Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 3- Is cryptocurrency solution to bad governance in the banking system in India?

Context

There’s an opportunity to stabilize the financial system and prevent a rival power from widening its lead.

The backdrop of YES bank failure time for cryptocurrency

- Perfect time for cryptocurrency: Confidence in the Indian financial system has been breaking down for some time. Instead of trying to restore trust, it may be time to require less of it — with the help of an official rupee cryptocurrency.

- The last straw: The collapse of corporate lender Yes Bank Ltd. was the last straw, which failed in slow motion in full view of authorities.

- Depositors have been assured that their $20 billion-plus in stuck funds will be released after a rescue by the government-controlled State Bank of India.

- What could be the impact on the sentiment of the people? While that may help prevent widespread panic, even temporarily stopping people from accessing their funds would mean that from now on, not all savings and current accounts will be treated by individuals and businesses as a perfect substitute for cash.

Why it would be costly and difficult to revive the public faith?

- It will be both difficult and costly to revive the public’s dwindling faith.

- Nationalisation not an option: A nuclear option is to nationalize the banks and non-bank finance firms that provide $1.75 trillion in annual funding. Doing so would be a doomed throwback to the late 1960s when India lurched toward stultifying socialist-style state controls.

- Corruption in banking won’t go away: Similarly, it would be unrealistic to assume that the Yes Bank embarrassment would trigger an improvement in the status quo.

- Deep crony-capital relationship: The crony-capital relationships between financiers and borrowers in India are steeped in its colonial history.

- Basel III won’t solve the problem: Putting on the gloss of Basel III capital requirements, which are supposed to make lenders less prone to failure, doesn’t make corruption in banking go away.

Can cryptocurrency be an answer?

- It offers hope: Blockchain technology, which the Indian establishment is trying to snuff out in finance, offers hope. Government should consider official crypto to obviate the need for trusted intermediaries, which are in short supply, anyway.

- China expected to launch digital currency: Before the coronavirus outbreak, China was widely expected to start its own central bank digital currency this year.

- But India’s need is greater, and its motivation very different from Beijing’s desire to shake the hegemony of the dollar.

- After the Yes Bank debacle and botched rescue, deposits in India will probably gravitate toward four or five large lenders, whose managers may be emboldened to make risky bets with other people’s money. The remaining banks will struggle for liquidity. A perennially unstable credit delivery network will always be one misstep away from the next blowup. While every country has its share of manias, panics and crashes, to be gripped by absolute financial mistrust every few years is not an environment where growth can flourish.

- Opportunity to think afresh: Earlier this month, India’s highest court set aside the Reserve Bank of India’s directive that asked banks to not offer services to cryptocurrency traders and exchanges.

- A legal defeat has provided the opportunity to think afresh.

- But in parallel, the government is considering a blanket ban on private virtual tokens. The crypto activity could get slammed again.

- Possibility of misuse: To be sure, one popular use of technology is money laundering.

- But to kill the industry and send practitioners packing would be to lose out on a valuable innovation at a time when India needs to build on the globally recognized successes of its digital payments industry, which has gained users’ trust just as banks and shadow banks have lost it.

Implications for deposit in the aftermath of Yes bank debacle

- Deposits may gravitate towards big banks: After the Yes Bank debacle and botched rescue, deposits in India will probably gravitate toward four or five large lenders, whose managers may be emboldened to make risky bets with other people’s money.

- The remaining banks will struggle for liquidity.

- Next blowup: A perennially unstable credit delivery network will always be one misstep away from the next blowup.

- Impact on growth: While every country has its share of manias, panics and crashes, to be gripped by absolute financial mistrust every few years is not an environment where growth can flourish.

Possible pathways for central banks digital currency

- Pathways suggested by BIS: After surveying 17 projects around the world — from Norway and Sweden to China, Cambodia and South Africa — the Bank for International Settlements (BIS) has identified four possible pathways for a central bank digital currency.

