Note4Students

From UPSC perspective, the following things are important :

Prelims level: 74th Constitutional Amendment Act

Mains level: Paper 2- Municipal finances

Context

Recently, the Indian Institute for Human Settlements (IIHS) analysed data from 80 urban local bodies (ULBs) across 24 States between 2012-13 and 2016-17 to understand ULB finance and spending, and found some key trends.

Health of municipal finances

- The 74th Constitution Amendment Act was passed in 1992 mandating the setting up and devolution of powers to urban local bodies (ULBs) as the lowest unit of governance in cities and towns.

- Constitutional provisions were made for ULBs’ fiscal empowerment.

- Challenges in fiscal empowerment: Three decades since, growing fiscal deficits, constraints in tax base expansion, and weakening of institutional mechanisms that enable resource mobilisation remain challenges.

- Revenue losses after implementation of the Goods and Services Tax (GST) and the pandemic have exacerbated the situation.

Analysing the trends in municipal finances

Recently, the Indian Institute for Human Settlements (IIHS) analysed data from 80 ULBs across 24 States between 2012-13 and 2016-17 to understand ULB finance and spending, and found some key trends.

1] Own sources of revenue less than half of total revenue

- Key sources of revenue: The ULBs’ key revenue sources are taxes, fees, fines and charges, and transfers from Central and State governments, which are known as inter-governmental transfers (IGTs).

- Important indicator of financial health: The share of own revenue (including revenue from taxes on property and advertisements, and non-tax revenue from user charges and fees from building permissions and trade licencing) to total revenue is an important indicator of ULBs’ fiscal health and autonomy.

- The study found that the ULBs’s own revenue was 47% of their total revenue.

- Of this, tax revenue was the largest component: around 29% of the total.

- Property tax, the single largest contributor to ULBs’ own revenue, accounted for only about 0.15% of the GDP.

- Figures for developing countries: The corresponding figures for developing and developed countries were significantly higher (about 0.6% and 1%, respectively) indicating that this is not being harnessed to potential in India.

2] High dependence on IGTs

- Most ULBs were highly dependent on external grants — between 2012-13 and 2016-17, IGTs accounted for about 40% of the ULBs’ total revenue.

- Transfers from the Central government are as stipulated by the Central Finance Commissions and through grants towards specific reforms, while State government transfers are as grants-in-aid and devolution of State’s collection of local taxes.

3] Tax revenue is largest revenue for larger cities, while smaller cities are more dependent on grants

- here are considerable differences in the composition of revenue sources across cities of different sizes.

- Class I-A cities (population of over 50 lakh) primarily depend on their own tax revenue, while Class I-B cities and Class I-C cities (population of 10 lakh-50 lakh and 1 lakh-10 lakh, respectively) rely more on IGTs.

- Own revenue mobilisation in Class I-A cities increased substantially.

- It was primarily driven by increases in non-tax revenue

4] Increasing operations and maintenance (O&M) expenses

- Operations and maintenance (O&M) expenses are on the increase but still inadequate.

- While the expenses were on the rise, studies (such as ICRIER, 2019 and Bandyopadhyay, 2014) indicate that they remained inadequate.

- For instance, O&M expenses incurred in 2016-17 covered only around a fifth of the requirement forecast by the High-Powered Expert Committee for estimating the investment requirements for urban infrastructure services.

- O&M expenses should ideally be covered through user charges, but total non-tax revenues, of which user charges are a part, are insufficient to meet current O&M expenses.

- The non-tax revenues were short of the O&M expenditure by around 20%, and this shortfall contributed to the increasing revenue deficit in ULBs.

Way forward

- Improving own revenue: It is essential that ULBs leverage their own revenue-raising powers to be fiscally sustainable and empowered and have better amenities and quality of service delivery.

- Stability in IGT: Stable and predictable IGTs are particularly important since ULBs’ own revenue collection is inadequate.

- O&M expenses: Increasing cost recovery levels through improved user charge regimes would not only improve services but also contribute to the financial vitality of ULBs.

- Measures need to be made to also cover O&M expenses of a ULB for better infrastructure and service.

- Tapping into property taxes, other land-based resources and user charges are all ways to improve the revenue of a ULB.

Conclusion

The health of municipal finances is a critical element of municipal governance which will determine whether India realises her economic and developmental promise.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: National Coal Index

Mains level: Paper 3- Need for increasing the domestic production of coal

Context

With inflation at unprecedented levels in many countries, concerns over energy security have gained centre stage.

National Coal Index to factor in the increased price of imported coal

- This index was created to provide a benchmark for revenue-sharing contracts being executed after the auctions for commercial mining of coal.

- The NCI had to be introduced as the wholesale price index (WPI) for coal has no component of imported coal.

- For the last six months, the WPI for Coal has been stable at around 131.

- Over the same period, the NCI has jumped from about 165 to about 238 reflecting the sharp increase in international coal prices.

Needs to increase domestic coal production

- High prices of coal and coal-based generation will only encourage imported coal and expose the country to price risks from international energy prices.

- The domestic coal industry has responded to increasing internation prices with an increase of over 30 per cent in coal production from April to June this year.

- Anticipating these problems, a big effort toward permitting commercial mining has been made to get the private sector to produce more coal.

- Gradual transition: Looking at coal from a singular focus on GHG emissions will give a myopic view of energy requirements for a growing economy like India.

- The path to achieving 500 GW of renewables needs to be gradual, ensuring an orderly transition as coal is unavoidable in the near future.

- Reducing coal imports and increasing domestic production of coal needs focused attention

Suggestions to increase domestic production of coal

1] Sensitising the financial community

- The financial community has to be sensitised to the need of increasing domestic coal production to meet the growing energy demand.

- The draft National Electricity Policy released in May 2021, recognised the need to increase coal-based generation.

- This policy has not yet been finalised.

- It should clearly articulate the importance of domestic coal-based generation.

- Holistic approach in ESG criteria: Apart from the government, the industry should also take up this issue with the financial community in adopting a more holistic approach toward environmental, social, and governance (ESG) criteria.

2] The regulator needs to facilitate greater role of private sector

- There is the need for a regulator to address the issues arising from a greater role of the private sector.

- The current arrangements were put in place at a time when the public sector dominated.

- There are several issues where new private commercial miners would need help.

- Single point of contact: A single point of contact for the industry in the form of a dedicated regulator would give great comfort to private players and would help to overcome problems that could arise in due course.

3] Diversifying the production base

- Increasing domestic production of coal and diversifying the production base are both needed.

- This must be complemented with efforts to improve the quality of the coal produced.

4] Remove financial burden due to cross subsidies

- The undue financial burden on the coal sector due to various cross subsidies needs attention.

- The regime needs to be reformed.

Conclusion

Action on the issues discussed above will only help to deepen and strengthen these reforms which are needed to overcome the challenges that have resurfaced over the past few months.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Article 21

Mains level: Paper 2- Consolidation of multiple FIRs

Context

The Supreme Court’s (SC) refused to consolidate multiple FIRs filed in several states against former BJP spokesperson.

When are multiple FIRs clubbed?

- In 2001, the SC, in TT Antony vs. State of Kerala, made it clear that only the earliest information in regard to the commission of an offence could be investigated and tried.

- In Babubhai vs. State of Gujarat (2010), the Court explained that the test to determine the sameness of the offence is to identify whether “the subject matter of the FIRs is the same incident, same occurrence or are in regard to incidents which are two or more parts of the same transaction”.

