Note4Students

From UPSC perspective, the following things are important :

Prelims level: Pigmentation of Tigers

Mains level: Not Much

A team of scientists has resolved the genetic mystery of Simlipal’s so-called black tigers.

What are Black Tigers?

- Tigers have a distinctive dark stripe pattern on a light background of white or golden.

- A rare pattern variant, distinguished by stripes that are broadened and fused together, is also observed in both wild and captive populations.

- This is known as pseudo-melanism, which is different from true melanism, a condition characterized by unusually high deposition of melanin, a dark pigment.

- This pseudo-melanism is linked to a single mutation in Transmembrane Aminopeptidase Q (Taqpep), a gene responsible for similar traits in other cat species.

Where are they mostly found?

- While truly melanistic tigers are yet to be recorded, pseudo-melanistic ones have been camera-trapped repeatedly, and only, in Simlipal, a 2,750-km tiger reserve in Odisha, since 2007.

- Launched in 2017, the study was the first attempt to investigate the genetic basis for this unusual phenotype (appearance).

Why they are rare?

- Mutants are genetic variations which may occur spontaneously, but not frequently, in nature.

- A cub gets two copies of each gene from both parents, and a recessive gene can show up only in the absence of the dominant one.

- So, two normal-pattern tigers carrying the recessive pseudo-melanism gene will have to breed together for a one-in-four probability of giving birth to a black cub.

- But recessive genes are rare and it is unlikely that two unrelated tigers will carry the same one and pass it on together to a cub.

Connection with Simlipal TR

- In an ideal tiger world, where far-ranging individuals are never short of choices for partners, that makes succession of black tigers a rarity.

- Under exceptional circumstances, a black tiger may succeed as part of a very small population that is forced to inbreed in isolation for generations.

- As it turned out, that is what happened at Simlipal.

- Pseudo-melanistic tigers are also present in three zoos in India — Nandankanan (Bhubaneswar), Arignar Anna Zoological Park (Chennai) and Bhagwan Birsa Biological Park (Ranchi) — where they were born in captivity.

- All of them have ancestral links to one individual from Simlipal.

What about natural selection?

- Natural selection eliminates the weakest from a gene pool, and the traits of the more successful get passed on.

- Niche modelling, the study said, shows higher frequency of melanistic leopards in darker tropical and subtropical forests than in drier open habitats.

- Likewise, darker coats may confer a selective advantage in both hunting and avoiding hunters in Simlipal’s tropical moist deciduous and semi-evergreen closed-canopy forest, with a relatively darker understory.

Try this PYQ:

Two important rivers – one with its source in Jharkhand (and known by a different name in Odisha), and another, with its source in Odisha – merge at a place only a short distance from the coast of Bay of Bengal before flowing into the sea. This is an important site of wildlife and biodiversity and a protected area.

Which one of the following could be this?

(a) Bhitarkanika

(b) Chandipur-on-sea

(c) Gopalpur-on-sea

(d) Simlipal

Post your answers here.

Back2Basics: Project Tiger

- Project Tiger is a tiger conservation program launched in April 1973 during PM Indira Gandhi’s tenure.

- In 1970 India had only 1800 tigers and Project Tiger was launched in Jim Corbett National Park.

- The project is administrated by the National Tiger Conservation Authority (NTCA).

- It aims at ensuring a viable population of Bengal tigers in their natural habitats, protecting them from extinction etc.

- Under this project the govt. has set up a Tiger Protection Force to combat poachers and funded relocation of villagers to minimize human-tiger conflicts.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: CTSO, NATO

Mains level: Not Much

The Prime Minister has participated virtually in the Joint SCO (Shanghai Cooperation Organization)-CSTO Outreach Session on Afghanistan.

What is CSTO?

- The CSTO is a Russia-led military alliance of seven former Soviet states that was created in 2002.

- Current CSTO members are Armenia, Belarus, Kazakhstan, Kyrgyzstan, the Russian Federation and Tajikistan. Afghanistan and Serbia hold observer status in the CSTO.

- Its purpose is to ensure the collective defence of any member that faces external aggression.

- It has been described by political scientists as the Eurasian counterpart of NATO, which has 29 member states, while the CSTO has just six.

Outlined functions of CSTO

- CSTO supports arms sales and manufacturing as well as military training and exercises, making the CSTO the most important multilateral defence organization in the former Soviet Union.

- Beyond mutual defence, the CSTO also coordinates efforts in fighting the illegal circulation of weapons among member states and has developed law enforcement training for its members in pursuit of these aims.

What does CSTO membership provide?

- While CSTO membership means that member states are barred from joining other military alliances, limiting, for example, their relationship with NATO.

- Its members receive discounts, subsidies, and other incentives to buy Russian arms, facilitating military cooperation.

- Most importantly, membership presumes certain key security assurances – the most significant of which is deterring military aggression by third countries.

- In the CSTO, aggression against one signatory is perceived as aggression against all.

- It however remains unclear whether this feature works in practice.

Back2Basics: NATO (North Atlantic Treaty Organization)

- NATO was found in the aftermath of the Second World War.

- Its purpose was to secure peace in Europe, to promote cooperation among its members and to guard their freedom – all of this in the context of countering the threat posed at the time by the Soviet Union.

- It is a military alliance established by the North Atlantic Treaty (also called the Washington Treaty) of April 4, 1949.

- It sought to create a counterweight to Soviet armies stationed in Central and Eastern Europe after World War II.

- Its original members were Belgium, Canada, Denmark, France, Iceland, Italy, Luxembourg, the Netherlands, Norway, Portugal, the United Kingdom, and the United States.

- NATO has spread a web of partners, namely Egypt, Israel, Sweden, Austria, Switzerland and Finland.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: General Sherman Tree

Mains level: NA

Two wildfires in California are burning through the Sequoia National Park in the Sierra Nevada that is home to some of the largest trees in the world.

Among these trees is the world’s largest tree popularly known as General Sherman, which firefighters are now trying to protect from the blaze.

About General Sherman

- The General Sherman tree is the world’s largest in terms of volume and exists in the Giant Forest sequoia grove of the national park.

- As per recent estimates, General Sherman is about 2,200 years old.

- It stands at a height of 275 feet (taller than the leaning tower of Pisa) and has a diameter of 36 feet at the base.

- Even 60 feet above the base, the tree has a diameter of 17.5 feet.

- Giant sequoia trees have existed in the national park for thousands of years and there are an estimated 2,000 such trees in the park.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: TRIPS waiver

Mains level: Paper 3- Sustaining recovery

Context

To revive and sustain growth, action is needed both at the international and national levels.

Hopes of V-shaped recovery of Indian economy

- The National Statistical Office (NSO) had recently estimated that India’s economic growth has surged to 20.1% in the April-June quarter.

- In its recently launched Trade and Development Report 2021, UNCTAD has estimated global growth to hit 5.3% in 2021 and growth in India to hit 7.2%.

- According to the report, India showed strong quarterly growth of 1.9% in the first quarter of 2021, on the back of the momentum of the second half of 2020 and supported by government spending in goods and services.

- Given the inherent fragilities, India’s growth in 2021 as a whole is estimated at 7.2%, which is one of the fastest compared to most countries in the analysis.

- But it is still not sufficient to regain the pre-COVID-19 income level.

- However, going forward, the economy is likely to experience a deceleration of growth to 6.7% growth in 2022.

