Note4Students

From UPSC perspective, the following things are important :

Prelims level: Special theory of relativty

Mains level: Paper 3- Theories of relativity

Context

In 1921, the Nobel Prize Committee concluded that Einstein would have to wait and the Committee decided not to award the Prize to anyone in 1921. Opinions changed in a year and when Einstein did receive the 1921 Prize in 1922.

Background

- Noble Prize was not awarded for his theories of relativity but for “his services to Theoretical Physics, and especially for his discovery of the law of the photoelectric effect”.

- The citation harked back to the revolutionary theories that Einstein had established in 1905. ‘Annus Mirabilis’, or the Year of Miracles, is how 1905 is remembered by physicists because Einstein, only 26 then, published four remarkable papers that year.

- One of them explained that light was made of photons and when the light shone on metal, each photon’s energy correlated to the electron’s speed on the metal’s surface.

- This theory redefined the composition of light and Einstein himself dubbed it revolutionary.

- It was for this that he received the Nobel Prize.

Special theory of relativity

- The special theory of relativity was published in 1905.

- James Maxwell had established that light was an electromagnetic wave and the value of its speed was calculated. Building on this,

- Speed of light remains constant for all observers: Einstein understood that while moving from one frame of reference to another, which is moving at a different speed, the speed of light remains a constant.

- He gave a physical interpretation to the equations governing the transformation from one frame to another based on this fact.

- Time slows down when measured from the rest: Einstein’s theory establishes that time moves slower within a moving body when measured from a point at rest (but moves normally within the moving body itself).

- Length reduces: The length of the moving body contracts when measured from an outside point at rest.

- When a moving body emits light, the length contraction and time slowdown of the moving body are just exactly what are needed to restore the speed of light to its constant value.

- Einstein’s insight was that there was no absolute time because time was measured by the simultaneity of two events and this simultaneity would be observed differently.

- As lagniappe to the scientific community, Einstein published his famous mass-energy equivalence E=mc2 in late 1905.

- A mundane example of the application of the special theory of relativity is the use of GPS on our phones.

General theory of relativity

- The theory is general enough to apply to all forms of motion, including those where gravity does not appear.

- Einstein worked out equations using tensors, the mathematical implement to describe the transformation of different dimensions.

- In November 1915, Einstein completed the general theory of relativity.

- As per this theory, space and time form a continuum, like a fabric, and every object in the universe distorts this fabric, much like how dropping a large ball distorts a taut trampoline sheet.

- This distortion is gravity. It produces two effects.

- One, the fabric causes any other object in the vicinity to move towards the heavier object and this is why gravity causes an object to pull things towards it.

- Two, it bends light in the process of attracting it.

Conclusion

In just two decades, Einstein led physics out of its traditional moorings, laid the entablature of modern physics on Newtonian and Maxwellian pillars of classical physics and opened it up to newer questions.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: UN Security Council

Mains level: Paper 2- Afghanistan issue

Context

The Afghan government and its defence forces have completely collapsed. The world over, television screens are full of images of the extraordinary takeover of Afghanistan by the Taliban.

Background of the US intervention in Afghanistan

- The original trigger for the US military intervention in Afghanistan was the 9/11 attacks.

- The objective then was to eliminate the al Qaeda sanctuaries hosted by the Taliban.

- That goal was quickly attained, as was another one — the elimination of Osama Bin Laden in Abbottabad, Pakistan, in 2011.

- The US was thereafter stuck into a vortex in which its mission oscillated between counter-terrorism and counter-insurgency.

- The military presence in Afghanistan has been questioned by the US political firmament for a decade.

Factors driving the US exit

- China factor: The US now regards China as its principal strategic competitor.

- China’s muscle-flexing in the East and South China Seas calls for a renewed effort by the US to protect its stakes.

- The rise of China is the main geo-strategic threat for the US.

- In 2001, the US had taken its eye off the ball in diverting its attention to the global war on terror.

- Beginning with Afghanistan, it meandered through Iraq, Libya and Syria, with mixed results.

- Taiwan: China’s recent ratcheting up of pressure on Taiwan has also sounded the alarm.

Implications of Taliban’s return for region

- The new regime in Kabul is likely to open the door to economic investments from China.

