Note4Students

From UPSC perspective, the following things are important :

Prelims level: Agriculture households in India

Mains level: Paper 3- Need to focus on India's actual farming population

The article highlights the ambiguity about the number of farmers in India and related issues.

How many farmers does India really have

- The Agriculture Ministry’s last Input Survey for 2016-17 pegged the total operational holdings at 146.19 million.

- The NABARD All India Rural Financial Inclusion Survey of the same year estimated the country’s “agricultural households” at 100.7 million.

- The Pradhan Mantri Kisan Samman Nidhi (PM-Kisan) has around 111.5 million enrolled beneficiaries.

- Agricultural households, as per NABARD’s definition, cover any household whose value of produce from farming activities is more than Rs 5,000 during a year.

- That obviously is too little to qualify as living income.

Who is real farmer

- Agricultural households, as per NABARD’s definition, cover any household whose value of produce from farming activities is more than Rs 5,000 during a year.

- That obviously is too little to qualify as living income.

- A “real” farmer is someone who would derive a significant part of his/her income from agriculture.

- This, one can reasonably assume, requires growing at least two crops in a year.

- The 2016-17 Input Survey report shows that out of the total 157.21 million hectares (mh) of farmland with 146.19 million holdings, only 140 mh was cultivated.

- And even out of this net sown area, a mere 50.48 mh was cropped two times or more, which includes 40.76 mh of irrigated and 9.72 mh of un-irrigated land.

- Taking the average holding size of 1.08 hectares for 2016-17, the number of “serious full-time farmers” cultivating a minimum of two crops a year would be hardly 47 million.

- The above figure is also consistent with other data from the Input Survey.

- These pertain to the number of cultivators planting certified/high yielding seeds (59.01 million), using own or hired tractors (72.29 million) and electric/diesel engine pumpsets (45.96 million), and availing institutional credit (57.08 million).

- Whichever metric one considers, the farmer population significantly engaged and dependent on agriculture as a primary source of income is well within 50-75 million.

- The current agriculture crisis is largely about these 50-75 million farm households.

Lack of price parity

- At the heart of farmers’ crisis is the absence of price parity.

- In 1970-71, when the minimum support price (MSP) of wheat was Rs 76 per quintal, 10 grams of 24-carat gold cost about Rs 185.

- Today, the wheat MSP is at Rs 1,975/quintal, gold prices are Rs 45,000/10g.

- The absence of farm price parity didn’t hurt much initially when crop productivity was rising.

- Since the 1990s, yields have further gone up to 5.1-5.2 tonnes/hectare in wheat and 6.4-6.5 tonnes for paddy. But so have production costs.

- The demand for making MSP a legal right is basically a demand for price parity that gives agricultural commodities sufficient purchasing power with respect to things bought by farmers.

Way forward

- Most government welfare schemes are aimed at poverty alleviation and uplifting those at the bottom of the pyramid.

- But there’s no policy for those in the “middle” and in danger of slipping to the bottom.

- When crop prices fail to keep pace with escalating costs — of not only inputs, but everything the farmer buys — the impact is on the 50-75 million surplus producers.

- Any “agriculture policy” has to first and foremost address the problem of price parity.

- Farmers’ interest be even better served by the government guaranteeing a minimum “income” rather than “price” support.

- Subsistence or part-time agriculturalists, on the other hand, would benefit more from welfare schemes and other interventions to boost non-farm employment.

Conclusion

Whether it is crop, livestock or poultry, agriculture policy has to focus on “serious full-time farmers”, most of them neither rich nor poor. This rural middle class that was once very confident of its future in agriculture today risks going out of business. That shouldn’t be allowed to happen.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Article 324

Mains level: Paper 2- Need for clarity on the powers of ECI

The article highlights the issue of lack of clarity on the extent of the power of the Election Commission of India.

Where ECI derives its power from

- Supreme Court held in Mohinder Singh Gill vs Chief Election Commissioner that Article 324 contains plenary powers to ensure free and fair elections.

- These plenary powers are vested in the ECI which can take all necessary steps to achieve this constitutional object.

- Thus, the model code of conduct has been issued in exercise of its powers under Article 324.

- Besides the code, the ECI issues from time to time directions, instructions and clarifications on a host of issues which crop up in the course of an election.