Ways to sustain growth

1) Efforts at the International level

- To revive and sustain growth, action is needed both at the international and national levels.

- TRIPS waiver: The report strongly supports India’s proposed temporary suspension of the World Trade Organization TRIPS waiver.

- Waiver is considered as a necessary step to enable the local manufacture of vaccines in developing countries

2) Steps to be taken at the national level

- Resilience: At the national level, COVID-19 has reinforced the idea that resilience is a public good and responsibility of the state.

- It has to be delivered through a robust public sector with the resources to make the necessary investments, provide the complementary services and coordinate the multiple activities that building resilience involves.

- Mobilising financial resources: We need a financial system that accords a more significant role to public banks, breaks up and guards against the emergence of megabanks, and exercises stronger regulatory oversight is more likely to deliver a healthier investment climate.

- Minimum wage: Wages are a critical source of demand and their growth can stimulate productivity and underpin a strong social contract.

- Minimum wages and related labour legislation are needed for appropriate protection against abusive practices.

- Policies for informal sector: Policies targeting informality are of particular importance, especially for a country like India with a large informal economy.

Conclusion

It is important to build a healthy, diversified economy. For this, a strong industrial policy focusing on building digital capacities is needed. A resilient economy goes beyond offering a residual category of safety nets designed to stop those left behind from falling further.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: E-Shram Portal

Mains level: National database for workers: Prospects and challenges

The E-Shram portal has come into existence more than a decade after the passage of the Unorganized Workers’ Social Security Act in 2008.

E-Shram

- On August 26, 2021, the Ministry of Labour and Employment (MOLE) launched the E-Shram, the web portal for creating a National Database of Unorganized Workers (NDUW), which will be seeded with Aadhaar.

- It seeks to register an estimated 398-400 million unorganized workers and to issue an E-Shram card.

Better late than never move

- It has come about even after repeated nudging by the Supreme Court of India.

- It is the result of state apathy.

- Had the Central and the State governments begun these legally mandated processes on time, much of the distress of lakhs of vulnerable workers would have been avoided.

- In fact, the political class owe an ‘apology’ to informal workers.

Issues with E-Shram

(A) Time constraints

- Long process: Given the gigantic nature of registering each worker, it will be a long-drawn process.

- No gestation period: The Government has not mentioned a gestation period to assess its strategy and efficiency.

- No hasty process: Employers are or required their workers to register even.While the Government can appeal to them, any penal measure will hurt the ease of doing business.

(B) Pandemic hides

- Considering the estimated 380 million workers as the universe of registration — debatable as the novel coronavirus pandemic has pushed lakhs of workers into informality.

(C) Data security

- Privacy: One of the vital concerns of e-portals is data security, including its potential abuse especially when it is a mega-sized database.

- No national framework yet: There are also media reports pointing out the absence of a national architecture relating to data security.

- Local server issues: It has been reported that in some States such as Maharashtra, the server was down for a few days.

(D) Structural issue

- Aadhaar seeding: Many workers will not have an Aadhaar-seeded mobile or even a smartphone. Aadhaar-seeding is a controversial issue with political overtones, especially in the North-eastern regions.

- Eligibility: There are several issues concerning the eligibility of persons to register as well as the definitional issues.

- Exclusion: By excluding workers covered by EPF and ESI, lakhs of contract and fixed-term contract workers will be excluded from the universe of UW. Hazardous establishments employing even a single worker will have to be covered under the ESI, which means these workers also will be excluded.

- No benefits for the aged: The NDUW excludes millions of workers aged over 59 from its ambit, which constitutes age discrimination.

(D) Complex identities of workers

- Migration: Many are circular migrant workers and they quickly, even unpredictably, move from one trade to another.

- Mixed work: Many others perform formal and informal work as some during non-office hours may belong to the gig economy, for example as an Uber taxi or a Swiggy employee. They straddle formal and informal sectors.

- Gig workers: Even though MOLE has included gig workers in this process, it is legally unclear whether the gig/platform worker can be classified first as a worker at all.

(E) Other impediments

- Dependence on States: The central government will have to depend on the State governments for this project to be successful.

- Lack of coordination: In many States, the social dialogue with the stakeholders especially is rather weak or non-existent. The success of the project depends on the involvement of a variety of stakeholders apart from trade unions.

- Corruption: There is also the concern of corruption as middle-service agencies such as Internet providers might charge exorbitant charges to register and print the E-Shram cards.

Benefits: No immediate carrot

- Workers stand to gain by registration in the medium to long run.

- But the instant benefit of accident insurance upto ₹0.2 million to registered workers is surely not an attractive carrot.

- The main point of attraction is the benefits they stand to gain during normal and crisis-ridden periods such as the novel coronavirus pandemic now which the Government needs to disseminate properly.

Way forward

- E-Shram is a vital system to provide hitherto invisible workers much-needed visibility.

- It will provide the Labour Market Citizenship Document to them.

- The govt should go one step further for triple linkage for efficient and leakage-less delivery of all kinds of benefits and voices to workers/citizens: One-Nation-One-Ration Card (ONOR), E-Shram Card (especially bank account seeded) and the Election Commission Card.

- Last but not least, registrations cannot be a source of exclusion of a person from receiving social assistance and benefits.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Bad Banks

Mains level: Asset reconstruction initiaitives by the govt

Paving the way for a major clean-up of bad loans in the banking system, the Union Cabinet has cleared a ₹30,600-crore guarantee programme for securities to be issued by the newly incorporated ‘bad bank’ for taking over and resolving non-performing assets (NPAs) amounting to ₹2 lakh crore.

What is a Bad Bank?

- A bad bank conveys the impression that it will function as a bank but has bad assets to start with.

- Technically, it is an asset reconstruction company (ARC) or an asset management company that takes over the bad loans of commercial banks, manages them and finally recovers the money over a period of time.

- Such a bank is not involved in lending and taking deposits, but helps commercial banks clean up their balance sheets and resolve bad loans.

- The takeover of bad loans is normally below the book value of the loan and the bad bank tries to recover as much as possible subsequently.

Bad Banks to be established

- The NARCL-IDRCL structure is the new bad bank.

- The National Asset Reconstruction Company Limited (NARCL) has already been incorporated under the Companies Act.

- It will acquire stressed assets worth about Rs 2 lakh crore from various commercial banks in different phases.

- Another entity — India Debt Resolution Company Ltd (IDRCL), which has also been set up — will then try to sell the stressed assets in the market.

How will the NARCL-IDRCL work?

- The NARCL will first purchase bad loans from banks.

- It will pay 15% of the agreed price in cash and the remaining 85% will be in the form of “Security Receipts”.

- When the assets are sold, with the help of IDRCL, , the commercial banks will be paid back the rest.

- If the bad bank is unable to sell the bad loan, or has to sell it at a loss, then the government guarantee will be invoked.

- The difference between what the commercial bank was supposed to get and what the bad bank was able to raise will be paid from the Rs 30,600 crore that has been provided by the government.

Will a bad bank resolve matters?

- From the perspective of a commercial bank saddled with high NPA levels, it will help.

- That’s because such a bank will get rid of all its toxic assets, which were eating up its profits, in one quick move.

- When the recovery money is paid back, it will further improve the bank’s position.

- Meanwhile, it can start lending again.

Why do we need a bad bank?

- The idea gained currency during Rajan’s tenure as RBI Governor.

