NPA Crisis

RBI’s New Guidelines for Asset Reconstruction Companies (ARCs)

From UPSC perspective, the following things are important :

Prelims level: Asset Reconstruction Companies, SARFAESI Act, 2002;

Mains level: NA

Why in the news?

The RBI has introduced updated guidelines for Asset Reconstruction Companies (ARCs) through a master direction, effective from April 24, 2024.

What is an Asset Reconstruction Company (ARC)?

| Description | |

| About | ARC is a special financial institution that acquires debtors from banks at a mutually agreed value and attempts to recover the debts or associated securities. |

| Regulation | ARCs are registered under the RBI.

Regulated under the SARFAESI Act, 2002 (Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act). |

| Objective | ARCs take over a portion of the bank’s non-performing assets (NPAs) and engage in asset reconstruction or securitization, aiming to recover the debts. |

| Functions | Asset Reconstruction: Acquisition of bank loans or other credit facilities for realization.

Securitization: Acquisition of financial assets by issuing security receipts. |

| Foreign Investment | 100% FDI allowed in ARCs under the automatic route. |

| Limitiations | ARCs are prohibited from undertaking lending activities.

They can only engage in securitization and reconstruction activities. |

| Working | Bank with NPA agrees to sell it to ARC at a mutually agreed value.

ARC transfers assets to trusts under SARFAESI Act. Upfront payment made to bank, rest through Security Receipts. Recovery proceeds shared between ARC and bank. |

| Security Receipts | Issued to Qualified Institutional Buyers (QIBs) for raising funds to acquire financial assets. |

| Significance | Banks can clean up their balance sheets and focus on core banking activities.

Provides a mechanism for resolution of NPAs and debt recovery. |

What are the new guidelines laid out by the RBI?

- Enhanced Capital Requirements:

-

-

- Minimum Capital Requirement Increase: ARCs are now mandated to maintain a minimum capital requirement of Rs 300 crore, a significant increase from the previous Rs 100 crore stipulation established on October 11, 2022.

- Transition Period for Compliance: Existing ARCs are granted a transition period to reach the revised Net Owned Fund (NOF) threshold of Rs 300 crore by March 31, 2026.

- Interim Requirement: However, by March 31, 2024, ARCs must possess a minimum capital of Rs 200 crore to comply with the new directives.

-

- Supervisory Actions for Non-Compliance:

-

-

- ARCs failing to meet the prescribed capital thresholds will face supervisory action, potentially including restrictions on undertaking additional business until compliance is achieved.

-

- Expanded Role for Well-Capitalized ARCs:

-

- Empowerment of Well-Capitalized ARCs: ARCs with a minimum NOF of Rs 1000 crore are empowered to act as resolution applicants in distressed asset scenarios.

- Investment Opportunities: These ARCs are permitted to deploy funds in government securities, scheduled commercial bank deposits, and institutions like SIDBI and NABARD, subject to RBI specifications. Additionally, they can invest in short-term instruments such as money market mutual funds, certificates of deposit, and corporate bonds commercial papers.

- Investment Cap: Investments in short-term instruments are capped at 10% of the NOF to mitigate risk exposure.

PYQ:[2018] With reference to the governance of public sector banking in India, consider the following statements:

Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

RBI flags supervisory concerns over ARCs functioning

From UPSC perspective, the following things are important :

Prelims level: Asset Reconstruction Companies, SARFAESI Act, 2002;

Mains level: NA

Why in the News?

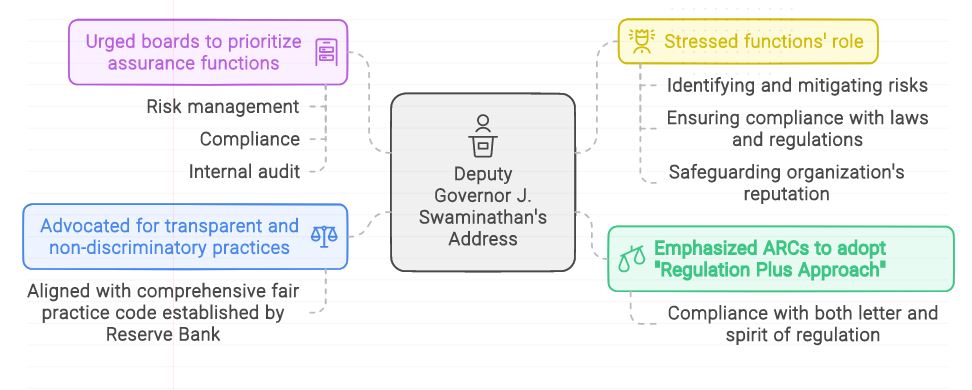

- After the allegations of ‘unethical practices’ by ARCs, including aiding defaulting promoters, the RBI intervened, with the Deputy Governor urging integrity and ethical conduct in their operations.

|

The new guidelines laid out by the RBI:

- Enhanced Capital Requirements:

- Minimum Capital Requirement Increase: ARCs are now mandated to maintain a minimum capital requirement of Rs 300 crore, a significant increase from the previous Rs 100 crore stipulation established on October 11, 2022.

- Transition Period for Compliance: Existing ARCs are granted a transition period to reach the revised Net Owned Fund (NOF) threshold of Rs 300 crore by March 31, 2026.

- Interim Requirement: However, by March 31, 2024, ARCs must possess a minimum capital of Rs 200 crore to comply with the new directives.

- Supervisory Actions for Non-Compliance:

- ARCs failing to meet the prescribed capital thresholds will face supervisory action, potentially including restrictions on undertaking additional business until compliance is achieved.

- Expanded Role for Well-Capitalized ARCs:

- Empowerment of Well-Capitalized ARCs: ARCs with a minimum NOF of Rs 1000 crore are empowered to act as resolution applicants in distressed asset scenarios.

- Investment Opportunities: These ARCs are permitted to deploy funds in government securities, scheduled commercial bank deposits, and institutions like SIDBI and NABARD, subject to RBI specifications. Additionally, they can invest in short-term instruments such as money market mutual funds, certificates of deposit, and corporate bonds commercial papers.

- Investment Cap: Investments in short-term instruments are capped at 10% of the NOF to mitigate risk exposure.

About Asset Reconstruction Company (ARC):

| Description | |

| About | ARC is a special financial institution that acquires debtors from banks at a mutually agreed value and attempts to recover the debts or associated securities. |

| Regulation |

(Note: For reading more details on SARFAESI Act you can visit on our article named “RBI asks for SARFAESI Act Compliance” of Sept 2023) |

| Objective | ARCs take over a portion of the bank’s non-performing assets (NPAs) and engage in asset reconstruction or securitization, aiming to recover the debts. |

| Functions |

|

| Foreign Investment | 100% FDI allowed in ARCs under the automatic route. |

| Limitiations |

|

| Working |

|

| Security Receipts | Issued to Qualified Institutional Buyers (QIBs) for raising funds to acquire financial assets. |

| Significance |

|

PYQ:[2018] With reference to the governance of public sector banking in India, consider the following statements:

Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

RBI tightens norms for Alternative Investment Funds (AIFs)

From UPSC perspective, the following things are important :

Prelims level: Alternative Investment Funds (AIFs)

Mains level: Not Much

Central Idea

- The Reserve Bank of India (RBI) has introduced tighter norms for Regulated Entities (REs) to curb the practice of evergreening loans through investments in Alternative Investment Funds (AIFs).

- The norms apply to all banks, all India Financial Institutions, and Non-Banking Financial Companies (NBFCs), including Housing Finance Companies.

