Minimum Support Prices for Agricultural Produce

[pib] Price Support Scheme (PSS) for Moong and Urad

Why in the News?

The Union Ministry of Agriculture has approved the procurement of Moong and Urad in Madhya Pradesh and Urad in Uttar Pradesh under the Price Support Scheme (PSS).

Back2Basics:Moong (Green Gram):

Urad (Black Gram):

|

About Price Support Scheme (PSS):

- Overview: PSS is a component of the Pradhan Mantri Annadata Aay Sanrakshan Abhiyan (PM-AASHA), launched in 2018 to ensure remunerative prices for farmers.

- Objective: It ensures procurement at the Minimum Support Price (MSP) for oilseeds, pulses, and cotton when market prices fall below MSP.

- Nodal Agency: It is implemented by the Department of Agriculture & Cooperation through:

- National Agricultural Cooperative Marketing Federation of India (NAFED) (Central nodal agency)

- Food Corporation of India (FCI) (in specific cases)

- How PSS Works:

-

- MSPs are announced before each cropping season based on recommendations from the Commission for Agricultural Costs and Prices (CACP).

- If the market price falls below MSP, central and state nodal agencies procure the produce directly from farmers.

- Only crops meeting the Fair Average Quality (FAQ) standards are procured.

- Procurement continues until market prices stabilise at or above MSP.

- Eligibility and Access:

-

- All farmers cultivating notified crops are eligible to benefit under PSS.

- They must sell their produce at designated procurement centres, such as APMCs.

- Government employees are typically excluded from the scheme’s benefits.

What is the PM-AASHA Scheme?

|

| [UPSC 2020] With reference to pulse production in India, consider the following statements:

1. Black gram can be cultivated as both kharif and rabi crop. 2. Green-gram alone accounts for nearly half of pulse production. 3. In the last three decades, while the production of kharif pulses has increased, the production of rabi pulses has decreased. Which of the statements given above is/are correct? Options: (a) 1 only * (b) 2 and 3 only (c) 2 only (d) 1, 2 and 3 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

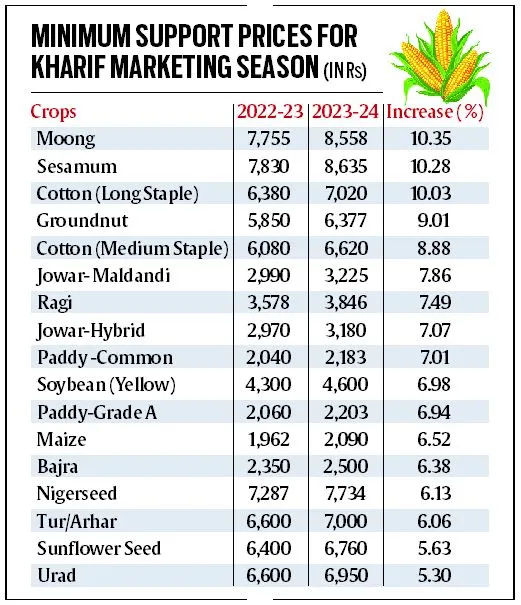

Cabinet approves hike in MSP for Kharif Crops

Why in the News?

The Cabinet Committee on Economic Affairs chaired by Prime Minister has approved the increase in the Minimum Support Price (MSP) for 14 kharif crops for 2025-26.

What is the Minimum Support Price (MSP)?

- MSP in India originated in response to food shortages in the 1960s, notably during the Bihar famine of 1966–1967.

- Agricultural Price Commission (APC) was established in 1965 to implement price policies like procurement at pre-decided prices and MSP.

- Over time, the APC evolved into the Commission for Agricultural Costs and Prices (CACP) in 1985, with broader terms of reference.

- Announcement: The government bases its announcement on the recommendations given by the Commission for Agricultural Costs & Prices (CACP).

Steps involved in Fixing MSPs:

|

How is MSP fixed?

- Formulae for Calculation:

- A2: Costs incurred by the farmer in production of a particular crop. It includes several inputs such as expenditure on seeds, fertilisers, pesticides, leased-in land, hired labour, machinery and fuel

- A2+FL: Costs incurred by the farmer and the value of family labour

- C2: A comprehensive cost, which is A2+FL cost plus imputed rental value of owned land plus interest on fixed capital, rent paid for leased-in land

- National Commission of Farmers also known as the Swaminathan Commission (2004) recommended that the MSP should at least be 50 per cent more than the weighted average Cost of Production (CoP), which it refers to as the C2 cost.

- The government maintains that the MSP was fixed at a level of at least 1.5 times of the all-India weighted average CoP, but it calculates this cost as 1.5 times of A2+FL.

- Crops covered are: CACP currently recommends MSPs for 23 key crops:

-

- 7 Cereals: Paddy, Wheat, Maize, Sorghum (Jowar), Pearl Millet (Bajra), Barley, and Ragi

- 5 Pulses: Gram (Chana), Tur (Arhar), Moong, Urad, and Lentil (Masur)

- 7 Oilseeds: Groundnut, Rapeseed-Mustard, Soybean, Sesame, Sunflower, Safflower, and Nigerseed

- 4 Commercial Crops: Copra, Cotton, Raw Jute and Sugarcane (Fair and Remunerative Price (FRP) is announced by CACP.)

| [UPSC 2020] Consider the following statements:

1. In the case of all cereals, pulses and oil-seeds, the procurement at Minimum Support Price (MSP) is unlimited in any State/UT of India. 2. In the case of cereals and pulses, the MSP is fixed in any State/UT at a level to which the market price will never rise. Which of the statements given above is/are correct? Options: (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2* |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

Explained: Why farmers prefer growing rice and wheat

Why in the News?

The combination of assured government support and scientific advancements in breeding technologies has made rice and wheat the most preferred crops among Indian farmers, while other crops lag due to lack of similar incentives and innovations.

Why do farmers prefer rice and wheat?

- Assured Procurement at MSP: The government provides near-guaranteed purchases of rice and wheat at Minimum Support Prices (MSP), reducing market risk. Eg: In Punjab, rice area increased from 29.8 lakh hectares in 2015-16 to 32.4 lakh hectares in 2024-25 due to consistent MSP support.

- Lower Yield Risk Due to Irrigation and Research Support: Rice and wheat are mostly grown under irrigated conditions and benefit from superior public research, leading to more stable yields. Eg: Wheat variety HD-3385, released in 2023, offers 6 tonnes/hectare yield with resistance to rust diseases and adaptability to different sowing times.

- Continuous Breeding Innovations and Higher Returns: These crops have seen regular improvements through breeding, enhancing productivity, stress tolerance, and input efficiency. Eg: Genetically-edited rice variety Kamala yields up to 9 tonnes/hectare and matures faster, saving water and fertilizer costs.

What drives yield growth in these crops?

- Genetic Improvements and Breeding Innovations: Continuous breeding has led to development of high-yielding, stress-resistant varieties. Eg: Wheat variety HD-3385, released in 2023 by ICAR, yields an average of 6 tonnes/hectare with a potential of 7.3 tonnes, and is resistant to all three major rusts (yellow, brown, and black).

- Improved Agronomic Practices and Technology Adoption: Advanced farming practices like early sowing, use of fertiliser-responsive varieties, and direct seeding have boosted productivity. Eg: Direct-Seeded Rice (DSR) technology eliminates the need for nursery and transplanting, saving water and labour, and supporting yield levels up to 10 tonnes/hectare in some hybrid varieties.

- Public Research and Extension Support: Rice and wheat receive consistent support from government research institutions, unlike many other crops. Eg: The CRISPR-Cas edited rice variety Kamala, developed by ICAR in 2024, produces 450-500 grains per panicle (vs. 200-250 in parent variety), yields up to 9 tonnes/hectare, matures 15-20 days earlier, and requires less fertiliser and water.

How has government policy influenced the cropping patterns in states?

- Minimum Support Price (MSP) and Procurement Assurances: Farmers prefer crops with assured government procurement at MSP, reducing market risk. Eg: In Punjab, rice area increased from 29.8 lakh hectares in 2015-16 to 32.4 lh in 2024-25 due to near-guaranteed MSP procurement, while cotton area declined from 3.4 lh to 1 lh.

