Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 3- Provisions in the budget to revive the economy-need for the fiscal stimulus, policies of the Government with respect to agriculture.

Context

The stimulus needs to continue and the reforms will help to keep the economy going. If gross savings and investment rates keep on falling it is difficult to revive the economy.

What was expected in the last budget?

- Increase in pubic investment: The first thing, it said, was to increase public investment and not play statistical or token announcement games.

- The upswing in manufacturing growth, from negative to slightly less than 3 per cent (not industrial growth, because that includes mining and electricity), needed consolidation.

- Real outlays in infra did not go up: Real outlays on the infrastructure needed to go up, but they did not.

- So the push to private demand and a virtuous cycle of growth was missed.

- The implicit numbers in the Budget math comprise growth of around 7 per cent, assuming a 5 per cent inflation rate.

Prospects of the Agri-sector

- A good sign in Agri in midterm: For agriculture, in the medium-term, we are alright. Kharif grain production was 6.4 per cent higher than the previous five-year average output.

- Kharif oilseeds output around eleven lakh tonnes above the earlier year.

- This was, however, based on a delayed monsoon which caused problems and anxieties in the second quarter of this year.

- Nightmare of government unloading grain in the market: Foodgrains are doing well and we have huge food stocks.

- But, instead of a blessing, the government turned public operations in grain into a nightmare by announcing that FCI will unload grain at a reserve price less than MSP.

- Rabi acreage recovered and is now 8 per cent more than last year, but the policy of government operations to reduce the market price of grain by its intervention is a nightmare.

- This is bound to affect input growth in the expanded acreage in the winter crops.

Wrong policy in Agriculture

- Terms of trade against agriculture: The terms of trade are going against agriculture, according to CACP (Commission for Agricultural Costs & Prices) estimates, and selling of the grain will make it worse.

- While the fundamentals are alright, to wallop the farmer with a “cut in the reserve price” would harm the farmers.

- The rabi report of CACP will say that the terms of trade have gone down more.

Conclusion

The Government should continue with the stimulus and opt for the reforms in the economy only to keep the economy going. If the gross savings and investment rates keep falling it would be difficult to revive the economy. If savings keep up, the government will have actual space to divert some real resources to infrastructure investment.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 2- 6th Schedule, Demand for separate states in North-East.

Context

It is to be seen if the pact will lead to true autonomy, true peace, and true development.

What the pact involved?

- Which groups signed the deal?

- Four factions of the National Democratic Front of Bodoland (NDFB), along with an influential Bodo students’ organization and a Bodo civilian pressure group, signed the peace agreement with the central and Assam governments.

- What are the major concessions given?

- The Bodoland Territorial Area Districts, the name given to Kokrajhar, Baksa, Chirang and Udalguri, the four contiguous districts bordering Bhutan and Arunachal Pradesh, will now be known as Bodoland Territorial Region.

- Acknowledgement of Bodo homeland: The changed nuance from districts to the region is significant as it acknowledges a Bodo homeland within the state of Assam, without separating from Assam.

- Why this acknowledgement matters: This is dialled down from earlier rebel demands for a breakaway state and later suggestions for Union territory status.

- What is the significance of the change from district to the region?

- Satisfying identity aspiration: The renaming is designed to satisfy the identity and aspirations of the Bodo people.

- Not ceding territory solved tricky matter: Renaming also solved the politically tricky matter of ceding territory for the government of Assam.

- Ceding territory would also have fuelled similar demands from the other parts of the state like- Karbi Anglong, Dima Hasao and Cachar, which also have homelands of non-Ahom ethnicities.

- Avoiding similar demand from other states: Indeed, it could have affected the ongoing Naga peace process, leading Naga rebels to demand territorial and administrative autonomy in Naga homelands in Manipur.

Scope of the success of the pact

- Inherent vulnerability: There is already an inherent vulnerability to the Bodo peace deal even without the overhang of ceding territory.

- This is rooted in the birth of the Bodo rebellion, which began in the 1980s on account of administrative and development apathy of the state of Assam.

