Oil and Gas Sector – HELP, Open Acreage Policy, etc.

What are Strategic Petroleum Reserves (SPR)?

Why in the News?

India is planning to establish six new Strategic Petroleum Reserve (SPR) sites to boost energy security amid rising global oil risks.

About Strategic Petroleum Reserves (SPR):

- Overview: SPRs are emergency stockpiles of crude oil maintained by the government to manage supply disruptions caused by events like wars, embargoes, or price shocks.

- Purpose: To ensure national energy security and reduce vulnerability to external supply shocks.

- Historical Context: India realised the need for SPRs after the 1990 Gulf War, which caused supply cuts and spiking oil prices and ultimately the Balance of Payment (BoP) Crisis.

- Foundation: The SPR project began in the early 2000s based on advice from the Planning Commission’s Integrated Energy Policy.

- Governing Body: In 2004, the government set up Indian Strategic Petroleum Reserves Limited (ISPRL) as a Special Purpose Vehicle under the Oil Industry Development Board (OIDB).

- India’s three-pronged oil security framework:

-

- Commercial oil stocks by public and private oil marketing companies (OMCs).

- Strategic reserves by ISPRL for emergencies.

- Equity oil assets abroad through companies like ONGC Videsh Ltd. (OVL).

- Storage: Unlike commercial stocks, SPRs are stored in underground rock caverns, which are safer, more secure, and suited for long-term preservation.

Current SPR Infrastructure:

- SPR Locations: India has three active SPR sites:

- Visakhapatnam (Andhra Pradesh)

- Mangaluru (Karnataka)

- Padur (Karnataka)

- Total Capacity: The combined SPR capacity is 5.33 MMT or roughly 39 million barrels.

- Coverage Duration: This reserve can meet about 9.5 days of India’s daily oil requirement (≈5.5 million barrels/day).

- Distinction from OMC Stocks: These strategic stocks are separate from commercial stocks held by companies like IOCL, HPCL, and BPCL.

Planned Expansion of SPRs in India:

- Goal: India aims to double SPR capacity due to rising geopolitical risks and import dependence.

- New Facilities Planned:

- Chandikhol (Odisha) – 4 MMT (in two phases)

- Padur Phase II (Karnataka) – 2.5 MMT

- 6 new SPR locations are being planned at various sites, including Mangalore SEZ (Karnataka) and salt caverns in Bikaner (Rajasthan).

- Future Capacity: After expansion, India’s total SPR stock will be 11.83 MMT, covering around 22 days of national demand.

- Strategic Vision: The long-term objective is to build up 90 days of oil reserves, in line with International Energy Agency (IEA) guidelines.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

The ongoing oil price tensions

Why in the News?

In May 2025, Saudi Arabia led OPEC+ to reverse previous production cuts, sparking a full-fledged oil price war—a new form of global conflict fought aggressively over barrels of crude oil rather than through military aggression.

What is OPEC+?OPEC+ is a group consisting of the Organization of the Petroleum Exporting Countries (OPEC) plus several non-OPEC oil-producing countries that coordinate their oil production policies to manage global oil supply and influence prices. Key points about OPEC+:

|

What led OPEC+ to increase oil production in May 2025?

- Ineffectiveness of previous cuts: Despite voluntary output cuts of 2.2 million barrels per day (bpd) by eight members in 2023 (including a collective cut of 5 million bpd earlier), oil prices kept declining.

- Oversupply & competition: New producers (e.g., Brazil, Guyana, shale oil players) increased their market share, reducing OPEC+’s control.

- Saudi frustration: Overproduction by OPEC+ members like Kazakhstan, Iraq, UAE, and Nigeria undermined collective output discipline.

- Market flooding strategy: To discipline overproducers and regain market share, Saudi Arabia led a reversal in strategy, increasing output (411,000 bpd) starting June 2025.

- Preemptive move: Anticipating return of major sanctioned producers (Iran, Venezuela, Russia), OPEC+ may be frontloading production before supply increases further.

Why is Saudi Arabia called a “swing producer”?

- Large spare production capacity: It can increase or decrease output swiftly to influence global oil prices.

- Stabilizing role: Prefers stable and moderately high prices to ensure consistent oil revenue.

- Historical precedence: Has previously launched price wars (1985–86, 1998, 2014–16, 2020) to discipline the market and punish overproducers.

- Current context: Took the largest voluntary cut (3 million bpd) in 2024, but shifted to increasing output as a strategic move to reassert influence.

Who are the key oil producers under U.S. sanctions?

|

How does the oil price war affect India’s economy?

- Lower Import Bill and Fiscal Savings: Falling oil prices reduce India’s import costs significantly. Eg: In 2024–25, India spent $137 billion on crude imports. A $1 drop in global oil prices can save India roughly $1.5 billion annually.

- Reduced Export Earnings from Petroleum Products: India exports refined petroleum products, a top export item. Lower crude prices reduce global demand and margins for these exports. Eg: Refinery margins decline, affecting companies like Reliance Industries and Indian Oil Corporation, and reducing foreign exchange earnings.

- Negative Impact on Gulf Economies and Remittances: Gulf countries face revenue drops, leading to reduced infrastructure spending and job losses for Indian expatriates. Eg: Over 9 million Indians work in the Gulf, sending home more than $50 billion in remittances annually. Job losses or salary cuts can hurt India’s balance of payments.

- Lower Tax Revenues from Oil Sector: As oil prices drop, the government earns less in excise duties, royalties, and other taxes from oil and gas sales. Eg: The petroleum sector contributes significantly to India’s tax base—lower prices reduce collections, affecting fiscal planning and public spending.

- Strained Bilateral Economic Ties with Oil Exporters: Economic decline in oil-exporting countries (like Saudi Arabia, UAE, and Nigeria) affects India’s project exports, bilateral trade, and inbound investments. Eg: Indian companies working on infrastructure projects in Gulf countries may face payment delays or cancellations due to budgetary constraints in host nations.

Way forward:

- Diversify Energy Sources and Boost Renewables: Reduce dependency on crude oil imports by accelerating adoption of renewable energy, energy efficiency, and alternative fuels like hydrogen and biofuels to enhance energy security.

- Strengthen Economic Resilience and Diplomatic Engagement: Build strategic petroleum reserves, improve fiscal buffers, and deepen diplomatic ties with diverse energy suppliers to better manage supply shocks and geopolitical risks.

Mains PYQ:

[UPSC 2013] It is said the India has substantial reserves of shale oil and gas, which can feed the needs of country for quarter century. However, tapping of the resources doesn’t appear to be high on the agenda. Discuss critically the availability and issues involved.

Linkage: It focuses on the potential of unconventional sources like shale oil/gas within India, which could impact its energy security and reduce dependence on imports influenced by global price tensions.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

Cabinet approves Mechanism for procurement of ethanol by Public Sector Oil Marketing Companies (OMCs) under EBP Programme

From UPSC perspective, the following things are important :

Mains level: Ethanol Production ;

Why in the News?

The Cabinet Committee on Economic Affairs (CCEA) has approved a revision in the ethanol procurement price for Public Sector Oil Marketing Companies (OMCs) for the Ethanol Supply Year (ESY) 2024-25.

What is the significance of the Price Revision?

The recent revision of the ethanol procurement price for Public Sector Oil Marketing Companies (OMCs) is significant for several reasons:

- Price Stability and Remuneration: The increase from ₹56.58 to ₹57.97 per litre ensures price stability and provides a more remunerative rate for ethanol suppliers, which is crucial for maintaining a steady supply of ethanol.

- Support for Sugarcane Farmers: The separate payment of Goods and Services Tax (GST) and transportation charges will benefit sugarcane farmers, enhancing their income and encouraging production.

- Meeting Blending Targets: The 3% increase in the price is aimed at ensuring adequate availability of ethanol to meet the ambitious blending target of 20% by 2025-26, advancing from the original target of 2030.

- Reducing Crude Oil Dependency: This initiative is part of a broader strategy to reduce India’s dependency on crude oil imports, leading to substantial foreign exchange savings and environmental benefits.

What is Ethanol Blended Petrol (EBP)?

The Ethanol Blended Petrol (EBP) Programme is a government initiative aimed at promoting the blending of ethanol with petrol to create a more sustainable and environmentally friendly fuel option.

- OMCs are currently blending up to 20% ethanol with petrol, which helps reduce reliance on imported crude oil and lowers carbon emissions.

- Ethanol blending has dramatically increased from 38 crore litres in the Ethanol Supply Year (ESY) 2013-14 to 707 crore litres in ESY 2023-24, achieving an average blending rate of 14.60%.