- Starting point- Rupee token: Of the pathways suggested by the BIS, a rupee token that doesn’t require the holder to have an account with anyone but has value guaranteed by the Reserve Bank of India could be a starting point.

- Who should enable the fund transfer? Cryptography (“I know a secret, therefore I own the funds”) rather than an account relationship (“I am who I say I am, therefore I own the funds”) would be used to enable transfers.

- Later, the RBI can open up the validation of transactions to authorized parties on distributed ledgers.

- What is the current system and issues with it? Currently, a deposit holder has to rely on everyone from the bank’s management and board to the auditors, the rating firms and the regulator to do their jobs.

- When they all fail, as in the case of Yes, the bank’s chequebook, ATM card, and online banking password cease to generate liquidity.

- Deposits stop being the same as cash, even if the state guarantees their safety.

- It would be far less painful if deposit owners only had to trust the RBI, not as a banking regulator but as a money-printing authority that could never run out of resources to settle its IOUs.

Conclusion

- China’s ambition challenge dollars position as a reserve currency: China wants the yuan to take over from the dollar as the world’s reserve currency. A tech-enabled global alternative to the greenback — of the kind that Facebook Inc.’s proposed Libra had threatened to be — would have been an obstacle. Hence, Beijing accelerated its tokenized currency initiative.

- India should jump the bandwagon: India needs to jump on the bandwagon for self-preservation. If the RBI doesn’t make easy-to-transact digital rupees available and leaves ordinary folks at the mercy of poorly run and supervised banks like Yes, people would rather store their wealth in Silicon Valley-sponsored tokenized money — or Beijing’s digital yuan — whenever they arrive.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 3- Role of agri-growth in inclusive growth and reforms in PDS.

Context

Last month, Montek Singh Ahluwalia’s book, Backstage: The Story Behind India’s High Growth Years, was released. Which tilt in favour of consumer in food policy reduces incentives for farmers, makes it difficult to unlock resources for growth.

What is covered in the book

- Besides some very interesting episodes pertaining to author’s personal and professional life, the book is full of useful insights into policy debates and their complexities.

- At many places, it provides evidence of the impact of these policies.

- This can be extremely useful as we try to rejuvenate the country’s sluggish economy and abolish poverty.

Inclusive growth and agriculture

- Growth in agriculture must for inclusive growth: During the UPA period, from 2004-05 to 2013-14, it was believed that inclusive growth is not feasible unless agriculture grows at about 4 per cent per year while the overall economy grows at about 8 per cent annually.

- The reason was simple: More than half of the working force at that time was engaged in agriculture and much of their income was derived from agriculture.

- But many political heavyweights, did not believe that agri-growth could reduce poverty fast enough.

- Main instrument of agricultural strategy: The main instrument of agricultural strategy was the Rashtriya Krishi Vikas Yojana (RKVY), which gave more leverage to states to allocate resources within agriculture-related schemes.

What was the impact of strategy?

- Agri-growth increased: The agricultural strategy, along with other infrastructure investments in rural areas, had a beneficial impact on agri-growth.

- Agri-growth increased from 2.9 per cent during the Vajpayee period (1998-99 to 2003-04) to 3.1 per cent during the UPA-1 period (2004-05 to 2008-09) and further to 4.3 per cent during UPA-2 (2009-10 to 2013-14).

- The agri-GDP growth during UPA-2 was driven not as much by RKVY as it was by high agri-prices in the wake of the global economic crisis of 2007-08.

- Impact on poverty reduction: Agri-GDP growth had a significant impact on poverty reduction, whichever way it was measured — the Lakdawala poverty line or Tendulkar poverty line, which is higher.

- At what rate poverty reduced? The rate of decline in poverty (headcount ratio), about 0.8 per cent per year during 1993-94 to 2004-05, accelerated to 2.1 per cent per year, and for the first time, the absolute number of the poor declined by a whopping 138 million during 2004-05 to 2013-14.

