FDI in Indian economy

[pib] Amendments to the Foreign Exchange Management (Non-debt Instruments) Rules, 2019

From UPSC perspective, the following things are important :

Prelims level: Foreign Exchange Management (Non-debt Instruments) Rules, 2019, FEMA

Why in the News?

The Finance Ministry has issued a notification amending the Foreign Exchange Management (Non-debt Instruments) Rules, 2019, to simplify Foreign Direct Investment (FDI) rules.

Key amendments made by the Finance Ministry:

| Details | |

| Cross-Border Share Swaps | Simplifies the process for Indian companies to engage in cross-border share swaps with foreign companies. |

| Clarity on Downstream Investments | Provides clearer guidelines on the treatment of downstream investments by OCI-owned entities on a non-repatriation basis, aligning them with NRI-owned entities. |

| FDI in White Label ATMs (WLAs) | Allows FDI in White Label ATMs to increase the geographical spread of ATMs, particularly in semi-urban and rural areas. |

| Standardization of ‘Control’ Definition | Standardizes the definition of ‘control’ to ensure consistency with other Acts and laws. |

| Harmonization of ‘Startup Company’ Definition | Aligns the definition of ‘startup company’ with the Government of India’s notification G.S.R. 127 (E) dated February 19, 2019. |

About The Foreign Exchange Management (Non-debt Instruments) Rules, 2019

- These rules govern foreign investment in India in non-debt instruments like equity shares, mutual funds, and real estate (excluding agricultural land).

- These rules, effective from October 17, 2019, were issued under FEMA, 1999 (Foreign Exchange Management Act).

It covers the following key aspects:

- FDI Regulation: Specifies guidelines for foreign direct investment (FDI) in various sectors, including sectoral caps and conditions.

- Investment Vehicles: Allows investment through entities like Alternative Investment Funds (AIFs), Real Estate Investment Trusts (REITs), and mutual funds.

- Repatriation: Provides a framework for repatriation of profits, dividends, and capital by foreign investors.

- Reporting: Mandates detailed reporting for companies receiving foreign investments.

- Sectoral Caps and Conditions: Sets sectoral limits and approval requirements for foreign investment, with some sectors requiring government approval.

- Prohibited Sectors: Prohibits foreign investment in sectors like lottery, gambling, chit funds, and agricultural land.

- Transfer of Shares: Outlines guidelines for share transfer between residents and non-residents, ensuring compliance with regulatory conditions.

PYQ:[2020] With reference to Foreign Direct Investment in India, which one of the following is considered its major characteristic? (a) It is the investment through capital instruments essentially in a listed company. (b) It is a largely non-debt creating capital flow. (c) It is the investment which involves debt-servicing. (d) It is the investment made by foreign institutional investors in the Government securities. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

How to read India’s Balance of Payments?

From UPSC perspective, the following things are important :

Prelims level: Balance of Payment; Current Account deficit; Capital Account Deficit;

Mains level: Impact of BOP on Indian economy;

Why in the news?

India’s current account showed a surplus in Q4 of 2023-24. However, current account surpluses are not always beneficial, and deficits are not inherently detrimental.

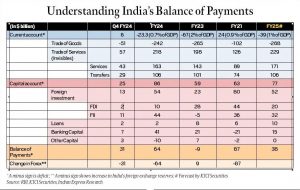

Latest Data from the Reserve Bank of India (RBI)

|

What is Balance of Payments (BoP)?

- The BoP is a ledger of a country’s transactions with the rest of the world, recording all monetary transactions between residents of a country and the rest of the world.

- It shows the amount of money flowing into and out of the country, indicating the relative demand for the rupee compared to foreign currencies (usually in dollar terms).

Constituents of the BoP

The BoP has two main accounts: the Current Account and the Capital Account.

- Current Account: It covers the trade in goods (exports and imports), trade in services (transportation, tourism, licensing, etc.), Income (wages, interest, dividends, etc.), and current transfers (remittances, foreign aid, etc.).

- Trade of Goods (Merchandise Account): Records export and import of physical goods. A trade deficit occurs when imports exceed exports.

- Invisibles of Trade: Includes services (banking, insurance, IT, tourism), transfers (remittances), and income (earnings from investments). These are transactions not visible like physical goods.

- Net Balance: The sum of the merchandise trade and invisible trade determines the current account balance. Q4 showed a surplus in the current account due to a surplus in invisible despite a trade deficit.

- Capital Account: It covers debt forgiveness, migrants’ transfers of financial assets, taxes on gifts and inheritances, and ownership transfers of fixed assets.

- Investments: Captures transactions related to investments such as Foreign Direct Investment (FDI) and Foreign Institutional Investments (FII).

- Net Balance: Q4 showed a net surplus of $25 billion in the capital account.

Impact on the Indian Economy:

- Exchange Rate Stability: The current account surplus in Q4 helped stabilize the exchange rate of the rupee. By absorbing excess dollars, the Reserve Bank of India (RBI) prevented excessive appreciation of the rupee, which helps maintain the competitiveness of Indian exports.

- Improved Sovereign Ratings: A current account surplus can positively impact India’s sovereign credit ratings, as it indicates stronger external financial health and reduces reliance on foreign borrowing.

- Foreign Exchange Reserves: The surplus contributed to an increase in India’s foreign exchange reserves, enhancing the country’s ability to manage external shocks and providing a buffer against global economic uncertainties.

- Investment Climate: A surplus in the capital account, driven by Foreign Direct Investment (FDI) and Foreign Institutional Investments (FII), indicates investor confidence in the Indian economy, potentially leading to more robust economic growth and development.

- Economic Health Indicators: Despite the Q4 surplus, the annual current account deficit suggests robust domestic demand and investment needs. This aligns with a growing economy that requires imports of capital goods to enhance production capacity and future export potential.

Way forward:

- Enhance Export Competitiveness: India should focus on boosting its export sector by diversifying export products and markets, improving product quality, and providing incentives for export-oriented industries.

- Promote Sustainable Foreign Investment: Encouraging sustainable and long-term foreign investments, particularly in sectors like manufacturing, technology, and renewable energy, can strengthen the capital account.

Mains PYQ:

Q Craze for gold in Indian has led to surge in import of gold in recent years and put pressure on balance of payments and external value of rupee. In view of this, examine the merits of Gold Monetization scheme. (UPSC IAS/2015)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

Drop in FDI inflows mirrors Global Trends: Finmin

From UPSC perspective, the following things are important :

Prelims level: Indian Economy; Trends in FDI

Mains level: Indian Economy; Trends in FDI

Why in the News?

India’s net Foreign Direct Investment (FDI) inflows have dropped almost 31% to $25.5 billion over the first ten months of 2023-24 as per the Finance Ministry

Recent key Observations related to FDI inflow as per the Finance Ministry

Recent FDI in the context of India:

- From April 2023 to January 2024, the net inflows decreased more significantly due to increased repatriation of investment.

- India remains one of the top destinations for global greenfield projects, with a stable number of new project announcements.

- The country received significant FDI in sectors like services, pharmaceuticals, construction, and non-conventional energy.

- The Netherlands, Singapore, Japan, the USA, and Mauritius contribute around 70% of total FDI equity inflows into India.

- There’s a possibility of a modest increase in global FDI flows in the current year, driven by a decline in inflation and borrowing costs in major markets. However, significant risks remain, including geopolitical issues, high debt levels in many countries, and concerns about further economic fracturing.

Recent FDI scenario in the context of the world:

- Overall, global FDI flows rose by 3% to an estimated $1.4 trillion in 2023 due to economic uncertainty and higher interest rates led to a 9% fall in FDI flows to developing countries.