About Alternative Investment Funds (AIFs)

| Details | |

| Definition | AIFs are privately pooled investment vehicles established in India, collecting funds from sophisticated investors for investing. |

| Regulation | Governed by the SEBI (Alternative Investment Funds) Regulations, 2012. |

| Formation | Can be formed as a company, Limited Liability Partnership (LLP), trust, etc. |

| Investor Profile | Aimed at high rollers, including domestic and foreign investors in India. Generally favored by institutions and high net worth individuals due to high investment amounts. |

| Categories of AIFs | Category I: Invests in start-ups, early-stage ventures, SMEs, etc. Includes venture capital funds, angel funds, etc.

Category II: Includes funds not in Category I/III, like real estate funds, debt funds, etc. No leverage or borrowing except for operational requirements. Category III: Employs complex trading strategies, may use leverage. Includes hedge funds, PIPE Funds, etc. |

| Fund Structure | Category I and II AIFs must be close-ended and have a minimum tenure of three years.

Category III AIFs can be open-ended or close-ended. |

Background and Regulatory Concerns

- Investment Practices: REs often invest in units of AIFs as part of their regular investment operations.

- RBI’s Observations: The RBI noted certain transactions involving AIFs that substituted direct loan exposure with indirect exposure, raising regulatory concerns.

RBI’s New Guidelines

- Restriction on Investments: REs are prohibited from investing in any AIF scheme that indirectly or directly has downstream investments in a debtor company of the RE.

- Mandatory Liquidation: If an AIF scheme, where an RE is already an investor, makes a downstream investment in a debtor company, the RE must liquidate its investment in the scheme within 30 days from the date of such investment by the AIF.

- Provision for Existing Investments: For existing investments in such schemes, REs have 30 days from the issuance of the circular to liquidate. Failure to do so requires them to make a 100% provision on these investments.

- Capital Fund Deductions: Investments by REs in subordinated units of any AIF scheme with a ‘priority distribution model’ are subject to full deduction from the RE’s capital funds.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

Controversy over Germany’s Debt Brake Rule

From UPSC perspective, the following things are important :

Prelims level: Debt Brake Rule

Mains level: NA

Central Idea

- On November 15, Germany’s constitutional court declared the government’s reallocation of €60 billion to a “climate and transformation fund” (KTF) as unlawful.

Understanding the Debt Brake Rule

- Definition and Purpose: The debt brake rule caps government borrowing and restricts the federal government’s fiscal deficit to 0.35% of GDP, while prohibiting deficit spending by Germany’s 16 regions.

- Enactment: This rule was incorporated into German law in 2009 by a coalition, mirroring the EU’s Stability and Growth Pact and the 2012 Fiscal Compact Treaty.

Legal Challenge and Its Implications

- Opposition’s Argument: It argued that climate change and energy transition investments, being long-term, shouldn’t be funded by the debt brake’s emergency exemption, which was specific to COVID-19 relief.

- Government’s Defense: The government contended that the reallocated funds addressed economic consequences of the pandemic by linking investment shortfalls to COVID-19’s economic impact.

Germany’s Post-2009 Economic Performance

- Mixed Outcomes: Germany experienced growth and budget surpluses in the last decade, benefiting from low-interest policies of the ECB.

- Zero-Deficit Budget: The government achieved a zero-deficit budget, promoting it as an ideal approach for the EU during a sovereign debt crisis.

- Challenges and Criticisms: A cooling economy highlighted under-investment in infrastructure. Critics urged for expansionary fiscal measures, while others favored higher taxation. Chancellor Angela Merkel emphasized the need to avoid burdening the younger generation with debt.

- Pandemic Response: In 2020, the debt brake rule was suspended for pandemic-related borrowing, with plans for reinstatement.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

PCA Framework extended to government NBFCs

From UPSC perspective, the following things are important :

Prelims level: Prompt Corrective Action (PCA)

Mains level: Read the attached story

Central Idea

- The RBI has announced the extension of the Prompt Corrective Action (PCA) framework to Government Non-Banking Financial Companies (NBFCs), excluding those in the Base Layer, starting from October 1, 2024.

PCA Framework Expansion

- Scope: Government-owned NBFCs, such as PFC, REC, IRFC, and IFCI, will now fall under the PCA framework.

- Impact: These NBFCs will face restrictions on dividend distribution and profit remittances. Promoters and shareholders will have limitations on equity infusion, and leverage reduction will be required. Issuing guarantees or taking contingent liabilities on behalf of group companies will also be restricted.

What is Prompt Corrective Action (PCA) Framework?

- Definition: The PCA Framework is a watchlist of banks identified as financially weak by the central bank.

- Regulatory Measures: When a bank falls under PCA, the regulator imposes restrictions on its operations, such as curbs on lending activities.

- Coverage: The PCA Framework applies exclusively to commercial banks and does not extend to cooperative banks or non-banking financial companies (NBFCs).

- History: The RBI introduced the PCA Framework in December 2002 as an early intervention mechanism, inspired by the US Federal Deposit Insurance Corporation’s PCA framework.

- Last Update: The revised PCA framework came into effect on January 1, 2022.

- Monitoring Areas: The revised framework places a heightened focus on capital adequacy, asset quality, and leverage.

- Risk Threshold: The RBI has updated the level of capital adequacy ratio shortfall that triggers classification into the “risk threshold three” category.

Trigger Points for PCA Inclusion

- Capital-to-Risk Weighted Assets Ratio (CRAR): CRAR measures a bank’s capital in relation to risk-weighted assets. If CRAR falls below 9 percent, the RBI takes action, including the submission of a capital restoration plan, restrictions on business activities, and dividend payments. Additional steps may follow if CRAR is below 6 percent but equal to or above 3 percent.

- Net Non-Performing Assets (NPA): If net NPAs exceed 10 percent but remain below 15 percent, the RBI initiates measures to reduce bad loans and strengthen credit appraisal skills.

- Return on Assets (RoA): If RoA drops below 0.25 percent, restrictions are imposed on deposit renewal, access to costly deposits and CDs, and the bank’s entry into new lines of business.

Rationale for Expansion

- Growing Significance: NBFCs have witnessed substantial growth and have strong linkages with various financial segments.

- Supervisory Enhancement: In 2022, the RBI introduced the PCA framework for NBFCs to strengthen supervisory tools. The objective is to facilitate timely supervisory intervention and mandate corrective actions to restore financial health.

- Market Discipline: The framework serves as a mechanism for effective market discipline, ensuring that NBFCs adhere to financial prudence.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

RBI asks for SARFAESI Act Compliance

From UPSC perspective, the following things are important :

Prelims level: SARFAESI Act

Mains level: Not Much

Central Idea

- The RBI has issued a directive requiring commercial banks and Non-Banking Financial Companies (NBFCs), collectively referred to as Regulated Entities (REs), to disclose borrower information.

- This disclosure pertains to borrowers whose secured assets have been repossessed under the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (SARFAESI Act).

What is the SARFAESI Act?

- Objective: The SARFAESI Act, introduced in 2002, is formally known as the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act. Its primary objective is to protect financial institutions against loan defaults.

- Empowering Banks: The Act empowers banks to seize, manage, or sell securities pledged as collateral for loans, facilitating the recovery of bad debts without the need for court intervention.

- Broad Application: The SARFAESI Act applies nationwide and covers all types of assets, whether movable or immovable, provided as security to lenders.

Aim of the SARFAESI Act

The SARFAESI Act serves two key purposes:

- Efficient NPA Recovery: It streamlines and expedites the recovery of non-performing assets (NPAs) for financial institutions and banks.

- Asset Auction: It enables financial organizations and banks to auction residential and commercial assets in cases of borrower default.

Why was such a Law needed?

- Pre-SARFAESI Era: Before the enactment of the SARFAESI Act in December 2002, financial institutions and banks faced complex procedures for recovering bad debts.

- Legal Complexity: Lenders had to navigate legal complexities, resorting to civil courts or designated tribunals to secure ‘security interests’ for recovering defaulted loans, resulting in slow and cumbersome debt recovery.

