Finance Commission – Issues related to devolution of resources

States and the challenge before the Finance Commission

From UPSC perspective, the following things are important :

Mains level: Issues related to the Devolution of funds;

Why in the News?

Recently, Tamil Nadu hosted the Sixteenth State Finance Commission, highlighting the need for fair resource allocation to performing states and addressing fiscal imbalances between the Union and states.

What are the primary challenges faced by State Finance Commissions?

- Vertical Fiscal Imbalance: There is a significant disparity in revenue-raising capabilities between the Union and state governments. The Union holds greater powers to generate revenue, while states bear most of the expenditure responsibilities. This imbalance has led to insufficient funds for states to meet developmental needs.

- Inequitable Resource Distribution: Despite efforts to achieve equitable redistribution through vertical and horizontal devolution, actual outcomes often fall short of expectations.

- For instance, the Fifteenth Finance Commission’s effective devolution was only 33.16% of the Union’s gross tax revenue, despite a declared share of 41%.

- Inadequate Devolution: The increasing reliance on cess and surcharges by the Union government has further constrained the financial resources available to states. This trend undermines the intended fiscal autonomy that states require to implement local schemes effectively.

- Demographic and Urbanization Challenges: Progressive states like Tamil Nadu face unique challenges related to ageing populations and rapid urbanisation, which strain their fiscal capacities while necessitating increased investment in infrastructure and services.

How can compliance with constitutional mandates be improved?

- Strengthening Legal Frameworks: Ensuring that SFCs operate within a robust legal framework that mandates transparency and accountability can enhance compliance with constitutional directives. This includes clearer guidelines on resource allocation and devolution processes.

- Public Disclosure: Mandating public disclosure of financial data and project details in accessible formats can foster greater transparency and allow for citizen engagement in governance, thereby ensuring that SFCs adhere more closely to their constitutional roles.

- Participatory Budgeting: Encouraging participatory budgeting practices can help align state financial decisions with local needs, ensuring that resources are allocated in a manner that reflects constitutional mandates for equitable development across regions.

What reforms are necessary to enhance the effectiveness of SFCs?

- Revising Devolution Principles: A reassessment of the principles governing vertical and horizontal devolution is essential to create a fairer distribution system that recognizes both the needs of less-developed states and the contributions of high-performing states like Tamil Nadu.

- Augmenting State Resources: Increasing the share of gross central taxes allocated to states from 41% to at least 50% could provide states with greater fiscal autonomy, allowing them to fund locally relevant initiatives effectively.

- Focus on Growth Incentives: Developing a progressive resource allocation methodology that rewards high-performing states can stimulate economic growth while ensuring that less-developed states also receive adequate support for their development needs.

- Addressing Urbanization Needs: Specific reforms aimed at addressing urbanization challenges—such as earmarking funds for infrastructure development—will be crucial for progressive states experiencing rapid urban growth.

Conclusion: State Finance Commissions must address fiscal imbalances, enhance devolution principles, and prioritise growth incentives to empower states. This is vital for achieving Sustainable Development Goals (SDGs) through equitable and inclusive development.

Mains PYQ:

Q Discuss the recommendations of the 13th Finance Commission which have been a departure from the previous commissions for strengthening the local government finances. (UPSC IAS/2013)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

What is Vertical Fiscal Imbalance?

From UPSC perspective, the following things are important :

Prelims level: Finance Commission

Mains level: Vertical Fiscal Imbalance (VFI) in India;

Why in the News?

The financial relationship between the Union and State governments in India is imbalanced, similar to other nations with a federal constitutional structure.

What is Vertical Fiscal Imbalance (VFI)?

Vertical fiscal imbalance (VFI) refers to the mismatch between the revenue-raising powers and expenditure responsibilities of different levels of government (between the Center and state) within a country.

Why should Vertical Fiscal Imbalance (VFI) be reduced?

- Decentralization of Expenditure: States are responsible for 61% of the revenue expenditure, focusing on crucial sectors like health, education, and infrastructure, but they generate only 38% of the revenue.

- This imbalance creates a dependency on central transfers, limiting the States’ fiscal autonomy.

- Need Efficiency in Spending: Reducing VFI would provide states with more resources, allowing them to respond better to local needs and improve governance efficiency.

- Need to strengthen Fiscal Federalism: A reduction in VFI promotes a healthier system of cooperative federalism, ensuring that states have adequate resources to carry out their constitutional responsibilities and meet the demands of their populations.

- Need Preparedness for crises: VFI becomes more pronounced during crises (e.g., COVID-19), leading to fiscal stress for States. A more balanced fiscal arrangement ensures better crisis management at the sub-national level.

Present Scenario of VFI and Tax Devolution in India

- VFI Extent: The 15th Finance Commission noted that despite States‘ heavy spending responsibilities, their revenue-raising powers are limited.

- Tax Devolution Rates: The 14th and 15th FC recommended devolving 42% and 41%, however, estimates suggest that an average share of 48.94% was necessary between 2015-2023 to eliminate the VFI.

- Exclusion of Cesses and Surcharges: The exclusion of cesses and surcharges from the divisible pool of taxes shortens the net proceeds. States argue this limits the resources available to them to meet their expenditure responsibilities.

- Fiscal Responsibility: Despite the constraints, states have largely adhered to borrowing limits under fiscal responsibility legislation. However, states still struggle to meet their expenditure responsibilities, highlighting the need for greater financial support from the Centre.

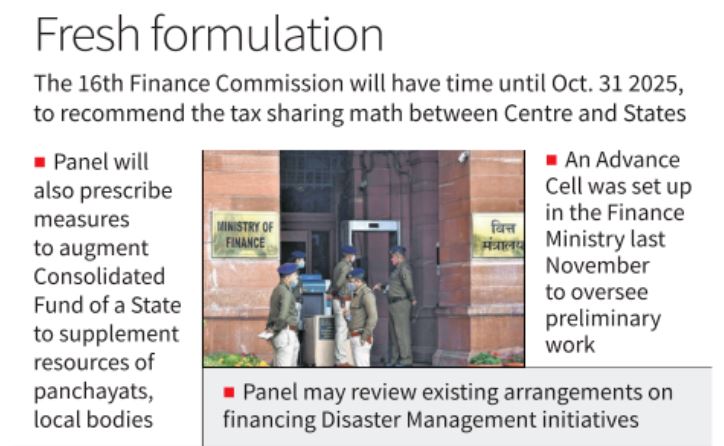

| Note: The Sixteenth Finance Commission was constituted on December 31 2023 with Dr. Arvind Panagariya as the Chairman. The 16th FC has been requested to make its report available by the 31st day of October 2025 covering 5 years commencing on the 1st day of April, 2026. |

What should be the role objective of the 16th FC?

- Increase Tax Devolution: Many States demand that tax devolution from the Union’s net proceeds should be raised to 50%. The 16th Finance Commission must consider raising the devolution rate to around 49% to address the VFI and ensure sufficient untied funds for States.

- Address Cesses and Surcharges: The 16th Finance Commission should evaluate the exclusion of cesses and surcharges from the divisible pool.

- Empower States with Fiscal Autonomy: The Commission’s objective should be to empower States with greater fiscal autonomy by ensuring adequate resources for them to perform their constitutional duties without undue dependence on the Centre.

- Support Local Priorities: The Commission should aim to provide States with untied resources, enabling them to cater to jurisdictional needs and set priorities that align with their specific developmental challenges, ensuring a more responsive governance system.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

[pib] XVI Finance Commission constitutes Advisory Council

From UPSC perspective, the following things are important :

Prelims level: XVI Finance Commission and its terms of references

Why in the News?

The Sixteenth Finance Commission (chaired by Arvind Panagariya, the former Vice-Chairman of NITI Aayog) has constituted an Advisory Council of five members.

Role and Functions of the Advisory Council

- To advise the Commission on any of the Terms of Reference (ToR) or related subjects that may be of relevance.

- To assist in the preparation of papers or research studies and to monitor or assess studies commissioned by the Finance Commission, thereby enhancing the Commission’s understanding of the issues in its ToR.

- To help broaden the Commission’s ambit and understanding by seeking the best national and international practices on matters pertaining to fiscal devolution and improving the quality, reach, and enforcement of its recommendations.

About Finance Commission

- The Finance Commission is a Constitutional body created every five years to transfer financial resources from the centre to states.

- It is a quasi-judicial body.

- The origin of the Finance Commission lies in Article 280 of the Constitution.