- Drivers of Global FDI: Capital-intensive projects, particularly in renewable energy, batteries, and metals sectors, drove a large proportion of global FDI in 2023, highlighting the importance of energy transition.

- Decline in International Investment Projects: Both greenfield projects and project finance (mainly infrastructure) and cross-border Mergers and Acquisitions (M&As) saw declines in 2023, attributed to higher financing costs. International project finance and M&A activity decreased by 21% and 16%, respectively.

What is Foreign direct investment (FDI)?

Foreign direct investment (FDI) is a category of cross-border investment in which an investor resident in one economy establishes a lasting interest in and a significant degree of influence over an enterprise resident in another economy.

Government Bodies regulating FDI:

India offers an automatic route for FDI in several sectors, simplifying the investment process for foreign investors in India. However, certain sectors require government approval, and reporting requirements, in line with the Foreign Exchange Management Act (FEMA), are in place to ensure transparency in foreign investments in India. FDI in India is subject to regulation and oversight by various government bodies, such as:

- Department for Promotion of Industry and Internal Trade (DPIIT): DPIIT formulates and implements policies to promote and regulate foreign investment in India across sectors.

- Reserve Bank of India (RBI): RBI manages the monetary aspects of foreign investments in India.

- Securities and Exchange Board of India (SEBI): SEBI regulates FDI in the capital market.

Conclusion: India remains a top destination for greenfield projects, but international investment projects declined due to higher financing costs. This is indeed a silver lining for the Indian government to plan and execute for targeting more FDI inflow considering the Global scenario.

Practice Question for mains

Q- Explain the reasons for India’s decline in net FDI inflows in 2023-24 and analyze its implications amid global trends

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

India’s rise is the big story. So where’s the FDI?

From UPSC perspective, the following things are important :

Prelims level: Basic concepts

Mains level: India's growth prospects and decline FDI flows to India, concerns reasons and way forward

What’s the news?

- The Indian economy grew at 7.8 percent in the first quarter of the ongoing financial year. There is a decline in FDI.

Central idea

- Projections by experts, including the RBI and the IMF, indicate a prospective annual growth rate of 6–6.5 percent, reaffirming India’s status as a global growth powerhouse. However, beneath this optimistic narrative lies a concerning trend: foreign direct investment (FDI) in India has been steadily declining.

India’s growth prospects

- India is likely to grow at around 6–6.5 percent over the full year.

- Medium-term assessments, such as those by the IMF, peg growth at roughly 6 percent between 2023 and 2028.

- This momentum positions India as a formidable player in global growth, potentially rivaling China.

- Multinationals are increasingly eyeing India as an alternative investment destination, capitalizing on shifting geopolitical dynamics.

Declining trend in FDI in India

- FDI Decline: FDI inflows into India have been declining. In the fiscal year 2022–23, FDI stood at $71.3 billion, which marked a 16 percent decrease compared to the previous fiscal year (2021–22). This trend of decline continued in the first four months of the current fiscal year, with a 26 percent drop in FDI inflows compared to the same period the previous year.

- Equity Flows: A substantial portion of the decline has been in fresh equity flows. Equity flows decreased from approximately $59.6 billion in 2021–22 to around $47.6 billion in 2022–23. In the first four months of the current year, equity flows further plummeted to $13.9 billion, down from $22 billion the previous year.

- Policy Uncertainty: One possible explanation for the decline in FDI is the presence of policy uncertainty in India. An uncertain business environment, an uneven playing field, and the fear of arbitrary changes to rules and regulations may be acting as deterrents to foreign investors.

- Trade Agreements: India’s absence from major trading blocks, such as the RCEP agreement, and the lack of trade agreements with entities like the European Union can disadvantage India in the global manufacturing ecosystem. Comprehensive trade agreements with lower tariffs and other benefits can incentivize foreign investment.

- Comparative Analysis: Despite rising interest rates in developed economies, countries like Vietnam and Indonesia have managed to maintain or increase their FDI inflows.

Key sectors affected by the decline in FDI

- Automobile Industry: The decline in FDI has had an impact on the automobile industry in India. This sector plays a crucial role in the country’s manufacturing landscape and contributes significantly to both economic growth and employment.

- Construction (Infrastructure Activities): Infrastructure development is essential for India’s economic growth. The decline in FDI may slow down construction and infrastructure activities, potentially affecting the country’s development.

- Metallurgical Industries: Metallurgical industries, which include sectors like steel production, are also mentioned in the article as being affected by the decline in FDI. These industries are vital for various manufacturing processes and contribute to both domestic consumption and exports.

Areas that India might need to address to reverse this trend

- FDI Decline in Multiple Sectors: The decline in FDI is not limited to a specific sector but has affected various industries, including technology, the automobile industry, construction, and metallurgical industries. This broad-based decline underscores the need for comprehensive solutions.

- Navigating Policy Uncertainty: To attract foreign investors, India needs to provide a stable and predictable business environment, reduce regulatory uncertainty, and ensure a level playing field.

- Global Investment Landscape: India’s FDI decline is notable when compared to countries like Vietnam and Indonesia, which have managed to maintain stable FDI inflows. This highlights the need for India to remain competitive in the global investment landscape.

- The Trade Agreement Imperative: The absence of India from major trading blocks, such as the RCEP agreement, could be a factor contributing to the FDI decline. India may benefit from pursuing trade agreements that lower trade barriers and enhance market access.

Conclusion

- The decline in FDI flows to India raises pertinent questions about the country’s attractiveness as an investment destination. While India’s growth story appears promising, investors seek stability, policy clarity, and access to global trade networks. Addressing these concerns and leveraging India’s potential as a China plus one option requires a comprehensive strategy to reinvigorate FDI inflows and capitalize on its growth prospects.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

FinMin pushes for reforms to spur FDI inflows

From UPSC perspective, the following things are important :

Prelims level: Foreign Direct Investment (FDI)

Mains level: Read the attached story

Central Idea

- The Finance Ministry of India emphasized the need to address challenges faced by global investors to facilitate Foreign Direct Investment (FDI) flows.

- In this article, we delve into the factors affecting FDI inflows and propose measures to attract and sustain FDI in India.

What is Foreign Direct Investment (FDI)?

- FDI refers to the investment made by individuals, companies, or governments from one country into business interests located in another country.

- It involves the direct ownership or control of assets in the foreign country, typically in the form of establishing new ventures, acquiring existing businesses, or creating strategic partnerships.

Understanding FDIImagine you have a successful toy manufacturing company based in Country A. You have been experiencing steady growth and want to expand your business operations to a new market in Country B. However, entering a foreign market can be challenging due to unfamiliarity with the local business environment, regulations, and market dynamics. To overcome these challenges, you decide to make a Foreign Direct Investment (FDI) in Country B. Instead of exporting toys from Country A to Country B, you establish a new manufacturing plant or acquire an existing toy company in Country B. By doing so, you gain direct ownership and control over the assets and operations in Country B. |

India’s FDI feats

- In terms of investor countries of FDI Equity inflow, Singapore is at the top with 27%, followed by the US with 18% and Mauritius with 16% for the FY 2021-22.

- ‘Computer Software & Hardware’ has emerged as the top recipient sector of FDI Equity inflow during this period with around 25% share followed by Services Sector and Automobile Industry with 12% each.

- With 53 % Karnataka has received the majority share of FDI equity in the `Computer Software & Hardware’ sector.

FDI in India

- Foreign investment was introduced in 1991 under Foreign Exchange Management Act (FEMA), driven by then FM Manmohan Singh.