- the SC extensively relied upon TT Antony while granting similar relief to two journalists.

Reasons given by the SCs for refusal to club the FIRs

- The bench said that party spokespersons and journalists cannot be treated identically.

- The Constitution creates no hierarchical difference between journalists and ordinary citizens when it comes to the enforcement of fundamental rights.

- The right to approach the SC under Article 32 is in itself a fundamental right.

- Nor did the SC craft any distinction on the basis of the status or affiliation of the accused in TT Antony.

- Second, the bench said that she has not unconditionally apologised for her remarks and her political clout is apparent from the fact that she has not been arrested despite an FIR being filed against her.

- This view is again misplaced. Whether or not the person has tendered an apology is not germane to the issue at hand.

- Seeking or tendering an apology may be a mitigating factor while deciding punishment but only after the guilt is proved.

Why the multiple FIRs should be consolidated

- Abuse of statutory power of investigation: Filing of successive FIRs amounts to an abuse of statutory power of investigation and is a fit case for the SC to exercise its writ powers under Article 32 because high courts cannot transfer cases from one state to another.

- Wastage of state resources and judicial time: Prudence demands that state resources and judicial time are not spent on a multiplicity of proceedings.

- The multiplicity of proceedings would result in violation of fundamental rights under Article 21 as parallel investigations would result in her being forced to join investigations in different police stations in different states.

- This serves no practical purpose because ultimately it is only one of the police reports that would be tried by a court of law.

Conclusion

In the absence of strict guidelines, some degree of caution is necessary on the part of judges to work within the confines of judicial propriety.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Return of Euro-centrism

Context

The Russian aggression against Ukraine has led to an unmissable feeling of insecurity in Europe, particularly in Germany.

Euro-centric world order and new security consciousness

- For centuries, Europe imagined itself to be the centre of the world — its order, politics and culture.

- What contributed to its decline? Decolonisation, the emergence of the United States as the western world’s sole superpower, and the rise of the rest dramatically diminished the centuries old domination of the European states and their ability to shape the world in their own image.

- The political and military aftermath of Russia’s war on Ukraine could potentially tilt the current global balance and take us back to a Euro-centric world order.

- US dominance: For sure, the U.S. continues to dominate the trans-Atlantic security landscape and this is likely to remain so.

- And yet, the new security consciousness in Europe will reduce Washington’s ability to continue as the fulcrum of the trans-Atlantic strategic imagination.

- If wars have the potential to shape international orders, it is Europe’s turn to shape the world, once again.

- The United States, fatigued from the Iraq and Afghan wars, does not appear to be keen on another round of wars and military engagements.

- A pervasive sense of what some described as “existential insecurity” has brought about a renewed enthusiasm about the future of the European Union and the North Atlantic Treaty Organization (NATO).

- The European Union (EU) Commission has backed Kyiv’s bid for EU candidature.

- This new military unity is not just words, but is backed with political commitment and financial resources from the world’s richest economies.

- Berlin, for instance, has decided to spend an additional €100 billion for defence over and above its €50 billion annual expenditure on defence.

Implications

1] Weakened faith in the institutions and globalisation

- Germany, the engine of this new security thinking in Europe, is coming out of its self-image of being a pacifist nation.

- There appears little faith in the United Nations or the UN Security Council anymore in Berlin, they have decided to put their faith in a revitalised EU and NATO.

- European states are deeply worried about globalisation-induced vulnerability and this has set in a rethink about the inherent problems of indiscriminate globalisation.

- The combined effect of European re-militarisation (however modest it may be for now), its loss of faith in multilateral institutions, and the increased salience of the EU and NATO will be the unchecked emergence of Europe as an even stronger regulatory, norm/standard-setting superpower backed with military power.

2] Unilateral and Euro-centric decision making

- The EU already has a worryingly disproportionate ability to set standards for the rest of the world.

- Instruments such as the Digital Services Act and the Digital Assets Act or its human rights standards will be unilaterally adopted, and will be unavoidable by other parts of the world.

- While these instruments and standards may in themselves be progressive and unobjectionable for the most part, the problem is with the process which is unilateral and Euro-centric.

3] Euro-centric worldview

- A euro-centric worldview of ‘friends and enemies’ will define its engagement with the rest of the world.

- India is a friend, but its take on the Ukraine war is not friendly enough for Europe.

- The EU will lead the way in setting standards for the rest of us and we will have little option but to follow that.

- For sure, Europe will seek partners around the world: to create a Euro-centric world order, not a truly global world order.

4] Dilemma for India

- This unilateral attempt to ‘shape the world’ in its image will also be portrayed as an attempt to counter Chinese attempts at global domination.

- To oppose or not? When presented as such, countries such as India will face a clear dilemma: to politically and normatively oppose the setting of the global agenda by Europeans or to be practical about it and jump on the European bandwagon.

Conclusion

The key message from the European narratives about the Ukraine war is that European states would want to see their wars and conflicts as threatening international stability and the ‘rules-based’ global order.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Incheon commitment

Mains level: Paper 2- Political inclusion of persons with disability

Context

The Department of Empowerment of Person with Disabilities (DoEPwD) recently released the draft of the national policy for persons with disabilities.

Why new policy?

- Signing of UN convention: The necessity for a new policy which replaces the 2006 policy was felt because of multiple factors such as India’s signing of the United Nations Convention on Rights of Persons with Disabilities.

- Increased number of disabilities: Enactment of Rights of Persons with Disabilities Act 2016, which increased the number of disabilities from seven conditions to 21 necessitated the change.

- Incheon Strategy: Being a party to the Incheon Strategy for Asian and Pacific Decade of Persons with Disabilities, 2013-2022 (“Incheon commitment”).

- Changed discourse from medical model to human right: These commitments have changed the discourse around disability by shifting the focus from the individual to society, i.e., from a medical model of disability to a social or human rights model of disability.

- The principle of the draft policy is to showcase the Government’s commitment to the inclusion and empowerment of persons with disabilities by providing a mechanism that ensures their full participation in society.

Absence of commitment to political uplift

- Article 29 of the Convention on Rights of Persons with Disabilities mandates that state parties should “ensure that persons with disabilities can effectively and fully participate in political and public life on an equal basis with others, directly or through freely chosen representatives….”

- The Incheon goals also promote participation in political processes and in decision making.

- The Rights of Persons with Disabilities Act 2016 embodies these principles within its fold.

- India does not have any policy commitment that is aimed at enhancing the political participation of disabled people.

- The exclusion of disabled people from the political space happens at all levels of the political process in the country, and in different ways.

- Section 11 of the Rights of Persons with Disabilities Act prescribes that “The Election Commission of India and the State Election Commissions shall ensure that all polling stations are accessible to persons with disabilities and all materials related to the electoral process are easily understandable by and accessible to them”.

- Although this mandate has been in existence for a few years, the disabled people still report accessibility issues before and on election day.

- There is often a lack of accessible polling booths in many locations.

- Lack of aggregate data: The lack of live aggregate data on the exact number of the disabled people in every constituency only furthers their marginalisation.

Lack of representation

- Representation plays an imperative role in furthering the interests of the marginalised community.

- Disabled people are not represented enough at all three levels of governance.

- However, few States have begun the initiative at local levels to increase participation.