- The President of India shall constitute a Finance Commission every five years to give recommendations about the transfer of central revenues (tax) to the states and its allocation among them (states).

- The recommendations of the Fifteenth Finance Commission are valid up to the financial year 2025-26.

Composition of the FC:

- The Finance Commission consists of a chairman and four other members appointed by the President.

- They hold office for such a period as specified by the president in his order and are eligible for reappointment.

Qualifications:

- Parliament determines the qualifications of members of the commission and the manner in which they should be selected.

- Chairman should be a person having experience in public affairs, and

- Four other members should be selected from amongst individuals with specialized knowledge of finance, accounts, economics, or administration.

Terms of Reference for 16th Finance Commission

- Division of Tax Proceeds, principles for Grants-in-Aid, enhancing State Funds for Local Bodies and evaluation of Disaster Management Financing

PYQ:[2023] Consider the following:

For the horizontal tax devolution, the Fifteenth Finance Commission used how many of the above as criteria other than population area and income distance? (a) Only two |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

What is on the agenda for the 16th Finance Commission?

From UPSC perspective, the following things are important :

Prelims level: Finance Commission

Mains level: Role of Finance Commission

Why in the news?

The 16th Finance Commission, under Article 280, focuses on devolving funds. Amendments like 73rd and 74th mandate it to bolster state funds for panchayats and municipalities.

About 16th Finance Commission

|

How do other countries devolve funds to their local governments?

- International Comparison: Countries like South Africa, Mexico, the Philippines, and Brazil allocate significantly higher percentages of their GDP (1.6% to 5.1%) to urban local bodies compared to India’s 0.5%.

- Importance of Intergovernmental Transfers (IGTs): IGTs make up about 40% of Urban Local Bodies (ULBs) revenue in India but suffer from unpredictability, lack of earmarking for vulnerable groups, and horizontal equity.

- Financial Health of ULBs: Despite efforts by multiple Finance Commissions, financial devolution to cities in India remains inadequate, affecting city productivity and quality of life.

Why is the Census significant?

- Data Dependence: The absence of the 2021 Census data makes it challenging to accurately assess urban growth and demographic changes crucial for evidence-based fiscal devolution.

- Urban Dynamics: India has approximately 4,000 statutory towns, an equal number of Census towns, and a large number of effectively urban villages, which need accurate enumeration for effective planning and resource allocation.

- Migration Impact: The Census data is essential to capture the significant migration to Tier-2 and Tier-3 cities, impacting their infrastructure and service needs.

What about cities and the Taxation system?

- Impact of GST: The introduction of GST has reduced ULBs’ tax revenue (excluding property tax) significantly, impacting their financial autonomy.

- Low IGTs: Intergovernmental transfers from States to ULBs in India are minimal (around 0.5% of GDP), much lower than other developing nations, exacerbating fiscal challenges.

- Constitutional Provisions: Despite the 74th constitutional amendment aimed at empowering ULBs, progress has been limited over three decades, hampering urban development.

- Parallel Agencies: The growth of parallel agencies and schemes like MP/MLA Local Area Development Schemes distort the federal structure and weaken ULBs’ financial and operational autonomy.

Way forward:

- Enhanced Intergovernmental Transfers (IGTs): Increase IGTs from States to Urban Local Bodies (ULBs) to at least 2% of GDP, ensuring predictability and earmarking for vulnerable groups.

- Reform in Urban Governance and Fiscal Autonomy: Strengthen constitutional provisions to empower ULBs further, reducing dependence on parallel agencies like MP/MLA Local Area Development Schemes.

Mains PYQ:

Q How is the Finance Commission of India constituted? What do you know about the terms of reference of the recently constituted Finance Commission? Discuss. (UPSC IAS/2018)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

Finance Commission and Indian Cities

From UPSC perspective, the following things are important :

Prelims level: Finance commission

Mains level: 16th Finance Commission can catalyse municipal-level financial reforms

Why in the news?

With the new Lok Sabha and Union government in place, this final piece focuses on how the 16th Finance Commission can drive substantive public finance reforms for India’s cities.

Note: The Sixteenth Finance Commission has been requested to make its recommendations available by October 31, 2025, covering an award period of 5 years commencing 1st April, 2026.

16th Finance Commission can catalyse municipal-level financial reforms

- Strengthening State Finance Commissions: The Commission should emphasize the need for state governments to constitute state finance commissions on time, provide them with adequate resources, and ensure their recommendations are taken seriously.

- Fiscal Decentralization: The 16th FC should recommend a formula-based approach for predictable fiscal transfers from state governments to municipalities, moving away from the current practice of ad hoc, discretionary grants. This will enhance the financial autonomy of urban local bodies.

- Revenue Optimization: The Commission should incentivize municipalities to enhance their own revenues through measures like property tax reforms, user charges, and leveraging land assets. This will reduce their dependence on state grants and promote fiscal responsibility.

- Fiscal Responsibility and Budget Management: The 16th FC can provide incentives for municipalities to adopt fiscal responsibility and budget management frameworks to accelerate municipal borrowings for infrastructure development. This will enable cities to access capital markets for financing their growth.

- Transparency and Citizen Participation: The 16th FC can encourage municipalities to enhance transparency and citizen participation in urban governance for improved accountability at the neighbourhood level. This will make urban local bodies more responsive to the needs of citizens.

Need for the Reforms

- Inadequate Funding and Resource Utilization: Indian cities face significant financial shortfalls and struggle to effectively utilize the funds they have, leading to underdeveloped infrastructure and services.

- Lack of Accountability: There is minimal accountability regarding how municipal spending improves citizens’ lives, resulting in inefficient use of resources and unmet public needs.

- Fiscal Decentralization: Cities need predictable fiscal transfers for effective planning, but state governments often delay constituting State Finance Commissions (SFCs) and implementing their recommendations.

- Revenue Optimization: Cities underutilize their revenue-generating powers due to outdated valuation processes controlled by state governments. Comprehensive reforms are needed at all stages of revenue collection.

- Transparency and Fiscal Responsibility: The legal framework for financial accounting, reporting, and budgeting is inconsistent across states. Standardized formats, mandatory accounting standards, and management accounting systems are necessary to improve transparency and fiscal responsibility.

Activities by State Governments

- Timely Constitution and Implementation of State Finance Commissions: State governments must ensure the timely establishment and effective implementation of SFC recommendations to support fiscal decentralization and provide predictable funding to cities.

- Updating Valuation Processes: States should regularly update guidance values or circle rates to reflect current market values, enabling cities to optimize revenue collection and ensure financial sustainability.

- Enhancing Legal and Institutional Frameworks: States should establish and enforce standardized formats for financial accounting, reporting, and budgeting to ensure consistency, transparency, and comparability across municipalities.

- Empowering Local Governments: States should delegate reasonable expenditure authority to city councils, reducing dependency on state-level approvals and enabling more efficient and responsive local governance.

- Mandating Transparency and Citizen Participation: States should mandate public disclosure of municipal financial data and project details in machine-readable formats and support the implementation of participatory budgeting to enhance transparency and citizen involvement in governance.

Conclusion: The 16th Finance Commission can drive critical municipal-level financial reforms by strengthening state finance commissions, promoting fiscal decentralization, optimizing revenues, enhancing fiscal responsibility, and encouraging transparency and citizen participation in governance.

Mains PYQ:

Q How is the Finance Commission of India constituted? What do you know about the terms of reference of the recently constituted Finance Commission? Discuss. (15) (UPSC IAS/2018)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

Premium- Indian Federalism as a Mad Hatter’s Tea Party

From UPSC perspective, the following things are important :

Prelims level: Article 1, Article 3; Finance Commission; NITI Aayog; Federal Ssytem; Emergency Provisions;

Mains level: Issues related to Federalism in India;

Why in the News?

In recent times, the Central government has exerted significant political and financial control over the regional states.

What is Federalism?

|

Indian Federalism:

- India opted for a federal form of government because of linguistic and regional diversity. It has dual objectives, to safeguard and promote the unity, and to accommodate regional diversity.

- However, Indian Federalism has been described as quasi-federal since it contains major federation and union features (Article 1 says, “India that is ‘Bharat’, shall be the Union of the states”).

- The central government has more authority, especially in fiscal matters (due to which it is sometimes called “asymmetrical federalism”).

- Federalism is part of the basic structure which cannot be altered or destroyed under the constituent powers of the Parliament without undergoing judicial review by the Supreme Court.