- Skewed Research and Input Support: Rice and wheat have received consistent research and extension support, unlike pulses or oilseeds. Eg: ICAR has developed multiple improved wheat and rice varieties (e.g., HD-3385, Kamala), while no major breakthrough has happened in cotton since Bt cotton (2002-06).

- Irrigation Infrastructure Bias: Government investment in irrigation has favoured crops like rice and wheat, making them less yield-risk prone. Eg: In Madhya Pradesh, wheat area rose from 59.1 lh to 78.1 lh and rice from 20.2 lh to 38.7 lh, as irrigation expansion supported these water-reliant crops.

Which innovations improved rice varieties?

- Semi-Dwarf and High-Yielding Varieties: Introduction of semi-dwarf varieties reduced lodging and increased fertiliser response and yields. Eg: IR-8, released in 1966, was the first semi-dwarf rice variety, yielding 4.5–5 tonnes/hectare in just 130 days, compared to 1–3 tonnes in traditional varieties over 160–180 days.

- Gene Editing using CRISPR-Cas Technology: Advanced gene-editing allows precision improvements in yield and stress tolerance. Eg: Kamala, a GE mutant of Samba Mahsuri developed by ICAR in 2024, yields up to 9 tonnes/hectare, matures earlier, and has 450–500 grains per panicle (vs. 200–250 in the original).

- Abiotic Stress Tolerance Breeding: Development of varieties tolerant to drought, salinity, and heat stress for resilience in changing climates. Eg: Pusa DST Rice 1, a GE version of Cottondora Sannalu, with edited DST gene, shows improved tolerance to drought and salt stress, enabling cultivation in marginal soils.

Way forward:

- Diversify MSP and R&D Focus: Extend assured procurement and research support to pulses, oilseeds, and millets to reduce over-reliance on rice and wheat.

- Promote Sustainable Practices: Encourage water-saving technologies like direct-seeded rice, crop rotation, and climate-resilient varieties to ensure long-term agricultural sustainability.

Mains PYQ:

[UPSC 2024] What are the major challenges faced by Indian irrigation system in recent times? State the measures taken by the government for efficient irrigation management.

Linkage: Farmers prefer rice and wheat partly because of access to irrigation which reduces yield risk. Challenges and management of irrigation systems directly impact this aspect of their decision-making.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

No, legal guarantee for MSP is not a “folly”

From UPSC perspective, the following things are important :

Mains level: Issues and benefits related to MSP;

Why in the News?

There is an ongoing heated discussion about whether farmers should be given a legal guarantee for Minimum Support Price (MSP).

Is a legal guarantee for MSP feasible within India’s economic framework?The arguments in favour of the legalisation of MSP:

The arguments against the legalisation of MSP:

|

What mechanisms can ensure farmers receive the MSP without direct government purchases?

- Widening Food Basket: Expanding the food basket in the Public Distribution System (PDS) and increasing procurement levels at MSP can help ensure farmers receive fair prices without direct purchases.

- Market Intervention Schemes: Establishing targeted market intervention schemes can prevent prices from falling below the MSP, thus providing farmers with necessary price support.

- Price Deficit Payment (PDP): A legally mandated compensation mechanism for farmers when market prices fall below the MSP could be implemented. This would not require direct procurement but would ensure farmers are compensated based on official data regarding area sown and average productivity.

What are the broader implications of a legal MSP guarantee on agricultural policy and farmer welfare?

- Social Contract: The demand for a legally guaranteed MSP reflects an unwritten social contract between the Indian state and farmers. Breaching this contract could lead to further disenfranchisement of farmers facing challenges like climate change and global competition.

- Market Dynamics: A legal guarantee could alter market dynamics by ensuring that farmers are not solely dependent on volatile market conditions. This might encourage more stable agricultural production and investment in rural areas.

- Political Considerations: Given the electoral implications of food prices in a democracy, a legally guaranteed MSP could compel governments to prioritise farmer welfare over consumer price suppression, potentially leading to more balanced agricultural policies.

Way forward:

- Strengthen Decentralized Procurement and PDP Mechanisms: Expand the food basket under PDS and introduce Price Deficit Payment (PDP) schemes to ensure farmers receive MSP without burdening government finances through direct procurement. This would also reduce inefficiencies in distribution.

- Promote Diversification and Agri-Infrastructure: Encourage crop diversification by linking MSP with environmentally sustainable and high-value crops, supported by improved storage, transportation, and market access to minimize post-harvest losses and enhance farmer incomes sustainably.

Mains PYQ:

Q What do you mean by Minimum Support Price (MSP)? How will MSP rescue the farmers from the low-income trap? (UPSC IAS/2018)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

On Kisan Diwas: Why terms of trade have improved more for farm workers than farmers

From UPSC perspective, the following things are important :

Mains level: Issues related to agricultural labour;

Why in the News?

Crop prices have lagged behind the rising production costs, while agricultural wages have grown faster than inflation over the past two decades.

What is ‘Terms of Trade’?

|

What factors have contributed to the improved terms of trade for farm workers compared to farmers?

- Wage Growth: Agricultural labourers have experienced significant increases in wages, with their Index of Prices Received (IPR) rising more than threefold from 49.1 to 151.4 between 2004-05 and 2013-14, while their Index of Prices Paid (IPP) increased only modestly from 76.4 to 129.3 during the same period. This resulted in a substantial improvement in their ToT from 64.2% to 117.1%.

- Stagnation of Farmer Incomes: In contrast, farmers’ IPR rose by only 56.3% from 2013-14 to 2022-23, while their IPP increased by 58.4%. This led to a decline in their ToT from 98.6% to 97.2%, indicating that farmers are facing a cost squeeze as input prices rise faster than the prices they receive for their produce.

- Economic Diversification: The expansion of employment opportunities outside agriculture has allowed agricultural labourers to seek better-paying jobs in sectors like construction and services, increasing their bargaining power and wage rates.

How do government policies impact the economic conditions (of farmers versus farm workers)?

- Employment Schemes: Government initiatives such as the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) have provided rural labourers with guaranteed employment, improving their income stability and negotiating power against employers.

- Income Support Programs: Various states have implemented income support schemes targeting women, which have further tightened the labour market and increased wage demands among agricultural workers. For example, Mukhya Mantri Mahila Kisan Sashaktikaran Yojana (MMKSY).

- Subsidies and Minimum Support Prices: While subsidies on inputs like fertilizers and electricity have provided some relief to farmers, they have not sufficiently offset the rising costs or improved farmers’ ToT significantly, leading to ongoing economic distress among this group.

What are the broader implications of these changes for the agricultural sector and rural economy?

- Shift in Economic Power: The improved ToT for agricultural labourers relative to farmers reflects a shift in economic power dynamics within rural areas, potentially leading to greater social mobility for labourers but also highlighting the vulnerabilities faced by farmers.

- Increased Demand for Labor: As agricultural labourers gain better wages and conditions, there may be a reduction in available labour for farming activities, leading to challenges for farmers who may struggle to find enough workers willing to accept lower wages or demand better working conditions.

- Social Tensions: The disparities between the economic conditions of farmers and agricultural labourers can lead to social tensions, especially as farmers express dissatisfaction over stagnant incomes while labourers experience wage growth. This situation may exacerbate calls for policy reforms aimed at addressing these inequities.

Way forward:

- Enhance Farmer Profitability: Introduce policies to ensure fair pricing for crops, reduce input costs through targeted subsidies, and promote crop diversification and value addition to improve farmers’ income and Terms of Trade (ToT).

- Strengthen Rural Employment: Expand employment opportunities in rural non-farm sectors and align government schemes like MGNREGA with skill development programs to sustain wage growth for agricultural labourers while addressing labour shortages in farming.

Mains PYQ:

Q What are the main constraints in the transport and marketing of agricultural produce in India? (UPSC IAS/2020)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

PREMIUM – Subsidies – Good or Bad for India?

From UPSC perspective, the following things are important :

Prelims level: Agricultural subsidies; Policies and Programs by government;

Mains level: Issue of Subsidies in India; Policies and Programs by Government;

Why in the News?

