Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 3- Agri-GDP

Context

The United Nations latest report, “Population Prospects” forecasts that India will surpass China’s population by 2023, reaching 1.5 billion by 2030 and 1.66 billion by 2050.

Poverty eradication: Lessons from China

- China’s story since 1978 is unique – the country has achieved the fastest decline in poverty.

- Its experiences hold some important lessons for India, especially because in 1978, when China embarked on its economic reforms, its per capita income at $156.4 was way below that of India at $205.7.

- Today, China is more than six times ahead of India in terms of per capita income – China’s per capita income in 2021 was $12,556, while that of India was $1,933 in 2020.

- China started its economic reforms in 1978 with a primary focus on agriculture.

- Contribution of agriculture: It broke away from the commune system and liberated agri-markets from myriad controls.

- Increase in agri-GDP: As a result, during 1978-84, China’s agri-GDP grew by 7.1 per cent per annum and farmers’ real incomes grew by 14 per cent per annum with the liberalisation of agri-prices.

- Creation of demand: Enhanced incomes of rural people created a huge demand for industrial products, and also gave political legitimacy for pushing further the reform agenda.

- The aim of China’s manufacturing through Town and Village Enterprises (TVEs) was basically to meet the surging demand from the hinterlands.

- Population factor: China introduced the one-child per family policy in September 1980, which lasted till early 2016.

- It is this strict control on population growth, coupled with booming growth in overall GDP over these years, that led to a rapid increase in per capita incomes.

- Chinese population growth today is just 0.1 per cent per annum compared to India’s 1.1 per cent per annum.

Growth story of Indian agriculture

- Over a 40-year period, 1978-2018, China’s agriculture has grown at 4.5 per cent per annum while India’s agri-GDP growth ever since reforms began in 1991 has hovered at around 3 per cent per annum.

- Market and price liberalisation in agriculture still remains a major issue, and at the drop of any hint of food price rise, the government clamps down exports, imposes stock limits on traders, suspends futures markets, and pushes other measures that strangle markets.

- Implicit taxation of farmers: The net result of all this is reflected in the “implicit taxation” of farmers to favour the vocal lobby of consumers, especially the urban middle class.

Way forward

- Population control: The only way is through effective education, especially that of the girl child, open discussion and dialogue about family planning methods and conversations about the benefits of small family size in society.

- Effective education: As per the National Family Health Survey-5 (2019-21), of all the girls and women above the age of 6 years, only 16.6 per cent were educated for 12 years or more.

- Based on unit-level data of NFHS5 (2019-21), it is found that women’s education is the most critical determinant of the status of malnutrition amongst children below the age of five.

- Unless a focused and aggressive campaign is launched to educate the girl child and provide her with more than 12 years of good quality education, India’s performance in terms of the prosperity of its masses, and the human development index may not improve significantly for many more years to come

- If government can take up this cause in sync with state governments, this will significantly boost the labour participation rate of women, which is currently at a meagre 25 per cent, and lead to “double engine” growth.

- Nutrition interventions: The NFHS-5 data shows that more than 35 per cent of our children below the age of five are stunted, which means their earning capacity will remain hampered throughout life. They will remain stuck in a low-level income trap.

Conclusion

From a policy perspective, if there is any subsidy that deserves priority, it should be for the education of the girl child. This policy focus can surely bring a rich harvest, politically and economically, for many years to come.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: 74th Constitutional Amendment Act

Mains level: Paper 2- Municipal finances

Context

Recently, the Indian Institute for Human Settlements (IIHS) analysed data from 80 urban local bodies (ULBs) across 24 States between 2012-13 and 2016-17 to understand ULB finance and spending, and found some key trends.

Health of municipal finances

- The 74th Constitution Amendment Act was passed in 1992 mandating the setting up and devolution of powers to urban local bodies (ULBs) as the lowest unit of governance in cities and towns.

- Constitutional provisions were made for ULBs’ fiscal empowerment.

- Challenges in fiscal empowerment: Three decades since, growing fiscal deficits, constraints in tax base expansion, and weakening of institutional mechanisms that enable resource mobilisation remain challenges.

