Note4Students

From UPSC perspective, the following things are important :

Prelims level: Fiscal deficit and its relation with inflation, CAD etc.

Mains level: Paper 3- Should India consider a package to ease the sufferings inflicted by the covid-19 even at the cost of large fiscal deficit?

Context

The Centre can afford to step up its COVID-19 assistance to a higher scale; fiscal deficit is no worry.

Comparison with the US

- Unemployment benefit in the US: In the United States, for instance, where the lockdown has raised the number of persons filing unemployment claims from 2.8 lakh to 6.6 million in a matter of days, those affected can fall back on unemployment benefit.

- Comparison of packages: The US government has approved a package of ameliorative steps costing roughly 10% of that country’s GDP to cope with the crisis.

- In India by contrast, the Finance Minister’s package comes to less than 1% of its GDP; and much of it is just a repackaging of already existing schemes.

- New expenditure comes to just a little over half of the ₹1.7-lakh crore earmarked for the package.

- Migrant workers are not the beneficiary: Besides, none of the steps will help the migrant workers; not even the larger foodgrain ration which in principle could, because most of them would have ration cards back home rather than in the places where they stay.

What can be done?

Consider the cash transfer

- Many economists and civil society activists had suggested a cash transfer of ₹7,000 per month for a two-month period to the bottom 80% of households to tide over the crisis, in addition to enhanced rations of foodgrains and the inclusion of certain other essential commodities within the ration basket.

- The cost of their proposed cash transfers alone would come to ₹3.66-lakh crore, which is more than 10 times the cash transfers provided in the Finance Minister’s package.

- Providing assistance on the scale proposed by civil society organisations is necessary; it will no doubt pose logistical problems, but not financial problems.

- Two possible effects of cash transfer: Even if all of it is financed through a fiscal deficit for the time being, the economic implications of such an enlarged deficit would not be forbidding.

- These implications can manifest themselves in two ways: one is through inflation, and the other by precipitating a balance of payments problem. Let us consider each of these.

Effect of cash transfer on inflation

- As long as supplies of essential commodities are plentiful and these are made available through the Public Distribution System to the vast majority of the people so that they are insulated against the effects of inflation, any inflation per se should not be a matter of great concern. This is the case in India at present.

- Foodgrain stocks with the FCI: The supply of the most essential of goods, food grains, is plentiful. Currently, there are 58 million tonnes of foodgrain stocks with the government, of which no more than about 21 million tonnes are required as buffer-cum-operational stocks.

- This leaves a surplus of 37 million tonnes which can be used for distribution as enhanced ration, or for providing a cushion against inflation.

- The rabi crop is supposed to be good; as long as it is safely harvested, this would further boost the government’s food stocks.

- Rise in demand of other commodities: Likewise, the supplies of other essential commodities which consist of manufactured goods and where output has been demand-constrained all along will get boosted in response to higher demand; and in special cases, imports may have to be resorted to.

- There is in short no reason to think that inflation of a worrisome magnitude will follow if the fiscal deficit is increased.

- What about the multiplier effect? There is an additional factor here. The increase in total demand caused by an initial increase in demand, which is financed by a fiscal deficit, is a multiple of the latter.

- Now in a situation like the present, when even if the lockdown is lifted social distancing and restrictions on social activities will continue, the value of the multiplier will be lower than usual.

- People, in short, would hold on to purchasing power to a much greater extent than usual because of the continuing restrictions on demand, which would act as an automatic anti-inflationary factor.

- Of course, there will be shortages of some less essential commodities and also hoarding on account of such shortages. But since these shortages will be expected to be temporary, a result of the pandemic unlikely to last long, there will be a damper on hoarding.

Effect of cash transfer on deficit

- The price rise of non-rationed commodities: If inflationary expectations are strong and persistent, then the prices of non-rationed commodities may rise sharply for speculative reasons.