The model code of conduct

- The model code of conduct issued by the ECI is a set of guidelines meant for political parties, candidates and governments to adhere to during an election.

- This code is based on consensus among political parties.

- The model code is observed by all stakeholders for fear of action by the ECI.

- However, there exists a considerable amount of confusion about the extent and nature of the powers which are available to the ECI in enforcing the code as well as its other decisions in relation to an election.

Issues with model code of conduct

1) Issue of enforceability

- As the code of conduct is framed on the basis of a consensus among political parties, it has not been given any legal backing.

- A committee of Parliament recommended that the code should be made a part of the Representation of the People Act 1951.

- However, the ECI did not agree to it on the ground that once it becomes a part of the law, all matters connected with the enforcement of the code will be taken to court, which would delay elections.

- But then the question about the enforceability of the code remains unresolved.

- Paragraph 16A of the Election Symbols (Reservation and Allotment) Order, 1968 says that the commission may suspend or withdraw recognition of a recognised political party if it refuses to observe the model code of conduct.

- But it is doubtful whether this provision is legally sustainable.

- When the code is legally not enforceable, how can the ECI resort to a punitive action such as withdrawal of recognition?

2) Transfer of officials

- Observers of ECI report to it about the conduct of certain officials of the States where elections are to be held.

- Transfer of an official is within the exclusive jurisdiction of the government.

- It is actually not clear whether the ECI can transfer a State government official in exercise of the general powers under Article 324 or under the model code.

- Transfer of an official is within the exclusive jurisdiction of the government.

- It is actually not clear whether the ECI can transfer a State government official in exercise of the general powers under Article 324 or under the model code.

- Further, to assume that a police officer or a civil servant will be able to swing the election in favour of the ruling party is extremely unrealistic and naive.

3) ECI’s intervention in administrative decisions

- According to the model code, Ministers cannot announce any financial grants in any form, make any promise of construction of roads, provision of drinking water facilities, etc or make any ad hoc appointments in the government. departments or public undertakings.

- These are the core guidelines relating to the government.

- But in reality, no government is allowed by the ECI to take any action, administrative or otherwise, if the ECI believes that such actions or decisions will affect free and fair elections.

- A recent decision of the ECI to stop the Government of Kerala from continuing to supply kits containing rice, pulses, cooking oil, etc is a case in point.

- The Supreme Court had in S. Subramaniam Balaji vs Govt. of T. Nadu & Ors (2013) held that the distribution of colour TVs, computers, cycles, goats, cows, etc, done or promised by the government is in the nature of welfare measures and is in accordance with the directive principles of state policy, and therefore it is permissible during an election.

- So, how can the distribution of essential food articles which are used to stave off starvation be electoral malpractice?

Consider the question “The model code of conduct issued by the Election Commission of India is in the forms of guidelines and lacks legal backing. In light of this, examine the issues that arise due to the lack of legal backing.”

Conclusion

There is no doubt that the ECI, through the conduct of free and fair elections in an extremely complex country, has restored the purity of the legislative bodies. However, no constitutional body is vested with unguided and absolute powers.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

National Green Tribunal has directed Central Pollution Control Board (CPCB) and Delhi Pollution Control Committee (DPCC) to take remedial action against the three waste-to-energy plants in Ghazipur, Okhla and Narela-Bawana.