Powers Granted to Banks under the Law

- Default Trigger: The SARFAESI Act comes into play when a borrower defaults on payments for more than six months.

- Notice Period: The lender is required to issue a notice to the borrower, providing them with a 60-day window to clear their outstanding dues.

- Asset Possession: If the borrower fails to comply within the stipulated period, the financial institution gains the right to take possession of the secured assets and manage, transfer, or sell them.

- Appellate Avenue: The defaulter has the option to appeal to an appellate authority established under the law within 30 days of receiving a notice from the lender.

SARFAESI Act: Applicability

The SARFAESI Act primarily deals with various legal aspects related to:

- Registration of asset reconstruction companies.

- Acquisition of rights or interest in financial assets.

- Measures for asset reconstruction.

- Resolution of disputes.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

Private: Evergreening of Loans

NPA Crisis

Private: Expected Credit Loss Norms:

NPA Crisis

Finmin lifts bar on CPSUs issuing Letters of Comfort

From UPSC perspective, the following things are important :

Prelims level: Letter of Comfort

Mains level: NPA crisis

Central idea: The Finance Ministry has allowed central public sector firms (CPSUs) to issue letters of comfort with a condition that they should clearly state that the Government of India will not be liable for any consequences arising from such letters.

What is a Letter of Comfort?

- A letter of comfort is a support document issued to a borrower that adds some strength to the transaction when giving loans.

- Letter of comforts are usually issued by a third party or a stakeholder in the transaction.

- For instance, a holding company can give a letter of comfort on behalf of its subsidiary or a government can issue a letter of comfort for public sector enterprises.

- The letter of comfort can also be issued by banks, NBFCs and auditors.

Obligation status of LoCs

- The letter of comfort is not legally binding or an obligation by the holding company to repay the loans.

- It is just an assurance to the lender that the holding company is aware of the transaction, the policies of the subsidiary and its intentions in seeking a loan.

- This provides some comfort to the financial institution to lend money for short term or long term.

- One can say that the letter of comfort could become a moral obligation and not a legal one.

How is it different from letter of guarantee?

- A letter of comfort is different from a letter of guarantee.

- As spelled out in the name, the letter of guarantee acts as a commitment to the lender that the issuing company is taking responsibility for the repayment.

- It is also legally binding and the transaction becomes an obligation for the guarantor.

- Holding companies usually give letters of comfort when they are unable or unwilling to give letters of guarantees.

Try this MCQ-

Q. Which of the following statements is true about a Letter of Comfort?

A) It is a legally binding document that obligates the holding company to repay the loan.

B) It is issued only by banks and NBFCs.

C) It is an assurance provided by a third party to the lender that adds strength to the transaction when giving loans.

D) It is the same as a Letter of Guarantee in terms of its legal obligations.

Post your answers here.

Are you an IAS Worthy Aspirant? Get a reality check with the All India Smash UPSC Scholarship Test

Get upto 100% Scholarship | 900 Registration till now | Only 100 Slots Left

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

What is the Expected Credit Loss (ECL) regime?

From UPSC perspective, the following things are important :

Prelims level: Loan-Loss Provision

Mains level: NPA crisis

The Reserve Bank of India is moving closer towards ring-fencing the banking system from credit losses as it proposes to move to provision on the principles of ‘expected losses’ from ‘incurred losses. ‘

What is a Loan-Loss Provision?

- The RBI defines a loan loss provision as an expense that banks set aside for defaulted loans.

- Banks set aside a portion of the expected loan repayments from all loans in their portfolio to cover the losses either completely or partially.

- In the event of a loss, instead of taking a loss in its cash flows, the bank can use its loan loss reserves to cover the loss.

- The level of loan loss provision is determined based on the level expected to protect the safety and soundness of the bank.

What is Expected Credit Loss (ECL) regime?

- The Expected Credit Loss (ECL) regime is a new accounting standard that was introduced by the International Financial Reporting Standards (IFRS) in response to the global financial crisis of 2008.

- The ECL regime requires banks and other financial institutions to estimate and report the expected losses from their loan portfolios over the lifetime of the loans.

- Under the ECL regime, financial institutions must assess the credit risk associated with each loan and estimate the expected losses that will result from default or other credit events.

- These expected losses must be recognized in the financial institution’s accounts and reported to investors and other stakeholders.

- Under this practice, a bank is required to estimate expected credit losses based on forward-looking estimations rather than wait for credit losses to be actually incurred before making corresponding loss provisions.

Benefits of the ECL regime

- ECL will result in excess provisions as compared to a shortfall in provisions, as seen in the incurred loss approach.

- It will further enhance the resilience of the banking system in line with globally accepted norms.

Issues with this regime

- It requires banks to provide for losses that have already occurred or been incurred.

- The delay in recognizing loan losses resulted in banks having to make higher levels of provisions which affected the bank’s capital.

- This affected banks’ resilience and posed systemic risks.

- The delays in recognizing loan losses overstated the income generated by the banks, which, coupled with dividend payouts, impacted their capital base.

Attempt UPSC 2024 Smash Scholarship Test | FLAT* 100% OFF on UPSC Foundation & Mentorship programs

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

Extradition of Fugitive Economic Offenders (FEOs)

From UPSC perspective, the following things are important :

Prelims level: Fugitive Economic Offenders (FEOs)

Mains level: Extradiction of FEOs

Central idea: India has called upon G20 countries to adopt multilateral action for faster extradition of fugitive economic offenders (FEOs) and recovery of assets both on the domestic front as well as from abroad.

Who are Fugitive Economic Offenders (FEOs)?

- FEOs are individuals who have fled their home country to avoid facing prosecution for financial crimes such as money laundering, fraud, and embezzlement.

- These individuals typically engage in illegal activities that involve large sums of money and often cause significant damage to the economy of the country they have fled.

FEOs and India

- India has put in place specialized legislation in this regard, in the form of the Fugitive Economic Offenders Act, 2018.

- It defines the term- as an individual against whom a warrant of arrest in relation to a scheduled offense has been issued by any court in India and who has left the country so as to avoid criminal prosecution; or the FEO abroad, refuses to return to face criminal prosecution”.

Why do offenders go fugitive?

- Finding safe heavens: FEOs seek refuge in countries that do not have an extradition treaty with their home country or that have weak extradition laws.

- Evading justice: FEOs often exploit legal loopholes and the differences in laws and regulations across countries to evade justice.

- Asset offshoring: They may move their assets to offshore accounts or invest in assets such as real estate and art that are difficult to seize.

How FEOs impact the economy?

FEOs can have a significant impact on the economy of the country they have fled from.

- Loan defaults: They may default on loans, engage in fraudulent activities, and siphon off large amounts of money from banks and financial institutions.

- NPA crisis: This can lead to a rise in non-performing assets (NPAs), a slowdown in economic growth, and a loss of investor confidence.

International mechanisms for FEOs

Some of the key international mechanisms for FEOs are:

- Extradition treaties: Many countries have extradition treaties in place with other countries that enable them to request the extradition of individuals who have fled to other countries to avoid prosecution.

- Mutual Legal Assistance Treaties (MLATs): MLATs are agreements between countries that facilitate the exchange of information and evidence in criminal investigations and proceedings.

- International Conventions and Agreements: There are several international conventions and agreements that address financial crimes and provide a framework for international cooperation. Ex. UN Convention against Corruption, FATF etc.

- INTERPOL: Interpol facilitates cross-border police cooperation and coordination. It maintains a database of wanted individuals, including FEOs, and works with member countries to locate and apprehend them.

- Asset recovery: Such mechanisms are designed to enable countries to recover assets by means of seizure and repatriation of assets, as well as the freezing of assets to prevent FEOs from accessing them.

Way forward

- Strengthening domestic laws: India can strengthen its domestic laws and regulations to make it easier to prosecute FEOs and recover their assets.