- How the government can prevent the price rise? But the government can prevent such expectations, by adopting measures such as bringing down petro-product prices, taking advantage of the collapse of world oil prices.

- A larger fiscal deficit, therefore, need not cause disquiet on account of inflation.

- Balance of payment issue: On the balance of payments front, the worry associated with a larger fiscal deficit is financial flight caused by frightened investors.

- Some financial flight is already happening, with the rupee taking a fall.

- Rush to dollar: This flight is not because of our fiscal deficit but because, whenever there is panic in financial markets, the tendency is to rush to dollars, even though the cause of the panic may lie in the United States itself.

- Using foreign exchange reserves: India has close to half a trillion dollars of foreign exchange reserves. These can be used, up to a point, to check the flight from the rupee to the dollar.

- Restriction on capital outflow: If the flight nonetheless persists, then India will have a legitimate reason for putting restrictions on capital outflows in the context of the pandemic.

Way forward

- The Centre must not worry about its fiscal deficit; and since the State governments will bear a substantial expenditure burden on account of the pandemic.

- The Centre must make more resources available to the states.

- The centre should raise their borrowing limits, perhaps double their current limits as a general rule, apart from negotiating the magnitude of fiscal transfers it should make towards them.

Conclusion

If the hardships of the people are not ameliorated through larger government expenditure, because of the fear that the larger fiscal deficit required for it would frighten finance into fleeing, then the privileging of finance over people would have reached its acme.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 2-How steps government must take to ensure that the stranded labour are not left without food.

Context

The impact of the lockdown, effected from midnight of March 24, has been particularly severe on migrant workers. The state must utilise FCI stock for those who have ration cards and those who don’t.

India’s labour force and impact of lockdown on it

- Nearly one-fifth of India’s labour force consists of internal migrants.

- As per the 2011 census, a quarter of the urban population consists of migrants.

- These tend to be predominantly male, from the less developed northern states, in the lower-income strata, and dependent on daily wages or precarious livelihoods.

- The impact of the lockdown has been particularly severe on migrant workers.

- Uncertainty and reverse migration: Due to uncertainty over the duration of the lockdown, and about their own livelihoods and food security, the lockdown has led to massive reverse migration from cities back to villages.

- Further, due to the absence of train and bus services, many of these workers took to simply walking back.

- The ground reality of inadequate preparation or insufficient provision means that neither their anxiety nor plight is assuaged.

- Migrant workers tend to depend on public eating places or community arrangements for food.

- Under a lockdown, there is simply no choice for them, except to depend on the government’s efforts or charitable organisations.

Utilising the grain stocks with the FCI

- The government has a large stock of wheat and rice procured over the last three years.

- Stock in excess of buffer norm: The buffer norm for April 1 is 21.4 million tonnes, against which the country had about 7 million tonnes on March 1: This comprises 27.5 million tonnes of wheat and 50.2 million tonnes of rice.

- In most districts of India, the Food Corporation of India and state agencies have a storage capacity of more than the three months requirement of the public distribution system.

- The warehouses are spread across all the districts in every state.

- The government has already announced that an additional quantity of five kg of foodgrains will be provided, free of cost, to all ration card holders for the next three months.

- Most of the unorganised labour and families migrating back from their place of work will probably have their ration cards in the villages itself.

- So, it should not be much of a problem for them to find food during the period of lockdown.

What should the state do to feed those who do not have ration cards

- For those who do not have ration cards in the villages, it is the right time to use this extra stock of foodgrains.

- Using school and Anganwadi infrastructure: In villages, primary schools have facilities for cooking mid-day meals for children. Some Anganwadi also have this facility. This infrastructure can be used to provide cooked meals to those who do not have ration cards in the villages.

- The government can easily offer to meet their requirement of wheat and rice over the next three weeks and panchayats can be asked to meet a part of the expenditure required to purchase vegetables, spices and cooking oil.