- Feeling of subsuming in Bodo: A feeling that Bodo, the people, the language, the identity, was subsumed by the Assamese and migrants.

- The relation between NDFB and the Front: The Bodoland People’s Front, is in majority in the District council. Will the front be comfortable with newly peaceable colleagues of NDFB?

Conclusion

The Government of Assam needs to ensure that the pact signed changes the situation on the ground and leads to a development on the ground. The state also needs to allay the fears in the Bengali-speaking minority. Moreover, true autonomy, true peace, and true development are always worth more than the paper on which they are promised.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 3- Digital payments in India, growth potential, various security challenges and how to tackle it.

Context

Digital payments in India are witnessing consistent growth at a compound annual growth rate (CAGR) of 12.7%.

Growth potential and challenges involved in digital payments

- Expected growth in mobile wallet payment: The mobile wallet market is expected to continuously grow at a CAGR of 52.2% by volume between 2019-23, according to a recent report by KPMG.

- This digital explosion can be seen in the accelerating rise in the download and use of electronic wallets as well as an unprecedented increase in digital transactions/payments.

- UPI/IMPS use growth: Payment systems such as UPI/IMPS are likely to register average annualised growth of over 100%, according to RBI’s 2021 vision document.

- Challenge of Cybersecurity: Cybersecurity is one of the most critical challenges faced by stakeholders of the digital payment ecosystem.

- Types of risks involved: With more and more users preferring digital payments, the chances of getting exposed to cybersecurity risks such as-

- Online fraud

- Information theft.

- Malware or virus attacks are also increasing.

- Digital payment frauds account for about half of all bank frauds in India.

Steps taken by the RBI

- Guidelines issued: In view of risks, the Reserve Bank of India (RBI) has also issued some guidelines as security and risk mitigation measures for digital payments.

- It has also issued guidelines that limit the liability of customers on unauthorised electronic banking transactions

- Steps taken: The central bank has taken steps for securing card transactions, internet banking, electronic payments, ATM transactions, and prepaid payment instruments (PPIs).

Securing the fintech revolution

- Fraudsters building advanced technologies: The changing nature of cybersecurity attacks such as-

- Web application attack.

- Ransomware.

- Reconnaissance.

- The DDoS attack clearly establishes cyber-risk as a new reality.

- What needs to be done to secure the fintech revolution?

- A robust regulatory framework.

- An effective customer redressal framework.

- Foolproof security measures to enable confidence and trust.

- Incentives for larger participation and benefits similar to cash transactions- are some measures that can help ensure long-term success for digital payments.

- Leveraging technology: Technology can be leveraged for making popular methods of cashless payments secure.

- Biometric authentication-enabled cards can provide a greater layer of security by enabling replacement of the traditional PIN.

- Through biometric authentication, consumers can authenticate transactions by placing their finger on a fingerprint sensor embedded in the card.

- Ensuring security: Safety is ensured as the consumer’s fingerprint is stored only in the secure chip within the card and the same chip is used to match the scanned fingerprint with the stored one.

- The biggest advantage: The biggest advantage is that the bank or merchant cannot access the consumer’s biometric data, which also counters potential privacy concerns.

Conclusion

To reap the advantages of the promising fintech revolution steps must be taken to secure the digital environment.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: FRBM act

Mains level: Read the attached story

Context

- As the years have rolled by, fiscal deficit has become a key factor to watch out for in every Budget presentation.

- It is considered the most important marker of a government’s financial health.

- A government that abides by the FRBM rules enjoys greater credibility among the rating agencies and market participants – both national and international.

FRBM Act

- The FRBM is an act of the parliament that set targets for the Government of India to establish financial discipline, improve the management of public funds, strengthen fiscal prudence and reduce its fiscal deficits.

- It was first introduced in the parliament of India in the year 2000 by Vajpayee Government for providing legal backing to the fiscal discipline to be institutionalized in the country.

- Subsequently, the FRBM Act was passed in the year 2003.