- Developing extradition treaties: India can work to develop and strengthen extradition treaties with other countries to ensure that FEOs are not able to evade justice by fleeing to other countries.

- Enhancing international cooperation: India can enhance its cooperation with other countries and international organizations to facilitate the sharing of information and intelligence about FEOs.

- Seizing and repatriating assets: India can work to seize and repatriate assets that have been acquired through illegal means by FEOs.

- Improving transparency and accountability: India can improve transparency and accountability in its financial system to prevent FEOs from exploiting loopholes and engaging in illegal activities.

Attempt UPSC 2024 Smash Scholarship Test | FLAT* 100% OFF on UPSC Foundation & Mentorship programs

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

Why India’s bankruptcy regime needs to be fixed?

From UPSC perspective, the following things are important :

Prelims level: IBC

Mains level: Reforms in the IBC

The government is proposing to make changes to India’s six-year-old Insolvency and Bankruptcy Code (IBC).

What is the Insolvency and Bankruptcy Code (IBC)?

- The IBC, 2016 is the bankruptcy law of India that seeks to consolidate the existing framework by creating a single law for insolvency and bankruptcy.

- It is a one-stop solution for resolving insolvencies which previously was a long process that did not offer an economically viable arrangement.

- The code aims to protect the interests of small investors and make the process of doing business less cumbersome.

Key features

Insolvency Resolution: The Code outlines separate insolvency resolution processes for individuals, companies, and partnership firms. The process may be initiated by either the debtor or the creditors. A maximum time limit, for completion of the insolvency resolution process, has been set for corporates and individuals.

- For companies, the process will have to be completed in 180 days, which may be extended by 90 days, if a majority of the creditors agree.

- For startups (other than partnership firms), small companies, and other companies (with assets less than Rs. 1 crore), the resolution process would be completed within 90 days of initiation of request which may be extended by 45 days.

Insolvency regulator: The Code establishes the Insolvency and Bankruptcy Board of India, to oversee the insolvency proceedings in the country and regulate the entities registered under it. The Board will have 10 members, including representatives from the Ministries of Finance and Law, and the RBI.

Insolvency professionals: The insolvency process will be managed by licensed professionals. These professionals will also control the assets of the debtor during the insolvency process.

Bankruptcy and Insolvency Adjudicator: The Code proposes two separate tribunals to oversee the process of insolvency resolution, for individuals and companies:

- National Company Law Tribunal: for Companies and Limited Liability Partnership firms; and

- Debt Recovery Tribunal: for individuals and partnerships

What are the changes being proposed?

- Easier settlements: The process is being proposed to be divided into two phases—phase I will focus on finding potential buyers and handing over the management to the acquirer. Phase II would address the distribution of proceeds among creditors and settle inter-creditor disputes. This would make an effort to revive the units with better management, wherever possible.

- Preventing delays: Average days taken to resolve a case has risen to 679 days in H1FY23 from 230 days in FY18. The changes presently under consideration seek to address inter-creditor disputes, which have been identified as the leading cause of delays.

Why is the IBC seen as a game-changer?

- The IBC has proved to be a deterrent for many unscrupulous borrowers and imparted tools to banks to be reasonably confident about recovering NPAs.

- Fear of losing control of the firm nudges debtors to settle their dues.

- Till September 2022, 23,417 applications for initiation of the Corporate Insolvency Resolution Process (CIRP), with an underlying default amount of ₹7.31 trillion, were resolved before admission.

- Indirectly, the code provides an exit route by winding up commercially unviable units.

Click and get your FREE Copy of CURRENT AFFAIRS Micro Notes

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

What is a Loan Write-Off?

From UPSC perspective, the following things are important :

Prelims level: Loan Write-Off

Mains level: NPAs

Banks have written off bad loans worth ₹10,09,511 crore during the last five financial years, finance minister informed the Parliament.

What is a loan write-off?

- Writing off a loan essentially means it will no longer be counted as an asset.

- By writing off loans, a bank can reduce the level of non-performing assets (NPAs) on its books.

- The bank moves the defaulted loan, or NPA, out of the assets side and reports the amount as a loss.

- An additional benefit is that the amount so written off reduces the bank’s tax liability.

- The loans written off by the banks are the depositors’ money.

Why do banks resort to write-offs?

- Recovery issues: The bank writes off a loan after the borrower has defaulted on the loan repayment and there is a very low chance of recovery. However, the chances of recovery from written-off loans are very low.

- Provisioning: After the write-off, banks are supposed to continue their efforts to recover the loan using various options. They have to make provisioning as well.

- Reduce tax liability: The tax liability will also come down as the written-off amount is reduced from the profit.

Who is at the forefront of write-offs?

- Public sector banks reported the lion’s share of write-offs at Rs 734,738 crore accounting for 72.78 per cent of the exercise.

- Among individual public sector banks, reduction in NPAs due to write-offs in the case of State Bank of India Rs 204,486 crore in the last five years.

- Among private banks, ICICI Bank’s reduction in NPAs due to write-offs was Rs 50,514 crore in the last five years.

- Axis Bank wrote off Rs 49,715 crore and HDFC Bank Rs 34,782 crore during the period, according to the RBI.

What about recovery of such loans?

- Since the loan account is not closed in write-off, the right to recovery of the amount is not waived by the lender or the bank.

- The bank or lender can try to recover the loan amount from the loan defaulter.

Back2Basics: Non-Performing Assets (NPAs)

- A NPA is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

- Banks are required to classify NPAs further into Substandard, Doubtful and Loss assets.

- Substandard assets: Assets which has remained NPA for a period less than or equal to 12 months.

- Doubtful assets: An asset would be classified as doubtful if it has remained in the substandard category for a period of 12 months.

- Loss assets: As per RBI, “Loss asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted, although there may be some salvage or recovery value.”

Click and get your FREE Copy of CURRENT AFFAIRS Micro Notes

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

What is First Loss Default Guarantee (FLDG) System?

From UPSC perspective, the following things are important :

Prelims level: FLDG

Mains level: NA

Two months after the RBI issued guidelines on digital lending, banks, NBFCs and fintech players are still awaiting clarity on many aspects, including the First Loss Default Guarantee (FLDG) system.

What is FLDG System?

- FLDG is an arrangement between a fintech company and regulated entity (RE), including banks and non-banking finance companies, wherein the fintech compensates the RE to a certain extent if the borrower defaults.

- Under this, the fintech originates a loan and promises to compensate the partners up to a pre-decided percentage in case customers fail to repay.

- The bank/NBFC partners lend through the fintech but from their own books.

- FLDG helps expand the customer base of traditional lenders but relies on the fintechs underwriting capabilities.

- FLDG is also seen as a validation of the fintechs underwriting capabilities for loans disbursed.

Issues with FLDGs

- A report by an RBI-constituted working group on digital lending has laid down risks of FLDG agreements with unregulated entities.

- The other concern is that FLDG costs are often passed on to customers.

Click and get your FREE Copy of CURRENT AFFAIRS Micro Notes

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

With eye on defaulters, Centre tweaks Overseas Investment Rules

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: Preventive fugitive offences

The Finance Ministry has released the Rules for Foreign Exchange Management (Overseas Investment Rules), 2022 subsuming extant regulations for Overseas Investments and Acquisition and Transfer of Immovable Property outside India Regulations, 2015.

What are the news Overseas Investment Rules?

- With an eye on wilful defaulters, the new rules stipulate that:

- Any Indian resident will have to seek an no objection certificate before making any overseas financial commitment:

- Who has an account appearing as a non-performing asset

- Or is classified as a wilful defaulter by any bank

- Or is under investigation by a financial service regulator or by investigative agencies in India

What are the tweaks in overseas investment norms?