- Revenue losses after implementation of the Goods and Services Tax (GST) and the pandemic have exacerbated the situation.

Analysing the trends in municipal finances

Recently, the Indian Institute for Human Settlements (IIHS) analysed data from 80 ULBs across 24 States between 2012-13 and 2016-17 to understand ULB finance and spending, and found some key trends.

1] Own sources of revenue less than half of total revenue

- Key sources of revenue: The ULBs’ key revenue sources are taxes, fees, fines and charges, and transfers from Central and State governments, which are known as inter-governmental transfers (IGTs).

- Important indicator of financial health: The share of own revenue (including revenue from taxes on property and advertisements, and non-tax revenue from user charges and fees from building permissions and trade licencing) to total revenue is an important indicator of ULBs’ fiscal health and autonomy.

- The study found that the ULBs’s own revenue was 47% of their total revenue.

- Of this, tax revenue was the largest component: around 29% of the total.

- Property tax, the single largest contributor to ULBs’ own revenue, accounted for only about 0.15% of the GDP.

- Figures for developing countries: The corresponding figures for developing and developed countries were significantly higher (about 0.6% and 1%, respectively) indicating that this is not being harnessed to potential in India.

2] High dependence on IGTs

- Most ULBs were highly dependent on external grants — between 2012-13 and 2016-17, IGTs accounted for about 40% of the ULBs’ total revenue.

- Transfers from the Central government are as stipulated by the Central Finance Commissions and through grants towards specific reforms, while State government transfers are as grants-in-aid and devolution of State’s collection of local taxes.

3] Tax revenue is largest revenue for larger cities, while smaller cities are more dependent on grants

- here are considerable differences in the composition of revenue sources across cities of different sizes.

- Class I-A cities (population of over 50 lakh) primarily depend on their own tax revenue, while Class I-B cities and Class I-C cities (population of 10 lakh-50 lakh and 1 lakh-10 lakh, respectively) rely more on IGTs.

- Own revenue mobilisation in Class I-A cities increased substantially.

- It was primarily driven by increases in non-tax revenue

4] Increasing operations and maintenance (O&M) expenses

- Operations and maintenance (O&M) expenses are on the increase but still inadequate.

- While the expenses were on the rise, studies (such as ICRIER, 2019 and Bandyopadhyay, 2014) indicate that they remained inadequate.

- For instance, O&M expenses incurred in 2016-17 covered only around a fifth of the requirement forecast by the High-Powered Expert Committee for estimating the investment requirements for urban infrastructure services.

- O&M expenses should ideally be covered through user charges, but total non-tax revenues, of which user charges are a part, are insufficient to meet current O&M expenses.

- The non-tax revenues were short of the O&M expenditure by around 20%, and this shortfall contributed to the increasing revenue deficit in ULBs.

Way forward

- Improving own revenue: It is essential that ULBs leverage their own revenue-raising powers to be fiscally sustainable and empowered and have better amenities and quality of service delivery.

- Stability in IGT: Stable and predictable IGTs are particularly important since ULBs’ own revenue collection is inadequate.

- O&M expenses: Increasing cost recovery levels through improved user charge regimes would not only improve services but also contribute to the financial vitality of ULBs.

- Measures need to be made to also cover O&M expenses of a ULB for better infrastructure and service.

- Tapping into property taxes, other land-based resources and user charges are all ways to improve the revenue of a ULB.

Conclusion

The health of municipal finances is a critical element of municipal governance which will determine whether India realises her economic and developmental promise.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: National Coal Index

Mains level: Paper 3- Need for increasing the domestic production of coal

Context

With inflation at unprecedented levels in many countries, concerns over energy security have gained centre stage.

National Coal Index to factor in the increased price of imported coal

- This index was created to provide a benchmark for revenue-sharing contracts being executed after the auctions for commercial mining of coal.

- The NCI had to be introduced as the wholesale price index (WPI) for coal has no component of imported coal.

- For the last six months, the WPI for Coal has been stable at around 131.

- Over the same period, the NCI has jumped from about 165 to about 238 reflecting the sharp increase in international coal prices.

