Note4Students

From UPSC perspective, the following things are important :

Prelims level: Anti-defection law

Mains level: Paper 2- Paragraph 4 of Tenth Schedule

Context

The ongoing political crisis in Maharashtra, and many others before it, are grim reminders of what the Tenth Schedule can and cannot do.

About 10th Schedule

- In 1985 the Tenth Schedule, popularly known as the anti-defection law, was added to the Constitution.

- But its enactment was catalyzed by the political instability after the general elections of 1967.

- This was the time when multiple state governments were toppled after MLAs changed their political loyalties.

- The purpose of the 1985 Constitution Amendment was to bring stability to governments by deterring MPs and MLAs from changing their political parties on whose ticket they were elected.

- The penalty for shifting political loyalties is the loss of parliamentary membership and a bar on becoming a minister.

Provisions of the 10th Schedule

- Instances of floor crossing have long gone unchecked and unpunished.

- In part, this can be attributed to the exemption given to mergers between political parties which facilitate bulk defections.

- Disqualification provision: The second paragraph of the Tenth Schedule allows for disqualification of an elected member of a House if such member belonging to any political party has voluntarily given up membership of their party, or if they vote in the House against such party’s whip.

- Exceptions: Paragraph 4 creates an exception for mergers between political parties by introducing three crucial concepts — that of the “original political party”, the “legislature party”, and “deemed merger”.

- What is the legislature party? It means the group consisting of all elected members of a House for the time being belonging to one political party.

- Original political party: An “original political party” means the political party to which a member belongs (this can refer to the party generally, outside of the House).

- Paragraph 4 does not clarify whether the original political party refers to the party at the national level or the regional level.

How Paragraph 4 of the 10th Schedule deals with mergers?

- Paragraph 4 is spread across two sub-paragraphs, a conjoint reading of which suggests that a merger can take place only when an original party merges with another political party, and at least two-thirds of the members of the legislature party have agreed to this merger.

- It is only when these two conditions are satisfied that a group of elected members can claim exemption from disqualification on grounds of merger.

- The second sub-paragraph (of Paragraph 4) says that a party shall be “deemed” to have merged with another party if, and only if, not less than two-thirds of the members of the legislature party concerned have agreed to such merger.

- However, in most cases there is no factual merger of original political parties at the national (or even regional) level.

- Creation of legal fiction: Paragraph 4 seems to be creating a “legal fiction” so as to indicate that a merger of two-third members of a legislature party can be deemed to be a merger of political parties, even if there is no actual merger of the original political party with another party.

- In statutory interpretation, “deemed” has an established understanding.

- The word “deemed” may be used in a law to create a legal fiction, and give an artificial construction to a word or a phrase used in a statute.

- In other cases, it may be used to include what is obvious or what is uncertain.

- In either of these cases, the intention of the legislature in creating a deeming provision is paramount.

Merger exception and issues with it

- The merger exception was created to save instances of the principled coming together of political groups from disqualification under the anti-defection law, and to strike a compromise between the right of dissent and party discipline.

- In the absence of mergers of original political parties, the deeming fiction could, presumably, be used as a means to allow mergers of legislature parties.

- Encouraging defection: Reading Paragraph 4 in this manner would empower legislature parties to solely merge with another party, and thus, practically ease defection.

What if sub-paragraphs are read conjunctively?

- For a valid merger then, an original political party has to first merge with another political party, and then two-thirds of the legislature party must support that merger.

- Given the politics of current times, stark differences in parties’ respective ideologies, and deep-seated historical rivalries, it is unimaginable how a merger between major national or regional parties would materialise.

Way forward

- Remove Paragraph 4: In a situation where either reading of Paragraph 4 in its current form yields undesirable results, its deletion from the Tenth Schedule is a possible way forward.

- The Law Commission in 1999 and the National Commission to Review the Working of the Constitution (NCRWC) in 2002 made similar recommendations.

- Revisiting by Supreme Court: Till that happens, an academic revisiting of the Tenth Schedule by the Supreme Court, so as to guide future use of the anti-defection law, is timely and should happen soon.

Conclusion

Neither of these two interpretations of Paragraph 4complements the ‘mischief’ that the Tenth Schedule was expected to remedy — that of curbing unprincipled defections. Amending it is the need of the hour.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- India-UAE relations

Context

Prime Minister Narendra Modi’s visit to the UAE on June 28 was his fourth, having visited the country earlier in August 2015, in February 2018 and again in August 2019.

Why do the Gulf and UAE matters to India?