Federal Features

Non-federal features

The Present Political Federal Issues in India:

- Centralization of Power: Certain propositions laid down in the Supreme Court’s judgment, have upheld the prospects of Federalism in India

- For example, the abrogation of Article 370 concerning Jammu and Kashmir’s special status by the central government without adequate consultation with the state government was seen as a move towards the Centralization of power.

- Reorganization of States: The provision under Article 3 of the Constitution states that the President shall refer the Bill for the reorganization of any State to the legislature of the State concerned to elicit its opinion.

- The recent SC’s verdict that dismissed the challenges to the abrogation of Article 370 led to a serious undermining of federalism and the rights of the elected State legislatures.

- Lack of clarity in Division of Powers: Although the subjects are enlisted in the Seventh Schedule and Emergency Provisions of the Constitution, the distribution of power between the Central government and the states lacks clarity and equity.

- For example, internal security assumes utmost importance with the Maoist challenge and cross-border terrorism, which threaten all the states across the country.

- The Constitution does not refer either to ‘security’ or ‘internal security’ anywhere. However, it mentions five related terms namely ‘pubic order’ (List II, Entry 2), ‘war’ (Article 352), ‘external aggression’ (Article 352), ‘armed rebellion’ (Article 352), and ‘internal disturbance’ (Article 355).

- Further, the imposition of President’s Rule in states under Article 356 has been recently criticized for being used arbitrarily by the central government.

- Unequal Representation in Rajya Sabha: The representation of states in Parliament and other federal institutions does not accurately reflect their population, size, or contributions. Some states are over-represented while others are under-represented.

- For example, the allocation of 80 Lok Sabha seats to Uttar Pradesh and only one to Sikkim results in unequal representation, impacting resource distribution and decision-making.

- Simultaneous Elections: Measures discussed and recommended like the “One Nation One Election” undermined India’s federal structure and conflated the different priorities voters had for National, State, and “Panchayati raj” institutions, degrading each one’s different sphere of responsibility.

The Present Fiscal Federal issues in India:

- Fiscal Divisible Pool: The states often face financial constraints due to their dependence on the central government for funds. The unequal distribution of resources can exacerbate disparities among states.

- For example, states like Bihar and Uttar Pradesh receive more funds from the central government under various schemes. However, recently the Kerala government faced serious financial crunches due to a lack of funds.

- Implementation of Goods and Services Tax (GST): GST’s implementation has raised issues related to fiscal autonomy. States have voiced concerns about the loss of their taxation powers and uncertainties regarding compensation from the central government for revenue losses.

Bodies related to the Federal System in India:

Committee Recommendation:

|

Way Forward: The Centre cannot afford to ignore the importance of states to effectively respond to the Federal issues:

- Empowerment of State Governments: Strengthen the powers and autonomy of state governments in decision-making processes, allowing them greater authority over issues within their jurisdiction, and revenue management is necessary.

- Promoting Co-operative Federalism: Enhance the effectiveness of the Inter-State Council as a forum for dialogue and cooperation between the Centre and states on matters of common interest, ensuring meaningful participation of state leaders in decision-making processes.

- Need a Balanced Approach: First, the government needs to review and make necessary amendments to clarify the distribution of powers, ensuring a more balanced and transparent framework for political governance. Second, implement a balanced system of grants where states with weaker fiscal capacities receive adequate support to address developmental disparities.

- Bringing Clarity: Clearly define revenue-sharing boundaries and internal security mechanisms between the Centre and states to ensure equitable distribution of resources.

Prelims PYQ

Q) Which one of the following is not a feature of Indian federalism? (UPSC IAS/2017)

- a) There is an independent judiciary in India.

- b) Powers have been clearly divided between the Centre and the States.

- c) The federating units have been given unequal representation in the Rajya Sabha.

- d) It is the result of an agreement among the federating units.

Q) Consider the following statements: (UPSC IAS/2020)

1) The Consititution of India defines its ‘basic structure’ in terms of federalism, secularism, fundamental rights and democracy.

2) The Constitution of India provides for ‘judical review to safeguard the citizens’ liberties and to preserve the ideals on which the Constitution is based.

Which of the Statement given above is/are correct?

- a) 1 only

- b) 2 only

- c) Both 1 and 2

- d) Neither 1 nor 2

Mains PYQ

Q1 How far do you think cooperation, competition and confrontation have shaped the nature of federation in India? Cite some recent examples to validate your answer. (UPSC IAS/2020)

Q2 The concept of cooperative federalism has been increasingly emphasised in recent years. Highlight the drawbacks in the existing structure and the extent to which cooperative federalism would answer the shortcomings.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

Should State Governments borrow more? | Explained

From UPSC perspective, the following things are important :

Prelims level: Finance Commission; State Government; FRBM Act;

Mains level: Fiscal Federalism and its challenges

Why in the News?

Recently, the SC rejected Kerala’s plea for immediate relief in its case urging the Union government to ease borrowing constraints, allowing the state to secure extra funds in the ongoing fiscal year.

State governments receive funds from three sources:

- Own revenues (tax and non-tax)

- Transfers from the Union government as shares of taxes and as grants

- Market borrowings

Fiscal Demands for Extra Funds:

- Increased Expenditure: In 2020-21, the Kerala government sharply increased its spending to 18% of its GSDP, to provide economic relief in the wake of the COVID-19 pandemic, aided by the relaxation in borrowing norms then

- Central Gov transfers to Kerala declined: As ratios of GSDP, the Union government’s transfers to Kerala declined to 2.8% in 2023-24, significantly lower than previous years, even as the State’s revenues remained at around 8.0%.

- This meant that, in 2023-24, the State government could meet its modest budget expenditure, equivalent to 14.2% of GSDP, only by raising the borrowing to 3.4% of the GSDP

Socio-Economic for Extra Funds:

- Aging Population: Kerala, like many other states, faces the challenge of an aging population, which puts pressure on pension funds and healthcare systems, necessitating long-term financial planning and investment.

- Pension Liabilities: The substantial outgo for pensions poses a financial burden on the state’s budget, requiring strategies for sustainable pension management to ensure fiscal stability.

- Youth Outmigration: Kerala experiences significant outmigration of its youth, leading to a loss of productive workforce and potential tax revenues, highlighting the need for policies to retain skilled workers and stimulate economic growth

About Net Borrowing Ceiling (NBC):

|

Basis of the Net Borrowing Ceiling:

- Fiscal Responsibility Legislation: Both the central and state governments in India adhere to the FRBM Act, which establishes fiscal deficit goals to uphold fiscal discipline. Under the FRBM, states are required to maintain a fiscal deficit limit of 3% of the Gross State Domestic Product (GSDP).

- Central Government Guidelines: The central government, through the Department of Expenditure in the Ministry of Finance, sets the annual borrowing limits for each state based on a formula that considers the state’s GSDP, existing debt levels, fiscal discipline, and other relevant factors. These limits can be revised in response to special circumstances, such as natural disasters or significant economic downturns.

- Finance Commission Recommendations: The Finance Commission, which is constituted every five years, recommends how the central taxes are to be divided between the centre and the states and suggests measures to maintain fiscal stability. It also provides recommendations regarding the borrowing limits of states.

Conclusion: States need to put in place an effective forecasting and monitoring mechanism for cash inflows and outflows so that a need-based approach is followed for market borrowings and the interest cost of cash surpluses is minimized.

