Note4Students

From UPSC perspective, the following things are important :

Prelims level: ED, PMLA

Mains level: Read the attached story

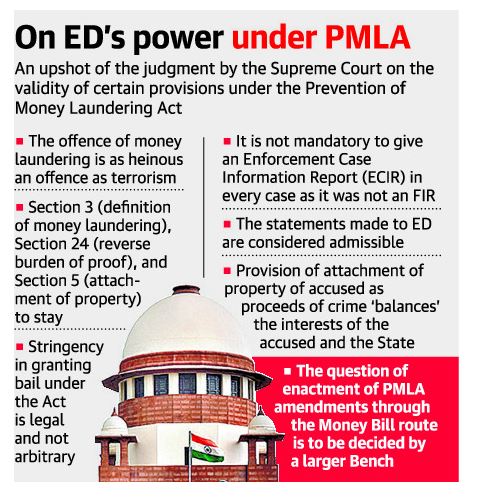

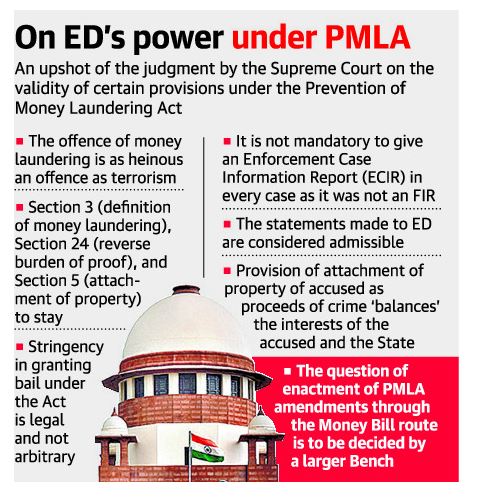

The Supreme Court upheld the core amendments made to the Prevention of Money Laundering Act (PMLA), which gives the government and the Enforcement Directorate (ED) virtually unbridled powers of summons, arrest, and raids, and makes bail nearly impossible while shifting the burden of proof of innocence on to the accused rather than the prosecution.

Did the judgement say?

- The Supreme Court called the PMLA a law against the “scourge of money laundering” and not a hatchet wielded against rival politicians and dissenters.

- Money laundering is an offence against the sovereignty and integrity of the country. It is no less a heinous offence than the offence of terrorism, the court noted.

Why in news?

- The verdict came on an extensive challenge raised against the amendments introduced in 2002 Act by way of Finance Acts.

- The three-judge Bench said the method of introduction of the amendments through Money Bills would be separately examined by a larger Bench of the top court.

What were the petitions?

- Petitions were filed against the amendments, which the challengers claimed would violate personal liberty, procedures of law and the constitutional mandate.

- The petitioners included many veteran politicians who all claimed that the “process itself was the punishment”.

- There were submissions that the accused’s right against self-incrimination suffered when the ED summoned them and made them sign statements on threats of arrest.

- But the court said these statements were recorded as part of an “inquiry” into the proceeds of crime.

- A person cannot claim right against self-incrimination at a summons stage.

About Enforcement Directorate (ED)

- It goes back to May 1, 1956, when an ‘Enforcement Unit’ was formed in the Department of Economic Affairs.

- It then aimed for handling Exchange Control Laws violations under the Foreign Exchange Regulation Act (FERA).

- The ED today is a multi-dimensional organisation investigating economic offences under the Prevention of Money Laundering Act (PMLA), Fugitive Economic Offenders Act, Foreign Exchange Management Act and FERA.

From where does the ED get its powers?

- When proceeds of crime (property/money) are generated, the best way to save that money is by parking it somewhere, so one is not answerable to anyone in the country.

- Therefore, there was a need to control and prevent the laundering of money.

- The PMLA was brought in for this exact reason in 2002, but was enacted only in 2005.

- The objective was to prevent parking of the money outside India and to trace out the layering and the trail of money.