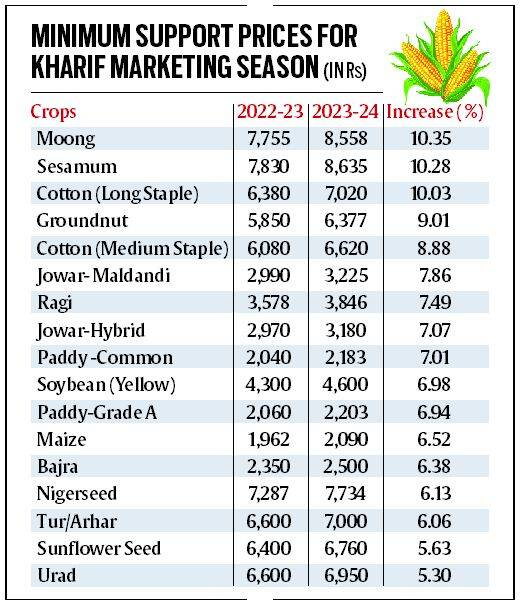

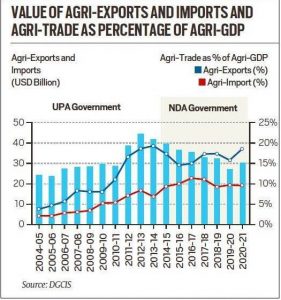

Issues have been raised by the World Trade Organization (WTO) concerning Agricultural Subsidies in India. Major subsidies in India are on fertilizer, power, credit, output, seed, and export products.

What is Subsidy?

|

Historical Background

- Post-Independence Era (1947 onwards): The government introduced various subsidies to promote industrialization, agriculture, and social welfare, aiming to reduce poverty and achieve self-sufficiency in key sectors.

- Green Revolution (1960s): During the 1960s and 1970s, Subsidies on fertilizers, seeds, and credit were provided to farmers to encourage the adoption of new agricultural technologies and boost food production.

- Liberalization Reforms (1991): While liberalization led to a reduction in some subsidies and a shift towards market-oriented policies, the government continued to provide support to sectors deemed crucial for social welfare and economic development.

Types of Subsidies:

- Food subsidy: The food subsidy’s main objective is to provide essential eatables to a large section of the population living below the poverty line in India.

- The major food items supplied to the BPL families (by PDS system) vary as per the region, it includes – Wheat, Rice, Sugar, Milk, Cooking oil, and more.

- Education subsidy: The Central government extends the education subsidy to eligible students to pursue higher technical and professional education.

- Export subsidy: To make exports attractive and lend support to the companies, the government offers export subsidies.

- Fertilizer subsidy: The fertilizer is provided at a fixed MRP that is below the actual price; the government pays the difference between the actual coat and the MRP.

(Note: There are various types of subsidies but UPSC usually asks for Agriculture subsidies)

Subsidies in Agriculture:

Direct Subsidies:

- Credit Subsidies: Subsidized credit programs offer farmers loans at lower interest rates or with relaxed repayment terms to finance agricultural activities, such as purchasing inputs, machinery, or land.

- Ex-The Government of India provides interest subvention of 2% and Prompt Repayment Incentive of 3% to the farmers, thus making the credit available at a very subsidized rate of 4% per annum as per Kisan Credit Card.

- Direct Income Transfers: Governments provide direct cash transfers or income support schemes to farmers to supplement their incomes, improve their financial stability, and alleviate rural poverty. Ex-PM Kisan Samman Nidhi Scheme under which support of Rs.6000/- per year

Indirect Subsidies

- Fertilizer Subsidies: Governments often provide subsidies on fertilizers to reduce the cost burden on farmers and promote fertilizer use, which enhances crop productivity. Ex- the Union Budget for the fiscal year 2024-25 (FY25) allocated ₹1.64 trillion for fertilizer subsidy.

- Seed Subsidies: Subsidies on quality seeds help farmers access improved varieties that are disease-resistant, drought-tolerant or have higher yields. Ex- the government provides a subsidy of Rs. 1000/- per quintal or 50% of the cost.

- Water Subsidies: Subsidized irrigation infrastructure and water supply schemes aim to improve water availability for agricultural purposes, especially in regions facing water scarcity. Ex- Pradhan Mantri Krishi Sinchai Yojana.

- Minimum Support Prices (MSP): Governments guarantee a minimum price for certain crops to protect farmers from market price fluctuations and ensure stable income. Procurement agencies purchase crops from farmers at MSP, often for staples like wheat, rice, and pulses. Ex- the government of India sets the MSP twice a year for 24 commodities (23 crops + 1 sugarcane).

- Crop Insurance Subsidies: Subsidies are offered on crop insurance premiums to encourage farmers to enroll in crop insurance schemes, which protect them against yield or revenue losses due to adverse weather, pests, or other risks. Ex- Pradhan Mantri Fasal Bima Yojana (PMFBY)

- Subsidized Agricultural Machinery: Governments may subsidize the purchase of farm machinery, equipment, and tools to mechanize agricultural operations, increase efficiency, and reduce labor costs. Ex- Sub-mission On Agriculture Mechanization (SMAM scheme)

Present issues raised by the WTO:

- Market Distortion: The WTO contends that agricultural subsidies have the potential to disrupt global markets. For instance, subsidies like India’s Minimum Support Price (MSP) may result in the undervaluation of Indian agricultural goods on the international stage.

- Trade Barriers: Subsidies can create challenges for foreign producers without subsidies to compete effectively in markets where subsidized goods are sold.

- Overproduction of certain crops: Subsidies can lead to overproduction of certain crops, which can further distort the market and lead to wastage.

- Negative Environmental Impact: Overuse of fertilizers and water for irrigation, encouraged by subsidies, can lead to environmental degradation.

- Inequity: The benefits of subsidies often go to larger farmers rather than small-scale farmers who need them the most.

Limitations Faced by Indian Agriculture:

- Subsidies on few crops: Subsidies like MSP, which are applicable for only a few crops, have led to cereal-centric agriculture with distorted cropping patterns, as farmers tend to grow only those crops for which they are given subsidies.

- Benefiting only wealthy Farmers: As per the Economic Survey 2018, wealthy farmers benefited over small farmers from the farm subsidies. Thus the objective of giving subsidies is not fulfilled. This is the case frequently witnessed in Punjab and Haryana, where affluent farmers enjoy taxpayer money.

- Fiscal deficit: Also, the subsidies lead to a substantial financial deficit and burden on the financial exchequer.

- Cause of pollution: Subsidies for agriculture can foster the overloading of croplands, which leads to erosion and compaction of topsoil, pollution from synthetic fertilizers and pesticides, and release of greenhouse gases, among other adverse effects.

Way Forward:

- Diversification of Subsidies: Expand subsidy programs to cover a wider range of crops, including fruits, vegetables, pulses, and other diversified agricultural products, to promote crop diversification and mitigate the cereal-centric focus.

- Targeted Subsidy Programs: Implement targeted subsidy schemes that prioritize support for small and marginalized farmers, ensuring that subsidies reach those who need them most and reducing the disproportionate benefit to wealthy farmers.

- Price Stabilization Mechanisms: Develop price stabilization mechanisms beyond MSP, such as futures markets, crop insurance, and warehouse receipt systems, to mitigate price volatility and provide income security to farmers without distorting cropping patterns.

Prelims PYQ

In India, markets in agricultural products are regulated under the (UPSC IAS/2015)

a) Essential Commodities Act, 1955

b) Agricultural Produce Market Committee Act enacted by States

c) Agricultural Produce (Grading and Marking) Act, 1937

d) Food Products Order, 1956 and Meat and Food Products Order, 1973

Mains PYQ

Q How do subsidies affect the cropping pattern, crop diversity and economy of farmers? What is the significance of crop insurance, minimum support price and food processing for small and marginal farmers? (UPSC IAS/2017)

Q What are the different types of agriculture subsidies given to farmers at the national and at state levels? Critically analyse the agricultural subsidy regime with reference to the distortions created by it (UPSC IAS/2013)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

Understanding perspectives: Farmers’ Protests raise divisive opinions

From UPSC perspective, the following things are important :

Prelims level: Agriculture Sector and Farmers Protest;

Mains level: Farmer Demands and Government Initiatives;

Why in the news?

A recent survey conducted by CSDS-Lokniti aimed to gather opinions regarding the ongoing farmer protests.

Opinion about the Farmer Protest:

The major key demands of Farmers in India include:

- On Minimum Support Price (MSP): Farmers demand a legal guarantee for MSP for crops, which is a crucial lifeline for farmers facing market uncertainties.

- On Electricity Act 2020: Farmers are demanding the repeal of the Electricity Act 2020, which they believe will negatively impact their income.