Features of the FRBM Act

- It was mandated by the act that the following must be placed along with the Budget documents annually in the Parliament:

- Macroeconomic Framework Statement

- Medium Term Fiscal Policy Statement and

- Fiscal Policy Strategy Statement

Fiscal Indicators

It was proposed that the four fiscal indicators be projected in the medium-term fiscal policy statement viz.

- Revenue deficit as a percentage of GDP,

- Fiscal deficit as a percentage of GDP,

- Tax revenue as a percentage of GDP and

- Total outstanding liabilities as a percentage of GDP

Why FRBM is back in debate?

- Not letting the fiscal deficit go completely out of control has been one of the standout achievements of the incumbent NDA government.

- However, as India’s economic growth has decelerated, there have been growing pressures on the government to breach the FRBM orthodoxy and spend in excess of fiscal deficit targets to reboot domestic growth.

- Others, however, continue to caution that the “real” fiscal deficit is already far more than the official number, and as such, there is no room for further increasing the expenditure by the government.

Which of these narratives is true?

- Actually, neither. But to understand that one has to first understand what are the different types of deficits and why does it matter to limit them.

Different types of deficits

- Fiscal is the excess of what the amount the government plans to spend over what the government expects to receive.

- Obviously, to make up this gap, the government has to borrow money from the market.But all government expenditure is not of the same kind.

- For instance, if the expenditure is for paying salaries then it is counted as “revenue” expenditure but if it goes into building a road or a factory – that is, something that in turn increases the economy’s capacity to produce more – then it is characterized as “capital” expenditure.

- The fiscal deficit is another key marker and it maps the excess of revenue expenditure over revenue receipts.

- The difference between fiscal deficit and revenue deficit is the government’s capital expenditure.

What FRBM says on deficits?

- As a broad rule, it is considered fiscally imprudent for a government to borrow money for “revenue” purposes.

- As a result, the FRBM Act of 2003 had mandated that, apart from limiting the fiscal deficit to 3% of the nominal GDP, the revenue deficit should be brought down to 0%.

- This would have meant that all the government borrowing (or fiscal deficit) for the year would have funded only capital expenditure by the government.

Why prefer capital expenditure over revenue expenditure?

- In any economy, when the government spends money or cuts taxes it has an impact on the economic activity of the country.

- But this impact (also called the “Multiplier” effect) is quite different for revenue expenditure and capital expenditure.

- In other words, when the government spends Rs 100 on increasing salaries in India, the economy grows by a little less than Rs 100.

- But, when the government uses that money to make a road or a bridge, the economy’s GDP grows by Rs 250.

- The question then is: How to get governments to switch from revenue expenditure to capital expenditure? That’s where the FRBM Act comes in handy.

What is the significance of an FRBM Act?

- The popular understanding of the FRBM Act is that it is meant to “compress” or restrict government expenditure. But that is a flawed understanding.

- The truth is that FRBM Act is not an expenditure compressing mechanism, rather an expenditure switching one.

- In other words, the FRBM Act – by limiting the total fiscal deficit (to 3% of nominal GDP) and asking for revenue deficit to be eliminated altogether – is helping the governments to switch their expenditure from revenue to capital.

- This also means that – again, contrary to popular understanding – adhering to the FRBM Act should not reduce India’s GDP, rather increase it.

Here’s how: When you cut on revenue deficit – that is, reduce your borrowings for funding revenue expenditure – and instead borrow to only spend on building capital, you increase the overall GDP by 2.5 times the amount of money borrowed. So adhering to FRBM Act is a win-win.

What has been India’s record on adhering to FRBM Act?

- Between 2004 and 2008, the Indian government had made giant strides on reducing both revenue deficit and fiscal deficit.

- But this process was reversed thereafter thanks largely to the Global Financial Crisis and a domestic slowdown.

- Since then, there have been several amendments to the Act essentially postponing the targets.

- But the worst development happened in 2018 when the Union government stopped targeting revenue deficit and instead focussed only on fiscal deficit.

Way Forward

- There is a need to revert back to the original FRBM Act if 2003 by recognising and prioritizing the reduction in revenue deficit.