- Interestingly, this holds even on the basis of the international poverty line of $1.9 per capita per day (on 2011 purchasing power parity, PPP, also see graphs).

Right to food and debate around it

- Scepticism over the success of agriculture support to food subsidy: Instead of celebrating this success of the growth strategy in alleviation of poverty, several NGOs and even Congress stalwarts remained sceptical.

- They advocated food subsidy under the Right to Food Campaign.

- National Advisory Council (NAC) came up with a proposal to subsidise 90 per cent of people by giving them rice and wheat at Rs 3/kg and Rs 2/kg.

What were the arguments put forward by Montek Singh Ahluwalia?

- Burden on exchequer: He tried to convince them that this was likely to create an unsustainable burden on the exchequer.

- India could end up importing food: He also argued that India could end up importing grains to the tune of 13-15 million tonnes per year.

- Cap the population coverage at 40%: He favoured a cap at 40 per cent of the population to be covered under the Food Security Act as the poverty ratio (HCR) in 2011-12 was 22 per cent.

- Smart card to beneficiaries: He also favoured providing smart cards to the beneficiaries so that they could opt for buying more nutritious food rather than just relying on rice and wheat.

- Chance for diversification of agriculture: Smart card with beneficiaries would have also allowed diversification of agriculture and augmented farmers’ incomes.

- But he could not win over the NAC — although the coverage for food subsidy was reduced from the original proposal of 90 per cent to 67 per cent of the population.

- Against the ban on agri. export: Montek also argued against export bans on agricultural commodities as these impacted farmers’ incomes adversely.

- Government siding with consumers: But the government of the day often ended up taking the consumer’s side, as that was considered pro-poor.

- This reduced the incentives for farmers, who then had to be compensated by increasing input subsidies.

What are the result of this strategy adopted by the government?

- Negative PSE: No wonder, years later, when we estimated the producer support estimates (PSEs), as per the OECD methodology — used by countries that produce more than 70 per cent of the global agri-output — we found a deeply negative PSE.

- What negative PSE indicates? This indicates implicit taxation of agriculture through trade and marketing policies, even when one has accounted for large input subsidies going to farmers (see graph on PSE).

- Consumer bias in the system: Today, the food subsidy is the biggest item in the Union budget’s agri-food space. In the current budget, it is provisioned at Rs 1,15,570 crore.

- Borrowing by FCI not factored in: But this factor hides more than it reveals. Lately, the government has been asking the Food Corporation of India (FCI) to borrow from myriad sources, and not fully funding the food subsidy, which should logically be a budgetary item.

- The outstanding dues of the FCI are more than the provisioned subsidy, and if one adds these dues to the budgeted food subsidy, the effective amount of food subsidy comes to Rs 3,57,688 crore.

- This displays the consumer bias in the system.

Conclusion

- Restrict the population coverage of food subsidy: The Economic Survey of 2019-20 makes a case for restricting food subsidy to 20 per cent of the population — the headcount poverty in 2015 as per the World Bank’s $1.9/per capita per day (PPP) definition was only 13.4 per cent.

- For the others, the issue prices of rice and wheat need to be linked to at least 50 per cent of the procurement price or, even better, 50 per cent of the FCI’s economic cost.

- Unless we make progress on this front, it is difficult to unlock resources for the growth of agriculture, which slumped from 4.3 per cent during UPA-2 to 3.1 per cent during Modi 1.0.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 2- Strategies to deal with the COVID-19 pandemic.

Context

Currently, India has entered Stage 2 of the COVID 19 epidemic, but can we do something urgently to halt it before Stages 3 and 4, and prevent it from becoming another China or Italy? Let’s look at what COVID 19 is doing globally and what it has already done in India.

Nature and characteristics of COVID-19

- It belongs to a simple family of cold viruses: Coronavirus 19, which emerged from China but has now spread globally, belongs to a simple family of common cold viruses which look innocent and harmless, unlike the sinister flu.