- The village panchayats which take up such a feeding programme must be provided Rs 20 per person per day from State Disaster Relief Fund for the expenditure on vegetables, cooking oil, spices, which are not covered by the PDS.

- In some villages, the local community may also be willing to help the panchayats to feed such people.

- Efforts must also be made by the panchayats to raise donations in kind from the local community for rabi pulses like chana (chickpea), masoor (lentil), matar (field pea) which are available in plenty in pulse-growing states.

How to feed those who are stuck in the cities

- A number of labourers and self-employed: In urban areas, as per the Periodic Labour Force Survey, there were about 6 crore casual labourers and four crore self-employed persons in 2017-18.

- Even after the reverse migration to villages, there would still be millions of them who are stuck in cities at their place of work.

- These are people who do not have any savings or source of income which can sustain them during the period of the lockdown. These people living in slums, in the poorer areas of cities, are in need of urgent assistance for food, at least for the next three weeks.

- The most distressed at present are those stuck in the cities, or who have been walking hundreds of kilometres to reach their homes in small towns and villages.

- Allocating funds form relief funds: The district collectors should be allocated funds from the State Disaster Relief Fund to provide them with food and open all community buildings en route for them.

- Engaging various players: The states must engage NGOs, factories and charities including religious organisations to raise funds for meeting the expenditure on milk, eggs, cooking oil and vegetables, and even soaps and sanitisers.

- More than 67,000 NGOs are registered with the Niti Aayog on their NGO Darpan platform — which was created to bring about a greater partnership between the government and the voluntary sector and to foster transparency, efficiency and accountability.

- This is the time to use such a platform.

- The Centre can easily provide free rice and wheat to the NGOs from its stock and the NGOs can provide cooked meals in urban areas for the next three weeks.

- For one crore individuals, for three weeks, the government needs to provide just about 75,000 tonnes of rice. Since the milling of wheat would be difficult due to the closure of flour mills, only rice can be provided at this stage.

Conclusion

The rabi harvest is expected to be a bumper one. The utilisation of the FCI stock — for not only the ration card holders but also the non-ration cardholders, and for providing food to the poor stuck in urban areas — is the most appropriate use of the foodgrain stock with the government. This is urgent and must be done.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 3- Oil war in international oil market and implications for India.

Context

In the post-COVID world, India will, once again, confront the challenge of oil and gas supply security. We should, therefore, ask: What will be the landscape of the petroleum sector, post-COVID? And what should India do now to prepare for an uncertain and contingent energy future?

Oil war and the death knell of OPEC

- The concept of MAD (Mutually Assured Destruction) deterred the nuclear powers during the Cold War. It has had no such effect on the oil powers.

- Implications of the decision of Saudi Arabia and Russia: At a time when the virus had pushed the global economy into recession, Russia and Saudi Arabia took a set of decisions last month that knocked the economic props from under the oil market.

- What were the reasons behind the decisions: The Saudis decided to flood the market to hold onto market share and the Russians accepted the consequent decline in prices to push the US shale industry to the wall.

- Future of OPEC: Both may achieve their objectives but they have sounded the death knell of OPEC and possibly that of the oil industry as well.

Two reasons for the decline in the oil prices

- Today, the price of oil, at just above $30/bbl , is at its lowest in a decade, and volatile downwards. The average price in 2019 was $64/bbl.

- The reason is two-fold.

- One, the Saudis have ramped up production from 9.8mbd (before the March meeting) to in excess of 12 mbd today.

- Two, there has been an unprecedented COVID-induced crash in demand. This is because of the lockdown of the two main drivers of oil consumption — transportation and industry.

- It is estimated that oil consumption in the current quarter will fall by approximately 25 mbd.

- This is almost as much as OPEC’s production.

- The Saudis and Russia may still come to an understanding that rallies the price.

- There will be three major implications for the oil-producing countries.

1. Budgetary crisis

- Every major oil-exporting country will face a budgetary crisis.