- Doing this will help the government boost the kind of expenditure that actually increases the GDP.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

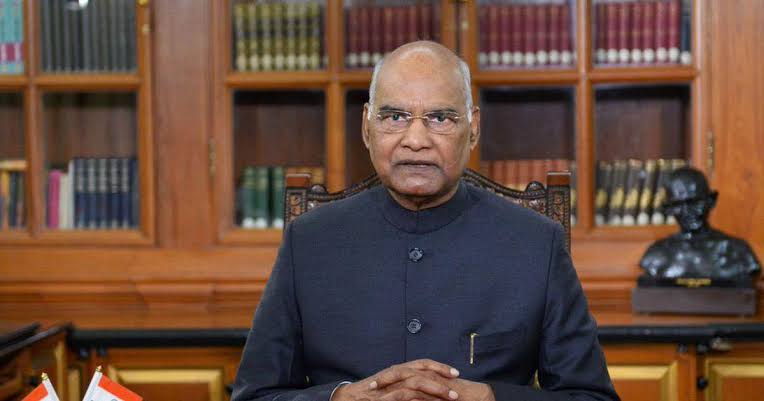

Prelims level: Provisions for the President/Governors' address

Mains level: President/Governors' address

Today, with the first day of the Budget Session of Parliament, Hon’ble President will address a joint sitting of the two Houses.

President’s or Governor’s Address

- Commonly referred to as the President’s or Governor’s Address, they are a constitutional requirement.

- The Constitution gives the President and the Governor the power to address a sitting of the legislature. The special power is with regard to two occasions.

- The first is to address the opening session of a new legislature after a general election. The second is to address the first sitting of the legislature each year.

- A session of a new or a continuing legislature cannot begin without fulfilling this requirement.

- When the Constitution came into force, the President was required to address each session of Parliament.

- So during the provisional Parliament in 1950, the President gave an address for all three sessions. At the suggestion of Speaker G V Mavalankar, the first Constitutional Amendment in 1951 changed this position.

- Besides being a constitutional requirement, the President’s or Governor’s Address is keenly watched as it outlines the government’s policy agenda and stand on issues.

What procedures follow the address?

- After the President or Governor delivers the address, a debate takes place not only on the contents of the address but also the broad issues of governance in the country.

- This then paves the way for discussion on the Budget.

Significance of the address

- The President’s Address in India is mirrored on the British system.

- During the framing of the Constitution, B R Ambedkar drew a similarity between the President and the monarch under the English system.

- He said the President “is the Head of State but not of the executive. He represents the nation but does not rule the nation.

- He is the symbol of the nation. His place in the administration is that of a ceremonial device of a seal by which the nation’s decisions are made known”.

- The Constitution binds the President and the Governor to act on the aid and advice of the Council of Ministers of the Union and state governments respectively, on a majority of issues.

- Therefore, the speech that the President or the Governor reads before the legislature is the viewpoint of the government and is prepared by it.

Are there parallels in other countries?

- Similar provisions exist in other democracies. In the United States, it is referred to as the “State of the Union”.

- The phrase comes from an article in the US Constitution which specifies that the President from time to time give to Congress information of the State of the Union and recommend measures as he shall judge necessary and expedient.

- In the United Kingdom, it is referred to as the Queen’s Speech and is part of the ceremony to mark the formal start of the parliamentary year.

What is the content of the President’s or Governor’s address?

- During the making of the Constitution, an unsuccessful attempt was made to bring some specificity to the content of the President’s Address.

- The President’s speech follows the convention of the British system, where it contains legislative and policy proposals that the government intends to initiate.

- The speech also recaps the government’s accomplishment in the previous years. The contents of the speech are put together by aggregating inputs from various ministries of the government.

Is the text of the speech binding?

- The President or a Governor cannot refuse to perform the constitutional duty of delivering an address to the legislature.

- But there can be situations when they deviate from the text of the speech prepared by the government.

- So far, there have been no instances of President doing so. But there has been an occasion when a Governor skipped a portion of the address to the Assembly.