- The UAE has given crucial support to India in the Islamic world, first by inviting our late External Affairs Minister Sushma Swaraj as a guest of honour at an OIC foreign ministers meeting in Abu Dhabi.

- The UAE stood with us on Jammu and Kashmir following the abrogation of Article 370.

- The Gulf is our third-largest trading partner.

- The Gulf region is our principal source of hydrocarbons.

- It is also a major source of foreign investment.

- The region is home to some 8 million Indians who send in over $50 billion annually in remittances.

Deepening bilateral ties

- CEPA: In a virtual summit with Sheikh Mohamed in February 2022, both sides signed a Comprehensive Economic Partnership Agreement (CEPA).

- CEPA is a significant milestone that was negotiated and finalised in just 88 days and promises to increase bilateral trade from $60 billion to $ 100 billion in five years.

- It is expected to help Indian exports in areas ranging from gems and jewellery and textiles to footwear and pharmaceuticals, apart from enhanced access for Indian service providers to 11 specific sectors.

- Vision statement: An ambitious, forward-looking Joint Vision Statement titled, “Advancing the India and UAE Comprehensive Strategic Partnership: New Frontiers, New Milestones” was also issued.

- The Dubai-based DP World and India’s National Skills Development Council signed an agreement to set up a Skill India Centre in Varanasi to train local youth in logistics, port operations and allied areas so that they can pursue overseas employment.

New avenues for multilateral cooperation

- The rapid normalisation of ties between the UAE and Israel following the Abraham Accords of August 2020 has also opened new avenues of trilateral and multilateral cooperation.

- Technology, capital and scale: Some Israeli tech companies are already establishing a base in Dubai and seeking to marry niche technologies with Emirati capital and Indian scale.

- 2I2U: The US has announced that President Joe Biden’s forthcoming visit to West Asia will see a virtual summit of what it calls the 2I2U, a new grouping that brings together India, Israel, the US and UAE.

Conclusion

The UAE today is India’s closest partner in the Arab world. Both countries need to expand the areas of cooperation and deepen their engagement.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: Abraham Accords

- The Israel–UAE normalization agreement is officially called the Abraham Accords Peace Agreement.

- It was initially agreed to in a joint statement by the United States, Israel and the United Arab Emirates (UAE) on August 13, 2020.

- The UAE thus became the third Arab country, after Egypt in 1979 and Jordan in 1994, to agree to formally normalize its relationship with Israel as well as the first Persian Gulf country to do so.

- Concurrently, Israel agreed to suspend plans for annexing parts of the West Bank.

- The agreement normalized what had long been informal but robust foreign relations between the two countries.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Office of the VP

Mains level: Read the attached story

The Election Commission has announced that the election to the post of the Vice-President (VP) will be held on August 6, as M. Venkaiah Naidu’s term was coming to an end on August 10.

About Vice President of India

- The VP is the deputy to the head of state of the Republic of India, the President of India.

- His/her office is the second-highest constitutional office after the president and ranks second in the order of precedence and first in the line of succession to the presidency.

- The vice president is also a member of the Parliament as the ex officio Chairman of the Rajya Sabha.

Qualifications

- As in the case of the president, to be qualified to be elected as vice president, a person must:

- Be a citizen of India

- Be at least 35 years of age

- Not hold any office of profit

- Unlike in the case of the president, where a person must be qualified for election as a member of the Lok Sabha, the vice president must be qualified for election as a member of the Rajya Sabha.

- This difference is because the vice president is to act as the ex officio Chairman of the Rajya Sabha.

Roles and responsibilities

- When a bill is introduced in the Rajya Sabha, the vice president decides whether it is a money bill or not.

- If he is of the opinion that a bill introduced in the Rajya Sabha is a money bill, he shall refer it to the Speaker of the Lok Sabha.

- The vice president also acts as the chancellor of the central universities of India.

Election procedure

- Article 66 of the Constitution of India states the manner of election of the vice president.

- The vice president is elected indirectly by members of an electoral college consisting of the members of both Houses of Parliament and NOT the members of state legislative assembly.

- The election is held as per the system of proportional representation using single transferable votes.

- The voting is conducted by Election Commission of India via secret ballot.

- The Electoral College for the poll will comprise 233 Rajya Sabha members, 12 nominated Rajya Sabha members and 543 Lok Sabha members.

- The Lok Sabha Secretary-General would be appointed the Returning Officer.

- Political parties CANNOT issue any whip to their MPs in the matter of voting in the Vice-Presidential election.

Removal

- The Constitution states that the vice president can be removed by a resolution of the Rajya Sabha passed by an Effective majority (majority of all the then members) and agreed by the Lok Sabha with a simple majority( Article 67(b)).