- Economic liberalisation started in India in the wake of the 1991 crisis and since then, FDI has steadily increased in the country.

- India, today is a part of top 100-club on Ease of Doing Business (EoDB) and globally ranks number 1 in the Greenfield FDI ranking.

There are two routes by which India gets FDI.

1) Automatic route: By this route, FDI is allowed without prior approval by Government or RBI.

2) Government route: Prior approval by the government is needed via this route. The application needs to be made through Foreign Investment Facilitation Portal, which will facilitate the single-window clearance of FDI application under Approval Route.

- India imposes a cap on equity holding by foreign investors in various sectors, current FDI in aviation and insurance sectors is limited to a maximum of 49%.

- In 2015 India overtook China and the US as the top destination for the Foreign Direct Investment.

Sectors that come under the ‘100% Automatic Route’ category are

- Agriculture & Animal Husbandry, Air-Transport Services (non-scheduled and other services under civil aviation sector)

- Airports (Greenfield + Brownfield),

- Asset Reconstruction Companies,

- Auto-components, Automobiles,

- Biotechnology (Greenfield),

- Broadcast Content Services (Up-linking & down-linking of TV channels, Broadcasting Carriage Services,

- Capital Goods, Cash & Carry Wholesale Trading (including sourcing from MSEs), Chemicals, Coal & Lignite, Construction Development,

- Construction of Hospitals,

- E-commerce Activities, Electronic Systems,

- Food Processing, Gems & Jewellery, Healthcare, Industrial Parks, IT & BPM, Leather, Manufacturing, Mining & Exploration of metals & non-metal ores, Other Financial Services,

- Pharmaceuticals, Plantation sector

- Ports & Shipping, Railway Infrastructure, Renewable Energy, Roads & Highways,

- Single Brand Retail Trading, Textiles & Garments,

- Thermal Power,

- Tourism & Hospitality and

- White Label ATM Operations.

Sectors that come under up to 100% Automatic Route’ category are–

- Infrastructure Company in the Securities Market: 49%

- Insurance: up to 49%

- Medical Devices: up to 100%

- Pension: 49%

- Petroleum Refining (By PSUs): 49%

- Power Exchanges: 49%

Sectors that come under the ‘up to 100% Government Route’ category are–

- Banking & Public sector: 20%

- Broadcasting Content Services: 49%

- Core Investment Company: 100%

- Food Products Retail Trading: 100%

- Mining & Minerals separations of titanium bearing minerals and ores: 100%

- Multi-Brand Retail Trading: 51%

- Print Media (publications/ printing of scientific and technical magazines/ specialty journals/ periodicals and facsimile edition of foreign newspapers): 100%

- Print Media (publishing of newspaper, periodicals and Indian editions of foreign magazines dealing with news & current affairs): 26%

- Satellite (Establishment and operations): 100%

Prohibited Sectors

There are a few industries where FDI is strictly prohibited under any route. These industries are

- Atomic Energy Generation

- Any Gambling or Betting businesses

- Lotteries (online, private, government, etc.)

- Investment in Chit Funds

- Nidhi Company

- Agricultural or Plantation Activities (although there are many exceptions like horticulture, fisheries, tea plantations, Pisciculture, animal husbandry, etc.)

- Housing and Real Estate (except townships, commercial projects, etc.)

- Trading in TDR’s

- Cigars, Cigarettes, or any related tobacco industry

Benefits offered by FDI

- Employment generation: FDI boosts the manufacturing and services sector which results in the creation of jobs and helps to reduce unemployment rates in the country.

- Economic growth: Increased employment translates to higher incomes and equips the population with more buying powers, boosting the overall economy of a country.

- Human capital development: Skills that employees gain through training and experience can boost the education and human capital of a specific country. Through a ripple effect, it can train human resources in other sectors and companies.

- Technology boost: The introduction of newer and enhanced technologies results in company’s distribution into the local economy, resulting in enhanced efficiency and effectiveness of the industry.

- Increase in exports: Many goods produced by FDI have global markets, not solely domestic consumption. The creation of 100% export oriented units help to assist FDI investors in boosting exports from other countries.

- Exchange rate stability: The flow of FDI into a country translates into a continuous flow of foreign exchange, helping a country’s Central Bank maintain a prosperous reserve of foreign exchange which results in stable exchange rates.

- Improved Capital Flow: Inflow of capital is particularly beneficial for countries with limited domestic resources, as well as for nations with restricted opportunities to raise funds in global capital markets.

- Creation of a Competitive Market: By facilitating the entry of foreign organizations into the domestic marketplace, FDI helps create a competitive environment, as well as break domestic monopolies.

- Climate mitigation: The United Nations has also promoted the use of FDI around the globe to help combat climate change

Factors Affecting recent FDI inflows

(1) Inflationary Pressures and Tighter Monetary Policies

- The dip in FDI inflows in 2022-23 can be attributed to inflationary pressures and tighter monetary policies.

- Policymakers should address these factors to encourage a favorable investment climate.

(2) Geopolitics vs. Geography

- The Ministry highlights the influence of “political distance more than geographical distance” on FDI flows.

- Geopolitical factors have dominated over traditional geographical considerations.

(3) Global FDI Trends

- Gross FDI flows declined by 16% in 2022, compared to the record high of $84.8 billion in 2021-22.

- Net inflows experienced a sharper decline of 27.4%.

- Similar trends were observed in emerging market economies, where net FDI inflows declined by 36% in 2022.

Challenges for India’s Growth Outlook

(1) External Sector Challenges:

- The review identifies the external sector as a potential challenge for India’s growth in 2023-24.

- Factors such as geopolitical stress, volatility in global financial systems, price corrections in global stock markets, El-Nino impact, and weak global demand could constrain growth.

- Policymakers must closely monitor FDI data and undertake measures to facilitate FDI inflows.

(2) Fragmentation of FDI Flows:

- The Ministry highlights the phenomenon of “friend shoring,” wherein FDI is directed towards geopolitically aligned countries.

- This has led to a fragmentation of FDI flows globally, as per research from the International Monetary Fund (IMF).

- Additionally, inflows from foreign portfolio investors (FPIs) into Indian markets have become less volatile.

Conclusion

- To attract and sustain FDI inflows, India needs to address challenges related to inflation, monetary policies, geopolitical factors, and last-mile infrastructure.

- Additionally, mitigating trade risks and fostering inclusive growth through job creation will contribute to a favorable investment climate.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

Internationalising the rupee without the ‘coin tossing’

From UPSC perspective, the following things are important :

Prelims level: Currency swap agreements, Rupee Internationalization and its direct and indirect impact on economy

Mains level: Rupee Internationalization, its significance of Indian economy, challenges and learnings from China and reforms

Central Idea

- The recent announcement by the Indian government regarding a long-term road map for the internationalization of the rupee holds immense potential for the country’s economic growth. This move aims to revive the rupee’s historical prominence as a widely accepted currency in the Gulf region and strengthen its position in the global foreign exchange market.

*Relevance of the topic*

The Indian government has been consistently focused on promoting the internationalization of the rupee.

India has been exploring the use of the rupee for bilateral trade settlements with its trading partners, for instance amidst Russian oil ban, India explored Rupee-Rubel settlement for oil imports.

China, Russia and a few other countries have become more vocal in questioning the US dollar-dominated global currency system

Historical Context

- Indian Rupee as Legal Tender in the Gulf Region: In the 1950s, the Indian rupee held the status of legal tender in several Gulf countries, including the United Arab Emirates, Kuwait, Bahrain, Oman, and Qatar. It was widely used for various transactions, and these Gulf monarchies purchased rupees using the pound sterling.

