Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Prime Minister Dhan-Dhaanya Krishi Yojana

Why in the News?

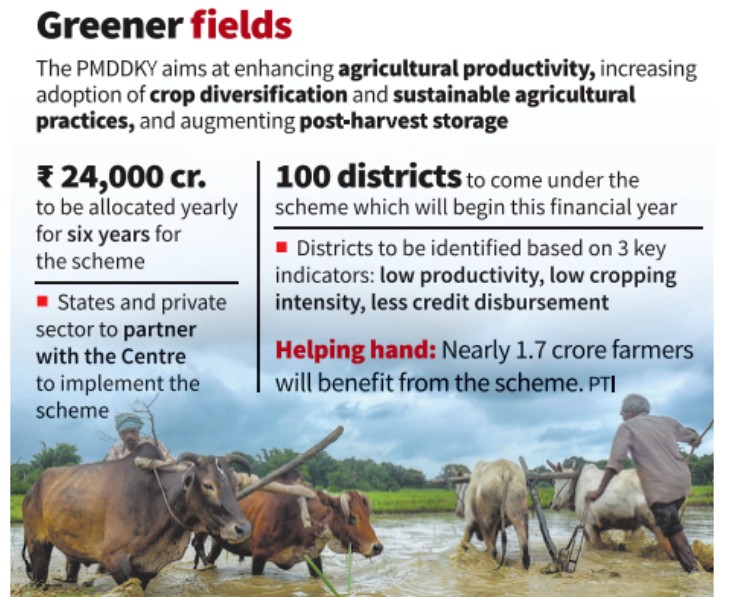

The Union Cabinet has approved the Prime Minister Dhan-Dhaanya Krishi Yojana (PMDDKY), aimed at enhancing agricultural productivity, promoting sustainable practices, and improving rural livelihoods.

About Prime Minister Dhan-Dhaanya Krishi Yojana (PMDDKY)

- Objective: Aims to transform agriculture in 100 low-performing districts by addressing productivity gaps.

- Inspiration: Modelled on NITI Aayog’s Aspirational Districts Programme; first scheme focused solely on agriculture and allied sectors.

- Launch: Announced in Union Budget 2025–26 and approved by the Union Cabinet chaired by PM Narendra Modi.

- Approach: Driven by convergence of schemes, collaboration across stakeholders, and healthy competition among districts.

Key Features:

- Scheme Integration: Merges 36 schemes from 11 ministries into one unified framework.

- Budget & Duration: ₹24,000 crore annual outlay for six years (starting 2025–26).

- District Selection:

- 100 districts with low productivity, cropping intensity, and credit access

- At least one district from each state/UT

- Focus Areas:

- Boosting productivity

- Promoting crop diversification and sustainability

- Improving irrigation and water efficiency

- Expanding post-harvest storage

- Enhancing credit access

- Performance Monitoring: Monthly ranking on 117 Key Performance Indicators (KPI) via centralized dashboard.

- Support Mechanism: NITI Aayog to provide capacity-building and reviews.

- Expert Note: Credit-based selection criteria may require refinement.

Implementation:

- District Planning: Each district to prepare an Agriculture and Allied Activities Plan.

- Plan Approval: Handled by District Dhan Dhaanya Samiti, chaired by the Collector and including progressive farmers.

- National Alignment:

- Agricultural self-sufficiency

- Soil and water conservation

- Promotion of organic/natural farming

- Governance: Committees at district, state, and national levels to guide execution.

- Monitoring: Central Nodal Officers (CNOs) to conduct field visits and track progress.

- Technical Support: Agricultural universities to serve as knowledge partners.

- Expected Outcomes: Boost farm income, create local livelihoods, and support Atmanirbhar Bharat through enhanced agri-productivity.

| [UPSC 2020] Under the Kisan Credit Card scheme, short-term credit support is given to farmers for which of the following purposes?

1. Working capital for maintenance of farm assets 2. Purchase of combine harvesters, tractors and mini truck 3. Consumption requirements of farm households 4. Post-harvest expenses 5. Construction of family house and setting up of village cold storage facility Select the correct answer using the code given below: (a) 1, 2 and 5 only (b) 1, 3 and 4 only* (c) 2, 3, 4 and 5 only (d) 1, 2, 3, 4 and 5 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

India to host Regional Wing of International Potato Center (CIP)

Why in the News?

The Union Cabinet approved the establishment of the CIP-South Asia Regional Centre (CSARC) of the International Potato Centre (CIP) in Singna, Agra, Uttar Pradesh.

About the International Potato Centre (CIP):

- Establishment: The CIP was founded in 1971 in Lima, Peru, to promote research on potato, sweet potato, and Andean root crops.

- Global Reach: CIP operates in South America, Africa, and Asia, focusing on sustainable agriculture and nutritional security.

- India Collaboration: CIP began its work in India in 1975 through an agreement with the Indian Council of Agricultural Research (ICAR).

- Germplasm Collection: It maintains the world’s largest germplasm bank for potato and sweet potato, making it central to crop breeding and biotech innovation.

- Research Areas: CIP’s activities include crop improvement, pest and disease control, post-harvest technologies, and market linkages.

- Partnership Model: The center works with local governments, agricultural institutions, and NGOs to develop climate-resilient, high-yielding varieties.

Functions of the New Regional Center (CSARC) in India:

- Location and Purpose: The new CIP-CSARC is being set up in Singna, Agra, to serve India and South Asia.

- Core Focus: It will work on developing climate-resilient, disease-free, and processing-grade varieties of potato and sweet potato.

- Food Security Goals: The center aims to enhance food and nutrition security, farmer income, and rural employment through improved productivity and value-added agri-products.

- Global Linkages: It will provide Indian researchers access to CIP’s global network, innovations, and genetic resources.

- Post-Harvest Development: It will strengthen seed quality, post-harvest systems, and improve India’s export potential in potato-based crops.

- National Importance: This will be the second major international agri-research institute in India, after IRRI-SARC in Varanasi.

Potato Cultivation in India:

|

| [UPSC 2024] Consider the following plants:

1. Groundnut 2. Horse-gram 3. Soybean How many of the above belong to the pea family? Options: (a) only one (b) only two (c) All three* (d) None |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Continuation of Modified Interest Subvention Scheme (MISS)

Why in the News?

The Union Cabinet has approved the continuation of the Interest Subvention (IS) component under the Modified Interest Subvention Scheme (MISS) for the financial year 2025–26.

About Modified Interest Subvention Scheme (MISS):

- Central Sector Scheme: It helps farmers get low-interest short-term loans through the Kisan Credit Card (KCC).

- Nodal Agencies: The scheme is monitored by RBI and NABARD and implemented through Public Sector Banks, RRBs, Cooperative Banks, and Private Banks.

- Loan Details:

- Borrowing Limit: Farmers can borrow up to ₹3 lakh at 7% interest.

- Interest Support: Banks get 1.5% interest support from the government, helping them offer cheaper loans.

- Extra Discount: Farmers who repay on time get a 3% Prompt Repayment Incentive, reducing their effective interest rate to 4%.

- For Livestock & Fisheries: Loans up to ₹2 lakh also qualify for this benefit.

- Digital Support: The Kisan Rin Portal (KRP), launched in August 2023, improves transparency and tracking of loan disbursal.

Back2Basics: Kisan Credit Card (KCC) Scheme

|

| [UPSC 2020] Under the Kisan Credit Card scheme, short-term credit support is given to farmers for which of the following purposes?

1. Working capital for maintenance of farm assets 2. Purchase of combine harvesters, tractors and mini truck 3. Consumption requirements of farm households 4. Post-harvest expenses 5. Construction of family house and setting up of village cold storage facility Select the correct answer using the code given below: Options: (a) 1, 2 and 5 only (b) 1, 3 and 4 only* (c) 2, 3, 4 and 5 only (d) 1, 2, 3, 4 and 5 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Potato Cultivation in India

Why in the News?

India is likely to become the world’s largest potato producer, overtaking China, by 2050, according to experts from the International Potato Center (CIP) based in Peru.

Back2Basics: International Potato Center (CIP)

|

Potato Cultivation in India:

- About: Potato (Solanum tuberosum) is known as the “King of Vegetables” and is India’s fourth most important food crop after rice, wheat, and maize.

- Origin: Introduced to India by Portuguese traders in the 17th century.

- Geographic Spread: Grown in 23 states, but 85% of production comes from the Indo-Gangetic plains in North India.

- Top Producing States:

- Uttar Pradesh: ~30% of total output

- West Bengal: ~23.5%

- Bihar: ~17%

- Other contributors: Punjab, Gujarat, Madhya Pradesh

- Climate Needs: Potato is a cool-season crop.

- Ideal growth temp: 24°C

- Ideal tuber formation temp: 20°C

- Soil Requirements: Prefers well-drained, fertile soils with moisture retention.

- Planting Seasons:

- Himachal Pradesh, Uttarakhand: Spring (Jan–Feb), Summer (May)

- Punjab, Haryana, UP, Bihar, Bengal: Main crop in October

- MP, Maharashtra, Karnataka: Both kharif and rabi seasons

- Seed Management: Use disease-free, sprouted seeds (30–50g);

- Popular varieties: Kufri Jyoti, Kufri Bahar, Kufri Pukhraj, and Kufri Chandramukhi.