- The RBI had then initiated an asset quality review (AQR) of banks and found that several banks had suppressed or hidden bad loans to show a healthy balance sheet.

- However, the idea remained on paper amid lack of consensus on the efficacy of such an institution.

- ARCs have not made any impact in resolving bad loans due to many procedural issues.

- While commercial banks resume lending, the so-called bad bank, or a bank of bad loans, would try to sell these “assets” in the market.

Good about the bad banks

- The problem of NPAs continues in the banking sector, especially among the weaker banks.

- The bad bank concept is in some ways similar to an ARC but is funded by the government initially, with banks and other investors co-investing in due course.

- The presence of the government is seen as a means to speed up the clean-up process.

- Many other countries had set up institutional mechanisms such as the Troubled Asset Relief Programme (TARP) in the US to deal with a problem of stress in the financial system.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: MMD Biosphere Reserve, BRs in India

Mains level: Not Much

UNESCO has designated Mura-Drava-Danube (MDD) as the world’s first ‘five-country biosphere reserve’.

About Mura-Drava-Danube BR

- The biosphere reserve covers 700 kilometres of the Mura, Drava and Danube rivers and stretches across Austria, Slovenia, Croatia, Hungary and Serbia.

- The total area of the reserve — a million hectares — in the so-called ‘Amazon of Europe’, makes it the largest riverine protected area on the continent.

- The reserve is home to floodplain forests, gravel and sand banks, river islands, oxbows and meadows.

- It is home to continental Europe’s highest density of breeding white-tailed eagle (more than 150 pairs), as well as endangered species such as the little tern, black stork, otters, beavers and sturgeons.

- It is also an important annual resting and feeding place for more than 250,000 migratory birds, according to WWF.

- Almost 900,000 people live in the biosphere reserve. (UPSC may ask if it is uninhabited.)

Significance of this BR

- The new reserve represented an important contribution to the European Green Deal and contributes to the implementation of the EU Biodiversity Strategy in the Mura-Drava-Danube region.

- The strategy’s aim is to revitalize 25,000 km of rivers and protect 30 per cent of the European Union’s land area by 2030.

- The declaration as BR puts river revitalization, sustainable business practices enhancing cross-border cooperation into focus.

Ignore at your own risk! Its better to correct it here itself.

Such PYQs are ought to repeat any number of times in UPSC CSE.

Q. Consider the following statements:

- The boundaries of a National Park are defined by legislation.

- A Biosphere Reserve is declared to conserve a few specific species of flora and fauna.

- In a Wildlife Sanctuary, limited biotic interference is permitted.

Which of the above statements is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Post your answers here.

Back2Basics: UNESCO Biosphere Reserves

- Biosphere reserves are ‘learning places for sustainable development’.

- They are nominated by national governments and remain under the sovereign jurisdiction of the states where they are located.

- They are designated under the intergovernmental MAB Programme by the Director-General of UNESCO following the decisions of the MAB International Coordinating Council (MAB ICC).

- Their status is internationally recognized. Member States can submit sites through the designation process.

- Biosphere reserves include terrestrial, marine and coastal ecosystems.

They integrate three main “functions”:

- Conservation of biodiversity and cultural diversity

- Economic development that is socio-culturally and environmentally sustainable

- Logistic support, underpinning development through research, monitoring, education and training

(a) Core Areas

It comprises a strictly protected zone that contributes to the conservation of landscapes, ecosystems, species and genetic variation

(b) Buffer Zones

It surrounds or adjoins the core area(s), and is used for activities compatible with sound ecological practices that can reinforce scientific research, monitoring, training and education.

(c) Transition Area

The transition area is where communities foster socio-culturally and ecologically sustainable economic and human activities.

UNESCO recognized BRs in India

Year of

recognition

|

Name

|

States

|

| 2000 |

Nilgiri Biosphere Reserve |

Tamil Nadu |

| 2001 |

Gulf of Mannar Biosphere Reserve |

Tamil Nadu |

| 2001 |

Sundarbans Biosphere Reserve |

West Bengal |

| 2004 |

Nanda Devi Biosphere Reserve |

Uttarakhand |

| 2009 |

Pachmarhi Biosphere Reserve |

Madhya Pradesh |

| 2009 |

Nokrek Biosphere Reserve |

Meghalaya |

| 2009 |

Simlipal Biosphere Reserve |

Odisha |

| 2012 |

Achanakmar-Amarkantak Biosphere Reserve |

Chhattisgarh |

| 2013 |

Great Nicobar Biosphere Reserve |

Great Nicobar |

| 2016 |

Agasthyamala Biosphere Reserve |

Kerala and Tamil Nadu |

| 2018 |

Kanchenjunga Biosphere Reserve |

Part of North and West Sikkim districts |

| 2020 |

Panna Biosphere Reserve |

Madhya Pradesh |

|

|

|

|

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Shankhlipi Script, Gupta Period

Mains level: Zenith of arts and cultural development during Gupta Period

Last week, the Archaeological Survey of India (ASI) discovered remains of an ancient temple dating back to the Gupta period (5th century) in a village in Uttar Pradesh’s Etah district.

Findings of the excavation

- The Bilsarh site was declared ‘protected’ in 1928.

- Every year, the ASI undertakes scrubbing work at the protected sites.

- This year, the team discovered two decorative pillars close to one another, with human figurines resembling an ancient temple.

- The stairs of the temple had ‘shankhalipi’ inscriptions, which were deciphered by the archaeologists as saying, ‘Sri Mahendraditya’, the title of Kumaragupta I of the Gupta dynasty.

You will find tons of PYQs on Gupta Period. Try this recent one:

Q. With reference to the period of Gupta dynasty in ancient India, the towns Ghantasala, Kadura and Chaula were well known as:

(a) ports handling foreign trade

(b) capitals of powerful kingdoms

(c) places of exquisite stone art and architecture

(d) important Buddhist pilgrimage centres

Post your answers here.

Who was Kumaragupta I?

- Kumaragupta I was an emperor of the Gupta Empire of Ancient India.

- A son of the Gupta emperor Chandragupta II and queen Dhruvadevi, he seems to have maintained control of his inherited territory, which extended from Gujarat in the west to Bengal region in the east.

- In the 5th century, Kumaragupta I ruled for 40 years over north-central India.

- Skandagupta, son and successor of Kumaragupta I is generally considered to be the last of the great Gupta rulers.

- He assumed the titles of Vikramaditya and Kramaditya.

What is the Shankhalipi script?

- Shankhalipi or “shell-script” is a term used by scholars to describe ornate spiral characters assumed to be Brahmi derivatives that look like conch shells or shankhas.

- They are found in inscriptions across north-central India and date to between the 4th and 8th centuries.

- Both Shankhalipi and Brahmi are stylised scripts used primarily for names and signatures.

- The inscriptions consist of a small number of characters, suggesting that the shell inscriptions are names or auspicious symbols or a combination of the two.

Chronology and meaning

- The script was discovered in 1836 on a brass trident in Uttarakhand’s Barahat by English scholar James Prinsep, who was the founding editor of the Journal of the Asiatic Society of Bengal.

- A year later, he came across two more similar scripts at Nagarjuna group of caves in the Barabar Hills near Gaya.

- Prominent sites with shell inscriptions include the Mundeshwari Temple in Bihar, the Udayagiri Caves in Madhya Pradesh, Mansar in Maharashtra and some of the cave sites of Gujarat and Maharashtra.