- But no such resolution may be moved unless at least 14 days’ notice in advance has been given.

- Notably, the Constitution does not list grounds for removal.

- No Vice President has ever faced removal or the deputy chairman in the Rajya Sabha cannot be challenged in any court of law per Article 122.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: PACS

Mains level: Rural banking in India

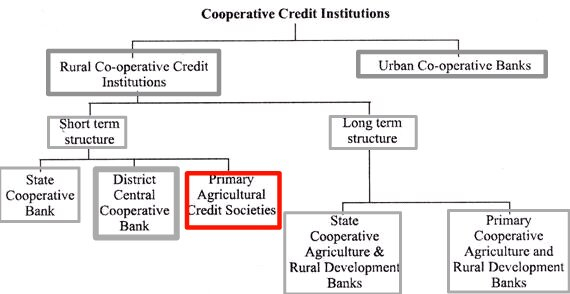

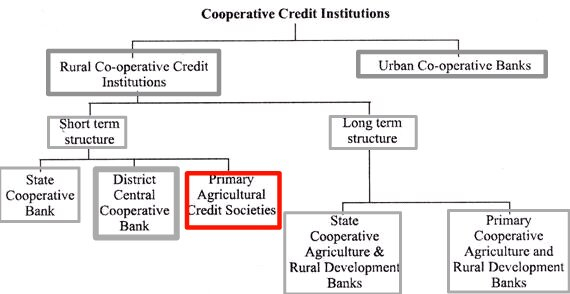

The Cabinet Committee on Economic Affairs (CCEA) has approved a proposal to digitise around 63,000 primary agricultural credit societies (PACS).

What are the Primary Agricultural Credit Societies (PACS)?

- PACS is a basic unit and smallest co-operative credit institutions in India.

- In 1904 the first Primary Agricultural Credit Society (PACS) was established.

- It works on the grassroots level (gram panchayat and village level).

- PACS is the final link between the ultimate borrowers, i.e., rural people, on the one hand, and the higher agencies, i.e., Central cooperative bank, state cooperative bank, and Reserve Bank of India, on the other.

Who regulates PACS?

- PACS are registered under the Co-operative Societies Act and also regulated by the RBI.

- They are governed by the “Banking regulation Act-1949” and Banking Laws (Co-operative societies) Act 1965.

Various objectives of PACS

- To raise capital for the purpose of making loans and supporting members’ essential activities.

- To collect deposits from members with the goal of improving their savings habit.

- To supply agricultural inputs and services to members at reasonable prices,

- To arrange for the supply and development of improved breeds of livestock for members.

- To make all necessary arrangements for improving irrigation on land owned by members.

- To encourage various income-generating activities through supply of necessary inputs and services.

Functions of PACS

- As registered cooperative societies, PACS have been providing credit and other services to their members.

- PACS typically offer the following services to their members:

- Input facilities in the form of a monetary or in-kind component

- Agriculture implements for hire

- Storage space

Who can form PACS?

- A primary agricultural credit society can be formed by a group of ten or more people from a village. The society’s management is overseen by an elected body.

- The membership fee is low enough that even the poorest agriculturist can join.

- Members of the society have unlimited liability, which means that each member assumes full responsibility for the society’s entire loss in the event of its failure.

What capitalizes PACS?

- The primary credit societies’ working capital is derived from their own funds, deposits, borrowings, and other sources.

- Share capital, membership fees, and reserve funds are all part of the company’s own funds.

- Deposits are made by both members and non-members.

- Borrowings are primarily made from central cooperative banks.

Why need digitization?

- PACS account for 41 % (3.01 Cr. farmers) of the KCC loans given by all entities in the country and 95 % of these KCC loans (2.95 Cr. farmers) through PACS are to the small and marginal farmers.

- The other two tiers viz. State Cooperative Banks (StCBs) and District Central Cooperative Banks (DCCBs) have already been automated by the NABARD and brought on Common Banking Software (CBS).

- Majority of PACS have so far been not computerized and still functioning manually resulting in inefficiency and trust deficit.

Significance of digitization

- Computerization of PACS will increase their transparency, reliability and efficiency, and will also facilitate the accounting of multipurpose PACS.

- Along with this, it will also help PACS to become a nodal centre for providing services such as direct benefit transfer (DBT), Interest subvention scheme (ISS), crop insurance scheme (PMFBY), and inputs like fertilizers and seeds.