- Qatar has the most robust balance sheet of all OPEC members. But it still needs an oil price of around $40/bbl to balance its books.

- Algeria has the weakest. It needs an excess of $100/bbl.

- Saudi Arabia is at the Algerian end of the spectrum requiring a price of around $80/bbl.

- Abundant foreign reserves: This does not mean these countries are about to go financially belly up. Most of them, the Gulf producers, in particular, have abundant sovereign reserves.

- But what it does mean is they will be hard-pressed to sustain their social and economic commitments.

- They will have to cut back on subsidies, raise taxes and the citizens will be required to tighten their belts.

- What India should do? India should build into its oil supply plans with the likelihood of civil strife in these countries.

2. Reconfiguration of the oil industry will take place

- Already, at current prices, a large number of companies are finding it difficult to cover their cash costs and have been forced to cut production and shutter operations.

- At even lower prices, they will become bankrupt.

- Whatever the final outcome, one fact is clear. Those that survive the carnage will have substantially slimmed balance sheets and reduced valuations.

- Exxon’s market capitalisation has, for instance, halved over the past month.

- Implication for India: Against this backdrop, we should drop the expectation of international interest in BPCL. Or for that matter ME investment into India.

- Ratnagiri refinery: The $40-billion Ratnagiri refinery project by Saudi Aramco and UAE will certainly not see the light of day.

- We should also expect a drop in the intensity of domestic exploration.

3. Behavioural changes and uncertainties

- The world, post-COVID will be different from the world pre-COVID. Behaviours will shift and these will deepen uncertainties.

- “Social distancing” may change the dynamics of “shared mobility”.

- Teleporting may reduce business travel.

- Heightened awareness of the porosity of national boundaries may accelerate the push towards decarbonisation? These uncertainties will push the petroleum market deeper into no man’s land.

Way forward for India

- Whatever be the shape of the post- COVID international petroleum market, India will be dependent on it to secure its domestic energy requirement. The question should, therefore, be asked. What should the decision-makers do today to respond to such a contingent and uncertain future?

- 1. Increase the strategic reserves: It should fill the oil caverns with strategic reserves. Prices may fall further but rather than bottom fish, it should leverage the availability of capacity to secure discounted supplies.

- The world has run out of storage capacity and producers may pay premium dollar to find space for their unsold cargoes.

- 2. Reduce the dependency and risk: India should increase its imports of gas (LNG ) from Australia, Africa and the US.

- This will reduce the political risks of dependency on oil supplies from the Middle East.

- Gas is also now economically competitive. The landed price of LNG is low enough to kick-start some of the stranded gas-based power plants.

- 3. Increase operational efficiency of oil companies: It should unthread the “patchwork quilt of authority” exercised by bureaucrats, regulators and politicians, which today stifles management and operational efficiency of the petroleum companies.

- 4. Integrated energy policy: India should create an institutional basis for an integrated energy policy. If there is one message we must internalise from COVID, it is the importance of collaboration and coordination.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not Much

Mains level: Read the attached story

(This newscard is the excerpt from an article published in the TOI, authored by former RBI governor Raghuram Rajan. It discusses a series of reformative measures to boost our economy once the lockdown restrictions are eased.)

Context

- Economically speaking, India is faced today with perhaps its greatest emergency since Independence.

- The global financial crisis in 2008-09 was a massive demand shock but our financial system was largely sound, and our government finances were healthy.

- None of this is true today as we fight the coronavirus pandemic.

- With the right resolve and priorities, and drawing on India’s many sources of strength, it can beat this virus back and even set the stage for a much more hopeful tomorrow.

To begin with: 21 day Lockdown

- The immediate priority, of course, is to suppress the spread of the pandemic through widespread testing, rigorous quarantines, and social distancing.

- The 21-day lockdown is a first step, which buys India time to improve its preparedness.

- The government is drawing on our courageous medical personnel and looking to all possible resources – public, private, defence, retired – for the fight, but it has to ramp up the pace manifold.