- The programme has resulted in estimated savings of over ₹1,13,007 crore in foreign exchange and has substituted approximately 193 lakh metric tonnes of crude oil over the past decade.

What are other initiatives taken to promote biofuels?

|

Way forward:

- Strengthen Feedstock Supply Chain: Enhance agricultural productivity and diversify feedstock sources including maize and non-food biomass, to ensure a stable and sustainable ethanol supply.

- Expand Infrastructure and Investments: Develop ethanol storage, blending, and distribution networks while encouraging private sector participation through financial incentives and policy support.

Prelims PYQ:

[2013] With reference to the usefulness of the by-products of the sugar industry, which of the following statements is/are correct?

- Bagasse can be used as biomass fuel for the generation of energy.

- Molasses can be used as one of the feedstocks for the production of synthetic chemical fertilizers.

- Molasses can be used for the production of ethanol.

Select the correct answer using the codes given below.

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

What is OPEC+?

From UPSC perspective, the following things are important :

Prelims level: OPEC+

Why in the News?

- With Donald Trump potentially returning to the White House, OPEC+ delegates express concern over higher US oil production.

- His administration’s focus on deregulating the energy sector could lead to increased oil output, contributing to a further erosion of OPEC+’s market share.

About ‘Organization of the Petroleum Exporting Countries’ Plus (OPEC+)

| What is OPEC+? | Formation and Purpose:

OPEC Members:

Non-OPEC Members in OPEC+:

Global Influence: OPEC+ countries together produce approximately 40% of the world’s crude oil and control about 80% of the world’s proven oil reserves. |

| Factors are influencing OPEC+’s oil production cuts |

|

| Implications of OPEC+’s policies |

|

PYQ:[2009] Other than Venezuela, which one among the following from South America is a member of OPEC? (a) Argentina |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

Green hydrogen and the financing challenge

From UPSC perspective, the following things are important :

Mains level: Significance and issues related to hydrogen;

Why in the news?

India aims to produce 5 million metric tonnes of green hydrogen annually by 2030 to lead in the sector and reduce emissions, but the high costs of financing may hinder this goal.

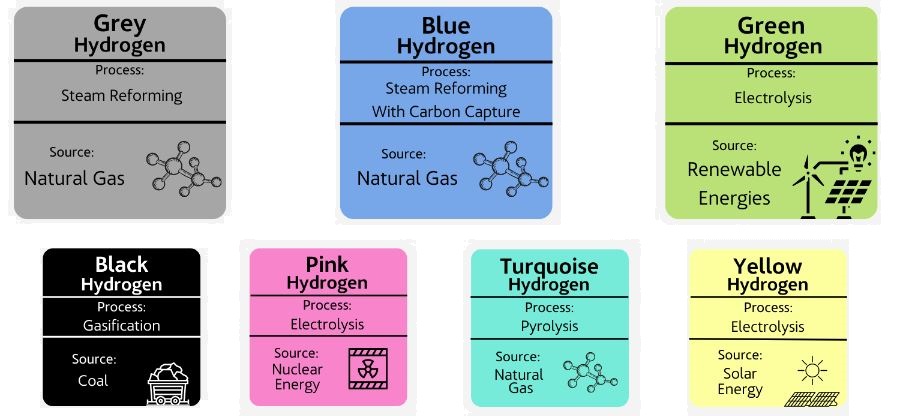

Hydrogen fuel comes in three types:

What are the key financial barriers to scaling green hydrogen production?

|

How can innovative financing mechanisms be developed?

- Blended Finance Models: Combining public and private capital can help lower risks and make investments in green hydrogen more attractive. Government-backed financial instruments or concessional loans can reduce borrowing costs, lowering WACC.

- Green Bonds and Climate Financing: The issuance of green bonds to raise capital for renewable energy projects can provide long-term funding at lower costs. These bonds can appeal to investors with an interest in sustainable investments.

- Private-Public Partnerships (PPP): Collaborations between government and private sectors can help mitigate risks and ensure the financing of green hydrogen projects. To attract private investors, governments can provide financial support through incentives, subsidies, or tax breaks.

- Carbon Credits and Offtake Agreements: Green hydrogen projects could leverage carbon credits or long-term offtake agreements to secure steady revenue streams, which would increase investor confidence and help finance production scale-up.

What role do policy frameworks play in facilitating investment in green hydrogen?

- Incentives and Subsidies: Government policies offering subsidies, tax incentives, or feed-in tariffs can help offset the high initial costs of green hydrogen production and encourage private investment.

- Long-Term Policy Clarity: Clear, stable, and long-term policy frameworks provide certainty to investors, reducing perceived risks and lowering the cost of capital. Such policies could include long-term targets for green hydrogen production, financing support, and infrastructure development.

- Regulatory Support for Innovation: Governments can encourage innovation by providing regulatory frameworks that support new technologies, such as electrolyzers and advanced hydrogen storage solutions, ensuring the rapid scaling of green hydrogen.

- Market Creation and Demand-Driven Initiatives: Policies that create demand for green hydrogen, such as mandatory usage targets for industries like steel, transportation, or chemicals, can drive off-take agreements and ensure market stability.

Mains PYQ:

Q Describe the major outcomes of the 26th session of the Conference of the Parties (COP) to the United Nations Framework Convention on Climate Change (UNFCCC). What are the commitments made by India in this conference? (2021)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

How Oilfields Amendment Bill aims to delink petroleum, mineral oil production from mining activities

From UPSC perspective, the following things are important :

Mains level: Oilfields in India;

Why in the News?

The Rajya Sabha passed the Oilfields (Regulation and Development) Amendment Bill, 2024, aimed at boosting domestic petroleum and mineral oil production while encouraging private investment to reduce reliance on imports.

What is the Oilfields Bill?

|

What are the major proposed changes?

- Definition of Mineral Oils: The Bill expands the definition of “mineral oils” to include naturally occurring hydrocarbons such as crude oil, natural gas, coal bed methane, and shale gas/oil. However, it explicitly excludes coal, lignite, and helium from this definition.

- Introduction of Petroleum Leases: The Bill replaces references to “mining leases” with “petroleum leases,” defining these leases as agreements for various activities including exploration and production of mineral oils. Existing mining leases will remain valid under this new framework.

- Decriminalization of Offences: The Bill removes criminal penalties for violations of the Oilfields Act, replacing them with financial penalties. For instance, violations that previously could lead to imprisonment will now incur fines up to ₹25 lakh, with additional daily penalties for ongoing violations.

- Central Government Powers: The Bill empowers the central government to create rules regarding the granting and regulation of petroleum leases, including aspects like environmental protection and dispute resolution mechanisms.

- Encouragement of Private Investment: It includes provisions aimed at attracting private investment into the sector by ensuring stable lease terms and clarifying regulatory frameworks.

What are the criticisms and concerns?

- Impact on State Rights: Critics, including members from the DMK party, argue that the Bill undermines state rights regarding taxation on mining activities. They fear that redefining leases could shift regulatory power away from states to the central government, potentially affecting state revenue from royalties.

- Legal Challenges: There are concerns that framing petroleum operations under a different legal category could lead to conflicts with existing judicial rulings that affirm state powers over mining taxes. A recent Supreme Court ruling emphasized that states have exclusive rights to tax mining activities.

- Environmental Concerns: Opposition members have raised alarms about the potential environmental impacts of allowing greater private sector involvement in petroleum extraction. They advocate for prioritizing public sector companies like ONGC over private entities.

Way forward:

- Balanced Federal Approach: Establish a collaborative mechanism between the Centre and states to address concerns over taxation and royalties, ensuring equitable revenue sharing while maintaining clear regulatory roles.

- Sustainable Exploration Framework: Mandate robust environmental safeguards and prioritize public sector leadership alongside private investment to balance economic growth with ecological preservation.

Mains PYQ:

Q “In spite of adverse environmental impact, coal mining is still inevitable for Development”. Discuss. (UPSC IAS/2017)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

Windfall Gains Tax on Oil Production, Diesel-Petrol Export Removed

From UPSC perspective, the following things are important :

Prelims level: Windfall Gains Tax

Why in the News?

With global oil prices stabilizing and domestic fuel supply improving, the government has decided to scrap the windfall gains tax, ensuring more predictable taxation for the oil industry.

What is Windfall Tax?

- A windfall tax is a levy imposed on companies experiencing unexpected profits due to external factors like market shifts or crises.

- In India, it was introduced on July 1, 2022, targeting domestic crude oil production and exports of diesel, petrol, and ATF.