- Any resident in India acquiring equity capital in a foreign entity or overseas direct investment (ODI), will have to submit an Annual Performance Report (APR) for each foreign entity, every year by December 31.

- No such reporting shall be required where a person resident in India is holding less than 10% of the equity capital without control in the foreign entity.

- There is no other financial commitment other than equity capital or a foreign entity is under liquidation.

Ceiling on investment

- Any resident individual can make ODI by way of investment in equity capital or overseas portfolio investment (OPI) subject to the overall ceiling under the Liberalised Remittance Scheme (LRS) of the Reserve Bank.

- Currently, the LRS permits $2,50,000 outward investment by an individual in a year.

- These norms make it easier for domestic corporates to invest abroad.

What are the prohibitions?

- Any Indian resident, who has been classified as a wilful defaulter or is under investigation by the CBI, the ED or the Serious Frauds Investigation Office (SFIO), will have to obtain a no-objection certificate (NOC).

- NOC can be obtained from his or her bank, regulatory body or investigative agency before making any overseas “financial commitment” or disinvestment of overseas assets.

- The rules also provide that if lenders, the concerned regulatory body or investigative agency fail to furnish the NOC within 60 days of receiving an application, it may be presumed that they have no objection to the proposed transaction.

- Additionally, the new rules also prohibit Indian residents from making investments into foreign entities that are engaged in real estate activity, gambling in any form, and dealing with financial products linked to the Indian rupee without the specific approval of the RBI.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

India’s banking sector shows progress

From UPSC perspective, the following things are important :

Prelims level: Credit growth in India

Mains level: Paper 3- India's banking sector

Context

The RBI’s latest Financial Stability Report (FSR) has given the banking system a reasonably clean bill of health. It’s a significant achievement, considering the stress of the previous decade, the shock of the pandemic and the associated slowdown of the economy.

Two indicators of banking system’s progress

- 1] Reduced NPAs: Successive waves of recapitalisation have given banks enough resources to write off most of their bad loans.

- As a result, they have been able to bring down their gross NPAs (non-performing loans) from 11 per cent of total advances in 2017-18 to 5.9 per cent in 2021-22.

- Even after these large write-offs, most banks retain comfortable levels of capital.

- 2] Credit growth doubled: During the decade when banks were under stress, non-food bank credit growth had been declining, reaching just 6 per cent in 2020, its lowest point in six decades.

- Since then, credit growth has nearly doubled.

Concerns

- Role of credit in supporting GDP growth: The problem is that very little of this credit is going to large-scale industry or for financing investment.

- Reluctance of banks to provide credit to industry: Over the last decade, banks have increasingly shifted away from providing credit to industry, favouring instead lending to consumers.

- This trend is continuing — in the year ending March 2022, consumer loans grew at 13 per cent, whereas loans to industry grew at just 8 per cent.

- Banks favoring MSMEs in industry loans: Bulk of the industry loans has been extended to the smaller firms (MSMEs), which benefitted from the credit guarantee scheme offered by the government in the wake of the pandemic.

- Reduced lending to private sector investment: A related problem is that there has been little lending for private sector investment.

- Over the last one year, bank lending to infrastructure has grown by 9 per cent, up from 3 per cent in 2020, but this was fuelled mainly by public sector capital expenditure.

Why is there so little lending for investment by large firms?

- Demand side reason: On the demand side, private sector investment has been sluggish for nearly a decade.

- The boom-and-bust of the mid-2000s had saddled firms with excess capacity, giving them little reason to expand their production facilities.

- In addition, the global financial crisis had shown the dangers of ambitious expansion supported by excessive borrowing, leading firms to conclude that it would be prudent to scale back their plans and instead focus on reducing their debts.

- Supply side reason: On the supply side, banks have learned similar lessons.

- During the period 2004-2009, rapid GDP growth in the Indian economy was fuelled by an unprecedented lending boom.

- Subsequently, many of those loans turned bad, leading to high levels of NPAs on bank balance sheets.

- As a result of these financial problems, banks for a decade were unable to extend much in the way of credit.

Challenges

- On the positive side, firms seem to have finally used up much of their spare capacity.

- Fundamental problems not resolved: But on the negative side, the fundamental problems that led to the difficulties of the past decade still have not been resolved.

- No framework for risk reduction: There is still no framework that will reduce the risk of private sector investment in infrastructure, certainly not in the critical and highly troubled power sector.

- Nor is there any reassurance for the banks that if problems do develop, they can be resolved expeditiously, since the Insolvency and Bankruptcy Code has been plagued by delays and other problems.

Way forward

- We need deep structural reforms — to the infrastructure framework, the resolution process, and indeed, in the risk management processes at the banks themselves.

- In the event that these reforms do not materialise, there may continue to be shortfalls in credit, investment, and ultimately in economic recovery and growth.

Conclusion

A healthy balance sheet of the banking sector is a necessary but not a sufficient condition for economic growth. The important question is whether banks and firms will once again be willing to take on the risk of investment in industry and infrastructure.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

Bank frauds

From UPSC perspective, the following things are important :

Prelims level: National Asset Reconstruction Company Ltd. (NARCL)

Mains level: Paper 3- Impact of banking scams

Context

The biggest banking scam in India has come to the forefront; in this case, DHFL has hoodwinked a consortium of banks driven by the Union Bank of India to the tune of ₹35,000 crore through financial misrepresentation.

How scams affect economy

- The banking system of any country is the backbone of its economy.

- Excessive losses to banks affect every person in the country because the amounts deposited in banks belong to the citizens of the country.

- The NPAs that banks incur are mainly due to bad loans and scams.

- The data by the RBI also show that one of the fundamental problems in the way of the development of banking in India is on account of rising bank scams and the costs consequently forced on the framework.

- Strangely, as in a Global Banking Fraud survey (KPMG), the issue is not just for India alone; it is a worldwide issue.

Reasons for scams

- Frauds in the banking industry can be grouped under four classifications: ‘Management’, ‘Outsider’, ‘Insider’ and ‘Insider and Outsider’ (jointly).

- Operational failures: All scams, whether interior or outside, are results of operational failures.

- Limited asset monitoring: Research by Deloitte has shown that limited asset monitoring after disbursement (38%) was the foremost reason behind stressed assets and insufficient due diligence before disbursement (21%) was among the major factors for these NPAs.

- Poor bank corporate governance: A study by the Indian Institute of Management Bangalore has shown that poor bank corporate governance is the cause behind rising bank scams and NPAs.

The problems of high NPA

- In a Financial Stability Report released by the RBI in December 2021, there is a projection of the gross NPAs of banks rising from 6.9% in September 2021 to 8.1% of total assets by September 2022 (under a baseline scenario) and to 9.5% under a severe stress scenario.

- A high NPA also reduces the net interest margin of banks besides increasing their operating cost; these banks meet this cost by increasing the convenience fee from their small customers on a day-to-day basis.

Suggestions

- Banks have to exercise due diligence and caution while offering funds.

- Regulation and control of CAs: The regulation and the control of chartered accountants is a very important step to reduce non-performing assets of banks.

- Banks should be cautious while lending to Indian companies that have taken huge loans abroad.

- Tightening audit system: There is also an urgent need to tighten the internal and external audit systems of banks.

- Fast rotation of employees: The fast rotation of employees of a bank’s loan department is very important.

- Public sector banks should set up an internal rating agency for rigorous evaluation of large projects before sanctioning loans.

- Effective MIS: Further, there is a need to implement an effective Management Information System (MIS) to monitor early warning signals about business projects.

- CIBIL score of the borrower: The CIBIL score of the borrower (formerly the Credit Information Bureau (India) Limited) should be evaluated by the bank concerned and RBI officials.

- Use of AI: Financial fraud can be reduced to a great extent by the use of artificial intelligence (AI) to monitor financial transactions.