- Footprints of similar epidemics: It has footprints of two similar epidemics: SARS (2002) and MERS (2012) apart from Ebola, which were contained well globally in the last two decades.

- They are the group of viruses: Coronaviruses are large groups of viruses seen in humans as well as animals like camels, bats, cats, and even cattle, which India should take note of.

- The current COVID 19 appears to be a bat-originated beta variant of the coronavirus.

- Who is the most vulnerable? The human COVID disease is fatal predominantly in elderly or vulnerable groups, such as people with a chronic disease like hypertension, diabetes, cancer or people with suppressed immune systems.

- How it is spread? It is spread via airborne droplets (sneeze or cough) or contact with the surface. It is possible that a person can get COVID-19 by touching a surface or an object that has the virus on it and then touching their own nose, eyes or mouth.

Susceptibility and the measures needed to contain the spread

- Mode of spread: The way virus spreads creates vulnerability and susceptibility of the spread of the virus through airborne droplets and contact surfaces — which are now, therefore, targets of public hygiene for preventing the spread.

- Why India is more vulnerable? We are vulnerable due to the large population constantly travelling and working: This needs immediate containment to halt the virus spread. We are a ticking time bomb now with less than 30 days to explode in Stage 3, which will be the virus getting deeper into communities, and which will then be impossible to contain.

- Poor public hygiene in India: Public hygiene in India is poor despite the “Swachh Bharat (Clean India)” movements. We need to have legislation with a penalty to stop spitting in public as well as private spaces.

- Past performance: India has done very well to contain both SARS and the novel Nipah viral spread very well.

Should India shut down the cities?

- From China to global spread: The COVID 19 virus possibly came from the Wuhan epicentre of central China. Subsequent it assumed a large enough proportion to be called a pandemic. It rapidly transitioned across different geographies of the world including Korea, Japan, Iran, Italy and others for the WHO to declare it as a pandemic.

- Neighbouring countries shutting down the cities: neighbouring countries like Thailand and Singapore shut down their major cities and towns for a few weeks to stop it from moving onto the next stages.

- Should India shut down the cities? The big question today is, should the Indian government and the state governments stop the virus spread from Stage 2 to 3 by totally shutting down cities and towns when the economy is already fragile and on the brink?

- From cluster to community spread: India had its first case diagnosed on January 30, from a student who returned from China. Later, it had a very slow spread despite the global transit involved. Such individual cases will become small clusters.

- These clusters will then spread to communities.

- We must halt the community-wide spread: Currently, we have just moved from case to clusters, but we must halt the community-wide spread.

- Biphasic or dual-phase infection: COVID 19 usually follows what is known as a biphasic or dual-phase infection, which means the virus persists and causes a different set of symptoms than observed in the initial bout.

- Also, sometimes, the recovered person can relapse.

- The possibility of “super spreader”: Currently, the cases and clusters in India are simple spreaders which means an infected person with normal infectivity.

- What is it? But COVID 19 can also have a “super spreader”, which means an infected person with high infectivity who can infect hundreds in no time.

- This was reportedly seen in Wuhan where a fringe group spread the virus via a place of worship in Korea, infecting almost 51 cases.

- India saw a mini spurt of cases on March 4, and then again between March 10 and 13, when cases jumped from 23 to 35, yet no super spreader was present.

- We need to halt transition from stage 2 to stage 3: Now we have almost crossed a hundred cases and we must be vigilant.

- As we enter Stage 2, we will now see a geometric jump in the number of cases which will put us at risk of rapidly transitioning from Stage 2 to 3 like Italy, which we need to halt urgently.

Conclusion

The ICMR has rightly advised the government to go into partial shutdown but is it too little too late now? It’s time to halt COVID 19 by smartly locking the country at home so that we can have a better tomorrow. This needs a political will which we currently have.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: SDRF/NDRF

Mains level: Coronovirus outbreak and its mitigation

The Ministry of Home Affairs has decided to treat COVID-19 as a notified disaster for the purpose of providing assistance under the State Disaster Response Fund (SDRF).