- It will have to test significantly more to reduce the fog of uncertainty on where the hotspots are, and it will have to keep some personnel and resources mobile so that they can be rushed to areas where shortages are acute.

Restarting with caution

- The 21 day lockdown is about a week ahead to get lifted. It is hard to lockdown the country entirely for much longer periods, so we should also be thinking of how we can restart certain activities.

- Restarting requires better data on infection levels, as well as measures to protect those returning to work.

- Healthy youth, lodged with appropriate distancing in hostels at the workplace, maybe ideal workers for restarting.

Pacing up manufacturing

- Since manufacturers need to activate their entire supply chain to produce, they should be encouraged to plan on how the entire chain will reopen.

- The administrative structure to approve these plans and facilitate movement for those approved should be effective and quick – it needs to be thought through now.

Most crucial: Ensuring workforce sustenance

- In the meantime, policymakers need to ensure that the poor and non-salaried lower middle class who are prevented from working for longer periods can survive.

- Direct transfers to households may reach most but not all, as a number of commentators have pointed out.

- Furthermore, the quantum of transfers seems inadequate to see a household over a month.

- The state and Centre have to come together to figure out quickly some combination of public and private participation and DBTs that will allow needy households to see through the next few months.

- We have already seen one consequence of not doing so – the movement of migrant labour. Another will be people defying the lockdown to get back to work if they cannot survive otherwise.

Gearing up for fiscal shocks

- Our limited fiscal resources are certainly a worry. However, spending on the needy at this time is a high priority use of resources, the right thing to do as a humane nation.

- This does not mean that we can ignore our budgetary constraints, especially given that our revenues will also be severely affected this year.

- Unlike the US or Europe, which can spend 10% more of GDP without fear of a ratings downgrade, we already entered this crisis with a huge fiscal deficit, and will have to spend yet more.

- A ratings downgrade coupled with a loss of investor confidence could lead to a plummeting exchange rate and a dramatic increase in long term rates in this environment, and substantial losses for our financial institutions.

Channelizing expenditures

- So we have to prioritise, cutting back or delaying less important expenditures, while refocusing on immediate needs.

- At the same time, to reassure investors, the government could express its commitment to return to fiscal rectitude.

- The govt. must back up its intent by accepting the setting up of an independent fiscal council and setting a medium term debt target, as suggested by the NK Singh committee.

Boosting up Industries

1) MSMEs

- Many MSMEs already weakened over the last few years, may not have the resources to survive.

- We need to think of innovative ways in which bigger viable ones, especially those that have considerable human and physical capital embedded in them, can be helped.

- SIDBI can make the terms of its credit guarantee of bank loans to SMEs even more favourable, but banks are unlikely to want to take on much more credit risk at this point.

- The government could accept responsibility for the first loss in incremental bank loans made to an SME, up to the quantum of income taxes paid by the SME in the past year.

2) Large industries

- Large firms can also be a way to channel funds to their smaller suppliers. They usually can raise money in bond markets and pass it on.

- Banks, insurance companies, and bond mutual funds should be encouraged to buy new investment-grade bond issuances, and their way eased by the RBI.

- The government should also require each of its agencies and PSUs, including at the state level, to pay their bills immediately, so that private firms get valuable liquidity.

Looping in everyone’s participation

- The government should call on people with proven expertise and capabilities, of whom there are so many in India, to help it manage its response.

- It may even want to reach across the political aisle to draw in members of the opposition who have had experience in previous times of great stress like the global financial crisis.

- If, however, the government insists on driving everything from the PMO, with the same overworked people, it will do too little, too late.

Conclusion

- Globally, it is said that India reforms only in crisis.