- Fertilization & Irrigation: Apply balanced nutrients, especially phosphorus and potassium; drip irrigation is recommended.

- Harvesting: Ready in 90–120 days, harvested manually or mechanically.

Global Comparison and Future Outlook:

- Global Rank: India is the second-largest producer after China.

- Production Volume: Over 50 million tonnes/year currently; projected to reach 100 million tonnes by 2050 (CIP experts).

- Growth Drivers: Expansion is due to large cultivation area, strong domestic demand, and government support.

- Tuber Crop Potential: Promoting crops like sweet potato can improve nutrition, livelihoods, and climate resilience.

Policy measure for Potato Farmers: Operation Greens

|

| [UPSC 2014] In India, cluster bean (Guar) is traditionally used as a vegetable or animal feed, but recently the cultivation of this has assumed significance.

Which one of the following statements is correct in this context? Options: (a) The oil extracted from seeds is used in the manufacture of biodegradable plastics. (b) The gum made from its seeds is used in the extraction of shale gas.* (c) The leaf extract of this plant has the properties of antihistamines. (d) It is a source of high quality biodiesel. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Agriculture Infrastructure Fund (AIF) Scheme

From UPSC perspective, the following things are important :

Prelims level: Agriculture Infrastructure Fund (AIF) Scheme

Why in the News?

Punjab has fully utilized ₹4,713 crore allocated under the Agriculture Infrastructure Fund (AIF), making it the top-ranked state in India for implementing this scheme.

As a result, Punjab has been granted an additional ₹2,337 crore to further expand its agricultural infrastructure projects.

What is the Agriculture Infrastructure Fund (AIF) Scheme?

- The AIF is a ₹1 lakh crore financing facility launched by the Government of India in July 2020 to support post-harvest agricultural infrastructure and community farming assets.

- AIF provides medium- to long-term debt financing at subsidized interest rates, along with credit guarantee support, to eligible beneficiaries.

Key Features of the AIF Scheme:

- Total Corpus & Disbursement: ₹1 lakh crore, disbursed over 10 years (2020-21 to 2029-30).

- Interest Subvention & Loan Benefits:

- 3% interest subvention on loans up to ₹2 crore.

- Credit guarantee support through CGTMSE and NABSanrakshan.

- Maximum interest rate capped at 9% for a 7-year tenure.

- Eligible Projects:

- Post-harvest infrastructure: Warehouses, cold storage, silos, drying yards, sorting, and packaging units.

- Processing & Value Addition: Food processing plants, oil mills, flour mills, kinnow and cashew processing.

- Technology-driven solutions: Drone projects, hi-tech farm equipment rental centers.

- Renewable energy: Solar-powered irrigation and cold storage units.

- Integration with Other Government Schemes: Can be combined with State & Central subsidies for maximum benefit.

- Implementation & Monitoring:

- Managed via online MIS platform for real-time tracking.

- National, State & District-level monitoring committees ensure effective execution.

Eligible Beneficiaries Under AIF:

- Individual Farmers: Seeking on-farm storage or processing units.

- Farmer Producer Organizations (FPOs): For community-based infrastructure.

- Self-Help Groups (SHGs) & Joint Liability Groups (JLGs): Engaged in agricultural activities.

- Cooperative Societies & Primary Agricultural Credit Societies (PACS): For collective farming and value addition.

- Startups & Agri-Tech Companies: Developing post-harvest management solutions.

- State Agencies & PPP Projects: Government-backed rural infrastructure projects.

- Entrepreneurs & Agripreneurs: Working in food processing and value addition.

PYQ:[2017] Which of the following is/are the advantage/advantages of implementing the ‘National Agriculture Market’ scheme? 1. It is a pan-India electronic trading portal for agricultural commodities. 2. It provides the farmers access to nationwide market, with prices commensurate with the quality of their produce. Select the correct answer using the codes given below: (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Prime Minister Dhan-Dhaanya Krishi Yojana (PMDKY)

From UPSC perspective, the following things are important :

Prelims level: Prime Minister Dhan-Dhaanya Krishi Yojana (PMDKY)

Why in the News?

Finance Minister while presenting the Union Budget announced the launch of the Prime Minister Dhan-Dhaanya Krishi Yojana (PMDKY).

About the Prime Minister Dhan-Dhaanya Krishi Yojana (PMDKY):

- The PMDKY aims to enhance agricultural productivity, crop diversification, storage infrastructure, irrigation, and credit access.

-

- Inspired by the Aspirational Districts Programme (ADP), it will focus on 100 underperforming agricultural districts in partnership with state governments.

- Key Features

-

- Identifies 100 districts with low productivity, moderate cropping intensity, and below-average credit access.

- Develops panchayat/block-level storage and expands irrigation coverage.

- Ensures affordable short-term & long-term loans for farmers.

- Uses data-driven governance & district rankings.

- Structural Mandate:

-

- Implementation: Jointly executed by Central & State Governments.

- Funding: Drawn from existing schemes under the Ministry of Agriculture & Farmers’ Welfare and the Ministry of Fisheries, Animal Husbandry & Dairying.

- Evaluation: Assessed based on yield improvements, credit flow, and irrigation expansion.

PYQ:[2015] ‘Pradhan Mantri Jan-Dhan Yojana’ has been launched for: (a) providing housing loan to poor people at cheaper interest rates (b) promoting women’s Self-Help Groups in backward areas (c) promoting financial inclusion in the country (d) providing financial help to the marginalized communities |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

10 New Agricultural Commodities added to the E-NAM platform

From UPSC perspective, the following things are important :

Prelims level: electronic-National Agriculture Market (E-NAM)

Why in the News?

The Agriculture Ministry has allowed trading of 10 additional commodities on the electronic-National Agriculture Market (E-NAM), taking the total number of tradable items on the platform to 231.

About the 10 new commodities:The newly added commodities include dried Tulsi leaves, Besant (Chickpea flour), wheat flour, chana sattu (Roasted Chickpea Flour), water Chestnut flour, asafoetida, dried fenugreek leaves, baby corn, dragon fruit and water Chestnut, the ministry said in a statement. Current Status of E-NAM (As of December 2024):

|

What is E-NAM?

- E-NAM is a pan-India electronic trading platform launched by the Government of India on April 14, 2016.

- It integrates existing Agriculture Produce Market Committees (APMCs) to create a unified national market for agricultural commodities.

- The Small Farmers Agribusiness Consortium (SFAC), under the Ministry of Agriculture and Farmers’ Welfare, is the implementing agency for e-NAM.

- The platform enables farmers, traders, and buyers to trade agricultural commodities online, across states, ensuring better price discovery and transparency.

Objectives of e-NAM

- Improve market efficiency by integrating APMC mandis into a unified online platform.

- Enhance price discovery through a competitive bidding process, ensuring fair market prices for farmers.

- Promote inter-state trade by removing barriers and unifying agricultural markets across India.

- Reduce dependency on middlemen, ensuring direct benefits to farmers.

- Facilitate e-payments to ensure quick and transparent financial transactions for farmers.

What is E-NAM 2.0?

|

PYQ:[2017] What is/are the advantage/advantages of implementing the ‘National Agriculture Market’ scheme?

Select the correct answer using the code given below: (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

New Makhana Board and Food Institute to be opened in Bihar

From UPSC perspective, the following things are important :

Prelims level: Makhana Board

Why in the News?

The Union Budget 2025 has announced the establishment of a Makhana Board in Bihar to improve production, processing, value addition, and marketing of makhana (fox nut).

What is Makhana?

|

About the Makhana Board

- The Makhana Board will train farmers, ensure market access, regulate pricing, and promote exports.

- The Food Processing Institute will focus on value addition, quality control, research, and global trade facilitation.

- Aims & Objectives:

- Increase production by promoting high-yield varieties like Swarna Vaidehi and Sabour Makhana-1.

- Improve processing infrastructure to reduce wastage and enhance product quality.

- Support exports through cargo infrastructure, trade partnerships, and branding initiatives.

- Structural Mandate:

- Governing body led by government officials, farmer representatives, and industry experts.

- Regional centers in key makhana-producing districts to assist farmers.

- Partnerships with ICAR, NABARD, and agricultural universities for research and financial support.

- ₹100 crore initial funding for infrastructure, training, and market expansion.

- Powers & Functions: Regulate production, enforce quality standards, provide subsidies, promote research, develop export infrastructure, and launch branding campaigns.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Only a radical policy shift can lift farmers from widespread distress

From UPSC perspective, the following things are important :

Mains level: Challenges in Agriculture;

Why in the News?

Agriculture has been given little attention, even though the National Crime Records Bureau (NCRB) data shows that 1,00,474 farmers and agricultural workers took their own lives between 2015 and 2022.

What are the root causes of the current agrarian distress faced by farmers in India?

- Unmet Minimum Support Price (MSP) Promise: Despite repeated promises, the government has failed to implement the MSP at the rate of C2+50% (one-and-a-half times the comprehensive cost of production) as recommended by the M.S. Swaminathan Commission.

- Rising Input Costs and Economic Burden: The cost of agricultural inputs such as fertilizers, seeds, insecticides, diesel, water, and electricity has been steadily rising.