- On Compensation: Farmers are demanding compensation for farmers who died during the previous agitation in Lakhimpur Kheri.

- Withdrawal of Cases: Farmers are demanding the withdrawal of cases registered against farmers during the 2020-21 agitation.

Government Initiatives:

- Negotiations: The government has taken several steps to address the farmer agitation, including negotiations with protesting farmers, proposing the formation of a committee to provide statutory backing to the Minimum Support Price (MSP), and engaging in talks with farmer representatives.

- Demands: Despite promises made to farmers in 2021, the government has not fully responded to their demands, leading to continued tensions and protests. The government’s reaction to the protest still appears to be focused on maintaining law and order rather than proactively addressing the underlying issues raised by the farmers

Conclusion: The CSDS-Lokniti 2024 pre-poll survey highlights divisive opinions on farmer protests, citing demands for an MSP guarantee, repeal of the Electricity Act, and compensation for fatalities. Despite negotiations, unresolved grievances persist, indicating a need for proactive governmental action and dialogue

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

Centre brings wheat and rice under price stabilization fund

From UPSC perspective, the following things are important :

Prelims level: Price stabilization fund

Mains level: Significance of Price stabilization fund

Why in the news?

The government has approved the inclusion of wheat and rice under its price stabilization fund to provide subsidies for the quantity allocated under Bharat atta and rice sale.

Context: After it started selling Bharat atta and rice as part of its retail intervention in a bid to tame inflation as prices are soaring ahead of general elections

What is the Price Stabilisation Fund (PSF)?

A Price Stabilization Fund is established to mitigate excessive fluctuations in specific commodity prices. The fund’s resources are typically deployed to moderate high or low prices through various initiatives, such as procuring particular goods and distributing them as needed, ensuring prices stay within a desired range. |

Background-

- During the fiscal year 2014-15, the Price Stabilization Fund (PSF) was instituted within the Department of Agriculture, Cooperation & Farmers Welfare (DAC&FW) to manage the fluctuating costs of crucial agricultural commodities like onions, potatoes, and pulses.

- These commodities will be procured directly from farmers or their organizations at farm gates or designated marketplaces, and subsequently offered to consumers at a more affordable rate. Any incurred losses in the coordination between the central government and the states during these operations must be divided.

The significance of the Price Stabilization Fund (PSF) in the context of recent expansion to include of wheat and rice-

- Addressing Inflationary trends : The inclusion of wheat and rice under the PSF marks a significant expansion beyond the previously covered commodities like onions, potatoes, and pulses. This expansion reflects the government’s commitment to addressing inflationary trends across a broader spectrum of essential food items.

- Buffer Stock Management: The PSF is utilized to build up buffer stocks of key food commodities such as wheat and rice. These stocks are strategically released into the market during periods of price surges to stabilize prices and ensure affordability for consumers.

- Subsidy Allocation: The government provides subsidies to agencies like the Food Corporation of India (FCI) for supplying wheat and rice to central procurement agencies. This subsidy support helps in maintaining the affordability of these commodities, particularly under the Bharat brand, which is sold at subsidized prices.

- Inflation Mitigation: The inclusion of wheat and rice in the PSF is aimed at mitigating rising food inflation, which has been a concern ahead of general elections. By intervening in the market through strategic buffer stock management and subsidized sales, the government seeks to curb inflationary pressures and ensure food affordability for consumers.

- Policy Response to Market Dynamics: The decision to expand the PSF reflects a proactive policy response to address market dynamics, particularly concerning rising rice prices. By taking measures to stabilize prices and increase availability through the PSF, the government aims to alleviate the burden on consumers and mitigate potential electoral repercussions associated with food inflation.

The Price Stabilization Fund (PSF) addresses inflationary pressures and aids in maintaining food affordability through several mechanisms:

- Buffer Stock Management: The PSF accumulates buffer stocks of essential food commodities during periods of surplus production or lower prices. These stocks are strategically released into the market during periods of scarcity or price surges. By increasing the supply of commodities during shortages, the PSF helps stabilize prices and prevents excessive inflation.

- Subsidy Provision: The PSF provides subsidies to support the procurement and distribution of essential commodities. These subsidies enable the government to sell commodities at lower prices, making them more affordable for consumers. Subsidies can also incentivize increased production, leading to a greater supply of commodities and further price stability.

- Market Intervention: The PSF allows for direct intervention in the market to address sudden price fluctuations. By purchasing commodities during periods of low prices and selling them during periods of high prices, the PSF helps moderate price volatility and ensures that prices remain within a reasonable range.

- Consumer Protection: By stabilizing prices and ensuring the availability of essential food items, the PSF protects consumers from sudden spikes in food prices, which can disproportionately affect vulnerable populations. Affordable food prices contribute to improved food security and overall economic stability.

- Incentivizing Domestic Production: The PSF incentivizes domestic production by providing a guaranteed market for farmers’ produce at stable prices. This encourages farmers to increase their production levels, contributing to overall food security and helping to mitigate inflationary pressures.

Conclusion: The government is expanding the Price Stabilization Fund to include wheat and rice amid soaring food prices ahead of elections. This aims to manage inflation by subsidizing essential commodities and maintaining buffer stocks.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

Guaranteed MSP is an ethical imperative

From UPSC perspective, the following things are important :

Prelims level: MSP, National Commission on Farmers, 2004

Mains level: Farmers woes and role of MSP

Why in the news?

As the upcoming general elections approach, agricultural issues have once again become the focus of attention.

Context-

-

- Farmers from the regions known for the Green Revolution have journeyed to the outskirts of the capital not only to express their concerns but also to influence the topics being discussed in the election campaigns.

- What is the guarantee on MSP?

-

- There are legal provisions for farmers to get the MSP for all 23 crops when they sell them—a guarantee by the government to ensure that prices do not fall below the minimum.

Key issues related to MSP in India (Produce and perish trap in India)

- Inadequate implementation of MSP- Despite annual announcements, the implementation of Minimum Support Price (MSP) for 23 crops across both kharif and rabi seasons still needs to be improved.

- Only a small fraction, around 6% of farmers (as per The Shanta Kumar Committee, in its 2015 report), particularly those growing paddy and wheat in states like Punjab, actually benefit from MSP.

- Vicious Cycle of Debt and Suicide– Farmers trapped in a cycle of produce and perish face crippling debt and tragically, suicides. The inability to sell crops at MSP exacerbates financial struggles.

- Dependency on Intermediaries The MSP procurement system frequently relies on intermediaries like middlemen, commission agents, and officials from Agricultural Produce Market Committees (APMCs).

- This setup can pose difficulties for smaller farmers, limiting their access to these channels and resulting in inefficiencies and diminished benefits for them.

- Inconsistent Implementation Across States- While some states like Maharashtra and Karnataka have made efforts towards ensuring MSP through legislative measures, there are challenges due to a lack of political will and comprehensive strategies.

- Financial Burden on Government- The government bears a substantial financial burden in procuring and maintaining buffer stocks of MSP-supported crops.

- This allocation of resources detracts from potential investments in other agricultural or rural development initiatives.

- Lack of political will- Unable to prevent purchasing of food crops below the MSP. For example, A few years ago, Maharashtra attempted to amend its Agricultural Produce Market Committee (APMC) Act to prevent the purchase of agricultural produce below MSP, but the effort failed due to a lack of political will and a comprehensive strategy

What are the measures suggested?

- Amendment to State APMC Acts or Essential Commodities Act- Minor amendments to these laws could introduce provisions ensuring that transactions of farmers’ produce do not occur below the MSP.

- Development of Backward and Forward Linkages- Alongside legal recourse to MSP, it is proposed to develop essential backwards and forward linkages. This includes crop planning, market intelligence, and the establishment of post-harvest infrastructure for the storage, transportation, and processing of farm commodities.

- Enhancing MSP- There’s a suggestion to enhance MSP to provide a 50% profit margin over total cost, which is seen as feasible considering the current margins.

- Effective Procurement and Distribution- Emphasizing the need for effective procurement and distribution mechanisms as envisioned under the National Food Security Act, 2013, to ensure MSP and address hunger and malnutrition.

- Scheme ensure MSP- Recognizing the potential of schemes like PM-AASHA, which comprises price support, price deficiency payment, and incentives to private traders to ensure MSP, although it’s noted that such schemes have been sidelined in policy circles.