- At the geopolitical level, the BRI may well receive a boost, given China’s interests in connectivity that could straddle the region, from Pakistan to Iran.

- Pakistan has shown alacrity in welcoming the change of guard in Kabul.

- The change in Afghanistan has security implications for India and the region at large.

- A spill-over of any chaos and instability in Afghanistan beyond its borders could give terrorism a shot in the arm.

- It could also singe Pakistan if it does not review its malevolent practices, which favour terror as an instrument of state policy.

Way forward for India

- India should prioritise the welfare of the Afghan people, whenever the opportunity presents itself.

- Currently, about 2,500 Afghan students are enrolled in educational and vocational institutions across India.

- They will no doubt wish to extend their scholarships.

- As a close neighbour, India has keen stakes in ensuring a stable, secure and developed Afghanistan.

- As the rotational President of the UN Security Council for August, India has an opportunity to engage important stakeholders on the way forward.

- Beyond that too, India’s presence in the UN Security Council till the end of 2022 will provide a platform to explore options with greater flexibility.

Conclusion

The global community needs to underscore the continued participation of women in governance in Afghanistan and keep an eye on violations of human rights and international humanitarian law.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: National Livestock Mission

Mains level: Paper 3- Addressing the lack of quality and affordable fodder and feed through Sub-Mission on Fodder and Feed

Context

The government recently announced a Sub-Mission on Fodder and Feed.

Why availability of good and affordable quality feed and fodder matters

- A study by the Indian Grassland and Fodder Research Institute has observed that for every 100 kg of feed required, India is short of 23.4 kg of dry fodder, 11.24 kg of green fodder, and 28.9 kg of concentrate feed.

- Low milk productivity: The lack of good quality feed and fodder impacts the productivity levels of cattle.

- This is one of the chief reasons why Indian livestock’s milk productivity is 20%-60% lower than the global average.

- High input cost: If we break down the input costs, we find that feed constitutes 60%-70% of milk production costs.

- When the National Livestock Mission was launched in 2014, it focused on supporting farmers in producing fodder from non-forest wasteland/grassland, and cultivation of coarse grains.

- However, this model could not sustain fodder availability due to a lack of backward and forward linkages in the value chain.

Why Sub-Mission on Fodder and Feed is significant

- As about 200 million Indians are involved in dairy and livestock farming, the scheme is important from the perspective of poverty alleviation.

- The Sub-Mission on Fodder and Feed intends to create a network of entrepreneurs who will make silage (the hub) and sell them directly to the farmers (the spoke).

- Bringing down the input cost: The large-scale production of silage will bring down the input cost for farmers since silage is much cheaper than concentrate feed.

- Objective: The revised scheme has been designed with the objectives of increasing productivity, reducing input costs, and doing away with middlemen (who usually take a huge cut).

- Since India has a livestock population of 535.78 million, effective implementation of this scheme will play a major role in increasing the return on investment for our farmers.

About the Sub-Mission on Fodder and Feed

- The scheme will provide 50% capital subsidy up to ₹50 lakh towards project cost to the beneficiary for infrastructure development and for procuring machinery for value addition in feed such as hay/silage/total mixed ration.

- Private entrepreneurs, self-help groups, farmer producer organizations, dairy cooperative societies, and Section 8 companies (NGOs) can avail themselves of the benefits under this scheme.

- The scheme can be used for covering the cost of infrastructure/machinery such as bailing units, harvester, chaff cutter, sheds, etc.

Challenges and solution

- Seasonal availability: A major challenge in the feed sector emanates from the fact that good-quality green fodder is only available for about three months during the year.

- Fermenting green fodder: Ideal solution would be to ferment green fodder and convert it into silage.

- Hence, under the fodder entrepreneurship program, farmers will receive subsidies and incentives to create a consistent supply chain of feed throughout the year.

Conclusion

The mission will help marginal farmers reduce their input costs and help them in increasing the return on capital employed.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Oil Bonds

Mains level: Oil prices volatility and its impact on India

The Centre has argued that it cannot reduce taxes on petrol and diesel as it has to bear the burden of payments in lieu of oil bonds issued by the previous UPA government to subsidize fuel prices.