Try this PYQ from CSP 1999:

Q.The farmers are provided credit from a number of sources for their short and long term needs. The main sources of credit to the farmers include-

(a) the Primary Agricultural Cooperative Societies, commercial banks, RRBs and private money lenders

(b) the NABARD, RBI, commercial banks and private money lenders

(c) the District Central Cooperative Banks (DCCB), the lead banks, IRDP and JRY

(d) the Large Scale Multi-purpose Adivasis Programme, DCCB, IFFCO and commercial banks

Post your answers here.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: New GST slabs

Mains level: Rationalization of GST

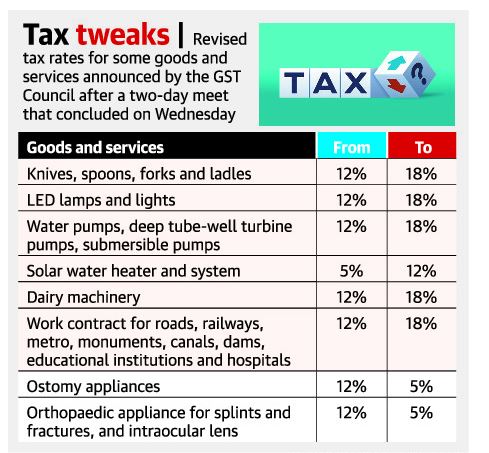

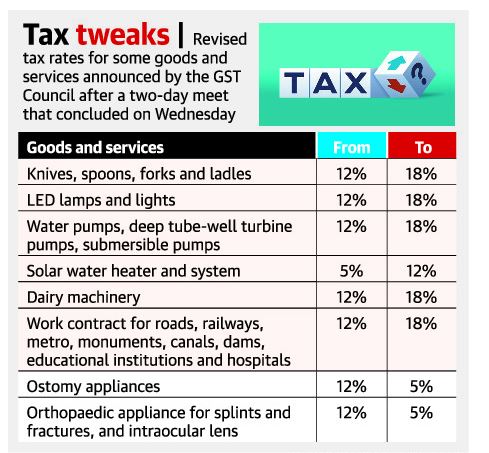

The Goods and Services Tax (GST) Council has decided to hike and lower GST on certain commodities.

What is the news?

- From July 18, tax hikes will kick in for over two dozen goods and services, ranging from unbranded food items, curd and buttermilk to low-cost hotels, cheques and maps.

- Tax rates will be lowered for about half-a-dozen goods and services, including ropeways and truck rentals where fuel costs are included.

- It scrapped GST for items imported by private vendors for use by defence forces.

What is GST?

- GST launched in India on 1 July 2017 is a comprehensive indirect tax for the entire country.

- It is charged at the time of supply and depends on the destination of consumption.

- For instance, if a good is manufactured in state A but consumed in state B, then the revenue generated through GST collection is credited to the state of consumption (state B) and not to the state of production (state A).

- GST, being a consumption-based tax, resulted in loss of revenue for manufacturing-heavy states.

What are GST Slabs?

- In India, almost 500+ services and over 1300 products fall under the 4 major GST slabs.

- There are five broad tax rates of zero, 5%, 12%, 18% and 28%, plus a cess levied over and above the 28% on some ‘sin’ goods.

- The GST Council periodically revises the items under each slab rate to adjust them according to industry demands and market trends.

- The updated structure ensures that the essential items fall under lower tax brackets, while luxury products and services entail higher GST rates.

- The 28% rate is levied on demerit goods such as tobacco products, automobiles, and aerated drinks, along with an additional GST compensation cess.

Why rationalize GST slabs?

- From businesses’ viewpoint, there are just too many tax rate slabs, compounded by aberrations in the duty structure through their supply chains with some inputs are taxed more than the final product.

- These are far too many rates and do not necessarily constitute a Good and Simple Tax.

- Multiple rate changes since the introduction of the GST regime in July 2017 have brought the effective GST rate to 11.6% from the original revenue-neutral rate of 15.5%.

- Merging the 12% and 18% GST rates into any tax rate lower than 18% may result in revenue loss.

Haven’t GST revenues been hitting new records?

- Yes, they have – GST revenues have scaled fresh highs in three of the first four months of 2022, going past ₹1.67 lakh crore in April.

- But there is another key factor — the runaway pace of inflation.

- Wholesale price inflation, which captures producers’ costs, has been over 10% for over a year and peaked at 15.1% in April.

- Inflation faced by consumers on the ground has spiked to a near-eight year high of 7.8% in April.

- The rise in prices was the single most important factor for higher tax inflows along with higher imports.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: G7, G12, G20

Mains level: Not Much

India is expected to host the G-20 summit in Delhi, while a number of States, including Jammu and Kashmir and north-eastern States, have been asked to suggest venues for about 100 “preparatory” meetings.