- Introduction of the Gulf Rupee: To tackle challenges related to gold smuggling, the Reserve Bank of India (Amendment) Act was enacted in 1959. This legislation led to the creation of the Gulf Rupee, which was intended for circulation only in the West Asian region. The central bank issued notes specific to the Gulf region, and individuals holding Indian currency were given a six-week window to exchange their rupees for the new Gulf rupee.

- Devaluation of Indian Rupee and Transition to Local Currencies: In 1966, India devalued its currency, which eventually had repercussions on the acceptance of the Gulf rupee. The devaluation eroded confidence in the stability of the Indian rupee, prompting some West Asian countries to replace the Gulf rupee with their own sovereign currencies. The introduction of sovereign currencies in the region was driven by both economic factors and concerns about the Indian rupee’s stability.

- Impact of Demonetisation: In 2016, the Indian government implemented a demonetisation exercise, which involved invalidating high-value currency notes, including the ₹1,000 and ₹500 denominations. This move aimed to curb black money, corruption, and counterfeit currency. However, it also had an impact on the confidence in the Indian rupee, both domestically and among neighboring countries such as Bhutan and Nepal.

- Withdrawal of ₹2,000 Note: In recent times, the decision to withdraw the ₹2,000 note from circulation has further affected confidence in the rupee. This move has led to concerns and uncertainties among the public and businesses, particularly regarding the stability and continuity of currency denominations.

What does it mean by Internationalizing the Indian Rupee?

- Internationalizing the Indian Rupee refers to the process of increasing the acceptance, use, and recognition of the Indian rupee as a global currency. It involves making the rupee more widely used and traded in international markets, increasing its convertibility, and promoting its adoption for cross-border transactions, trade settlements, and investment activities

Advantages of internationalization of the rupee

- Enhanced Trade and Investment: Internationalization of the rupee can facilitate smoother trade transactions between India and other countries. This can lead to increased bilateral trade, attract foreign investment, and boost economic growth.

- Reduced Exchange Rate Risks: Internationalisation reduces exchange rate risks associated with fluctuations in major global currencies. When the rupee becomes more widely accepted and used in international transactions, it reduces the vulnerability of the Indian economy to external currency volatility.

- Lower Transaction Costs: Greater international acceptance of the rupee can reduce transaction costs for businesses and individuals engaged in cross-border trade and remittances.

- Strengthening Financial Markets: A more internationalized rupee would lead to the development of deeper and more liquid rupee-denominated financial markets. This includes rupee bond markets and derivatives markets. It helps diversify funding sources and provide greater stability and opportunities for investors and businesses.

- Reserve Currency Status: The internationalisation of the rupee can potentially lead to its recognition as a reserve currency. Reserve currency status enhances a country’s monetary and financial influence globally and promotes stability in international financial systems.

- Boosting India’s Global Standing: Internationalisation of the rupee signals the country’s economic strength, reforms, and openness to international trade and investment. It can improve India’s reputation as an attractive investment destination and strengthen its role in regional and global economic decision-making forums.

The Challenge of International Demand for the rupee

- Low Daily Average Share: The daily average share of the rupee in the global foreign exchange market is approximately 1.6%. This indicates that the rupee is not extensively traded or widely used for international transactions compared to currencies like the US dollar or the euro.

- Limited International Transactions: Although India has taken steps to promote the internationalisation of the rupee, such as enabling external commercial borrowings in rupees and encouraging trade in rupees with select countries, the volume of such transactions is still limited. For instance, India continues to purchase oil from Russia in dollars, and efforts to settle trade in rupees with Russia have faced challenges.

- Capital Account Convertibility Constraints: India imposes significant constraints on capital account convertibility, which refers to the movement of local financial investments into foreign assets and vice versa. These restrictions are in place to mitigate risks of capital flight and exchange rate volatility, given India’s current and capital account deficits. However, they limit the ease of converting rupees into other currencies, reducing international demand.

- Lack of Reserve Currency Status: For a currency to be considered a reserve currency, it needs to be fully convertible, readily usable, and available in sufficient quantities. The rupee does not currently enjoy reserve currency status, and its limited convertibility and usage hinder its attractiveness for central banks and international institutions to hold significant amounts of rupees as part of their foreign exchange reserves.

Learning from China’s Experience

- Phased Approach: China adopted a phased approach to internationalise the Renminbi (RMB). It initially allowed the use of RMB outside China for current account transactions, such as commercial trade and interest payments, and gradually expanded it to select investment transactions. This gradual approach helped in managing risks and ensuring a smooth transition.

- Offshore Markets and Clearing Banks: China established offshore markets, such as the “Dim Sum” bond and offshore RMB bond market, which allowed financial institutions in Hong Kong to issue RMB-denominated bonds. Additionally, China permitted central banks, offshore clearing banks, and offshore participating banks to invest excess RMB in debt securities. These measures enhanced the RMB’s liquidity and facilitated its usage in international transactions.

- Currency Swap Agreements: China entered into currency swap agreements with several countries, including Brazil, the United Kingdom, Uzbekistan, and Thailand. These agreements enabled the exchange of equivalent amounts of money in different currencies, facilitating trade and investment transactions in RMB and reducing reliance on other currencies.

- Free Trade Zones: China launched the Shanghai Free Trade Zone, which facilitated free trading between non-resident onshore and offshore accounts. This zone provided a platform for international businesses to transact in RMB and boosted the currency’s international usage.

- Reserve Currency Status: China’s efforts towards internationalisation of the RMB led to its recognition as a reserve currency. By the second quarter of 2022, the RMB’s share of international reserves reached approximately 2.88%. This status further solidified the RMB’s acceptance and usage in global financial markets.

Way forward: Reforms for Rupee Internationalisation

- Full Convertibility: The rupee should be made more freely convertible, with a goal of achieving full convertibility by 2060. This would involve allowing financial investments to move freely between India and abroad, removing significant restrictions on currency exchange and capital flows.

- Deeper and More Liquid Rupee Bond Market: The Reserve Bank of India (RBI) should focus on developing a deeper and more liquid rupee bond market. This would enable foreign investors and Indian trade partners to have more investment options in rupees, enhancing the attractiveness and usage of the currency.

- Trade Settlement in Rupees: Indian exporters and importers should be encouraged to invoice their transactions in rupees. Optimising the trade settlement formalities for rupee import/export transactions would facilitate greater usage of the rupee in international trade, reducing reliance on foreign currencies.

- Currency Swap Agreements: India can establish additional currency swap agreements with trading partners. These agreements would allow India to settle trade and investment transactions in rupees, eliminating the need for reliance on reserve currencies like the US dollar.

- Tax Incentives for Foreign Businesses: The government can provide tax incentives to foreign businesses operating in India, encouraging them to utilize the rupee in their operations. This would boost the demand for the rupee and promote its usage in international transactions.

- Currency Management Stability: The RBI and the Ministry of Finance should ensure consistent and predictable issuance and retrieval of notes and coins, promoting currency management stability. This stability is crucial for building confidence in the rupee’s value and maintaining trust among market participants.

- Exchange Rate Regime Improvement: Improving the exchange rate regime by adopting transparent and market-based mechanisms can enhance the stability and credibility of the rupee’s exchange rate. This would instill confidence among investors and businesses dealing in rupee-denominated transactions.

- Higher Profile in International Organizations: Efforts should be made to push for making the rupee an official currency in international organizations. This would raise the profile and acceptability of the rupee globally, contributing to its internationalisation.

