Note4Students

From UPSC perspective, the following things are important :

Prelims level: Pandora papers

Mains level: Paper 3- Tax evasion and tax avoidance

Context

The Pandora Papers, published on October 3, once again expose the illegal activities of the rich and the mighty across the world.

About the Pandora Papers investigation

- It is “the world’s largest-ever journalistic collaboration, involving more than 600 journalists from 150 media outlets in 117 countries”.

- The International Consortium of Investigative Journalists (ICIJ) has researched and analysed the approximately 12 million documents in order to unravel the functioning of the global financial architecture.

- The Pandora Papers, unlike the previous cases, are not from any one tax haven; they are leaked records from 14 offshore services firms. The data pertains to an estimated 29,000 beneficiaries.

- The 2.94 terabytes of data have exposed the financial secrets of over 330 politicians and public officials, from more than 90 countries and territories.

- These include 35 current and former country leaders.

Role of financial centres and banks

- A large extent of the illicit financial flows have a link to New York City and London, the biggest financial centres in the world that allow financial institutions such as big banks to operate with ease.

- The big financial entities operating from these cities have been prosecuted for committing illegalities.

- In 2012, an investigation into the London Interbank Offered Rate or LIBOR — crucial in calculating interest rates — led to the fining of leading banks such as Barclays, UBS, Rabobank and the Royal Bank of Scotland for manipulation.

- These banks also operate a large number of subsidiaries in tax havens to help illicit financial flows.

Modus operandi

- Tax havens enable the rich to hide the true ownership of assets by using: trusts, shell companies and the process of ‘layering’.

- Financial firms offer their services to work this out for the rich.

- They provide ready-made shell companies with directors, create trusts and ‘layer’ the movement of funds.

- The process of layering involves moving funds from one shell-company in one tax haven to another in another tax haven and liquidating the previous company.

- This way, money is moved through several tax havens to the ultimate destination.

- Since the trail is erased at each step, it becomes difficult for authorities to track the flow of funds.

- It appears that most of the rich in the world use such manipulations to lower their tax liability even if their income is legally earned.

Why funds are moved to the tax havens?

- Even citizens of countries with low tax rates use tax havens.

- Over the three decades, tax havens have enabled capital to become highly mobile, forcing nations to lower tax rates to attract capital.

- This has led to the ‘race to the bottom’, resulting in a shortage of resources with governments to provide public goods, etc., in turn adversely impacting the poor.

- Lowering tax liability: It appears that most of the rich in the world use such manipulations to lower their tax liability even if their income is legally earned.

- Moving funds out of reach of creditors: Revelations suggest that funds are moved out of national jurisdiction to spirit them away from the reach of creditors and not just governments.

- Many fraudsters are in jail but have not paid their creditors even though they have funds abroad.

Challenges in checking the illicit financial flows

- The very powerful who need to be onboard to curb illicit financial flows (as the Organisation for Economic Co-operation and Development, or the OECD is trying) are the beneficiaries of the system and would not want a foolproof system to be put in place to check it.

- Strictly speaking, not all the activity being exposed by the Pandora Papers may be illegal due to tax evasion or the hiding of proceeds of crime.

- The authorities will have to prove if the law of the land has been violated.

- Operators outside the purview of tax authorities: Many Indians have become non-resident Indians or have made some relative into an NRI who can operate shell companies and trusts outside the purview of Indian tax authorities.

- That is why prosecution has been difficult in the earlier cases of data leakage from tax havens.

- The Supreme Court of India-monitored Special Investigation Team (SIT) set up in 2014 has not been able to make a dent.

- Role of organised sector: The Government’s focus on the unorganised sector as the source of black income generation is also misplaced since data indicate that it is the organised sector that has been the real culprit and also spirits out a part of its black incomes.

Way forward

- Global minimum tax: Recent development has been the agreement among almost 140 countries to levy a 15% minimum tax rate on corporates.

- Though it is a long shot, this may dent the international financial architecture.

- Ending banking secrecy: Other steps needed to tackle the curse of illicit financial flows are ending banking secrecy and a Tobin tax on transactions; neither of which the OECD countries are likely to agree to.

Consider the question “How illicits financial flows affect the economies of the nations? What are the challenges in curbing it?”

Conclusion

To curb the illicit financial flows, the global community needs to reach a consensus on several issues and tackle the challege collectively.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Article 312

Mains level: Paper 2- Reforms in bureaucracy

Context

The bureaucracy that took India through the last 75 years can’t be the one to take it through the next 75 — we need a proactive, imaginative, technology-savvy, enabling bureaucracy.