- In fact, shell inscriptions are also reported in Indonesia’s Java and Borneo.

- Scholars have tried to decipher shell script but have not been successful.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: Gupta Empire

- The Gupta Empire was an ancient Indian empire which existed from the early 4th century CE to late 6th century CE.

- This period is considered as the Golden Age of India by historians.

- The ruling dynasty of the empire was founded by the king Sri Gupta; the most notable rulers of the dynasty were Chandragupta I, Samudragupta, and Chandragupta II alias Vikramaditya.

- The 5th-century CE Sanskrit poet Kalidasa credits the Guptas with having conquered about twenty-one kingdoms, both in and outside India, including the kingdoms of Parasikas, the Hunas, the Kambojas, tribes located in the west and east Oxus valleys, the Kinnaras, Kiratas, and others.

- Many of the literary sources, such as Mahabharata and Ramayana, were canonized during this period.

- The Gupta period produced scholars such as Kalidasa, Aryabhata, Varahamihira, and Vatsyayana who made great advancements in many academic fields.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: White Goods, PLI Scheme

Mains level: Success of the PLI Scheme

A total of 52 companies have filed their application with a committed investment of Rs 5,866 crore under the PLI scheme to incentivize the domestic manufacturing of components of White Goods.

What are White Goods?

- White goods refer to heavy consumer durables or large home appliances, which were traditionally available only in white.

- They include appliances such as washing machines, air conditioners, stoves, refrigerators, etc. The white goods industry in India is highly concentrated.

Why PLI scheme for white goods?

- Indian appliance and consumer electronics (ACE) market reached INR 76,400 crore (~$10.93 bn) in 2019.

- Appliances and consumer electronics industry is expected to double to reach INR 1.48 lakh crore (~$21.18 bn) by 2025.

- The PLI Scheme on White Goods is designed to create complete component ecosystem for Air Conditioners and LED Lights Industry in India and make India an integral part of the global supply chains.

- Only manufacturing of components of ACs and LED Lights will be incentivized under the Scheme.

What is PLI Scheme?

- As the name suggests, the scheme provides incentives to companies for enhancing their domestic manufacturing apart from focusing on reducing import bills and improving the cost competitiveness of local goods.

- PLI scheme offers incentives on incremental sales for products manufactured in India.

- The scheme for respective sectors has to be implemented by the concerned ministries and departments.

Criteria laid for the scheme

- Eligibility criteria for businesses under the PLI scheme vary based on the sector approved under the scheme.

- For instance, the eligibility for telecom units is subject to the achievement of a minimum threshold of cumulative incremental investment and incremental sales of manufactured goods.

- The minimum investment threshold for MSME is Rs 10 crore and Rs 100 crores for others.

- Under food processing, SMEs and others must hold over 50 per cent of the stock of their subsidiaries, if any.

- On the other hand, for businesses under pharmaceuticals, the project has to be a greenfield project while the net worth of the company should not be less than 30 per cent of the total committed investment.

What are the incentives offered?

- An incentive of 4-6 per cent was offered last year on mobile and electronic components manufacturers such as resistors, transistors, diodes, etc.

- Similarly, 10 percent incentives were offered for six years (FY22-27) of the scheme for the food processing industry.

- For white goods too, the incentive of 4-6 per cent on incremental sales of goods manufactured in India for a period of five years was offered to companies engaged in the manufacturing of air conditioners and LED lights.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: NITI Aayog

Mains level: Evolving concept of urban development

NITI Aayog has launched a report titled ‘Reforms in Urban Planning Capacity in India’ on measures to ramp up urban planning capacity in India.

Reforms in Urban Planning

- The report has been developed by NITI Aayog, in consultation with concerned ministries and eminent experts in the domain of urban and regional planning.

- It underscores urban challenges, including town planning and emphasizes need greater policy attention in our country.

Why such report?

- India is home to 11% of the total global urban population.

- By 2027, India will surpass China as the most populous country in the world.

- Unplanned urbanization, however, exerts great strain on our cities. In fact, the Covid-19 pandemic has revealed the dire need for the planning and management of our cities.

- The existing urban planning and governance framework is complex, which often leads to ambiguity and lack of accountability.

Highlights of the report

The report makes several recommendations that can unblock bottlenecks in the value chain of urban planning capacity in India. Some of them are:

Programmatic Intervention for Planning of Healthy Cities:

- Every city must aspire to become a ‘Healthy City for All’ by 2030.

- The report recommends a Central Sector Scheme ‘500 Healthy Cities Programme’, for a period of 5 years, wherein priority cities and towns would be selected jointly by the states and local bodies.

Programmatic Intervention for Optimum Utilization of Urban Land:

- All the cities and towns under the proposed ‘Healthy Cities Programme’ should strengthen development control regulations based on scientific evidence to maximize the efficiency of urban land (or planning area).

- The report recommends a sub-scheme ‘Preparation/Revision of Development Control Regulations’ for this purpose.

Ramping Up of Human Resources:

- To combat the shortage of urban planners in the public sector, the report recommends that the states/UTs may need to a) expedite the filling up of vacant positions of town planners.

- It asks to additionally sanction 8268 town planners’ posts as lateral entry positions.

Ensuring Qualified Professionals for Undertaking Urban Planning:

- State town and country planning departments face an acute shortage of town planners.

- This is compounded by the fact that in several states, ironically, a qualification in town planning is not even an essential criterion for such jobs.

- States may need to undertake requisite amendments in their recruitment rules to ensure the entry of qualified candidates into town-planning positions.

Re-engineering of Urban Governance:

- The report recommends the constitution of a high-powered committee to re-engineer the present urban-planning governance structure.

- The key aspects that would need to be addressed in this effort are:

- clear division of the roles and responsibilities of various authorities, appropriate revision of rules and regulations, etc.,

- creation of a more dynamic organizational structure, standardisation of the job descriptions of town planners and other experts, and

- extensive adoption of technology for enabling public participation and inter-agency coordination.

Revision of Town and Country Planning Acts:

- Most States have enacted the Town and Country Planning Acts, that enable them to prepare and notify master plans for implementation.

- However, many need to be reviewed and upgraded.

- Therefore, the formation of an apex committee at the state level is recommended to undertake a regular review of planning legislations (including town and country planning or urban and regional development acts or other relevant acts).

Demystifying Planning and Involving Citizens:

- While it is important to maintain the master plans’ technical rigour, it is equally important to demystify them for enabling citizens’ participation at relevant stages.

- Therefore, the committee strongly recommends a ‘Citizen Outreach Campaign’ for demystifying urban planning.

Steps for Enhancing the Role of Private Sector:

- The report recommends that concerted measures must be taken at multiple levels to strengthen the role of the private sector to improve the overall planning capacity in the country.

- These include the adoption of fair processes for procuring technical consultancy services, strengthening project structuring and management skills in the public sector, and empanelment of private sector consultancies.

Steps for Strengthening Urban Planning Education System:

- The Central universities and technical institutions in all the other States/UTs are encouraged to offer PG degree programmes (MTech Planning) to cater to the requirement of planners in the country.

- The committee also recommends that all such institutions may synergize with Ministry of Rural Development, Ministry of Panchayati Raj and respective state rural development departments.

Measures for Strengthening Human Resource and Match Demand–Supply:

- The report recommends the constitution of a ‘National Council of Town and Country Planners’ as a statutory body.

