mains level: UDAY scheme, its success and failures

Part of the package announced by Finance Minister was a Rs 90,000-crore liquidity injection into power distribution companies (or discoms).

Practice question:

Ujwal DISCOM Assurance Yojana (UDAY) has failed to turn around the precarious financial position of state power DISCOMs in India. Discuss.

Fiscal push for DISCOMs

- The move is aimed at helping the discoms clear their dues with gencos (or electricity generation companies), who in turn can clear their outstanding dues with suppliers, such as coal miners, easing some of the working capital woes of Coal India Ltd and contract miners.

- This is subject to the condition that the Centre will act as guarantor for loans given by the state-owned power finance companies such as PFC and REC Ltd to the discoms.

Why was this needed?

- The primary trigger is the poor financial condition and revenue collection abilities of most state discoms.

- This is despite several interventions, including a scheme called UDAY that was launched in 2015 to fix the problems of a sector where the upstream side (electricity generation) was drawing investments even as the downstream (distribution) side was leaking.

How do the DISCOMs work?

To understand how the sector works, we have to imagine a three-stage process.

- First stage: Electricity is generated at thermal, hydro or renewable energy power plants, which are operated by either state-owned companies or private companies.

- Second stage: The generated electricity then moves through a complex transmission grid system comprising electricity substations, transformers, and power lines that connect electricity producers and the end-consumers.

- The entire electricity grid consists of hundreds of thousands of miles of high-voltage power lines and millions of miles of low-voltage power lines with distribution transformers that connect thousands of power plants to millions of electricity customers all across the country.

- Third stage: This last-mile link is where discoms come in, operated largely by state governments. However, in cities such as Delhi, Mumbai, Ahmedabad, and Kolkata, private entities own the entire distribution business or parts of it.

Why there is a problem?

- Discoms essentially purchase power from generation companies through power purchase agreements (PPAs), and then supply it to their consumers (in their area of distribution).

- The key issue with the power sector currently is the continuing problem of the poor financial situation of state discoms.

- This has been affecting their ability to buy power for supply, and the ability to invest in improving the distribution infrastructure. Consequently, this impacts the quality of electricity that consumers receive.

There are two fundamental problems here:

1) Lack of competitiveness

- One, in India, electricity price for certain segments such as agriculture and the domestic category (what we use in our homes) is cross-subsidised by the industries (factories) and the commercial sector (shops, malls).

- This affects the competitiveness of the industry.

2) Transmission and distribution losses

- There is the problem of AT&C (aggregate transmission and distribution losses), which is a technical term that stands for the gap in the bills that it raises and the final collection process from end-consumers.

- As a result, the discoms are perennially short of funds, even to pay those supplying power to them, resulting in a cascading impact up the value chain.

Back2Basics: UDAY Scheme

https://www.civilsdaily.com/news/uday-scheme-for-financial-turnaround-of-power-distribution-companies/

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

UDAY Scheme for Discoms

[pib] Draft Electricity Act (Amendment) Bill, 2020

From UPSC perspective, the following things are important :

Prelims level: Not Much

Mains level: Highlights of the policy

The Ministry of Power has issued a draft proposal for amendment of Electricity Act, 2003 in the form of the draft Electricity Act (Amendment) Bill, 2020.

Draft Electricity Act (Amendment) Bill 2020

Major amendments proposed in the Electricity Act are as follows:

Viability of DISCOMs

- Cost reflective Tariff: To eliminate the tendency of some Commissions to provide for regulatory assets, it is being provided that the Commissions shall determine tariffs that are reflective of cost so as to enable Discoms to recover their costs.

- Direct Benefit Transfer: It is proposed that tariff be determined by Commissions without taking into account the subsidy, which will be given directly by the government to the consumers.

Sanctity of Contracts

- Establishment of Electricity Contract Enforcement Authority: Such an authority headed by a retired Judge of the High Court is proposed to be set-up with powers of the Civil Court to enforce performance of contracts related to purchasing or sale or transmission of power between a generating, distribution or transmission companies.

- Establishment of adequate Payment Security Mechanism for scheduling of electricity: It is proposed to empower Load Dispatch Centres to oversee the establishment of adequate payment security mechanism before scheduling dispatch of electricity, as per contracts.