- Improve loan recovery process: Rather than having to continuously write off the bad loans of large corporates, India has to improve its loan recovery processes and establish an early warning system in the post-disbursement phase.

- Risk assessment: Banks need to carry out fraud risk assessments every quarter.

- Only establishment of National Asset Reconstruction Company Ltd. (NARCL) or the ‘bad bank’ is not a real solution.

- These measures can help only after a loan is bad but not the process of a loan going bad.

Conclusion

While the Government of India and the RBI have taken several measures to try and resolve the issue of scams in the banking industry, the fact is that there is still a long way to go.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

What are Bad Banks?

From UPSC perspective, the following things are important :

Prelims level: Bad Banks

Mains level: Bad Banks in India

The finance ministry said the Rs 6,000-crore National Asset Reconstruction Company (NARCL) or bad bank is expected to take over the first set of non-performing accounts of banks next month.

What is a Bad Bank?

- A bad bank conveys the impression that it will function as a bank but has bad assets to start with.

- Technically, it is an asset reconstruction company (ARC) or an asset management company that takes over the bad loans of commercial banks, manages them and finally recovers the money over a period of time.

- Such a bank is not involved in lending and taking deposits, but helps commercial banks clean up their balance sheets and resolve bad loans.

- The takeover of bad loans is normally below the book value of the loan and the bad bank tries to recover as much as possible subsequently.

Bad Banks to be established

- The NARCL-IDRCL structure is the new bad bank.

- The National Asset Reconstruction Company Limited (NARCL) has already been incorporated under the Companies Act.

- It will acquire stressed assets worth about Rs 2 lakh crore from various commercial banks in different phases.

- Another entity — India Debt Resolution Company Ltd (IDRCL), which has also been set up — will then try to sell the stressed assets in the market.

How will the NARCL-IDRCL work?

- The NARCL will first purchase bad loans from banks.

- It will pay 15% of the agreed price in cash and the remaining 85% will be in the form of “Security Receipts”.

- When the assets are sold, with the help of IDRCL, , the commercial banks will be paid back the rest.

- If the bad bank is unable to sell the bad loan, or has to sell it at a loss, then the government guarantee will be invoked.

- The difference between what the commercial bank was supposed to get and what the bad bank was able to raise will be paid from the Rs 30,600 crore that has been provided by the government.

Will a bad bank resolve matters?

- From the perspective of a commercial bank saddled with high NPA levels, it will help.

- That’s because such a bank will get rid of all its toxic assets, which were eating up its profits, in one quick move.

- When the recovery money is paid back, it will further improve the bank’s position.

- Meanwhile, it can start lending again.

Why do we need a bad bank?

- The idea gained currency during Rajan’s tenure as RBI Governor.

- The RBI had then initiated an asset quality review (AQR) of banks and found that several banks had suppressed or hidden bad loans to show a healthy balance sheet.

- However, the idea remained on paper amid lack of consensus on the efficacy of such an institution.

- ARCs have not made any impact in resolving bad loans due to many procedural issues.

- While commercial banks resume lending, the so-called bad bank, or a bank of bad loans, would try to sell these “assets” in the market.

Good about the bad banks

- The problem of NPAs continues in the banking sector, especially among the weaker banks.

- The bad bank concept is in some ways similar to an ARC but is funded by the government initially, with banks and other investors co-investing in due course.

- The presence of the government is seen as a means to speed up the clean-up process.

- Many other countries had set up institutional mechanisms such as the Troubled Asset Relief Programme (TARP) in the US to deal with a problem of stress in the financial system.

Back2Basics: NARCL

- NARCL has been incorporated under the Companies Act and has applied to Reserve Bank of India for license as an Asset Reconstruction Company (ARC).

- NARCL has been set up by banks to aggregate and consolidate stressed assets for their subsequent resolution.

- Public Sector Banks will maintain 51% ownership in NARCL.

- The NARCL will acquire assets by making an offer to the lead bank.

- Once NARCL’s offer is accepted, then, IDRCL will be engaged for management and value addition.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

Why special situation funds are necessary

From UPSC perspective, the following things are important :

Prelims level: Alternative Investment Funds (AIFs)

Mains level: Paper 3- What are Special situation funds (SSFs)

Context

India suffers from a chronic bad debt problem. To overcome this problem, banks and financial institutions were initially allowed to sell their stressed loans only to ARCs. Now they can sell to SSFs too.

How bad debt affects the credit supply in economy?

- Higher bad debt requires higher provisioning, locking up more capital in the banking system.

- This reduces credit supply and hurts economic growth.

- To overcome this problem, banks and financial institutions were initially allowed to sell their stressed loans only to ARCs.

- Transfer of stressed loans would release capital locked-up in the banking system and help improve credit supply.

Two crucial reforms in financial markets

- Indian financial markets witnessed two crucial reforms earlier this year.

- 1] SSF: SEBI came out with a dedicated regulatory framework for special situation funds (SSFs).

- 2] Dual structure bad bank: The RBI approved the new dual-structure bad bank, NARCL-IDRCL.

- While the bad bank is an upgraded version of the existing asset restructuring companies (ARCs) model, the SSF is a relatively novel concept.

Understanding AIFs and SSF

- SEBI has introduced SSFs as a distinct sub-category of Category I Alternative Investment Funds (AIFs).

- AIFs manage privately pooled funds raised from sophisticated investors with deep pockets.

- AIFs in equity market: While AIFs have traditionally played a prominent role in equity markets, their participation in distressed debt markets has been limited.

- No participation in secondary market for corporate loans: Regulations did not permit AIFs to participate in the secondary market for corporate loans extended by banks and NBFCs.

- The new regulations now create a special sub-category of AIFs, namely SSFs, which are allowed to participate in the secondary market for loans extended to companies that have defaulted on their debt obligations.

What is Syndicated lending?

- Syndicated lending is a financial instrument where a group of lenders, known as a syndicate, work together to provide a large loan to a single borrower.

- This collaborative approach allows lenders to share the risk of borrower default, making it more manageable for individual lenders.

- The syndicate typically includes a lead bank or underwriter, which plays a crucial role in assembling the syndicate and managing administrative tasks.

Why SSFs must be allowed full participation across the entire spectrum of secondary market for corporate debt

- Default is a lagging indicator of financial stress.

- Lesser haircut: If lenders and bond investors could offload potentially stressed assets to SSFs before defaulting in the secondary market, they would benefit from a lesser haircut.

- SSFs would also get adequate time for debt aggregation before default, reducing the collective action problems that may arise after default during insolvency or restructuring.

- It would improve the liquidity: Allowing SSFs to purchase investment-grade loans would also improve the liquidity in the secondary market for corporate loans.

- Traditionally, banks originated loans and held them till maturity.

- Over time, lending moved from involving a single lender to multiple lenders via syndicated lending.

- As volumes in the primary syndication market increased, demand for secondary trading also developed to allow liquidity, risk and portfolio management.

- Suggestion by RBI task force: Secondary trading of loans is now institutionalised in international financial markets.

- The RBI task force on secondary markets for corporate loans, chaired by T N Manoharan, made this suggestion in 2019.

- These markets are liquid precisely because they are open to a wide variety of non-bank participants including insurance companies, pension funds, hedge funds and private equity funds.

- SSFs are unlikely to jeopardise financial stability: SSFs cannot borrow funds or engage in any leverage except for temporary funding requirements.

- Consequently, risks associated with liquidity, credit or maturity transformation and asset-liability mismatches are unlikely to arise.

- Given their structure, SSFs are likely to acquire sufficient debt in a distressed company to acquire control or to influence its subsequent insolvency or restructuring process to maximise its value through business turnaround or sale.

Consider the question “What are special situation funds (SSFs)? Suggest the changes needed in the secondary trading of loans in India’s.”