- Also, a ‘National Digital Platform of Town and Country Planners’ is suggested to be created within the National Urban Innovation Stack of MoHUA.

- This portal will enable self-registration of all planners and evolve as a marketplace for potential employers and urban planners.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: National Development Council

Mains level: Paper 3- Dealing with the recession

Context

The Centre is facing a serious financial crisis because of the exigencies created by the pandemic and its own policies. However, monetising assets and cutting down funds to states could aggravate the crisis.

3 Policies aggravating the crisis

1) NMP and disinvestment

- Union Finance Minister, while announcing the National Monetisation Pipeline (NMP), said that asset monetisation is based on the philosophy of creation through monetisation and is aimed at “tapping private sector investment for new infrastructure creation”.

- Loss of dividend: Disinvestment of profitable Navratna companies will result in a loss of dividend, a major source of income for the Centre.

- Loss due to tax exemptions: Tax exemptions to the investors will take away another major share of income.

- Central funds will be squeezed and this, in turn, will have a bearing on state finances.

- NMP will seriously hurt the interests of the country.

2) Cutting down funds to States

- Kerala’s case: The state was getting about 3.92 per cent from the divisible pool in the 1970s and 1980s.

- It came down to 2.66 per cent and 2.34 per cent in the awards of the 12th and 13th Finance Commissions.

- The 14th Finance Commission award increased it to 2.45 (2.50) per cent.

- Now, the 15th Finance Commission has reduced it to 1.92 per cent.

- This arbitrary cut is a result of the adoption of certain new yardsticks by the commission without considering the state government’s views

- The 15th Finance Commission’s special grant (RD grant) of Rs 19,800 crore for this year will no longer be available in the coming years.

- Karnataka and many other states have also suffered because of the policy to reduce the divisible pool share.

3) Tax exemptions and surcharge

- Exemptions amounting to Rs 99,842.06 crore were extended to corporate houses in 2019-20.

- Many taxes on goods were reduced because of electoral compulsions. This reduced central revenues.

- Along with such tax exemptions, the increased use of cesses and surcharges is responsible for the shrinking of the shareable pool.

- The shareable resources with the Centre was around Rs 6.8 lakh crore in 2019-20 which has come down to Rs 5.5 lakh crore in 2020-21.

- All the cesses and surcharges that are not shared with states come to about 20 per cent of the total revenues of the Centre.

- States have been demanding that this money should be shared with them, particularly while fighting a pandemic.

- States complaining for resources does not augur well for cooperative federalism.

Way forward

- Developing basic infrastructure and the production sector is the only way to face an economic crisis.

- That should not be done by selling or handing over public assets to private individuals and corporations.

- We need massive public investment that will help people to form cooperatives and collectives in agriculture and industrial production.

- Parliament, the National Development Council and the GST Council should discuss this unprecedented situation.

Conclusion

We need to find a way out collectively. Handing over the rights on public properties to private individuals will take the country back to the colonial era. This must not be allowed.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: New Development Bank

Mains level: Paper 2- India-China relations

Context

Deng Xiaoping had told then-Indian Prime Minister Rajiv Gandhi in 1988 that the 21st century would be “India and China’s century”, the current Chinese leadership has no patience for such pablum. They believe — indeed believe they know — that it is destined to be China’s century alone.

The policy of side-stepping contentious issues and encouraging bilateral economic relations

- There have always been political tensions, both over each country’s territorial claims over land controlled by the other, and China’s alliance with Pakistan, and India’s hospitality to the Dalai Lama.

- But neither country had allowed these tensions to overwhelm them:

- China had declared that the border dispute could be left to “future generations” to resolve.

- India had endorsed the “One China” policy, refusing to support Tibetan secessionism while limiting official reverence for the Dalai Lama to his status as a spiritual leader.

- India actions and statements have usually been designed not to provoke, but to relegate the border problem to the back burner while enabling trade relations with China (now worth close to $100 billion) to flourish.

- India made it clear that it was unwilling to join in any United States-led “containment” of China.

- From negligible levels till 1991, trade with China had grown to become one of India’s largest trading relationships.

- India engages with China diplomatically in the BRICS as well as conducting annual summits of RIC (Russia-India-China).

- India is an enthusiastic partner in the Chinese-led Asian Infrastructure Investment Bank and the New Development Bank (NDB).

- However, it has become increasingly apparent that the policy of side-stepping contentious issues and encouraging bilateral economic relations has played into Chinese hands.

Chinese strategy in Galwan

- In the Galwan clash, the Chinese troops seem to have been engaged in a tactical move to advance their positions along areas of the LAC that it covets, in order to threaten Indian positions and interdict patrols.

- They are threatening India’s construction of roads, bridges and similar infrastructure on undisputed Indian territory, a belated effort to mirror similar Chinese efforts near the LAC in Tibet.

- They have established a fixed presence in these areas well beyond China’s own ‘Claim Line’.

- The objective seems to be to extend Chinese troop presence to the intersection of the Galwan river and the Shyok river, which would make the Galwan Valley off bounds to India.

- The Chinese have constructed permanent structures in the area of their intrusion and issued statements claiming that sovereignty over the Galwan valley has “always belonged” to China.

- Consolidation of LOC: China’s strategy seems to be to consolidate the LAC where it wants it, so that an eventual border settlement — that takes these new realities into account — will be in its favour.

- Implications for India: In the meantime, border incidents keep the Indians off-balance and demonstrate to the world that India is not capable of challenging China, let alone offering security to other nations.

India’s options

- India has reinforced its military assets on the LAC to prevent deeper incursions for now.

- And hopes to press the Chinese to restore the status quo ante through either diplomatic or military means.

- Chinese and Indian officials are currently engaged in diplomatic and military-to-military dialogue to ease tensions, but de-escalation has been stalled for months.

- Economic options: India has responded with largely symbolic acts of economic retaliation.

- India has also reimposed tighter limits on Chinese investment in projects such as railways, motorways, public-sector construction projects, and telecoms.

Limits to India’s economic retaliation

- India is far too dependent on China for vital imports — such as pharmaceuticals, and even the active ingredients to make them, automotive parts and microchips that many fear it will harm India if it acted too strongly against China.

- Imports from China have become indispensable for India’s exports to the rest of the world.

- Various manufacturing inputs, industrial equipment and components, and even some technological know-how come from China; eliminating them could have a seriously negative effect on India’s economic growth.

- And there are limits to the effectiveness of any Indian retaliation: trade with China may seem substantial from an Indian perspective, but it only represents 3% of China’s exports.

- Drastically reducing it would not be enough to deter Beijing or cause it to change its behaviour.

Consider the question “State of India-China relationship hardly indicate the 21st Century being the “India and China’s century”. In light of this, examine the factors responsible for this and suggest the way forward for India.”

Conclusion

This range of considerations seems to leave only two strategic options. Playing second fiddle to an assertive China or aligning itself with a broader international coalition against Chinese ambitions. Since the first is indigestible for any democracy, is China de facto pushing India into doing something it has always resisted — allying with the West?

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: GST

Mains level: Paper 3- Changes needed in GST

Context

After one and a half years of dispute, and with the economy showing signs of recovery, a path forward for the GST finally seems visible. This opportunity needs to be seized to strike the Centre-State bargain.

How GST performed so far

- The contributors are many but the critical one has been simply a lack of revenues.