- Pursuing Expert Committee Recommendations: Recommendations from expert committees, such as the Tarapore Committees, should be pursued. These recommendations include reducing fiscal deficits, lowering gross inflation rates, and addressing banking non-performing assets. Implementing these measures would enhance macroeconomic stability and strengthen the rupee’s attractiveness.

Conclusion

- The government’s road map for the internationalisation of the rupee holds immense potential for Indian businesses, financial stability, and the government’s ability to finance deficits. With predictable currency management policies and a phased approach, the rupee’s journey towards internationalisation can contribute to India’s economic growth and strengthen its position in the global economy.

Also read:

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

Private: Is Private Capital Formation Declining?

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: Corporate Investment, employment and growth

Context

- In a meeting held with the country’s corporate leaders, Finance Minister Nirmala Sitharaman drew attention to an important aspect of the economy today. She rightly flagged concerns about sluggish corporate investment, despite the government’s business friendly stance, including a reduction in the corporate tax.

What is mean by Corporate Investment?

- Corporate investment is an investment that is made by companies rather than by governments or individual people. Corporate investing simply means investing the profits / surplus cash of your business, instead of drawing it as income or holding it in cash bank accounts.

What is mean by Capital Investment?

- Capital investment is the acquisition of physical assets by a company for use in furthering its long-term business goals and objectives. Real estate, manufacturing plants, and machinery are among the assets that are purchased as capital investments.

What is the Present situation of corporate Investment in Indian Economy?

What is the Present situation of corporate Investment in Indian Economy?

- Gross capital formation (GCF): Over 90% of GCF consists of fixed investments.The National Accounts Statistics provides disaggregation of gross capital formation (GCF) by sectors, type of assets and modes of financing.

- Share of Private investment: Private investment accounts for close to 75% of total capital formation in the economy. Its revival therefore is essential for sustained growth of the economy.

- No change in investment distribution: The investment distribution has hardly changed over the last decade, with the public sector’s share remaining 20%.

- Fall in share of agriculture and industry: Between 2014-15 and 2019-20, the shares of agriculture and industry in fixed capital formation/GDP fell from 7.7% and 33.7% to 6.4% and 32.5%, respectively.

Why Private capital formation is declining in the economy?

Why Private capital formation is declining in the economy?

- Low productivity of companies: Very low productivity of capital for Indian companies at 2-3% despite the cost tailwinds in FY21 due to the pandemic shock.

- Low Government spending: Despite the bump-up in capital allocations by government (30% YoY) the progress towards improving the mix of government spending towards capital outlay has been moderate.

- Dismal Public capital formation: Capex as % of total spending has increased marginally to 16.5%, and its impact on overall capital formation has been less than 4% of GDP; overall public sector capital formation has remained low at 7% of GDP (vs 9% in FY08).

- No crowding in: While total government revenue spending in nominal terms remained higher compared to our framework (averaging at 12% YoY during FY11-FY21), the real growth has been modest, averaging at 5.8%. Thus, amid the declining trade/GDP ratio, weak private capex, rising unemployment and several shocks the crowding in role of fiscal expansion has been missing.

- Declining savings rate: India’s saving rate continues to decline at 30% (37% FY08), along with sharply lower household savings rate (19.3% in FY20, 24% at the peak) and household financial savings rate (7.8% vs 10.5%). Domestic savings explains 98% of domestic invests & it should precede a private capex cycle.

Why is there a Conducive environment for private investment in the Indian Economy?

Why is there a Conducive environment for private investment in the Indian Economy?

- Improved financial condition: There has been considerable improvement in external balance position, including CAD turning surplus in FY21 at 0.9% of GDP, steep rise in RBI’s forex buffer. Favourable financial conditions have enabled fund raising by many sectors, including banks.

- Deleveraging of corporate balance sheets: There is a sharp decline in debt/equity ratio of the non-financial sector for BSE500 companies (constant set of companies existing since 1998) to 63% in FY21 from 92% in FY20.

- Declining NPA’s: Higher capital base of banks (CAR at 15.8% in FY21), lower NPAs (7.5% of advances) and deleveraged corporate balance sheets are necessary buffer for private capex revival and ability of banks to fund it.

Conclusion

- The present scenario is indicative of high-risk aversion among banks and companies. While there has been some positive progress in FY21 towards private capex inflection point, there are a few crucial laps to finish before it decisively breaks from the 13 years of decline. A big push on demand recovery backed either by public spending or positive global spill over will be necessary in shortening the revival process

Mains Question

Q.Discuss the current status of private capital formation in India. What factors in the Indian economy create a conducive environment for private capital investment?

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

FDI inflow ‘highest ever’ at $83.57 bn

From UPSC perspective, the following things are important :

Prelims level: FDI, FPI

Mains level: Read the attached story

The foreign direct investment (FDI) in the financial year 2021-22 has touched a “highest-ever” figure of $83.57 billion.

Get aware with the recently updated FDI norms. Key facts mentioned in this newscard can make a direct statement based MCQ in the prelims.

Ex. FDI source in decreasing order: Singapore – Mauritius – Netherland – Ceyman Islands – Japan – France

What is Foreign Direct Investment (FDI)?

- An FDI is an investment in the form of a controlling ownership in a business in one country by an entity based in another country.

- It is thus distinguished from a foreign portfolio investment by a notion of direct control.

- FDI may be made either “inorganically” by buying a company in the target country or “organically” by expanding the operations of an existing business in that country.

- Broadly, FDI includes “mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations, and intra company loans”.

- In a narrow sense, it refers just to building a new facility, and lasting management interest.

FDI in India

- Foreign investment was introduced in 1991 under Foreign Exchange Management Act (FEMA), driven by then FM Manmohan Singh.

- There are two routes by which India gets FDI.

1) Automatic route: By this route, FDI is allowed without prior approval by Government or RBI.

2) Government route: Prior approval by the government is needed via this route. The application needs to be made through Foreign Investment Facilitation Portal, which will facilitate the single-window clearance of FDI application under Approval Route.

- India imposes a cap on equity holding by foreign investors in various sectors, current FDI in aviation and insurance sectors is limited to a maximum of 49%.

- In 2015 India overtook China and the US as the top destination for the Foreign Direct Investment.

Features of FDI

- Any investment from an individual or firm that is located in a foreign country into a country is FDI.

- Generally, FDI is when a foreign entity acquires ownership or controlling stake in the shares of a company in one country, or establishes businesses there.

- It is different from foreign portfolio investment where the foreign entity merely buys equity shares of a company.

- In FDI, the foreign entity has a say in the day-to-day operations of the company.

- FDI is not just the inflow of money, but also the inflow of technology, knowledge, skills and expertise.

- It is a major source of non-debt financial resources for the economic development of a country.

Significance of rising FDI

- This is a testament of India’s status among global investors.

Recent amendments in 2020

- The govt. has amended para 3.1.1 of extant FDI policy as contained in Consolidated FDI Policy, 2017.

- In the event of the transfer of ownership of any existing or future FDI in an entity in India, directly or indirectly, resulting in the beneficial ownership, such subsequent change in beneficial ownership will also require Government approval.

The present position and revised position in the matters will be as under:

Present Position

- A non-resident entity can invest in India, subject to the FDI Policy except in those sectors/activities which are prohibited.

- However, a citizen of Bangladesh or an entity incorporated in Bangladesh can invest only under the Government route.

- Further, a citizen of Pakistan or an entity incorporated in Pakistan can invest, only under the Government route, in sectors/activities other than defence, space, atomic energy and sectors/activities prohibited for foreign investment.