- Inadequate Government Support and Infrastructure: Government allocations to agriculture and allied sectors have been declining, from 5.44% of the total budget in 2019 to just 3.15% in 2024.

- At the same time, public investment in irrigation and power infrastructure has decreased, leading to water scarcity and unreliable electricity supply.

How can policy reforms effectively address the challenges faced by farmers?

- Implementation of MSP: Establishing a statutory MSP at C2+50% is essential to ensure that farmers receive fair compensation for their produce. This reform would help alleviate financial distress and reduce the incidence of farm suicides.

- Subsidy Increases and Cost Controls: The government should raise subsidies for agricultural inputs and impose strict controls on prices charged by private corporations for fertilizers and seeds. Supporting public sector production can help stabilize prices and ensure availability.

- Comprehensive Loan Waiver: A one-time loan waiver for farmers can provide immediate relief from debt burdens. This measure should be coupled with long-term strategies to prevent future indebtedness through better financial management and support systems.

What role do government support and institutional frameworks play in alleviating farmer distress?

- Financial Assistance and Subsidies: Government support through subsidies for fertilizers, seeds, and irrigation systems helps reduce the financial burden on farmers. For example, the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) provides direct income support to farmers, aiding those facing economic hardship.

- Crop Insurance and Risk Mitigation: Institutional frameworks such as the Pradhan Mantri Fasal Bima Yojana (PMFBY) offer insurance schemes to protect farmers against crop losses due to natural disasters, thereby reducing the risk of distress when unforeseen events occur.

- Market Access and Price Support: The government ensures fair prices and stable markets through Minimum Support Price (MSP) and procurement schemes. The Food Corporation of India (FCI) buys surplus crops like wheat and rice from farmers at MSP, offering a safety net during market fluctuations.

- Agricultural Credit and Loans: Institutional frameworks like the NABARD (National Bank for Agriculture and Rural Development) and other banks offer affordable loans to farmers, allowing them to invest in better farming techniques or recover from losses, thus mitigating financial stress.

- For example, Kisan Credit Cards (KCC) provide short-term credit to meet the farmers’ needs for inputs and daily expenses.

Way forward:

- Strengthen Infrastructure and Support Systems: Invest in reliable irrigation, power supply, and crop insurance schemes, ensuring farmers have access to resources that help them cope with climate-related challenges and reduce dependency on private traders.

- Enhance Financial Accessibility and Risk Management: Expand access to affordable credit, implement statutory MSP at C2+50%, and provide better financial literacy programs to help farmers manage debts and reduce vulnerability to market fluctuations.

Mains PYQ:

Q Explain various types of revolutions, took place in Agriculture after Independence in India. How these revolutions have helped in poverty alleviation and food security in India? (UPSC IAS/2017)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Banana Cultivation in India

From UPSC perspective, the following things are important :

Prelims level: Banana Cultivation

Why in the News?

India has seen a 10x increase in banana exports over the past decade and now targets $1 billion in exports within the next five years. In the fiscal year 2022-23, India’s banana production was estimated at around 34.9 million metric tons.

Do you know?

|

Banana Cultivation in India

- Bananas thrive in tropical and subtropical climates with temperatures between 15°C and 35°C and high humidity.

- Common varieties: Dwarf Cavendish, Robusta, Grand Naine, Nendran, Rasthali, Poovan, Red Banana, Monthan, Safed Velchi, Lal Velchi, Ardhapuri, Karpuravalli, Elakki Bale, Basrai, Amrit Sagar, Champa, Chinia, Malbhog, Rajapuri, and Yelakki.

- The crop requires well–drained, loamy soil with a pH of 6.5–7.5 and 1,800–2,000 mm of water annually, often supported by drip irrigation.

- Fusarium Wilt is the most common disease affecting Bananas.

- Seasons for Planting:

- Maharashtra: Kharif (June–July) and Rabi (October–November).

- Tamil Nadu: February–April and November–December.

- Kerala: Rainfed crop (April–May) and irrigated crop (August–September).

PYQ:[2011] Recently, our scientists have discovered a new and distinct species of banana plant which attains a height of about 11 metres and has orange coloured fruit pulp. In which part of India has it been discovered? (a) Andaman Islands (b) Anaimalai Forests (c) Maikala Hills (d) Tropical rain forests of northeast |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

[pib] Yuva Sahakar Scheme

From UPSC perspective, the following things are important :

Prelims level: Yuva Sahakar Scheme

Why in the News?

The Ministry of Cooperation, in written reply to a question in the Lok Sabha has informed about the progress of the Yuva Sahakar Scheme.

Current Financial Details:

|

About the Yuva Sahakar Scheme:

| Details | ||

| Overview and Objectives |

|

|

| Features and Provisions |

|

|

| Significance |

|

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

[pib] New Policy Initiatives in Agriculture Sector

From UPSC perspective, the following things are important :

Prelims level: Various initiatives mentioned

Why in the News?

- The Government of India, recognizing agriculture as a State subject, actively supports State governments through various policy measures and budgetary allocations aimed at improving the welfare of farmers.

- Below are some key initiatives approved by the Union Cabinet:

| Clean Plant Programme (CPP) |

|

| Digital Agriculture Mission |

(Discussed in detail in one of the today’s articles.) |

| Agriculture Infrastructure Fund Scheme |

|

| National Mission on Edible Oils – Oilseeds (NMEO-Oilseeds) |

|

| National Mission on Natural Farming (NMNF) |

|

| Additional Key Programmes Initiated in 2024-25 |

|

PYQ:[2020] In India, which of the following can be considered as public investment in agriculture?

Select the correct answer using the code given below: (a) 1, 2 and 5 only (b) 1, 3, 4 and 5 only (c) 2, 3 and 6 only (d) 1, 2, 3, 4, 5 and 6 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Prospects and Concerns for the Rabi Crop

From UPSC perspective, the following things are important :

Prelims level: Rabi Cropping Seasons

Why in the News?

Due to high October temperatures and shortages of di-ammonium phosphate (DAP) fertiliser, the planting of key Rabi (winter-spring) crops such as wheat, mustard, and chana (chickpea) has been slower than usual.

Low Rabi Sowing this Year

|

About Rabi Cropping Season in India:

- Rabi crops are generally sown in mid-November, once the monsoon rains have receded.

- These crops grow using the rainwater that has percolated into the soil or with the help of irrigation systems.

- The harvesting of Rabi crops generally occurs from April to May.

- Major Rabi Crops:

- Wheat: The largest and most important Rabi crop in India.

- Barley: Grown mainly in North and Central India.

- Mustard: An essential oilseed crop grown across various regions.

- Sesame: Grown in many states but harvested early.

- Peas: Harvested early, with a market peak from January to March (especially in February).

- Agronomic Features:

- Rabi crops rely heavily on irrigation and residual moisture from the previous monsoon season.

- Excessive winter rainfall can harm Rabi crops but benefits the kharif crops grown later.

PYQ:[2013] Consider the following crops:

Which of these are Kharif crops? (a) 1 and 4 (b) 2 and 3 only (c) 1, 2 and 3 (d) 2, 3 and 4 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Central government scheme to promote natural farming launched

From UPSC perspective, the following things are important :

Prelims level: Natural Farming;

Mains level: Significance of Natural Farming; National Mission on Natural Farming (NMNF);

Why in the News?

Recently, the Union Cabinet approved the “National Mission on Natural Farming (NMNF)”, a Centrally Sponsored Scheme by the Agriculture Ministry to promote natural farming nationwide in mission mode.

What is Natural Farming?

|

How is the NMNF Different from Earlier Interventions?

The NMNF represents an evolution of previous initiatives, particularly the Bhartiya Prakritik Krishi Paddhti (BPKP), which was launched in 2019.

- Higher Budgetary Outlay: The NMNF has a total financial outlay of ₹2,481 crore, with ₹1,584 crore from the central government and ₹897 crore from states until 2025-26.

- Targeting More Farmers: The mission aims to engage over one crore farmers, significantly expanding its reach compared to earlier efforts.

- Establishment of Standards: It seeks to create scientifically supported standards and streamlined certification processes for naturally grown produce, along with a national brand for such products.

Why is it Necessary to Diversify the Farming Basket?

- Environmental Sustainability: Reducing chemical inputs helps restore soil health and biodiversity, making agriculture more resilient to climate change.

- Economic Viability: By promoting local inputs and reducing dependency on purchased fertilizers, farmers can lower their costs and increase their profitability.

- Food Security: A diverse agricultural system can lead to improved food quality and nutritional security for communities.

Why a Mission on Natural Farming is Needed?

- Excessive Fertilizer Use: The initiative targets districts with high fertiliser consumption, aiming to shift practices towards more sustainable methods that rejuvenate soil health and reduce environmental degradation.

- Health Risks: By eliminating synthetic chemicals from farming, the mission aims to lower health risks associated with pesticide exposure for both farmers and consumers.

- Climate Resilience: Natural farming practices enhance resilience against climate-related challenges such as droughts and floods by improving soil structure and water retention capabilities.

Way forward:

- Policy and Infrastructure Support: Strengthen institutional frameworks by expanding Bio-input Resource Centres (BRCs), offering financial incentives, and ensuring easy access to natural farming resources and certification systems.