- Initially, the GST performed well, with collections soaring to Rs 11.8 lakh crore in the first full year of implementation in 2018-19.

- But in 2019-20, the growth rate decelerated sharply. And in 2020-21, collections actually fell.

- As future collections became uncertain, a gap opened up between the amount that the Centre felt it could afford to promise and the minimum that the states felt they needed and were entitled to.

- More recently, however, confidence in GST has improved.

- Collections have revived, averaging Rs 1.1 lakh crore in the first five months of the current fiscal year, exceeding even pre-pandemic levels.

What explains the weak revenue performance of the GST?

- Slowing economy: The GST’s past performance now seems much better than it once did.

- We now know that after 2018-19, nominal GDP growth slowed from 10.5 per cent in 2018-19 to 7.8 per cent the next year and -3 per cent in 2020-21.

- Effective rate cuts: The RBI has pointed out, the effective tax rate has fallen by nearly 3 percentage points because of rate cutting in 2019, in which both the Centre and states were complicit.

- Thus the weak revenue performance of the GST now seems attributable to wider economic difficulties and policy actions, rather than problems with the tax itself.

Necessary changes: Opportunity for striking bargain for Centre and States

1) Principle of compensation must be re-cast: Create revenue buffer

- As the GST was a new tax, so states were guaranteed against the teething troubles that would inevitably arise for the next five years.

- Five years on, this logic is less compelling.

- The GST as tax reform has reached maturity, well understood by producers, consumers, and tax officials.

- At the same time, the last few years have exposed the vulnerability of the states to shocks such as Covid-19 pandemic.

- Way forward: To prevent this situation from recurring, the authorities should create a revenue buffer that could be tapped in a time of need.

- In sum, there is a bargain waiting to be struck: The states give up their demand for an extension of the compensation mechanism, while the Centre offers a new counter-cyclical buffer.

- As the figure shows, in good economic times, GST revenues will be robust but it is against downturns that states need protection.

- The shift to revenue insurance, in turn, should allow the compensation cess to be abolished.

2) The GST structure needs to be simplified and rationalised

- The GST structure needs to be simplified and rationalised, as recommended by the Fifteenth Finance Commission and the Revenue Neutral Rate report.

- New rate structure: A new structure should have one low rate (between 8 and 10 per cent), one standard rate (between 16 and 18 per cent) and one rate for all demerit goods.

- The single rate on demerit goods also requires eliminating the cesses with all their complexity.

3) The GST Council’s working needs changes

- Consensus-based decision making in GST Council can be sustained only if there is a shared sense of participatory and inclusive governance.

- Nearly two decades ago, when the VAT was being introduced, Yashwant Sinha established a culture of consensual discussions on indirect taxes.

- He did this by requiring the Empowered Committee of State Finance Ministers to be headed by a finance minister from an Opposition-run state government.

- The spirit of this idea could be translated to the GST Council.

Consider the question “Inherent importance of GST and its significance for the cooperative federalism underline the necessity for the Centre and the States to strike the win-win bargain. In light of this, examine the issues with the GST and suggest the way forward to deal with these issuef.”

Conclusion

Cooperative federalism is not a gesture or one-off outcome. It is, above all, a disposition, resulting from quotidian democratic practice. By rehabilitating cooperative federalism’s finest achievement — the GST — the Centre and states can help restore India’s broader economic prospects.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Issues with the NEET

The Tamil Nadu Assembly has passed a bill exempting the State from the National Eligibility-cum-Entrance Test (NEET) for admission to undergraduate (UG) medical courses.

About NEET

The NEET has replaced the formerly All India Pre-Medical Test (AIPMT).

It is an all-India pre-medical entrance test for students who wish to pursue undergraduate medical (MBBS), dental (BDS) and AYUSH (BAMS, BUMS, BHMS, etc.) courses.

The exam is conducted by National Testing Agency (NTA).

TN law: Permanent Exemption for NEET

- The Bill exempts medical aspirants in Tamil Nadu from taking NEET examination for admission to UG degree courses in Indian medicine, dentistry and homeopathy.

- Instead, it seeks to provide admission to such courses on the basis of marks obtained in the qualifying examination, through “Normalization methods”.

- The aim of the Bill is to ensure “social justice, uphold equality and equal opportunity, protect all vulnerable student communities from being discriminated”.

- It seeks to bring vulnerable student communities to the “mainstream of medical and dental education and in turn ensure a robust public health care across the state, particularly the rural areas”.

Why TN is against NEET?

- Non-representative: TN opposes because NEET undermined the diverse societal representation in MBBS and higher medical studies.

- Disfavors the poor: It has favored mainly the affordable and affluent sections of the society and thwarting the dreams of underprivileged social groups.

- Exams for the elite: It considers NEET not a fair or equitable method of admission since it favored the rich and elite sections of society.

- Healthcare concerns: If continued, the rural and urban poor may not be able to pursue medical courses.

Can any state legislate against NEET?

- Admissions to medical courses are traceable to entry 25 of List III (Concurrent List), Schedule VII of the Constitution.

- Therefore, the State can also enact a law regarding admission and amend any Central law on admission procedures.

Views of the stakeholders appointed by TN

- A majority of stakeholders were not in favor of the NEET requirement.

- NEET only worked against underprivileged government school students, and had profited coaching centres and affluent students.

- NEET had not provided any special mechanism for testing the knowledge and aptitude of the students.

- The higher secondary examination of the State board itself was an ample basis for the selection of students for MBBS seats.

A move inspired by a SC Judgement

- This thinking of the State may be due to the observation made by the Supreme Court in the selection process of postgraduate (PG) courses in medicine.

- The Medical Council of India (MCI) had prescribed certain regulations providing reservations for in-service candidates.

- The Supreme Court struck down regulation 9(c) made by the MCI on the ground of the exercise of power beyond its statute.

Not a similar case

- It must be remembered that the Supreme Court was only dealing with a regulation framed by the MCI.

- The requirement of NEET being a basic requirement for PG and UG medical courses has now been statutorily incorporated under Section 10D of the Indian Medical Council (IMC) Act.

- When the Tamil Nadu government issued an order in 2017 providing for the reservation of 85% of the seats for students passed out from the State board it was struck down by the Madras High Court.

- The introduction of internal reservation for government school students is under challenge before the Madras High Court. Similarly, NEET as a requirement is also pending in the Supreme Court.

- Unless these two issues are decided, NEET cannot be removed by a State amendment.

The bill cannot be passed

- The present move to pass a fresh Bill on the same lines is most likely to meet the same fate.

- The President refused to give his assent to this bill.

- It is significant that no other State in India has sought an exemption from NEET and, therefore, exempting Tamil Nadu alone may not be possible.

- Even among the seats allotted to the State, there is no bar for students from other States from competing or selecting colleges in Tamil Nadu.

The bigger question

- The question is not whether the State government can amend a law falling under the Concurrent List.

- The question is whether the State government can exempt Section 10D of the IMC Act, which is a parliamentary law that falls under the Central List (Entry 66).

- Moreover, the Supreme Court has also upheld NEET as a requirement.

- Mere statistics highlighting that a majority of the stakeholders do not want NEET in Tamil Nadu is not an answer for exempting the examination.

Again, it is State and Centre are at crossroads

- Normally, a Bill requires assent from the Governor to become a law. Stalin’s contention is that this Bill deals with education, which is a Concurrent List subject.