Mains PYQ

Q What were the reasons for the introduction of Fiscal Responsibility and Budget Management (FRBM) Act, 2013? Discuss critically its salient features and their effectiveness. (UPSC IAS/2013)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

Explained: Financial Devolution among States

From UPSC perspective, the following things are important :

Prelims level: Article 270, Article 280 (3)

Mains level: Not Much

Introduction

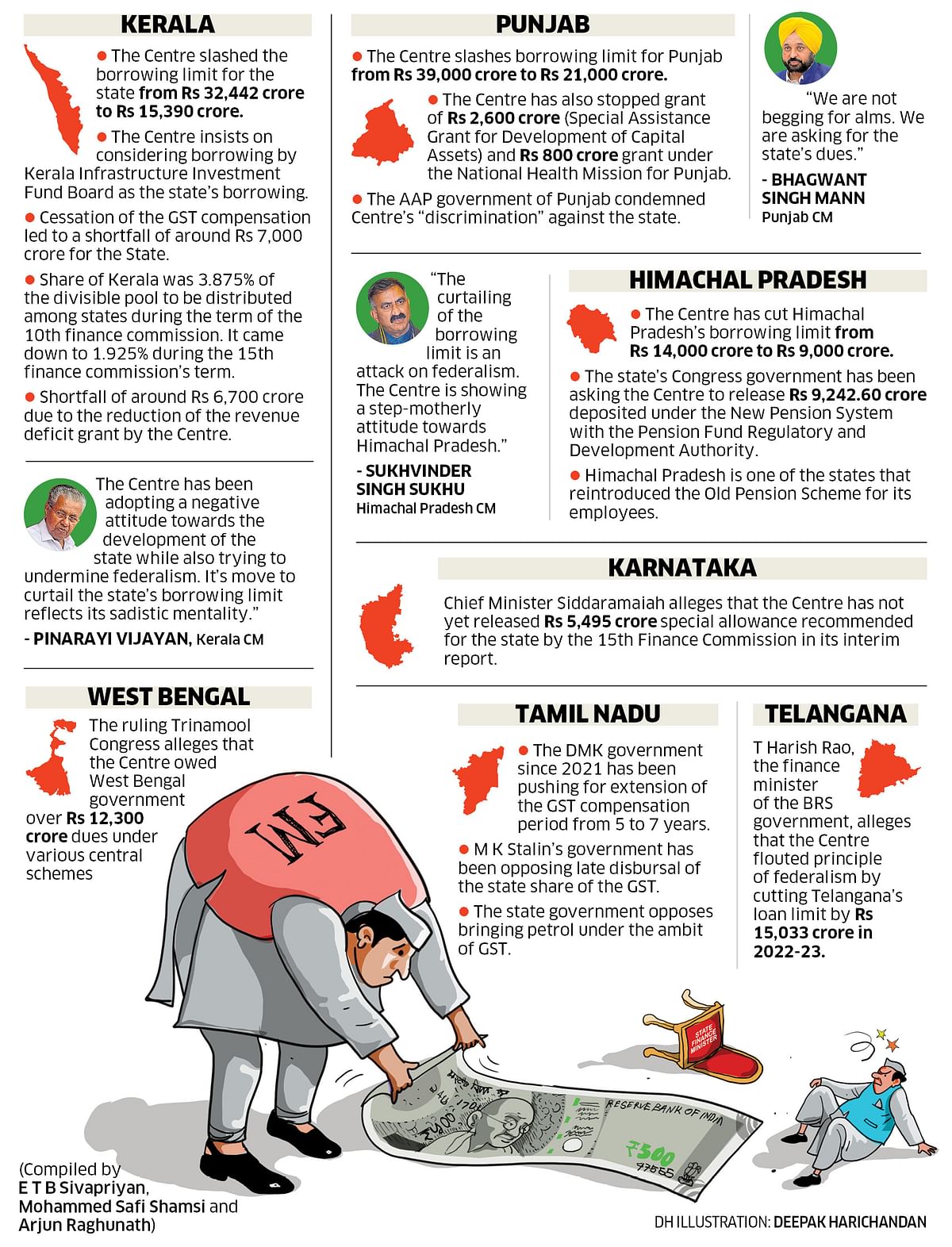

- Several Opposition-ruled states, particularly from southern India, have voiced concerns over the present scheme of financial devolution, citing disparities in the allocation of tax revenue compared to their contributions.

- Understanding the concept of the divisible pool of taxes and the role of the Finance Commission (FC) is crucial in addressing these issues.

Divisible Pool of Taxes: Overview

- Constitutional Provision: Article 270 of the Constitution outlines the distribution of net tax proceeds between the Centre and the States.

- Share of taxes: Taxes shared include corporation tax, personal income tax, Central GST, and the Centre’s share of Integrated Goods and Services Tax (IGST), among others.

- Finance Commission’s Role: Article 280(3) (a) mandates FC, constituted every five years, recommends the division of taxes and grants-in-aid to States based on specific criteria.

- XVI FC: It consists of a chairman and members appointed by the President, with the 16th Finance Commission recently constituted under the chairmanship of Arvind Panagariya for the period 2026-31.

Basis for Allocation: Horizontal and Vertical Devolution

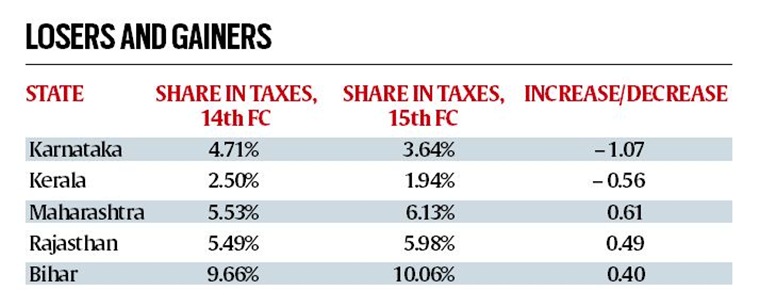

- Vertical Devolution: States receive a share of 41% from the divisible pool, as per the 15th FC’s recommendation.

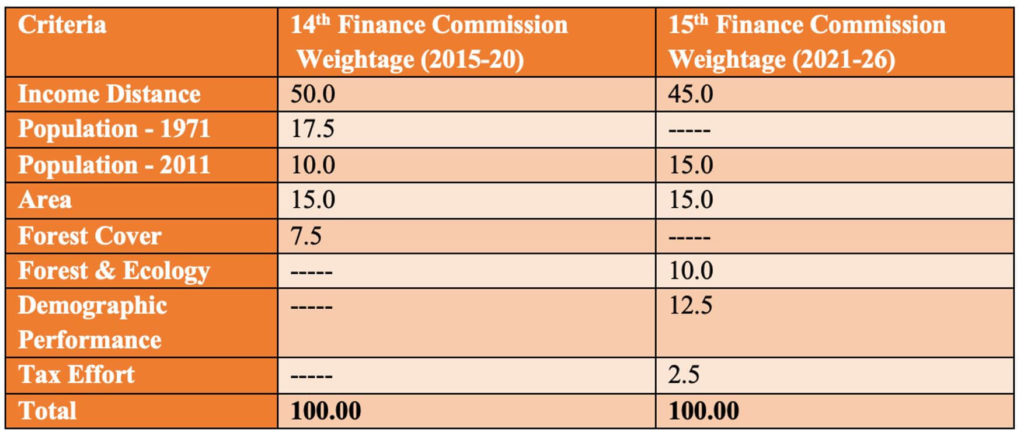

- Key criteria for horizontal devolution: For horizontal devolution, FC suggested 12.5% weightage to demographic performance, 45% to income, 15% each to population and area, 10% to forest and ecology and 2.5% to tax and fiscal efforts.

- Income Distance: Reflects a state’s income relative to the state with the highest per capita income (Haryana), aiming to maintain equity among states.

- Population: Based on the 2011 Census, replacing the earlier 1971 Census for determining weightage.

- Forest and Ecology: Considers each state’s share of dense forest in the total forest cover.

- Demographic Performance: Rewards states for efforts in controlling population growth.

- Tax Effort: Rewards states with higher tax collection efficiency.

Challenges and Issues

- Exclusion of Cess and Surcharge: Around 23% of the Centre’s gross tax receipts come from cess and surcharge, which are not part of the divisible pool, leading to disparities in revenue sharing.

- Variation in State Contributions: Some states receive less than a rupee for every rupee they contribute to Central taxes, indicating disparities in revenue distribution.

- Reduced Share for Southern States: Southern states have witnessed a decline in their share of the divisible pool over successive FCs, affecting their fiscal autonomy.

Proposed Reforms

- Expansion of Divisible Pool: Including a portion of cess and surcharge in the divisible pool could enhance revenue sharing among states.

- Enhanced Weightage for Efficiency: Increasing the weightage for efficiency criteria in horizontal devolution, such as GST contribution, can promote equitable distribution.

- Greater State Participation in FC: Establishing a formal mechanism for state participation in the FC’s constitution and functioning, akin to the GST council, can ensure a more inclusive decision-making process.

Conclusion

- Addressing issues of financial devolution requires a collaborative approach between the Centre and the States, focusing on equitable distribution and fiscal federalism.

- Reforms in revenue-sharing mechanisms, along with enhanced state participation in decision-making bodies like the FC, are essential for promoting balanced development and resource allocation across the country.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

Call for imposing Financial Emergency in Kerala

From UPSC perspective, the following things are important :

Prelims level: Financial Emergency under Article 360

Mains level: Not Much

In the news

- The Supreme Court proceeded with hearing a suit filed by the State of Kerala against the Centre for alleged arbitrary interference in its financial matters, following unsuccessful negotiations between the two parties.