Needs to increase domestic coal production

- High prices of coal and coal-based generation will only encourage imported coal and expose the country to price risks from international energy prices.

- The domestic coal industry has responded to increasing internation prices with an increase of over 30 per cent in coal production from April to June this year.

- Anticipating these problems, a big effort toward permitting commercial mining has been made to get the private sector to produce more coal.

- Gradual transition: Looking at coal from a singular focus on GHG emissions will give a myopic view of energy requirements for a growing economy like India.

- The path to achieving 500 GW of renewables needs to be gradual, ensuring an orderly transition as coal is unavoidable in the near future.

- Reducing coal imports and increasing domestic production of coal needs focused attention

Suggestions to increase domestic production of coal

1] Sensitising the financial community

- The financial community has to be sensitised to the need of increasing domestic coal production to meet the growing energy demand.

- The draft National Electricity Policy released in May 2021, recognised the need to increase coal-based generation.

- This policy has not yet been finalised.

- It should clearly articulate the importance of domestic coal-based generation.

- Holistic approach in ESG criteria: Apart from the government, the industry should also take up this issue with the financial community in adopting a more holistic approach toward environmental, social, and governance (ESG) criteria.

2] The regulator needs to facilitate greater role of private sector

- There is the need for a regulator to address the issues arising from a greater role of the private sector.

- The current arrangements were put in place at a time when the public sector dominated.

- There are several issues where new private commercial miners would need help.

- Single point of contact: A single point of contact for the industry in the form of a dedicated regulator would give great comfort to private players and would help to overcome problems that could arise in due course.

3] Diversifying the production base

- Increasing domestic production of coal and diversifying the production base are both needed.

- This must be complemented with efforts to improve the quality of the coal produced.

4] Remove financial burden due to cross subsidies

- The undue financial burden on the coal sector due to various cross subsidies needs attention.

- The regime needs to be reformed.

Conclusion

Action on the issues discussed above will only help to deepen and strengthen these reforms which are needed to overcome the challenges that have resurfaced over the past few months.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Treaty of Friendship

Mains level: India-Bhutan Relations

After over two years of the COVID-19-induced lockdown, Bhutan will open its doors to tourists on September 23 with a new expensive policy for Indians and other foreign tourists.

India-Bhutan Relations: A backgrounder

- India and Bhutan have had long-standing diplomatic, economic and cultural relations

- Bhutan and India relations are governed by a friendship treaty that was renegotiated only in 2007, subjecting the Himalayan nation’s security needs to supervision.

- Treaty of Friendship in 2007, which brought into the India-Bhutan relationship “an element of equality.”

- The Treaty provides for perpetual peace and friendship, free trade and commerce, and equal justice to each other’s citizens.

What is the Treaty of Friendship?

- On August 8, 1949, Bhutan and India signed the Treaty of Friendship, calling for peace between the two nations and non-interference in each other’s internal affairs.

- India re-negotiated the 1949 treaty with Bhutan and signed a new treaty of friendship in 2007.

- The new treaty replaced the provision requiring Bhutan to take India’s guidance on foreign policy with broader sovereignty and not require Bhutan to obtain India’s permission over arms imports.

- Under the 2007 India-Bhutan Friendship Treaty, the two sides have agreed to “cooperate closely with each other on issues relating to their national interests.”

- Neither Government shall allow the use of its territory for activities harmful to the national security and interest of the other

Various facets of ties

(1) Commercial Relations

- India is Bhutan’s largest trading partner.

- India and Bhutan have signed an Agreement on Trade, Commerce and Transit on in 2016, which provides for a free trade regime between the two countries.

- Tourism is another point of convergence.

(2) Energy Cooperation

- A scheme titled “Comprehensive Scheme for Establishment of Hydro-meteorological and Flood Forecasting Network on rivers Common to India and Bhutan” is in operation.

- The network consists of 32 Hydro-meteorological/ meteorological stations located in Bhutan and being maintained by the Royal Government of Bhutan with funding from India.

- The data received from these stations are utilized in India for formulating flood forecasts.