- Awareness and Capacity Building: Conduct large-scale training programs for farmers on natural farming practices, promote successful models through Krishi Vigyan Kendras (KVKs), and foster collaborations with agricultural universities for research and innovation.

Mains PYQ:

Q What is an Integrated Farming System? How is it helpful to small and marginal farmers in India? (UPSC IAS/2022)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

‘Yield’ can’t be the sole indicator for agriculture

From UPSC perspective, the following things are important :

Mains level: Issues related to agricultural productivity;

Why in the News?

Government must embrace a new approach where the success of agriculture is defined by its capacity to nourish people, support livelihoods, and safeguard our planet for future generations.

What are the limitations of using yield as the sole indicator of agricultural success?

- Nutritional Quality Neglect as per ICAR (Indian Council for Agricultural Research): Focusing on yield has led to a decline in the nutritional profile of crops. High-yielding varieties often have lower micronutrient densities, as seen in reduced zinc and iron levels in rice and wheat.

- Increased Input Costs: Higher yield does not always correlate with increased farmer income. The cost of achieving additional yield may be high, especially as the response to fertilizers has declined significantly since the 1970s.

- Biodiversity Loss: The emphasis on a few high-yielding varieties leads to the loss of diverse, local crop varieties. For example, India has lost around 104,000 rice varieties since the Green Revolution.

- Environmental Impact: Intensive farming to maximize yield can degrade soil health, reduce water availability, and harm the ecosystem, making agriculture less sustainable.

- Reduced Resilience: The prioritization of yield over other factors makes crops less resilient to extreme weather events such as floods, droughts, and heatwaves.

How do other indicators complement yield in assessing agricultural sustainability?

- Nutritional Output Per Hectare: This indicator measures not just the quantity but the quality of the food produced, addressing nutritional security.

- Soil Health Metrics: Including soil biological activity and soil organic carbon in evaluations helps ensure long-term soil fertility and productivity.

- Water-Use Efficiency: Metrics like water-use efficiency track the amount of water required to produce crops, promoting conservation.

- Farm Biodiversity: Assessing crop diversity at the farm and regional levels (Landscape Diversity Score) improves resilience to pests, diseases, and climate variability.

- Economic Resilience Metrics: Indicators such as income diversification (through intercropping, livestock rearing, etc.) can help measure farmers’ economic stability.

- Environmental Impact Measures: Tracking parameters like carbon footprint and ecosystem services evaluates the broader impact of agricultural practices.

What practices can farmers adopt to improve sustainability beyond just increasing yield? (Way forward)

- Intercropping: Growing multiple crops together (e.g., sugarcane with vegetables) can provide year-round income and enhance soil health.

- Agroecological Approaches: Practices such as crop rotation, organic farming, and reduced pesticide use help maintain biodiversity and soil fertility.

- Water Management Techniques: Using methods like drip irrigation and AI-powered tools for optimal irrigation ensures better water use.

- Integrated Pest Management (IPM): Combining biological, mechanical, and chemical control methods reduces reliance on harmful pesticides.

- Conservation Agriculture: Techniques such as no-till farming and mulching help improve soil structure and retain moisture.

- Adopting Climate-Resilient Varieties: Growing drought-tolerant or flood-resistant crop varieties helps mitigate the impacts of climate change.

Mains PYQ:

Q Discuss the various economic and socio-cultural forces that are driving increasing feminization of agriculture in India. (UPSC IAS/2014)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

What is the National Agriculture Code, currently being formulated by BIS?

From UPSC perspective, the following things are important :

Mains level: Agriculture;

Why in the News?

The Bureau of Indian Standards (BIS) has initiated the development of a National Agriculture Code (NAC), similar to the existing National Building Code and National Electrical Code.

What is the National Agricultural Code (NAC)?

- The NAC is a comprehensive set of standards for the agricultural sector, formulated by the Bureau of Indian Standards (BIS).

- It aims to standardize all agricultural practices and post-harvest operations, including the use of machinery, field preparation, water use, crop management, and input management like fertilisers and pesticides.

- It will cover both traditional and emerging agricultural practices like organic farming, natural farming, and the use of the Internet of Things (IoT) in agriculture.

What Role Will the NAC Play in Standardization?

- Comprehensive Framework: The NAC will provide a standardized framework for agricultural processes, ensuring quality, consistency, and efficiency in farming practices across India.

- Sector-wide Application: It will set guidelines for various aspects of the agriculture sector, including crop selection, land preparation, irrigation, soil and plant health management, post-harvest operations, sustainability, and documentation.

- Incorporation in Policies: The NAC will serve as a reference for policymakers, agriculture departments, and regulators to incorporate into schemes, policies, and regulations, aiding in quality control across the agricultural value chain.

Who is Involved in the Formulation of the NAC?

- The Bureau of Indian Standards (BIS) is leading the formulation of the NAC.

- The BIS has formed working panels consisting of university professors, R&D organizations, and experts in 12-14 specific areas of agriculture to draft the NAC.

- The BIS is collaborating with premier agricultural institutes and has already signed Memoranda of Understanding (MoUs) with institutes like Govind Ballabh Pant University of Agriculture and Technology (GBPUAT) for setting up Standardized Agriculture Demonstration Farms (SADFs).

How will the NAC Impact Farmers’ Livelihoods?

- Improved Decision-Making: The NAC will provide farmers with a structured guide for better decision-making in agricultural practices, which will help improve crop yields and reduce resource wastage.

- Capacity Building: The BIS plans to offer training to farmers on NAC standards, enhancing their technical knowledge and helping them adopt sustainable practices.

- Quality Assurance and Market Access: Standardized agricultural practices can ensure that crops meet quality requirements, potentially opening up better market access, higher incomes, and improved livelihoods for farmers.

- Adoption of New Technologies: With standards in place for emerging technologies like IoT in agriculture, farmers can integrate modern technology into their operations, increasing productivity and efficiency.

Way forward:

- Training and Capacity Building: Implement widespread training programs for farmers and agricultural professionals on NAC standards, ensuring smooth adoption of standardized practices and emerging technologies like IoT for improved efficiency.

- Policy Integration and Support: Ensure seamless incorporation of NAC recommendations into national agricultural policies, with financial incentives and technical support to promote sustainable and quality-driven farming practices across India.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Government launches National Mission Edible Oils-Oilseeds to boost domestic production

From UPSC perspective, the following things are important :

Mains level: Significance of NMEO-Oilseeds;

Why in the News?

The Union Cabinet has approved the National Mission on Edible Oils-Oilseeds (NMEO-Oilseeds) to enhance domestic oilseed production and attain self-sufficiency in edible oils.

About the Newly Launched NMEO-Oilseeds:

- Aim: Boost domestic oilseed production, achieve self-reliance in edible, and boost farmers’ incomes. Currently, imports account for 57% of India’s domestic demand for edible oils.

- Focus: It will focus on increasing edible oil production from Oil Palm by enhancing the production of key primary oilseed crops (Rapeseed-Mustard, Groundnut, Soybean, Sunflower, and Sesamum)

- Increasing collection and extraction efficiency from secondary sources (Cottonseed, Rice Bran, and Tree Borne Oils).

- Tenure: 7 years (from 2024-25 to 2030-31)

Roadmap for the Mission:

- Increase Edible Oil Production: Achieve 25.45 million tonnes of domestic edible oil production by 2030-31, meeting 72% of domestic demand.

- Seed Infrastructure: It will introduce an online 5-year rolling seed plan through the Seed Authentication, Traceability & Holistic Inventory (SATHI) portal to ensure timely availability of seeds.

- Seed Hubs & Storage: Establish 65 new seed hubs and 50 seed storage units to strengthen seed production infrastructure.

- Value Chain Clusters: Develop over 600 value chain clusters across 347 districts, covering 10 lakh hectares annually. These clusters will focus on providing high-quality seeds and promoting Good Agricultural Practices (GAP).

Other Initiatives by the Government:

- National Mission on Edible Oils – Oil Palm (NMEO-OP): Launched in 2021 with a budget of Rs 11,040 crore to boost oil palm cultivation.

- Import Duties: A 20% import duty on edible oils has been imposed to protect domestic producers from cheap imports and encourage local oilseed cultivation.

- MSP & PM-AASHA: The Minimum Support Price (MSP) for mandated edible oilseeds has been increased, and the Pradhan Mantri Annadata Aay Sanrakshan Abhiyan (PM-AASHA) ensures oilseed farmers receive MSP through price support and deficiency payment schemes.

Way forward:

- Strengthen Research and Development: Invest in research initiatives focused on developing climate-resilient, high-yield oilseed varieties through advanced technologies like genome editing.

- Enhance Farmer Engagement and Training: Implement comprehensive training programs for farmers on Good Agricultural Practices (GAP) and effective resource management.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

[pib] Cabinet approves PM Rashtriya Krishi Vikas Yojana (PM-RKVY) and Krishonnati Yojana (KY)

From UPSC perspective, the following things are important :

Prelims level: PM-RKVY, KY

Why in the News?