- So as per the Act, the ED got its power to investigate under Sections 48 (authorities under act) and 49 (appointment and powers of authorities and other officers).

At what stage does the ED step in when a crime is committed?

- Whenever any offence is registered by a local police station, which has generated proceeds of crime over and above ₹1 crore, the investigating police officer forwards the details to the ED.

- Alternately, if the offence comes under the knowledge of the Central agency, they can then call for the First Information Report (FIR) or the chargesheet if it has been filed directly by police officials.

- This will be done to find out if any laundering has taken place.

What differentiates the probe between the local police and officers of the ED?

Case study:

- If a theft has been committed in a nationalised bank, the local police station will first investigate the crime.

- If it is learnt that the founder of the bank took all the money and kept it in his house, without being spent or used, then the crime is only theft and the ED won’t interfere because the amount has already been seized.

- But if the amount which has been stolen is used after four years to purchase some properties, then the ill-gotten money is brought back in the market.

- Or if the money is given to someone else to buy properties in different parts of the country, then there is ‘laundering’ of money.

- Hence the ED will need to step in and look into the layering and attachment of properties to recover the money.

- If jewellery costing ₹1 crore is stolen, police officers will investigate the theft. The ED, however, will attach assets of the accused to recover the amount of ₹1 crore.

What are the other roles and functions of the ED?

- The ED carries out search (property) and seizure (money/documents) after it has decided that the money has been laundered, under Section 16 (power of survey) and Section 17 (search and seizure) of the PMLA.

- On the basis of that, the authorities will decide if arrest is needed as per Section 19 (power of arrest).

- Under Section 50, the ED can also directly carry out search and seizure without calling the person for questioning.

- It is not necessary to summon the person first and then start with the search and seizure.

- If the person is arrested, the ED gets 60 days to file the prosecution complaint (chargesheet) as the punishment under PMLA doesn’t go beyond seven years.

- If no one is arrested and only the property is attached, then the prosecution complaint along with attachment order is to be submitted before the adjudicating authority within 60 days.

Can the ED investigate cases of money laundering retrospectively?

- If an ill-gotten property is acquired before the year 2005 (when the law was brought in) and disposed off, then there is no case under PMLA.

- But if proceeds of the crime were possessed before 2005, kept in storage, and used after 2005 by buying properties, the colour of the money is still black and the person is liable to be prosecuted under PMLA.

Under Section 3 of PMLA, a person shall be guilty of money-laundering, if such person is found to have directly or indirectly attempted to indulge or knowingly assist a party involved in one or more of the following activities:

- Concealment; possession; acquisition; use; or projecting as untainted property; or claiming as untainted property in any manner etc.

Also read:

[Burning Issue] Enforcement Directorate (ED): Dreaded nightmare of Indian Politicians & Businessmen

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: RLF

Mains level: Population stabilization in India

India has achieved replacement level fertility, with 31 States and UTs reaching a Total Fertility Rate (an average number of children per woman) of 2.1 or less, Union Minister of State for Health and Family Welfare has informed Parliament.

What is Replacement Level Fertility?

- Replacement level fertility is the level of fertility at which a population exactly replaces itself from one generation to the next.

- In simpler terms, it denotes the fertility number required to maintain the same population number of a country over a given period of time.

- In developed countries, replacement level fertility can be taken as requiring an average of 2.1 children per woman.

- In countries with high infant and child mortality rates, however, the average number of births may need to be much higher.

- RLF will lead to zero population growth only if mortality rates remain constant and migration has no effect.

Benefits of achieving RLF

- RLF helps ensure greater food security.

- The reduced demand for food would in turn lessen agri- culture’s impact on the environment.

- It would also likely lead to economic benefits through a “demographic dividend.”

- Finally, achieving replacement level fertility would yield significant social benefits―especially for women.

How did India achieve this?

- Between 2012 and 2020, the country added more than 1.5 crore additional users for modern contraceptives, thereby increasing their use substantially.