- Earlier, Kerala Governor sought for the Presidential imposition of a financial emergency in the State under Article 360(1) of the Constitution due to dwindling situation of finances in the State.

What is Financial Emergency?

- Enshrined in Article 360: It is a vital provision aimed at addressing severe financial crises threatening India’s economic stability.

- Declaration and Authority: It can be declared by the President upon satisfaction that the financial stability or credit of India or any part of its territory is under threat.

- CoM Advice: The declaration is made based on the advice of the Council of Ministers, reflecting the collective responsibility of the executive branch.

Legislative Approval

- While the President can proclaim a Financial Emergency, its extension beyond two months needs approval from both Houses of Parliament.

- Once approved, it remains in effect until revoked by the President, allowing for flexible management of financial crises.

Effects and Implications

- The Centre’s executive authority expands significantly during a Financial Emergency, enabling it to issue directives to states on financial matters.

- Centralization of fiscal policies occurs, with the President empowered to reserve money bills passed by state legislatures for consideration.

- Austerity measures, including salary and allowance reductions for public officials, can be implemented to address economic challenges.

Judicial Review and Criticism

- 38th Amendment Act (1975) made the President’s decision final and immune from judicial review.

- However, the 44th Amendment Act (1978) allowed for judicial scrutiny.

- This amendment ensured checks and balances within the constitutional framework, preventing unchecked executive authority.

Historical Context and Usage

- Financial Emergencies have been sparingly invoked in India’s history, despite facing significant financial crises such as in 1991.

- The cautious utilization of this provision underscores the importance of aligning its implementation with democratic principles and federalism.

Conclusion

- The Supreme Court’s intervention in the Kerala-Centre financial dispute underscores the importance of cooperative federalism in addressing intergovernmental conflicts.

- The forthcoming hearings aim to reconcile differences and ensure the equitable distribution of resources, fostering harmonious relations between the Centre and states.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

The severe erosion of fiscal federalism

From UPSC perspective, the following things are important :

Prelims level: Fiscal deficit

Mains level: Net Borrowing Ceiling (NBC)

Central Idea:

The article discusses Kerala’s protest against the imposition of a Net Borrowing Ceiling (NBC) by the Central Government, which restricts the state’s ability to borrow funds. It argues that this imposition undermines fiscal federalism and challenges the constitutional authority of the state legislature over financial matters.

Key Highlights:

- Kerala Chief Minister Pinarayi Vijayan leads a protest against the Central Government’s imposition of a financial embargo on Kerala.

- The NBC limits states’ borrowings, including those from state-owned enterprises like the Kerala Infrastructure Investment Fund Board (KIIFB), leading to a severe financial crisis in Kerala.

- The article questions the constitutionality of including state-owned enterprises’ debt in the state’s total debt, arguing that it encroaches on the state legislature’s authority over financial matters.

- Kerala’s Fiscal Responsibility Act, 2003, aims to reduce fiscal deficit, demonstrating the state’s commitment to fiscal discipline.

- The article criticizes the move towards “annihilative federalism,” where the central government’s actions detrimentally affect states’ ability to meet welfare obligations.

Key Challenges:

- Balancing fiscal discipline with the need for states to fund development projects and welfare schemes.

- Addressing the erosion of fiscal federalism and the encroachment of central authority over state finances.

- Resolving the conflict between the powers of the central government and state legislatures regarding financial matters.

- Mitigating the impact of borrowing restrictions on states’ ability to fulfill their financial obligations.

Key Terms:

- Net Borrowing Ceiling (NBC): Limit imposed on states’ borrowings from all sources.

- Kerala Infrastructure Investment Fund Board (KIIFB): State-owned body responsible for funding infrastructure projects.

- Fiscal Responsibility Act: Legislation aimed at reducing fiscal deficit and promoting financial discipline.

- Fiscal Federalism: Distribution of financial powers and responsibilities between the central government and states.

- Annihilative Federalism: Central government actions that undermine states’ financial autonomy and welfare obligations.

Key Quotes:

- “The wide array of constitutional issues…point at the severe erosion of fiscal federalism in the country.”

- “The borrowing restrictions are an example of ‘annihilative federalism’ at play.”

Key Examples and References:

- Kerala’s protest led by Chief Minister Pinarayi Vijayan against the financial embargo imposed by the Central Government.

- The inclusion of KIIFB’s debt in Kerala’s total debt, leading to funding constraints for welfare schemes.

- Comparison of Kerala’s fiscal deficit reduction efforts with the central government’s fiscal deficit estimates.

Key Facts and Data:

- Kerala’s fiscal deficit reported to have reduced to 2.44% of the GSDP.

- Central government’s fiscal deficit estimated to be 5.8% for 2023-2024.

Critical Analysis:

The article underscores the tension between central authority and state autonomy in financial matters, highlighting the constitutional ambiguity surrounding the imposition of borrowing restrictions. It argues for a balanced approach that acknowledges states’ fiscal responsibilities while ensuring fiscal discipline.

Way Forward:

- Reevaluate the imposition of borrowing restrictions to ensure they do not unduly impede states’ ability to meet financial obligations.

- Enhance dialogue and cooperation between the central government and states to address fiscal challenges while respecting constitutional principles.

- Clarify the division of financial powers between the central government and state legislatures to mitigate conflicts and promote fiscal federalism.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

Arvind Panagariya appointed as Sixteenth Finance Commission chief

From UPSC perspective, the following things are important :

Prelims level: Finance Commission

Mains level: Read the attached story

Central Idea

- The Centre has appointed Arvind Panagariya, a renowned trade economist and former Niti Aayog vice chairman, as the chairman of the Sixteenth Finance Commission.

Who is Arvind Panagariya?

- Panagariya is a professor at Columbia University.

- He served as the first vice chairman of the Niti Aayog from 2015 to 2017, succeeding the Planning Commission.

About Finance Commission

- Establishment: The Finance Commission (FC) of India was established by the President in 1951 under Article 280 of the Indian Constitution.

- Purpose: Its primary role is to define and regulate the financial relations between the central government and the individual state governments.

- Legislative Framework: The Finance Commission (Miscellaneous Provisions) Act, 1951, further outlines the qualifications, appointment, disqualification, term, eligibility, and powers of the Finance Commission.

- Composition: Appointed every five years, the FC comprises a chairman and four other members.

- Evolution: Since the First FC, changes in India’s macroeconomic landscape have significantly influenced the Commission’s recommendations.

Constitutional Provisions

- Article 268: Facilitates the levy of duties by the Centre, with collection and retention by the States.

- Article 280: Outlines the FC’s composition, qualifications for members, and its terms of reference. It mandates the FC to recommend the distribution of net tax proceeds between the Union and States and the allocation among States. It also addresses the financial relations between the Union and States and the devolution of unplanned revenue resources.

Key Functions of the Finance Commission

- Tax Devolution: Recommends how net tax proceeds should be distributed between the Center and States.

- Grants-in-Aid: Determines the principles governing these grants to States.

- Augmenting State Funds: Advises on measures to enhance the States’ Consolidated Funds to support local bodies and panchayats, based on State Finance Commissions’ recommendations.

- Other Financial Functions: Addresses any other financial matters referred by the President.

Members of the Finance Commission

- Structure and Standards: The Finance Commission (Miscellaneous Provisions) Act, 1951, provides a structured format and global standards for the FC.

- Qualifications and Powers: Specifies rules for members’ qualifications, disqualification, appointment, term, eligibility, and powers.

- Composition: The Chairman is chosen for their experience in public affairs. The other members are selected based on their judicial experience, knowledge of government finances, administrative and financial expertise, or special economic knowledge.

Challenges for the 16th Finance Commission

- Overlap with GST Council: The coexistence with the GST Council, a permanent constitutional body, presents a new challenge.

- Conflict of Interest: Decisions by the GST Council on tax rates could impact the FC’s revenue-sharing calculations.

- Feasibility of Recommendations: While the Centre often adopts the FC’s suggestions on tax devolution and fiscal targets, other recommendations may be overlooked.

Major Outstanding Recommendations

- Fiscal Council Creation: The 15th FC proposed a Fiscal Council for collective macro-fiscal management, but the government has shown reluctance.