Why in news?

- The clarifications came in response to questions being raised over reports in the media about the possibility of holding the summit itself in Jammu and Kashmir.

- Pakistan had issued a strong protest last week, sent formal demarches to Foreign Ministries in G-20 member-states, asking them not to attend such meetings.

- Pakistan (alone) believes J&K is internationally recognised disputed territory.

Why such move?

- The participation of the delegates from G-20 countries will be a major boost to the efforts of the Centre to project the situation in J&K as normal.

- This is especially after J&K’s special constitutional position was ended in 2019.

What is G-20?

- Formed in 1999, the G20 is an international forum of the governments and central bank governors from 20 major economies.

- Collectively, the G20 economies account for around 85 percent of the Gross World Product (GWP), 80 percent of world trade.

- To tackle the problems or address issues that plague the world, the heads of governments of the G20 nations periodically participate in summits.

- In addition to it, the group also hosts separate meetings of the finance ministers and foreign ministers.

- The G20 has no permanent staff of its own and its chairmanship rotates annually between nations divided into regional groupings.

Aims and objectives

- The Group was formed with the aim of studying, reviewing, and promoting high-level discussion of policy issues pertaining to the promotion of international financial stability.

- The forum aims to pre-empt the balance of payments problems and turmoil on financial markets by improved coordination of monetary, fiscal, and financial policies.

- It seeks to address issues that go beyond the responsibilities of any one organization.

Members of G20

The members of the G20 consist of 19 individual countries plus the European Union (EU).

- The 19 member countries of the forum are Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, United Kingdom and the United States.

- The European Union is represented by the European Commission and by the European Central Bank.

Its significance

- G20 is a major international grouping that brings together 19 of the world’s major economies and the European Union.

- Its members account for more than 80% of global GDP, 75% of trade and 60% of population.

India and G20

- India has been a member of the G20 since its inception in 1999.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: CAPSTONE satellite

Mains level: Not Much

NASA has launched CAPSTONE, a microwave oven-sized CubeSat weighing just 55 pounds (25 kg).

What is CAPSTONE?

- CAPSTONE, short for Cislunar Autonomous Positioning System Technology Operations and Navigation Experiment, is designed to test a unique, elliptical lunar orbit.

- It aims to help reduce risk for future spacecraft by validating innovative navigation technologies, and by verifying the dynamics of the halo-shaped orbit.

Its launch

- It is heading toward an orbit intended in the future for Gateway, a Moon-orbiting outpost that is part of NASA’s Artemis program.

- The orbit is known as a near-rectilinear halo orbit (NRHO).

- It is significantly elongated, and is located at a precise balance point in the gravities of Earth and the Moon.

- This offers stability for long-term missions like Gateway, NASA said on its website.

Mission details

- CAPSTONE will enter NRHO, where it will fly within 1,600 km of the Moon’s North Pole on its near pass and 70,000 km from the South Pole at its farthest.

- The spacecraft will repeat the cycle every six-and-a-half days and maintain this orbit for at least six months to study dynamics.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- G-7 and India

Context

The meeting of G7 leaders that concluded in Bavaria was attended by India as an observer.

About G7

- The G-7 or ‘Group of Seven’ includes Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States.

- It is an intergovernmental organisation that was formed in 1975 by the top economies of the time as an informal forum to discuss pressing world issues.

- Initially, it was formed as an effort by the US and its allies to discuss economic issues.

- The G-7 forum now discusses several challenges such as oil prices and many pressing issues such as financial crises, terrorism, arms control, and drug trafficking.

- It does not have a formal constitution or a fixed headquarters. The decisions taken by leaders during annual summits are non-binding.

- Canada joined the group in 1976, and the European Union began attending in 1977.

- The G7 is trying hard not to be yesterday’s club.

- It is still a powerful grouping, with seven of its members in the top 10 economies of the world, three of them permanent members of the UNSC.

Important outcomes of the G7 meeting

- Statement on support for Ukraine: A standalone G7 Statement on Support for Ukraine was issued.

- There was an unconditional commitment that the grouping will provide financial, humanitarian, military and diplomatic support and stand with Ukraine for as long as it takes.

- Russia was also warned that any use of chemical, biological and nuclear weapons would be met with severe consequences.

- Further intensification of sanctions against Russia was contemplated.

- Tough language on China: Significantly, the G7 final communique has tough language on China as well.

- It says there is no legal basis for China’s expansive maritime claims in the South China Sea, it calls on China to press Russia to withdraw troops from Ukraine and expresses grave concern about the country’s human rights situation.