Revised Position

- A non-resident entity can invest in India, subject to the FDI Policy except in those sectors/activities which are prohibited.

[spot the difference]

- However, an entity of a country, which shares a land border with India or where the beneficial owner of investment into India is situated in or is a citizen of any such country, can invest only under the Government route.

- Further, a citizen of Pakistan or an entity incorporated in Pakistan can invest, only under the Government route, in sectors/activities other than defence, space, atomic energy and sectors/activities prohibited for foreign investment.

In response to China

- China accused that India’s recently adopted policy goes against the principles of the World Trade Organisation (WTO).

- It tends to violate WTO’s principle of non-discrimination, and go against the general trend of liberalisation and facilitation of trade and investment.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

The Bilateral Investment Treaties (BITs) to review

From UPSC perspective, the following things are important :

Prelims level: Model BIT

Mains level: Paper 3- Reviev of BITs

Context

The report of the Standing Committee on External Affairs on ‘India and bilateral investment treaties (BITs)’ was presented to Parliament last month.

Factor’s that necessitated the review of India’s BITs

- Investor’s started suing India frequently: Since 2011, when India lost its first investment treaty claim in White Industries v. India, foreign investors have sued India around 20 times for alleged BIT breaches.

- This made India the 10th most frequent respondent-state globally in terms of investor-state dispute settlement (ISDS) claims from 1987 to 2019 (UNCTAD).

- Adoption of new Model BIT: India adopted a new Model BIT in 2016, which marked a significant departure from its previous treaty practice.

- Negotiating new BITs: India is in the process of negotiating new investment deals (separately or as part of free trade agreements) with important countries such as Australia and the U.K.

Recommendations of the Committee

- 1] Speed of the existing negotiations: India has signed very few investment treaties after the adoption of the Model BIT.

- It recommends that India expedite the existing negotiations and conclude the agreements at the earliest because a delay might adversely impact foreign investment.

- 2] Sign more BIT’s in core sector: The committee recommends that India should sign more BITs in core or priority sectors to attract FDI.

- Generally, BITs are not signed for specific sectors.

- It will require an overhauling of India’s extant treaty practice that focuses on safeguarding certain kinds of regulatory measures from ISDS claims rather than limiting BITs to specific sectors.

- 3] Fine-tune Model BIT: Model BIT gives precedence to the state’s regulatory interests over the rights of foreign investors.

- The Model BIT should be recalibrated keeping two factors in mind:

- a) tightening the language of the existing provisions to circumscribe the discretion of ISDS arbitral tribunals.

- b) striking a balance between the goals of investment protection and the state’s right to adopt bonafide regulatory measures for public welfare.

- 4] Improve the capacity of government officials: The committee recommends bolstering the capacity of government officials in the area of investment treaty arbitration.

- While the government has taken some steps in this direction through a few training workshops, more needs to be done.

- What is needed is an institutionalised mechanism for capacity-building through the involvement of public and private universities.

- The government should also consider establishing chairs in universities to foster research and teaching activities in international investment law.

Need to improve poor governance

- A very large proportion of ISDS claims against India is due to poor governance.

- This includes changing laws retroactively which led to Vodafone and Cairn suing India.

- Annulling agreement in the wake of imagined scam which resulted in taking away S-band satellite spectrum from Devas.

- The judiciary’s fragility in getting its act together (sitting on the White Industries case for enforcement of its commercial award for years).

Suggestions

- The Committee could have emphasised on greater regulatory coherence, policy stability, and robust governance structures to avoid ISDS claims.

- The government should promptly assemble an expert team to review the Model BIT.

Consider the question “India is one of the most frequent respondent-state globally in terms of investor-state dispute settlement (ISDS) claims. In context of this, examine the reasons for such frequent disputes and suggest the way forward.”

Conclusion

The committee’s report on India’s BITs have novel suggestions, but it is lacking in several aspects.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: ISDS mechanism

- Investor-state dispute settlement (ISDS) is a mechanism in a free trade agreement (FTA) or investment treaty that provides foreign investors, with the right to access an international tribunal to resolve investment disputes.

- ISDS promotes investor confidence and can protect against sovereign or political risk.

- If a country does not uphold its investment obligations, an investor can have their claim determined by an independent arbitral tribunal, usually comprising three arbitrators.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

Is India’s current investor rush too much of a good thing?

From UPSC perspective, the following things are important :

Prelims level: Impact of funding surge on economy

Mains level: Paper 3- PE funding in India

Human traits driving financial markets

- To imitate and to conform — do what others around us are doing — are common and very powerful human tendencies.

- In financial markets, “herd behaviour” is a warning sign: When markets are doing well, people invest for no other reason than their neighbours having become wealthier (and vice versa).

- There is another human trait that affects markets — success increases risk appetite.

- If someone’s financial investments work, they are very likely to invest more, and ignore safety measures.

Factors driving the private equity investments

- Better physical infrastructure (rural roads, electrification, phone penetration, data access).

- Several layers of innovation (universal bank account access, surging digital payments on the “India Stack”).

- 45 lakh software developers (largest in the world).

- Maturing industries (for example, as research budgets of Indian pharmaceutical manufacturers have grown 10 times in the last 15 years.

- The ecosystem can take on more challenging projects now, versus just generic filings a decade back).

- Strong medium-term economic growth prospects create fertile ground for private equity investments.

- Investors with patient capital (knowing that the businesses will not make money for several years) are now betting on and financing a faster transition to electric vehicles than was earlier anticipated.

- In financial services, innovative methods of lending, insurance underwriting and wealth management are being experimented with, which are likely to only expand the market meaningfully.

- An army of Software-as-a-Service (SaaS) firms have been funded in the hope of revolutionising the development and distribution of software.

- There are also new-age distribution and logistics companies, education technology firms, and branded consumer goods suppliers, in addition to “normal” e-commerce, gaming and food-delivery startups.

Risks involved in a rapid infusion of capital

- Allocation inefficiency: Theoretically, an economy India’s size is capable of absorbing the $52 billion of PE funding seen over the last 12 months, but in practice, such a rapid surge creates allocation inefficiency.

- As investors rush to deploy ever-larger sums of money, they appear to be running out of companies to invest in that can productively deploy this capital.

- The result is companies’ valuations rising manifold within months and small firms getting more capital inflows than they can deploy, often resulting in wasteful business plans.

- When investors rush to deploy funds, the risk of fraud rises — inadequate disclosures and weak due diligence are compounded by incentives to misrepresent financial data.

- The discovery of any such frauds would likely freeze funding for the industry for a few quarters.

Why now?

- India has never lacked entrepreneurs, but lacked risk capital given the low per capita wealth.

- As savers like pension and insurance funds in the developed world responded to record-low interest rates by allocating more to PE as an asset class, private funding markets have grown rapidly in the last 15 years globally.

- In India, PE funding has exceeded public-market fund-raising every year in the past decade.

- While earlier, only a few business groups could muster sizeable amounts of risk capital to establish new businesses and disrupt old ones, entrepreneurs can now lay hands on hundreds of millions of dollars if the idea makes sense.

Conclusion

For now, this flow of funds is a welcome booster for the economy as it recovers from the scars of the pandemic-driven lockdowns. While valuations can be volatile in the near term, we are in the early stages of this reshaping of India’s corporate landscape.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

Holding transnational corporations accountable

From UPSC perspective, the following things are important :

Prelims level: BIT

Mains level: Paper 3- Using BITs to hold TNCs accountable

Context

Given the enormous power that transnational corporations (TNCs) wield, questions about their accountability have arisen often. There have been many instances where the misconduct of TNCs has come to light such as the corruption scandal involving Siemens in Germany.