- India has witnessed a paradigm shift from the concept of population control to population stabilisation to interventions being embedded toward ensuring harmony of continuum care.

Way forward

- Although India has achieved replacement level fertility, there is still a significant population in the reproductive age group that must remain at the centre of our intervention efforts.

- India’s focus has traditionally been on the supply side, the providers and delivery systems but now it’s time to focus on the demand side which includes family, community and society.

- Significant change is possible with this focus, instead of an incremental change.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: HCES

Mains level: Not Much

The Centre has kicked off the process for conducting the quinquennial Household Consumption Expenditure Survey (HCES) this month.

What is the Household Consumer Expenditure Survey (CES)?

- The HCES is traditionally a quinquennial (recurring every five years) survey conducted by the government’s National Sample Survey Office (NSSO).

- It is designed to collect information on the consumer spending patterns of households across the country, both urban and rural.

- Typically, the Survey is conducted between July and June and this year’s exercise is expected to be completed by June 2023.

Why HCES?

- The HCES is used to arrive at estimates of poverty levels as well as review key economic indicators like Gross Domestic Product (GDP).

- The results of the survey are also utilised for updating the consumption basket and for base revision of the Consumer Price Index.

- It helps generate estimates of household Monthly Per Capita Consumer Expenditure (MPCE) as well as the distribution of households and persons over the MPCE classes.

- It is used to arrive at estimates of poverty levels in different parts of the country and to review economic indicators such as the GDP, since 2011-12.

Why need this survey?

- India has not had any official estimates on per capita household spending.

- It provides separate data sets for rural and urban parts, and also splice spending patterns for each State and Union Territory, as well as different socio-economic groups.

What about the previous survey?

- The survey was last held in 2017-2018.

- The government announced that it had data quality issues.

- Hence the results were not released.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Honkong, Taiwan

Mains level: Honkong, Taiwan issue

Hong Kong’s controversial national security law should be repealed, experts on the UN Human Rights Committee said, amid concerns the legislation is being used to crack down on free speech and dissent in the former British colony.

Why in news?

- Chinese and Hong Kong officials have repeatedly used the NSL imposed by Beijing in 2020 to restore stability after the city was rocked for months by sometimes violent anti-government and anti-China protests in 2019.

- The committee, which monitors the implementation of the International Covenant on Civil and Political Rights (ICCPR) by state parties, released its findings on Hong Kong following a periodic review.

- The Hong Kong Special Administrative Region is a signatory to the ICCPR but China is not.

About Hong Kong

- A former British Colony and Autonomous Territory: Hong Kong is an autonomous territory, and a former British colony, in south-eastern China.

- It became a colony of the British Empire at the end of the First Opium War in 1842.

- Sovereignty over the territory was returned to China in 1997.

- Special Administrative Region (SAR): As a SAR, Hong Kong maintains governing power and economic systems that are separate from those of mainland China.

- The 1984 Sino-British Joint Declaration guarantees the Basic Law for 50 years after the transfer of sovereignty.

- It does not specify how Hong Kong will be governed after 2047.

- Thus, the central government’s role in determining the territory’s future system of government is the subject of political debate and speculation in Hong kong.

What is this law all about?

- Hong Kong was always meant to have a security law, but could never pass one because it was so unpopular.

- So this is about China stepping in to ensure the city has a legal framework to deal with what it sees as serious challenges to its authority.

- The details of the law’s 66 articles were kept secret until after it was passed. It criminalises any act of:

- Secession – breaking away from the country

- Subversion – undermining the power or authority of the central government

- Terrorism – using violence or intimidation against people

- Collusion– with foreign or external forces

What provisions do fall under the law?

- The law came into effect at 23:00 local time on 30 June 2020, an hour before the 23rd anniversary of the city’s handover to China from British rule.

- It gives Beijing power to shape life in Hong Kong it has never had before.