What is a Disaster?

According to the Disaster Management Act, 2005 a disaster is defined as-

- A catastrophe, mishap, calamity or grave occurrence in any area, arising from natural or manmade causes, or by accident or negligence which results in substantial loss of life or human suffering or damage to, and destruction of, property, or damage to, or degradation of, environment, and is of such a nature or magnitude as to be beyond the coping capacity of the community of the affected area.

- The MHA has defined a disaster as an “extreme disruption of the functioning of a society that causes widespread human, material, or environmental losses that exceed the ability of the affected society to cope with its own resources.

What is the State Disaster Response Fund?

- The SDRF is constituted under the Disaster Management Act, 2005 and is the primary fund available with state governments for responses to notified disasters.

- The Central government contributes 75 per cent towards the SDRF allocation for general category states and UTs, and over 90 per cent for special category states/UTs (which includes northeastern states, Sikkim, Himachal Pradesh and Uttarakhand).

- For SDRF, the Centre releases funds in two equal instalments as per the recommendation of the Finance Commission.

- The disasters covered under the SDRF include cyclones, droughts, tsunamis, hailstorms, landslides, avalanches and pest attacks among others.

The NDRF

The National Disaster Response Fund, which is also constituted under the Disaster Management Act, 2005 supplements the SDRF of a state, in case of a disaster of severe nature, provided adequate funds are not available in the SDRF.

Categories of disaster

- A High Power Committee on Disaster Management was constituted in 1999 to identify disaster categories.

- It identified 31 disaster categories organised into five major subgroups, which are: water and climate-related disasters, geological related disasters, chemical, industrial and nuclear-related disasters and biological related disasters, which includes biological disasters and epidemics.

Have there been such instances in the past?

- In 2018, in view of the devastation caused by the Kerala floods, political leaders in Kerala demanded that the floods be declared a “national calamity”.

- As of now, there is no executive or legal provision to declare a national calamity.

- In 2001, the National Committee on Disaster Management under then PM was mandated to look into the parameters that should define a national calamity.

- However, the committee did not suggest any fixed criterion.

- In the past, there have been demands from states to declare certain events as natural disasters, such as the Uttarakhand flood in 2013, Cyclone Hudhud in Andhra Pradesh in 2014, and the Assam floods of 2015.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Essential commodities

Mains level: Regulation of essential commodities

Following reports of shortage and irrational pricing of hand sanitisers and masks, the union government has declared these items “essential commodities” until the end of June. It has notified an Order under the Essential Commodities Act to declare these items as Essential Commodities up to 30th June, 2020 by amending the Schedule of the Essential Commodities Act, 1955.

Why such move?

- The coronavirus pandemic has triggered panic buying of masks and hand sanitisers at many places around the world, including in India.

- The government’s order has come in the wake of reports of a shortage of these commodities and a sudden and sharp spike in their prices, and the alleged hoarding of stocks by manufacturers.

What does the government’s declaration mean?

- The Essential Commodities Act provides, “in the interest of the general public, for the control of the production, supply and distribution of, and trade and commerce, in certain commodities”.

- The law was passed in 1955 to essentially protect consumers from unreasonable and exploitative increases in prices of commodities in times of shortage.

- It has been amended several times over the years, and made more stringent.

- Under the Act, the government can also fix the maximum retail price (MRP) of any packaged product that it declares an “essential commodity”.

What kinds of items or products are generally classified as essential commodities?

- The government has sweeping powers in this regard. The Act defines an “essential commodity” as simply “a commodity specified in the Schedule”.

- The Act empowers the central government to add new commodities to the list of Essential Commodities as and when the need arises, and to remove them from the list once the crisis is over or the situation improves.