Significance of Bhutan to India

- Buffer to China: Bhutan is a buffer state between India and China. Bhutan shares a 470 km long border with China.

- Vital connectivity through chicken’s neck: The Chumbi Valley is situated at the tri-junction of Bhutan, India and China and is 500 km away from the “Chicken’s neck” in North Bengal.

- Security in North-East: Bhutan has in the past cooperated with India and helped to flush out militant groups in NE.

- Chinese inroad in Bhutan: China is interested in establishing formal ties with Thimphu, where it does not yet have a diplomatic mission.

China factor in ties: China predates on small neighbours

- Bhutan is strategically important for both India and China. Chinese territorial claims in western Bhutan are close to the Siliguri Corridor.

- Beijing is reportedly insisting on Bhutan establishing trade and diplomatic relations as a quid pro quo for a border settlement.

- Bhutan is currently India’s only neighbour who has stayed away from joining China’s Belt and Road Initiative (BRI), but that may change if India can’t make itself an attractive ally and neighbour.

Why does India need Bhutan?

- Bhutan has always been India’s most trusted ally in South Asia and has often put India’s security at the forefront.

- Come to think of it, in December 2003, Bhutan’s fourth king personally led the army to throw out Indian militants living in Bhutan’s jungles.

- Bhutan was also the only South Asian country besides India not to attend China’s Belt and Road Initiative forum in May 2017.

- In other words, land-locked Bhutan has held its end of the bargain.

Various cooperation developments

- Maitri Initiative: Bhutan is the first country to receive the Covishield vaccines under India’s Vaccine Maitri Initiative.

- Financial connectivity: It has touched new heights through the launch of the RuPay card and the BHIM app.

- Start-Up ecosystem: Both nations successfully linked up the Start-Up systems of our two countries via structured workshops; through the National Knowledge Network & the Druk-REN connection.

- E-Library project: It has opened up new vistas of education and knowledge sharing between two countries.

Irritants in ties

- India has not invested in significantly in Bhutan and other smaller neighbours that modicum of trust which is critical in building genuine goodwill.

- This means not only increasing people-to-people contact but also being sensitive to Bhutan’s desire for a wider engagement beyond India’s borders. This means respecting Bhutan as an equal, sovereign nation-state.

Conclusion

- The Indo-Bhutan friendship is built on shared values and aspirations, trust and mutual respect.

- Bhutan’s foreign policy framework holds the relationship with India as being integral to its national interest.

- The Indian approach to Bhutan has necessarily to be tailored while being sensitive to the growing Bhutanese aspirations of being considered equal.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