- It calls on China to respect universal human rights and fundamental freedoms in both Tibet and Xinjiang, highlighting the issue of forced labour in the latter.

Significance of India’s observer status

- The fact is that even the G7 knows its clout has declined compared to, say, 20 years ago.

- That explains the move to invite key G20 countries as observers to its summits.

- As for India, its importance lies in the undeniable truth that no global problem can be seriously tackled without New Delhi’s involvement.

- For India, G7 summits have always been an invaluable opportunity to exchange views not just in a plurilateral format but also in the bilateral meetings on the margins of the main meetings.

- 2 statements: India has lent its name to two statements issued by the G7. One is titled “Resilient Democracies Statement” and the other is “Joining Forces to Accelerate Clean and Just Transition towards Climate Neutrality”.

- The first statement talks of democracies as reliable partners seeking to promote a rules-based international order and supporting democracy worldwide including through electoral assistance.

- The other statement to which India is a signatory is the one on clean and just transition towards carbon neutrality.

Conclusion

India’s participation in this meeting as an observer serves to advance its foreign and security policy objectives and will keep it in good stead when it assumes the G20 presidency in December.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Horn of Africa Region

Mains level: Geostrategic significance of HOA

China recently held the first China-Horn of Africa Peace, Governance and Development Conference.

Why in news?

- China has been investing across the African continent throughout the last decade.

- The conference held in Ethiopia witnessed the participation of foreign ministries from the following countries of the Horn: Kenya, Djibouti, Ethiopia, Sudan, Somalia, South Sudan, and Uganda.

Major objectives

- No doubt that china predates small nations with debt-trapping the countries.

- It focuses on increasing the infrastructural investments in African countries and converting them to security assets.

- It asserted three objectives in Africa:

- Controlling the pandemic

- Implementing a Forum on China-Africa Cooperation (FOCAC) outcomes, and

- Upholding common interests while fighting hegemonic politics

What is FOCAC?

- The FOCAC promotes China’s role in the infrastructural and societal development of the Horn.

- In the 2021 forum, the entire region of the Horn participated and four resolutions were adopted:

- Dakar Action Plan

- China-Africa Cooperation Vision 2035

- Sino-African Declaration on Climate Change

- Declaration of the Eighth Ministerial Conference of FOCAC

How has China garnered goodwill in HOA?

- HOA have benefited from China’s vaccine diplomacy.

- Beijing has also initiated the “2035 vision for China-Africa cooperation”; it aims to transform the health sector, alleviate poverty, promote trade and investments, and expand digital innovation.

- The vision also focuses on green development, capacity building, improving people-to-people exchanges and facilitating peace and security in the continent.

What are China’s primary interests/investments in the Horn of Africa?

China’s interests are related to four major areas: infrastructural projects, financial assistance, natural resources and maritime interests.

(1) Infrastructure

- Looking at Chinese investments in infrastructure, one of its landmark projects was fully funding the $200 million African Union headquarters in Addis Ababa.

- It has also made significant investments in railways; it is building the Addis-Djibouti railway line connecting the land-locked country with Eritrean ports in the Red Sea.

- China has also invested in the Mombasa-Nairobi rail link in Kenya, and has already delivered on railway projects in Sudan.

- It also has a viable military hardware market in Ethiopia and has built over 80 infrastructural projects in Somalia, including hospitals, roads, schools and stadiums.

(2) Debts and ‘assistances’

- With respect to financial assistance, Ethiopia, is one of the top five African recipients of Chinese investments, and also has a debt of almost $14 billion.

- China accounts for 67% of Kenya’s bilateral debt.

- In 2022, China promised to provide $15.7 million assistance to Eritrea.

(3) Mineral explorations

- The third major Chinese interest in Africa is the presence of natural resources — oil and coal. Beijing has invested $400 million in Mombasa’s oil terminal.

- China is also interested in minerals such as gold, iron-ore, precious stones, chemicals, oil and natural gas in Ethiopia.

- South Sudan, a source for petroleum products, has had continued Beijing investment in the industry since the latter’s initial entry in 1995.

(4) Maritime interest

- China’s first and only military base outside its mainland is in Djibouti.

- During his visit in early 2022, Wang hinted at China’s willingness to develop Eritrea’s coast which would connect to China’s investments in land-locked Ethiopia.

- The US has speculated that China wishes to build another military base in Kenya and Tanzania, thereby increasing its military presence in the region.

Has the Horn of Africa been welcoming of China’s presence?

- Africa has been keen on interacting with China.

- Despite the wariness surrounding China’s projects in Africa, the governments have mostly been welcoming.