- The tax aimed to capture windfall profits and ensure adequate domestic fuel supply amid rising global prices after Russia’s invasion of Ukraine.

- The tax was imposed as Special Additional Excise Duty (SAED) on crude oil, and Additional Excise Duty (AED) or Road and Infrastructure Cess (RIC) on fuel exports.

- Initially, the tax was Rs 23,250 per tonne on crude oil, Rs 13 per litre on diesel exports, and Rs 6 per litre on petrol and ATF exports.

- The tax was regularly reviewed based on global oil price fluctuations.

Impact of Removing Windfall Tax

- Stable Tax Environment: Boosts predictability, encouraging long-term investments in oil production.

- Revenue Decline: The tax was generating less revenue, falling from Rs 25,000 crore in FY 2022-23 to Rs 6,000 crore in FY 2024-25.

- Oil Companies’ Profitability: Increased profits for producers like ONGC and Reliance Industries as they no longer pay the levy.

- Encourages Domestic Production: Promotes higher domestic oil production and exploration.

- Policy Confidence: Signals that India is confident in stable global oil prices and future supply.

PYQ:[2020] The term ‘West Texas Intermediate’, sometimes found in news, refers to a grade of: (a) Crude oil (b) Bullion (c) Rare earth elements (d) Uranium |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

[pib] India’s first modern Compressed Biogas (CBG) Plant

From UPSC perspective, the following things are important :

Prelims level: Compressed Biogas (CBG)

Why in the News?

PM Modi inaugurated the 100 TPD cattle dung-based Compressed Bio-Gas (CBG) plant in Gwalior.

About the CBG Plant

Working features:

|

What is Compressed Biogas (CBG)?

| Details | |

| About |

|

| Process of Making CBG |

|

| Significance of CBG |

|

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

Government scraps Windfall Tax on Crude Oil

From UPSC perspective, the following things are important :

Prelims level: Windfall Tax

Why in the News?

The Government of India has scrapped the windfall tax on crude oil, which was previously set at ₹1,850 per tonne.

What is Windfall Tax?

| Details | |

| Definition | A higher tax levied on companies that earn unexpected and extraordinary profits due to external factors. |

| Purpose | To capture a portion of excess profits from industries benefiting from global price surges, such as oil. |

| Imposition in India | Imposed as a Special Additional Excise Duty (SAED) on crude oil production and exports of diesel, petrol, and aviation turbine fuel (ATF). |

| Dynamic Tax Rate | Revised every 15 days based on international oil prices in the preceding fortnight. |

| First Imposed | July 1, 2022, during the Russia-Ukraine conflict and post-COVID recovery. |

| Application | Applies to domestically produced crude oil and exports of diesel, petrol, and ATF. |

| Reasons for Imposing |

|

| Benefits |

|

India’s Crude Oil Trade:

|

PYQ:[2020] The term ‘West Texas Intermediate’, sometimes found in news, refers to a grade of: (a) Crude oil (b) Bullion (c) Rare earth elements (d) Uranium [2017] Petroleum refineries are not necessarily located nearer to crude oil producing areas, particularly in many of the developing countries. Explain its implications. (250 words) |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

US overtaskes UAE as India’s second largest LNG supplier

From UPSC perspective, the following things are important :

Prelims level: Data related to LNG import

Mains level: Trade dynamics related to LNG

Why in the news?

In 2023, the US surpassed the UAE to become India’s second-largest supplier of liquefied natural gas (LNG), providing 3.09 million tonnes (MT).

World LNG Report 2024 by International Gas Union (IGU)

- US as a Major Supplier: The report highlights that the United States has displaced the UAE to become India’s second-largest supplier of liquefied natural gas (LNG) in 2023, with shipments reaching 3.09 million tonnes (MT).

- Trade Growth: The US supplied India with 1.8 MT of LNG in 2019, which increased to 3.86 MT in 2021, indicating a significant rise in trade volume despite a decrease in 2022 due to rising prices.

- Qatar’s Dominance: Qatar remained India’s largest LNG supplier from 2019 to 2023, with shipments peaking at 10.92 MT in 2023, reflecting its consistent role in India’s energy supply.

- The decline of African Suppliers: The report notes a significant decline in LNG shipments from African nations, particularly Nigeria and Angola, which saw their exports to India drop from pre-pandemic levels of around 2.7 MT and 2.9 MT, respectively, to just 0.73 MT each in 2023.

Present trade dynamics

- Price Sensitivity: Indian companies remain price-sensitive, with LNG imports being contingent on competitive pricing. Analysts suggest that if LNG prices stay below $12 per mBtu, there could be significant growth in imports.

- Geographical Advantage: The proximity of US LNG cargoes to India via the Cape of Good Hope makes it more cost-effective for sellers to export to India compared to North Asia.

- Long-term Contracts: Ongoing long-term contracts signed by Indian entities with US suppliers continue to underpin LNG consumption, despite fluctuations in global prices.

Use of LNG in India:

|

What can be done?

- Strengthening Domestic Policies: India could benefit from reforms in domestic gas policies, including greater transparency over LNG inventory levels and improvements in gas pipeline capacity, to enhance the efficiency of LNG imports and distribution.

- Creating Price Stability: The need to establish a stronger index link between LNG import prices and domestic gas prices could mitigate price risks for LNG importers, ensuring that long-term contracts remain aligned with market conditions.

- Enhancing Infrastructure: Govt. should invest in LNG infrastructure, including regasification terminals and transportation networks, which can facilitate increased imports and improve supply chain efficiency.

- Diversifying Supply Sources: To reduce dependency on specific regions, India should explore diversifying its LNG supply sources, including potential agreements with emerging suppliers in different regions.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

[pib] Green Ammonia Production under SIGHT Program

From UPSC perspective, the following things are important :

Prelims level: Green Ammonia, SIGHT Program, National Green Hydrogen Mission.

Why in the News?

- Solar Energy Corporation of India (SECI) has initiated the bidding process for a total capacity of 5.39 lakh Metric Tonnes (MT) per annum of Green Ammonia production.

- The initiative falls under Mode 2A of the Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme, part of the National Green Hydrogen Mission led by the Ministry of New & Renewable Energy (MNRE).

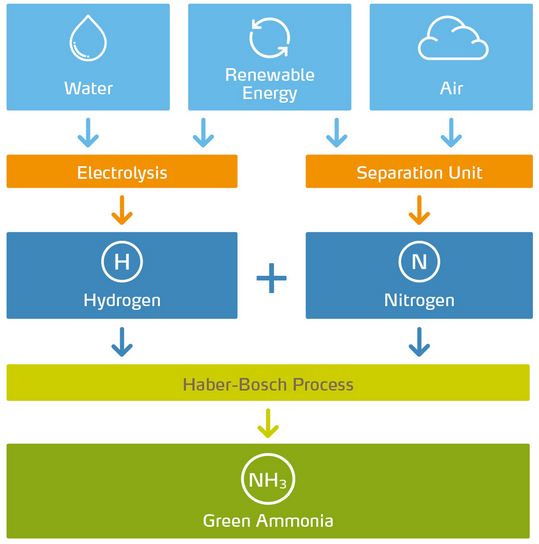

What is Green Ammonia?

|

About the National Green Hydrogen Mission

- The National Green Hydrogen Mission was launched in January 2023.

- Objective: To make India a ‘global hub’ for using, producing and exporting green hydrogen.

- Earlier, the National Hydrogen Mission was launched on August 15, 2021, with a view to cutting down carbon emissions and increasing the use of renewable sources of energy.

- The Ministry of New and Renewable Energy (MNRE) formulates the scheme guidelines for the implementation of these missions.

Key features of the NGHM

- Power capacity: The mission seeks to promote the development of a green hydrogen production capacity of at least 5 MMT per annum with an associated renewable energy capacity addition of about 125 GW in the country by 2030.

- Job creation: It envisages an investment of over ₹8 lakh crore and creation of over 6 lakh jobs by 2030.

- Reducing energy import bill: It will also result in a cumulative reduction in fossil fuel imports of over ₹1 lakh crore and abatement of nearly 50 MMT of annual greenhouse gas emissions by 2030.

- Export promotion: The mission will facilitate demand creation, production, utilisation and export of green hydrogen.

- Incentivization: Under the Strategic Interventions for Green Hydrogen Transition Programme (SIGHT), distinct financial incentive mechanisms are provided.

- Green Hydrogen Hubs: Regions capable of supporting large-scale production and/or utilisation of hydrogen will be identified and developed as Green Hydrogen Hubs.