- Its key provisions include:

- Crimes of secession, subversion, terrorism and collusion with foreign forces are punishable by a maximum sentence of life in prison

- Damaging public transport facilities can be considered terrorism

- Those found guilty will not be allowed to stand for public office

- Companies can be fined if convicted under the law

- This office can send some cases to be tried in mainland China – but Beijing has said it will only have that power over a “tiny number” of cases

- In addition, Hong Kong will have to establish its own national security commission to enforce the laws, with a Beijing-appointed adviser

- Hong Kong’s chief executive will have the power to appoint judges to hear national security cases, raising fears about judicial autonomy

- Importantly, Beijing will have power over how the law should be interpreted, not any Hong Kong judicial or policy body. If the law conflicts with any Hong Kong law, the Beijing law takes priority

- Some trials will be heard behind closed doors.

- People suspected of breaking the law can be wire-tapped and put under surveillance

- Management of foreign non-governmental organizations and news agencies will be strengthened

- The law will also apply to non-permanent residents and people “from outside [Hong Kong]… who are not permanent residents of Hong Kong“.

What has changed in Hong Kong since the law was introduced?

- Hundreds of protestors, activists and former opposition lawmakers have been arrested since the law came into force.

- The arrests are an ominous sign that its crackdown on Hong Kong is only going to escalate.

- Beijing has said the law is needed to bring stability to the city, but critics say it is designed to squash dissent.

Why did China do this?

- Hong Kong was handed back to China from British control in 1997.

- But under a unique agreement – a mini-constitution called the Basic Law and a so-called “one country, two systems” principle.

- They are supposed to protect certain freedoms for Hong Kong: freedom of assembly and speech, an independent judiciary and some democratic rights – freedoms that no other part of mainland China has.

- Under the same agreement, Hong Kong had to enact its own national security law – this was set out in Article 23 of the Basic Law – but it never happened because of its unpopularity.

How can China do this?

- Many might ask how China can do this if the city was supposed to have freedoms guaranteed under the handover agreement.

- The Basic Law says Chinese laws can’t be applied in Hong Kong unless they are listed in a section called Annex III – there are already a few listed there, mostly uncontroversial and around foreign policy.

- These laws can be introduced by decree – which means they bypass the city’s parliament.

- Critics say the introduction of the law this way amounts to a breach of the “one country, two systems” principle, which is so important to Hong Kong – but clearly, it is technically possible to do this.

Must read:

[Burning Issue] National Security Law debate in Hong Kong

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Warehousing Act

Mains level: Read the attached story

The Union Food and Public Distribution Ministry has suggested major amendments to the Warehousing (Development and Regulation) Act of 2007.

Warehousing Act, 2007

- The GOI has introduced a negotiable warehouse receipt system in the country by enacting the Warehousing (Development and Regulation) Act, 2007 (37 of 2007).

- It has been made effective with effect from the 25th October, 2010.

- The Negotiable Warehouse Receipt (NWR) system was formally launched on the 26th April, 2011.

Why was this Act enacted?

- To make provisions for the development and regulation of warehouses, negotiability of warehouse receipts, establishment of a Warehousing Development and Regulatory Authority (WDRA) and related matters.

- The Negotiable Warehouse Receipts (NWRs) issued by the warehouses registered under this Act would help the farmers to seek loans from banks against NWRs.

- It will avoid distress sale of agricultural produce.

What is the amendment about?

- The aim is to help farmers get access to the services of quality warehouses.

- The amendment is:

- To make registration of godowns compulsory

- To raise the penalty for various offences and

- To do away the jail term as a punishment for the offences

- Central government will have powers to exempt any class of warehouses from registration with the Authority.

- At present, registration with the Warehousing Development and Regulation Authority (WDRA) is optional.

- After the proposed amendment, which is yet to be cleared by the cabinet, registration of all third party warehouses throughout the country, will be undertaken in a phased manner.

- The Act wants to establish a system of negotiable and non-negotiable warehouse receipt (NWR), which is now in electronic form.