- Non-Lapsable Fund for Internal Security: Though the Centre agreed ‘in principle’ to establish this fund, its implementation details are pending.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

Cabinet clears terms of reference for 16th Finance Commission

From UPSC perspective, the following things are important :

Prelims level: Finance Commission

Mains level: Read the attached story

Central Idea

- The Union Cabinet approved the terms of reference (ToR) for the Sixteenth Finance Commission.

- The Commission will devise a formula for revenue sharing between the Centre and the States for the period starting April 1, 2026.

About Finance Commission

- Establishment: The Finance Commission (FC) of India was established by the President in 1951 under Article 280 of the Indian Constitution.

- Purpose: Its primary role is to define and regulate the financial relations between the central government and the individual state governments.

- Legislative Framework: The Finance Commission (Miscellaneous Provisions) Act, 1951, further outlines the qualifications, appointment, disqualification, term, eligibility, and powers of the Finance Commission.

- Composition: Appointed every five years, the FC comprises a chairman and four other members.

- Evolution: Since the First FC, changes in India’s macroeconomic landscape have significantly influenced the Commission’s recommendations.

Constitutional Provisions

- Article 268: Facilitates the levy of duties by the Centre, with collection and retention by the States.

- Article 280: Outlines the FC’s composition, qualifications for members, and its terms of reference. It mandates the FC to recommend the distribution of net tax proceeds between the Union and States and the allocation among States. It also addresses the financial relations between the Union and States and the devolution of unplanned revenue resources.

Key Functions of the Finance Commission

- Tax Devolution: Recommends how net tax proceeds should be distributed between the Center and States.

- Grants-in-Aid: Determines the principles governing these grants to States.

- Augmenting State Funds: Advises on measures to enhance the States’ Consolidated Funds to support local bodies and panchayats, based on State Finance Commissions’ recommendations.

- Other Financial Functions: Addresses any other financial matters referred by the President.

Members of the Finance Commission

- Structure and Standards: The Finance Commission (Miscellaneous Provisions) Act, 1951, provides a structured format and global standards for the FC.

- Qualifications and Powers: Specifies rules for members’ qualifications, disqualification, appointment, term, eligibility, and powers.

- Composition: The Chairman is chosen for their experience in public affairs. The other members are selected based on their judicial experience, knowledge of government finances, administrative and financial expertise, or special economic knowledge.

Challenges for the 16th Finance Commission

- Overlap with GST Council: The coexistence with the GST Council, a permanent constitutional body, presents a new challenge.

- Conflict of Interest: Decisions by the GST Council on tax rates could impact the FC’s revenue-sharing calculations.

- Feasibility of Recommendations: While the Centre often adopts the FC’s suggestions on tax devolution and fiscal targets, other recommendations may be overlooked.

Major Outstanding Recommendations

- Fiscal Council Creation: The 15th FC proposed a Fiscal Council for collective macro-fiscal management, but the government has shown reluctance.

- Non-Lapsable Fund for Internal Security: Though the Centre agreed ‘in principle’ to establish this fund, its implementation details are pending.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

Why is Bihar demanding the Special Category Status?

From UPSC perspective, the following things are important :

Prelims level: Special Category Status

Mains level: Read the attached story

Central Idea

- Recently, Bihar govt passed a resolution seeking Special Category Status (SCS) for the state.

- This demand comes in light of the revelations from the “Bihar Caste-based Survey, 2022,” which unveiled that nearly one-third of Bihar’s population continues to grapple with poverty.

Special Category Status (SCS): An Overview

- Definition: SCS is a classification conferred by the Central government to support the development of states facing geographical or socio-economic disadvantages.

- Origins: SCS was instituted in 1969, based on the recommendations of the 5th Finance Commission (FC).

- Criteria: Five criteria are assessed before granting SCS, including factors like hilly terrain, low population density, and economic backwardness.

- Historical Allocation: Initially, three states—Jammu & Kashmir, Assam, and Nagaland—were granted SCS. Subsequently, eight more states, including Himachal Pradesh and Uttarakhand, received this status.

Benefits of having SCS

- Financial Assistance: SCS states used to receive grants based on the Gadgil-Mukherjee formula, accounting for approximately 30% of total central assistance.

- Devolution of Funds: Post the abolition of the Planning Commission and the recommendations of the 14th and 15th FCs, SCS assistance has been subsumed into increased devolution of funds for all states (now 41% in the 15th FC).

- Funding Ratio: SCS states enjoy a favourable 90:10 Centre-State funding split for centrally sponsored schemes, compared to 60:40 or 80:20 for general category states.

- Additional Incentives: SCS states receive concessions in customs and excise duties, income tax rates, and corporate tax rates to attract investments.

Why Bihar’s Demand for SCS?

- Resource Challenges: Bihar attributes its poverty and underdevelopment to limited natural resources, irregular water supply for irrigation, recurring floods in the north, and severe droughts in the south.

- Industrial Shift: The state’s bifurcation led to the relocation of industries to Jharkhand, creating unemployment and investment voids.

- Per-Capita GDP: Bihar’s per-capita GDP, at around ₹54,000, consistently ranks among the lowest in India.

- Welfare Funding: Chief Minister Nitish Kumar asserts that Bihar houses approximately 94 lakh poor families and that SCS recognition would generate about ₹2.5 lakh crore, crucial for funding welfare initiatives over the next five years.

SCS Demands from Other States

- Andhra Pradesh: Since its bifurcation in 2014, Andhra Pradesh has sought SCS due to revenue loss post-Hyderabad’s transfer to Telangana.

- Odisha: Odisha’s appeal for SCS underscores its vulnerability to natural disasters, such as cyclones, and a significant tribal population (around 22%).

- Central Government’s Response: Despite these demands, the Central government, citing the 14th Finance Commission’s report, which recommended against granting SCS to any state, has consistently rejected them.

Is Bihar’s Demand Justified?

- Criteria Fulfillment: Bihar meets most SCS criteria but lacks hilly terrain and geographically difficult areas, crucial for infrastructural development.

- Alternative Solutions: In 2013, the Raghuram Rajan Committee proposed a ‘multi-dimensional index’ methodology instead of SCS, which could be revisited to address Bihar’s socio-economic challenges effectively.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

What the 16th Finance Commission needs to do differently

From UPSC perspective, the following things are important :

Prelims level: 16th Finance Commission

Mains level: 16th Finance Commission and India's fiscal federalism

What’s the news?

- India’s fiscal landscape, transformed by GST, calls for a comprehensive reevaluation of fiscal federalism to address tax-sharing challenges and regional disparities.

Central idea

- The 122nd Constitutional Amendment of 2016 and the subsequent introduction of the GST regime in 2017 reshaped India’s fiscal landscape, replacing production-based taxation with a consumption-oriented approach. This shift highlights the importance of reevaluating fiscal federalism as the 16th Finance Commission forms, addressing tax-sharing principles and regional balance in taxation.

What is meant by fiscal federalism?

- Fiscal federalism refers to the division of financial responsibilities and resources between different levels of government within a federal or decentralized system.

- It encompasses the principles and mechanisms by which revenues are generated, collected, shared, and spent by various levels of government, typically at the national (central) and subnational (state or regional) levels.

- India operates as a federal republic with a multi-tiered system of governance, and fiscal federalism is an essential aspect of this arrangement.

Potential challenges faced by the 16th Finance Commission

- Revisiting Tax-sharing Principles: The 16th Finance Commission faces the challenge of reexamining and redesigning tax-sharing principles due to the shift from production-based to consumption-based taxation under the GST regime.

- Efficient Tax Collection: Variations in the cost of tax collection (ranging from 7 to 10 percent) have emerged as a challenge, given the joint collection of taxes by the Union and states under GST.

- Redesigning Horizontal Distribution: The Commission must address the challenge of redesigning criteria for distributing the divisible pool among states to ensure equitable distribution of tax revenues and grants.

- Reviewing the Compensation Scheme: The necessity, viability, and desirability of the GST compensation scheme must be reviewed by the Commission, considering the performance of GST revenues over the past six years.

- Institutional Relationships: Establishing formalized institutional relationships between the GST Council and the Finance Commission presents a challenge in the evolving federal financial structure.

The need for a comprehensive reevaluation of India’s fiscal federalism

- Shift to the GST Regime: The introduction of the Goods and Services Tax (GST) regime represents a monumental shift in India’s taxation system. This change from a production-based tax system to a consumption-based one necessitates a reevaluation of fiscal federalism to align with this new tax paradigm.