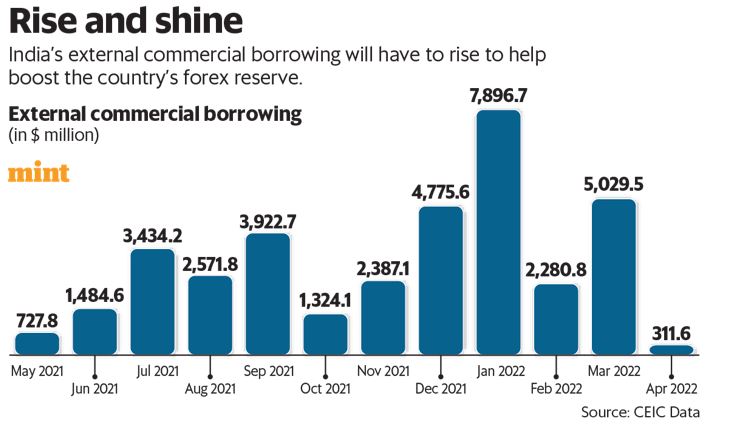

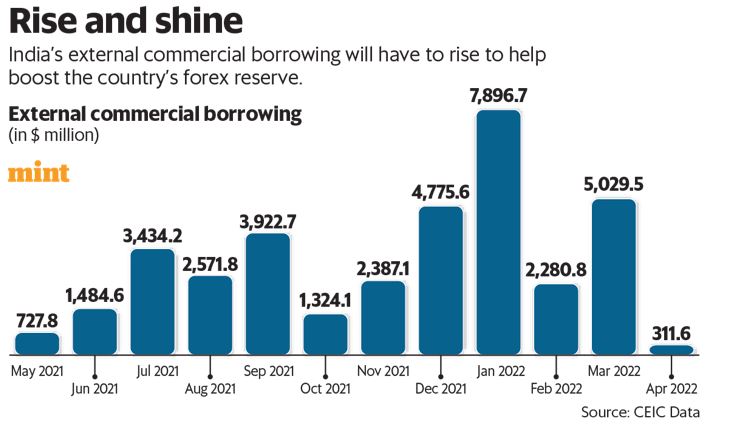

Prelims level: ECB

Mains level: Not Much

The Reserve Bank of India has relaxed norms for companies raising external commercial borrowings (ECBs), as part of a set of measures to stem the slide in the rupee.

What are ECBs taken by Indian companies?

- ECBs are commercial loans that eligible resident entities can raise from outside India, i.e. from a recognized non-resident entity.

- ECBs can be buyer’s credit, supplier’s credit, foreign currency convertible bonds, foreign currency exchangeable bonds, loans etc.

- ECBs can be raised via the automatic route where cases are examined by the Authorized Category Dealer, or the approval route where borrowers are mandated to forward their request to RBI through their authorized dealers.

- Borrowers must follow norms on minimum maturity period, maximum all-in-cost ceiling, end-uses etc.

What is the relaxation offered by the RBI?

- RBI earlier had raised borrowing limit under the automatic route from $750 million or its equivalent per financial year to $1.5 bn up till up to 31 December, 2022.

Why such move?

- The objective was to increase the supply of foreign exchange reserves.

- This in turn would thereby prevent the fast depreciation of the rupee witnessed over the last few months.

What clarity do foreign lenders want from RBI?

- Lenders want to know whether the investment grade needs to be rated by domestic or international agencies.

- If it is only by global agencies, it would limit the number of potential borrowers.

- This is because companies which might be rated high domestically might not necessarily have made the investment grade when rated by international agencies.

Why do Indian firms go for ECBs?

- Low cost: ECBs give companies the benefit of borrowing abroad at lower interest rates.

- Long term repayment: They are also an avenue to borrow a large volume of funds for a relatively long period of time.

- Surpassing exchange fluctuation: Also, borrowing in foreign currencies enables companies to pay for their machinery import etc., thereby nullifying the impact of varying exchange rate.

- Long term profitability: ECBs can help diversify the investor base and funds available at lower cost, helping improve profitability of companies.

- Better credit ratings: ECB interest rates are also a function of their ratings in the international market.

What are the risks for firms raising ECBs?

- Though companies get attracted to ECBs due to lower interest rates, the comfort level of the borrower depends on how stable the rate of exchange is.

- Depreciation of the rupee will raise debt servicing burden as compared to what has been worked out at the time of availing of the ECB facility.

- Thus, the companies might need to incur hedging costs (amount equal to the aggregate costs, fees, and expenses) to cover the exchange rate risk.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Read the attached story

Mains level: NA

This article provides a quick summary of what has been happening in the global economy. These are few key terms that one is likely to hear repeatedly in the coming days and weeks:

- Yield Inversion

- Soft-landing and

- Reverse Currency War

Here’s a quick look at what they mean and why they are significant at present.

(1) Bond Yield Inversion

What is Bond Yeild?

- Bonds are essentially an instrument through which governments (and also corporations) raise money from people.

- Typically government bond yields are a good way to understand the risk-free interest rate in that economy.

- This 2019 piece provides an introduction to government bonds and explains how yields are calculated.

What is Yield Curve?

- The yield curve is the graphical representation of yields from bonds (with an equal credit rating) over different time horizons.

- In other words, if one was to take the US government bonds of different tenures and plot them according to the yields they provide, one would get the yield curve.

The chart below provides a sense of the different types of yield curves one could have.

How to see this?

- Under normal circumstances, any economy would have an upward sloping yield curve.

- That is to say, as one lends for a longer duration — or as one buys bonds of longer tenure — one gets higher yields. This makes sense.

