Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 3- How could higher import tariffs affect the Indian economy?

Context

It is important to have a stable tariff policy which would help to link effectively to global value chains.

Why countries levy tariff?

- The tariff is a tax levied on an imported good at the border.

- Countries use tariffs to-

- Provide easy market access or restrict them to protect domestic industry.

- It also serves the purpose of revenue collection and-

- To achieve some strategic objectives by giving/denying tariff concessions to countries.

Harmonised System in international trade

- What is it? Goods are classified at 2, 4, 6, 8 digits and some countries have even up to 10 digits, depending upon the level of trade potential of a country.

- WCO’s system of codes: The classification of these codes is streamlined under an international coding system called ‘Harmonized System’ (HS) under World Customs Organization (WCO) to which 138 countries are contracting parties and about 200 customs authorities are signatories.

- India’s national tariff lines are about 11,000 at HS 8-digit.

Historic background of the tariffs

- Colonial-era: During the colonial era tariffs were heavily used to protect the domestic industry, enjoy unbridled access to the colonized markets and raise tariffs against competitors.

- Adam Smith’s advocacy of free trade: Adam Smith in 18th Century challenged this idea of regimented trade with his advocacy of free trade that was convincingly brought out in his seminal work ‘Wealth of Nations’.

- Theory of comparative advantage: Further, in the 19th Century, David Ricardo, building on this concept, propagated the ‘theory of comparative advantage’.

- The theory proposes that nations should remain focused on their specific areas of competence and allowed to trade freely with other countries.

- This theory is against import substitution and considers raising tariffs as a drag on economic growth.

- What proponents of high tariff said? Proponents of high tariffs assert that-

- Developed countries dominated global markets for decades with high tariffs, developing countries should continue to enjoy differential tariff treatment until they catch up with the rest.

How countries calibrate tariffs?

- Each country calibrates its tariffs taking into account its-

- Domestic production.

- Demand and

- Sensitivities.

- Typically, tariff structures of a manufacturing country reveal a pattern:

- Low tariffs on raw materials and intermediate goods in the range of 0-5%.

- Slightly higher tariffs for finished goods in the range of 7-10%.

- Higher tariffs for agriculture products at above 15%, sometimes up to bound rates as allowed under WTO.

- As agriculture lines are politically sensitive, most countries zealously guard them with high tariffs.

Export-import linkage and effects of high tariffs

- How tariffs could harm export competitiveness: Availability of cheaper raw materials and intermediate products support making of competitively priced finished goods for export markets.

- The challenge for an entrepreneur is to find these cheaper inputs.

- If these inputs are not available domestically at competitive rates, they look to source them from outside.

- But as high tariffs act as barriers to sourcing cheaper inputs, they undermine export competitiveness of a product.

- Implications for MSMEs

- For MSMEs (micro, small and medium enterprises), this dependency linkage is even more critical, without which they might close down their operations under threat of persistent losses or low returns.

- Impact on jobs and economy: This would have consequential impact on jobs, income and consumer choices in an economy.

- Inefficiency and corruption at entry points: High tariffs could breed inefficiency and corruption at the entry points as it leaves much scope for discretion at the hands of officials, circumvention through under/over-invoicing and violation of rules of origin.

- Impairing demand: Overtime, high tariffs run the risks of impairing demand and paralyzing domestic manufacturing.

- Maintaining judicious balance: Leveraging tariffs for benchmarking domestic prices is not an uncommon practice in any country.

- But maintaining a judicious balance between the interests of primary producers and user industries is imperative, given that there exists an intimate link between imports and exports.

India and Global Value Chain (GVC)

- 80% trade through More than 80% of the global trade runs through Global Value Chains (GVCs) which have evolved extensively in various regions of the world.

- Low tariffs help GVCs to thrive, essentially for the purpose of sourcing and accessing foreign markets.

- Why stable tariff policy is important for India?

- For India to emerge as a global hub for “networked products” and make every district an ‘export hub’ for a specific item, as envisaged in this year’s Budget, it is important to have a stable and predictable tariff policy which would help to link effectively to GVCs.