The Union Cabinet approved the rationalization of all Centrally Sponsored Schemes (CSS) under the Ministry of Agriculture and Farmers Welfare into two umbrella schemes:

- Pradhan Mantri Rashtriya Krishi Vikas Yojana (PM-RKVY) – A cafeteria scheme aimed at promoting sustainable agriculture.

- Krishonnati Yojana (KY) – Focuses on food security and agricultural self-sufficiency.

About PM Rashtriya Krishi Vikas Yojana (PM-RKVY):

| Details | |

| Objective | To promote sustainable agriculture and improve agricultural productivity. |

| Total Proposed Expenditure | Rs 1,01,321.61 crore (combined with Krishonnati Yojana). |

| Central Share (DA&FW) | Rs 57,074.72 crore under PM-RKVY. |

| Key Initiatives under PM-RKVY |

|

| Key Focus | Sustainable agricultural practices, soil health, water conservation, crop diversification, organic farming, and agricultural mechanization. |

| Flexibility for States | Increased flexibility for state governments to reallocate funds based on unique requirements of the states. |

| Implementation Method | Funds allocated to states, with state governments developing Comprehensive Strategic Documents addressing crop production, climate resilience, and value chains. |

| Benefits | Avoid duplication, ensure convergence, and streamline the approval process for quicker implementation of Annual Action Plans (AAP). |

Schemes merged into Krishonnati Yojana (KY):

- National Food Security Mission (NFSM)

- National Mission on Oilseeds and Oil Palm (NMOOP)

- Mission for Integrated Development of Horticulture (MIDH)

- National Mission on Sustainable Agriculture (NMSA)

- Sub-Mission on Agricultural Mechanization (SMAM)

- National Mission on Agricultural Extension and Technology (NMAET)

- Mission Organic Value Chain Development for North Eastern Region (MOVCDNER)

PYQ:[2014] Consider the following pairs:

Which of the pairs given above is/are correctly matched? (a) Only 1 and 2 (b) Only 3 (c) 1, 2 and 3 (d) None of these |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

[pib] Pest-Control Pheromone Dispenser

From UPSC perspective, the following things are important :

Prelims level: Pest-Control Pheromone Dispenser

Why in the News?

A new sustainable pheromone dispenser has been developed through a collaborative research project by scientists from Jawaharlal Nehru Centre for Advanced Scientific Research (JNCASR) and ICAR–National Bureau of Agricultural Insect Resources (ICAR–NBAIR).

What is the Pest-Control Pheromone Dispenser?

| Details | |

| What is it? | A device designed to release pheromones that alter the behaviour of pests, primarily used in agriculture to control infestations and prevent crop damage. |

| Developed By | A collaborative project by scientists from Jawaharlal Nehru Centre for Advanced Scientific Research (JNCASR), Bengaluru, and ICAR–National Bureau of Agricultural Insect Resources (ICAR–NBAIR), India. |

| How it Works |

|

| Technology |

|

| Benefits |

|

| Scalability | Suitable for both small-scale farms and large industrial agricultural operations, making it highly scalable. |

PYQ:[2018] With reference to the Genetically Modified mustard (GM mustard) developed in India, consider the following statements: 1. GM mustard has the genes of a soil bacterium that give the plant the property of pest-resistance to a wide variety of pests. 2. GM mustard has the genes that allow the plant cross-pollination and hybridization. 3. GM mustard has been developed jointly by the IARI and Punjab Agricultural University. Which of the statements given above is/are correct? (a) 1 and 3 only (b) 2 only (c) 2 and 3 only (d) 1, 2 and 3 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

India raises Import Tax on Edible Oils

From UPSC perspective, the following things are important :

Prelims level: Edible Oil Trade in India

Why in the News?

- India has increased the basic import tax on crude and refined edible oils by 20% to protect domestic farmers suffering from low oilseed prices.

- The move could push up edible oil prices, reduce demand, and potentially lower imports of palm oil, soyoil, and sunflower oil.

Edible Oil Scenario in India

- India imports more than 70% of its vegetable oil demand, mainly sourcing:

- Palm oil from Indonesia, Malaysia, and Thailand, and

- Soyoil and sunflower oil from Argentina, Brazil, Russia, and Ukraine.

- Palm oil constitutes over 50% of India’s edible oil imports.

NITI Aayog Report on Edible Oil Self-sufficiency: Key Highlights

NITI Aayog, along with the Ministry of Agriculture and other stakeholders, released a report titled “Pathways and Strategies for Accelerating Growth in Edible Oils Towards the Goal of Atmanirbharta.”

| Details | |

| Consumption Details | India consumes 19.7 kg/year per capita edible oil, with 16.5 million tonnes of imports in 2022-23; only 40-45% of demand met through domestic production. |

| Projections |

|

| Strategic Interventions |

|

| Self-sufficiency Targets |

|

| Key Recommendations | Focus on seed quality, modern processing infrastructure, and public-private partnerships for growth |

| PYQ:

[2018] Consider the following statements 1. The quantity of imported edible oils is more than the domestic production of edible oils in the last five years. 2. The Government does not impose any customs duty on all imported edible oils a special case. Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

The role of district agro-met offces in supporting farmers

From UPSC perspective, the following things are important :

Mains level: Challenges to Indian agriculture;

Why in the News?

Last week, PTI reported that the India Meteorological Department (IMD) plans to reintroduce District Agro-Meteorology Units (DAMUs) as part of the Gramin Krishi Mausam Sewa (GKMS) scheme.

Background: In 2018, the IMD set up 199 District Agro-Meteorology Units (DAMUs) in collaboration with the Indian Council of Agricultural Research to provide sub-district level agricultural advisories based on weather data. However, these DAMUs were shut down in March following an order from the IMD.

What are Agro-Meteorological Advisories?

- Agro-meteorological advisories provide farmers with critical information about weather conditions that affect agricultural practices. This includes forecasts related to rainfall, temperature, and wind speeds, which are crucial for planning sowing, harvesting, irrigation, and the use of fertilizers and pesticides.

- These advisories are particularly important for small and marginal farmers, who make up about 80% of India’s farming community and primarily rely on rain-fed agriculture.

- The advisories are disseminated in local languages, ensuring accessibility. They are shared through various channels, including text messages, WhatsApp groups, newspapers, and direct communication from DAMU staff.

- By providing timely weather information, these advisories help farmers plan their agricultural activities effectively and ultimately contribute to enhancing crop yields and farmers’ incomes.

Why Did the Government shut down the District Agro-Met Units (DAMUs)?

- Agro-meteorological data was automated: The closure of DAMUs was influenced by claims from the NITI Aayog that agro-meteorological data was automated, which undermined the role of DAMU staff in preparing and disseminating agricultural advisories. This misrepresentation led to recommendations for privatization and monetization of the services previously offered for free.

- Financial and Administrative Issues: The decision to shut down DAMUs was attributed to ongoing financial challenges, including delayed salary disbursements for DAMU staff, and administrative issues that hampered the program’s effectiveness.

- Shift Towards Centralization: The government suggested transitioning to a centralized model for weather data collection and advisory services, which could potentially reduce the localized support that DAMUs provided to farmers.

Way forward:

- Re-establish Local Support: Reinstate District Agro-Meteorology Units (DAMUs) to provide localized, targeted weather advisories and support, ensuring that small and marginal farmers receive timely, relevant information.

- Improve Data Integration and Communication: Enhance the integration of automated weather data with localized advisory services, and streamline communication channels to reach farmers through various platforms effectively.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

What is Digital Agriculture Mission?

From UPSC perspective, the following things are important :

Prelims level: Digital Agriculture Mission

Why in the News?

The Union Cabinet has approved the “Digital Agriculture Mission” with a budget of ₹2,817 Crore, including ₹1,940 Crore as the central share.

About Digital Agriculture Mission

| Category | Details |

| Historical Context | Originally planned for the financial year 2021-22 but delayed due to the Covid-19 pandemic.

Announced in the Union Budgets of 2023-24 and 2024-25. |

| Funding Breakdown | Total outlay: Rs 2,817 crore

• Rs 1,940 crore from the Centre |

| Objective | To create Digital Public Infrastructure (DPI) in the agriculture sector, similar to other e-governance initiatives like Aadhaar, DigiLocker, eSign, UPI, and electronic health records. |

| Major Components of DPI | 1. AgriStack: – A comprehensive digital platform integrating various agricultural services. – Facilitates access to information, services, and benefits related to farming and agricultural practices. – Centralizes agricultural data to improve accessibility and efficiency. |

| 2. Krishi Decision Support System (DSS): – Provides data-driven insights and recommendations for farmers. – Assists in decision-making related to crop management, pest control, and resource optimization based on real-time data. – Utilizes advanced analytics to enhance productivity and mitigate risks. |

|

| 3. Soil Profile Maps: – Detailed digital maps on a 1:10,000 scale covering approximately 142 million hectares. – Provides comprehensive information about soil characteristics and health. – Supports precision agriculture by offering targeted soil data for optimal crop planning. |

|

| Additional Component | Digital General Crop Estimation Survey (DGCES): – A tech-based system to provide accurate estimates of agricultural production. – Aims to offer reliable data for policy decisions, agricultural planning, and resource allocation. |

| Impact on Farmers | The mission will enable farmers to access a range of digital services, improve decision-making through data analysis, enhance productivity with detailed soil information, and provide accurate crop estimations to better manage agricultural practices. |

| Timeline | Rolled out across the country over the next two years (until 2025-26). |

PYQ:[2020] In India, the term “Public Key Infrastructure” is used in the context of: (a) Digital security infrastructure (b) Food security infrastructure (c) Health care and education infrastructure (d) Telecommunication and transportation infrastructure |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Expansion of Agricultural Infrastructure Fund (AIF) Scheme

From UPSC perspective, the following things are important :

Prelims level: Agricultural Infrastructure Fund (AIF) Scheme

Why in the News?