- Reducing Intermediaries’ Share– Establishing a legally binding MSP may reduce the share of intermediaries, leading to resistance from them.

- However, this reduction could lead to farmers receiving a higher percentage of the price paid by consumers.

- Addressing Free Market Dogma- Critiquing the adherence to free market ideology and advocating for government intervention, particularly in ensuring a legally binding MSP, to address the ongoing crisis in farmer incomes.

Conclusion: Inadequate MSP implementation leads to a vicious cycle of debt and dependence on intermediaries. Solutions include legal guarantees, better procurement, reducing intermediary influence, and challenging free market ideologies to ensure fair compensation for farmers.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

The cost of legal MSP is greatly exaggerated

From UPSC perspective, the following things are important :

Prelims level: National Food Security Act (NFSA)

Mains level: demands of farmers for a legal guarantee of Minimum Support Prices (MSP) in India

![]()

Central Idea:

The article discusses the ongoing demands of farmers for a legal guarantee of Minimum Support Prices (MSP) in India, highlighting the necessity of such a mechanism to stabilize agricultural commodity prices and support farmers’ incomes. It addresses misconceptions surrounding MSP, emphasizing its importance in insulating farmers from market price volatility and rectifying imbalances in agricultural productivity and regional procurement.

Key Highlights:

- Farmers are demanding a legal guarantee for MSP to ensure price stability and protect their incomes.

- MSP has been a longstanding mechanism in India to stabilize agricultural commodity prices, but its implementation has been limited.

- Misconceptions about the fiscal costs and operational aspects of MSP have led to hesitancy in legalizing it, despite political consensus.

- Government procurement under MSP primarily benefits consumers, not farmers, as it fulfills obligations under the National Food Security Act (NFSA).

- Expansion of MSP to cover a wider range of crops and regions is necessary to address regional imbalances in agricultural productivity and support crop diversification.

Key Challenges:

- Misunderstanding of MSP’s fiscal implications and operational requirements.

- Limited government intervention beyond rice and wheat procurement, leading to neglect of other crops and regions.

- Concerns over excessive government expenditure and market distortions.

- Ensuring effective implementation and monitoring of MSP across diverse agricultural sectors and regions.

Main Terms or keywords for answer writing:

- Minimum Support Price (MSP)

- National Food Security Act (NFSA)

- Market Price Volatility

- Agricultural Commodity Procurement

- Price Stability

- Geographical Imbalances

- Crop Diversification

Important Phrases for answer quality enrichment:

- Legal Guarantee for MSP

- Price Stability Mechanism

- Market Price Volatility

- Government Intervention in Agricultural Markets

- Regional Imbalances in Agricultural Productivity

- Income Protection for Farmers

Quotes:

- “A guaranteed MSP may not solve the farmers’ problems. But it offers a good opportunity to rectify the imbalances in the MSP and procurement system.”

- “Price stability will protect the average consumer from the vagaries of inflation.”

- “Protecting the income of farmers will help revive the rural economy.”

Anecdotes:

- Instances of government procurement primarily benefiting consumers rather than farmers, highlighting the need for MSP reform.

- Farmers’ struggles with declining real incomes and wages, reflecting long-standing neglect of the agrarian economy.

Useful Statements:

- “Misconceptions surrounding the fiscal costs of MSP overlook its role in stabilizing prices and supporting farmers’ incomes.”

- “Expansion of MSP to cover a wider range of crops and regions is necessary to address regional imbalances in agricultural productivity.”

Examples and References:

- Government procurement data for rice and wheat compared to other crops, illustrating limited intervention beyond major staples.

- Comparative analysis of MSP implementation in India and other countries with similar price stabilization mechanisms.

Facts and Data:

- Government procurement figures for rice and wheat in recent years.

- Estimates of the potential fiscal costs of implementing a legal guarantee for MSP.

- Statistics on declining real incomes and wages in the agrarian sector.

Critical Analysis:

- Emphasizes the importance of MSP in stabilizing agricultural prices and supporting farmer livelihoods.

- Addresses misconceptions and challenges surrounding MSP implementation.

- Advocates for reforms to expand MSP coverage and address regional imbalances in agricultural productivity.

Way Forward:

- Implement legal guarantee for MSP to ensure price stability and support farmer incomes.

- Expand MSP coverage to include a wider range of crops and regions.

- Enhance monitoring and evaluation mechanisms to ensure effective implementation of MSP.

- Address misconceptions and concerns regarding fiscal costs and market distortions associated with MSP.

Overall, the article underscores the necessity of legalizing MSP to support farmers’ incomes, stabilize agricultural prices, and address long-standing neglect in the agrarian sector. It advocates for comprehensive reforms to expand MSP coverage and ensure its effective implementation across diverse agricultural sectors and regions.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

The cost of legal MSP is greatly exaggerated

From UPSC perspective, the following things are important :

Prelims level: National Food Security Act (NFSA)

Mains level: demands of farmers for a legal guarantee for MSP

Central Idea:

Farmers in India are demanding a legal guarantee for Minimum Support Prices (MSP) to stabilize agricultural commodity prices and ensure their livelihoods. Despite the longstanding demand and political consensus, successive governments have been hesitant to implement this, primarily due to concerns about fiscal costs. However, the actual costs and benefits of such a guarantee are often misunderstood, leading to fear mongering and misconceptions about its implications.

Key Highlights:

- Farmers’ demands for a legal guarantee for MSP stem from the need for stability in agricultural commodity prices to protect their incomes.

- MSP is a mechanism to ensure price stability for essential agricultural commodities, but its implementation is limited, mainly focusing on rice and wheat.

- Misconceptions about the fiscal costs of MSP guarantee have hindered its implementation, despite political consensus and support from various parties and unions.

- The cost of procuring agricultural produce is often misconstrued, with the majority being a subsidy to consumers rather than to farmers.

- A guaranteed MSP offers an opportunity to rectify imbalances in the MSP and procurement system, promoting regional diversification and crop expansion.

- Neglect of the agrarian economy has led to declining real incomes and wages for farmers, highlighting the urgency of reforming the MSP system.

Key Challenges:

- Misunderstanding and fear mongering about the fiscal costs and implications of implementing a legal guarantee for MSP.

- Limited implementation of MSP, primarily focusing on rice and wheat, leaving other crops and regions underserved.

- Neglect of the agrarian economy leading to declining real incomes and wages for farmers.

- Political hesitancy to implement MSP guarantee despite consensus and support from various stakeholders.

- Lack of comprehensive understanding of the benefits of MSP guarantee in stabilizing agricultural commodity prices and reviving the rural economy.

Main Terms:

- Minimum Support Prices (MSP)

- National Food Security Act (NFSA)

- Price Stability

- Market Intervention

- Agricultural Commodity Prices

- Fiscal Costs

- Marketable Surplus

- Procurement System

- Agrarian Economy

- Regional Diversification

Important Phrases:

- Legal guarantee for MSP

- Fear mongering and misconceptions

- Fiscal requirements

- Price volatility

- Market intervention

- Income protection

- Regional imbalances

- Declining real incomes

- Rural economy revival

- Comprehensive reform

Quotes:

- “A guaranteed MSP may not solve the farmers’ problems. But it offers a good opportunity to rectify the imbalances in the MSP and procurement system.”

- “Protecting the income of farmers will help revive the rural economy at a time when it’s struggling with deficient demand and rising inflation.”

- “Misconceptions about the fiscal costs of MSP guarantee have hindered its implementation, despite political consensus and support from various parties and unions.”

Anecdotes:

- The article references the fear mongering and misconceptions similar to those observed during the enactment of the National Food Security Act and the National Rural Employment Guarantee Act.

- It highlights the success of MSP implementation for rice and wheat during the last two years, where market prices were higher than MSP.

Useful Statements:

- “Despite political consensus, successive governments have dithered on legalizing this mechanism, primarily due to the fear of excessive fiscal requirements.”

- “A guaranteed MSP offers an opportunity to rectify the imbalances in the MSP and procurement system, promoting regional diversification and crop expansion.”

- “Protecting the income of farmers will help revive the rural economy, particularly during times of deficient demand and rising inflation.”

Examples and References:

- Reference to the successful implementation of MSP for rice and wheat during the last two years, despite market prices being higher than MSP.

- Comparison with other countries where similar mechanisms exist to stabilize agricultural commodity prices.