Holding TNCs accountable: Background

- The effort was made at the UN to develop a multilateral code of conduct on TNCs.

- However, due to differences between developed and developing countries, it was abandoned in 1992.

- Role of BITs: Aim was to use international law to institutionalise the forces of economic globalisation, leading to the spread of BITs.

- Asymmetry in BITs: These treaties promised protection to foreign investors under international law by bestowing rights on them and imposing obligations on states.

- This structural asymmetry in BITs, which confer rights on foreign investors but impose no obligations, relegated the demand for investor accountability.

- In 2014, the UN Human Rights Council established an open-ended working group with the mandate to elaborate on an international legally binding instrument on TNCs and other businesses concerning human rights.

- Since then, efforts are being made towards developing a treaty and finding ways to make foreign corporations accountable.

- The latest UN report is a step in that direction.

UN report on human rights-compatible international investment agreements

- The UN working group on ‘human rights, transnational corporations (TNCs) and other businesses’ has published a new report on human rights-compatible international investment agreements.

- It urges states to ensure that their bilateral investment treaties (BITs) are compatible with international human rights obligations.

- It emphasises investor obligations at the international level i.e., the accountability of TNCs in international law.

Using BITs to hold TNCs accountable

- BITs can be harnessed to hold TNCs accountable under international law.

- The issue of fixing accountability of foreign investors came up in an international law case, Urbaser v. Argentina (2016).

- Subjecting corporates to international law: In this case, the tribunal held that corporations can be subjects of international law and are under a duty not to engage in activities that harm or destroy human rights.

- The case played an important role in bringing human rights norms to the fore in BIT disputes.

- It also opened up the possibility of using BITs to hold TNCs accountable provided the treaty imposes positive obligations on foreign investors.

- Recalibrating BITs: In the last few years, states have started recalibrating their BITs by inserting provisions on investor accountability.

- Issues with BITs: However, these employ soft law language and are hortatory.

- They do not impose positive and binding obligations on foreign investors.

- They fall short of creating a framework to hold TNCs accountable under international law.

Takeaways for India

- The recent UN report has important takeaways for India’s ongoing reforms in BITs.

- Best endeavour clauses not enough: India’s new Model BIT of 2016 contains provisions on investor obligations.

- However, these exist as best endeavour clauses. They do not impose a binding obligation on the TNC.

- Impose positive binding obligations: India should impose positive and binding obligations on foreign investors, not just for protecting human rights but also for imperative issues such as promoting public health.

- The Nigeria-Morocco BIT, which imposes binding obligations on foreign investors such as conducting an environmental impact assessment of their investment, is a good example.

Consider the question ” Ensuring that the bilateral investment treaties (BITs) are compatible with international human rights obligations in the need of the hour. In light of this, assess the progress made globally on this issue and suggest way forward for India in framing its BITs.”

Conclusion

Reforms would help in harnessing BITs to ensure the answerability of foreign investors and creating a binding international legal framework to hold TNCs to account.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

RBI, IRDAI nod must for FDI in bank-led insurance

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: FDI in insurance

Applications for foreign direct investment in an insurance company promoted by a private bank would be cleared by the RBI and IRDAI to ensure that the 74% limit of overseas investment is not breached.

What does one mean by Insurance?

- Insurance is a contract, represented by a policy, in which an individual or entity receives financial protection or reimbursement against losses from an insurance company.

- The company pools clients’ risks to make payments more affordable for the insured.

- Insurance is a capital-intensive business so has to maintain a solvency ratio. The solvency ratio is the excess of assets over liabilities.

- Simply put, as an insurance company sells more policies and collects premiums from policyholders, it needs higher capital to ensure that it is able to meet future claims.

- In addition, insurance is a long gestation business. It takes companies 7-10 years to break even and start becoming profitable.

Types of Insurance

Insurance sector of India

- The insurance regulator, the Insurance Regulatory and Development Authority of India (IRDAI), mandates that insurers should maintain a solvency ratio of at least 150 percent.

- The insurance industry of India has 57 insurance companies 24 are in the life insurance business, while 34 are non-life insurers.

- Among the life insurers, Life Insurance Corporation (LIC) is the sole public sector company.

- In addition to these, there is a sole national re-insurer, namely the General Insurance Corporation of India (GIC Re).

- Other stakeholders in the Indian Insurance market include agents (individual and corporate), brokers, surveyors, and third-party administrators servicing health insurance claims.

- In India, the overall market size of the insurance sector is expected to be $280 billion in 2020.

Recent developments

The chronological order of events:

- Nationalization of life (LIC Act 1956) and non-life sectors (GIC Act 1972)

- Constitution of the Insurance Regulatory and Development Authority of India (IRDAI) in 1999

- Opening up of the sector to both private and foreign players in 2000

- Increase in the foreign investment cap to 26% from 49% in 2015

- Increase in FDI limit from 49% to 74% in March 2020

Issues with India’s insurance sector

Insurance is considered a sensitive sector as it holds the long-term money of people. Various attempts were made in the past to open up the sector but without much success.

- Lower insurance penetration due to various economic reasons such as poverty, etc.

- Domination of the Public Sector ex. LIC

- Trust issues in private insurances due to insolvency of private players

- Saving habits of the public

Significance of the recent amendment

- The current amendment is an enabling amendment that gives companies access to foreign capital if they need it.

- It is an important shift instance as the increase in the FDI cap means insurance companies can now be foreign-owned and -controlled as against the current situation wherein they are only Indian-owned and -controlled.

- The move is expected to increase India’s insurance penetration or premiums as a percentage of GDP, which is currently only 3.76 percent, as against a global average of more than 7 percent.

What does this mean for Indian insurance companies?

- India has more than 60 insurance companies specializing in life insurance, non-life insurance, and health insurance.

- The number of state-owned firms is only six and the remaining are in the private sector.

- A higher FDI limit will help insurance companies access foreign capital to meet their growth requirements.

How does this impact Indian promoters of insurance companies?

- Most of the Indian promoters of insurance companies are either Indian business houses or financial institutions like banks.

- Many entered into the insurance space when they were financially strong but are now struggling to cater to the constant need to infuse capital into their insurance joint ventures.

- Over the years, the sector has seen large-scale consolidation and exits of many promoters.

- A higher FDI cap will mean that more promoters could now completely exit or bring down their stakes in their insurance joint ventures.

What higher does FDI mean for policyholders?

- Higher FDI limits could see more global insurance firms and their best practices entering India.

- This could mean higher competition and better pricing of insurance products.

- Policyholders will get a wide choice, access to more innovative products, and a better customer service and claims settlement experience.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: Foreign Direct Investment

- An FDI is an investment in the form of controlling ownership in a business in one country by an entity based in another country.

- It is thus distinguished from a foreign portfolio investment by a notion of direct control.

- FDI may be made either “inorganically” by buying a company in the target country or “organically” by expanding the operations of an existing business in that country.

- Broadly, FDI includes “mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations, and intra company loans”.

- In a narrow sense, it refers just to building a new facility, and lasting management interest.

FDI in India

- Foreign investment was introduced in 1991 under Foreign Exchange Management Act (FEMA), driven by then FM Manmohan Singh.

- There are two routes by which India gets FDI.

1) Automatic route: By this route, FDI is allowed without prior approval by Government or RBI.

2) Government route: Prior approval by the government is needed via this route. The application needs to be made through the Foreign Investment Facilitation Portal, which will facilitate the single-window clearance of the FDI application under the Approval Route.