- The Union Cabinet has approved the expansion of the Agricultural Infrastructure Fund (AIF) scheme.

- It will now include financial support for Farmers’ Producers Organizations (FPOs) to enhance their financial security and creditworthiness.

About Agriculture Infrastructure Fund (AIF) Scheme:

| Details | |

| Launch | July 2020, Central Sector Scheme |

| Nodal Ministry | Ministry of Agriculture and Farmers Welfare, Government of India |

| Fund Allocation | Rs. 1 lakh crore, with disbursements planned until 2025-26; interest subvention and credit guarantee assistance extended till 2032-33. |

| Aim | To mobilize medium to long-term debt financing for investment in viable projects relating to post-harvest management infrastructure and community farming assets, to enhance agricultural infrastructure in India. |

| Key Features | – Interest Subvention: 3% on loans up to Rs. 2 crore, with additional rate reductions for NABARD loans for PACS. – Credit Guarantees: Under the CGTMSE scheme for loans up to Rs. 2 crore. – Fund Usage: Supports up to 25 projects per beneficiary across different locations. |

| Target Beneficiaries | Farmers, Farmer Producer Organizations (FPOs), Primary Agricultural Credit Societies (PACS), entrepreneurs, startups, Self Help Groups, Agricultural Produce Market Committees, and federations. |

| Management | Managed through an online MIS platform with national, state, and district level monitoring committees for real-time monitoring and feedback. |

| Lending Institutions | Includes 24 commercial banks, 40 cooperative banks, and NABARD among others. |

| Hassle-Free Process | Supported by a user-friendly online portal to facilitate speedy loan sanctions. |

Key changes introduced:

| Description | |

| Support for FPOs | Includes financial support for Farmers’ Producers Organizations (FPOs) to improve financial security and creditworthiness. |

| Broader Eligible Projects | Expand the scope to cover more types of agricultural infrastructure projects. |

| Community Farming Assets | Allows the creation of community farming assets to enhance productivity and sustainability. |

| Integrated Processing Projects | Adds integrated primary and secondary processing projects as eligible activities; standalone secondary projects remain under MoFPI schemes. |

| Alignment with PM-KUSUM | Converges AIF with PM-KUSUM Component-A for joint development of agricultural infrastructure and clean energy solutions. |

| Extended Credit Guarantee | Extends credit guarantee coverage to FPOs through NABSanrakshan, in addition to CGTMSE, to boost investment confidence. |

PYQ:[2015] With reference to ‘National Investment and Infrastructure Fund’, which of the following statements is/are correct? 1. It is an organ of NITI Aayog. 2. It has a corpus of 4,00,000 crore at present. Select the correct answer using the codes given below: (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

The road to 2047 for Indian agriculture

From UPSC perspective, the following things are important :

Mains level: Challenges to Indian agriculture;

Why in the News?

India’s 100th independence anniversary in 2047 is approaching, and the goal to become ‘a developed nation’ has a significant focus.

Goals of Indian Agriculture by Vision 2047:

|

Present starking Imbalance in the Indian Economy

- Workforce vs. GDP Contribution: Despite agriculture engaging nearly 46% of the workforce, it contributes only about 18% to the GDP, revealing a significant imbalance.

- Growth Disparity: While the overall GDP has grown at 6.1% annually since 1991-92, agricultural GDP has lagged at 3.3%. In the last decade (2013- 2023), overall GDP growth was 5.9%, with agriculture growing at 3.6%, which is insufficient for the sector’s socio-economic importance.

- Future Projections: By 2047, agriculture’s share in GDP might shrink to 7%-8%, but it could still employ over 30% of the workforce, necessitating significant structural changes to avoid exacerbating the disparity.

Government Initiatives:

- For Water Management: The Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) has promoted water-use efficiency through micro-irrigation, covering 78 lakh hectares with a ₹93,068 crore allocation for 2021-26.

- For Risk Management: The Pradhan Mantri Fasal Bima Yojana (PMFBY) offers financial assistance for crop losses, with 49.5 crore farmers enrolled and claims totalling over ₹1.45 lakh crore.

- For Market Access: The Electronic National Agriculture Market (eNAM) integrates existing markets through an electronic platform, benefiting 1.76 million farmers and recording trade worth ₹2.88 lakh crore by September 2023.

- For better Farmer Support: The Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme, disbursing ₹6,000 annually to farmers, has benefited over 11.8 crore farmers.

- For enhanced Soil Health: The Soil Health Card (SHC) scheme aims to optimize soil nutrient use, enhancing productivity, with over 23 crore SHCs distributed.

Need for Strategic Planning

- Population Growth: India’s population is projected to reach 1.5 billion by 2030 and 1.59 billion by 2040, increasing the demand for food by approximately 2.85% annually.

- Future Demand: By 2047-48, food grain demand is projected to range from 402 million tonnes to 437 million tonnes, requiring sustainable production exceeding demand by 10%-13% under the Business-As-Usual scenario.

Way Forward:

- Investment in R&D: To meet future demands sustainably, significant investments in agricultural research, infrastructure, and policy support are necessary.

- Budget Allocation: The Budget for 2024-25 includes ₹20 lakh crore for targeted agricultural credit and the launch of the Agriculture Accelerator Fund, highlighting a proactive approach to fostering agricultural innovation and growth.

- Enhance Digital Infrastructure: Support and expand digital platforms like eNAM to improve market access, provide real-time data, and facilitate better price realization for farmers.

Mains PYQ:

Q Give the vulnerability of inidan agriculture to vagaries of nature, discuss the need for crop insurance and bring out the salient features of the Pradhan Mantri Fasal Bima Yojana (PMFBY). (2016)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

The Green Revolution in Maize

From UPSC perspective, the following things are important :

Prelims level: Green Revolution

Mains level: Present India’s Maize Production

Why in the news?

Over the past two decades, India’s maize production has more than tripled, emerging as a private sector-driven green revolution success story. Maize has transitioned from being primarily a feed crop to also serving as a fuel crop.

What was the Green Revolution?

- Began in 1968 with the introduction of high-yielding variety (HYV) seeds, especially for wheat and rice, developed by agronomist Norman Borlaug

- Institutions like CIMMYT (International Maize and Wheat Improvement Center) and IARI (Indian Agricultural Research Institute), led by scientists like Norman Borlaug and M S Swaminathan, played a crucial role.

- The Green Revolution is credited to M.S. Swaminathan, known as the “Father of the Indian Green Revolution”, who introduced Borlaug’s wheat varieties and other technologies.

- The initiative focused on increasing agricultural productivity through advanced breeding techniques, fertilizers, and irrigation methods.

- Wheat production increased from 12 million tons in 1964-65 to 20 million tons in 1970-71.India became self-sufficient in food grain production and a major exporter

Present India’s Maize Production called as a Green Revolution in Maize

- Significant Production Increase: Over the last two decades, India’s maize production has surged from 11.5 million tonnes in 1999-2000 to over 35 million tonnes in 2023-24, showcasing a remarkable increase in both yield and output.

- Private Sector Leadership: This growth has been largely driven by the private sector, with more than 80% of the maize area planted with high-yielding hybrids developed by private seed companies, indicating a successful private sector-led green revolution.

- Diverse Utilization: Maize in India has evolved from being primarily a feed crop for poultry and livestock to also being a vital industrial crop used for starch and ethanol production, reflecting its expanded role in the economy.

On Starch and Ethanol Production

- Maize contains 68-72% starch, with significant industrial applications in textiles, paper, pharmaceuticals, food, and beverages.

- Maize is emerging as a key feedstock for ethanol production, especially for blending with petrol.

- IARI has developed a waxy maize hybrid with high amylopectin content, enhancing its suitability for ethanol production.

- The new Pusa Waxy Maize Hybrid-1 has 71-72% starch with 68-70% recoverable, increasing ethanol yield per tonne.

Can India adopt new strategies? (Way forward)

- India can adopt new strategies through innovative breeding techniques like the doubled haploid (DH) technology used by CIMMYT.

- The DH facility in Karnataka speeds up the development of genetically pure inbred lines, enhancing the efficiency of maize breeding.

- IARI’s waxy maize hybrid is ready for field trials and commercial release, potentially boosting ethanol production.

- Collaboration between public sector institutions and private seed companies can drive the adoption of high-yielding, disease-resistant maize varieties.

- Private sector-bred hybrids account for over 80% of India’s maize area, indicating strong potential for further growth and innovation in maize production.

Mains PYQ:

Q Explain various types of revolutions, that took place in Agriculture after Independence in India. How these revolutions have helped in poverty alleviation and food security in India? (UPSC IAS/2017)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Choosing the right track to cut post-harvest losses

From UPSC perspective, the following things are important :

Prelims level: Agronomy; Food production;

Mains level: Challenges in Farm Sector; Value Chains;

Why in the News?