- For instance, Chhattisgarh started the initiative of nominating at least one disabled person in each panchayat.

- If a disabled person is not elected then they are nominated as a panchayat member as per changes in the law concerned.

- This is a step that has increased the participation of the disabled in the political space at local level.

- The goal of the policy document — of inclusiveness and empowerment — cannot be achieved without political inclusion.

Suggestions: Follow four pronged approach

- The policy can follow a four-pronged approach:

- 1] Capacity building: Building the capacity of disabled people’s organisations and ‘empowering their members through training in the electoral system, government structure, and basic organisational and advocacy skills’;

- 2] Legal and regulatory framework: The creation, amendment or removal of legal and regulatory frameworks by lawmakers and election bodies to encourage the political participation of the disabled;

- 3] Participation of civil society: Inclusion of civil societies to ‘conduct domestic election observation or voter education campaigns’;

- 4] Framework for outreach by political parties: A framework for political parties to ‘conduct a meaningful outreach to persons with disabilities when creating election campaign strategies and developing policy positions’.

Conclusion

The document lays emphasis on the point that central and State governments must work together with other stakeholders to “make the right real”. This right can be made real only when it includes political rights/political participation within it.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Language in legislature

Context

Language not only changes across region but also profession. Similarly, Parliament, too, has its own list of absurd and archaic phrases.

Debate over expunged words

- Today there is much debate on language again after the Lok Sabha Secretariat compiled a list of 151 words, which have been expunged in 2021 and 2020 in Parliaments across the Commonwealth countries and State Assemblies in India.

- Many of these words may look harmless, but in a heated exchange between parliamentarians, they may not exactly be virtuous.

- The current compilation has especially caused consternation among Opposition parties which see this as an attempt to restrict their vocabulary.

- The government argues that this list is at best only “instructive” and not “definitive”.

- The preface of the document states that the context in which these words were used is far more important than the words themselves.

- Ultimately, the final call of whether a word is “unparliamentary” or not lies with the presiding officer of the House.

- In the first two decades of the Indian Parliament, English was the primary language used for parliamentary work.

- This changed as the social composition of Parliament changed from the 1970s onwards.

- At present, as many as 30 languages are used by parliamentarians during speeches, with many insisting on speaking their mother tongue during crucial debates.

- Perhaps, the next such compilation will also have words expunged from different regional languages.

Challenges in digital age

- The proceedings of both Houses of Parliament are relayed in real time on TV channels and YouTube.

- There have been instances where live transmission has been halted on the Chair’s orders.

- To circumvent this, many members have recorded the proceedings on their mobile phone cameras.

- There are many instances of the Chair intervening and expunging words or phrases that it finds “objectionable”.

- Herein lies the problem. The order of the Chair is often relayed by late evening to reporters, but by then, the video clip would have already been circulated many times over.

- Print reporters are careful and abide by the orders, but in a digital ecosystem, this is not easy.

Conclusion

The problems posed to the Parliament in terms of language and words should be dealt with keeping in focus the freedom of speech of the members.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: CEPA

Mains level: Paper 2- India-South Korea ties

Context

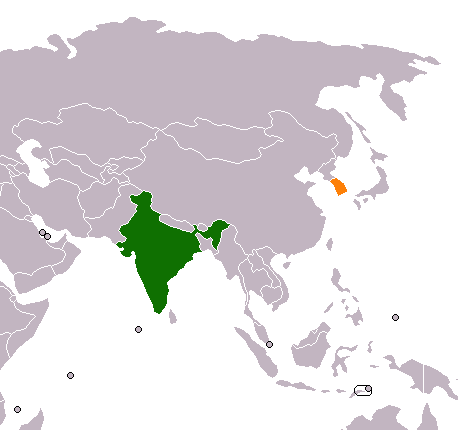

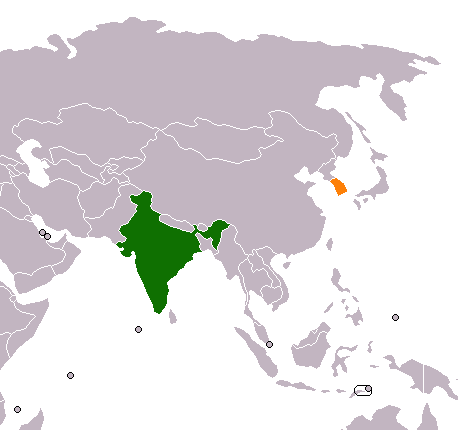

- During the past five years, India and South Korea have experienced considerable divergence in their respective national objectives.

Background

- Bilateral relations between India and South Korea, officially known as the Republic of Korea, were established in 1962 and upgraded to Ambassador-level in 1973.

- South Korea’s open market policies found resonance with India’s economic liberalization, and its ‘look east policy’ and ‘act east policy’.

- The relations has become truly multidimensional, spurred by a significant convergence of interests, mutual goodwill and high level exchanges.

- During PM Modi’s visit to ROK in May 2015, the sides elevated the ties to ‘Special Strategic Partnership’.

- President Moon’s India visit marked the 45th anniversary of bilateral diplomatic ties.

Why India is important for South-Korea?

- One of the points that the Koreans have been making to India is that they see India as a country that is now strategically important to them

- South Korea also finds in India a very acceptable partner.

- India doesn’t have edges which can create problems for them. They are aware of one factor which they have grown up with, which is the Pakistan factor.

- With new issues cropping up in ties with China and America, export-driven South Korea must find new markets.

- South Korea’s economic growth has slowed, presenting it with important challenges.

- South Korea is targeting economies with the greatest growth potential like India.

- South Korea is too heavily dependent on China’s market. So diversification is essential for South Korea..

- Need cooperation for development in third countries, like capacity building programmes in Africa

India – South Korea Relations

- Political:

- In May 2015, the bilateral relationship was upgraded to ‘special strategic partnership’.

- India has a major role to play in South Korea’s Southern Policy under which Korea is looking at expanding relations beyond its immediate region.

- Similarly, South Korea is a major player in India’s Act East Policy under which India aims to promote economic cooperation, cultural ties and develop strategic relationships with countries in the Asia-Pacific.

- Regional Stability:

- The regional tensions in South Asia especially between India and China create a common interest for India and South Korea.

- This could be a collaborative approach for regional stability.

- Nuclear:

- South Korea’s key interest in managing their nuclear neighbour (North Korea) is similar to India’s considerations toward Pakistan.

- The US alliance system, established with South Korea and Japan, puts pressure on North Korea to cap its nuclear programme.

- Containing North Korea is beneficial to India’s economic and regional ambit in East Asia.

- It also adds to its approach to the nuclear non-proliferation regime as a responsible nuclear state.

- Economic:

- The current bilateral trade between India and South Korea is at USD 21 billion and the target that has been set is USD 50 billion by the year 2030.

- India and South Korea have signed the Comprehensive Economic Partnership Agreement (CEPA), 2010 which has facilitated the growth of trade relations.

- To facilitate investment from Korea, India has launched a “Korea Plus”facilitation cell under ‘Invest India’ to guide, assist and handhold investors.

- Diplomatic:

- There is a long-lasting regional security dilemma with the continued verbal provocations and a conventional arms race.

- Thus, despite the alliance system, Seoul appears to be searching for a stronger diplomatic stand on imminent regional issues beyond the alliance system.