What are Oil Bonds?

- Oil bonds are special securities issued by the government to oil marketing companies in lieu of cash subsidy.

- These bonds are typical of a long-term tenure like 15-20 years and oil companies are paid interest.

- Before the complete deregulation of petrol and diesel prices, oil marketing companies were faced with a huge financial burden as the selling price of petrol and diesel in India was lower than the international market price.

- This ‘under-recovery is typically compensated through fuel subsidies allocated in the Union budget.

- However, between 2005 and 2010, the UPA government issued oil bonds to the companies amounting to Rs 1.4 lakh crore to compensate them for these losses.

Why do governments issue such bonds?

- Compensation to companies through issuance of such bonds is typically used when the government is trying to delay the fiscal burden of such a payout to future years.

- Governments resort to such instruments when they are in danger of breaching the fiscal deficit target due to unforeseen circumstances that lead to a collapse in revenues or a surge in expenditure.

- These types of bonds are considered to be ‘below the line’ expenditure in the Union budget and do not have a bearing on that year’s fiscal deficit, but they do increase the government’s overall debt.

- However, interest payments and repayment of these bonds become a part of the fiscal deficit calculations in future years.

Backgrounder: Deregulation of fuel prices

- Fuel price decontrol has been a step-by-step exercise, with the government freeing up prices of aviation turbine fuel in 2002, petrol in 2010, and diesel in 2014.

- Prior to that, the government would intervene in fixing the price at which retailers were to sell diesel or petrol.

- This led to under-recoveries for oil marketing companies, which the government had to compensate for.

- The prices were deregulated to make them market-linked, unburden the government from subsidizing prices, and allow consumers to benefit from lower rates when global crude oil prices tumble.

- Price decontrol essentially offers fuel retailers such as Indian Oil, HPCL or BPCL the freedom to fix prices based on calculations of their own cost and profits.

- However, the key beneficiary in this policy reform of price decontrol is the government.

Impact: Loss of consumers

- While oil price deregulation was meant to be linked to global crude prices, Indian consumers have not benefited from a fall in global prices.

- The central, as well as state governments, impose fresh taxes and levies to raise extra revenues.

- This forces the consumer to either pay what she’s already paying, or even more.

Why are the Oil Bonds in news?

- As prices of petrol and diesel climb steeply, the Centre has been under pressure to cut the high taxes on fuel.

- Taxes account for 58 per cent of the retail selling price of petrol and 52 per cent of the retail selling price of diesel.

- However, the government has so far been reluctant to cut taxes as excise duties on petrol and diesel are a major source of revenue, especially at a time the pandemic has adversely impacted other taxes such as corporate tax.

- The government is estimated to have collected more than Rs 3 lakh crore from tax on petrol and diesel in the 2020-21 fiscal year.

The blame game

- The present government has blamed the UPA regime for its inability to cut taxes.

- It pointed out that the bonds issued by the Manmohan Singh government have weakened the financial position of the oil marketing companies and added to the government’s fiscal burden now.

- It is an argument that has been often repeated since 2018.

What budget documents show

- Budget documents show that such bonds will be up for redemption over the next few years — beginning with two to be redeemed in the current fiscal year — till 2026.

- The government has to repay a principal amount of Rs 10,000 crore this year, according to these documents.

- The government has paid around Rs 10,000 crore annually as interest over the last decade.

- The government is likely to pay a similar amount of interest for the current fiscal as well.

Is the issuance of such special securities restricted to the UPA era?

- Besides oil bonds, the UPA era also saw the issuance of fertilizer bonds from 2007 to compensate fertilizer companies for their losses due to the difference in the cost price and selling price.

- However, the issuance of such special securities is not limited to the UPA regime.

- Over the years, the Modi government has issued bank recapitalization bonds to specific public sector banks (PSBs) as it looked to meet the large capital requirements of these PSBs without allocating money from the budget.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: NPA Crisis

The contentious issue of whether banks should disclose inspection reports by the Reserve Bank of India (RBI) is back in the news once again after a division bench of the Supreme Court referred writ petitions filed by banks to another bench for reconsideration.

What is RBI’s inspection on banks?

- The Banking Regulation Act, 1949 empowers the Reserve Bank of India to inspect and supervise commercial banks.