- Admissions to medical courses fall under Entry 25 of List III, Schedule VII of the Constitution, and therefore the state is competent to regulate the same.

- Yet, as far as matters relating to the determination of standards for higher education are concerned, the central government has the power to amend a clause or repeal an Act.

- So, just the passing of the Bill doesn’t enable the students to get exempted from writing NEET.

- Already, Union Higher Education Secretary Amit Khare has held that if any State wants to opt out of the exam, it has to seek permission from the Supreme Court.

Options for Tamil Nadu

- Data is necessary only when there is power to legislate on the subject concerned.

- Since the Bill, which will become an Act only after the President’s nod, will come into effect only from the next academic year, the battle for and against the NEET requirement will continue in courts.

- Hopefully, the courts will determine the legality and have a definite solution to the question of medical admissions within the next year.

- Till such time, students who wrote NEET will fill the seats under the State quota.

Way forward: Preventing Commercialization of Medical Education

- The time may also have come to examine whether NEET has met its purposes of improving standards and curbing commercialization and profiteering.

- Under current norms, one quite low on the merit rank can still buy a medical seat in a private college, while those ranked higher but only good enough to get a government quota seat in a private institution can be priced out of the system.

- The Centre should do something other than considering an exemption to Tamil Nadu.

- It has to conceive a better system that will allow a fair admission process while preserving inter se merit and preventing rampant commercialization.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: AUKUS, Quad

Mains level: Maritime cooperations for Indo-Pacific

The Biden administration has announced a new trilateral security partnership for the Indo-Pacific, between Australia, the U.K., and the U.S. (AUKUS).

What is AUKUS?

- AUKUS, as the partnership is being called, will strive over the next 18 months to equip Australia with nuclear propulsion technology.

- As part of this, Australia will acquire nuclear-powered submarines with help from the UK and the US.

- It will also involve a new architecture of meetings and engagements between the three countries, as well as cooperation across emerging technologies (applied AI, quantum technologies and undersea capabilities).

- Australia’s nuclear-powered submarines, when they deploy, will be armed with conventional weapons only and not nuclear weapons.

Why such an alliance?

- Tensions have been high between Australia and an increasingly assertive China, its largest trade partner.

- Australia banned Chinese telecom giant Huawei in 2108 and its PM called for an investigation into the origins of COVID-19 last year.

- China retaliated by imposing tariffs on or capping Australian exports.

Not to substitute Quad or others

- This alliance does not and will not supersede or outrank existing arrangements in the Indo-Pacific region such as the Quad, which the US and Australia form with India and Japan, and ASEAN.

- AUKUS will complement these groups and others.

Significance

- There has been only one other time that the US has shared as “extremely sensitive” submarine propulsion technology — more than 60 years ago, back in 1958, with Great Britain.

- The US is working to move past the 20-year war in Afghanistan and the chaotic U.S. exit from Kabul.

- The Biden Administration has put countering China at the center of his economic and national security efforts, describing it as the biggest challenge of this era.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: AGR

Mains level: Stress in the telecom sector

In big bang reforms, the Union Cabinet approved a relief package for the telecom sector that includes a four-year moratorium on payment of statutory dues by telecom companies as well as allowing 100% foreign investment through the automatic route.

What is AGR?

- Adjusted Gross Revenue (AGR) is the usage and licensing fee that telecom operators are charged by the Department of Telecommunications (DoT).

- It is divided into spectrum usage charges and licensing fees, pegged between 3-5 per cent and 8 per cent respectively.

Why is AGR important?

- The definition of AGR has been under litigation for 14 years.

- While telecom companies argued that it should comprise revenue from telecom services, the DoT’s stand was that the AGR should include all revenue earned by an operator, including that from non-core telecom operations.

- The AGR directly impacts the outgo from the pockets of telcos to the DoT as it is used to calculate the levies payable by operators.

- Currently, telecom operators pay 8% of the AGR as licence fee, while spectrum usage charges (SUC) vary between 3-5% of AGR.

Why do telcos need to pay out large amounts?

- Telecom companies now owe the government not just the shortfall in AGR for the past 14 years but also an interest on that amount along with penalty and interest on the penalty.

- While the exact amount telcos will need to shell out is not clear, as in a government affidavit filed in the top court, the DoT had calculated the outstanding licence fee to be over ₹92,000 crore.

- However, the actual payout can go up to ₹1.4 lakh crore as the government is likely to also raise a demand for shortfall in SUC along with interest and penalty.

- Of the total amount, it is estimated that the actual dues is about 25%, while the remaining amount is interest and penalties.

Is there stress in the sector?

- The telecom industry is reeling under a debt of over ₹4 lakh crore and has been seeking a relief package from the government.

- Even the government has on various occasions admitted that the sector is indeed undergoing stress and needs support.

- Giving a ray of hope to the telecom companies, the government recently announced setting up of a Committee of Secretaries to examine the financial stress in the sector, and recommend measures to mitigate it.

Issue of lower tariff

- Currently, telecom tariffs are among the lowest globally, driven down due to intense competition following the entry of Reliance in the sector.

- The TRAI examines the merits of a “minimum charge” that operators may charge for voice and data services.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Tarballs

Mains level: Oil spills and the threats posed

A beach in South Mumbai, saw black oil-emanating balls lying on the shore.

What are Tarballs?

- Tarballs are dark-coloured, sticky balls of oil that form when crude oil floats on the ocean surface.

- Tarballs are formed by weathering of crude oil in marine environments.

- They are transported from the open sea to the shores by sea currents and waves.

- Tarballs are usually coin-sized and are found strewn on the beaches. Some of the balls are as big as a basketball while others are smaller globules.

- However, over the years, they have become as big as basketballs and can weigh as much as 6-7 kgs.

How are tarballs formed?

- Wind and waves tear the oil slick into smaller patches that are scattered over a much wider area.

- Various physical, chemical and biological processes (weathering) change the appearance of the oil.

Why are tarballs found on the beaches during the monsoon?

- It is suspected that the oil comes from the large cargo ships in the deep sea and gets pushed to the shore as tarballs during monsoon due to wind speed and direction.

- All the oil spilt in the Arabian sea eventually gets deposited on the western coast in the form of tarballs in the monsoon season when wind speed and circulation pattern favour transportation of these tarballs.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Hybodont Shark

Mains level: Not Much

In a rare discovery, teeth of new species of Hybodont shark of Jurassic age have been reported for the first time from Jaisalmer by a team of officers from the Geological Survey of India (GSI).

Hybodont Shark

- Hybodonts, an extinct group of sharks, was a dominant group of fishes in both marine and fluvial environments during the Triassic and early Jurassic time.

- However, hybodont sharks started to decline in marine environments from the Middle Jurassic onwards until they formed a relatively minor component of open-marine shark assemblages.

- They finally became extinct at the end of the Cretaceous time 65 million years ago.

Significance of the fossil

- The newly discovered crushing teeth from Jaisalmer represents a new species named by the research team as Strophodusjaisalmerensis.

- These sharks have been reported for the first time from the Jurassic rocks (approximately, between 160 and 168 million years old) of the Jaisalmer region of Rajasthan.

- The genus Strophodus has been identified for the first time from the Indian subcontinent and is only the third such record from Asia, the other two being from Japan and Thailand.