- Mention of the fear mongering and misconceptions observed during the enactment of previous agricultural legislations like the National Food Security Act.

Facts and Data:

- Government procurement of wheat in 2022 was only 19 million tonnes against a target of 44 million tonnes.

- In 2023, government procurement of rice and wheat was 26 million tonnes against a target of 35 million tonnes.

- Reference to the cost of procuring agricultural produce being misconstrued, with the majority being a subsidy to consumers rather than to farmers.

Critical Analysis:

The article provides a comprehensive analysis of the demands of farmers for a legal guarantee for MSP, highlighting the misconceptions and challenges surrounding its implementation. It emphasizes the importance of rectifying imbalances in the MSP and procurement system to promote regional diversification and crop expansion. However, it could further delve into the specific policy measures needed to address these challenges and provide a more detailed analysis of the potential benefits of implementing a guaranteed MSP.

Way Forward:

- Implementing a legal guarantee for MSP to ensure stability in agricultural commodity prices and protect farmers’ incomes.

- Rectifying imbalances in the MSP and procurement system to promote regional diversification and crop expansion.

- Addressing misconceptions and fear mongering surrounding the fiscal costs and implications of MSP guarantee through public awareness campaigns and comprehensive policy discussions.

- Engaging with stakeholders, including farmers’ unions, political parties, and policymakers, to formulate and implement effective MSP policies that address the needs and concerns of all parties involved.

- Investing in rural infrastructure, storage facilities, and crop diversification programs to strengthen the agrarian economy and revitalize rural communities.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

From Europe to India, why are Farmers angry?

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: Farmers Protests, Key demands

Introduction

- Farmers worldwide are mobilizing in protest against various issues ranging from subsidy cuts to environmental regulations.

- The unrest is witnessed across continents, reflecting a shared struggle against challenges impacting agricultural livelihoods.

Farmers Protests: Worldwide Extent

- Europe: Farmers in several EU member-nations such as Belgium, France, Germany, and Spain have utilized tactics like tractors in city invasions and supermarket raids to protest subsidy cuts, high energy prices, and cheap imports. They protest against EU environment policies aimed at achieving net-zero emissions by 2050, which include pesticide reduction and nature restoration initiatives.

- South America: Protests spanned 67% of countries, driven by economic downturns and droughts, with Brazilian farmers rallying against unfair competition from genetically modified maize.

- Europe: 47% of countries saw protests against low crop prices and rising costs, with French farmers opposing low-cost imports and inadequate subsidies.

- North and Central America: Protests occurred in 35% of countries, with Mexican farmers protesting low prices and Costa Rican farmers seeking government assistance amid debt.

- Africa: 22% of countries witnessed protests due to poor pricing and high production costs, with Kenyan potato farmers demanding better prices and Cameroonian farmers opposing cocoa export bans.

- New Zealand: Farmers protested against government regulations, while Australian farmers opposed proposed high-voltage powerlines.

Asian Protests

- India: Farmers across nine states demand guaranteed crop prices and loan waivers, echoing protests in Nepal against unfair vegetable pricing.

- Malaysia and Nepal: Protests stem from low rice and sugarcane prices, respectively.

Government Responses

- France and Germany have made concessions such as rolling back fuel subsidy cuts and gradually phasing out fuel subsidies.

- EU politicians have voted against proposed pesticide regulations, and climate rules are being revised ahead of elections.

- Nature restoration plans have been deferred for now.

Issues Prompting Indian Protests

- Indian farmers demand legal backing for minimum support prices (MSP) and expansion of MSP coverage beyond rice and wheat, as per a 2021 agreement.

- Import of cheap edible oil and pulses, alongside climate shocks, have impacted farmer earnings.

- Additional demands include higher import duties, changes to crop insurance, better seed quality, debt waivers, and social security benefits.

Conclusion

- Farmer protests globally reflect a unified struggle against economic hardships, environmental regulations, and policy decisions impacting agricultural sustainability and livelihoods.

- Addressing these concerns requires proactive government responses and comprehensive policy reforms to ensure the welfare of farmers and agricultural resilience.

Also read:

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

Farmers’ Demands over Minimum Support Price (MSP) Guarantee

From UPSC perspective, the following things are important :

Prelims level: MSP, National Commission on Farmers, 2004

Mains level: Farmers woes and role of MSP

Introduction

- More than 200 farmers’ unions from Punjab plan to march to Delhi, demanding a legal guarantee for Minimum Support Price (MSP).

- The imposition of Section 144 across Delhi highlights the significance of this protest.

Behind the Protest: Key Demands

- Legal Guarantee for MSP: Farmers demand a law to enforce MSP for all crops, aligned with the recommendations of the Dr. M S Swaminathan Commission.

- Full Debt Waiver: Complete debt waiver for farmers and laborers.

- Land Acquisition Act Implementation: Implementation of the Land Acquisition Act of 2013, with provisions for farmer consent and fair compensation.

- Withdrawal from WTO: India’s withdrawal from the World Trade Organization (WTO) and freezing of all free trade agreements.

- Pensions for Farmers: Provision of pensions for farmers and farm laborers.

- Compensation for Protest Deaths: Compensation for farmers who lost their lives during protests, including job opportunities for their family members.

- Scrapping of Electricity Amendment Bill 2020: Rejection of the Electricity Amendment Bill 2020.

- Enhanced MGNREGA Benefits: Increase in the number of days of employment under MGNREGA, higher daily wage, and linkage with farming activities.

- Penalties for Fake Seeds and Pesticides: Imposition of strict penalties on companies producing fake seeds, pesticides, and fertilizers.

- National Commission for Spices: Establishment of a national commission for spices such as chili and turmeric.

- Indigenous Peoples’ Rights: Ensuring the rights of indigenous peoples over water, forests, and land.

Why such furore over MSP?

- Market Dynamics: Farmers often operate in a buyer’s market, lacking the bargaining power to influence prices for their produce.

- Need for Stability: MSP provides farmers with a safety net, ensuring they receive a minimum price for their crops regardless of market fluctuations.

What is the Minimum Support Price (MSP)?

- History of MSP:

- MSP in India originated in response to food shortages in the 1960s, notably during the Bihar famine of 1966–1967.

- Agricultural Price Commission (APC) was established in 1965 to implement price policies like procurement at pre-decided prices and MSP.

- Over time, the APC evolved into the Commission for Agricultural Costs and Prices (CACP) in 1985, with broader terms of reference.

- Announcement: The government bases its announcement on the recommendations given by the Commission for Agricultural Costs & Prices (CACP).

- Formulae for Calculation:

- A2: Costs incurred by the farmer in production of a particular crop. It includes several inputs such as expenditure on seeds, fertilisers, pesticides, leased-in land, hired labour, machinery and fuel

- A2+FL: Costs incurred by the farmer and the value of family labour

- C2: A comprehensive cost, which is A2+FL cost plus imputed rental value of owned land plus interest on fixed capital, rent paid for leased-in land

- National Commission of Farmers also known as the Swaminathan Commission (2004) recommended that the MSP should at least be 50 per cent more than the weighted average CoP, which it refers to as the C2 cost.

- The government maintains that the MSP was fixed at a level of at least 1.5 times of the all-India weighted average CoP, but it calculates this cost as 1.5 times of A2+FL.

- Crops covered are-

- The CACP recommends MSPs for 22 mandated crops and fair and remunerative price (FRP) for sugarcane.

- The mandated crops include 14 crops of the kharif season, 6 rabi crops and 2 other commercial crops.

Criticism of MSP and Alternatives

- Economists’ Perspective: Many economists criticize government-fixed MSPs, advocating for income support schemes as a more efficient alternative.

- Income Support Schemes: Direct income support offers fixed payments to farmers, irrespective of crop choice or market conditions, aiming to provide stable income.

Approaches to Guarantee MSP

- Conventional Methods: Historically, MSP was enforced through mandatory buyer payments or government procurement. However, these methods face challenges in implementation and sustainability.

- Price Deficiency Payments (PDP): PDP offers an alternative approach, wherein the government compensates farmers for the difference between MSP and market price, without physical procurement.

PDP Models in Practice

[1] Madhya Pradesh: Bhavantar Bhugtan Yojana

- Model: It experimented with PDP but encountered challenges in sustainability and central support.

- Operational Mechanism: Market price is determined based on average modal rates in APMC mandis, with payments backed by sale agreements, weighment slips, and payment letters.