- These powers are exercised through on-site inspection and off-site surveillance.

- RBI carries out dedicated and integrated supervision overall of credit institutions, i.e., banks, development financial institutions, and non-banking financial companies.

- The Board for Financial Supervision (BFS) carries out this function.

- Banks currently disclose the list of wilful defaulters and names of defaulters against whom they have filed suits for loan recovery.

Note: CAMELS is an international rating system used by regulatory banking authorities to rate financial institutions, according to the six factors represented by its acronym. The CAMELS acronym stands for “Capital adequacy, Asset quality, Management, Earnings, Liquidity, and Sensitivity.”

Why in news now?

- In 2015, the Supreme Court had come down on the RBI for trying to keep the inspection reports and defaulters list confidential.

- This was aimed for the public disclosure of such reports of the RBI, much against the wishes of the banking sector.

- The SC had said the RBI has no legal duty to maximize the benefit of any public sector or private sector bank, and thus there is no relationship of ‘trust’ between them.

- It added that the RBI was duty-bound to uphold the public interest by revealing these details under RTI.

What is the issue?

- The RBI was allowed to make such reports public following the Supreme Court order.

- The SC had wanted full disclosure of the inspection report.

- However, the court agreed that only some portions on bad loans and borrowers would be made public.

- Banks have been refusing to disclose inspection reports and defaulters’ lists.

Issues with report publication

- Bank defamation: As banks are involved in dealing in money, they fear any adverse remarks — especially from the regulator RBI — will affect their performance and keep customers away.

- Trust of the account holder: Banks are driven by the “trust and faith” of their clients that should not be made public.

- The invalidity of RTI: On the other hand, private banks insisted that the RTI Act does not apply to private banks.

- Right to Privacy: Banks also argued that privacy is a fundamental right, and therefore should not be violated by making clients’ information public.

Why are banks against disclosing inspection reports?

- Many feel that the RBI’s inspection reports on various banks, with details on alleged malpractices and mismanagement, can open up a can of worms.

- As these reports have details about how the banks were manipulated by rogue borrowers and officials, banks want to keep them under wraps.

- Obviously, banks don’t want inspection reports and defaulters’ lists to be made public as it affects their image.

- Customers may also keep out of banks with poor track records.

Try this PYQ now:

Q.In the context of the Indian economy non-financial debt includes which of the following?

- Housing loans owed by households

- Amounts outstanding on credit cards

- Treasury bills

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

Post your answers here (You need to sign-in for that).

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Financial Inclusion Index

Mains level: Financial inclusion of masses

The Reserve Bank of India (RBI) has announced the formation of a composite Financial Inclusion Index (FI-Index) to capture the extent of financial inclusion across the country.

Financial Inclusion Index

- The FI-Index will be published in July every year.

- The index captures information on various aspects of financial inclusion in a single value ranging between 0 and 100, where 0 represents complete financial exclusion and 100 indicates full financial inclusion.

- It has been conceptualized as a comprehensive index incorporating details of banking, investments, insurance, postal as well as the pension sector in consultation with the government and respective sectoral regulators.

- It has been constructed without any ‘base year’ and as such it reflects cumulative efforts of all stakeholders over the years towards financial inclusion.

Parameters of the index

- The FI-Index comprises three broad parameters viz.,

- Access (35%),

- Usage (45%), and

- Quality (20%)

- These parameters are the identification of the customer, reaching the last mile, and providing relevant, affordable and safe products.

- The index is responsive to ease of access, availability and usage of services, and quality of services for all 97 indicators.

This year’s highlight

- The annual FI-Index for the period ended March 2021 stood at 53.9 compared with 43.4 for the period ended March 2017.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Bioethanol, Ethanol blending

Mains level: Ethanol blended petrol (EBP) Program

India has been promoting 2G bioethanol to achieve its E20 target.

What is Bioethanol?

- Biomass has always been a reliable source of energy.

- Cultivated biomass has begun to be used to generate bioethanol.

- They are categorised as first (1G), second (2G) and third-generation (3G), based on the source of raw material used for bioethanol production.