Strengthening the regulatory regime

- Strengthening of the Appellate Tribunal (APTEL): It proposed to increase the strength of APTEL to seven apart from the Chairperson so that multiple benches can be set-up to facilitate quick disposal of cases.

- Doing away with multiple Selection Committees: It is proposed to have one Selection Committee for selection of Chairpersons and Members of the Central and State Commissions and uniform qualifications for appointments of Chairperson and Members.

- Penalties: In order to ensure compliance of the provisions of the Electricity Act and orders of the Commission, section 142 and section 146 of the Electricity Act are proposed to be amended to provide for higher penalties.

Renewable and Hydro Energy

- National Renewable Energy Policy: It is proposed to provide for a policy document for the development and promotion of generation of electricity from renewable sources of energy. It is also proposed that a minimum percentage of purchase of electricity from hydro sources of energy is to be specified by the Commissions.

- Penalties: It is being further proposed to levy penalties for non-fulfilment of obligation to buy electricity from renewable and/or hydro sources of energy.

Miscellaneous

- Cross border trade in Electricity: Provisions have been added to facilitate and develop trade in electricity with other countries.

- Franchisees and Distribution sub licensees: It is proposed to provide that the Distribution Companies, if they so desire, may engage Franchisees or Sub-Distribution Licensees to distribute electricity on its behalf in a particular area within its area of supply. However, it will be the DISCOM which shall be the licensee, and therefore, ultimately responsible for ensuring quality distribution of electricity in its area of supply.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

UDAY Scheme for Discoms

[op-ed snap] Power replay

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 3-Indian power sector-Problems faced by the Discoms and their solutions.

Context

Five years after the launch of UDAY, power-sector once again seems to be going deep into the troubles.

Where the Discoms stand now?

- Losses increased: The losses of state-owned distribution companies (discoms) risen.

- Dues increased: Discom’s dues for power purchases have also surged.

- Dues owed by discoms to power producers, both independent and state-run entities, stood at Rs 80,930 crore.

- Of these, Rs 71,673 crore extends beyond the allowed grace period of 60 days.

- Rajasthan leads the states with the most dues, followed by Tamil Nadu and Uttar Pradesh.

Components of UDAY and progress made

- The UDAY scheme, which involved state governments taking over the debt of discoms, had three critical components

- First-Reduction in AT&C losses: While progress has been made on some of these fronts, it hasn’t been in line with the targets laid out under UDAY.

- AT&C (Aggregate Technical and Commercial) losses have declined in some states, but not to the extent envisaged.

- Under UDAY, discoms were to bring down AT&C losses to 15 per cent by FY19.

- Second- Timely revision of tariffs: While some states have raised power tariffs, the hikes have not been sufficient.

- In tariff revision decisions political considerations prevailed over commercial decisions.

- Third- elimination of the gap between per unit of cost and revenue realised: The gap between the average cost per unit of power and the revenue realised has not declined in the manner envisaged.

- Because of this discoms were forced to reduce their power purchases and delay payments to power producers.

Way forward:

- The new plan, being formulated by the government reportedly, aims to address these issues by-

- Reducing electricity losses.

- Eliminating the tariff gap.

- Smart metering.

- Privatising discoms.

- Having distribution franchisees.

- Altering incentive structure: Along with the above, the Centre should also look at altering the incentive structures of states in order to ensure compliance.

- Provision of penalties: Stiff penalties need to be imposed for not meeting the targets laid out in the new scheme.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