- For investors: From an investor’s point of view a stable tariff policy is a huge motivation.

Free-trade agreements and hope of getting market access

- Market access: The assumption that tariff concessions under bilateral free trade agreements (FTAs) would help get market access is misplaced.

- Why the assumption is misplaced? In reality, this may not happen as same concessions can be offered by a country to other trading partners in a trade arrangement or throw open to all countries on an MFN (most favoured nation) basis.

- Inverted duties situation: Gradual tariff liberalization is a natural progression and failing to do so could result in a situation of inverted duties where finished products end up being cheaper than raw materials and intermediate goods

- Thus, calling for tariff correction in course of time.

Revenue Generation through tariffs

- Why it is not a good idea? The domestic consumers ultimately end up absorbing import duties as they get passed onto products they consume.

- Taxing own people: This is akin to taxing one’s own people in an indirect way by making them pay more for a product than in other markets.

- Revenue generation from enhanced activities: For these reasons, the idea of revenue collection from import duties is losing steam, and instead, revenue generation from enhanced economic activity is gaining wider acceptance as a dynamic process.

Conclusion

Increasing tariffs on the import can end up hurting the economy than benefitting it in the long run, so the government must reconsider the policy of tariff increase.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 2- India's preparedness to deal with epidemics.

Context

With multiple cities in China under a public health lockdown, global supply chains of various essential products and consumer goods are likely to be affected. This should be particularly worrisome for India, which has a roughly $93 billion total trade and about $57 billion trade imbalance with China.

Cause of worry turned into a reality

- Public health experts have worried most about an animal virus-

- That gets into humans.

- Causes human-to-human transmission.

- Has high infectivity and a range of clinical severity.

- With no human immunity, no diagnostic tests, drugs or vaccines.

- An emerging virus, called the 2019 novel coronavirus (2019-nCoV), appears to be just that.

- With the World Health Organisation declaring it a Public Health Emergency of International Concern (PHEIC), this outbreak is now a pandemic.

What is coronavirus

- Group of animal virus: Coronaviruses are a group of animal viruses identified by their crown-like (corona) appearance under a microscope.

- SAARS connection: The 2019-nCoV belongs to this group of viruses, six of which, including the 2003 Severe Acute Respiratory Syndrome (SARS) and the 2012 Middle East Respiratory Syndrome (MERS) viruses, were earlier known to cause disease in humans.

- Genetic similarity with other viruses: Genetic sequencing of the virus from five patients showed it to be 5 per cent identical to the SARS virus.

- Bats as hosts: Since the SARS outbreak in 2003, scientists have discovered a large number of SARS-related coronaviruses from their natural hosts-bats.

- Previous studies have shown some of these bat coronaviruses to have the potential to infect humans.

- Genetic sequencing showed it to human coronavirus to be over 96 per cent identical to a bat coronavirus.

- Thus, 2019-nCoV clearly originated from bats, jumped into humans either directly or through an intermediate host, and adapted itself to human-to-human transmission.

- Bats are a particularly rich reservoir for viruses with the potential to infect humans.

- Examples of these include viruses such as Hanta, Rabies, Nipah, Ebola and Marburg viruses, and others that have caused high levels of mortality and morbidity in humans.

- India has 117 species and 100 sub-species of bats, but we know little about the viruses they harbour and their disease potential.

India’s response

- India’s response includes-

- Surveillance of arriving passengers at airports.

- Awareness drives in the border states.

- Designation of hospitals with isolation wards and the availability of protective gear (e.g. masks) to health workers.

- SOP: There are clear operating procedures for sample collection and its transport to the National Institute of Virology, Pune, which is the nodal testing centre.

- A self-declaration mechanism is in place and a 24×7 telephone helpline has been set up.

- Two areas of concern

- 1. Promotion of untested medicines: There is mixed messaging promoting AYUSH products that are untested and of questionable efficacy.

- 2. India- a hot zone of zoonotic pathogens: India has been a “hot zone” for the emergence of new zoonotic (animal-derived) pathogens for over a decade.