Its types

- 1G bioethanol: Raw materials required are corn seeds and sugarcane; both are food sources. There is not enough food for everyone; so the use of 1G is a major concern. However, some countries have enough raw materials to manufacture 1G.

- 2G bioethanol: It can be produced using inedible farm waste left over after harvest. Corn cobs, rice husks, wheat straw and sugarcane bagasse can all be transformed into cellulose and fermented into ethanol that can then be mixed with conventional fuels.

- 3G bioethanol: Algae grown in wastewater, sewage or saltwater can be used to produce bioethanol. Water used for human consumption is not required. The benefit of 3G is that it does not compete with food. Nevertheless, economic viability remains a critical issue.

Ethanol blending in India

- India currently blends approximately 8.5 per cent ethanol with petrol.

- It is estimated that ethanol production in India will triple to approximately 10 billion litres per year by 2025.

- The 2G plant will play a major role in making bioethanol available for blending.

- In addition to reducing agricultural waste incineration, it can also help meet the goal of converting waste into energy.

Moves for production

- The first 2G ethanol biorefinery is being set up at Bathinda, Punjab.

- Hindustan Petroleum Corporation Ltd (HPCL) plans to set up four 2G ethanol plants that will convert agricultural waste into biofuel, reducing toxic air pollution in northern India.

- Additionally, HPCL has plans to build four plants to produce ethanol using grains, such as surplus maize, surplus rice and damaged grain.

Innovations in this field

- An Indian company has filed a patent for loop reactor technology.

- It is a long, serpentine tubular reactor, in which fermentable sugars are converted to ethanol with the help of brewer’s yeast.

- This sparked an idea to come up with reactive pipeline technology, wherein the pipeline connects the sugar factories where the ethanol is produced to the blending depot at the closest oil manufacturing companies.

- Reactive pipeline technology is poised to be a game-changer for sugar factories and grain-based distilleries since uninterrupted raw material supply is a major challenge.

Benefits offered by ethanol blending

(1) Energy security

- The Union government has emphasized that increased use of ethanol can help reduce the oil import bill.

- India’s net import cost stands at $551 billion in 2020-21. It is estimated that the E20 program can save the country $4 billion (Rs 30,000 crore) per annum.

(2) Emission reduction

- Use of ethanol-blended petrol decreases emissions such as carbon monoxide (CO), hydrocarbons (HC) and nitrogen oxides (NOx), the expert committee noted.

- Higher reductions in CO emissions were observed with E20 fuel — 50 per cent lower in two-wheelers and 30 per cent lower in four-wheelers.

Some issues to be addressed

(1) Fuel efficiency

- There is an estimated loss of six-seven per cent fuel efficiency for four-wheelers and three-four per cent for two-wheelers when using E20, the committee report noted.

- These vehicles are originally designed for E0 and calibrated for E10.

(2) Recalibrating engines

- The use of E20 will require new engine specifications and changes to the fuel lines, as well as some plastic and rubber parts due to the fuel’s corrosive nature.

- The engines, moreover, will need to be recalibrated to achieve the required power, efficiency and emission-level balance due to the lower energy density of the fuel.

Conclusion

- The country’s target of 20 per cent ethanol blending in petrol (E20) by 2025 can play a key role in reducing crude oil imports and bolstering India’s energy independence.

- But India may miss an earlier goal set by him in 2015 — of reducing crude oil import dependency 10 per cent by 2022.

- The target is far from being met and the country’s import dependency is only increasing.

- The country’s target of 20 per cent ethanol blending in petrol (E20) by 2025 can play a key role in reducing crude oil imports and bolstering India’s energy independence.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: EBP Programme

- Ethanol Blended Petrol (EBP) programme was launched in January 2003 for the supply of 5% ethanol blended petrol.

- The programme sought to promote the use of alternative and environment-friendly fuels and to reduce import dependency for energy requirements.

- OMCs are advised to continue according to priority of ethanol from 1) sugarcane juice/sugar/sugar syrup, 2) B-heavy molasses 3) C-heavy molasses and 4) damaged food grains/other sources.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: MEIS, RODTEP Scheme

Mains level: Export promotion schemes in India

The Centre has notified the rates and norms for the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme asserting that it would put ‘direct cash in the pockets of exporters’ soon.