Role of bureaucracy and challenges it faces

- The civil services, and the Indian Administrative Service (IAS) in particular played important role in holding India together post-Independence.

- Much of the impressive nation-building across sectors happened because of their dedication and commitment.

- It is also forgotten that the bureaucracy, unlike the private sector, is a creature of the Constitution and is bound by multiple rules, laws, and procedures.

- Understaffed: As per estimates compiled by the Institute of Conflict Management, the government of India (GOI) has about 364 government servants for every 1,00,000 residents, with 45 per cent in the railways alone.

- About 60 per cent and 30 per cent are in Groups C and D, respectively, leaving a skeletal skilled staff of just about 7 per cent to man critical positions.

- We are grossly understaffed.

- Inaction: Further, faced with extensive judicial overreach reporting to an often rapacious, short-sighted political executive, and a media ever ready to play the role of judge, jury and executioner, the bureaucracy has in large part found comfort in inaction and ensuring audit-proof file work.

Suggestions

- Get out of business: That we need not be in many sectors is well-recognised — leave them to the markets — and politicians must get bureaucrats out of business, in more ways than one.

- Prevent punitive actions: To increase the officers’ willingness to take decisions, one possible solution is to legally prevent enforcement agencies from taking punitive action, like arrest for purely economic decisions without any direct evidence of kickbacks.

- Lateral entry: The toughest challenge is to change an inactive bureaucracy to one that feels safe in taking genuine risks.

- Lateral entry needs to expand to up to 15 per cent of Joint/Additional and Secretary-level positions in GOI.

- Recruitment process: Changes in recruitment procedures, like the interview group spending considerable time with the candidates, along with psychometric tests, will improve the incoming pool of civil servants.

- Evaluation: Most importantly, after 15 years of service, all officers must undergo a thorough evaluation to enable them to move further, and those who do not make it should be put out to pasture.

- Adoption of technology: Every modern bureaucracy in the world works on technology-enabled productivity and collaboration tools.

- India procures about $600 billion worth of goods and services annually — can’t all payments be done electronically?

Consider this question ” The civil services held India together after Independence, but if the country’s potential is to be realised, existing problems of inefficiency and inaction must be fixed. In light of this, examine the factors reasponsible for inefficiency and suggest the reforms.”

Conclusion

India cannot hope to get to a $5-trillion economy without a modern, progressive, results-oriented bureaucracy, one which says “why not?” instead of “why?” when confronted with problems.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: BSF

Mains level: India's border security

The Ministry of Home Affairs (MHA) has extended the jurisdiction of the Border Security Force (BSF) up to 50 km inside the international borders in Punjab, West Bengal and Assam.

Do you know?

BSF currently stands as the world’s largest border guarding force. It has been termed as the First Line of Defence of Indian Territories.

About Border Security Force (BSF)

- The BSF is India’s border guarding organization on its border with Pakistan and Bangladesh.

- It comes under the Ministry of Home Affairs.

- It was raised in the wake of the 1965 War on 1 December 1965 for ensuring the security of the borders of India and for matters connected therewith.

- The BSF has its own cadre of officers but its head, designated as a Director-General (DG), since its raising has been an officer from the Indian Police Service (IPS).

What are the new modifications?

- The MHA has exercised the powers under the Border Security Force Act of 1968.

- It has thus outlined the area of BSF’s jurisdiction.

- While the places marked here are within 50 km of the respective borders, this is not meant to represent the BSF’s jurisdiction.

- At the same time, the Ministry has reduced BSF’s area of operation in Gujarat from 80 km from the border, to 50 km.

Powers exercised by BSF in its jurisdiction

BSFs jurisdiction has been extended only in respect of the powers it enjoys under:

- Criminal Procedure Code (CrPC)

- Passport (Entry into India) Act, 1920 and

- Passport Act, 1967

Arrest and search

- BSF currently has powers to arrest and search under these laws.

- It also has powers to arrest, search and seize under the NDPS Act, Arms Act, Customs Act and certain other laws.

Its powers under these will continue to be only up to 15 km inside the border in Punjab, Assam and West Bengal, and will remain as far as 80 km in Gujarat.

Sanctions behind such powers

- Scarcely populated borders: At that time, border areas were sparsely populated and there were hardly any police stations for miles.

- Trans-border crimes: To prevent trans-border crimes, it was felt necessary that BSF is given powers to arrest.

- Manpower crunch: While police stations have now come up near the border, they continue to be short-staffed.

Various issues at Borders

- Encroachment

- Illegal incursion

- Drug and cattle smuggling

Why has the government extended the jurisdiction?