- But we continue to lack the capacity to quickly identify, isolate and characterise a novel pathogen.

- Example of China: China is a good example of how investments in research and public health will allow it to take a lead on developing diagnostic tests, vaccines and drugs for this new virus. We must do the same and prepare for the future.

- Disruption in global supply chains and concerns for India

- With multiple cities in China under a public health lockdown, global supply chains of various essential products and consumer goods are likely to be affected.

- This should be particularly worrisome for India, which has a roughly $93 billion total trade and about $57 billion trade imbalance with China.

- Disruption in medicine supply: The Indian pharmaceuticals industry imports about 85 per cent of its active pharmaceutical ingredients from China.

- Any disruption in this supply chain would adversely affect the availability of medicines in India, which would be required in an outbreak situation.

- Need to support local pharma. industry: India must, therefore, take steps to correct this imbalance and support the local pharmaceuticals industry in reducing its dependence on China

Possible scenarios

- Public health experts estimate that the epidemic will peak in three months.

- From here on, there are a few possible scenarios, but which of these would play out is hard to guess.

- 1st possibility: There could be very large numbers of cases and global spread of the virus with a low CFR of 0.1-0.5 per cent, like the bad flu. Or the same with increased CFR, which would lead to significant mortality.

- 2nd possibility: It is also possible that the outbreak spiralled in China due to a combination of factors not present elsewhere, such as population density, food habits and the Chinese New Year, which sees large population movements.

- It is also possible that the pandemic may not sustain outside China and die out like the 2003 SARS outbreak.

- Whatever be the case, surveillance and sensible public health measures will be needed over the next few months.

Conclusion

India escaped the 2003 SARS and 2012 MERS outbreaks largely unscathed. This may still be the case with 2019-nCoV, but the laws of probability are likely to catch up soon. It would help to invest, build capacity and be ready.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Types of the GST returns.

Mains level: Paper 3- How the GST has performed and ways to improve it.

Context

Even as the 31-month-old GST evolves, the debate on its success rages on. Many have argued that GST is losing its sheen and needs a complete overhaul while others contend that the new tax system is on course and the trials and tribulations were not unexpected.

Analysis of GST collection

- 39% increase over the average of the base year 2015-16: The average monthly GST collection for the period August 2017 to January 2020 stands at Rs 97,188 crore which is an impressive 39 per cent increase over the average monthly collection of subsumed taxes in the base year 2015-16, at around Rs 70,000 crore.

- The average growth rate of 9.7% per year: This is an average growth rate of 9.7 per cent over the almost 4-year period post-2015-16 and a compounded growth rate of 8.55 per cent.

- Though less than 14% but not insignificant: This compounded growth rate is not insignificant even though it is just about 0.61 times the very ambitious 14 per cent rate of growth promised to the states before GST rollout.

- Perception of infectiveness due to ambitious 14% promise: The average growth rate of the collection in 18 non-special category states (accounting for the bulk of the revenue) during the 3-year period immediately preceding GST stood at around 8.9 per cent.

- Thus, if the perception about the effectiveness of GST has not been very encouraging, it is only in the context of the very ambitious 14 per cent compounded annual growth rate promised to the states.

Reasons for tepid growth in GST collections

- The overall economic situation in the country: The revenue performance of GST during the current fiscal year is not out of sync with the overall economic situation in the country.

- The growth rate in tax yield at 4.69 %: Accordingly, during the 10-month period ending January 2020, the growth rate in tax yield was 4.69 per cent.

- The relatively tepid growth was primarily due to a negative growth of 4.03 per cent in September-October 2019.

- After the dip in September-October 2019, GST collections rebounded and this is a reminder that one need not write GST off in a hurry.

- Complacency in the states due to 14% promise: Complacency in the states on account of assured 14 per cent growth cannot be ruled out.

- States were jolted with the delay in compensation for August-September 2019 and resorted to vigorous monitoring of compliance and action against toxic and unverified credits, circular trading and tax evasion which had resulted in unmatched credit claims of around Rs 50,000 crore.