- South Korea’s approach to India comes with strategic optimism for expanding ties to ensure a convergence of interest in planning global and regional strategic frameworks.

- Cultural:

- Korean Buddhist Monk Hyecho or Hong Jiao visited India from 723 to 729 AD and wrote the travelogue “Pilgrimage to the five kingdoms of India” which gives a vivid account of Indian culture, politics & society.

- Nobel Laureate Rabindranath Tagore had composed a short but evocative poem – ‘Lamp of the East’ – in 1929 about Korea’s glorious past and its promising bright future.

Challenges

- Stagnation in Economic relationship:

- The economic partnership is struck at $22 billion annually.

- Also, the defence partnership appears to have receded from great all-round promise to the mere sale and purchase of weapon systems.

- Trade between the two countries was sluggish and there was no major inflow of South Korean investment into India.

- No upgrade in CEPA: India and South Korea were also trying to upgrade their Comprehensive Economic Partnership Agreement (CEPA) agreement, but to no avail.

- Cultural Prejudices on both sides preventing people-to-people ties

- Cold War Era perception: There may be a widespread perception among South Koreans of India as a third world country, rife with poverty and hunger.?

- Indian Diaspora: Within South Korea, the integration of Indians in the local population is far from complete, with some instances of racial prejudice or discrimination toward Indians

- Inadequate acknowledgment of Korean Culture: To a certain extent Indians are unable to distinguish between the cultural and social characteristics of South Koreans from that of Japanese/Chinese.

- Unfulfilled potential of Cultural Centres

- Indian Culture Centre (ICC) was established in Seoul 10 years ago?to promote people-to-people contacts.

- However, ICC has to reach an exponentially wider audience and its focus has to expand beyond the urban, English-speaking elite of Seoul.

- The same may be applicable to South Korean culture centres in India.

- Divergence in objectives

- During the past five years, India and South Korea have experienced considerable divergence in their respective national objectives.

- There was a clear drift by South Korea away from multilateral security initiatives led by the United States, such as the Quad (the U.S., Australia, India and Japan); meanwhile, India has been actively participating in them.

Change in Korean foreign and security policies and opportunities for India

- The newly elected Korean President, Yoon Suk Yeol, has brought about a paradigm shift in South Korean foreign and security policies.

- He has proposed that South Korea should step up to become a “global pivotal state, anchored in liberal values and a rules-based order”.

- Opportunities for India: South Korea’s new willingness to become a global pivotal state and play an active role in regional affairs is bound to create multiple opportunities for a multi-dimensional India- Korea partnership.

- South Korea’s strategic policy shift to correct its heavy tilt towards China is bound to bring new economic opportunities for both countries.

- The trade target of $50 billion by 2030, which looked all but impossible a few months ago, now seems within reach.

- Convergence of capabilities: The emerging strategic alignment is creating a new convergence of capabilities and closer synergy in new areas of economic cooperation such as public health, green growth, digital connectivity, and trade, among others.

- With the strategic shift in South Korea’s defence orientation, new doors of cooperation for defence and security have emerged.

- Defence cooperation: Advanced defence technologies and modern combat systems are the new domains for the next level of defence cooperation between the two countries.

- A Roadmap for Defence Industries Cooperation between the Republic of India and the Republic of Korea (ROK) was signed in 2020.

- Maritime security: South Korea’s participation in additional maritime security activities in the Indian Ocean, such as the annual Malabar and other exercises with Quad countries, will further strengthen India’s naval footprint in the Indo-Pacific region.

- Defence policy coordination: The shift in South Korean policies will enable a strong India, South Korea and Japan defence policy coordination that could effectively forge new joint regional security policies.

Challenges

- Chinese pressure: The Chinese leadership is adversely impacted by policy changes brought in by the Yoon administration.

- The real challenge for global geopolitics is this: can South Korea withstand the inevitable Chinese pressure and stick to its new alignment?

- Tension with North Korea: South Korea’s peace process with North Korea has completely collapsed.

- In the coming days, as North Korea conducts more missile and nuclear tests, it may lead to regional tension.

- Any breakout of hostilities on the Korean Peninsula can derail South Korea’s Indo-Pacific project.

Way forward

- Strategic partnership: India has evolved excellent strategic partnerships with Japan, Vietnam and Australia.

- South Korea could be the fourth pillar in India’s Indo-Pacific strategy along with Japan, Australia, and Vietnam.

- This can bring about a paradigm shift in India’s position and influence in the region.

- The time has come for the Indian and South Korean bilateral partnership to be strategically scaled up at the political, diplomatic and security domain levels.

- With South Korea’s emergence as a leader in critical technologies, cybersecurity and cyber-capacity building, outer space and space situational awareness capabilities, South Korea can contribute immensely to enhance India’s foundational strengths in the Indo-Pacific.

- India can help South Korea withstand Chinese pressure and North Korean threats.

- This new partnership can have a long-term positive impact for both countries and the Indo-Pacific region.

- It is an opportunity that neither country can afford to miss.

Conclusion

An independent, strong, and democratic South Korea can be a long-term partner with India, that will add significant value to India’s Indo-Pacific strategy.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Article 53

Mains level: Paper 2- Role of the President as envisage by the Indian Constitution

Context

India is going to elect its new President on July 18. The new President will be sworn in on July 25. Choosing the presidential candidate is an intensely political exercise.

Election of the President

- Direct or indirect election: The main question debated therein was whether India should have a directly elected President or an indirectly elected one.

- The Assembly opted for an indirectly elected President.

- Dr. B.R. Ambedkar said: “Our President is merely a nominal figurehead. He has no discretion; he has no powers of administration at all.”

- Article 53 of the Constitution says that “the executive power of the Union shall be vested in the President and shall be exercised by him either directly or through officers subordinate to him in accordance with this Constitution.”

- It means the President exercises these powers only on the aid and the advice of the Council of Ministers.

People’s presence in the election of the President

- It is an indirect election in the sense that the people do not directly elect the President.

- Under Article 54, the President is elected by an electoral college consisting of only the elected members of both Houses of Parliament and the elected members of the State and Union Territory Assemblies.

- A matter of importance in this context is the vote value of Members of the Legislative Assemblies (MLAs) and the formula for its computation.

- The vote of an MLA, though one, is assigned a certain higher value.

- This value is calculated by first dividing the total population of the State (as per the 1971 Census) by the total strength of the Assembly, and then the quotient is divided by one thousand.

- In the computation of the value, the population of the State figures in a significant way.

- In other words, the population of the country is a crucial factor in the election of the President, which means the people’s presence in the process of electing the President is very much visible.

Moral authority of the President

- Wider base: The people’s presence in the election of the President gives a wider base to the President than a mere vote by the legislators on the basis of one member, one vote.

- This also gives the President a greater moral authority.

- So, the Indian President is not and cannot be a mere rubber stamp.

- Reconsideration of decision: He does not directly exercise the executive authority of the Union, but he can disagree with the decision of the Council of Ministers, caution them, counsel them, and so on.

- The President can ask the Cabinet to reconsider its decisions.

- However, the Cabinet, after such reconsideration, sends the same proposal back without any change, the President will have to sign it.

Role of the President as envisage by the Constitution

- Broader view of the things: The Constitution of India wants the President to be vigilant and responsive, and gives the freedom to him or her to take a broader view of things uninfluenced by the narrow political view of the executive.