What is the SIGHT Program?

- In the initial stage, two distinct financial incentive mechanisms proposed with an outlay of ₹ 17,490 crore up to 2029-30:

- Incentive for manufacturing of electrolysers

- Incentive for production of green hydrogen.

- Depending upon the markets and technology development, specific incentive schemes and programmes will continue to evolve as the Mission progresses.

PYQ:[2019] Consider the following statements:

Which of the statements given above is/are correct? (a) 1 and 3 only (b) 2 and 3 only (c) 2 only (d) 1, 2 and 3 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

GAIL inaugurates 10 MW Green Hydrogen Plant in Madhya Pradesh

From UPSC perspective, the following things are important :

Prelims level: Green Hydrogen; the National Green Hydrogen Mission

Why in the news?

GAIL (India) Ltd has commissioned its first green hydrogen plant at Vijaipur in Madhya Pradesh, marking a significant step for the nation’s largest natural gas transmission and distribution firm into new and alternate energy sources.

About Vijaipur Green Hydrogen Plant

Major Objective: Hydrogen Blending

|

What is Green Hydrogen?

- Green hydrogen is produced through electrolysis, where electricity derived from renewable sources, such as solar or wind power, is used to split water molecules into hydrogen and oxygen.

- Since it relies on renewable energy, green hydrogen production has no direct emissions of CO2 or other greenhouse gases.

What is the Green Hydrogen Standard?

- Definition of Green Hydrogen: It has defined green hydrogen as having a well-to-gate emission – including water treatment, electrolysis, gas purification, drying and compression of hydrogen – of not more than 2 kg CO2 equivalent per kg of hydrogen produced.

- Nodal Agency: The Bureau of Energy Efficiency, Ministry of Power, will be the nodal authority for green hydrogen production projects.

Back2Basics: National Green Hydrogen Mission, 2023

|

Significance of Hydrogen Energy

Types of HydrogenHydrogen extraction methods are classified into three types based on their processes: Grey, Blue, and Green etc.

|

PYQ:[2023] Consider the following heavy industries:

Green hydrogen is expected to play a significant role in decarbonizing how many of the above industries? (a) Only one [2023] With reference to green hydrogen, consider the following statements:

How many of the above statements are correct? (a) Only one |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

The Socio-ecological effects of LPG price hikes

From UPSC perspective, the following things are important :

Prelims level: Government Initiatives and Programmes;

Mains level: Issues related to affordability of LPG gas;

Why in the News?

The ACCESS survey (2014-2015), conducted by the Council on Energy, Environment and Water, found LPG’s cost to be the foremost barrier to its adoption and continued use in rural poor households.

Government Initiatives for LPG Fuel:

- Government Initiatives: The Indian government has promoted using LPG (liquefied petroleum gas) as a clean cooking fuel, particularly in rural households.

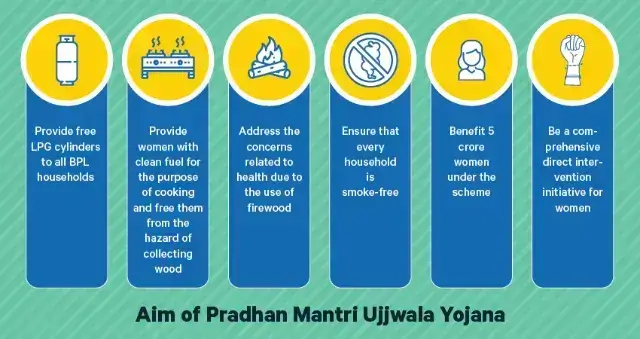

- These initiatives include the Rajiv Gandhi Gramin LPG Vitrak scheme, the ‘PAHAL’ scheme for direct benefit transfers, and the Pradhan Mantri Ujjwala Yojana (PMUY) aimed at providing LPG connections to below-poverty-line households.

- Subsidies and Incentives: The government has provided subsidies and incentives to encourage the adoption of LPG without subsidies for the people who can afford it.

- For example, the ‘Give it Up’ program encouraged consumers to voluntarily surrender their LPG subsidies, which were transferred to below-poverty-line households.

Challenges:

- Affordability: Despite government efforts, the affordability of LPG remains a challenge for many households, especially those in rural and below-poverty-line communities. Reports indicate that LPG prices in India were among the highest globally around ₹300/litre.

- Dependency on Traditional Fuels: Studies, such as the one conducted in the Jalpaiguri district of West Bengal, highlight the continued dependency of local communities on traditional fuelwood for cooking.

- Forest Dependency: The persistent use of fuelwood has implications for forest conservation and livelihoods, particularly in regions with degraded forests like Jalpaiguri.

Way Forward:

- Need for Comprehensive Solutions: While government initiatives have aimed to promote LPG use, addressing affordability issues and ensuring access to clean cooking fuels for marginalized communities require comprehensive solutions.

- Targeted Subsidies: Implement targeted subsidies for LPG cylinders to make them more affordable for rural and below-poverty-line communities. These subsidies can be based on income levels or geographic locations to ensure that those most in need receive assistance.

Mains PYQ:

Q In what way could replacement of price subsidy with direct benefit Transfer (DBT) change the scenario of subsidies in India? Discuss.(UPSC IAS/2015)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

The Clean Energy Transition has become messy

From UPSC perspective, the following things are important :

Prelims level: Major Global happenings; USA and European countries;

Mains level: Sustainable Development; Issues with the Petroleum Industry in the Global Market;

Why in the news?

The war in the Middle East, Russia, and Ukraine, and sanctions by the US have eventually resulted into a fragmented market in the petroleum industry.

Causes of Fragmentation in the Petroleum Industry:

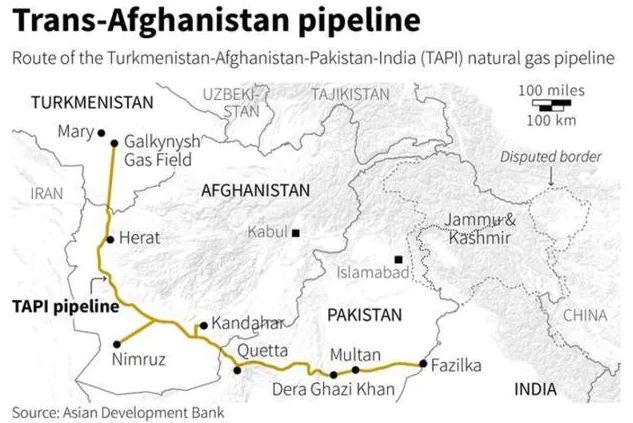

- Impact of Sanctions: The sanctions imposed by the US on countries like Venezuela, Iran, and Russia have led to a fragmentation of the petroleum market, with trading relations becoming more regional than global. This fragmentation has reshaped the dynamics of oil supply and demand, with different regions relying on specific suppliers based on geopolitical circumstances and sanctions

- Regional Trading Patterns: Trading relations in the petroleum industry have shifted regionally, with the US emerging as a major supplier of LNG and products in Europe, Russia becoming the largest supplier of crude to India, and Iran focusing on exports to China despite Western sanctions. This regionalization of trade has altered traditional market dynamics and diversified supply chains.

- Challenges Faced by Oil Companies: International petroleum majors are experiencing solid profits due to higher production and prices of oil and gas. However, they are confronted with the need to reconcile their investment strategies with net zero carbon emission targets. This balancing act poses a significant challenge for oil companies as they navigate between profitability and sustainability goals

- Geopolitical Uncertainties: The ongoing conflicts in the Middle East, particularly between Israel and Iran, have added to the complexities of the petroleum market. The region, which holds a significant portion of the world’s petroleum reserves, is facing a mix of warfare, racism, and radicalism, contributing to heightened tensions and uncertainties in the oil industry

- AI Industry’s Energy Demand: Increasing energy demand from the artificial intelligence (AI) industry for data centers, cloud storage facilities, and crypto mining. This growing demand for electricity poses a challenge as renewables may not be able to meet the requirements, leading to a dilemma for industry leaders committed to achieving net zero carbon emissions.

What needs to be done?

- Diversification of Energy Sources: To mitigate the impact of geopolitical uncertainties and sanctions-induced market fragmentation, there is a need for countries to diversify their energy sources.

- Strengthening Regional Cooperation: Regional cooperation agreements and partnerships can help stabilize petroleum markets and ensure energy security.

- Promotion of Energy Efficiency: Improving energy efficiency across various sectors, including transportation, manufacturing, and residential buildings, can reduce overall energy consumption and lessen dependence on petroleum products.