Two suggestions as corrective measures

- The GST Council deliberated on the recent trends in revenue collection and was cognizant of the need for corrective measures. Two options were suggested. One was the “big bang” approach-

- Big Bang approach: It involves an overhaul of-

- The legal framework.

- Processes and systems and-

- Re-writing GST almost de novo.

- A steady-state approach: A “steady-state” approach involved-

- Incremental reforms.

- Solving problems as they arise.

- Plugging loopholes.

- Improving the compliance environment through increased monitoring with better tools.

- The Council chose the second approach and the signs are already showing.

The steps taken-

- Red flag reports: The GSTN has developed red flag reports based on GSTR-1, auto-generated GSTR-2A, GSTR-3B and the national e-way bill system.

- These reports identify non-filers so that action can be taken against active taxpayers who defaulted in filing returns.

- Till November 2019, around 6 lakh dealers had defaulted in furnishing one or more returns from July 2017 involving estimated tax liabilities of around Rs 25,000 crore.

- Increase in the filing: An SOP has been developed for proceeding against such return defaulters and this has helped increase the percentage of filing which has contributed to revenue.

- Making Aadhaar mandatory: To further the ease of doing business, it was decided to grant registration without physical verification and a system of deemed registration was put in place.

- Spot verification has unearthed non-existent dealers and led to the cancellation of around 1 million entities.

- It has now been decided to mandate Aadhaar authentication for taking new registration and thereafter the existing registered taxpayer population would have to undergo Aadhaar authentication in a phased manner.

- Use of analytical tools: Advanced analytic tools are being used to unravel complex networks of firms created just for generating credit and these analyses are being strengthened through machine learning and AI.

- An all-India offence/enforcement database is being built.

- System of data exchange with other agencies: In order to identify dealers posing a “hazard” to revenue and do a 360-degree profile of risky taxpayers, a system of regular data exchange with banks, CBDT, ED, RoC and other agencies is being put in place.

- Fraudsters will find it almost impossible to game the system.

- The new return system set to roll from April 1 is expected to curb incidences of unmatched turnovers and utilisation of un-validated.

- System of e-invoicing: In order to validate and improve the quality and fidelity of invoice reporting and return filing, a system of e-invoicing is proposed to be implemented in a phased manner beginning April 1.

- This will begin with taxpayers with turnovers exceeding Rs 500 crore and will auto-populate e-way bill generation and filing of Anx-1 in the new return system apart from validating credit flow from taxpayers.

Conclusion

These measures will effect qualitative improvement to the compliance eco-system which will not only lead to an improvement in the collection but will also make life easier for taxpayers and tax authorities alike.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: AGR

Mains level: AGR disputes of Telecom companies

The Supreme Court came down heavily on the Department of Telecommunications (DoT) for issuing a notification that asked for no coercive action against telecom companies even though they had not paid the adjusted gross revenue (AGR) dues by the stipulated deadline.

What is AGR?

- Adjusted Gross Revenue (AGR) is the usage and licensing fee that telecom operators are charged by the Department of Telecommunications (DoT).

- It is divided into spectrum usage charges and licensing fees.

What does SC order on AGR mean?

- The order by the top court means that the telecom companies will have to immediately clear the pending AGR dues, which amount to nearly Rs 1.47 lakh crore.

- Vodafone Idea, which has to pay up nearly Rs 53,000 crore, faces the prospect of shutting down business.

- Bharti Airtel, which faces a payout of more than Rs 21,000 crore, could also be in trouble for not paying the AGR dues on time.

- Other than the telcos, non-telecom companies could also be facing huge payouts individually, which amount to total of Rs 3 lakh crore.

What exactly did the government notification say?

- The Licensing Finance Policy Wing of the DoT last month directed all government departments to not take any action against telecom operators if they failed to clear AGR-related dues as per the Supreme Court’s order.

- The order came as a huge relief for operators — mainly Bharti Airtel and Vodafone Idea — that would have otherwise faced possible contempt action for not paying dues by the deadline that ran out on that same day.

No more relief to telecoms

- Bharti Airtel and Vodafone Idea together owe the telecom department Rs 88,624 crore.