- Preserve, protect and defend the Constitution: The above point becomes clearer when we take a look at the oath the President takes before entering office.

- The oath contains two solemn promises.

- First, the President shall preserve, protect and defend the Constitution.

- Second, the President shall devote himself or herself to the service and the well-being of the people of India.

- Thus, it is possible for a President to disagree with the government or intervene on behalf of the citizenry against the tyranny of the executive and persuade it to give up its ways.

Conclusion

The method adopted for the election of the President and the promises made in the oath makes it clear that the President cannot act as a gramophone of the Prime Minister as mentioned by professor K.T. Shah.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: CAROTAR

Mains level: Paper 3- Addressing the issues in FTAs

Context

In recent months, India has signed trade agreements with Australia and UAE. n the last week of June, New Delhi began talks for a similar agreement with the EU.

How FTA with EU could help India

- India’s successful sectors like textiles, pharmaceuticals and leather could benefit from these deliberations, which would also be keenly watched by representatives of the services and renewable energy sectors.

- A successful free trade agreement (FTA) with the EU could help India to expand its footfall in markets such as Poland, Portugal, Greece, the Czech Republic and Romania, where the country’s exports registered double-digit annual growth rates in the last decade.

So, what are the factors India need to consider while signing FTA

1] Impact of tariff on domestic industry:

- It has been observed that when India is an importer, the preferential tariffs that accrue as a result of trade agreements are significantly lower than the rates charged from countries given Most Favoured Nation (MFN) status by India.

- But when the partner country is the importer, preferential tariffs on Indian goods, in most cases, are closer to the MFN tariffs.

- As a result, Indian exporters do not get the same returns as their counterparts in the partner countries.

- India’s trade with South Korea is a case in point.

- Before entering into a trade agreement care should, therefore, be taken to ensure that the domestic industry is not made to compete on unequal terms with the partner countries.

2] Adherence to the rules of origin

- The India-UAE Comprehensive Economic Partnership Agreement sets a good example.

- It includes a strong clause on the rules of origin.

- Forty per cent value addition or substantial processing of up to 40 per cent in the exporting country is required to qualify for lower tariffs.

- Rules of origin have been a bone of contention in most Indian trade agreements.

- (CAROTAR, 2020): In 2020, the country notified the Customs (Administration of Rules of Origin under Trade Agreements) Rules (CAROTAR, 2020), which require a basic level of due diligence from the importer.

3] Including the offset clauses

- “Offset clauses” — where the exporter is obliged to undertake activities that directly benefit the importing country’s economy — should be built into trade agreements, especially for technology intensive sectors.

4] Emergency action plan

- In February 2020, the US made India ineligible for claims under GSP, America’s oldest preferential trade scheme.

- The US Trade Representative’s Office deemed India as a developed country and suspended beneficial treatment under the GSP.

- A contingency plan should be in place to tackle such situations.

5] Inclusion of sunset clause

- India should also take a cue from the US-Mexico-Canada Agreement, to incorporate a “sunset” clause in trade agreements.

- The pact between the three North American nations provides for periodic reviews and the agreement is slated to end automatically in 16 years unless the countries renegotiate it.

6] Parity between services and merchandise

- India should negotiate for parity between services and merchandise.

- Low trade in services: India’s trade in services is low, and its overall score in the OECD’s Services Trade Restrictiveness Index (STRI) exceeds the world average.

- It is especially high in legal and accounting services due to the licencing requirements in both these segments.

- Expansion in banking and financial services: There is also significant room for expansion of trade in the banking and financial services industry.

Conclusion

A well-crafted trade agreement could help India enhance its share in global trade and help attain the government’s target of making the country a $5-trillion economy.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: CAROTAR Rules

- Importers will have to do their due diligence to ensure that imported goods meet the prescribed ‘rules of origin’ provisions.

- This is the essential availing concessional rate of customs duty under free trade agreements (FTAs).

- A list of minimum information, which the importer is required to possess, has also been provided in the rules along with general guidance.

- Also, an importer would now have to enter certain origin related information in the Bill of Entry, as available in the Certificate of Origin.

Why need CAROTAR?

- CAROTAR 2020 supplements the existing operational certification procedures prescribed under different trade agreements.

- India has inked FTAs with several countries, including Japan, South Korea and ASEAN members.

- Under such agreements, two trading partners significantly reduce or eliminate import/customs duties on the maximum number of goods traded between them.

- The new rules will assist customs authorities in the smooth clearance of legitimate imports under FTAs.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: AOSIS

Mains level: Paper 3- Challenges in climate finance

Context

From June 6-16, representatives from more than 100 countries descended on Bonn to hold preliminary discussions on what could be the final communiqué at the conclusion of COP27, to be held at Sharm-el-Sheikh later this year.

Key takeaways from the discussion

- Centred on climate finance: Discussions were centred around climate finance and there was hardly any convergence of issues.

- No convergence: The developed and developing countries or for that matter, big polluters and small polluters, were speaking from the ends of the spectrum with no meeting ground.

- Focus on adaptation and mitigation: Much of the discussion was around “loss and damage”, which was being experienced by many of the smaller countries, especially with big coastlines, due to rising river levels, loss of agricultural productivity, loss of livelihoods, etc.

- The idea to provide assistance for “loss and damage” was opposed by the US and the EU.

- Need for alternative funding: The Green Climate Fund is considered too cumbersome and the process too lengthy.

- Hence, the need for an alternate funding route was imperative.

- It was argued that one needs to look into this issue right now and provide financial assistance to cope with it.

- This brings into focus the debate between adaptation and mitigation.

- The demand of the developing countries for a provision of climate finance at a scale much higher than $100 billion a year fell on deaf ears.

- Incidentally, the figure of $100 billion was arrived at arbitrarily and that too way back in 2009.

Mitigation Vs Adaptation debate

- More funding directed toward mitigation: It is generally felt that whatever funding has come for climate change issues has mostly been directed towards mitigation.

- This is primarily because mitigation projects have a cost-benefit analysis and, therefore, it is easy to lend money because you can get it back through interest payments.

- Cost-benefit analysis: This is primarily because mitigation projects have a cost-benefit analysis and, therefore, it is easy to lend money because you can get it back through interest payments.

- Mitigation would mean, for example, setting up solar generation units to avoid carbon footprint.

- Cost-benefit analysis is difficult for adaptation projects, which would be in the form of grants.

Actions needed to limit the temperature rise to 1.5 degree Celsius

- 2.4°C by NDC: The Nationally Determined Contributions (NDCs), as on date, are good enough to limit temperature rise to 2.4 degrees centigrade, provided all the targets are met.

- 1.8°C with net-zero commitment: In addition, if countries also meet their net-zero commitments by 2050, the temperature rise will still be around 1.8 degrees centigrade.

- 1.5°C: To limit the temperature rise to 1.5 degrees centigrade, emissions will have to be cut down by half by 2030.

- The Alliance of Small Island States (AOSIS) expressed the view that to be more meaningful, the aim should be to reduce emissions by 20 per cent by 2025 itself.

- The logic is that the next round of NDCs is due only in 2025 and by that time, it would be too late to formulate a plan that is achievable by 2030.

Issue of using remaining carbon space

- The use of the remaining carbon space available to limit temperature rise to 1.5 degrees centigrade, a highly contentious issue, was also discussed in Bonn.