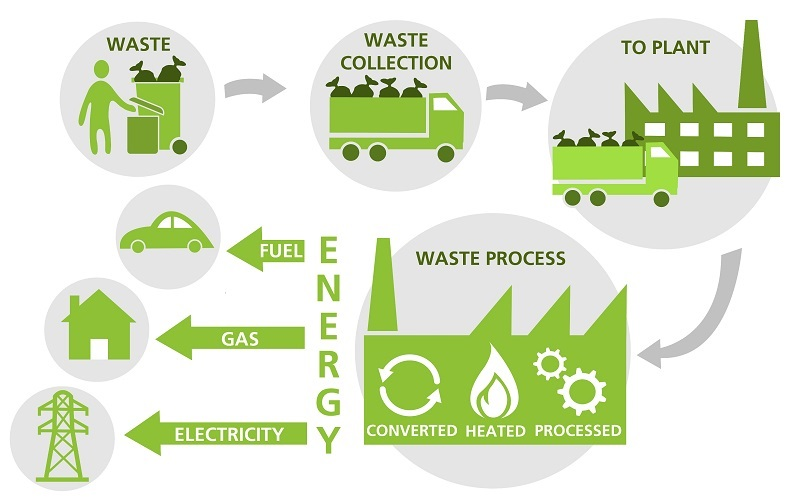

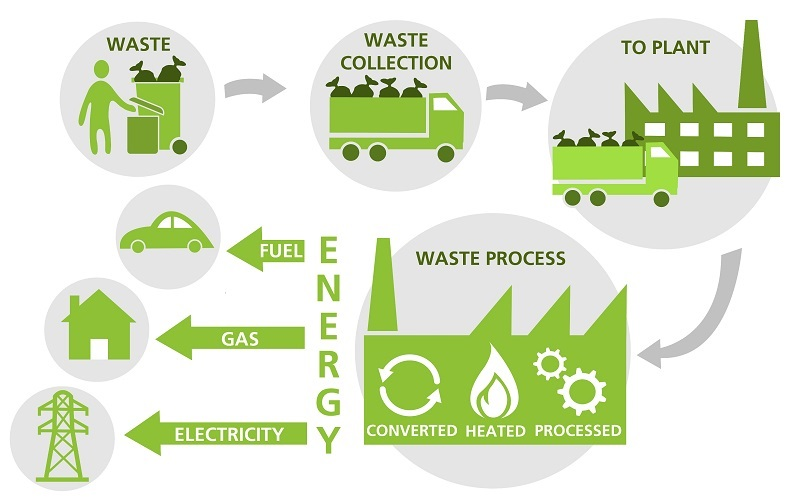

Waste to Energy:

- Waste to Energy or Waste to Power is the process of generating energy in the form of electricity and heat from the primary treatment of waste.

Methods for waste to Power generation:

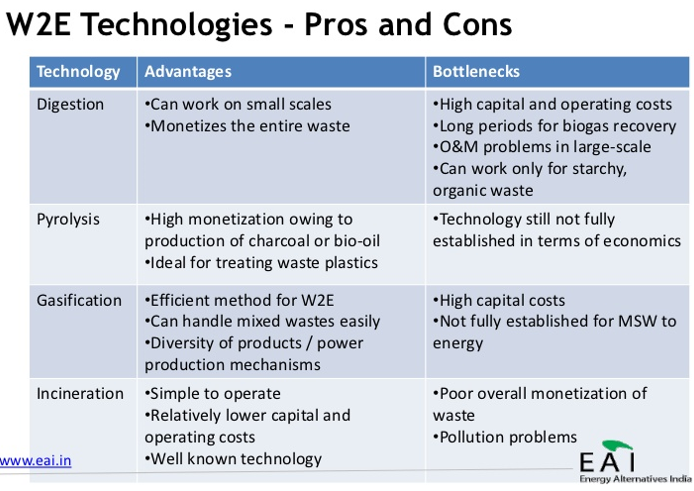

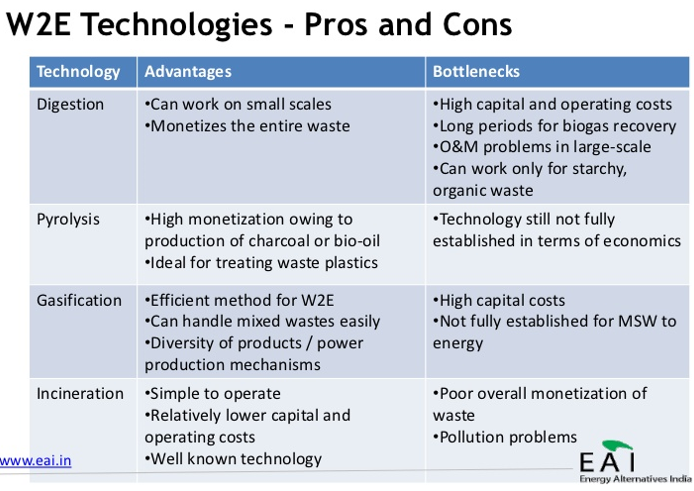

1. Thermal technologies:

- Incineration:

- It is the most common and popular method for waste to energy generation.

- The organics from the waste collected are burnt at high temperatures.