- Prior to the DoT order restraining coercive action, the companies had told the government that they would wait for the outcome of the Supreme Court hearing.

- Reliance Jio paid up its dues of Rs 195 crore on January 23.

- As things have turned out, however, the companies have got no relief from the Supreme Court.

What is the background of SC’s AGR order?

- On October 24, 2019, the court had agreed with DoT’s definition of AGR, and said the companies must pay all dues along with interest and penalty.

- Bharti Airtel and Vodafone Idea had tried to persuade DoT to relax the deadline and, after failing, moved the court seeking a review of its judgment.

- The court dismissed the review petition in mid-January, and also did not extend the deadline for paying AGR dues.

- It had, however, agreed to hear the companies’ modification plea.

Where does the government stand in this situation?

- The payout by telecom and non-telecom companies is likely to lead to windfall gains for the central government, which could help it close some of the fiscal deficit gap for the current financial.

- At the same time, however, the government will be under pressure to ensure that the telecom market does not turn into a duopoly if Vodafone Idea does indeed decide to shut shop.

- It will also have to manage the payouts to be done by non-telecom companies as most of them, such as Oil India, Power Grid, Gail, and Delhi Metro Rail Corporation are public sector units.

What does this situation mean for customers and lenders?

- If Vodafone Idea does exit, an Airtel-Jio duopoly will be created, which could lead to bigger bills, considering it was the cutthroat competition in the sector that made mobile telephony and Internet almost universally affordable.

- The AGR issue has triggered panic in the banking industry, given that the telecom sector is highly leveraged.

- Vodafone Idea alone has a debt of Rs 2.2 lakh crore that it has used to expand infrastructure and fund spectrum payments over the years.

- The mutual fund industry has an exposure of around Rs 4,000 crore to Vodafone Idea.

Assist this newscard with:

Explained: Adjusted Gross Revenue (AGR) in Telecom Sector

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: SyRI

Mains level: Debate over right to privacy

- In a first anywhere in the world, a court in the Netherlands recently stopped a digital identification scheme for reasons of exclusion.

- This has a context for similar artificial intelligence (AI) systems worldwide, especially at a time when identity, citizenship and privacy are pertinent questions in India.

SyRI

- Last week, a Dutch district court ruled against an identification mechanism called SyRI (System Risk Indicator), because of data privacy and human rights concerns.

- It held SyRI was too invasive and violative of the privacy guarantees given by European Human Rights Law as well as the EU’s General Data Protection Regulation.

- The Dutch Ministry of Social Affairs developed SyRI in 2014 to weed out those who are most likely to commit fraud and receive government benefits.

- Legislation passed by Dutch Parliament allowed government agencies to share 17 categories of data about welfare recipients such as taxes, land registries, employment records, and vehicle registrations with a private company.

- The company used an algorithm to analyse data for four cities and calculate risk scores.

What were the arguments in court?

- After taking into account community concerns, civil society groups and NGOs launched a legal attack on this case of algorithmic governance.

- Legal criticism mounted, alleging that the algorithm would begin associating poverty and immigrant statuses with fraud risk.

- The Dutch government defended the programme in court, saying it prevented abuse and acted as only a starting point for further investigation instead of a final determination.

- The government also refused to disclose all information about how the system makes its decisions, stating that it would allow gaming of the system.

- The court found that opaque algorithmic decision-making puts citizens at a disadvantage to challenge the resulting risk scores.

- The Netherlands continuously ranks high on democracy indices.

How relevant is this for India?

- Similar to the Supreme Court’s Aadhaar judgment setting limits on the ID’s usage, the Hague Court attempted to balance social interest with personal privacy.

- However, the Aadhaar judgment was not regarding algorithmic decision-making; it was about data collection.

- The ruling is also an example of how a data protection regulation can be used against government surveillance.

- India’s pending data protection regulation, being analysed by a Joint Select Committee in Parliament, would give broad exemptions to government data processing in its current form.