- In 1969, the Governor of West Bengal skipped two paragraphs of the address prepared by the United Front government.

- The skipped portion described as unconstitutional the dismissal of the first United Front government by the Congress-ruled central government. The issue was then debated in Parliament.

- The Opposition was critical of the Governor’s conduct and moved a motion disapproving it. But the motion was ultimately defeated.

How have members responded to the addresses over the years?

- The conduct of MLAs during the address has sometimes been an issue.

- The Governor’s speech in state legislatures has routinely been interrupted.

- In Parliament, the first instance of interruption of a President’s speech happened in 1963; President Sarvepalli Radhakrishnan was speaking when some MPs interrupted him.

- The Lok Sabha took note of the incident and a reprimand was issued to the MPs.

- Over the years, political parties have resolved to treat the President’s Address sacrosanct and agreed not to interrupt it.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Economic Survey

Mains level: Economic Survey and its significance

With the Indian economy in the doldrums, this year’s Economic Survey will be keenly watched. The Economic Survey for 2019-2020 will be tabled in Parliament today.

What is the Economic Survey?

- The Economic Survey is a report the government presents on the state of the economy in the past one year, the key challenges it anticipates, and their possible solutions.

- One day before the Union budget, the Chief Economic Adviser (CEA) of the country releases the Economic Survey.

- The document is prepared by the Economic Division of the Department of Economic Affairs (DEA) under the guidance of the CEA.

- Once prepared, the Survey is approved by the Finance Minister.

- The first Economic Survey was presented in 1950-51. Until 1964, the document would be presented along with the Budget.

- For the past few years, the Economic Survey has been presented in two volumes.

- For example, in 2018-19, while Volume 1 focussed on research and analysis of the challenges facing the Indian economy, Volume 2 gave a more detailed review of the financial year, covering all the major sectors of the economy.

Why is the Economic Survey significant?

- The Economic Survey is a crucial document as it provides a detailed, official version of the government’s take on the country’s economic condition.

- It can also be used to highlight some key concerns or areas of focus — for example, in 2018, the survey presented by the then CEA Arvind Subramanian was pink in colour, to stress on gender equality.

Is it binding on the government?

- The government is not constitutionally bound to present the Economic Survey or to follow the recommendations that are made in it.

- If the government so chooses, it can reject all suggestions laid out in the document.

- But while the Centre is not obliged to present the Survey at all, it is tabled because of the significance it holds.

What are the expectations from Economic Survey 2020?

- At a time when India’s growth has plummeted to a six-year low, the Economic Survey ahead of the Union Budget is expected to offer key insights into the path ahead for the government to revive growth.

- The conundrum of remaining fixated on deficit targets or making a concerted push towards more expenditure to kickstart growth is one of the key challenges the government is facing.

- The Survey is expected to shed light on the crucial gaps that the Budget will aim to fill in terms of unemployment, private investment, and a slump in consumption.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: PHEIC

Mains level: Global health emergencies

The World Health Organization (WHO) has declared the novel Coronavirus infection a Public Health Emergency of International Concern (PHEIC). In the past decade, WHO has declared public health emergencies for outbreaks including swine flu, polio and Ebola.

What is PHEIC?

Definition: Under the International Health Regulations (IHR), a public health emergency is defined as “an extraordinary event which is determined, as provided in these Regulations: to constitute a public health risk to other States through the international spread of disease; and to potentially require a coordinated international response”.

What criteria does the WHO follow to declare PHEIC?

- PHEIC is declared in the event of some “serious public health events” that may endanger international public health.

- The responsibility of declaring an event as an emergency lies with the Director-General of the WHO and requires the convening of a committee of members.

Implications of a PHEIC being declared

- There are some implications of declaring a PHEIC for the host country, which in the case of the coronavirus is China.

- Declaring a PHEIC may lead to restrictions on travel and trade.