Mains PYQ:

Q Discuss the multi-dimensional implications of uneven distribution of mineral oil in the world. (UPSC IAS/2021)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

Centre Directs Gas-Based Power Plants To Begin Operations Amid Rising Summer Demand

From UPSC perspective, the following things are important :

Prelims level: Status of Gas based plants in India; Section 11 (Electricity Act, 2003);

Mains level: Significance of Gas-Based Plants;

Why in the News?

- The Central government has issued directives under Section 11 of the Electricity Act, of 2003 to all gas-based generating stations to ensure Maximum Power Generation.

- This section empowers the Central/state government to specify the operation of generating stations in extraordinary circumstances.

Why India Needs Gas-based Plants?

- Electricity Demand in India: India faces a surge in electricity demand, especially during the upcoming summer season. The government has instructed gas-based power plants to commence operations to address this demand surge.

- Optimizing Power Availability: The directive aims to optimize power availability from gas-based generating stations during the anticipated high-demand period, similar to measures taken for imported-coal-based power plants.

- Ideal Transitioning Fuel: Gas-based power plants can be an ideal transition fuel for the shift from coal-based generation to renewable energy in the Indian power sector. They can provide the necessary flexibility and reliability to the grid as the share of renewable energy increases.

- Targets: The Indian government has set a target of increasing the share of non-fossil fuel, especially renewables, in power generation to 50% by 2030, and gas-based power plants can play a crucial role in achieving this target.

Challenges in building Gas-based Infrastructure:

- Underutilized Capacity: Despite having considerable capacity, gas-based generating stations remain underutilized, primarily due to commercial considerations.

- Non-availability of Affordable Fuel: India’s gas-based power plants are either stranded or operating at sub-optimal levels due to the non-availability of affordable fuel

- Lack of Domestic Gas Supply: The limited domestic gas supply has forced gas-based power producers to depend on LNG to meet their fuel needs, but the high cost of LNG has increased the variable cost of power, making it difficult to schedule in merit order dispatch

- Dependence on Imports: With barely half of the current gas consumption coming from local production, dependence on gas-based power plants can only be interim and not a long-term solution.

Initiatives taken by the Government:

- Setting up biogas plants: The Ministry of New and Renewable Energy, Government of India, launched the Biogas program to set up biogas plants for various applications, including power generation.

- Use of gas-based power for peaking and balancing: The government will use some gas-based power to meet the country’s peaking and balancing needs during the summer of 2024.

- Increasing gas-based power generation: The government wants the share of gas-based power to rise to 15% of India’s total installed power generation capacity.

Way forward:

- Diversification of fuel sources: Encourage the exploration and development of domestic gas reserves to reduce reliance on imported gas and mitigate price volatility.

- Investment in infrastructure: Develop infrastructure for transporting gas efficiently across the country to ensure a steady and reliable supply to power plants.

- Policy support: Provide long-term policy certainty and incentives for investment in gas-based power generation, including tax breaks, subsidies, and assured purchase agreements.

Mains PYQ

Q Environmental Impact Assessment studies are increasingly undertaken before a project is cleared by the Government. Discuss the environmental impacts of coal-fired thermal plants located at coal pitheads. (UPSC IAS/2014)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

How are hydrocarbons extracted from under the ground? | Explained

From UPSC perspective, the following things are important :

Prelims level: Hydrocarbons;

Mains level: The extraction of Hydrocarbons;

Why in the news?

The geological processes, extraction methods, and environmental impact of hydrocarbon extraction.

BACK2BASICSWhere are Hydrocarbons located?

|

How Hydrocarbons are extracted?

The extraction of hydrocarbons, such as oil and gas, has several negative impacts on the environment:

- Damage to Marine Life and Ecosystems: The extraction process can lead to the release of toxic substances and chemicals, which can harm marine life and ecosystems. This can lead to the death of fish, birds, and other marine animals, as well as the destruction of habitats.

- Deforestation and Destruction of Flora: The search for hydrocarbon deposits often involves the clearing of large areas of land, which can lead to deforestation and the destruction of plant life. This can have a significant impact on local ecosystems and biodiversity.

- Water Pollution: The extraction process can lead to the contamination of groundwater and surface water.

- Destruction of Fertile Land: The extraction process can destroy fertile land, which can have serious consequences for agriculture and food production. This can lead to soil erosion, desertification, and the loss of biodiversity.

Renewable sources that can serve as alternatives for hydrocarbons include:

- Hydroelectricity: This is the most significant renewable energy source at 6% of the global total

- Solar Energy: Solar power is a promising renewable energy source that can be harnessed using solar panels to convert sunlight into electrical energy. The solar power development sector is the fastest-growing renewable energy sector in the U.S

- Wind Energy: Wind turbines can generate electricity from wind power, and this technology is becoming increasingly popular and efficient

- Biomass Energy: Biomass energy can be derived from organic materials such as wood, agricultural waste, and municipal solid waste.

- Geothermal Energy: Geothermal energy is generated and stored in the Earth’s crust. This energy source can be used for heating, cooling, and electricity generation

- Renewable Natural Gas (RNG): RNG is a pipeline-quality gas that can be utilized by utilities interchangeably with conventional natural gas. RNG can be produced from methane waste sources such as farm and landfills

Conclusion: Hydrocarbons, found in subterranean rock formations, are extracted using petroleum geology techniques. Extraction poses environmental risks like marine damage, deforestation, and water pollution. Renewable alternatives include hydroelectric, solar, wind, biomass, geothermal energy, and renewable natural gas.

Mains PYQ:

Q Do you think India will meet 50 percent of its energy needs from renewable energy by 2030? Justify your answer. How will the shift of subsidies from fossil fuels to renewables help achieve the above objective? Explain.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

[pib] National Green Hydrogen Mission

From UPSC perspective, the following things are important :

Prelims level: National Green Hydrogen Mission

Mains level: NA

Why in the news?

- The Ministry of New & Renewable Energy has unveiled Guidelines for the implementation of an R&D Scheme under the National Green Hydrogen Mission.

- The scheme aims to catalyze advancements in the production, storage, transportation, and utilization of green hydrogen, with a focus on affordability, efficiency, safety, and reliability.

Hydrogen Energy: A Backgrounder

|

About National Green Hydrogen Mission (NGHM)

- The National Green Hydrogen Mission was launched in January 2023 to make India a ‘global hub’ for using, producing and exporting green hydrogen.

- Earlier, the National Hydrogen Mission was launched on August 15, 2021, with a view to cutting down carbon emissions and increasing the use of renewable sources of energy.

- The Ministry of New and Renewable Energy (MNRE) formulates the scheme guidelines for implementation of these missions.

Key features of the NGHM

- Power capacity: The mission seeks to promote the development of green hydrogen production capacity of at least 5 MMT per annum with an associated renewable energy capacity addition of about 125 GW in the country by 2030.

- Job creation: It envisages an investment of over ₹8 lakh crore and creation of over 6 lakh jobs by 2030.

- Reducing energy import bill: It will also result in a cumulative reduction in fossil fuel imports of over ₹1 lakh crore and abatement of nearly 50 MMT of annual greenhouse gas emissions by 2030.

- Export promotion: The mission will facilitate demand creation, production, utilisation and export of green hydrogen.

- Incentivization: Under the Strategic Interventions for Green Hydrogen Transition Programme (SIGHT), two distinct financial incentive mechanisms targeting domestic manufacturing of electrolysers and production of green hydrogen will be provided under the mission.

- Green Hydrogen Hubs: Regions capable of supporting large-scale production and/or utilisation of hydrogen will be identified and developed as Green Hydrogen Hubs.

Types of HydrogenHydrogen extraction methods are classified into three types based on their processes: Grey, Blue, and Green.

|

PYQ:[2010]Hydrogen fuel cell vehicles produce one of the following as “exhaust”: (a) NH3 (b) CH4 (c) H2O (d) H2O2

[2023]With reference to green hydrogen, consider the following statements: 1. It can be used directly as a fuel for internal combustion. 2. It can be blended with natural gas and used as fuel for heat or power generation. 3. It can be used in the hydrogen fuel cell to run vehicles. How many of the above statements are correct? (a) Only one (b) Only two (c) All three (d) None |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

[pib] International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE)

From UPSC perspective, the following things are important :

Prelims level: Hydrogen Fuel Cell and its Working, IPHE

Mains level: Hydrogen as a alternate fuel

Why in the news-

- The 41st Steering Committee Meeting of the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE) is being convened in New Delhi.