Issues

- Farmers pressure groups fears that the amendments are for bringing back certain provisions of the repealed Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Act through the backdoors.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Money Bill

Mains level: Issues with PMLA

The court has left it open for a seven-judge Bench to decide whether the amendments to the PMLA could have been made to the PMLA through the Money Bill route.

What was the case about Money Bill?

- In November 2019, a five-judge Bench led by then CJI Ranjan Gogoi had referred to a larger Bench the issue and question posed in the Roger Mathew vs South Indian Bank Ltd. Case.

- It inquired to whether amendments like these can be passed as a Money Bill in violation of Article 110 of the Constitution.

- The petitioners had questioned the legality of the PMLA amendments which were introduced via Finance Acts/Money Bills.

Correlation Money Bill

- A Money Bill is deemed to contain only provisions dealing with all or any of the matters under clauses (a) to (g) of Article 110(1), largely including the appropriation of money from the Consolidated Fund of India and taxation.

- In other words, a Money Bill is restricted only to the specified matters and cannot include within its ambit any other matter.

What is a Money Bill?

- A money bill is defined by Article 110 of the Constitution, as a draft law that contains only provisions that deal with all or any of the matters listed therein.

- These comprise a set of seven features, broadly including items such as-

- Imposition, abolition, remission, alteration or regulation of any tax

- Regulation of the borrowing of money by the GOI

- Custody of the Consolidated Fund of India (CFI) or the Contingency Fund of India, the payment of money into or the withdrawal of money from any such fund

- Appropriation of money out of the CFI

- Declaration of any expenditure charged on the CFI or increasing the amount of any such expenditure

- Receipt of money on account of the CFI or the public account of India or the custody or issue of such money, or the audit of the accounts of the Union or of a state

- Any matter incidental to any of the matters specified above.

Who controls such bills?

- In the event proposed legislation contains other features, ones that are not merely incidental to the items specifically outlined, such a draft law cannot be classified as a money bill.

- Article 110 further clarifies that in cases where a dispute arises over whether a bill is a money bill or not, the Lok Sabha Speaker’s decision on the issue shall be considered final.

Difference between money and finance bill

- While all Money Bills are Financial Bills, all Financial Bills are not Money Bills.

- For example, the Finance Bill which only contains provisions related to tax proposals would be a Money Bill.

- However, a Bill that contains some provisions related to taxation or expenditure, but also covers other matters would be considered a Financial Bill.

- Again, the procedure for the passage of the two bills varies significantly.

Issues with notifying a bill as Money Bill

- The Rajya Sabha (where the ruling party might not have the majority) has no power to reject or amend a Money Bill.

- However, a Financial Bill must be passed by both Houses of Parliament.

- The Speaker (nonetheless, a member of the ruling party) certifies a Bill as a Money Bill, and the Speaker’s decision is final.

- Also, the Constitution states that parliamentary proceedings, as well as officers responsible for the conduct of business (such as the Speaker), may not be questioned by any Court.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: USOF

Mains level: Expansion of internet connectivity

The Union Cabinet has approved a project for providing 4G mobile services in thousands of villages across the country under the USOF.

What do you mean by Universal Service?

- In the modern world, universal service refers to having a phone and affordable phone service in every home.

- It means, providing telecommunication service with access to a defined minimum service of specified quality to all users everywhere at an affordable price.

- In 1837, the concept was rolled on by Rowland Hill, a British educator and tax reformer, which included uniform rates across the UK and prepayment by sender via postage stamps.

What is USOF?

- The Universal Service Obligation Fund (USOF) was formed by an Act of Parliament, was established in April 2002 under the Indian Telegraph (Amendment) Act 2003.

- It aims to provide financial support for the provision of telecom services in commercially unviable rural and remote areas of the country.

- It is an attached office of the Department of Telecom, and is headed by the administrator, who is appointed by the central government.