- The objective of the move is to bring in uniformity and also to increase operational efficiency. Earlier BSF had different jurisdictions in different states.

- BSF often gets information relating to crime scenes that may be out of their jurisdiction.

- The move was also necessitated due to increasing instances of drone-dropping of weapons and drugs.

Impact on State Police jurisdiction

- This move will complement the efforts of the local police. Thus, it is an enabling provision.

- It’s not that the local police can’t act within the jurisdiction of the BSF.

- The state police have better knowledge of the ground. Hence BSF and local Police can act in cooperation.

Criticism of the move

- At a basic level, the states can argue that law and order is a state subject and enhancing BSF’s jurisdiction infringes upon powers of the state government.

- In 2012, then Gujarat CM and the present PM had opposed a central government moves to expand BSF’s jurisdiction.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Bioethanol, Ethanol blending

Mains level: Read the attached story

India is planning to use surplus rice, besides sugarcane, to meet its biofuel target of blending 20% ethanol with petrol.

Could this impede India’s crop diversification goals or worsen nutritional indicators? Let us see!

Govt’s plan to promote ethanol

- India is estimated to achieve about 8.5% blending with petrol by this year, which it plans to increase to a mandatory 20% blending by 2025.

Sources for ethanol

The plan is to divert its excess sugar production to produce ethanol, 3.5 million tonnes in 2021-22 and 6 million tonnes the next year, in addition to grains like rice, corn, and barley.

- Using surplus rice: The government’s food department revealed its plans to divert 17 million tonnes of surplus rice from its food stocks of 90 million tonnes to produce ethanol.

- Sugarcane: This is in addition to the 2 million tonnes of sugar which is already being diverted to produce ethanol.

How would this benefit the country?

- Cost saving: A successful biofuels programme can save India $4 billion or about ₹30,000 crore every year by lowering import of petroleum products.

- Emission cut: Ethanol is also less polluting and offers equivalent efficiency at a lower cost than petrol.

- Biofuel’s policy boost: Rising production of grains and sugarcane and feasibility of making vehicles compliant to ethanol-blended fuel makes its biofuels policy a strategic requirement.

- Early rollout: Towards this, govt has put in place interest subsidies for distilleries to expand capacity while auto firms have agreed to make compatible vehicles.

What are the unintended effects of the policy?

- Unsustainability of cash-crops: Increasing reliance on biofuels can push farmers to grow more water-intensive crops like sugarcane and rice.

- Huge water requirement: Currently use 70% of the available irrigation water, negating some positive impact on the environment of using more ethanol.

- Food and nutrition security: The move could impact India’s hunger situation by limiting the coverage of the food security schemes.

- Food inflation: Diversion of mass consumption grains can also push food prices up.

How will it impact crop diversification?

- Monotonous crops: Although the biofuels policy stresses on using less water-consuming crops, farmers prefer to grow more sugarcane and rice due to price support schemes.

- Water stress: Growing more of them can lead to an adverse impact in water-stressed areas in states.

What about food security?

- It is unethical to use edible grains to produce ethanol in a country where hunger is rampant.

- India is already a poor performer in Global Hunger Index.

- Although about 80 crore people are now receiving subsidized food grains, calculations show that over 10 crore eligible households are still excluded.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Customs Duty, Edible Oil Imports

Mains level: Edible oil scarcity in India

The Union Commerce Minister has announced that the government has decided to waive customs duty on import of crude sunflower, palm and soyabean oil, a move aimed at controlling their prices.

Edible Oil Imports and India

- Given the heavy dependency on imports, the Indian edible oil market is influenced by the international markets.

- Of the 20-21 million tonnes of edible oil that India consumes annually, around 4-15 mt is imported.

- India is second only to China (34-35 mt) in terms of consumption of edible oil.

- Crude and food-grade refined oil is imported in large vessels, mainly from Malaysia, Brazil, Argentina, Indonesia etc.

- Home-grown oilseeds such as soyabean, groundnut, mustard, cottonseed etc find their way to domestic solvent and expellers plants, where both the oil and the protein-rich component is extracted.

Do you know?

Palm oil (45%) is the largest consumed oil, mainly used by the food industry for frying namkeen, mithai, etc, followed by soyabean oil (20%) and mustard oil (10%), with the rest accounted for by sunflower oil, cottonseed oil, groundnut oil etc.

Prices and politics

- Prices of edible oil have been rising across the country since few months.

- Most edible oils are trading between Rs 130-Rs 190/litre.

- Also, the festive season will see increased buying of edible oils.