- The IPHE Steering Committee Meetings held biannually serve as a crucial platform for fostering international collaboration and coordination among member countries, stakeholders, and decision-makers.

What is a Fuel Cell?

Working of a Hydrogen Fuel Cell

|

About IPHE

- The IPHE was established in 2003 as an international inter-governmental partnership led by the US.

- It aims to accelerate progress in hydrogen and fuel cell technologies.

- IPHE comprises 21 member countries and the European Commission as a non-voting member.

- Member countries include major economies such as the United States, Japan, Germany, China, South Korea, and Canada, among others including India.

- Additionally, the United Kingdom, Russia, and Singapore have also been mentioned in various contexts within the provided sources but are NOT explicitly listed as members of IPHE.

Objectives of the IPHE

- Faster Transition: IPHE aims to facilitate and accelerate the transition to clean and efficient energy and mobility systems using hydrogen and fuel cell technologies across different applications and sectors.

- Information Sharing Platform: The partnership provides a platform for sharing information on member country initiatives, policies, technology status, safety, regulations, codes, standards, and outreach efforts.

- Advancing Clean Hydrogen Technologies: IPHE promotes a sustainable future by highlighting the versatility of hydrogen in various industries and its role in decarbonizing energy systems.

Key Initiatives: H2-DEIA Platform

- In 2023, IPHE announced the launch of the H2-DEIA platform in partnership with the Hydrogen Council.

- It is dedicated to advancing diversity, equity, inclusion, and accessibility (DEIA) within the hydrogen and fuel cell economy.

- It aims to foster a diverse workforce, share best practices, and support workforce development in the hydrogen sector.

PYQ:

Q.With reference to ‘Fuel Cells’ in which hydrogen-rich fuel and oxygen are used to generate electricity, consider the following statements:

- If pure hydrogen is used as a fuel, the fuel cell emits heat and water as by-products.

- Fuel cells can be used for powering buildings and not for small devices like laptop computers.

- Fuel cells produce electricity in the form of Alternating Current (AC).

Which of the statements given above is/are correct? (CSP 2015)

- 1 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Practice MCQ:

Regarding the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE), consider the following statements:

- IPHE is an international inter-governmental partnership based on the auspices of the United Nations.

- India is a member of IPHE.

Which of the given statements is/are correct?

- Only 1

- Only 2

- Both 1 and 2

- Neither 1 nor 2

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

India’s First Cattle Dung-based Bio-CNG Station in Gujarat

From UPSC perspective, the following things are important :

Prelims level: Cattle Dung-based Bio-CNG

Mains level: NA

In the news

- Nestled along the Deesa-Tharad highway in Gujarat’s Banaskantha district lies India’s pioneering gas-filling station, seemingly unremarkable at first glance.

- However, this station, powered by cattle and buffalo dung, marks a significant leap in renewable energy innovation.

Fuel Production from Dung: A Technological Marvel

- Innovative Concept: The ‘BioCNG’ outlet in Dama village of Deesa taluka stands as India’s sole gas-filling station utilizing cattle and buffalo dung.

- Daily Operations: The outlet serves 90-100 vehicles daily, selling 550-600 kg of gas generated from 40 tonnes of dung processed at an adjacent plant.

- Dung Utilization: Approximately 40,000 kg of dung are sourced daily from 2,700-2,800 animals belonging to 140-150 farmers residing within a 10 km radius of the plant.

Understanding the Dung-to-Fuel Process

- Biogas Production: Fresh dung, rich in methane and water, undergoes anaerobic digestion in a sealed vessel, yielding raw biogas.

- Purification Process: The raw biogas undergoes purification to remove impurities like CO2 and H2S, resulting in compressed biogas (CBG) suitable for vehicle use.

- Production Output: From 40 tonnes of dung, the plant generates 2,000 cubic meters of raw biogas containing 55-60% methane, 35-45% CO2, and 1-2% hydrogen sulphide (H2S) and moisture.

Dual Benefits: Fuel and Fertilizer

- Fuel Value: CBG is sold at the station for Rs 72/kg, offering a renewable and eco-friendly alternative to traditional fuels.

- Fertilizer Production: The process also yields bio-fertilizer, enriching soil health and providing an additional income stream for farmers.

- Fertilizer Sales: The Banaskantha Union markets 8,000-10,000 kg of bio-fertilizer daily, with phosphate-rich organic manure (PROM) fetching Rs 15-16/kg and compost Rs 8-10/kg.

Significance: Decentralized Model for Sustainable Agriculture

- Community Involvement: The initiative engages local farmers, who supply dung to the plant, fostering community participation and economic empowerment.

- Replicability and Scalability: The model holds potential for replication across districts and states, offering a scalable solution for energy and agricultural needs.

- Investment Plans: The Banaskantha Union plans to commission four additional 100-tonnes capacity plants by 2025, with a total investment of Rs 230 crore.

Conclusion

- The establishment of India’s first dung-based gas-filling station represents a significant stride towards renewable energy adoption and agricultural sustainability.

- As technology continues to evolve, decentralized models like these hold promise for transforming rural economies while mitigating environmental impact.

- With ongoing support and investment, such initiatives can pave the way for a greener and more resilient future.

Try this PYQ from CSE Prelims 2019:

Q.In the context of proposals to the use of hydrogen-enriched CNG (H-CNG) as fuel for buses in public transport, consider the following statements:

- The main advantage of the use of H-CNG is the elimination of carbon monoxide emissions.

- H-CNG as fuel reduces carbon dioxide and hydrocarbon emissions.

- Hydrogen up to one-fifth by volume can be blended with CNG as fuel for buses.

- H-CNG makes the fuel less expensive than CNG.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 4 only

(d) 1, 2, 3 and 4

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

How LPG subsidy can be redesigned to privilege low-income households

From UPSC perspective, the following things are important :

Prelims level: Pradhan Mantri Ujjwala Yojana (PMUY)

Mains level: challenges faced by low-income households in India in accessing LPG

Central Idea:

The article highlights the challenges faced by low-income households in India in accessing LPG refills despite government subsidies under the Pradhan Mantri Ujjwala Yojana (PMUY). It suggests reforms to the existing subsidy program to make it more effective, including on-time subsidy transfers and the use of digital payment solutions.

Key Highlights:

- The Pradhan Mantri Ujjwala Yojana (PMUY) aims to provide LPG access to low-income households in India.

- Despite subsidies, many households still rely on biomass for cooking due to liquidity constraints.

- Existing subsidy policies have evolved rapidly, but they may not adequately address the needs of PMUY households.

- Data analysis reveals that PMUY consumers are sensitive to the amount and timing of refill subsidies.

- Upfront subsidies, like those provided during the Pradhan Mantri Garib Kalyan Yojana (PMGKY), can significantly increase LPG usage.

- Fin-tech solutions, such as electronic subsidy transfers and digital vouchers, can alleviate the financial burden of refill purchases.

Key Challenges:

- Ensuring subsidy benefits reach the intended beneficiaries without leakage.

- Addressing liquidity constraints faced by low-income households.

- Educating households about subsidy timing and logistics.

- Overcoming credit constraints, especially for daily wage earners.

- Implementing digital payment solutions effectively in rural areas.

Main Terms or keywords for answer writing:

- LPG (Liquefied Petroleum Gas)

- PMUY (Pradhan Mantri Ujjwala Yojana)

- PAHAL (Pratyaksh Hanstantrit Labh)

- PMGKY (Pradhan Mantri Garib Kalyan Yojana)

- Fin-tech (Financial Technology)

- e-RUPI (Electronic Rupee)

Important Phrases for quality enrichment of mains answer:

- Liquidity constraint

- Direct benefit transfer

- Upfront subsidy

- Digital voucher

- Electronic payment

- Delayed subsidy transfer

Quotes for value addition:

- “Low-income households are sensitive to the amount and timing of refill subsidy.”

- “An upfront subsidy transfer can increase the demand for LPG refills significantly.”

- “Digital payment solutions hold promise in alleviating the financial burden of refill purchases.”

Anecdotes:

- The Pradhan Mantri Garib Kalyan Yojana (PMGKY) saw a spike in LPG consumption among low-income households during the period of upfront subsidy provision.

Useful Statements:

- “Ensuring subsidy benefits reach the intended beneficiaries without leakage is crucial for the success of LPG subsidy programs.”

- “Digital payment solutions can address liquidity constraints and improve access to LPG refills for low-income households.”

Examples and References:

- Data from Indore district reveals the sensitivity of PMUY consumers to refill market prices and subsidy amounts.