Scope of the USOF

- Initially, the USOF was established with the fundamental objective of providing access to ‘basic’ telecom services to people in rural and remote areas at affordable and reasonable prices.

- Subsequently, the scope was widened.

- Now it aims to provide subsidy support for enabling access to all types of telecom services, including mobile services, broadband connectivity and the creation of infrastructure in rural and remote areas.

Funding of the USOF

- The resources for the implementation of USO are raised by way of collecting a Universal Service Levy (USL), which is 5 percent of the Adjusted Gross Revenue (AGR) of Telecom Service Providers.

Nature of the fund

- USOF is a non-lapsable Fund.

- The Levy amount is credited to the Consolidated Fund of India.

- The fund is made available to USOF after due appropriation by the Parliament.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: United Nations Peacekeeping

Mains level: Read the attached story

Two BSF personnel recently got martyrdom who were part of the UN Peacekeeping Mission in the Democratic Republic of the Congo (DRC).

Why in news?

- A total 175 Indian peacekeepers have so far died while serving with the United Nations.

- India has lost more peacekeepers than any other UN Member State.

What is United Nations Peacekeeping?

- UN Peacekeeping helps countries navigate the difficult path from conflict to peace.

- UN peacekeepers are often referred to as Blue Berets or Blue Helmets because of their light blue berets or helmets) can include soldiers, police officers, and civilian personnel.

UNPKF in operation

- Since 1948, UN Peacekeepers have undertaken 71 Field Missions.

- There are approximately 81,820 personnel serving on 13 peace operations led by UNDPO, in four continents currently.

- This represents a nine-fold increase since 1999.

- A total of 119 countries have contributed military and police personnel to UN peacekeeping.

- Currently, 72,930 of those serving are troops and military observers, and about 8,890 are police personnel.

India’s contribution to UN Peacekeeping

- India has a long history of service in UN Peacekeeping, having contributed more personnel than any other country.

- To date, more than 2,53,000 Indians have served in 49 of the 71 UN Peacekeeping missions established around the world since 1948.

- Currently, there are around 5,500 troops and police from India who have been deployed to UN Peacekeeping missions, the fifth highest amongst troop-contributing countries.

- India has also provided and continues to provide, eminent Force Commanders for UN Missions.

- India is the fifth largest troop contributor (TCC) with 5,323 personnel deployed in 8 out of 13 active UN Peacekeeping Missions, of which 166 are police personnel.

History of India’s contribution

- India’s contribution to UN Peacekeeping began with its participation in the UN operation in Korea in the 1950s.

- This is where India’s mediatory role in resolving the stalemate over prisoners of war in Korea led to the signing of the armistice that ended the Korean War.

- India chaired the five-member Neutral Nations Repatriation Commission, while the Indian Custodian Force supervised the process of interviews and repatriation that followed.

- The UN entrusted the Indian armed forces with subsequent peace missions in the Middle East, Cyprus, and the Congo (since 1971, Zaire).

- India also served as Chair of the three international commissions for supervision and control for Vietnam, Cambodia, and Laos established by the 1954 Geneva Accords on Indochina.

Role of women in Indian Peacekeeping

- India has been sending women personnel on UN Peacekeeping Missions.

- In 2007, India became the first country to deploy an all-women contingent to a UN Peacekeeping Mission.

- The Formed Police Unit in Liberia provided 24-hour guard duty and conducted night patrols in the capital Monrovia, and helped to build the capacity of the Liberian police.

- These women officers not only played a role in restoring security in the West African nation but also contributed to an increase in the number of women in Liberia’s security sector.

Medical care as part of India’s Missions

- In addition to their security role, the members of the Indian Formed Police Unit also organized medical camps for Liberians, many of whom have limited access to health care services.

- Medical care is among the many services Indian Peacekeepers provide to the communities in which they serve on behalf of the Organization.

- They also perform specialized tasks such as veterinary support and engineering services.