- When conflict broke out in Tigray in November 2020, Addis Ababa appreciated Beijing for respecting Ethiopia’s sovereignty.

- In December 2021, Kenya defended Chinese projects in the country; President Uhuru Kenyatta maintained that China-Africa partnership was mutually beneficial.

- Similarly, in May 2022, the East African Community (EAC) welcomed Chinese investors to work in East Africa for the prosperity of the people.

Beijing’s principle of non-intervention

- Peace and stability is a mutual requirements for China and Africa.

- For Africa, Chinese investments could lead to stable environments which could help the countries achieve their peace and development objectives.

- For China, conflict in the region comes at a heavy cost.

- In Ethiopia. when the conflict broke out, over 600 Chinese nationals, working on different projects, were evacuated, putting several investments at risk.

- From a trading perspective, the region plays a significant role in achieving the objectives of the China-Africa Cooperation Vision 2035.

Why is HOA important?

- In the last decade, the region lying between Suez Canal and the Seychelles has emerged as a new geopolitical hotspot.

- It has factors like impressive economic growth of regional countries, emergence of new security threats, and the ensuing major power rivalry driving the strategic trajectory of the region.

- The straits of Bab el-Mandeb, which lies at the heart of this region, connects the energy-rich Middle East to Europe and, along with the Suez Canal, is considered a jugular vein for global trade.

Indian footprints in the region

- India has been paying greater attention to the region but still lags behind China.

- India has bolstered defence cooperation with Oman and France (which holds territories in the Southwestern Indian Ocean).

- It has signed logistics support agreements with these countries to ensure greater naval access in the region.

- Reportedly, India was in talks with Japan to grant access to Indian naval vessels at the Japanese base in Djibouti.

- India has also sought to open a military base in the Seychelles and plans to further enhance its naval presence in the Western Indian Ocean.

These efforts are directed to increase Indian leverage and limit Chinese influence in the region.

Lessons for India

- China’s move towards peace in Africa indicates a shift in its principle of non-intervention.

- It is China’s message that its presence in the continent has a larger objective and is not likely to be limited to the Horn of Africa.

- This includes an aim to project itself as a global leader and boost its international status.

- Further, the recent developments imply that China is focussing on a multifaceted growth in the continent for the long run.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: India-UAE Relations

PM Modi expressed gratitude to President of the United Arab Emirates Sheikh Mohamed bin Zayed (MBZ) al Nahyan for taking great care of 3.5 million Indian community in the UAE during the pandemic.

India- UAE Relations: A backgrounder

- The relation has greatly flourished especially after the accession of H. H. Sheikh Zayed Bin Sultan Al Nahyan, as the ruler of Abu Dhabi in 1966.

- The greater push has been achieved in bilateral relations when the visit of Indian PM’s to the UAE in August 2015.

- It marked the beginning of a new strategic partnership between the two countries.

- Further, the Crown Prince was invited in January 2017 as the chief guest at India’s Republic Day celebrations.

- In 2017 the two sides signed the agreement on Comprehensive Strategic Partnership (CSP).

Significance of ties

- Indian Diaspora in UAE: Around 3 million Indians are living harmoniously in the UAE.

- UAE – A willing partner: As India seeks to enhance economic engagement and deepen security cooperation with the Gulf, it finds a willing partner in the UAE.

- India being a natural partner: UAE’s ‘Look East’ find partners for its economic growth and with security concerns emanating from turmoil in West Asia and growing threat from terrorism.

- Investments: UAE has a special place due to its business-friendly atmosphere, willingness to invest in the Indian economy.

- India’s West Asia policy: The UAE occupies a key place in India’s West Asia policy. The high-level visit from both sides has given a new impetus to this partnership.

Why UAE is tilting toward India?

- Turmoil in West Asia: Geopolitical conditions as Iran is threatening continuously to close the Strait of Hormuz in case there is a conflict with Saudi Arabia or US.

- Disappointment from Pakistan: UAE saw Pakistan as a partner and incorporated a deep economic and security relationship with it. But in the present day, Pakistan does not seem to be of much help to UAE.

- India as a market: India is an important destination for oil and energy purchase. UAE also recognizes exhaustible nature of its fossil fuel reserves.

- Returns on investment: UAE’s massive sovereign wealth funds can act as a great resource in the development of infrastructure in India.

- Addressing Terrorism: There has been a rising convergence between India and UAE on the terror issue and both the countries talked of the need to combat terror groups without any discrimination.

- Lack of regional consensus: Countries like Syria, Iraq, Libya and Yemen are suffering from violent conflicts. The Gulf Cooperation Council (GCC) has not produced expected results.