- India’s proposed regulation is similar to the US in the loopholes that could be potentially exploited.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Southern Ocean

Mains level: Role of Southern Ocean in Climate dynamics

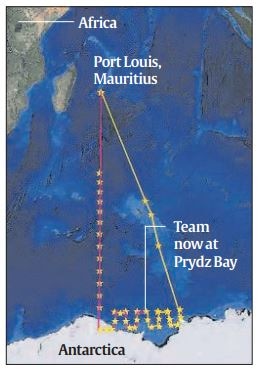

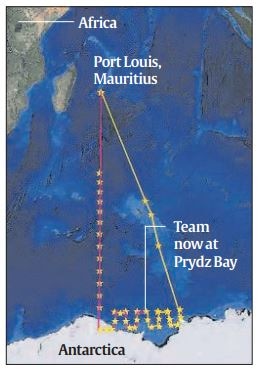

A South African oceanographic research vessel SA Agulhas set off from Port Louise in Mauritius, on a two-month Indian Scientific Expedition to the Southern Ocean 2020. Recently the vessel was at Prydz Bay, in the coastal waters of “Bharati”, India’s third station in Antarctica.

India’s polar mission

- This is the 11th expedition of an Indian mission to the Southern Ocean, or Antarctic Ocean.

- The first mission took place between January and March 2004.

About the Southern Ocean expedition

- The researchers from IITM Pune are collecting air and water samples from around 60 stations along the cruise track.

- These will give valuable information on the state of the ocean and atmosphere in this remote environment and will help to understand its impacts on the climate.

- A key objective of the mission is to quantify changes that are occurring and the impact of these changes on large-scale weather phenomenon, like the Indian monsoon, through tele-connection.

Why study Southern Ocean?

- We know that carbon dioxide is getting emitted into the atmosphere, and through atmospheric circulation goes to the Antarctic and Polar Regions.

- Since the temperature is very low there, these gases are getting absorbed and converted into dissolved inorganic carbon or organic carbon, and through water masses and circulation it is coming back to tropical regions.

- All oceans around the world are connected through the Southern Ocean, which acts as a transport agent for things like heat across all these oceans.

- The conveyor belt that circulates heat around the world is connected through the Southern Ocean and can have a large impact on how climate is going to change due to anthropogenic forces.

Core projects of the expedition

- Study hydrodynamics and biogeochemistry of the Indian Ocean sector of the Southern Ocean; involves sampling seawater at different depths. This will help understand the formation of Antarctic bottom water.

- Observations of trace gases in the atmosphere, such as halogens and dimethyl sulphur from the ocean to the atmosphere. This will help improve parameterizations that are used in global models.

- Study of organisms called coccolithophores that have existed in the oceans for several million years; their concentrations in sediments will create a picture of past climate

- Investigate atmospheric aerosols and their optical and radiative properties. Continuous measurements will quantify the impact on Earth’s climate.

- Study the Southern Ocean’s impact on Indian monsoons. Look for signs in a sediment core taken from the bottom of the ocean

- Dynamics of the food web in the Southern Ocean; important for safeguarding catch and planning sustainable fishing

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Various missions mentioned in the newscard

Mains level: Discovery Program investigations

NASA announced it has selected four Discovery Program investigations to develop concept studies for possible new missions.

What are the new missions?

- Two proposals are for trips to Venus, and one each is for Jupiter’s moon Io and Neptune’s moon Triton.

- After the concept studies are completed in nine months, some missions ultimately may not be chosen to move forward.

DAVINCI+

- DAVINCI+ stands for Deep Atmosphere Venus Investigation of Noble gases, Chemistry, and Imaging Plus.

- This will analyse Venus’s atmosphere to understand how it was formed and evolved, and if it ever had an ocean.

- This will advance understanding of the formation of terrestrial planets.

IVO

- Io Volcano Observer is a proposal to explore Jupiter’s moon Io, which is extremely volcanically active.

- This will try to find out how tidal forces shape planetary bodies.

- The findings could further knowledge about the formation and evolution of rocky, terrestrial bodies and icy ocean worlds in the Solar System.

TRIDENT

This aims to explore Neptune’s icy moon, Triton, so that scientists can understand the development of habitable worlds in the Solar System.