- Hopefully, this otherwise unmitigated tragedy will help us see how weakened we have become as a society, and will focus our politics on the critical economic and healthcare reforms we sorely need.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Great Economic Depression, Slowdown vs. Depression

Mains level: Impact of the depression on colonial India

With the novel coronavirus pandemic severely affecting the global economy, some experts have begun comparing the current crisis with the Great Depression — the devastating economic decline of the 1930s that went on to shape countless world events.

Looming depression ahead

- Experts have warned that unemployment levels in some countries could reach those from the 1930s era, when the unemployment rate was as high as around 25 per cent in the United States.

- Currently, unemployment levels in the US are already estimated to be at 13 per cent, highest since the Great Depression.

What was the Great Depression?

- The Great Depression was a major economic crisis that began in the United States in 1929, and went to have a worldwide impact until 1939.

- It began on October 24, 1929, a day that is referred to as “Black Thursday”, when a monumental crash occurred at the New York Stock Exchange as stock prices fell by 25 per cent.

- Though the crash was triggered by minor events, the extent of the decline was due to more deep-rooted factors such as a fall in aggregate demand, misplaced monetary policies, and an unintended rise in inventory levels.

- In the United States, prices and real output fell dramatically. Industrial production fell by 47 per cent, the wholesale price index by 33 per cent, and real GDP by 30 per cent.

What caused Great Depression?

The causes of the Great Depression are extremely complex and disputed to this day. The three main factors are:

- Financial instability and credit cycles: A period of stability encouraged more borrowing and lending than prudent, sowing the seeds for future instability.

- Monetary contraction, the gold standard, and bank runs: Monetary policy, driven in large part by the gold standard, tightened credit at the wrong time fueling bank-runs and economic slowdown.

- Debt deflation: Excess private debt created a dangerous condition where no one wanted to spend, causing deflation and economic weakening.

Worldwide impact

- The havoc caused in the US spread to other countries mainly due to the gold standard, which linked most of the world’s currencies by fixed exchange rates.

- In almost every country of the world, there were massive job losses, deflation, and a drastic contraction in output.

- Unemployment in the US increased from 3.2 per cent to 24.9 per cent between 1929 and 1933. In the UK, it rose from 7.2 per cent to 15.4 per cent between 1929 and 1932.

Latent outcomes

- The Depression caused extreme human suffering, and many political upheavals took place around the world.

- In Europe, economic stagnation that the Depression caused is believed to be the principal reason behind the rise of fascism, and consequently the Second World War.

- It had a profound impact on institutions and policymaking globally and led to the gold standard being abandoned.

How did Great Depression impact India?

- The Depression had an important impact on India’s freedom struggle.

- Due to the global crisis, there was a drastic fall in agricultural prices, the mainstay of India’s economy, and a severe credit contraction occurred as colonial policymakers refused to devalue the rupee.

- The effects of the Depression became visible around the harvest season in 1930, soon after Mahatma Gandhi had launched the Civil Disobedience movement in April the same year.

1) Rural India mainstreamed into freedom struggle

- The fallout made substantial sections of the peasantry rise in protest and this protest was articulated by members of the National Congress.

- There were “No Rent” campaigns in many parts of the country, and radical Kisan Sabhas were started in Bihar and eastern UP.

- Agrarian unrest provided a groundswell of support to the Congress, whose reach was yet to extend into rural India.

2) INC gained momentum

- The endorsement by farming classes is believed to be among the reasons that enabled the party to achieve its landslide victory in the 1936-37 provincial elections held under the Government of India Act, 1935.

- This is marked as a significant event in the history of INC as it flourished the party’s political might for years to come.

Back2Basics

Slowdown vs recession vs depression

- Slowdown simply means that the pace of the GDP growth has decreased. During slowdown, the GDP growth is still positive but the rate of growth has decreased.

- Recession refers to a phase of the downturn in the economic cycle when there is a fall in the country’s GDP for two quarters. It is a period of decline in total output, income, employment and trade, usually lasting six months to a year.