- The US resisted being labelled as a “big emitter” and was not willing to take responsibility for its historical emissions.

- There is no single estimate of how much carbon space is really available as on date, but broad indications are that at the given emissions rate, it would be roughly 10 years.

- The raging debate is how to distribute this available space equitably amongst countries, which would mean that someone has to take the burden of stiffer targets.

- What the US wanted other big emitters like China and India take on greater responsibilities for cutting down emissions.

- However, the like-minded group of developing countries (LMDCs) — which included China, India, Saudi Arabia and the Arab countries — were opposed to this.

Conclusion

If there was any hope that discussions at Bonn would provide an acceptable draft, which could be taken forward during COP27, it was misplaced.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: The Paris Agreement

- The Paris Agreement is a legally binding international treaty on climate change. It was adopted by 196 Parties at COP 21 in Paris, on 12 December 2015 and entered into force on 4 November 2016.

- Its goal is to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

- To achieve this long-term temperature goal, countries aim to reach global peaking of greenhouse gas emissions as soon as possible to achieve a climate-neutral world by mid-century.

- It is a landmark process because, for the first time, a binding agreement brings all nations into a common cause to undertake ambitious efforts to combat climate change and adapt to its effects.

- Implementation of the Paris Agreement requires economic and social transformation, based on the best available science.

- The Agreement works on a 5- year cycle of increasingly ambitious climate action carried out by countries.

- By 2020, countries submit their plans for climate action known as nationally determined contributions (NDCs).

NDCs

- In their NDCs, countries communicate actions they will take to reduce their Greenhouse Gas emissions in order to reach the goals of the Paris Agreement.

- Countries also communicate in the NDCs actions they will take to build resilience to adapt to the impacts of rising temperatures.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: National Asset Reconstruction Company Ltd. (NARCL)

Mains level: Paper 3- Impact of banking scams

Context

The biggest banking scam in India has come to the forefront; in this case, DHFL has hoodwinked a consortium of banks driven by the Union Bank of India to the tune of ₹35,000 crore through financial misrepresentation.

How scams affect economy

- The banking system of any country is the backbone of its economy.

- Excessive losses to banks affect every person in the country because the amounts deposited in banks belong to the citizens of the country.

- The NPAs that banks incur are mainly due to bad loans and scams.

- The data by the RBI also show that one of the fundamental problems in the way of the development of banking in India is on account of rising bank scams and the costs consequently forced on the framework.

- Strangely, as in a Global Banking Fraud survey (KPMG), the issue is not just for India alone; it is a worldwide issue.

Reasons for scams

- Frauds in the banking industry can be grouped under four classifications: ‘Management’, ‘Outsider’, ‘Insider’ and ‘Insider and Outsider’ (jointly).

- Operational failures: All scams, whether interior or outside, are results of operational failures.

- Limited asset monitoring: Research by Deloitte has shown that limited asset monitoring after disbursement (38%) was the foremost reason behind stressed assets and insufficient due diligence before disbursement (21%) was among the major factors for these NPAs.

- Poor bank corporate governance: A study by the Indian Institute of Management Bangalore has shown that poor bank corporate governance is the cause behind rising bank scams and NPAs.

The problems of high NPA

- In a Financial Stability Report released by the RBI in December 2021, there is a projection of the gross NPAs of banks rising from 6.9% in September 2021 to 8.1% of total assets by September 2022 (under a baseline scenario) and to 9.5% under a severe stress scenario.

- A high NPA also reduces the net interest margin of banks besides increasing their operating cost; these banks meet this cost by increasing the convenience fee from their small customers on a day-to-day basis.

Suggestions

- Banks have to exercise due diligence and caution while offering funds.

- Regulation and control of CAs: The regulation and the control of chartered accountants is a very important step to reduce non-performing assets of banks.

- Banks should be cautious while lending to Indian companies that have taken huge loans abroad.

- Tightening audit system: There is also an urgent need to tighten the internal and external audit systems of banks.

- Fast rotation of employees: The fast rotation of employees of a bank’s loan department is very important.

- Public sector banks should set up an internal rating agency for rigorous evaluation of large projects before sanctioning loans.

- Effective MIS: Further, there is a need to implement an effective Management Information System (MIS) to monitor early warning signals about business projects.

- CIBIL score of the borrower: The CIBIL score of the borrower (formerly the Credit Information Bureau (India) Limited) should be evaluated by the bank concerned and RBI officials.

- Use of AI: Financial fraud can be reduced to a great extent by the use of artificial intelligence (AI) to monitor financial transactions.

- Improve loan recovery process: Rather than having to continuously write off the bad loans of large corporates, India has to improve its loan recovery processes and establish an early warning system in the post-disbursement phase.

- Risk assessment: Banks need to carry out fraud risk assessments every quarter.

- Only establishment of National Asset Reconstruction Company Ltd. (NARCL) or the ‘bad bank’ is not a real solution.

- These measures can help only after a loan is bad but not the process of a loan going bad.

Conclusion

While the Government of India and the RBI have taken several measures to try and resolve the issue of scams in the banking industry, the fact is that there is still a long way to go.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Working principle of optical fibre

Mains level: Paper 3- Creating digital infrastructure for 5G

Context

5G technology is going to make inroads into the country very soon.

Making Digital India project successful

- With over 117 crore telecom users and more than 82 crore internet subscribers, India is one of the fastest-growing markets for digital consumers.

- A 2019 Mckinsey study rated India as the second-fastest digitising economy.

- Internet connectivity is critical for making the Digital India project inclusive, and widespread use of optical fibre in the remotest corners of the country is vital to ensure that no one is left behind in this endeavour.

Digital infrastructure for 5G

- Digital infrastructure, which seamlessly integrates with physical and traditional infrastructure, is critical to India’s growth story and the country’s thrust towards self-reliance.

- Networking equipment that relies on optical fibre and other semiconductor-based device ecosystems are at the heart of building the infrastructure that will be needed when the country takes the next step in its digital journey.

- The government has taken several measures to build the next generation of digital infrastructure.

- A basic requirement of 5G will be data transmission networks.

- Optical fibre is the backbone of the digital infrastructure required for this purpose — the data is transmitted by light pulses travelling through long strands of thin fibre.

Optical fibre industry in India

- In the last 10 years, domestic manufacturers invested more than Rs 5,000 crore in optical fibre industry, which has generated direct and indirect employment for around 4 lakh individuals.

- Exports from India: India exported optical fibre worth $138 million to over 132 countries between April 2020 and November 2021.

- India’s annual optic fibre manufacturing capacity is around 100 million fibre km (fkm) and the domestic consumption is around 46 million fkm. Indian optical fibre cable consumption is predicted to increase to 33 million fkm by 2026 from 17 million fkm in 2021.

- A little more than 30 per cent of mobile towers have fibre connectivity; this needs to be scaled up to at least 80 per cent.

Unfair competition from cheap imports

- India’s optical fibre industry has also seen unfair competition from cheap imports from China, Indonesia and South Korea.

- These countries have been dumping their products in India at rates lower than the market price.

- What is dumping? The World Trade Organisation defines dumping as “an international price discrimination situation in which the price of a product offered in the importing country is less than the price of that product in the exporting country’s market”.

- Way ahead: Imposing anti-dumping duties is one way of protecting the domestic industry.

- The Directorate General of Trade Remedies has recently begun investigations against optical fibre imports.