India holds the position of the second-largest agricultural producer globally however, it only accounts for 2.4% of global agricultural exports, ranking eighth worldwide due to the post-harvest loss.

A closer look at India’s post-harvest loss:

- Economic Impact: India faces annual post-harvest losses amounting to approximately ₹1,52,790 crore, significantly impacting farmer incomes and the agricultural economy.

- Perishable Commodities: The biggest losses occur in perishable commodities like livestock produce (22%), fruits (19%), and vegetables (18%). Export processes further add to these losses, particularly at the import-country stage.

- Supply Chain Inefficiencies: There is Inefficiencies in storage, transportation, and marketing, alongside a lack of assured market connectivity, contribute to significant post-harvest losses. Small and marginal farmers, who make up 86% of the farming community, struggle with economies of scale and market access.

Initiatives taken by the Railways Department:

- Truck-on-Train Service: Indian Railways introduced the truck-on-train service, allowing loaded trucks to be transported on railway wagons. This service has been expanded following successful trials with commodities like milk and cattle feed.

- Parcel Special Trains: During the COVID-19 pandemic, the Railways introduced parcel special trains to transport perishables and seeds between producers and markets, ensuring timely delivery and reducing post-harvest losses.

- The DFI (Doubling farmers’ income) committee recommends streamlining loading and unloading processes to minimize transit times and address staffing shortages through recruitment and training initiatives.

- Kisan Rail Scheme: It was launched to connect production surplus regions with consumption regions. This scheme facilitates the transportation of perishables (including milk, meat, and fish) more efficiently.

- Specialized Wagons and Facilities: Investment in specialized wagons for temperature-controlled transport and establishing rail-side facilities for safe cargo handling are essential steps taken by the Railways.

Way for Untapped Opportunities:

- Enhanced Environmental Benefits: Rail transport generates up to 80% less carbon dioxide for freight traffic compared to road transport.

- Public-Private Partnerships: The private sector can play a crucial role in enhancing operational efficiency and strengthening rail infrastructure through public-private partnerships, thereby improving the overall logistics ecosystem for agricultural produce.

- Budgetary Support and Infrastructure Development: The budgetary allocation for agriculture in 2024 aims to bridge the farm-to-market gap with modern infrastructure and value-addition support.

- Technology Integration: Incorporating advanced technologies like real-time tracking, temperature monitoring, and automated loading/unloading systems.

Way forward:

- Expand climate-controlled storage facilities and cold storage capacity to accommodate a larger share of agricultural produce.

- Provide small and marginal farmers access to storage facilities through cooperatives or subsidies.

- Invest in specialized rail wagons for temperature-controlled transport and establish rail-side cargo handling facilities.

Mains PYQ:

Q How do subsidies affect the cropping pattern, crop diversity and economy of farmers? What is the significance of crop insurance, minimum support price and food processing for small and marginal farmers? (UPSC IAS/2017)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

[pib] Release of Statistical Report on Value of Output from Agriculture and Allied Sectors, 2024

From UPSC perspective, the following things are important :

Prelims level: Key stats mentioned in the newscard; National Statistical Office (NSO)

Why in the News?

The National Statistical Office (NSO), under the Ministry of Statistics and Programme Implementation (MoSPI), has released the ‘Statistical Report on Value of Output from Agriculture and Allied Sectors 2024’.

Data Collection Strategies by NSO:

About the National Statistical Office (NSO)

Key organizations under NSO: Central Statistical Office (CSO)

Key Reports released by NSO:

|

Sector-wise share of Value of Output

Salient Features and Summary Results

- India’s Agricultural Rankings: India ranks second worldwide in arable land, third in cereal production, and is a leading producer of groundnut, fruits, vegetables, sugarcane, tea, and jute. It is also the largest producer of milk, second in egg production, and fifth in meat production.