- The success of the Pradhan Mantri Garib Kalyan Yojana (PMGKY) in increasing LPG usage among low-income households serves as a relevant example.

Facts and Data:

- Before PMUY, a high percentage of rural households in India used biomass for cooking.

- PMUY households have lower LPG refill consumption compared to non-PMUY households.

- A significant increase in refill subsidy decreases monthly consumption by about 25% for PMUY consumers.

Critical Analysis:

- The article effectively identifies the challenges hindering the effectiveness of LPG subsidy programs for low-income households.

- It provides data-driven insights into consumer behavior and the impact of subsidy policies.

- The proposed fin-tech solutions offer practical approaches to address liquidity constraints and improve subsidy delivery.

Way Forward:

- Implement electronic payment solutions and digital vouchers to facilitate on-time subsidy transfers.

- Educate households about subsidy timing and logistics to improve awareness.

- Continuously monitor and evaluate subsidy programs to ensure effectiveness and address any emerging challenges.

- Collaborate between government ministries, fin-tech companies, and local stakeholders to implement reforms successfully.

By addressing these challenges and implementing innovative solutions, India can enhance LPG access for low-income households and accelerate its energy transition goals.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

India to be biggest driver of global oil demand beyond China by 2027: IEA

From UPSC perspective, the following things are important :

Prelims level: International Energy Agency (IEA)

Mains level: Read the attached story

Introduction

- India’s burgeoning economy is poised to become a significant player in global oil demand, with projections indicating that it will outpace China by 2027.

- The International Energy Agency (IEA) forecasts robust growth in India’s oil demand, driven primarily by industrial expansion and increasing mobility.

About International Energy Agency (IEA)

| Details | |

| Nature | Autonomous inter-governmental organisation within the OECD framework |

| Mission | Works with governments and industry to shape a secure and sustainable energy future for all |

| Establishment | Founded in 1974 to ensure the security of oil supplies |

| Origin | Created in response to the 1973-1974 oil crisis |

| Membership | Consists of 31 member countries and eleven association countries |

| Criteria for Membership |

|

| India’s Membership | Joined as an Associate member in 2017 |

| Key Reports Published | World Energy Outlook, World Energy Balances, Energy Technology Perspectives, World Energy Statistics, Net Zero by 2050. |

India’s Projected Growth in Oil Demand

- Dominance in Oil Demand Growth: India is expected to surpass China as the biggest driver of global oil demand growth by 2027, according to the IEA.

- Magnitude of Increase: The IEA projects an increase of nearly 1.2 million barrels per day (bpd) in India’s oil demand by 2023, contributing to over a third of the global demand growth by the end of the decade.

- Key Drivers: Diesel consumption emerges as the primary driver of India’s oil demand growth, accounting for nearly half of the nation’s demand rise and a significant portion of global demand growth.

- Sectoral Analysis: While jet-kerosene demand is expected to grow substantially, petrol demand is projected to increase moderately due to the electrification of India’s vehicle fleet.

Factors Influencing Demand Growth

- Impact of EVs and Biofuels: Increased penetration of electric vehicles (EVs), energy efficiency measures, and growth in biofuels consumption are anticipated to mitigate around 500,000 bpd of additional oil demand by 2030.

- Role of EVs: EV penetration alone is projected to displace 200,000 bpd of oil demand by 2030.

Why such a forecast for surge?

- Rising Crude Oil Imports: India’s crude oil imports are expected to surge by over a fourth to 5.8 million bpd by 2030, driven by robust demand growth and declining domestic production.

- Limited Domestic Production: Despite efforts to attract foreign investment, domestic crude oil production is projected to decline steadily, further increasing import dependence.

- Strategic Petroleum Reserves (SPRs): India is enhancing its capacity to respond to oil supply disruptions through strategic petroleum reserves.

- Importance of SPRs: These reserves help mitigate the impact of emergencies on energy supplies and ensure oil resilience in case of market disruptions.

Major Policy Initiatives for Oil Import Cut

- Urja Sangam 2015: In March 2015, the PM inaugurated ‘Urja Sangam 2015,’ aiming to boost India’s energy security. Stakeholders were urged to increase domestic oil and gas production to reduce import dependence from 77% to 67% by 2022 and further to 50% by 2030.

- Production Sharing Contract (PSC) Regime: The government introduced policies like PSC, Discovered Small Field Policy, Hydrocarbon Exploration and Licensing Policy (HELP), and New Exploration Licensing Policy (NELP) to incentivize domestic production.

- Ethanol Blending Programme (EBP): India promotes the EBP to reduce crude oil imports, cut carbon emissions, and boost farmers’ incomes. The target for 20% ethanol blending in petrol (E20) was advanced to 2025 from 2030, expediting ethanol adoption as an alternative fuel.

Way Forward

- Diversification Strategies: India must focus on diversifying its energy mix and promoting alternative fuels to reduce reliance on oil imports.

- Investment in Renewable Energy: Accelerated investment in renewable energy sources such as solar and wind power can mitigate the growth in oil demand and enhance energy security.

- Policy Initiatives: Robust policy measures are essential to incentivize energy efficiency, promote electric mobility, and encourage sustainable practices in the transport sector.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

SIGHT Program for Green Hydrogen Transition

From UPSC perspective, the following things are important :

Prelims level: SIGHT Program

Mains level: Read the attached story

Introduction

- The Union Ministry of New and Renewable Energy (MNRE) has embarked Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme within the National Green Hydrogen Mission.

SIGHT Programme: An Overview

- Mission Alignment: SIGHT is an integral component of the National Green Hydrogen Mission, strategically designed to foster domestic electrolyser manufacturing and green hydrogen production.

- Financial Commitment: A substantial investment of Rs 17,490 crore has been allocated to SIGHT until 2029-30.

- Dual Incentive Mechanisms: SIGHT introduces two distinct financial incentive mechanisms:

-

- Incentive for Electrolyser Manufacturing: To boost the production of essential electrolysis equipment.

- Incentive for Green Hydrogen Production: Encouraging the generation of clean and sustainable green hydrogen.

- Adaptive Evolution: The incentive schemes and programs will evolve in response to market dynamics and technological advancements, ensuring the Mission’s adaptability.

- Execution Authority: The Solar Energy Corporation of India (SECI) is entrusted with executing the scheme, driving its effective implementation.

About National Green Hydrogen Mission

- Strategic Implementation: Launched by the MNRE, the mission commits an outlay of ₹ 19,744 crore from FY 2023–24 to FY 2029–30.

- Global Hub for Green Hydrogen: The overarching aim is to position India as a global hub for the production, utilization, and export of green hydrogen and its derivatives.

- Vision for 2030:

-

- Production Capacity: India’s green hydrogen production capacity is projected to reach 5 million metric tons (MMT) per annum, diminishing fossil fuel imports and saving ₹1 lakh crore by 2030.

- Economic Impact: The mission anticipates attracting over ₹8 lakh crore in investments and generating employment for more than 6 lakh people.

- Carbon Emission Reduction: A targeted production and utilization of green hydrogen is expected to avert nearly 50 MMT per annum of CO2 emissions.

- Pilot Projects: The Mission encompasses support for pilot initiatives in low-carbon steel, mobility, shipping, and ports.

- Flexible Allocations: The Mission allocates resources for various sub-components like SIGHT, pilot projects, research and development (R&D), enabling the funding of selected projects.

- State-Wide Impact: While the Mission has no state-wise allocation, its broad scope promises nation-wide benefits.

Significance of Green Hydrogen

- Eco-Friendly Production: Green hydrogen is produced through electrolysis, splitting water into hydrogen and oxygen using renewable energy sources like solar, wind, or hydropower.

- A Sustainable Fuel: This process yields a clean, emission-free fuel with immense potential to supplant fossil fuels and mitigate carbon emissions.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

India’s First Oil Production in Krishna-Godavari Basin

From UPSC perspective, the following things are important :

Prelims level: Krishna-Godavari Basin

Mains level: Read the attached story

Introduction

- Oil and Natural Gas Corporation (ONGC) commenced its ‘first oil production’ from the deep-water block in the Krishna Godavari (KG) basin off the Bay of Bengal on the Kakinada coast.

First Crude Oil Production: Significance

- Location: The oil extraction is taking place 30 kilometres off the coast of Kakinada, in the Krishna Godavari basin.

- Initial Production Phase: Currently, four out of 26 wells are operational.

- Production Forecast: By May or June, the production is expected to reach 45,000 barrels per day, accounting for 7% of India’s total crude oil production.