Suggestions

- India needs to invest in R&D, offer production-linked incentive (PLI) schemes to support indigenous high-tech manufacturing and develop intellectual property in critical aspects of digital connectivity.

Conclusion

The need of the hour is to unlock the full potential of India’s optical fibre industry and enable India to emerge as a major manufacturing and technology hub while achieving atmanirbharta in its 5G journey.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: About optical fibre

- Fiber optics, also spelled fibre optics, the science of transmitting data, voice, and images by the passage of light through thin, transparent fibers.

- In telecommunications, fiber optic technology has virtually replaced copper wire in long-distance telephone lines, and it is used to link computers within local area networks.

- Fibre optics is also the basis of the fiberscopes used in examining internal parts of the body (endoscopy) or inspecting the interiors of manufactured structural products.

- Through a process known as total internal reflection, light rays beamed into the fibre can propagate within the core for great distances with remarkably little attenuation or reduction in intensity.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: FRBM Act provisions

Mains level: Paper 3- Freebies and finances of the States

Context

Many states are pursuing the freebie culture, which raises several questions.

About freebies

- Why do governments give freebies? The obvious motivation for States in expanding freebies is to use the exchequer to build vote banks.

- Electoral calculations tempt them to place short-term gains ahead of long-term sustainability.

- Case in which it is necessary? A certain amount of spending on transfer payments to provide safety nets to the most vulnerable segments of the population is not only desirable but even necessary.

- What is the problem? The problem arises when such transfer payments become the main plank of discretionary expenditure, the spending is financed by debt, and the debt is concealed to circumvent the FRBM targets.

- Opportunity cost: The more States spend on transfer payments, the less they have for spending on physical infrastructure such as, for example, power and roads, and on social infrastructure such as education and health, which can potentially improve growth and generate jobs.

Questioning the logic of freebie culture

- Sustainability: Is borrowing and spending on freebies sustainable?

- Best use: Is this the best possible use of public money?

- Opportunity cost: What is their opportunity cost — what is it that the public are collectively giving up so that the government can fund these payments?

- Checks and balances: Should not there be some checks on how much can be spent on them?

Where should government spend the borrowed money?

- Ideally, governments should use borrowed money to invest in physical and social infrastructure that will generate higher growth, and thereby higher revenues in the future so that the debt pays for itself.

- On the other hand, if governments spend the loan money on populist giveaways that generate no additional revenue, the growing debt burden will eventually implode.

But what is the problem with freebies if states are confirming to the FRBM targets?

- Any analysis of State Budgets by the Reserve Bank of India shows that State finances are in good health and that all of them are conforming to the Fiscal Responsibility and Budget Management (FRBM) targets.

- This is a misleading picture.

- Off budget borrowing: Much of the borrowing that funds these freebies happens off budget, beyond the pale of FRBM tracking.

- The typical modus operandi for States has been to borrow on the books of their public enterprises, in some cases by pledging future revenues of the State as guarantee.

- Effectively, the burden of debt is on the State exchequer, albeit well concealed.

- The Comptroller and Auditor General of India (CAG) had in fact pointed out that in respect of some States.

- Huget cost: The costs of fiscal profligacy at the State level can be huge.

- The amount States borrow collectively every year is comparable in size to the Centre’s borrowing which implies that their fiscal stance has as much impact on our macroeconomic stability as does that of the Centre.

- The need, therefore, for instituting more effective checks that can make wayward States fall in line is compelling.

What are the institutional checks and balances? What are the reasons of their failure?

- 1] Legislature and opposition: In theory, the first line of defence has to be the legislature, in particular the Opposition, whose responsibility it is to keep the Government in line.

- But the Opposition does not dare speak up for fear of forfeiting vote banks that are at the end of these freebies.

- 2] Lag in CAG reports: Another constitutional check is the CAG audit which should enforce transparency and accountability.

- In practice, it has lost its teeth since audit reports necessarily come with a lag, by when political interest has typically shifted to other hot button issues.

- 3] The market: The market is another potential check.

- It can signal the health or otherwise of State finances by pricing the loans floated by different State governments differently, reflecting their debt sustainability.

- But in practice this too fails since the market perceives all State borrowing as implicitly guaranteed by the Centre, never mind that there is no such guarantee in reality.

Suggestions

- 1] Amend FRBM Act for complete disclosure: First, the FRBM Acts of the Centre as well as States need to be amended to enforce a more complete disclosure of the liabilities on their exchequers.

- Even under the current FRBM provisions, governments are mandated to disclose their contingent liabilities, but that disclosure is restricted to liabilities for which they have extended an explicit guarantee.

- The provision should be expanded to cover all liabilities whose servicing obligation falls on the Budget, or could potentially fall on the Budget, regardless of any guarantee.

- 2] Centre should impose conditionalities: Under the Constitution, States are required to take the Centre’s permission when they borrow.

- The Centre should not hesitate to impose conditionalities on wayward States when it accords such permission.

- 3] Use of financial emergency provision: There is a provision in the Constitution of India which allows the President to declare a financial emergency in any State if s/he is satisfied that financial stability is threatened.

- This provision has never been invoked so far for fear that this will turn into a political weapon.

- But the provision is there in the Constitution for a reason.

- After all, the root cause of fiscal irresponsibility is the lure of electoral nirvana. It will stop only if the political leadership fears punishment.

- 4] Course correction by the Centre: The Centre itself has not been a beacon of virtue when it comes to fiscal responsibility and transparency.

- To its credit, it has embarked on course correction over the last few years.

- It should complete that task in order to command the moral authority to enforce good fiscal behaviour on the part of States.

Conclusion

The state governments, as well as the Central government, need to avoid the freebies that harm financial health and cause long-term harm. For that, there is a need to implement the suggestions mentioned above.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: FRBM Act

- The FRBM is an act of the parliament that set targets for the Government of India to establish financial discipline, improve the management of public funds, strengthen fiscal prudence and reduce its fiscal deficits.

- It was first introduced in the parliament of India in the year 2000 by Vajpayee Government for providing legal backing to the fiscal discipline to be institutionalized in the country.

- Subsequently, the FRBM Act was passed in the year 2003.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- I2U2

Context

The first summit this week of I2U2, which brings together India, Israel, the United Arab Emirates and the United States – is exploratory in nature.

I2U2 forum

- Following the Abraham Accords between Israel and the UAE, I2U2 was founded in October 2021 to address marine security, infrastructure, and transportation challenges in the region.

- It was known as the ‘International Forum for Economic Cooperation’at the time. At that time, UAE had referred to the new grouping as the ‘West Asian Quad’.

- I2U2 seeks to empower the partners and encourages them to collaborate more closely, resulting in a more stable region.

- India is seen as a large consumer market as well as a large producer of high-tech and highly sought-after items in the United States.

- This has led India to enhance its relationship with Israel without jeopardising its ties with the UAE and other Arab states.

How I2U2 matters to India

- India can contribute to peace and prosperity in the region: The initiative signifies the US bet that India can contribute significantly to peace and prosperity in the region.

- West Asian engagement: It also underlines a new political will in Delhi to break the old taboos on India’s West Asian engagement.

- Consolidation of India’s Middle East Policy: The I2U2 marks the consolidation of a number of new trends in India’s Middle East policy that acquired greater momentum in the past few years.

- What stands out sharply in India’s new thinking in the Middle East is that the summit involves three countries that Delhi had traditionally kept a safe political distance from.