- India imposes a cap on equity holding by foreign investors in various sectors, current FDI in aviation and insurance sectors is limited to a maximum of 49%.

- In 2015 India overtook China and the US as the top destination for Foreign Direct Investment.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

For Cairns dispute, international arbitration is not the way forward

From UPSC perspective, the following things are important :

Prelims level: BITs

Mains level: Paper 3- Cairn Energy case

Context

The recent move by Cairn to seize India’s sovereign assets in order to enforce its arbitration award has brought into focus the dispute and the related issues.

Utility of Bilateral Investment Treaties (BIT)

- After the World Wars, as more countries gained sovereignty, they tended to look at foreign investments as a form of neo-colonialism.

- Bilateral investment treaties became the primary tool to forge relationships between developed and developing countries.

- The BITs help to adopt standards for prompt, adequate and effective compensation in case of expropriation.

- With the advent of globalisation, BITs became the means for foreign investment in developing countries.

- Although the impact of investment agreements on foreign investments remains highly contextualised and inconclusive, these came to govern international investment relations.

- The BITs retained the old-world construct that allowed international arbitration.

- However, many developing countries view arbitration of tax matters as a breach of their sovereign right to tax.

The Cairn Energy case

- In 2012, explanations were added to the Income Tax Act 1961 — these provisions were deemed as having a retrospective effect.

- This was more in response to the Supreme Court’s decision in the Vodafone case which denied the income tax department’s assertion of tax claims arising from the offshore transfer of interest that substantially derived their value from India.

- The 2012 explanations to the IT Act indeed sought to fix tax avoidance.

- Looking into the details of the Cairn case, one can see the series of reorganisations that tip-toed around tax laws of multiple jurisdictions, resulting in the non-payment of tax.

- Taxing offshore indirect transfers — a structuring device to gain tax advantage from the indirect sale of assets — is not unique to India (336 tax treaties contain such an article).

- It is also possible to see that the underlying assets of the subsidiaries were immovable assets in India.

- The UK-India tax treaty allowed for taxation of capital gains as per Indian law.

- India challenged the admissibility of the case before the arbitration tribunal.

- However, the case rests on a distinction between tax and tax-related investment.

- Surely, all investments have tax implications and the acceptance of such a distinction could create problems even where tax is explicitly carved out from the bilateral investment treaties.

- The option of arbitration upon an unsuccessful Mutual Agreement Procedure (MAP) resolution is not available in India.

- For this reason, over the years, there has been a rising trend in tax disputes involving BITs.

- The Cairn case is one such instance where arbitration was invoked especially since MAP was not an option.

Way forward

- The case raises many questions that administrators must address through reform.

- India’s model BIT introduced in 2016 rectifies the issue of the distinction between tax dispute and investment-related taxation dispute through the specific exclusion of taxation.

- The recognition of a tax-related investment dispute, distinct from a tax dispute, should not undermine such a carve-out.

Conclusion

It is also important to note even if the award is enforced, the matter of tax avoidance stands pending before the High Court. Given the complexity, the only reasonable solution would be a negotiated settlement. Even if there’s a resolution in the Cairns case, questions of law would remain.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

Failure to comply with international judicial rulings hurts India’s image as an investment destination

From UPSC perspective, the following things are important :

Prelims level: BITs

Mains level: Paper 3- Honouring the adverse international judicial ruling in dispute with investors

The article highlights the lack of immediate compliance by the Indian government in awards involving foreign investors.

Why honouring award is important

- An important factor that propels investors to invest in foreign lands is that the host state will honour contracts and enforce awards even when it loses.

- But when the host state refuses to do so, it shakes investors’ confidence in the host state’s credibility towards the rule of law, and escalates the regulatory risk enormously.

- To an extent, this has been India’s story over the last few years

- Last year, India lost two high-profile bilateral investment treaty (BIT) disputes to two leading global corporations — Vodafone and Cairn Energy — on retrospective taxation.

- India has challenged both the awards at the courts of the seat of arbitration.

- As India drags its feet on the issue of compliance, it harms India’s reputation in dealing with foreign investors.

Antrix-Devas agreement cancellation dispute

- The other set of high-profile BIT disputes involve the cancellation of an agreement between Antrix, a commercial arm of the Indian Space Research Organisation, and Devas Multimedia.

- This annulment led to three legal disputes — a commercial arbitration between Antrix and Devas Multimedia at the International Chambers of Commerce (ICC), and two BIT arbitrations brought by the Mauritius investors and German investors.

- India lost all three disputes.

- The ICC arbitration tribunal ordered Antrix to pay $1.2 billion to Devas after a U.S. court confirmed the award earlier this year.

- After the ICC award, Indian agencies started investigating Devas accusing it of corruption and fraud.

- Last month, the National Company Law Tribunal (NCLT) ordered the liquidation of Devas on the ground that the affairs of the company were being carried on fraudulently.

- This has led to Devas issuing a notice of intention to initiate a new BIT arbitration against India, sowing the seeds for complex legal battles again.

Implications for investment in India

- A closer reading of these cases reveals that whenever India loses a case to a foreign investor, immediate compliance rarely happens.

- Instead, efforts are made to delay the compliance as much as possible.

- While these efforts may be legal, it sends out a deleterious message to foreign investors.

- It shows a recalcitrant attitude towards adverse judicial rulings.

- This may not help India in attracting global corporations to its shores to ‘make for the world’.

Consider the question “What are the factors that are leading to more Indian business disputes being settled elsewhere? What are the implications of delay by the government in honouring the awards of the disputes?”

Conclusion

As India aspire to be the global destination of FDI, it needs to burnish its image on the dispute resolution front by honouring the awards.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

FDI in Indian economy

What explains the surge in FDI inflows?

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 3- What explained increased total FDI in Indian?

The article analyses the factors contributing to the claim of 10% rise in total Foreign Direct Investment in 2020-21 and its impact on economy.

Making sense of increased FDI

- Total foreign direct investment (FDI) inflow in 2020-21 is $81.7 billion, up 10% over the previous year, reported a recent Ministry of Commerce and Industry press release.

- The short press release highlighted industry and State-specific foreign investment figures without detailed statistical information.

- The Reserve Bank of India (RBI) bulletin, which was released a week earlier, has the details.

What explains increased gross inflows

- The gross inflow consists of (i) direct investment to India and (ii) repatriation/disinvestment.

- The disaggregation shows that direct investment to India has declined by 2.4%.

- Hence, an increase of 47% in “repatriation/disinvestment” entirely accounts for the rise in the gross inflows.

- In other words, there is a wide gap between gross FDI inflow and direct investment to India.

- Similarly, measured on a net basis (that is, “direct investment to India” net of “FDI by India” or, outward FDI from India), direct investment to India has barely risen (0.8%) in 2020-21 over the last year.

- What then accounts for the impressive headline number of 10% rise in gross inflow?

- It is almost entirely on account of “Net Portfolio Investment”, shooting up from $1.4 billion in 2019-20 to $36.8 billion in the next year.

- That is a whopping 2,526% rise.

- Further, within the net portfolio investment, foreign institutional investment (FIIs) has boomed by an astounding 6,800% to $38 billion in 2020-21, from a mere half a billion dollars in the previous year.

- This explains the surge in gross FDI inflows which is entirely on account of net foreign portfolio investment.

How FDI is different from FII

- FDI inflow, in theory, is supposed to bring in additional capital to augment potential output (taking managerial control/stake).

- In contrast, foreign portfolio investment, as the name suggests, is short-term investment in domestic capital (equity and debt) markets to realise better financial returns.