Impact of the move

- Consumers might not see a drastic reduction immediately in prices of edible oil.

- The reduction in duty is expected to affect the earnings of oilseed growers across the country.

Long-term implications

- Over the last few years, the government has taken a series of steps to remove India’s import dependency on pulses, and tried to do the same for oilseeds through national missions.

- However, frequent market interventions that ultimately bring down prices would backfire on the government and veer farmers away from growing oilseeds.

- We need continuity in prices to help farmers stick to oilseeds or pulses.

Back2Basic: Customs Duty

- Customs duty refers to the tax imposed on goods when they are transported across international borders.

- In simple terms, it is the tax that is levied on import and export of goods.

- Custom duty in India is defined under the Customs Act, 1962, and all matters related to it fall under the Central Board of Excise & Customs (CBEC).

- The government uses this duty to raise its revenues, safeguard domestic industries, and regulate movement of goods.

- The rate of Customs duty varies depending on where the goods were made and what they were made of.

Types of custom duty

- Basic Customs Duty (BCD): It is the duty imposed on the value of the goods at a specific rate at a specified rate of ad-valorem basis.

- Countervailing Duty (CVD): It is imposed by the Central Government when a country is paying the subsidy to the exporters who are exporting goods to India.

- Additional Customs Duty or Special CVD: It is imposed to bring imports on an equal track with the goods produced or manufactured in India.

- Protective Duty: To protect interests of Indian industry

- Safeguard Duty: It is imposed to safeguard the interest of our local domestic industries. It is calculated on the basis of loss suffered by our local industries.

- Anti-dumping Duty: Manufacturers from abroad may export goods at very low prices compared to prices in the domestic market. In order to avoid such dumping, ADD is levied.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Small Finance Bank

Mains level: Not Much

The Reserve Bank of India has issued a small finance bank (SFB) license to a consortium of fintech companies BharatPe and Centrum Financial Services Ltd.

What is a SFB?

- Small finance banks (SFBs) are a type of niche banks in India.

- They can be promoted either by individuals, corporate, trusts or societies.

- They are governed by the provisions of Reserve Bank of India Act, 1934, Banking Regulation Act, 1949 and other relevant statutes.

- They are established as public limited companies in the private sector under the Companies Act, 2013.

- Banks with a SFB license can provide basic banking service of acceptance of deposits and lending.

Objectives of setting-up an SFB

- To provide financial inclusion to sections of the economy not being served by other banks, such as small business units, small and marginal farmers, micro and small industries and unorganized sector entities

Key features of SFBs

- Existing non-banking financial companies (NBFC), microfinance institutions (MFI) and local area banks (LAB) can apply to become small finance banks.

- The banks will not be restricted to any region.

- 75% of its net credits should be in priority sector lending and 50% of the loans in its portfolio must in ₹25 lakh.

- The firms must have a capital of at least ₹200 crore.

- The promoters should have 10 years’ experience in banking and finance.

- Foreign shareholding will be allowed in these banks as per the rules for FDI in private banks in India.

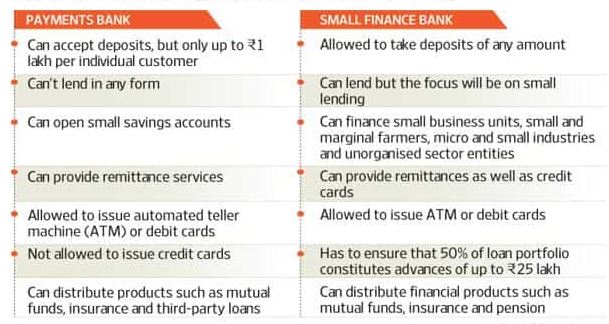

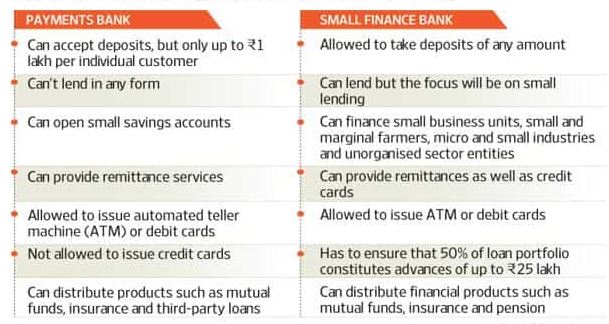

Back2Basics: Small Payments Bank Vs. Payment Bank

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Global Hunger Index

Mains level: Food and nutrition security of India

The Global Hunger Index 2021 has ranked India at 101 positions out of a total 116 countries.