- Over the years, a long list of items has been designated as essential commodities, including various drugs, fertilisers, cereals, pulses, sugar, edible oils, petroleum and petroleum products, and certain crops.

- In the present situation, the government can intervene to regulate the supply and pricing of masks and hand sanitisers, and also notify their stock-holding limits.

How do states and UTs implement these orders?

- They act on the notification issued by the Centre and implement the regulations.

- Anybody trading or dealing in the essential commodity, including wholesalers, retailers, manufacturers, and importers, is barred from stocking it beyond the specified quantity.

What if the retailers/traders/manufacturers do not comply?

- The purpose of designating any commodity as “essential” is to prevent profiteering at a time of extraordinary demand.

- Violators are, therefore, termed as illegal hoarders or black-marketeers who can be prosecuted.

- Besides penalties, the violation may lead to imprisonment for a maximum period of seven years.

- Agencies of state governments and UT administrations are empowered to conduct raids to catch violators.

- The government can confiscate excess stock hoarded by retailers/traders/manufacturers, and either auction it or sell it through fair-price shops.

Impact on Corona curbing

- It is important to note that the designation of masks and hand sanitisers as “essential commodities” does not mean that the government considers them to be ‘essential’, in the literal sense, in the fight against COVID-19.

- Doctors and health experts have underlined that the use of masks is helpful only if you have symptoms yourself, or if you are caring for someone who has symptoms.

- The infection is spreading mostly through infected surfaces — and masks, especially the cheap surgical ones, can’t actually block the virus out.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Excise duty

Mains level: Changes in taxation after GST regime

The Central levies on petrol and diesel were hiked amid sliding global crude oil prices. But the price of petrol and diesel registered a decline after oil companies further cut auto fuel prices in light of the substantial fall in global crude oil prices.

What is Excise Duty?

- Excise duty is a form of tax imposed on goods for their production, licensing and sale.

- It is the opposite of Customs duty in sense that it applies to goods manufactured domestically in the country, while Customs is levied on those coming from outside of the country.

- At the central level, excise duty earlier used to be levied as Central Excise Duty, Additional Excise Duty, etc.

- Excise duty was levied on manufactured goods and levied at the time of removal of goods, while GST is levied on the supply of goods and services.

Purview of excise duty

- The GST introduction in July 2017 subsumed many types of excise duty.

- Today, excise duty applies only on petroleum and liquor.

- Alcohol does not come under the purview of GST as exclusion mandated by constitutional provision.

- States levy taxes on alcohol according to the same practice as was prevalent before the rollout of GST.

- After GST was introduced, excise duty was replaced by central GST because excise was levied by the central government. The revenue generated from CGST goes to the central government.

Types of excise duty in India

Before GST kicked in, there were three kinds of excise duties in India.

Basic Excise Duty

- Basic excise duty is also known as the Central Value Added Tax (CENVAT). This category of excise duty was levied on goods that were classified under the first schedule of the Central Excise Tariff Act, 1985.

- This duty was levied under Section 3 (1) (a) of the Central Excise Act, 1944. This duty applied on all goods except salt.

Additional Excise Duty

- Additional excise duty was levied on goods of high importance, under the Additional Excise under Additional Duties of Excise (Goods of Special Importance) Act, 1957.

- This duty was levied on some special category of goods.

Special Excise Duty

- This type of excise duty was levied on special goods classified under the Second Schedule to the Central Excise Tariff Act, 1985.

- Presently the central excise duty comprises of a Basic Excise Duty, Special Additional Excise Duty and Additional Excise Duty (Road and Infrastructure Cess) on auto fuels.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Torreites sanchezi, Leap Year

Mains level: Evolution in the spin of earth and various factors affecting it

Earth spun 372 times a year 70 million years ago, compared to the current 365. This means the day was 23½ hours long, compared to 24 today.

Faster Earth in the olden days

- It has long been known that Earth’s spin has slowed over time.

- Previous climate reconstructions, however, have described long-term changes over tens of thousands of years.