VERITAS

Venus Emissivity, Radio Science, InSAR, Topography, and Spectroscopy will aim to map Venus’s surface to find out why Venus developed so differently from Earth.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Indian Pangolins

Mains level: Wildlife trade and its prevention

The Madhya Pradesh forest department has radio-tagged an Indian Pangolin (Manis crassicaudata) for the first time.

Pangolins

IUCN status: Endangered

- India is home to two species of pangolin.

- While the Chinese Pangolin (Manis pentadactyla) is found in northeastern India, the Indian Pangolin is distributed in other parts of the country as well as Sri Lanka, Bangladesh and Pakistan.

- Both these species are protected and are listed under the Schedule I Part I of the Wild Life (Protection) Act, 1972 and under Appendix I of the Convention on International Trade in Endangered Species (CITES).

- Commonly known as ‘scaly anteaters’, the toothless animals are unique, a result of millions of years of evolution.

- Pangolins evolved scales as a means of protection. When threatened by big carnivores like lions or tigers they usually curl into a ball.

- The scales defend them against dental attacks from the predators.

Why this radio-tagging?

- The radio-tagging aims to know its ecology and develop an effective conservation plan for it.

- The radio-tagging is part of a joint project by the department and non-profit, the Wildlife Conservation Trust (WCT) that also involves the species’ monitoring apart from other activities.

Why protect Pangolins?

- Pangolins are currently the most trafficked wildlife species in the world.

- These Scales has now become the main cause of the pangolin’s disappearance.

- The scales are in high demand in China, where they are used in traditional Chinese medicine.

- Pangolin meat is also in high demand in China and Southeast Asia.

- Consequently, pangolins have seen a rapid reduction in population globally. The projected population declines range from 50 per cent to 80 per cent across the genus.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Pale Blue Dot

Mains level: Voyager 1 mission

The Jet Propulsion Laboratory of the NASA published a new version of the image of Pale Blue Dot.

Pale Blue Dot

- The ‘Pale Blue Dot’ is one of the most iconic images in the history of astronomy.

- It shows Earth as a single bright blue pixel in empty space within a strand of sun rays, some of which are scattering from and enlightening the planet.

- The original image was taken by the Voyager 1 mission spacecraft on February 14, 1990 when it was just beyond Saturn.

- At the behest of astronomer Carl Sagan, the cameras were turned towards Earth one final time to capture the image.

- After this, the cameras and other instruments on the craft were turned off to ensure its longevity.

About Voyager 1

- Voyager 1 is a space probe launched by NASA on September 5, 1977.

- Having operated for more than 42 years, the spacecraft still communicates with the Deep Space Network to receive routine commands and to transmit data to Earth.

- At a distance of 148.67 AU (22.2 billion km) from Earth as of January 19, 2020 it is the most distant man-made object from Earth.

- The probe’s objectives included flybys of Jupiter, Saturn, and Saturn’s largest moon, Titan.

The Family Portrait of the Solar System

- The Pale blue dot image was a part of series of 60 images designed to produce what the mission called the ‘Family Portrait of the Solar System’.

- This sequence of camera-pointing commands returned images of six of the solar system’s planets, as well as the Sun.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Nagpur Orange

Mains level: Export promotion of Nagpur Oranges

The first consignment of Nagpur oranges was flagged off to Dubai from Vashi, Navi Mumbai.

Nagpur Orange

- Nagpur orange is rustic and pockmarked exterior which is sweet and has juicy pulp.

- It gives the city of Nagpur its pseudonym Orange City.

- It oranges blossom during the Monsoon season and are ready to be harvested from the month of December.

- The Geographical Indication was accorded to the Nagpur Orange by the registrar of GIs in India and is effective as of April 2014.

The best breed

- Nagpur mandarin in one of the best mandarins in the world. Production of this fruit crop in the central and western part of India is increasing every year.

- Mrig crop (monsoon blossom), which matures in February – March, has great potential for export since arrivals of mandarin fruit in international market are less during this period.

- In the whole region only one variety of Nagpur Mandarin is grown.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now