RoDTEP Scheme

- RoDTEP is a scheme for Exporters to make Indian products cost-competitive and create a level playing field for them in the Global Market.

- It has been kicked in from January 2021, replacing the earlier Merchandise and Services Export Incentive Schemes (MEIS and SEIS) that were in violation of WTO norms.

- The new RoDTEP Scheme is a fully WTO compliant scheme.

- It will reimburse all the taxes/duties/levies being charged at the Central/State/Local level which are not currently refunded under any of the existing schemes but are incurred at the manufacturing and distribution process.

Answer this PYQ:

Q.With reference to the international trade of India at present, which of the following statements is/are correct?

- India’s merchandise exports are less than its merchandise imports.

- India’s imports of iron and steel, chemicals, fertilizers and machinery have decreased in recent years.

- India’s exports of services ye more than its imports of services.

- India suffers from an overall trade/current account deficit.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 and 4 only

(c) 3 only

(d) 1, 3 and 4 only

Post your answers here (You need to sign-in for that).

Why need such a scheme?

- The scheme was announced last year as a replacement for the Merchandise Export from India Scheme (MEIS), which was not found not to be compliant with the rules of the World Trade Organisation.

- Following a complaint by the US, a dispute settlement panel had ruled against India’s use of MEIS as it had found the duty credit scrips awarded under the scheme to be inconsistent with WTO norms.

Coverage of the scheme

- It covers about 75% of traded items and 65% of India’s exports.

- To enable zero-rating of exports by ensuring domestic taxes are not exported, all taxes, including those levied by States and even Gram Panchayats, will be refunded under the scheme.

- Steel, pharma, and chemicals have not been included under the scheme because their exports have done well without incentives.

Back2Basics: Merchandise Exports from India Scheme (MEIS)

- MEIS was launched with an objective to enhance the export of notified goods manufactured in a country.

- This scheme came into effect on 1 April 2015 through the Foreign Trade Policy and was in existence till 2020.

- It intended to incentivize exports of goods manufactured in India or produced in India.

- The incentives were for goods widely exported from India, industries producing or manufacturing such goods with a view to making Indian exports competitive.

- The MEIS covered almost 5000 goods notified for the purpose of the scheme.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Major rivers of the world

Mains level: NA

The federal government in the US has declared a water shortage for the Colorado river basin due to a historic drought.

Try this PYQ

Q. Consider the following pairs

River – Flows into

- Mekong — Andaman Sea

- Thames — Irish Sea

- Volga — Caspian Sea

- Zambezi — Indian Ocean

Which of the pairs given above is/are correctly matched?(CSP 2020)

(a) 1 and 2 only

(b) 3 only

(c) 3 and 4 only

(d) 1, 2 and 4 only

Post your answers here (you need to sign-in for that).