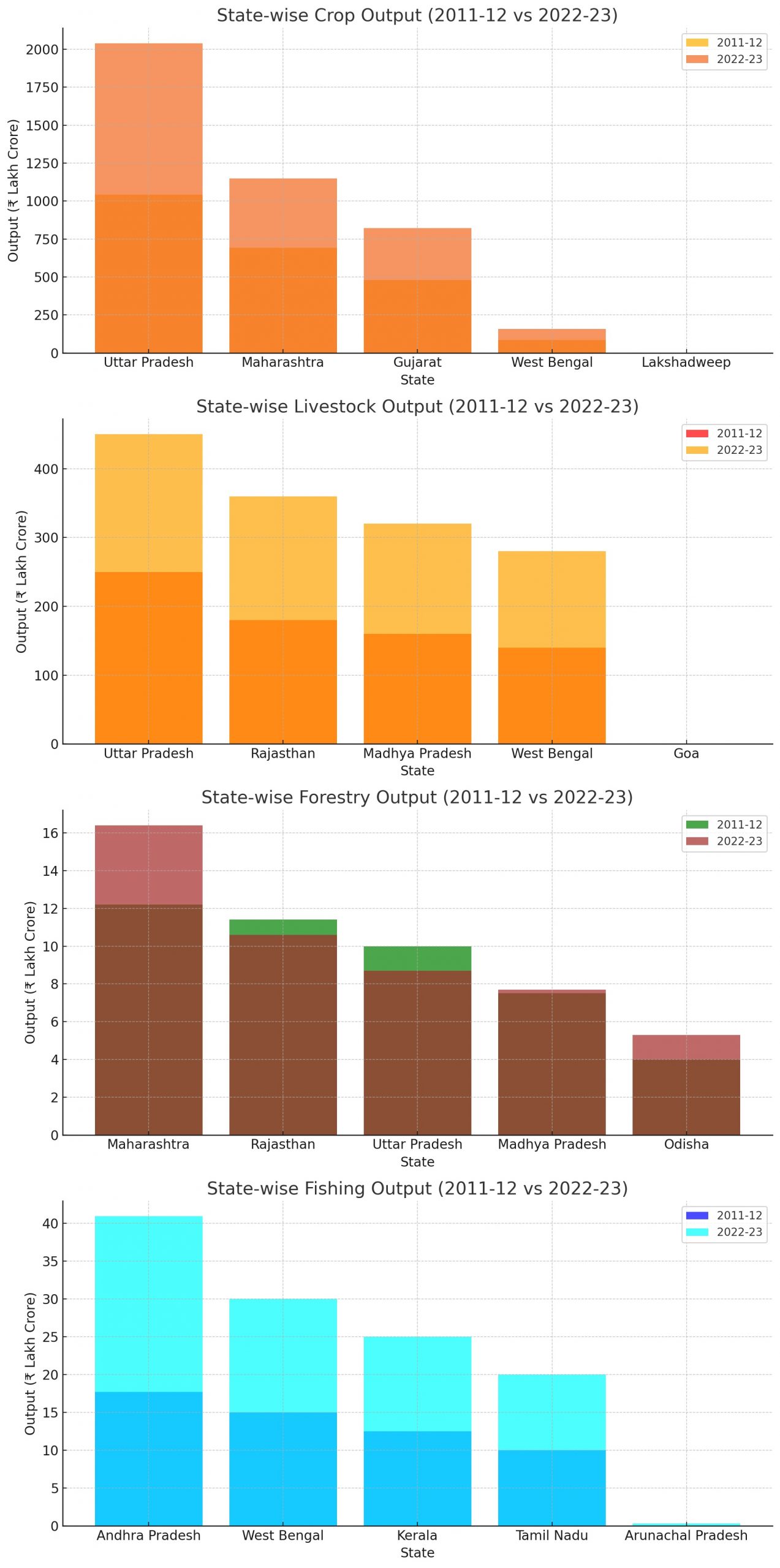

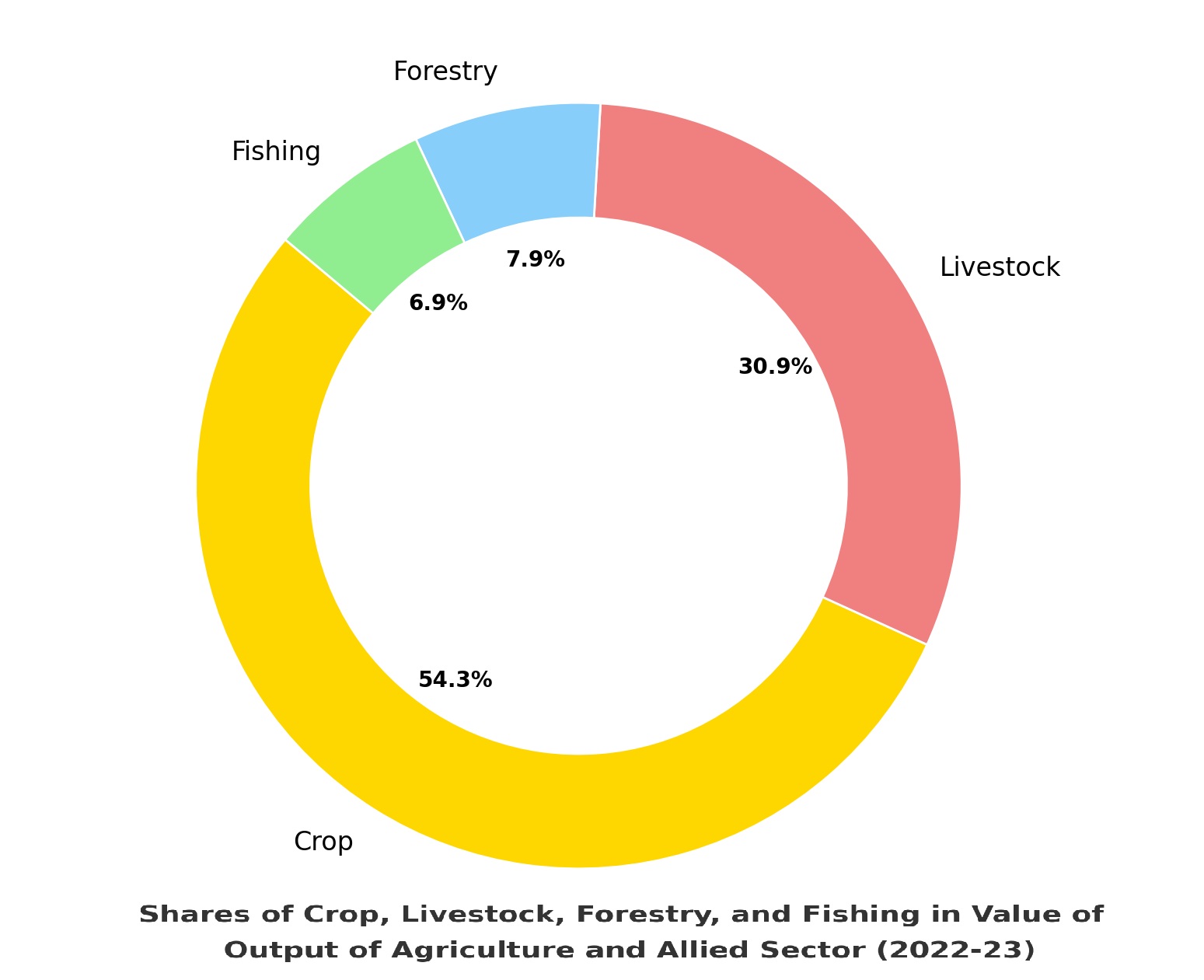

- GVA Contribution: The shares of Crop, Livestock, Forestry and Fishing sub-sectors in value of output of Agriculture and allied sector were 54.3%, 30.9%, 7.9% and 6.9% respectively in 2022-23.

- Crop Sub-sector Trends: The crop sub-sector remains the largest contributor to the Gross Value of Output (GVO) but has seen its share decline from 62.4% in 2011-12 to 54.3% in 2022-23. Fruits and vegetables’ output has significantly increased, highlighting the growing importance of horticulture.

- Livestock Sub-sector Growth: The livestock sub-sector has seen an increase in the output of milk, meat, and eggs, indicating a steady growth in this area.

- Forestry and Fishing: The forestry sector has diversified its output sources, and the fishing and aquaculture sector has seen significant growth, especially in Andhra Pradesh.

State-wise Details from 2011-12 to 2022-23

State-wise Value of Output of Crop

- Highest Output: Uttar Pradesh leading in cereals and sugarcane production.

- Lowest Output: Lakshadweep:

State-wise Value of Output of Livestock

- Highest Output:

- Uttar Pradesh and Rajasthan together accounted for about a quarter of the livestock sub-sector’s output.

- Lowest Output:

- Goa: Output remained at ₹0 lakh throughout the period.

- Key Trends:

- Madhya Pradesh: Significant increase in livestock output, particularly in milk and meat production.

- West Bengal: Steady growth in egg production.

State-wise Value of Output of Forestry and Logging

Major products: Industrial wood (68%), Fuelwood (20%), and Non-Timber Forest Products (NTFP) (12%) in 2022-23.

- Top States in 2022-23:Maharashtra: 16.4% share, Rajasthan: 10.6% share,Uttar Pradesh: 8.7% share, Madhya Pradesh: 7.7% share and Odisha: 5.3% share.

State-wise Value of Output of Fishing and Aquaculture

- Highest Output: Andhra Pradesh: Share increased from 17.7% in 2011-12 to almost 40.9% in 2022-23, leading in fish and prawn farming.

- Lowest Output: Arunachal Pradesh: Output increased from ₹0 lakh (2011-12) to ₹3 lakh (2022-23).

All India Item-wise Value of Output from Agriculture, Livestock, Forestry, and Fishing

- Cereals: Paddy and wheat are the top contributors to the cereals sub-sector. Paddy output in 2022-23 was ₹220,200 crore, while wheat output was ₹137,300 crore.

- Pulses: Gram and Arhar together accounted for nearly 59% of the pulses output. Madhya Pradesh led in pulses production with a 22% share in 2022-23.

- Oilseeds: Groundnut and Rapeseed & Mustard are the highest contributors within the oilseeds group. Gujarat and Rajasthan are the leading states in oilseeds production.

- Sugar Crops: Uttar Pradesh remains the largest producer of sugarcane, increasing its share from 41% in 2011-12 to 54.5% in 2022-23.

- Livestock Products: Milk, meat, and eggs are the major contributors within the livestock sub-sector. The share of milk, meat, and eggs in the livestock sub-sector was 66.5%, 23.6%, and 3.7% respectively in 2022-23.

- Forestry Products: The forestry sector’s output is mainly driven by industrial wood, fuelwood, and NTFP. The share of industrial wood increased to 68% in 2022-23.

- Fishing and Aquaculture: The fishing and aquaculture sector has seen a significant increase in output, with Andhra Pradesh leading the production. The output of fishing and aquaculture increased from ₹80 thousand crore in 2011-12 to ₹195 thousand crore in 2022-23.

PYQ:[2011] A state in India has the following characteristics:

Which one of the following states has all of the above characteristics? (a) Andhra Pradesh (b) Gujarat (c) Karnataka (d) Tamil Nadu |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Agricultural Sector and Marketing Reforms – eNAM, Model APMC Act, Eco Survey Reco, etc.

Why dal imports have hit a seven-year high?

From UPSC perspective, the following things are important :

Prelims level: Domestic Production of Pulses;

Mains level: Inflation; Cereals and Pulses;

Why in the News?

Due to food inflation during an El Niño year and an election year, the country has lost the self-sufficiency it had achieved in pulses.

Pulse Production in India:

Recent Decline in Domestic Production:

|

Significance of Pulse Production:

- Suitable for Drought Areas: Drought-resistant and deep-rooting species of pulses can supply groundwater to companion crops when planted in the intercropping pattern. Locally adapted pulse varieties can enhance production systems in dry environments.

- Enhances Fertility of Land: The leguminous plants of pulse also help in nitrogen fixation, thus ensuring higher soil fertility.

- High Nutritional Value: In a country like India, where many people are poor and vegetarian, pulses are an important and affordable source of protein.

- Low food wastage footprints: Pulses can be stored longer without losing their nutritional value and minimizing loss.

Imports have hit a seven-year high

Cause of the Inflation in Pulses

- Impact of EL Nino: El Niño-induced patchy monsoon and winter rain led to a decline in domestic pulse production from 27.30 million tonnes (mt) in 2021-22 to 23.44 mt in 2023-24, as per the Agriculture Ministry’s estimates.

- Sharp Output Falls: Both chana and Arhar/tur, the pulses with the highest inflation experienced sharp output falls. Chana production decreased from 13.54 mt in 2021-22 to 12.16 mt in 2023-24, while Arhar/tur production dropped from 4.22 mt to 3.34 mt over the same period.

- Impact of Irregular Rainfall: Poor crops in regions like Karnataka, Maharashtra, Andhra Pradesh, and Telangana were attributed to irregular and deficient rainfall, leading to reduced planting area and lower yields.

Effects of Inflation :

- Increased Retail Prices: Significant annual retail inflation, particularly for pulses like Arhar/tur and chana.

- Higher Import Costs: Surge in imports to meet domestic demand, leading to increased expenditure on foreign pulses.

- Economic Burden: Higher prices in the open market strain household budgets, especially for low-income families who cannot rely on subsidized distribution for pulses.

Challenges Ahead :

- Monsoon Uncertainty: Future prices largely depend on the upcoming southwest monsoon; continued irregular weather patterns could sustain high inflation.

- Import Dependency: Increased reliance on imports due to insufficient domestic production, especially for yellow/white peas and masoor.

- Supply Position: Precarious domestic supply with minimal government procurement from recent crops, necessitating higher imports.

Government initiatives as relief measures: The government has removed tariffs and quantitative restrictions by liberalizing imports on most pulses to boost supply and reduce prices like an extension of duty-free imports of Arhar/tur, urad, masoor, and desi chana till March 31, 2025.

Conclusion: While the government has taken significant steps to mitigate the impact of high dal prices through import liberalization and policy adjustments, the actual relief to consumers will hinge on the performance of the upcoming monsoon and the global pulse market dynamics.

Mains PYQ:

Q Mention the advantages of Cultivation of pulses because of which year 2016 was declared as the International year of Pulses By the United Nations. (UPSC IAS/2017)