- Depression is a prolonged period of economic recession marked by a significant decline in income and employment. It is a negative GDP growth of 10% of more, for more than 3 years.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not Much

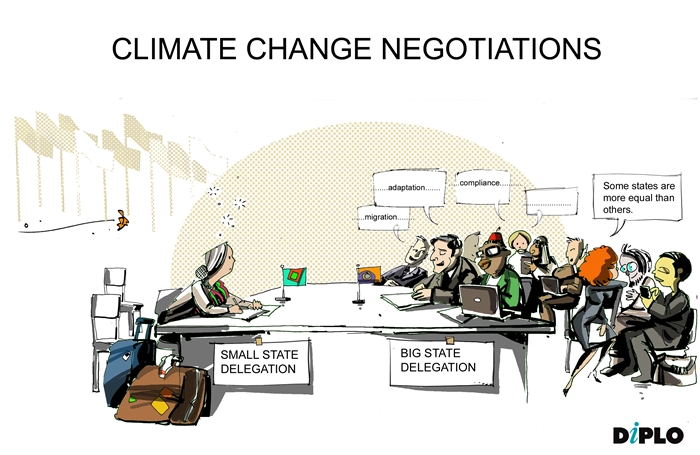

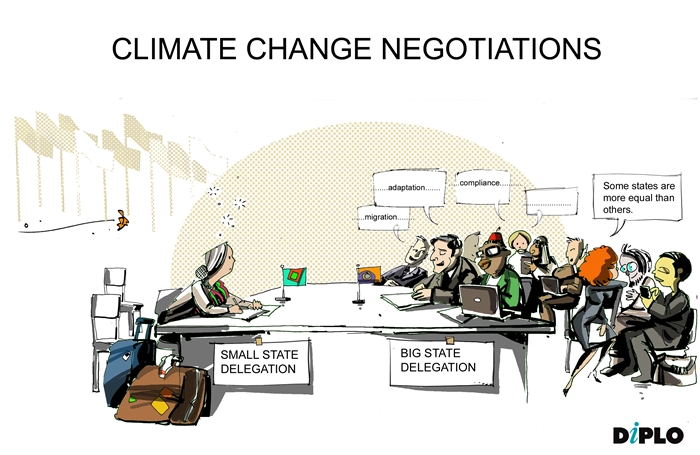

Mains level: COVID-19 and its impact on climate change negotiation

Context

- Amidst the pandemic, people are breathing cleaner air and are witness to clearer, bluer skies as the human movement has been restricted due to lockdowns imposed by various countries.

- But while the air may be getting cleaner, the lockdowns are not exactly good news for climate change research.

- Climate talks are witnessing setbacks in the form of funding cuts, cancelled climate conferences and reduced political will to tackle climate change.

COVID-19 impacting climate change research

- The hard paced climate change research has been halted and it might become difficult to restart the conversation around it, even after the pandemic is brought under control.

- The major projects that were scheduled to gather environmental data have all been cancelled or postponed and the crisis has also cast a shadow on routine monitoring of weather and climate change.

- Further, because commercial flights are running at a lesser frequency, it has also become difficult to collect ambient temperatures and the wind speed, which is taken by in-flight sensors.

- The other reason that other research has more or less been halted is because of restrictions including lockdowns, insistence on working from home and other social distancing requirements.

Scope for a back seat

- Due to the looming health crisis, human kind’s immediate survival is the biggest concern at the moment.

- However, completely ignoring environmental policy may not be in humanity’s best interest.

- Largely we still view the environment, and life on earth, as separate. This separation is a dangerous delusion.

- We can and must do better if we want to prevent the next infectious pandemic.

Climate change and infectious diseases are not separate

- The two are not directly related, which is to say that climate change did not lead to the spread of the coronavirus.

- However, there is a possibility that climate change could have exacerbated the impact of COVID-19 by making the consequences worse for some humans.

- For instance, air pollution’s impact on human health could make some consequences of the disease more severe for a few humans.