- Impact on Vertical and Horizontal Imbalances: The transition from a production-based to a consumption-based tax system has the potential to rectify historical vertical imbalances in tax revenue distribution. However, it also introduces new horizontal imbalances among states due to varying consumption patterns and economic development levels.

- Equitable Resource Allocation: To ensure a fair distribution of resources among states, it is imperative to revisit the criteria for resource allocation. The reevaluation should consider the principles of fiscal federalism and the specific needs of each state within the GST framework.

- Efficiency and Transparency: An updated fiscal federalism framework can lead to increased efficiency and transparency in revenue collection, sharing, and utilization. This can help streamline fiscal processes and reduce inefficiencies.

- Adaptation to Changing Economic Realities: India’s economic landscape is dynamic, with evolving challenges and opportunities. A comprehensive reevaluation allows fiscal policies to adapt to these changes, ensuring they remain relevant and effective.

- Fiscal Responsibility: To ensure fiscal sustainability, a reevaluation should assess the long-term fiscal health of both the central government and state governments. It can recommend measures to manage fiscal deficits and public debt responsibly.

Way forward

- Mandate of the 16th Finance Commission: The government should promptly constitute the 16th Finance Commission with a clear mandate to reexamine the tax-sharing principles and other related fiscal matters.

- Define Comprehensive Terms of Reference (ToR): The ToR for the 16th Finance Commission should be carefully formulated to guide the Commission in addressing the challenges posed by the GST regime and its impact on fiscal federalism.

- Pooling of Indirect Tax Sovereignty: Given the significant changes in the tax landscape, the Commission should comprehensively assess the pooling of indirect tax sovereignty between the Union and states under the GST system.

- Redesign Tax-sharing Principles: The Commission should undertake a thorough review and redesign of tax-sharing principles, especially with regard to the divisible pool, unsettled IGST, and settlement frequencies, in alignment with the GST structure.

- Distribution Criteria Reevaluation: Reevaluate the criteria for distributing the divisible pool among states, particularly for equalizing grants, to ensure that they align with the new consumption-based tax system and address regional imbalances effectively.

- Formalize Institutional Relationships: Formalize and strengthen the institutional relationship between the GST Council and the Finance Commission to facilitate seamless coordination, information exchange, and alignment of fiscal policies.

- Engage with Stakeholders: Engage in extensive consultations with relevant stakeholders, including state governments, economists, and experts, to gather diverse perspectives and insights.

Conclusion

- The 16th Finance Commission must reshape India’s fiscal federalism for the GST era by redefining the divisible pool, improving tax collection efficiency, revisiting distribution criteria, reviewing compensation, and formalizing institutional relationships. Flexible terms of reference are crucial for these essential reforms to align the fiscal system with the new tax paradigm and promote equitable growth.

Also read:

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

Why normative recommendations of finance commissions remain on paper

From UPSC perspective, the following things are important :

Prelims level: Finance Commissions

Mains level: Finance Commissions and its role, recommendations and challenges in implementation

What is the news?

- This article critically examines the historical outcomes of the 13th FC and underscores the need for realistic expectations regarding the forthcoming 16th FC

Central idea

- The Finance Commissions (FC) in India play a crucial role in determining the fiscal framework for resource allocation between the Union and state governments. Established under Article 280 of the Constitution, the FCs provide recommendations on vertical devolution, horizontal distribution, and grants-in-aid. However, the effectiveness of these recommendations in achieving their intended objectives remains a matter of contention

Purpose and Scope of Finance Commissions

- Finance Commissions are constituted under Article 280 of the Constitution and their recommendations encompass three key areas: vertical devolution, horizontal distribution, and grant-in-aid.

- Vertical devolution focuses on Union to state transfers

- Horizontal distribution involves the allocation of resources between states based on a specific formula.

- Grant-in-aid, covered under Article 275, provides financial assistance to states deemed in need.

- It is important to note the distinction between grants and grant-in-aid, as the latter operates at arm’s length and offers more flexibility in terms of control.

Recommendations of the previous Finance Commission

13th Finance Commission Recommendations:

- Increase the number of court working hours using existing infrastructure.

- Enhance support to Lok Adalats.

- Provide additional funding to State Legal Services Authorities to enhance legal aid for the marginalized.

- Promote the use of Alternative Dispute Resolution (ADR) mechanisms.

- Enhance the capacity of judicial officers and public prosecutors through training programs.

- Support the creation of a judicial academy in every state for training purposes.

- Allocate funds for the setting up of specialized courts.

15th Finance Commission Recommendations:

- Gather quantifiable data on the level of various services available in different states.

- Collect corresponding unit cost data to estimate cost disabilities among states.

- Fill gaps in statistical data through the efforts of the Ministry of Statistics.

Challenges encountered in the implementation of Finance Commission recommendations

- Lack of Implementation of Homilies: The recommendations made by Finance Commissions, both at the Union and state levels, are often ignored as mere pious intentions. This indicates a lack of commitment and follow-through in translating the recommendations into concrete actions.

- Conditionalities and Expenditure Restrictions: The objections raised by some states in the article indicate challenges related to conditionalities attached to grants. Conditionalities may restrict the expenditure options of states, creating obstacles in implementing the recommended reforms.

- Inadequate Resource Allocation: The allocated funds for specific reforms may not be sufficient, leading to inadequate implementation. Financial constraints and competing budgetary priorities can limit the availability of resources needed to effectively execute the recommended measures.

- Lack of Coordination: The implementation of Finance Commission recommendations requires cooperation between the Union and state governments. Any lack of coordination or disagreements between these entities can hinder the execution of reforms

Way forward: Need for realistic expectations regarding the forthcoming 16th FC

- Acknowledging Implementation Challenges: Recognize the challenges and complexities involved in implementing Finance Commission recommendations, such as coordination issues, administrative capacity, and resistance to change. This understanding will help shape realistic expectations and strategies for addressing these challenges.

- Strengthening Implementation Mechanisms: Focus on improving the implementation mechanisms and processes. This includes enhancing coordination and cooperation between the Union and state governments, strengthening administrative capacity at all levels, and streamlining the implementation of conditionalities to facilitate smoother execution.

- Robust Monitoring and Evaluation: Establish effective monitoring and evaluation mechanisms to track the progress and outcomes of implemented reforms. Regular assessment will help identify implementation gaps and provide opportunities for course correction and improvement.

- Building Stakeholder Consensus: Foster stakeholder engagement and consensus-building to ensure the buy-in and ownership of recommended reforms. Engage relevant stakeholders, including government departments, civil society organizations, and local communities, to create a shared vision and collective commitment towards implementation.

- Learning from Past Experiences: Analyze past experiences and identify the reasons behind the limited implementation of previous recommendations. This will help inform future strategies, learning from the challenges faced and replicating successful implementation models.

- Advocacy and Public Awareness: Create awareness among the public about the importance of Finance Commission recommendations and their impact on governance and development. Foster advocacy efforts to generate public support and hold governments accountable for implementing the recommended reforms.

Conclusion

- Finance Commissions in India fulfill a critical role in determining fiscal transfers between the Union and state governments. However, the implementation of their recommendations often falls short of expectations due to various challenges and limitations. By critically analyzing the past experiences of Finance Commissions, it becomes evident that a more pragmatic approach is necessary to align expectations with the actual outcomes.

Also read:

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

Finance Commission and the Challenges of Fiscal Federalism

From UPSC perspective, the following things are important :

Prelims level: Finance commission and its role, Concepts: Cess, surcharges, grants, freebies etc

Mains level: Fiscal Federalism, challenges and the role of Finance commission

Central Idea

- The government is set to appoint a Finance Commission in the coming months to address the crucial matter of distributing the Centre’s tax revenue among the States. This article examines the significance of the Finance Commission in India’s fiscal federalism, highlighting the changing dynamics post-reforms and the ensuing debates surrounding the horizontal distribution formula.

Evolution of the Finance Commission

- Constitutional Provision: The Finance Commission is a constitutional body established under Article 280 of the Indian Constitution. It was first constituted in 1951.

- Primary Objective: The primary objective of the Finance Commission is to recommend the distribution of financial resources between the Union (Centre) and the States.

- Five-Year Cycle: The Finance Commission is appointed every five years, or as specified by the President of India. The recommendations of the Commission cover a five-year period.

- Composition: The Commission consists of a Chairman and other members appointed by the President. The Chairman is usually a person with a background in economics, finance, or public administration.