Conclusion

Overall, the introduction of SSFs promises to usher in a modern era of distressed debt investing in India. To realise their true potential, SSFs must be allowed full participation across the entire spectrum of secondary market for corporate debt and not just be confined to the post-default stage.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

Co-Lending Model for Banks-NBFCs

From UPSC perspective, the following things are important :

Prelims level: NBFCs

Mains level: Co-Lending and associated issues

A November 2020 decision by the RBI to permit banks to “co-lend with all registered NBFCs based on a prior agreement” has led to unusual tie-ups between the banks and companies.

The ‘Co-Lending Model’

- In September 2018, the RBI had announced “co-origination of loans” by banks and Non-Banking Financial Companies (NBFCs) for lending to the priority sector.

- The arrangement entailed joint contribution of credit at the facility level by both the lenders as also sharing of risks and rewards.

- Subsequently, based on feedback from stakeholders, the RBI allowed the lenders greater operational flexibility, while requiring them to conform to regulatory guidelines.

- The primary focus of the revised scheme, rechristened as ‘Co-Lending Model’ (CLM), was to “improve the flow of credit to the unserved and underserved sector of the economy.

Repercussions of Co-Lending

(1) Bank-NBFC tie-ups at indiscriminate scale

- Several banks have entered into co-lending ‘master agreements’ with NBFCs, and more are in the pipeline.

- SBI, the country’s largest lender, signed a deal with Adani Capital, a small NBFC of a big corporate house, for co-lending to farmers to help them buy tractors and farm implements.

(2) Greater risk in co-lending

- NBFCs are required to retain at least a 20 per cent share of individual loans on their books.

- This means 80 per cent of the risk will be with the banks — who will take the big hit in case of a default.

(3) Corporates in banking

- While the RBI hasn’t officially allowed the entry of big corporate houses into the banking space, NBFCs — mostly floated by corporate houses — were already accepting public deposits.

- They now have more opportunities on the lending side through direct co-lending arrangements.

Back2Basics: Non-Banking Financial Company (NBFC)

- An NBFC is a company incorporated under the Companies Act 2013 or 1956.

- According to section 45-I (c) of the RBI Act, a Non–Banking Company carrying on the business of a financial institution will be an NBFC.

- It further states that the NBFC must be engaged in the business of Loans and Advances, Acquisition of stocks, equities, debt etc issued by the government or any local authority or other marketable securities.

NBFC business:

The NBFC business does not include business whose principal business is the following:

- Agricultural Activity

- Industrial Activity

- Purchase or sale of any goods excluding securities

- Sale/purchase/construction of any immovable property – Providing of any services

Difference between Banks and NBFCs:

- NBFCs lend and make investments and hence their activities are akin to that of banks; however there are a few differences as given below:

- NBFC cannot accept demand deposits;

- NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself;

- Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in the case of banks.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

Gross NPAs of Banks to Rise

From UPSC perspective, the following things are important :

Prelims level: NPAs and related terms

Mains level: NPA Crisis

Gross Non-Performing Assets (NPAs) of banks are expected to rise to 8-9% this fiscal from 7.5% as on March 31, 2021 but they would still remain below the peak of 11.2% seen at the end of fiscal 2018.

What are Non-Performing Assets?

- For a bank, the loans given by the bank is considered as its assets.

- Any asset which stops giving returns to its investors for a specified period of time is known as Non-Performing Asset (NPA).

- So, if the principle or the interest or both the components of a loan is not being serviced to the lender (bank), then it would be considered as NPA.

Classification of NPAs in India

- According to the RBI, a NPA is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

- Banks are required to classify NPAs further into Substandard, Doubtful and Loss assets.

- Substandard Assets: Assets which has remained NPA for a period less than or equal to 12 months.

- Doubtful Assets: An asset would be classified as doubtful if it has remained in the substandard category for a period of 12 months.

- Loss Assets: As per RBI, loss asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted, although there may be some salvage or recovery value.

NPAs of Agriculture Loans

In terms of Agriculture/Farm Loans, the NPA is defined as under:

- For short duration crop such as paddy, Jowar, Bajra etc. if the loan (instalment/interest) is not paid for 2 crop seasons, it would be termed as an NPA.

- For Long Duration Crops, the above would be 1 Crop season from the due date

Reasons for NPAs in India

Impact of NPA on Economy

- Depositors’ loss: Depositors do not get rightful returns and many times may lose uninsured deposits.

- High interest on lending: Banks may begin charging higher interest rates on some products to compensate NPA loan losses.

- Trust issues: Bad loans imply redirecting of funds from good projects to bad ones. Hence, the economy suffers due to loss of good projects and failure of bad investments

Steps taken to curb NPA

(A) By the Govt

- Mission Indradhanush:to make the working of public sector bank more transparent and professional in order to curb the menace of NPA in future.

- Insolvency and Bankruptcy Code: To make it easier for banks to recover the loans from the debtors.

- Stringent NPA recovery rules: The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act or SARFESI Act of 2002 was amended in 2016.

(B) By RBI

RBI introduced number of measures in last few years which include:

- Corporate Debt Restructuring (CDR) mechanism,

- Setting up a Joint Lenders’ Forum, providing banks to disclose the real picture of bad loans, asking them to increase provisioning for stressed assets,

Other terms related to NPAs

Write-off effect

- A loan write-off is a tool used by banks to clean up their balance-sheets.

- If a loan turns bad on the account of the repayment defaults for at least three consecutive quarters, the exposure (loan) can be written off.

- A loan write-off sets free the money parked by the banks for the provisioning of any loan.

Twin Balance Sheet

- It deals with two balance sheet problems. One with Indian companies and the other with Indian Banks.

- Debt accumulation on companies is very high and thus they are unable to pay interest payments on loans.

Four Balance Sheet Challenge

- In his paper named ‘India’s Great Slowdown’, Arvind Subramanian (former Chief Economic Advisor) mentions the new ‘Four balance sheet challenge’.

- It includes the original two sectors – infrastructure companies and banks, plus NBFCs and real estate companies.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

Why banks want inspection reports by RBI to be kept confidential?

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: NPA Crisis

The contentious issue of whether banks should disclose inspection reports by the Reserve Bank of India (RBI) is back in the news once again after a division bench of the Supreme Court referred writ petitions filed by banks to another bench for reconsideration.

What is RBI’s inspection on banks?

- The Banking Regulation Act, 1949 empowers the Reserve Bank of India to inspect and supervise commercial banks.

- These powers are exercised through on-site inspection and off-site surveillance.

- RBI carries out dedicated and integrated supervision overall of credit institutions, i.e., banks, development financial institutions, and non-banking financial companies.

- The Board for Financial Supervision (BFS) carries out this function.

- Banks currently disclose the list of wilful defaulters and names of defaulters against whom they have filed suits for loan recovery.

Note: CAMELS is an international rating system used by regulatory banking authorities to rate financial institutions, according to the six factors represented by its acronym. The CAMELS acronym stands for “Capital adequacy, Asset quality, Management, Earnings, Liquidity, and Sensitivity.”

Why in news now?

- In 2015, the Supreme Court had come down on the RBI for trying to keep the inspection reports and defaulters list confidential.

- This was aimed for the public disclosure of such reports of the RBI, much against the wishes of the banking sector.

- The SC had said the RBI has no legal duty to maximize the benefit of any public sector or private sector bank, and thus there is no relationship of ‘trust’ between them.

- It added that the RBI was duty-bound to uphold the public interest by revealing these details under RTI.

What is the issue?

- The RBI was allowed to make such reports public following the Supreme Court order.

- The SC had wanted full disclosure of the inspection report.

- However, the court agreed that only some portions on bad loans and borrowers would be made public.

- Banks have been refusing to disclose inspection reports and defaulters’ lists.