- Gas Production Outlook: Alongside oil, the project also anticipates contributing significantly to India’s gas output.

About Krishna-Godavari Basin and its Natural Resources

| Details | |

| Location | Eastern coast of India |

| Geological Setting | Rift basin formed during the Mesozoic era |

| Sedimentary Fill | Primarily composed of sedimentary rocks |

| Tectonic Evolution | Went through phases of rifting, subsidence, and sedimentation |

| Stratigraphy | Includes Krishna Formation, Godavari Formation, Cauvery Formation, and more |

| Source Rocks | Organic-rich shales and mudstones |

| Reservoir Rocks | Typically sandstones and limestone formations |

| Trap Structures | Anticlines, fault traps, stratigraphic pinch-outs, and more |

| Major Discoveries | KG-D6 Block (Dhirubhai-1 and Dhirubhai-3 fields) |

| Exploration and Production | Companies like Reliance Industries, ONGC, GAIL, and others are active |

| Land Size | Approximately 15,000 square kilometers |

| Geomorphological Units | Upland plains, coastal plains, recent flood plains, and delta plains |

| Notable Gas Discovery | ONGC made the first gas finding in 1983 in the D-6 block, noted for India’s largest natural gas reserves |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

How the psychology of Benjamin Netanyahu, Joe Biden and MBS is driving oil prices

From UPSC perspective, the following things are important :

Prelims level: Brent Oil

Mains level: impact of oil price fluctuations

Central idea

The article highlights the unpredictability of the international oil market, challenging conventional predictions due to a complex interplay of geopolitical, economic, and psychological factors. It underscores the significance of leaders’ personal challenges and decisions, particularly those of Netanyahu, Biden, and MBS, in shaping current market dynamics.

Key Highlights:

- Unpredictability of Oil Market: Predicting the international oil market is challenging due to factors beyond supply, demand, and geopolitics, including exchange rates, financial speculation, and human psychology.

- Recent Market Trends: Despite Middle East tensions, the oil price (Brent) did not sharply increase as expected, standing at $81 on December 1, influenced by factors like stable supply, new discoveries, and a slowdown in Chinese demand.

- Non-fundamental Drivers: The article argues that the current market conditions are shaped more by the psychology of key leaders, including Benjamin Netanyahu, Joe Biden, and Mohammed bin Salman, than the traditional fundamentals of demand and supply.

Key Challenges:

- Psychological Drivers: The dominant market drivers are identified as the personal challenges and state of mind of key leaders, potentially impacting their decisions in response to Middle East turmoil.

- Systemic Position vs. Personal Factors: While leaders hold a systemic position at the cross-section of geopolitics and geoeconomics, their current state of mind is considered more crucial in influencing the petroleum market.

Key Terms and Phrases:

- Brent Oil Price: Mention of the Brent oil price standing at $81 on December 1.

- Systemic Position: Leaders’ roles at the intersection of geopolitics and geoeconomics in the international oil market.

- Psychology of Leaders: The impact of the personal challenges and mental states of leaders like Netanyahu, Biden, and MBS on market dynamics.

Key Quotes:

- “Dominant drivers of market conditions today are not the fundamentals of demand and supply, but the non-fundamentals, the psychology of leaders.”

- “Might we not be experiencing the deceptive calm that precedes a volatile storm?”

Key Statements:

- Fundamentals vs. Non-fundamentals: The article questions whether the current market conditions are sustainable, highlighting the potential influence of leaders’ psychology over traditional supply and demand fundamentals.

- Deceptive Calm: Raises the possibility that the calm in the oil market may be deceiving, suggesting an impending volatile shift.

Key Examples and References:

- Recent Middle East Tensions: Refers to the attack by the Al Qassam brigade and the potential impact on oil prices, contrasting with the unexpected stable market conditions.

- US Troops Casualties: Hypothetical scenario of US troops being killed in Syria and Iraq, prompting debates on military responses with implications for oil prices.

Key Facts and Data:

- Oil Discoveries: Mentions recent oil discoveries in Brazil and Guyana, along with increasing US shale oil production.

- Chinese Economic Slowdown: Highlights the slowing demand for oil due to the slackening Chinese economy.

Critical Analysis:

- Leaders’ Influence: Emphasizes the potential impact of leaders’ personal challenges and decisions on the trajectory of the petroleum market, suggesting a shift from traditional market dynamics.

- Unpredictability of Oil Market: Acknowledges the difficulty in predicting the oil market, attributing it to a combination of fundamental and non-fundamental factors.

Way Forward:

- Contingency Actions: Encourages decision-makers to contemplate contingency actions based on two alternative scenarios: rising oil prices or a significant drop, suggesting strategic petroleum reserve buildup and streamlined trading norms for arbitrage opportunities in anticipation.

- Strategic Petroleum Reserves: Given the uncertainty in the oil market, India should accelerate efforts to build and expand its strategic petroleum reserves, providing a buffer against potential supply disruptions or price volatility.

- Strategic Collaboration: Explore collaborative efforts with key oil-producing nations to strengthen energy security, fostering partnerships that ensure stable and reliable oil supplies.

- Investment in Renewable Energy: Accelerate investments in renewable energy sources to reduce dependence on volatile oil markets, promoting sustainability and environmental conservation.

- Energy Efficiency Measures: Implement stringent energy efficiency measures across industries and sectors to mitigate the impact of oil price fluctuations and contribute to a more resilient energy landscape.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

Centre announces phased introduction of Biogas Blending for domestic use

From UPSC perspective, the following things are important :

Prelims level: Biogas , Natural Gas, LPG

Mains level: Read the attached story

Central Idea

- The Centre plans to enhance its domestic energy sustainability by introducing mandatory blending of compressed biogas (CBG) with Natural Gas.

Mandatory Biogas Blending

This initiative aims to reduce the country’s reliance on natural gas imports and lower emissions.

- Initial Phase (April 2025): The mandatory blending of CBG with natural gas will begin at 1%. This blend will be suitable for use in automobiles and households.

- Progressive Increase (By 2028): The government plans to gradually increase the mandatory blending percentage to around 5% by 2028. This step will further reduce the dependence on pure natural gas.

Why such move?

- India is among the world’s largest importers of oil and gas, with nearly half of its gas consumption relying on imports.

- The blending initiative is designed to curb import costs and enhance energy security.

- These measures align with India’s broader objective of achieving net-zero emissions by 2070.

Comparative Analysis of Biogas, Natural Gas, and LPG

| Biogas | Natural Gas | LPG (Liquefied Petroleum Gas) | |

| Composition | Organic matter decomposition (mainly methane and CO2). | Fossil fuel (primarily methane). | Byproduct of natural gas processing (propane, butane). |

| Production | Anaerobic digestion of organic waste. | Extracted from underground, requires refining. | Obtained during natural gas processing and refining. |

| Energy Content | Lower due to high CO2 content. | High, efficient for heating and power. | High per volume, efficient in liquefied state. |

| Environmental Impact | Renewable, carbon-neutral. | Cleaner than coal/oil, but emits greenhouse gases. | Fewer pollutants than gasoline/diesel, emits greenhouse gases. |

| Uses | Heating, electricity, vehicle fuel, cooking in rural areas. | Heating, electricity, industrial processes, vehicle fuel. | Heating, cooking, vehicles, industrial applications. |

| Storage/Transport | Stored as gas or liquid; requires tanks. | Pipelines for gas; LNG for long-distance. | Pressurized tanks as liquid. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Oil and Gas Sector – HELP, Open Acreage Policy, etc.

India’s Strategic Move: Reviving the Mozambique LNG Project

From UPSC perspective, the following things are important :

Prelims level: Mozambique LNG Project

Mains level: NA

Central Idea

- Union Minister for Petroleum and Natural Gas recently undertook a significant diplomatic mission to review the $20 billion liquefied natural gas (LNG) project in Mozambique.

- This project, situated in the northern Cabo Delgado province, holds immense strategic importance for India’s quest for energy self-sufficiency.

Mozambique LNG Project

- Discovery in 2010: The project originated in 2010 with the discovery of substantial natural gas reserves off the northern Mozambique coast.

- Resource Abundance: The Area 1 block holds around 75 trillion cubic feet (Tcf) of recoverable gas, promising a resource life of about 120 years with an initial production rate of 12.88 million tonnes of LNG per year.

- Indian Involvement: Three Indian public sector undertakings (PSUs) hold a 30% stake in the Mozambique LNG project.

- Strategic Location: Mozambique’s geographical proximity to India’s west coast, with numerous LNG terminals, enhances its significance as a preferred source for LNG supply.