Colorado River

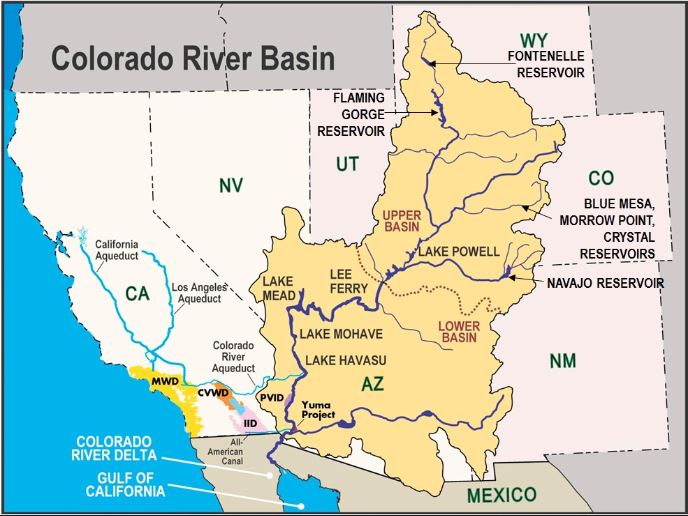

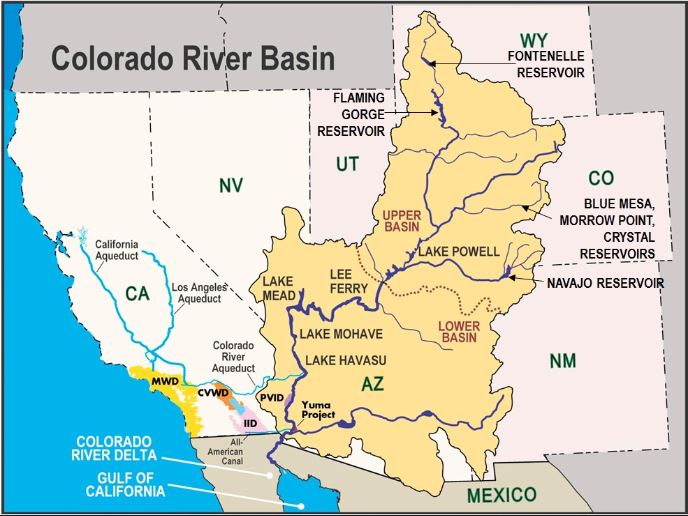

- The Colorado River flows from the Rocky Mountains into the southwestern US and into Mexico.

- The river is fed by snowmelt from the Rocky and Wasatch mountains and flows a distance of over 2,250 km (river Ganga flows through a distance of roughly 2,500 km) across seven states and into Mexico.

- The Colorado River Basin is divided into the Upper (Wyoming, Colorado, New Mexico, Utah and northern Arizona) and Lower Basins (parts of Nevada, Arizona, California, southwestern Utah and western New Mexico).

- In the Lower Basin, the Hoover Dam controls floods and regulates water delivery and storage.

- Apart from the Hoover dam, there is the Davis Dam, Parker Dam and the Imperial Dam that regulate the release of water from the Hoover Dam.

Major lakes in its basin

- Lake Mead is the largest reservoir in the US in terms of volume and was formed in the 1930s by the Hoover Dam in Southern Nevada.

- Its main source of water is obtained from the Rocky Mountain snowmelt and runoff.

- The other is Lake Powell, the reservoir created by the Glen Canyon Dam in Arizona.

Reasons for shortage

- Since the year 2000, this river basin has been experiencing a prolonged drought.

- This persistent drought has led to a lowering down of the water levels in the basin’s reservoirs to meet the demand over the years.

- But even with great water storing capacity, over the years the demand for water from the basin has increased whereas supply is restricted.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Maharaja Ranjit Singh

Mains level: Not Much

A bronze statue of the first ruler of the Sikh Empire, Maharaja Ranjit Singh, was vandalized in Pakistan.

Who was Maharaja Ranjit Singh?

- Maharaja Ranjit Singh (13 November 1780 – 27 June 1839), popularly known as Sher-e-Punjab or “Lion of Punjab”, was the first Maharaja of the Sikh Empire.

- He survived smallpox in infancy but lost sight in his left eye.

- Prior to his rise, the Punjab region had numerous warring misls (confederacies), twelve of which were under Sikh rulers and one Muslim.

- Ranjit Singh successfully absorbed and united the Sikh misls and took over other local kingdoms to create the Sikh Empire.

- He repeatedly defeated invasions by outside armies, particularly those arriving from Afghanistan, and established friendly relations with the British.

Empirical expansion

- Ranjit Singh’s trans-regional empire spread over several states. His empire included the former Mughal provinces of Lahore and Multan besides part of Kabul and the entire Peshawar.

- The boundaries of his state went up to Ladakh — Zorawar Singh, a general from Jammu, had conquered Ladakh in Ranjit Singh’s name — in the northeast.

- His empire extended till Khyber pass in the northwest, and up to Panjnad in the south where the five rivers of Punjab fell into the Indus.

- During his regime, Punjab was a land of six rivers, the sixth being the Indus.

His legacy

- Ranjit Singh’s reign introduced reforms, modernization, investment into infrastructure, and general prosperity.

- His Khalsa army and government included Sikhs, Hindus, Muslims, and Europeans.

- His legacy includes a period of Sikh cultural and artistic renaissance, including the rebuilding of the Harmandir Sahib in Amritsar, Takht Sri Patna Sahib, Bihar, and Hazur Sahib Nanded, Maharashtra under his sponsorship.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now