India’s views on UN Peacekeeping

- India is of the view that the international community must grasp the rapid changes that are underway in the nature and role of contemporary peacekeeping operations.

- The Security Council’s mandates to UN Peacekeeping operations need to be rooted in ground realities, and co-related with the resources provided for the peacekeeping operation.

- It is critical that troop and police contributing countries should be fully involved at all stages and in all aspects of mission planning.

- There should be greater financial and human resources for peace-building in post-conflict societies, where UNPKOs have been mandated, according to officials.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: FRBM Act

Mains level: Paper 2- Freebies and related issues

Context

In a recent address, the prime minister shared his anguish on what he called the “revdi” or the freebies culture.

Populist policies and its impact over the states’ finances

- What are freebies? N K Singh defined freebies as “something that is given to you without having to pay for them, especially as a way of attracting your support for or interest in something.”

- A recent report of the RBI on states’ finances highlighted the perilous condition of states’ finances and enhanced debt stress on account of flawed policies.

- Nothing undercuts more irresponsibly India’s abiding international and national commitments than the perils of this reckless populism.

Factors that need to be considered in devising welfare policies

1] Quest for sustainable development

- The initiatives undertaken at COP21 in Paris, the International Solar Alliance and subsequently at the COP26 in Glasgow represent India’s national consensus to forge a path of growth geared towards intergenerational equity and to exponentially increase development.

- Our ability to adhere to this commitment depends on two other commitments.

- 1] An increase in the percentage of renewable energy in our energy consumption.

- While subsidies are being promised in one form or the other by way of free electricity, the deteriorating health of state distribution companies seriously undercuts their financial viability.

- Lowering the price for some consumers, offset through overcharging industrial and commercial contracts, reduces competitiveness, ushers slower growth both in incomes and employment.

- 2] The inability of discoms to actively encourage solar power is stymied by their financial condition and the inability to evolve tariff structures.

- Regulatory capture, a fixation on unrealistic tariffs and cross-subsidy in energy utilisation prevent a credible coal plan, which is central to our energy planning.

2] Challenges in providing basic facilities

- The government seeks to address the challenge of inequity by ensuring access to a wide range of basic facilities.

- These include banking, electricity, housing, insurance, water and clean cooking fuel, to mention a few.

- Removing this inequity to access helps boost the productivity of our population.

3] Issue of access

- Benefits under various welfare schemes such as PM Awas Yojana, Swachh Bharat Mission and Jal Jeevan Mission have eliminated the biggest barrier for citizens — the exorbitant upfront cost of access.

- Moreover, they are leading to irreversible empowerment and self-reliance.

- For instance, a house built under the PM Awas Yojana is a lifelong asset for the beneficiary household that cannot be taken back by any government.

4] Use of technology in direct benefit transfer

- Identification of beneficiaries through the SECC and prioritisation based on deprivation criteria has enabled the government to assist those who need it the most.

- Governments that end up taking the shortcut of universal subsidies or freebies often end up ignoring the poor and transferring public resources to the affluent.

5] Expenditure prioritisation

- The next issue that needs to be considered is of expenditure prioritisation being distorted away from growth-enhancing items, leading to intergenerational inequity.

- Investors, both domestic and foreign, and credit rating agencies look to macro stability in terms of sustainable levels of debt and fiscal deficit.

- After years of fiscal profligacy, we returned to the path of fiscal rectitude in 2014.

- The last time such an effort was made was by enacting the first FRBM Act on August 26, 2003.

6] Impact on future of manufacturing and employment

- The next factor that need to be considered is the debilitating effect of freebies on the future of manufacturing and employment.

- Freebies lower the quality and competitiveness of the manufacturing sector by detracting from efficient and competitive infrastructure.

- They stymie growth and, therefore, gainful employment because there is no substitute for growth if we wish to increase employment.

Conclusion

The poor state finance position should serve as a timely reminder to those promising fiscally imprudent and unsustainable subsidies.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now