- Gasification: Produces combustible gas, hydrogen, synthetic fuels

- Thermal depolymerization: Produces synthetic crude oil, which can be further refined

- Pyrolysis: Produces combustible tar/bio-oil and chars

- Plasma arc gasification or plasma gasification process (PGP): Produces rich syngas including hydrogen and carbon monoxide usable for fuel cells or generating electricity to drive the plasma arch.

2. Non-thermal technologies:

- Anaerobic digestion: Biogas rich in methane

- Fermentation production: Examples are ethanol, lactic acid, hydrogen

- Mechanical biological treatment: Combines a sorting facility with a form of biological treatment such as composting.

Advantages of WTE plants:

- Decreases quantity of waste

- Efficient waste management

- Production of heat and power

- Reduction of pollution

- Incinerators have filters for trapping pollutants

- Saves on transportation of waste

- Provides better control over odour and noise

- Prevents the production of methane gas

Challenges for India:

- Lack of general awareness on waste management

- Unsegregated waste

- High moisture content

- Unorganized sector

- High wear and tear of equipment due to foreign materials

- Only electricity demand

- Cycle Efficiency is low

- Lack of enforcement of rules / regulations

- Lack of Transparency in plant management

- Lack of adequate waste disposal cost

- Lack of customization of plant and machinery to suit Indian condition

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

To provide relief to stressed companies, the Finance Ministry expanded the scope of a government-guaranteed credit facility to healthcare and stressed sector companies that have loan dues for up to 60 days (or SMA-1 accounts),as against 30 days earlier (SMA-0).

Key highlights:

- This has been expected to provide partial relief to stressed firms facing fresh uncertainty and business risks due to fresh lockdowns and restrictions being imposed by states.

- SMA-1 borrowers in the healthcare sector and 26 other high stress sectorsare now eligible under ECLGS 2.0.

- Companies from hospitality, travel & tourism, and leisure & sportingsectors are expected to benefit from the relaxation in the scheme.

- Accounts that are classified as non-performing assets or where overdueshave crossed 60 days (SMA-II) are not eligible.

- Companies that had loan dues up to 30 days (Special Mention Accounts or SMA-0) as on February 29, 2020, were being provided additional credit of 20 per cent outstanding under the scheme, which will now be given to SMA-1 accounts as well.

- The government has recently extended the ECLGS till June 2021, as against March 31, 2021 earlier.

About the ECLGS scheme:

- The Finance Ministry unveiled a Rs. 20 Lakh Crore comprehensive package, known as the Emergency Credit Line Guarantee Scheme (ECLGS), in view of the economic distress caused by the COVID-19 pandemic.

- This package is in aid of MSME sector, addressing working capital needs, operational liabilities and restart business impacted due the COVID-19 crisis.

- Borrowers with up to Rs. 25 Crore outstanding as on Feb 29, 2020 and up to Rs. 100 Crore annual turnover for FY 2020 are eligible for this scheme.

- Business Enterprises, MSMEs constituted as Proprietorship, Partnership, registered company, trusts and Limited Liability Partnerships (LLPs) shall also be eligible.

- Borrower accounts which had NPA or SMA-2 status as on Feb 29, 2020 shall not be eligible under the scheme.

- 20% of the total outstanding credit of borrowers can be sanctioned as a loan under the Guaranteed Emergency Credit Line (GECL), for those who having a loan as on Feb 29, 2020.

Special Mention Accounts:

- SMAs are those assets/accounts that shows symptoms of bad asset qualityin the first 90 days itself or before it being identified as NPA.

- The classification of Special Mention Accounts (SMA) was introduced by the RBI in 2014, to identify those accounts that has the potential to become an NPA/Stressed Asset.

- Logic of such a classification is because some accounts may turn NPA soon.

- An early identification will help to tackle the problem better.

- There are four types of Special Mention Accounts – SMA-NF, SMA 0, SMA1 and SMA 2.

- The Special Mention Accounts are usually categorized in terms of duration.

- For example, in the case of SMA -1, the overdue period is between 31 to 60 days.

- On the other hand, an overdue between 61 to 90 days will make an asset SMA -2.

- But some ‘Special Mention’ assets are identified on the basis of other factors that reflect sickness/irregularities in the account (SMA -NF).

- In the case of SMA -NF, non-financial indications about stress of an asset is considered.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now