Note the parameters over which the GHI is based and their weightage composition.

Global Hunger Index (GHI)

- The Global Hunger Index is a peer-reviewed annual report, jointly published by Concern Worldwide and Welthungerhilfe.

- It determines hunger on a 100-point scale, where 0 is the best possible score (no hunger) and 100 is the worst.

- It is designed to comprehensively measure and track hunger at the global, regional, and country levels.

- The aim of the GHI is to trigger action to reduce hunger around the world.

For each country in the list, the GHI looks at four indicators:

- Undernourishment (which reflects inadequate food availability): calculated by the share of the population that is undernourished (that is, whose caloric intake is insufficient)

- Child Wasting (which reflects acute undernutrition): calculated by the share of children under the age of five who are wasted (that is, those who have low weight for their height)

- Child Stunting (which reflects chronic undernutrition): calculated by the share of children under the age of five who are stunted (that is, those who have low height for their age)

- Child Mortality (which reflects both inadequate nutrition and unhealthy environment): calculated by the mortality rate of children under the age of five

India’s (poor) performance

- India is among the 31 countries where hunger has been identified as serious.

- Only 15 countries fare worse than India.

- Some of these include Afghanistan (103), Nigeria (103), Congo (105), Mozambique (106), Sierra Leone (106), Timor-Leste (108), Haiti (109), Liberia (110), Madagascar (111) and Somalia (116).

- India was also behind most of the neighbouring countries.

- Pakistan was placed at 92 rank, Nepal at 76 and Bangladesh also at 76.

Reasons for such poor performance

- Poor maternal health: Mothers are too young, too short, too thin and too undernourished themselves, before they get pregnant, during pregnancy, and then after giving birth, during breast-feeding.

- Poor sanitation: Poor sanitation, leading to diarrhoea, is another major cause of child wasting and stunting.

- Food insecurity: Low dietary diversity in India is also a key factor in child malnutrition.

- Poverty: Almost 50 million households in India are dependent on these small and marginal holdings.

- Livelihood loss: The rural livelihoods loss after COVID and lack of income opportunities other than the farm sector have contributed heavily to the growing joblessness in rural areas.

Issues over credibility of GHI

- India has ranked among many African countries while it is among the top 10 food-producing countries in the world.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Geographical Indication

Mains level: Not Much

In Tamil Nadu, the Karuppur kalamkari paintings and the Kallakurichi wood carvings recently received the geographical indication (GI) tags.

[A] Kallakurichi Wood Carvings

- The Kallakurichi wood carvings are a unique form of wood carving practiced in Tamil Nadu.

- It involves the application of ornamentation and designs, derived from traditional styles by the craftsmen.

- They are mainly practiced in Kallakurichi, Chinnaselam and Thirukkovilur taluks of Kallakurichi district.

[B] Karuppur Kalamkari Paintings

- Kalamkari paintings are done on pure cotton cloth, predominantly used in temples for umbrella covers, cylindrical hangings, chariot covers and asmanagiri (false ceiling cloth pieces).

- Documentary evidence shows that kalamkari paintings evolved under the patronage of Nayaka rulers in the early 17th century.

Back2Basics: Geographical Indication

- A GI is a sign used on products that have a specific geographical origin and possess qualities or a reputation that are due to that origin.

- Nodal Agency: Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry

- India, as a member of the World Trade Organization (WTO), enacted the Geographical Indications of Goods (Registration and Protection) Act, 1999 w.e.f. September 2003.

- GIs have been defined under Article 22 (1) of the WTO Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) Agreement.

- GI is granted for a term of 10 years in India. As of today, more than 300 GI tags has been allocated so far in India (*Wikipedia).

- The tag stands valid for 10 years.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: UFill

Mains level: NA

The Bharat Petroleum Corporation Limited (BPCL) has launched an automated fuelling technology -UFill- to ensure that its customers have a better experience at outlets.

What is UFill?

- UFill functionality, which has been described as swift, secure and smart, has been launched in 65 cities and will soon be launched across the country.

- It does not need any app download, and is payment app agnostic.

- Customer can use any payment app already downloaded on his/her phone.

- It offers real time QR and voucher code through SMS and is accepted at all BPCL Fuel Stations where the functionality is enabled.

Key features

- UFill aims to improve customer’s turn-around time (TAT) at fuel outlet and increase transactional transparency, thereby providing enhanced retail like experience.

- The technology provides the customer with control of fuelling as well as touch less pre-payment solution.

- There is no need to check zero before fuelling or final reading, the dispensing unit will automatically dispense the exact quantity of fuel.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now