- It opens a new window for further research in the domain of vertebrate fossils.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

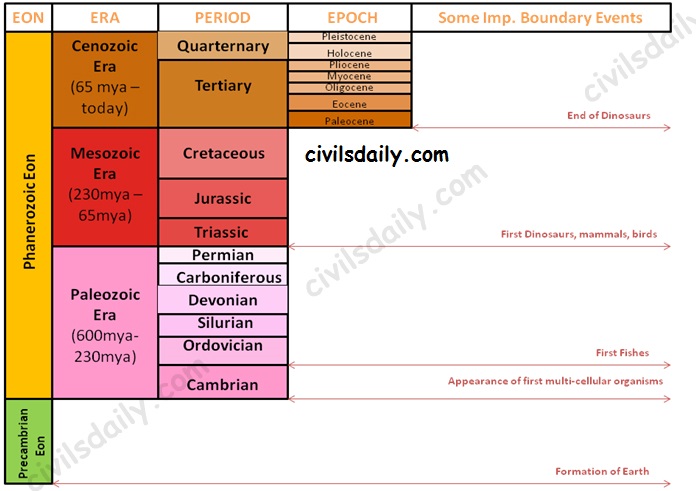

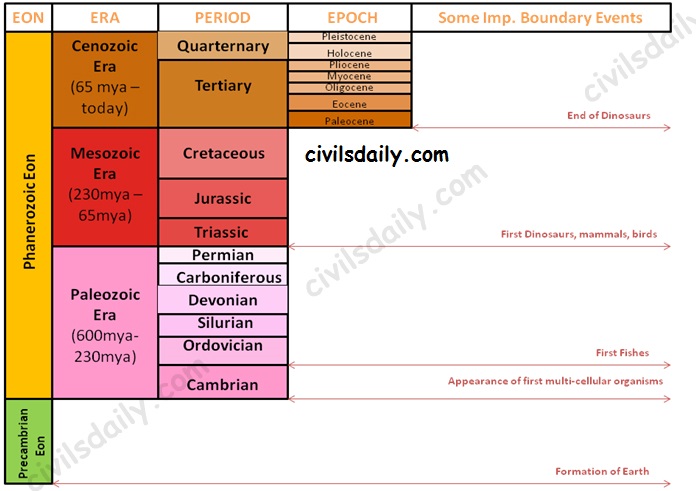

Back2Basics: Geological time-scale

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Malabar naval exercise

Mains level: Paper 2- India-Australia relations

Context

A few days ago, India’s Defence Minister and External Affairs Minister held the inaugural ‘2+2’ talks with their Australian counterparts.

Transforming relations between India-Australia

- Both are vibrant democracies which have respect for international laws and a belief in the equality of all nations irrespective of their size and strength.

- Both draw their congruence from a rule-based international order, believe in inclusive economic integration in the Indo-Pacific region, and face challenges from a belligerent China.

- Prime Minister Narendra Modi and Australian Prime Minister Scott Morrison elevated their bilateral strategic partnership to a Comprehensive Strategic Partnership in June 2020.

- Growing convergence on issues: There is a growing convergence of views on geo-strategic and geo-economic issues.

- The convergence is backed by a robust people-to-people connection.

- Both countries have stepped up collaborations through institutions and organisations on many issues in bilateral, trilateral, plurilateral and multilateral formats.

- Bilateral security cooperation: Given their common security challenges and in order to enhance regional security architecture, both countries have intensified bilateral security cooperation.

- Further, elevation of their ‘2+2’ Foreign and Defence Secretaries’ Dialogue to the ministerial level emphasises the positive trajectory of their transforming relations.

- They have also stepped up security dialogue with key partner-countries to deepen coordination in areas where security interests are mutual.

- The Malabar naval exercise by the Quad (Australia, India, Japan, the U.S.) is a step in this direction.

- Partnership with like-minded countries: Beyond bilateralism, both countries are also entering into partnerships with like-minded countries, including Indonesia, Japan and France, in a trilateral framework.

- Trade ties: Trading between India and Australia has seen remarkable growth in recent years.

- Two-way trade between them was valued at $24.4 billion in 2020.

- Trade is rapidly growing and encompasses agribusiness, infrastructure, healthcare, energy and mining, education, artificial intelligence, big data and fintech.

- An early harvest agreement by December will pave the way for an early conclusion of a bilateral Comprehensive Economic Cooperation Agreement between both countries.

Issues in deeper economic integration

- High tariff on agri products in India: India has a high tariff for agriculture and dairy products which makes it difficult for Australian exporters to export these items to India.

- Non-tariff barrier in Australia: At the same time, India faces non-tariff barriers and its skilled professionals in the Australian labour market face discrimination.

Consider the question “A growing convergence of views on geo-strategic and geo-economic issues between Indian and Australia makes it imperative to forge a partnership guided by principles with a humane approach. Comment.”

Conclusion

The Quad has gained momentum in recent months. The time is ripe for these countries to deliberate on a ‘Quad+’ framework. The geo-political and geo-economic churning in international affairs makes it imperative for India and Australia to forge a partnership guided by principles with a humane approach.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: V-Dem rating

Mains level: Paper 2- Declining democratic values

Context

India has performed poorly in every major global democracy report in the past few years.

India’s declining performance

- The Freedom House Index for 2021 pushed India down four points from last year, bringing its score from 71 to 67.

- V-Dem, the world-renowned think-tank from Sweden, has similarly downgraded India.

- It has labelled India an “electoral autocracy”.

- The Economist Intelligence Unit (EIU) study has shown India’s ranking has taken a nosedive from 27 to 53 out of 167 countries.

- The Reporters without Borders’ Press Freedom Report has placed India 167th out of 183 countries.

- Freedom House has also given India a score of 2 out of 4 in terms of press freedom.

Factors pointed out by the rating agencies

- The country has seen increased pressure being put on human rights organisations and civil rights groups.

- Journalists and activists have been intimidated and incarcerated, and minorities have been specifically targeted.

- Hate and polarisation are rampant.

- The most worrying trend has been the crackdown on freedom of speech, with statistics showing a 165 per cent increase in sedition cases between 2016 and 2019.

Issues with rejecting of global democratic indexes

- Indian government sought to challenge the rating of EIU after it released its 2021 report earlier this year.

- An offer made by the Indian government to supply ‘accurate’ data pertaining to the democratic index was firmly refused by the EIU.

- Shooting the messenger: This seeming retraction of Indian democratic values in global reports and the Indian indignation regarding it seems to be a clear case of shooting the messenger.

- Harming democracy: The Indian refusal to acknowledge and remedy them is irreparably harming its democracy.

- Trying to influence the rating agencies to doctor data to suit us is reprehensible.

- Difficulty for policymakers: Kaushik Basu, formerly the chief economist of the World Bank, commenting on this episode has said that the tendency of fabricating data to present an alternative image has beset the Indian administration.

- Not showcasing actual data is making it difficult for policymakers to attempt to remedy the situation.

Way forward

- A committee of secretaries’ meeting on January 30, 2020 discussed how India fared on various important parameters based on 32 internationally recognised indices in order to improve the performance on these indices.

- The desire to introspect and analyse what needs to be done to improve is correct and laudable.

- Let NITI Aayog and all concerned organisations focus on improving our performance in all the declining indicators.

Consider the question “Ranking of the various agencies shows the declining trend of democratic values in India. What are the reasons for such decline?vSuggest the steps to arrest this decline.”

Conclusion

Instead of denying these rankings and the reports of these agencies, India must work on fixing them.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now