- However, several countries have already issued advisories to their citizens to avoid travelling to China, while others are airlifting their citizens from it.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: IMO, VLSFO

Mains level: SOx pollution control measures

The International Maritime Organization (IMO), the shipping agency of the United Nations issued new rules aiming to reduce sulphur emissions, due to which ships are opting for newer blends of fuels.

What do the new IMO rules say?

- The IMO has banned ships from using fuels with sulphur content above 0.5 per cent, compared with 3.5 per cent previously.

- Sulphur oxides (SOx), which are formed after combustion in engines, are known to cause respiratory symptoms and lung disease, while also leading to acid rain.

- The new regulations, called IMO 2020, have been regarded as the biggest shake up for the oil and shipping industries in decades. It affects more than 50,000 merchant ships worldwide.

- The new limits are monitored and enforced by national authorities of countries that are members of the International Convention for the Prevention of Pollution from Ships (MARPOL) Annex VI.

Cleaner options

- Under the new policy, only ships fitted with sulphur-cleaning devices, known as scrubbers, are allowed to continue burning high-sulphur fuel.

- Alternatively, Ships can opt for cleaner fuels, such as marine gasoil (MGO) and very low-sulfur fuel oil (VLSFO).

- Of the two cleaner fuels, ship-owners were expected to opt for MGO, which is made exclusively from distillates, and has low sulphur content.

- However, many are reportedly choosing VLSFO, which has better calorific properties and other technical advantages.

Issues with the rule

- There are complaints against VLSFO as well, as testing companies have claimed that high sediment formation due to the fuel’s use could damage vessel engines.

- VLSFO, with 0.5 per cent sulphur content, can contain a large percentage of aromatic compounds, thus having a direct impact on black carbon emissions.

- Black carbon, which is produced due to the incomplete combustion of carbon-based fuels, contributes to climate change.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: PCI

Mains level: Terms of reference for PCI

The Union government is likely to announce the setting up of a Plantation Corporation of India in the upcoming budget.

Plantation Corporation of India

- The PCI will subsume all afforestation-related schemes currently underway in India including the Green India Mission, National Afforestation Programme and compensatory afforestation.

- The corporation will use Compensatory Afforestation Fund (CAF) money to undertake the plantations and investment will also come from the global pension fund.

- CAF is a huge corpus of money collected from projects proponents for diverting forest land to be used for non-forestry activity.

Issues with PCI

- Critics have raised concerns over the move’s impact on the federal structure of forest governance in the country.

- While forests are a concurrent subject, land-related issues are the responsibility of the states.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Exercise SAMPRITI

Mains level: India-Bangladesh Strategic Relations

As part of the ongoing Indo-Bangladesh defence cooperation, a joint military training exercise SAMPRITI-IX is being conducted in Meghalaya.

Exercise SAMPRITI

- It is an important bilateral defence cooperation endeavour between India and Bangladesh and will be the ninth edition of the exercise which is hosted alternately by both countries.

- During the joint military exercise SAMPRITI-IX, a Command Post Exercise (CPX) and a Field Training Exercise (FTX) will be conducted.

- For both the CPX and FTX, a scenario where both nations are working together in a Counter-Terrorism environment will be simulated under the UN Charter.

- The FTX curriculum is progressively planned where the participants will initially get familiar with each other’s organizational structure and tactical drills.

- The training will culminate with a final validation exercise in which troops of both armies will jointly practice a Counter Terrorist Operation in a controlled and simulated environment.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Fruit Train

Mains level: Logistics support for horticulture products

A ‘fruit train’, said to be the first of its kind in India, was flagged off from Tadipatri Railway Station in Anantapur district of Andhra.

About the fruit train

- This is the first time in India that an entire train is being sent to the gateway port (JNPT) for export.

- This helps save both time and fuel as 150 trucks would have been required to send a consignment of this size by road to JNPT, which is over 900 km away, before the temperature-controlled containers are loaded on ships.

- The bananas are being exported under the brand name ‘Happy Bananas’.

- Farmers from Putlur region in Anantapur and Pulivendula in Kadapa district are exporting ‘Green Cavendish’ bananas to many international markets.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now