- If one is parting with money for a longer duration, the return should be higher.

- Moreover, a longer tenure also implies that there is a greater risk of failure.

- An inversion of the yield curve essentially suggests that investors expect future growth to be weak.

Inversion of bond yield

- However, there are times when this bond yield curve becomes inverted.

- For instance, bonds with a tenure of 2 years end up paying out higher yields (returns/ interest rate) than bonds with a 10 year tenure.

- Such an inversion of the yield curve essentially suggests that investors expect future growth to be weak.

Here’s how to make sense of this?

- When investors feel buoyant about the economy they pull the money out from long-term bonds and put it in short-term riskier assets such as stock markets.

- In the bond market, the prices of long-term bonds fall, and their yield (effective interest rate) rises.

- This happens because bond prices and bond yields are inversely related.

- However, when investors suspect that the economy is heading for trouble, they pull out money from short-term risky assets (such as stock markets) and put them in long-term bonds.

- This causes the prices of the long-term bonds to rise and their yields to fall.

Why use inversion curve?

- Over the years, inversion of the bond yield curve has become a strong predictor of recessions. Of course, for it to be taken seriously, such an inversion has to last for several months.

- Over the past few weeks, such inversion is happening repeatedly in the US, suggesting to many that a recession is in the offing.

- In the current instance, the US Fed (their central bank) has been raising short-term interest rates, which further bumps up the short-end of the yield curve while dampening economic activity.

(2) Soft-Landing

- The process of monetary tightening that the US is currently unveiling involves not just reducing the money supply but also increasing the cost of money (that is, the interest rate).

- US is doing this to contain soaring inflation.

- Ideally, the US Fed or any central bank doing this would like to bring about monetary tightening in such a manner that slows down the economy but doesn’t lead to a recession.

- When a central bank is successful in slowing down the economy without bringing about a recession, it is called a soft-landing — that is, no one gets hurt.

- But when the actions of the central bank bring about a recession, it is called hard-landing.

(3) Reverse Currency War

- A flip side of the US Fed’s action of aggressively raising interest rates is that more and more investors are rushing to invest money in the US.

- This, in turn, has made the dollar become stronger than all the other currencies. That’s because the dollar is more in demand than yen, euro, yuan etc.

- On the face of it, this should make all other countries happier because a relative weakness of their local currency against the dollar makes their exports more competitive.

- For instance, a Chinese or an Indian exporter gets a massive boost.

- In fact, in the past the US has often accused other countries of manipulating their currency (and keeping its weaker against the dollar) just to enjoy a trade surplus against the US.

- This used to be called the currency war.

What explains this reverse currency war unfolding at the moment?

- The important thing to understand is that a stronger dollar has had a key benefit — importing cheaper crude oil.

- A currency which is losing value to the dollar, on the other hand, finds that it is getting costlier to import crude oil and other commodities that are often traded in dollars.

- But raising the interest rate is not without its own risks.

- Just like in the US, higher interest rates will decrease the chances of a soft-landing for any other economy.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Vice President of India

Mains level: Not Much

A major political party has declared that West Bengal Governor Jagdeep Dhankhar would be the candidate for the post of Vice-President.

About Vice President of India

- The VP is the deputy to the head of state of the Republic of India, the President of India.

- His/her office is the second-highest constitutional office after the president and ranks second in the order of precedence and first in the line of succession to the presidency.

- The vice president is also a member of the Parliament as the ex officio Chairman of the Rajya Sabha.

Qualifications

- As in the case of the president, to be qualified to be elected as vice president, a person must:

- Be a citizen of India

- Be at least 35 years of age

- Not hold any office of profit

- Unlike in the case of the president, where a person must be qualified for election as a member of the Lok Sabha, the vice president must be qualified for election as a member of the Rajya Sabha.

- This difference is because the vice president is to act as the ex officio Chairman of the Rajya Sabha.

Roles and responsibilities

- When a bill is introduced in the Rajya Sabha, the vice president decides whether it is a money bill or not.

- If he is of the opinion that a bill introduced in the Rajya Sabha is a money bill, he shall refer it to the Speaker of the Lok Sabha.