- A 2003 study on air pollution and the case fatality rate for SARS showed that people exposed to air pollution were more likely to suffer severe consequences from the disease.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Amma Canteen

Mains level: Food subsidization and its impact

The Amma Canteen, a delivery system to provide urban food security in Tamil Nadu, has become an effective mechanism in reaching the needy during the lockdown.

AMMA Canteen

- Amma Unavagam better known as Amma Canteen is a food subsidization programme run by the Government of Tamil Nadu.

- Under the scheme, municipal corporations of the state-run canteens serving subsidised food at low prices.

- The dishes are offered at low prices: ₹1 for an idli, ₹5 for a plate of sambar rice, ₹5 for a plate of “Karuvapellai Satham” (Curry leaves rice) and ₹3 for a plate of curd rice.

Feeding the stranded

- Migrants usually benefit from this canteen scheme. It is not uncommon to see policemen, municipal workers and people from the media having their breakfast in these canteens.

- The system, in short, has ensured urban food security and is a boon to migrants during lockdown. There are, thus, unexpected but pleasant benefits from this scheme.

Reasons for success

- It is a delivery system with minimum leakages and has reached to its target group very effectively compared to the PDS system.

- People realized the benefits of the scheme in due course of time and thus it emerged popularly.

A lesson for all

- Welfare schemes are started with the intention to provide benefits to vulnerable sections of society.

- The success of any welfare scheme depends on the seriousness of the people at the helm of affairs, the efficiency of the scheme’s functionaries and the involvement of the people.

- During the process of implementation, some deserving people get excluded from the scheme, while some of those who were undeserving manage to enjoy its benefits.

- Welfare schemes deliver unexpected but pleasant benefits sometimes.

Way forward

- For such a welfare scheme to be successful, it must be launched in letter and spirit.

- The benefits of the schemes cannot be realized at pan India level in the absence of a good delivery system.

- These states should explore the possibility of utilising available infrastructure in existing private canteens and hotels (closed during lockdown).

- This measure would not only help migrant workers but also provide employment to workers who remained unemployed since the lockdown came into effect.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Drive-through Testing

Mains level: Coronovirus outbreak and its mitigation

To work around the challenges of home-based testing in the country, a New Delhi based firm has offered ‘drive-through test’ for COVID-19.

Drive-through Testing

- Those who feel sick drive up to a test centre where nurses wearing protective gear collect a nose or throat sample from the car itself.

- Results are mailed or messaged in a day.

- This method of mass testing has allowed reduced contact between patients and healthcare workers, thereby lessening the chances of transmission.

- South Korea has led the world in the number of tests per million to check for coronavirus infection through this method.

Germany: leading through examples

- Germany is conducting around 3,50,000 coronavirus tests a week, far more than any other country.

- It means that more people with few or no symptoms are reported thereby increasing the number of known cases and adequate quarantines.

Limitations (for India)

- We have seen so far is that many are uncomfortable with the home collection process.

- Some people are worried that lab personnel visiting home in full protective gear would scare the neighbours.

- There are also instances when spouses of some healthcare personnel have separated for a while.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Pink Supermoon

Mains level: NA

A supermoon is all scheduled to show up in the sky on April 7. It would be the biggest and brightest full moon of 2020.

Pink Supermoon

- According to NASA, a supermoon takes place when a full moon is at its closest to the Earth.

- When the full moon appears at perigee (closest point from the earth) it is slightly brighter and larger than a regular full moon — and that is what we call a “supermoon.”

- They are called Supermoons because they are 7 per cent bigger and 15 per cent brighter, compared to an average full Moon.

- The moon will not be originally pink in colour. It got its name from the pink wildflowers – Wild Ground Phlox – that bloom in the spring and are native to North America.

- It is also called Paschal moon because, in the Christian calendar, this is used to calculate the date for Easter – the first Sunday after the Paschal Moon is Easter Sunday.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now