[2] Haryana: Bhavantar Bharpai Yojana

- Model: It combines physical procurement with PDP, demonstrating feasibility in certain crops.

- Operational Platform: BBY operates on the ‘Meri Fasal, Mera Byaura’ portal, where farmers register their details and area sown under different crops.

- Registration Process: Registration for kharif and rabi crops is open during specific periods, followed by crop area verification through satellite imaging.

- Hybrid Approach: Haryana combines physical procurement with PDP under BBY, depending on the gap between MSP and market price.

- Payment Structure: PDP rates are fixed, derived from average quotes at the National Commodity and Derivatives Exchange, with farmers paid based on the three-year average yield for their block/sub-district.

Way Forward

- Scaling PDP Nationwide: A nationwide PDP scheme, with central funding, could incentivize states to adopt similar models, leveraging existing market infrastructure for efficient MSP delivery.

- Infrastructure Development: Investing in market infrastructure and transaction recording systems is crucial for widespread MSP implementation, ensuring transparency and accountability.

Conclusion

- Policy Implications: The debate over MSP guarantee underscores the need for balanced policies that address farmers’ concerns while ensuring market efficiency.

- Alternative: Exploring innovative mechanisms like PDP alongside traditional approaches can offer a viable solution to the challenge of MSP guarantee, benefiting farmers across diverse agricultural landscapes.

Back2Basics: National Commission on Farmers, 2004 (MS Swaminathan Commission)

- Established in 2004 under the chairmanship of Prof. M. S. Swaminathan.

- Submits five reports between December 2004 and October 2006.

- Reflects priorities outlined in the Common Minimum Programme.

Key Recommendations

- Addressing Agrarian Distress: Implement holistic national policy for farmers; Ensure farmers’ control over resources like land, water, credit, and markets.

- Land Reforms: Distribute surplus land and prevent diversion of agricultural land; Advocate for inserting “Agriculture” in the Concurrent List of the Constitution.

- Water Management: Ensure sustained water access and promote rainwater harvesting.

- Infrastructure Investment: Increase public investment in agricultural infrastructure; Promote conservation farming and soil health.

- Credit and Financial Support: Expand rural credit, lower interest rates, and establish agriculture risk fund; Provide debt restructuring and health insurance to farmers.

- Food Security: Establish universal public distribution system and nutrition support programs.

- Preventing Farmers’ Suicides: Provide measures to prevent farmers’ suicides, including health insurance and debt restructuring.

- Market Reforms: Promote farmers’ organizations, improve MSP implementation, and market reforms.

- Employment Opportunities: Focus on creating productive employment opportunities and improving wage parity.

- Bioresources: Preserve traditional rights, conserve biodiversity, and enhance crop and animal breeds.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

Ashok Gulati writes: How subsidies for paddy in Punjab are choking Delhi

Central idea

The Supreme Court addresses urgent concerns over Delhi’s severe air pollution, emphasizing the need to immediately halt stubble burning in neighboring states like Punjab. Stubble burning, contributing nearly 38% to pollution, poses health risks, and the court advocates for swift measures, including economic incentives, to shift farmers away from paddy cultivation.

Key Highlights:

- Supreme Court urges adjoining states to curb stubble burning as Delhi’s air quality index breaches 400.

- Biomass burning, particularly stubble burning, contributes significantly to Delhi’s pollution, posing health risks and potential loss of 11.9 years of life for residents.

- Urgent action required to control stubble burning in Punjab, which accounts for a major portion of pollution.

Challenges:

- Stubble burning persists despite attempts to stop, revealing a breakdown in law and order.

- Inefficient alternatives and lack of farmer incentives contribute to the continuation of stubble burning.

- Over-reliance on rice and wheat in the Public Distribution System leads to environmental harm and health issues.

Key Phrases:

- Decision Support System for air quality management.

- Air Quality Life Index report by the University of Chicago’s Energy Policy Institute.

- Greenhouse gas emissions from paddy cultivation in Punjab.

- Subsidy on paddy cultivation and its impact on farmers’ choices.

Analysis:

- Biomass burning, especially stubble burning, is a major contributor to Delhi’s pollution, overshadowing the impact of transport and construction.

- The Supreme Court emphasizes the need to cut paddy cultivation in Punjab-Haryana and suggests alternatives to curb stubble burning.

- Economic incentives and policy changes are crucial to wean farmers away from paddy cultivation and address environmental concerns.

Key Data:

- Biomass burning, mainly stubble burning, accounts for 37.85% of Delhi’s pollution.

- Punjab farmers receive a subsidy of almost Rs 30,000/ha for paddy cultivation.

- Loss of 11.9 years of life for Delhi residents due to pollution.

Key Facts:

- The water table in Sangrur, Punjab, has gone down by 25 meters in the last 20 years.

- Stubble burning remains a significant challenge despite efforts by officials.

Key words for mains answer value addition:

- Stubble burning.

- Public Distribution System.

- Decision Support System.

- Air Quality Life Index.

- Greenhouse gas emissions.

Way Forward:

- Implement strong measures to control stubble burning, making the local Station House Office (SHO) responsible.

- Incentivize farmers to switch from paddy to pulses, oilseeds, and millets to create a crop-neutral incentive structure.

- Encourage private sector investment in ethanol plants based on maize to reduce reliance on paddy and lower air pollution from vehicular traffic.

- Limit paddy procurement by state agencies in areas with fast-depleting water tables and where farmers continue stubble burning.

- Promote a diversified market by offering nutritious crops through fair price shops, reducing reliance on rice and wheat and minimizing environmental impact.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

Centre raises MSP for Rabi Crops

From UPSC perspective, the following things are important :

Prelims level: Minimum Support Prices (MSP)

Mains level: Not Much

Central Idea

- The Cabinet Committee on Economic Affairs (CCEA) has increased the Minimum Support Prices (MSP) for all Rabi crops for the financial year 2024-25.

Understanding MSP

- Policy Framework: MSP is a government policy designed to safeguard farmers’ income. Unlike subsidized grains in the Public Distribution System (PDS), it isn’t an entitlement but a part of administrative decision-making.

- MSP Commodities: The Centre currently fixes MSPs for 23 agricultural commodities, guided by recommendations from the Commission for Agricultural Costs and Prices (CACP).

- No Legal Backing: There is currently NO statutory backing for these prices, nor any law mandating their enforcement.

Fixing MSPs

- Factors Considered: CACP considers multiple factors when recommending MSP for a commodity, notably the cost of cultivation.

- Key Determinants: These determinants encompass supply and demand dynamics, domestic and global market prices, parity with other crops, implications for consumers and the environment, and terms of trade between agriculture and non-agriculture sectors.

- 5 Times Formula: The 2018-19 Budget introduced a “pre-determined principle” where MSPs should be set at 1.5 times the production cost, simplifying CACP’s role to estimating production costs and applying the formula.

Production Cost Calculation

- Three Cost Categories: CACP calculates three production cost categories for each crop, at both state and all-India average levels.

- A2: Encompasses all paid-out costs directly incurred by the farmer, such as seeds, fertilizers, labor, land lease, fuel, and irrigation.

- A2+FL: Includes A2 and imputes a value for unpaid family labor.

- C2: A comprehensive cost accounting for rentals and forgone interest on owned land and capital assets in addition to A2+FL.

Back2Basics:

| Rabi Crops | Kharif Crops | Zaid Crops | |

| Growing Season | Winter (sown in Oct-Dec) | Monsoon (sown in Jun-Jul) | Summer (sown in Feb-Apr) |

| Harvest Season | Spring (harvested in Mar-Apr) | Autumn (harvested in Oct-Nov) | Early Autumn (harvested in May-Jun) |

| Examples | Wheat, barley, peas, gram | Rice, maize, cotton, soybean | Cucumber, watermelon, muskmelon |

| Water Requirement | Relies mainly on rainfall | Relies on monsoon rains | Requires irrigation and supplemental water |

| Temperature | Grows in cooler temperatures | Grows in warmer temperatures | Grows in hot temperatures |

| Crop Rotation | Often used in crop rotation | Less commonly used in crop rotation | Usually not part of crop rotation |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

MSP as a legal right: Pros and Cons

From UPSC perspective, the following things are important :

Prelims level: MSP and related facts

Mains level: Demand for a legal guarantee of MSP, challenges in existing structure and way forward

What’s the news?