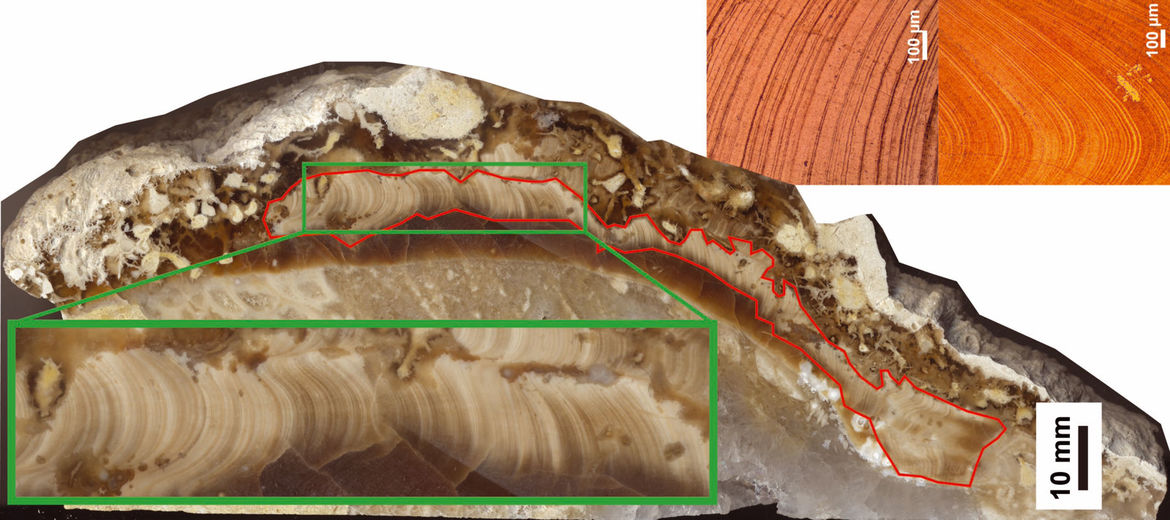

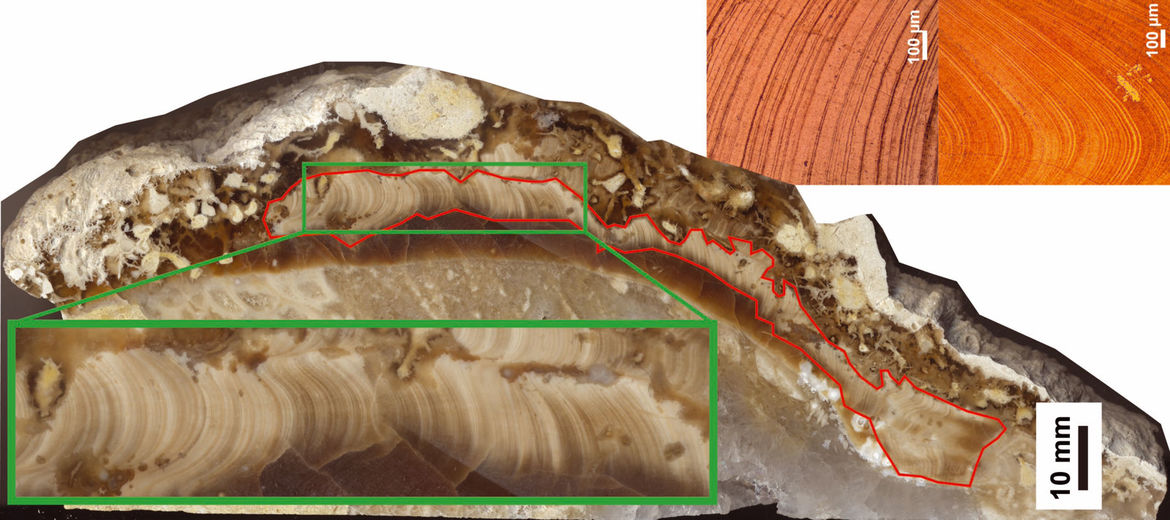

- The new study looked at daily and annual variations in the mollusc shell.