- Terms of Reference: The President determines the terms of reference for each Finance Commission, which guide the Commission in its deliberations and recommendations.

Significance of the Finance Commission in India’s fiscal federalism

- Vertical and Horizontal Distribution: The Finance Commission determines the vertical share, which is the proportion of the Centre’s tax revenue that should be given to the States, ensuring a fair allocation of resources. It also formulates the horizontal sharing formula, which determines how this revenue should be distributed among the States.

- Addressing Fiscal Disparities: The Finance Commission plays a crucial role in addressing these disparities by providing financial transfers to less economically developed states. Through revenue deficit grants and other means, the Commission helps bridge the fiscal gap and supports states with limited revenue-raising capacity.

- Promoting Cooperative Federalism: The Finance Commission acts as an institutional mechanism that fosters cooperative federalism by facilitating intergovernmental fiscal transfers. It encourages collaboration and coordination between the Centre and the States, fostering a sense of shared responsibility in fiscal matters.

- Constitutional Mandate: The Finance Commission is constitutionally mandated under Article 280 of the Indian Constitution. Its existence and functioning are enshrined in the constitutional framework, ensuring its independence and impartiality in making recommendations.

- Five-Year Review Cycle: The regular appointment of the Finance Commission every five years ensures a periodic review of the fiscal arrangements between the Centre and the States. This allows for adjustments and revisions based on evolving economic and social realities, ensuring that fiscal transfers remain relevant and effective.

- Expertise and Recommendations: The Finance Commission comprises experts in the fields of economics, finance, and public administration. Its recommendations are based on in-depth analysis, consultations, and assessments of various factors, including population, fiscal capacity, and development needs. These recommendations provide valuable insights and guidance to the Centre and the States in fiscal decision-making.

- Resolving Fiscal Conflicts: The Finance Commission helps resolve conflicts and disputes between the Centre and the States regarding fiscal matters. By providing an independent and objective platform for negotiation and deliberation, it promotes a sense of fairness and transparency in fiscal resource allocation.

- Strengthening Fiscal Discipline: The Finance Commission plays a role in promoting fiscal discipline and accountability. By assessing the fiscal performance and needs of the States, it encourages responsible fiscal behavior and discourages imprudent spending practices

Facts for Prelims

| Aspect | Vertical Distribution | Horizontal Distribution |

| Definition | Allocation of the Centre’s tax revenue between the Centre and the States | Allocation of funds among the States |

| Determined by | Finance Commission | Finance Commission |

| Factors considered | Fiscal capacity, needs of the States, population figures, and relevant indicators | Population, area, fiscal capacity, demographic trends, development indicators, and relevant parameters |

| Objective | Provide a fair and equitable share of revenue to the States | Promote equitable development and address regional imbalances |

| Purpose | Ensure States have sufficient resources for expenditure requirements and promote balanced development | Provide greater financial support to States with lower fiscal capacity and greater development needs |

| Focus | Centre-State distribution of revenue | State-State distribution of funds |

| Outcome | Ensures fair allocation of revenue between the Centre and the States | Reduces disparities and fosters balanced growth among the States |

Changing dynamics post reforms

- Decreased Role of Plan Financing: In the pre-reform era, the Centre had the flexibility to compensate States through plan financing. However, post-reforms, there has been a decline in fresh investments in public sector undertakings (PSUs) and the abolition of the Planning Commission in 2014. As a result, the Finance Commission has become the primary mechanism for the vertical and horizontal distribution of resources, making its role more critical.

- Devolution of Tax Revenues: With the amendment of the Constitution in 2000, States were given a share in the Centre’s tax revenue pool. This devolution of tax revenues has increased the significance of the Finance Commission in determining the distribution of funds between the Centre and the States.

- Shift in Population Figures: The use of population figures in determining the distribution of resources has seen a shift from the earlier practice of using 1971 census data to considering 2011 census data. This shift has led to debates and controversies, particularly among States that have successfully controlled population growth rates, as it can affect their share of devolution.

- Deepening Faultlines: In recent years, faultlines between States have deepened along political, economic, and fiscal dimensions. The outcome of elections and regional disparities in terms of infrastructure, private investment, social indicators, and the rule of law have widened the north-south gap and brought regional imbalances into focus. Managing these faultlines while ensuring equitable distribution poses challenges for the Finance Commission.

- Concerns of Fiscal Incapacity vs. Fiscal Irresponsibility: The Finance Commission faces the challenge of determining the extent to which a State’s deficit is due to its fiscal incapacity or fiscal irresponsibility. Striking a balance between supporting deficit-ridden States without penalizing fiscally responsible ones is a complex task, as providing more to one State would mean giving less to others.

- Changing Economic Landscape: The post-reform period has witnessed shifts in India’s economic landscape, with some states experiencing higher growth rates and greater fiscal capacity compared to others. This dynamic requires the Finance Commission to consider the changing economic realities and ensure that the distribution formula reflects the current context

Addressing the concerns related to cesses and surcharges

- Clear Guidelines: The Finance Commission should lay down clear guidelines on when and under what circumstances cesses and surcharges can be levied. These guidelines should ensure that cesses and surcharges are not used as routine measures but rather as exceptional instruments to address specific needs or challenges.

- Cap on Amount Raised: The Finance Commission can suggest a formula or mechanism to cap the amount that can be raised through cesses and surcharges. This would prevent excessive reliance on these instruments and ensure that they do not become a substantial portion of the Centre’s total tax revenue.

- Transparency and Accountability: The government should enhance transparency and accountability in the utilization of funds generated through cesses and surcharges. It should provide regular reports on the utilization of these funds, demonstrating how they contribute to the intended purposes and benefit the states and the overall economy.

- Consultation with States: The Finance Commission should engage in extensive consultations with states while formulating guidelines regarding cesses and surcharges. States should have the opportunity to provide their input, share their concerns, and suggest ways to strike a balance between the Centre’s revenue requirements and the states’ financial autonomy.

- Alignment with Fiscal Responsibility: Any levies on cesses and surcharges should be in line with the principles of fiscal responsibility and budget management. The Finance Commission can ensure that these instruments are used judiciously and do not undermine the fiscal discipline goals set by the FRBM Act.

- Review and Evaluation: Regular review and evaluation of the impact of cesses and surcharges should be conducted to assess their effectiveness in achieving the intended objectives. The Finance Commission can play a crucial role in monitoring the usage of these instruments and recommending necessary adjustments based on the evaluation outcomes.

Implementing restraint on freebies

- Clear Definition: Establishing a clear definition of what constitutes a freebie is crucial to avoid ambiguity and misuse of resources. It should encompass measures that go beyond essential public services and infrastructure development and instead focus on non-essential giveaways or subsidies.

- Fiscal Responsibility and Budgetary Constraints: The Finance Commission can emphasize the importance of adhering to fiscal responsibility guidelines and staying within budgetary constraints. This ensures that resources are allocated judiciously and in a sustainable manner, avoiding the accumulation of unsustainable debt.

- Prioritization of Essential Services: Encouraging governments to prioritize essential public services, such as healthcare, education, and infrastructure, over non-essential freebies. This ensures that resources are allocated to areas that have a more significant and long-lasting impact on the overall well-being and development of the population.

- Evaluation of Impact: Regular evaluation of the impact of freebies on the economy, fiscal health, and the intended beneficiaries is essential. This evaluation can help identify any unintended consequences, potential wastage of resources, or negative effects on economic growth.

- Public Awareness and Discourse: Creating public awareness about the implications of excessive freebies and the importance of responsible fiscal management. Encouraging open discourse and dialogue among citizens, policymakers, and experts can foster a deeper understanding of the long-term consequences of unsustainable giveaways.

- Role of the Finance Commission: The Finance Commission can play a pivotal role in setting guidelines and recommendations for restraint on freebies. This includes providing advice on responsible fiscal management and ensuring that resource allocation aligns with long-term development goals.

Conclusion

- The Finance Commission plays a crucial role in India’s fiscal federalism. To address concerns regarding cesses, surcharges, and freebies, the Commission must provide clear guidelines, ensure transparency, and emphasize long-term fiscal sustainability. Stakeholder consultation, periodic evaluation, and public awareness are key to maintaining a balance between meeting welfare needs and promoting responsible fiscal management.

Also read:

| The curious case of Fiscal Federalism in India |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Finance Commission – Issues related to devolution of resources

16th Finance Commission to be constituted in November

From UPSC perspective, the following things are important :

Prelims level: Finance Commission

Mains level: Read the attached story