- For years, farmers have been demanding a legal guarantee of the minimum support price (MSP), calculated according to the Swaminathan Commission formula.

Central idea

- The significance of MSP lies in its role in maintaining agricultural viability and preventing farmers from falling into debt and bankruptcy. However, the current MSP system falls short of its objectives, leaving most farmers without much-needed support. This op-ed emphasizes the need for a farmer-centric agricultural policy and a radical shift in approach to secure MSP with a legal guarantee.

Minimum support price (MSP)

- MSP is the price at which the government procures crops directly from farmers. It is calculated to be at least one-and-a-half times the cost of production incurred by the farmers.

- The MSP serves as a minimum guaranteed price for specific crops that the government considers remunerative and deserving of support for farmers.

Agriculture’s Role in the National Economy

- Employment and Livelihood: Agriculture is the largest source of employment and livelihood for about 50 percent of the country’s population, especially in rural areas. It provides direct and indirect employment for millions of people.

- Contribution to GDP: Agriculture contributes around 17–18 percent to India’s Gross Domestic Product (GDP). Although the share of agriculture in the overall GDP has been declining over the years due to the growth of other sectors, it remains a crucial component of the economy.

- Food Security: The agricultural sector plays a critical role in ensuring food security for the nation. By producing a variety of food crops like rice, wheat, pulses, fruits, and vegetables, it caters to the dietary needs of the population and helps manage food inflation.

- Source of Raw Materials: Agriculture is the primary source of raw materials for various industries, including textiles, sugar, jute, and vegetable oil. It provides the necessary inputs for industrial production, contributing to the overall industrial growth of the country.

- Export Earnings: Agricultural exports, such as rice, spices, tea, coffee, and cotton, generate foreign exchange earnings for the country. This helps improve the balance of trade and supports economic growth.

- Rural Development: The growth of agriculture has a significant impact on rural development. It improves rural infrastructure, raises the standard of living, and creates opportunities for the development of allied industries and services in rural areas.

- Poverty Alleviation: Agriculture remains an essential tool in poverty alleviation as it provides income and employment opportunities to the rural population, which is often more susceptible to poverty.

Important role of MSP

- Ensuring Income Security: MSP provides a minimum guaranteed price for farmers’ produce. It protects them from price fluctuations and market risks, ensuring a stable income for their efforts and investment in farming.

- Preventing Distress Sales: With MSP in place, farmers are less likely to resort to distress sales of their crops during times of market downturns.

- Encouraging Crop Diversification: The MSP system covers a range of crops, including cereals, pulses, oil seeds, and more. By providing a remunerative price for diverse crops, it encourages farmers to adopt crop diversification, contributing to agricultural sustainability and food security.

- Government Procurement: MSP sets a benchmark for government procurement of crops. The government procures crops at MSP through various agencies like FCI and state agencies, thereby supporting farmers and maintaining buffer stocks for food distribution.

- Addressing Regional Imbalances: MSP implementation considers regional variations in production costs and helps bridge the income gap between farmers in different regions. It addresses regional imbalances and ensures equitable growth in the agriculture sector.

Inadequacies of the MSP

- Limited Coverage: The current MSP system leaves the majority of farmers without much-needed support. Only around 6% of farmers in the country benefit from MSP, while the remaining face challenges in accessing remunerative prices for their produce.

- Debt and Bankruptcy: Despite MSP being introduced as a safety net, farmers still struggle with debt and bankruptcy. The average debt burden on a farmer’s family is over Rs 1 lakh, despite the subsidies provided by the government.

- Natural Disasters and Market Risks: Farmers remain vulnerable to natural disasters and market forces, making their income uncertain and apprehensive. Climate change adds complexity to farming, and farmers cannot be left at the mercy of such unpredictable factors.

- Insufficient Market Regulation: Middlemen exploit farmers, leading to a significant difference between the price at which farmers sell their produce and the price at which consumers buy the same produce. This lack of market regulation affects farmers’ income adversely.

- Inadequate MSP Calculation: The MSP calculation method may not fully reflect the input costs, market trends, and other economic factors, leading to an ineffective MSP for farmers.

- Rising Debt: The outstanding loan on farmers has increased significantly over the years, indicating the insufficiency of MSP and minimal increases in support prices.

Swaminathan Commission Recommendations

- Calculation of MSP: The Swaminathan Commission recommended that MSP be calculated by adding 50 percent profit to the C2 cost (comprehensive cost including imputed value of family labor) for crops. This method takes into account various input costs incurred by farmers, including labor, seeds, fertilizers, and other expenses.

- Expanded Coverage: The Commission suggested expanding the scope of MSP to cover a wide range of agricultural produce, including crops like ginger, garlic, turmeric, chili, and all agricultural produce and horticulture.

The Call for a Legal Guarantee of MSP

- Addressing Rising Debts: The outstanding loan to farmers has significantly increased over the years, reaching Rs 23.44 lakh crore in 2021–22. Legalizing MSP would offer a sustainable solution, reducing farmers’ dependence on debt.

- Fulfilling Promises: A legal guarantee makes MSP a binding obligation, ensuring farmers receive the promised prices for their crops and avoiding selling at lower rates.

- Empowering Farmers: Legalized MSP enhances farmers’ bargaining power and enables informed decisions in cropping and marketing.

- Supporting Sustainable Agriculture: MSP legislation promotes sustainable agriculture, diversification, and resilience against climate change.

- Promoting Farmer-Centric Policy: A Legal Guarantee of MSP emphasizes a farmer-centric approach, safeguarding their rights, interests, and livelihoods.

Way forward

- Reforming Agribusiness and Ensuring Fair Compensation:

- Promote farmer producer organizations (FPO’s) and cooperatives.

- Facilitate direct market access to reduce dependence on intermediaries.

- Adhering to the Swaminathan Commission’s Guidelines:

- Follow the MSP calculation as per the Swaminathan Commission’s recommendations.

- Consider comprehensive costs, including labor and input expenses.

- Promoting Sustainable Agriculture Practices:

- Encourage the adoption of sustainable farming practices and climate-resilient crop varieties.

- Invest in agricultural research and extension services for modern technologies.

- Ensuring Access to Credit and Insurance:

- Strengthen credit facilities for farmers.

- Provide insurance coverage to manage risks effectively.

- Investing in Rural Infrastructure:

- Improve irrigation facilities, storage, and transportation networks.

- Reduce post-harvest losses and improve market access.

- Promoting Agro-tourism and Direct Marketing:

- Encourage agro-tourism for additional income.

- Establish farmers’ markets and e-commerce platforms for direct marketing.

Conclusion

- The demand for a legal guarantee of MSP is a just and crucial step towards safeguarding the livelihoods of farmers. Providing farmers with a dignified life is not just a moral obligation but an economic imperative, as the growth of the agricultural sector directly impacts the nation’s prosperity.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Minimum Support Prices for Agricultural Produce

Centre hikes Kharif crop Minimum Support Price (MSPs)

From UPSC perspective, the following things are important :

Prelims level: MSP system

Mains level: Issues with MSP

The Centre has set the Minimum Support Price (MSP) for 17 kharif crops and variants.

What is MSP?

- The MSP assures the farmers of a fixed price for their crops, well above their production costs.

- MSP, by contrast, is devoid of any legal backing. Access to it, unlike subsidized grains through the PDS, isn’t an entitlement for farmers.

- They cannot demand it as a matter of right. It is only a government policy that is part of administrative decision-making.

- The Centre currently fixes MSPs for 23 farm commodities based on the Commission for Agricultural Costs and Prices (CACP) recommendations.

Fixing of MSPs

- The CACP considered various factors while recommending the MSP for a commodity, including the cost of cultivation.

- It also takes into account the supply and demand situation for the commodity; market price trends (domestic and global) and parity vis-à-vis other crops; and implications for consumers (inflation), environment (soil and water use) and terms of trade between agriculture and non-agriculture sectors.

What changed with the 2018 budget?

- The Budget for 2018-19 announced that MSPs would henceforth be fixed at 1.5 times of the production costs for crops as a “pre-determined principle”.

- Simply put, the CACP’s job now was only to estimate production costs for a season and recommend the MSPs by applying the 1.5-times formula.

How was this production cost arrived at?

- The CACP projects three kinds of production cost for every crop, both at the state and all-India average levels.