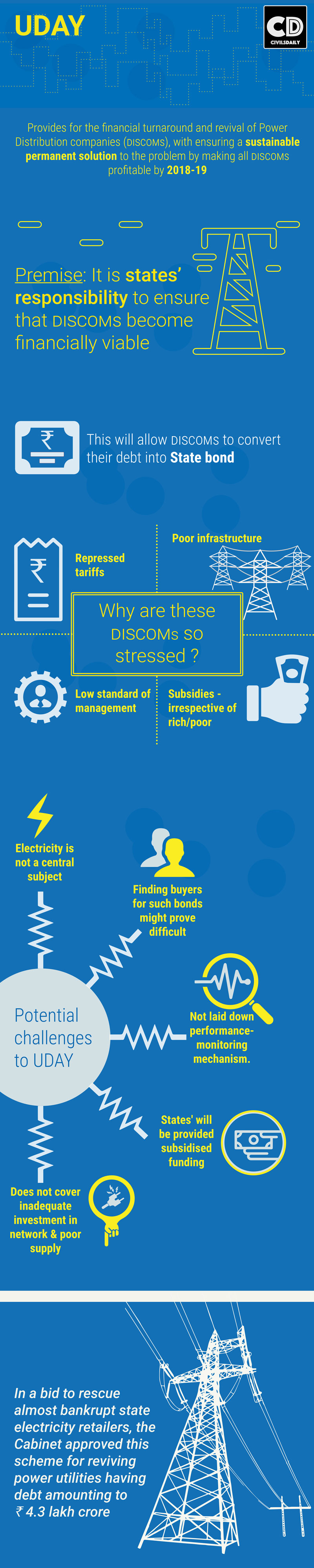

UDAY: Reviving Power Discoms

In a bid to rescue almost bankrupt state electricity retailers, the Cabinet recently approved this scheme for reviving power utilities having debt amounting to Rs 4.3 lakh crore.

What is Ujjwal Discom Assurance Yojana?

UDAY provides for the financial turnaround and revival of Power Distribution companies (DISCOMs), and importantly also ensures a sustainable permanent solution to the problem. It has ambitious target of making all discoms profitable by 2018-19.

The scheme will ease the financial crunch faced by power distribution companies, that has impaired their ability to buy electricity.

It is based on the premise that it is states’ responsibility to ensure that discoms become financially viable.

How UDAY will revive Discoms?

It has all the 3 elements —

- Clear up the legacy issues of past losses and debt.

- Provide a financial road map to bring tariffs in line with costs by FY19.

- Provide enough deterrents for the state govt to not allow the state discoms to become loss ridden post FY18, as losses start to impact their FRBM limits.

- The State govt. will takeover the discom liabilities over 2-5 year period.

- This will allow discoms to convert their debt into State bond. These bonds will have a maturity period of 10-15 years.

- It will allow transfer of 75% outstanding debts incurred by stressed discoms to States’ debt, 50% in 2015-16 and 25% in 2016-17.

- The central government will not include the loans of the discoms in calculation of the state’s deficit till 2016-17.

Why are these Discoms so stressed?

There are various reasons that lead to Discoms becoming unsustainable over the period of time.

- Politics of free power, repressed tariffs and power thefts leading high transmission losses.

- Poor infrastructure and low standard of management.

- Power subsidies are given to all, irrespective of rich/poor.

- Discoms in states of Rajasthan, Tamil Nadu and UP are the most stressed ones.

Almost 25% T&D ( Transmission & Distribution) losses suffered by discoms. Remaining 75% is sold at a price much lower than discoms’ procurement costs. Wondering Why??

The most obvious reason is political interference, i.e. tariff is set by a group of largely political appointees.

Financially stressed DISCOMs are not able to supply adequate power at affordable rates, which hampers quality of life and overall economic growth and development.

What will be the impact of this scheme?

- It is expected to help the banks in managing their bad loans.

- It will relieve discoms who can push power distribution in right way.

- It will allow states to align tariff costs, so that discoms run on a sustainable basis.

What are thrust areas of UDAY to turnaround discoms?

- Improve operational efficiency.

- Reduction in cost of power – By monitoring technical and commercial losses by smart metering and feeder separation.

- Reduction in the interest cost of discoms.

- Enforcing financial discipline on discoms through alignment with States’ finances.

What could be potential challenge to UDAY?

- Electricity is not a central subject, states’ cannot be made to participate in the programme.

- Finding buyers for such bonds might prove difficult, as these would enjoy the SLR status.

- It has not laid down a specific performance-monitoring and compliance mechanism.

- It does not cover inadequate investment in network & poor supply, which is essential for reliable and quality supply.

- No central monetary assistance is provided, rather states’ will be provided subsidised funding from the central govt.’s power schemes as well as priority in supply of coal.

Published with inputs from Pushpendra