Issues with report publication

- Bank defamation: As banks are involved in dealing in money, they fear any adverse remarks — especially from the regulator RBI — will affect their performance and keep customers away.

- Trust of the account holder: Banks are driven by the “trust and faith” of their clients that should not be made public.

- The invalidity of RTI: On the other hand, private banks insisted that the RTI Act does not apply to private banks.

- Right to Privacy: Banks also argued that privacy is a fundamental right, and therefore should not be violated by making clients’ information public.

Why are banks against disclosing inspection reports?

- Many feel that the RBI’s inspection reports on various banks, with details on alleged malpractices and mismanagement, can open up a can of worms.

- As these reports have details about how the banks were manipulated by rogue borrowers and officials, banks want to keep them under wraps.

- Obviously, banks don’t want inspection reports and defaulters’ lists to be made public as it affects their image.

- Customers may also keep out of banks with poor track records.

Try this PYQ now:

Q.In the context of the Indian economy non-financial debt includes which of the following?

- Housing loans owed by households

- Amounts outstanding on credit cards

- Treasury bills

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

Post your answers here (You need to sign-in for that).

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

[pib] Bad Bank launched for stressed assets

From UPSC perspective, the following things are important :

Prelims level: Bad Banks

Mains level: Asset reconstruction

The Government has launched a Bad Bank with all the regulatory approvals in place.

What is a Bad Bank?

- A bad bank conveys the impression that it will function as a bank but has bad assets to start with.

- Technically, it is an asset reconstruction company (ARC) or an asset management company that takes over the bad loans of commercial banks, manages them and finally recovers the money over a period of time.

- Such a bank is not involved in lending and taking deposits, but helps commercial banks clean up their balance sheets and resolve bad loans.

- The takeover of bad loans is normally below the book value of the loan and the bad bank tries to recover as much as possible subsequently.

Global examples of Bad Bank

- US-based BNY Mellon Bank created the first bad bank in 1988, after which the concept has been implemented in other countries including Sweden, Finland, France and Germany.

- However, resolution agencies or ARCs set up as banks, which originate or guarantee to lend, have ended up turning into reckless lenders in some countries.

Do we need a bad bank?

- The idea gained currency during Rajan’s tenure as RBI Governor.

- The RBI had then initiated an asset quality review (AQR) of banks and found that several banks had suppressed or hidden bad loans to show a healthy balance sheet.

- However, the idea remained on paper amid lack of consensus on the efficacy of such an institution.

- ARCs have not made any impact in resolving bad loans due to many procedural issues.

What is the stand of the RBI and government?

- While the RBI did not show much enthusiasm about a bad bank all these years, there are signs that it can look at the idea now.

- Experts, however, argue that it would be better to limit the objective of these asset management companies to the orderly resolution of stressed assets, followed by a graceful exit.

Good about the bad banks

- The problem of NPAs continues in the banking sector, especially among the weaker banks.

- The bad bank concept is in some ways similar to an ARC but is funded by the government initially, with banks and other investors co-investing in due course.

- The presence of the government is seen as a means to speed up the clean-up process.

- Many other countries had set up institutional mechanisms such as the Troubled Asset Relief Programme (TARP) in the US to deal with a problem of stress in the financial system.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

Bad bank

From UPSC perspective, the following things are important :

Prelims level: Bad bank

Mains level: Paper 3- Lessons from China as India operationalise its new bad bank

The article suggests drawing the lessons from China’s experience with the bad bank as India India gets ready to operationalise a new bad bank.

Bad bank in China and issues

- In the aftermath of the Asian financial crisis, China set up dedicated bad banks for each of its big four state-owned commercial banks.

- These bad banks were meant to acquire non-performing loans (NPLs) from those banks and resolve them within 10 years.

- In 2009, their tenure was extended indefinitely.

- Chinese banks can currently transfer NPLs only to the national or local bad banks.

- One of China’s biggest bad banks is the China Huarong Asset Management Co. Ltd. (Huarong).

- The Chinese government is its principal shareholder.

- Recently this bad bank stoked financial stability concerns when it skirted a potential bond default.

- An incentive to conceal: Recent research at the National University of Singapore and others highlights that Chinese bad banks effectively help conceal Non-Performing Loans.

- The banks finance over 90 per cent of NPL transactions through direct loans to bad banks or indirect financing vehicles.

- The bad banks resell over 70 per cent of the NPLs at inflated prices to third parties, who happen to be borrowers of the same banks.

- The researchers conclude that in the presence of binding financial regulations and opaque market structures bad bank model could create incentives to hide bad loans instead of resolving them.

- Broadening of tenure: In case of Huarong, the main source of the problem appears to be the gradual broadening of the original mandate and tenure of Chinese bad banks.

Four lessons for India

- India is about to operationalise a new bad bank, the National Asset Reconstruction Company Ltd. (NARCL).

- The Chinese experience holds four important lessons for India.

1) Finite tenure of bad bank

- A centralised bad bank like NARCL should ideally have a finite tenure.

- Such an institution is typically a swift response to an abrupt economic shock (like Covid) when orderly disposal of bad loans via securitisation or direct sales may not be possible.

- The banks could transfer their crisis-induced NPLs to the bad bank and focus on expanding lending activity.

- The bad bank in turn can restructure and protect asset value.

- Over time, it could gradually dispose of the assets to private players.

2) Narrow mandate

- A bad bank must have a specific, narrow mandate with clearly defined goals.

- Transferring NPLs to a bad bank is not a solution in itself.

- There must be a clear resolution strategy.

- Otherwise, allowing a bad bank to exist in perpetuity risks a potential mission creep, which might in the long run threaten financial stability itself.

3) Diversify the sources of funds for ARC

- Indian banks remain exposed to these bad loans even after they are transferred to asset reconstruction companies (ARCs).

- The RBI Bulletin (2021) notes that sources of funds of ARCs have largely been bank-centric.

- The same banks also continue to hold close to 70 per cent of the total security receipts (SRs).

- To address this problem, RBI has tightened bank provisioning while liberalising foreign portfolio investment norms.

4) Resolution of bad loans should be through market mechanism

- In a steady state, the resolution of bad loans should happen through a market mechanism and not through a multitude of bad banks.

- In India, the Narasimham Committee (1998) had envisaged a single ARC as a bad bank.

- Yet, the SARFAESI Act, 2002 ended up creating multiple, privately owned ARCs.

- As a result, regulations have treated ARCs like bad banks, although functionally they are closer to stressed asset funds registered as Alternative Investment Fund Category II (AIFs).

- With the setting up of NARCL as a centralised bad bank, the regulatory arbitrage between ARCs and AIFs must end.

- While AIFs should be allowed to purchase bad loans directly from banks and enjoy enforcement rights under the SARFAESI Act.

- ARCs should be allowed to purchase stressed assets from mutual funds, insurance companies, bond investors and ECB lenders.

- ARC trusts should be allowed to infuse fresh equity in distressed companies, within IBC or outside of it.

- Lastly, the continued interest of the manager/sponsor of ARCs should be at par with AIFs, that is, at least 2.5 per cent in each scheme or Rs 5 crore, whichever is lower.

Conclusion

The Chinese experience should nudge Indian policymakers to limit the mandate and tenure of NARCL, while facilitating market-based mechanisms for bad loan resolution in a steady state.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

NPA Crisis

Growth of ARCs not in line with NPA trends

From UPSC perspective, the following things are important :

Prelims level: ARCs

Mains level: Paper 3- RBI report on ARCs

Key takeaways from the RBI report

- The RBI report states that notwithstanding the rise in the number of Asset Reconstruction Companys (ARCs), the growth in their assets under management (AUM) has been largely trendless except for a major spurt in FY14.

- The growth of the ARC industry has not been consistent over time and not always been synchronous with the trends in non-performing assets (NPAs) of banks and non-banking financial companies (NBFCs).