India-Israel relations

- Although India was one of the first countries to extend recognition to Israel in 1950, Jawaharlal Nehru held back from establishing full diplomatic relations with the Jewish state.

- PV Narasimha Rao reversed that policy in 1992 but he did not travel to Israel nor did he receive an Israeli prime minister.

- Atal Bihari Vajpayee of the BJP, which had a more empathetic view of Israel, hosted Israeli PM Ariel Sharon in 2003.

- While the relationship steadily expanded, there was ideological reluctance in Delhi to give the partnership a political profile.

- In the past few years India imparted a political character to the Israel ties.

- No backlash from the Arab countries: There was little negative reaction to the more open pursuit of India’s ties with Israel.

- The problem was never with the Middle East but Delhi’s ideological preconceptions that distorted India’s view of the region.

- Turkey, now a champion of political Islam, had diplomatic ties with Israel since 1949.

- Egypt normalised ties in 1980.

- Under the Abrahamic accords promoted by the Trump Administration, the UAE, Bahrain, Sudan and Morocco set up formal ties with Israel in 2020.

India’s relations with the Arab countries

- India’s engagement with Israel was matched by effort to deepen India’s ties with the Arab world.

- During his first visit to Israel in 2018, Prime Minister Mode also became the first Indian PM to visit Palestine.

- Even more important has been the transformation of India’s relations with the Gulf Kingdoms, especially the UAE and Saudi Arabia.

- India’s traditional preference in the Arab world was for engaging the republics.

- Engagement with monarchies: Delhi remained wary of engagement with the monarchies, telling itself that they were pro-Pakistan.

- No Indian PM visited Saudi Arabia between 1982 and 2010 and UAE between 1981 and 2015.

- After 2015 India developed strong ties with these governments without a reference to Pakistan.

- Despite Delhi’s ideological posturing, the Middle East had long ceased to be a political priority for India.

- In contrast with the past, recently the prime minister has travelled four times to the UAE alone, negotiated a free trade agreement with it, and has ambitious plans for the transformation of bilateral relations.

- The UAE has also backed India’s 2019 constitutional changes in Kashmir and is ready to invest in the union territory.

Change in India’s approach to the region

- India-US ties: For political Delhi, the US and Western policies in the region were a main part of the problem.

- The immediate focus of Nehru’s policy after independence was to actively oppose US moves in the region in the name of promoting an “area of peace”.

- That policy had no lasting impact as many regional countries sought active economic, political, and security cooperation with the US and the West.

- The I2U2 then marks a big break from the anti-Western tradition in India’s approach to the region.

- Negotiating the terms of joint engagement: In the past, standing up to the West in the Middle East was part of India’s approach, India now is prepared to confidently negotiate the terms of a joint engagement.

Conclusion

India’s participation in the West Asian Quad brings Delhi in line with other major powers– including Europe, China, and Russia – to try and engage all parties in the region. The I2U2 sets the stage for a new and dynamic phase in India’s relations with the Middle East.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: Abraham Accords

- The Israel–UAE normalization agreement is officially called the Abraham Accords Peace Agreement.

- It was initially agreed to in a joint statement by the United States, Israel and the United Arab Emirates (UAE) on August 13, 2020.

- The UAE thus became the third Arab country, after Egypt in 1979 and Jordan in 1994, to agree to formally normalize its relationship with Israel as well as the first Persian Gulf country to do so.

- Concurrently, Israel agreed to suspend plans for annexing parts of the West Bank.

- The agreement normalized what had long been informal but robust foreign relations between the two countries.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: GST compensation to States

Mains level: Paper 3- GST compensation discontinuation

Context

The five-year transition period after the adoption of the Goods and Services Tax (GST) on July 1, 2017, came to an end on June 30, 2022. With this, the era of GST compensation that the state governments were entitled to has ended.

High estimated loan issuance

- Many state governments have asked for the compensation period to be extended by a few years.

- To tangibly assess the near-term outlook for state finances, we have to rely on the states’ own estimates for their market borrowing requirements for the second quarter of 2022-23.

- The indicative calendar of market borrowings by 23 state governments and two Union territories for the second quarter has pegged their total state development loan issuance — the primary source of financing state government deficits — at Rs 2.1 trillion.

- This projected issuance is 29 per cent higher than the same period last year, and at an eight-quarter high.

- This high level of issuance projected by states reflects concerns that some of them might rightfully have regarding the uncertainty of their cash flows in the post-GST compensation era.

- High dependence on GST compensation: Of these 23 states, Tamil Nadu, Andhra Pradesh, Haryana, Punjab and Gujarat have indicated large increases in borrowings.

- Most of these states have an above-average dependence on GST compensation.

Implications of discontinuation of GST compensation

- Alter the revenue compensation: The discontinuation of the GST compensation flows would alter the revenue composition of some states adversely, particularly those with a relatively larger share of such receipts in their overall revenue streams.

- Increase in debt level: To offset a portion of the associated revenue loss, such states are likely to enhance their borrowings and/or to undertake some expenditure adjustments in the quarters ahead.

Adjustment of borrowing limit of the States by the Centre

- At the time of communicating to states their annual borrowing limits for the ongoing year, we understand that the Centre had informed state governments that their off-budget borrowings for the past two years (2020-21 and 2021-22) would be adjusted from their borrowing ceiling this year.

- Data on off-budget borrowing: It appears that the calculation of the adjusted borrowing limit required the submission of detailed data by the state governments related to their off-budget borrowings for the last two fiscal years, followed by a thorough assessment of the same by the Centre.

Need for early step up in tax-devolution

- On the whole, though, states appear to have entered the year with a comfortable cash flow position.

- This follows from the back-ended release of the tax devolution to states for 2021-22 — nearly half of the full-year amount was released in the fourth quarter.

- Additionally, the total amount was also well above the revised estimate, providing an unexpected gain to states.

- This may have allowed them to temporarily withstand the changes related to their borrowing permission.

- Subsequently, the release of the GST compensation grant of Rs 869 billion for several months in May is likely to have further eased their cash flows.

- If the government does decide to step-up tax devolution to the states in the near term, instead of back-ending it as was done in the last year, it may reduce the size of state borrowings in the second quarter.

- But more significantly, such revenue certainty, despite the end of the GST compensation era, may embolden states to ringfence their capital spending, providing a positive impulse to the economy.

Conclusion

The discontinuation of the GST compensation flows would alter the revenue composition of some states adversely, tax devolution to the states in the near term could cushion the blow of the discontinuation.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: Compensation under GST regime

- The adoption of the GST was made possible by the States ceding almost all their powers to impose local-level indirect taxes and agreeing to let the prevailing multiplicity of imposts be subsumed under the GST.

- While the States would receive the SGST (State GST) component of the GST, and a share of the IGST (Integrated GST), it was agreed that revenue shortfalls arising from the transition to the new indirect taxes regime would be made good from a pooled GST Compensation Fund for a period of five years that is set to end in 2022.

- This corpus in turn is funded through a compensation cess that is levied on so-called ‘demerit’ goods.

- This GST Compensation Cess or GST Cess is levied on five products considered to be ‘sin’ or luxury as mentioned in the GST (Compensation to States) Act, 2017 and includes items such as- Pan Masala, Tobacco, and Automobiles etc.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Labour productivity and roads

Context