- The vice president also acts as the chancellor of the central universities of India.

Election procedure

- Article 66 of the Constitution of India states the manner of election of the vice president.

- The vice president is elected indirectly by members of an electoral college consisting of the members of both Houses of Parliament and NOT the members of state legislative assembly.

- The election is held as per the system of proportional representation using single transferable votes.

- The voting is conducted by Election Commission of India via secret ballot.

- The Electoral College for the poll will comprise 233 Rajya Sabha members, 12 nominated Rajya Sabha members and 543 Lok Sabha members.

- The Lok Sabha Secretary-General would be appointed the Returning Officer.

- Political parties CANNOT issue any whip to their MPs in the matter of voting in the Vice-Presidential election.

Removal

- The Constitution states that the vice president can be removed by a resolution of the Rajya Sabha passed by an Effective majority (majority of all the then members) and agreed by the Lok Sabha with a simple majority( Article 67(b)).

- But no such resolution may be moved unless at least 14 days’ notice in advance has been given.

- Notably, the Constitution does not list grounds for removal.

- No Vice President has ever faced removal or the deputy chairman in the Rajya Sabha cannot be challenged in any court of law per Article 122.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: GST Slabs

Mains level: Rationalization of GST

Customers will have to pay a 5% Goods and Services Tax (GST) on pre-packed, labelled food items such as atta, paneer and curd, besides hospital rooms with rents above ₹5,000.

What is GST?

- GST launched in India on 1 July 2017 is a comprehensive indirect tax for the entire country.

- It is charged at the time of supply and depends on the destination of consumption.

- For instance, if a good is manufactured in state A but consumed in state B, then the revenue generated through GST collection is credited to the state of consumption (state B) and not to the state of production (state A).

- GST, being a consumption-based tax, resulted in loss of revenue for manufacturing-heavy states.

What are GST Slabs?

- In India, almost 500+ services and over 1300 products fall under the 4 major GST slabs.

- There are five broad tax rates of zero, 5%, 12%, 18% and 28%, plus a cess levied over and above the 28% on some ‘sin’ goods.

- The GST Council periodically revises the items under each slab rate to adjust them according to industry demands and market trends.

- The updated structure ensures that the essential items fall under lower tax brackets, while luxury products and services entail higher GST rates.

- The 28% rate is levied on demerit goods such as tobacco products, automobiles, and aerated drinks, along with an additional GST compensation cess.

Why rationalize GST slabs?

- From businesses’ viewpoint, there are just too many tax rate slabs, compounded by aberrations in the duty structure through their supply chains with some inputs taxed more than the final product.

- These are far too many rates and do not necessarily constitute a Good and Simple Tax.

- Multiple rate changes since the introduction of the GST regime in July 2017 have brought the effective GST rate to 11.6% from the original revenue-neutral rate of 15.5%.

- Merging the 12% and 18% GST rates into any tax rate lower than 18% may result in revenue loss.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Anayoottu

Mains level: Not Much

Anayoottu, an annual ritual at the Sree Vadakkunnathan Temple, Thrissur was recently held.

Why in news?

- There is a history behind this annual ritual at the temple.

- Kerala’s elephant pooram was selected, along with other cultural forms of the country, for display at the opening ceremony of the Asian Games held in Delhi in 1982.

- Elephants were transported all throughout the country to New Delhi.

What is Anayoottu?

- The Aanayoottu (gaja pooja/ feeding of elephants) is a festival held in the precincts of the Vadakkunnathan temple in City of Thrissur, in Kerala.

- The festival falls on the first day of the month of Karkkidakam (timed against the Malayalam calendar), which coincides with the month of July.

- It involves a number of unadorned elephants being positioned amid a multitude of people for being worshipped and fed.

- Crowds throng the temple to feed the elephants.

Mythology behind

- It is believed that offering poojas and delicious feed to the elephants is a way to satisfy Lord Ganesha—the god of wealth and of the fulfillment of wishes.

- The Vadakkunnathan temple, which is considered to be one of the oldest Shiva temples in southern India, has hosted the Aanayottoo event for the past few years.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now