About the Mollusc

- A mollusc is an invertebrate of a large phylum which includes snails, slugs, mussels, and octopuses. They have a soft unsegmented body and live in aquatic or damp habitats, and most kinds have an external calcareous shell.

- The ancient mollusc, Torreites Sanchez, belonged to an extinct group called rudist clams.

- At 70 million years ago, it belonged to the Late Cretaceous — it was around the time this epoch ended, some 65 million years ago, that dinosaurs went extinct.

How did researchers conclude this variation?

- Torreites sanchezi grew very fast, laying down daily growth rings.

- Using lasers on a single individual, scientists sampled tiny slices and counted the growth rings accurately.

- This allowed them to determine the number of days in a year 70 million years ago, and more accurately calculate the length of a day.

Significance of the research

- It is important to note that the period of Earth’s orbit has remained the same. In other words, one year 70 million years ago was as long as one year today.

- However, if there were a calendar then, the year would have been 372 “days” long, with each “day” half-an-hour shorter than one day today.

- Today, Earth’s orbit is not exactly 365 days, but 365 days and a fraction, which is why our calendars have leap years, as a correction.

The Moon’s retreat

- Friction from ocean tides, caused by the Moon’s gravity, slows Earth’s rotation and leads to longer days.

- And as Earth’s spin slows the Moon moves farther away at 3.82 cm per year.

- If this rate is projected back in time, however, the Moon would be inside the Earth only 1.4 billion years ago.

- This new measurement, in turn, informs models of how the Moon formed and how closes it has been to Earth over their 4.5-billion-year gravitational relationship.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: SIRT1

Mains level: NA

A study by researchers from the Tata Institute of Fundamental Research, Mumbai (TIFR) has revealed that glucose in the body controls the function of SIRT1 enzymes directly.

What is SIRT1?

- SIRT1 is an enzyme that deacetylates (removal of acetyl) proteins which contribute to cellular regulation.

- A shortage or absence of the control by glucose may lead to a diabetic-like state, while excess feeding and sustained low levels of SIRT1 can lead to obesity and enhanced ageing.

- This information is expected to tackle lifestyle disorders and ageing-related diseases.

How do they function?

- In normal healthy individuals, SIRT1 protein levels are known to increase during fasting and decrease during the feed, which is essential to maintain a balance between glucose and fat metabolism.

- The glucose controls the functions of a protein SIRT1 which in turn maintains everyday feed-fast cycles and is also associated with longevity.

- The feed-fast cycle is a basic pattern and the metabolism-related to this is largely taken care of by the liver.

- Thus, the study shows that both over-activation and under-activation of SIRT1 can lead to diseases.

- Glucose puts a check on the activity of SIRT1 in the fed state. In the absence of this check, SIRT1 activity increases and results in hyperglycemia in a fasted state, mimicking diabetic state.

- The constant feeding or high-calorie intake that leads to a sustained reduction in the levels of SIRT1 by glucose which is associated with ageing and obesity.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Ro-Pax Ferry

Mains level: Not Much

Mumbai – the first metropolitan city in India has introduced Ro-Pax service to its transport infrastructure. M2M1 Ferry Vessel has commenced operations between Mumbai and Mandwa.

Ro-Pax Ferry

- Ro-Pax Ferry is a ferry that combines the features of a cruise ship and a roll-on/roll-off service.

- This service has brought much to the relief of daily commuters, job seekers and holiday-goers travelling between Mumbai and Mandwa and also other parts of Alibaug.

- Ro-Pax service enables people to ferry along with their vehicles on board, between Mumbai and Mandwa.

- With this, Mumbai, Alibaug and the adjoining Konkan region will experience a boost in tourism, hinterland connectivity and also job opportunities.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now