Economic Significance of the UAE

- UAE, due to its strategic location, has emerged as an important economic centre in the world.

- In recent years, the UAE, through its ‘Vision 2021’, has sought to diversify its economy and reduce its dependency on oil.

- Although the UAE has diversified its economy, the hydrocarbon sector remains very important followed by services and manufacturing.

- Within services, financial services, wholesale and retail trade, and real estate and business services are the main contributors.

India-UAE trade and investment ties

- India is UAE’s third largest trade partner after China and the United States.

- The UAE accounts for 8 percent of India’s oil imports and was fifth largest supplier of crude oil to India.

- The aim is to boost bilateral merchandise trade to above U.S.$100 billion and services trade to U.S.$15 billion in five years.

- As we are witnessing a big turnaround in manufacturing, the UAE would be an attractive export market for Indian electronics, automobiles, and other engineering products.

- The UAE’s investment in India is estimated to be around U.S.$11.67 billion, which makes it the ninth biggest investor in India.

Advanced technology and the knowledge economy

(1) Technology

- In 2018, India and UAE signed a MoU to generate an estimated $20 billion in the span of a decade.

- The Emirates have stepped up efforts to invest in the development of the knowledge economy by expanding the “golden visa”.

- Space is a new arena in which India and the UAE have collaborated through the work of the UAE Space Agency (UAESA) and the Indian Space Research Organization (ISRO).

- Space cooperation between India and the UAE gained quick momentum during PM Modi’s visit to the Emirates in 2015.

- The two countries are likely to work together on Emirates’ ‘Red planet Mission’.

(2) Security and Defence Cooperation

- Another significant pillar of India-UAE ties is reflected in their growing cooperation in security and defense sector.

- With the spread of radicalism in Gulf and South Asia, India looks to enhance security cooperation with UAE to counter terrorist threats and combat radicalization.

- ‘Desert Eagle II’, a ten day air combat exercise, was held between the air forces of India and UAE.

Way Forward

(1) Needs to ensure the execution of the investment projects with the required expertise

- Potential areas to enhance bilateral trade include defence trade, food and agricultural products as well as automobiles.

- Indian companies with expertise in renewable energy sector can invest in UAE.

- In defence sector, there is a need to further enhance cooperation through joint training programmes.

(2) Manifold Benefits of India-UAE Trade Agreements

- With India’s newfound strength in exports, a trade agreement with an important country such as the UAE would help sustain the growth momentum.

- As we are witnessing a big turnaround in manufacturing, the UAE would be an attractive export market for Indian electronics, automobiles, and other engineering products.

(3) Improving the relations with the GCC

- As part of the GCC, the UAE has strong economic ties with Saudi Arabia, Kuwait, Bahrain, and Oman and shares a common market and customs union with these nations.

- This FTA with the UAE will pave the way for India to enter the UAE’s strategic location, and have relatively easy access to the Africa market and its various trade partners.

- This can help India to become a part of that supply chain especially in handlooms, handicrafts, textiles and pharma.

(4) Solving the issue of UAE’s Non-Tariff Barriers (NTBs)

- The UAE tariff structure is bound with the GCC (applied average tariff rate is 5%), therefore, the scope of addressing Non-Tariff Barriers (NTBs) becomes very important.

- The reflection of NTBs can be seen through Non-Tariff Measures (NTMs) mostly covered by Sanitary and Phytosanitary (SPS) and Technical Barriers to Trade (TBT).

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: NATO

Mains level: Read the attached story

Turkey has agreed to support Finland and Sweden joining the NATO military alliance after weeks of angering partners by insisting it would veto the Scandinavian countries’ accession.

What is NATO?

- NATO is a military alliance established by the North Atlantic Treaty (also called the Washington Treaty) of April 4, 1949.

- It sought to create a counterweight to Soviet armies stationed in Central and Eastern Europe after World War II.

- Its original members were Belgium, Canada, Denmark, France, Iceland, Italy, Luxembourg, the Netherlands, Norway, Portugal, the United Kingdom, and the United States.

- NATO has spread a web of partners, namely Egypt, Israel, Sweden, Austria, Switzerland and Finland.

Expansion of NATO: Transforming Europe

- The war in Ukraine has already changed the geopolitics of Europe and the world.

- The admission of Finland and Sweden to NATO would bring about a transformation in the continent’s security map by giving NATO a contiguous long frontier in western Russia.

- Finland and Russia share a 1,300-km border — and doubling it from the present 1,200 km, parts of it in northern Norway, Latvia and Estonia, and Poland and Lithuania.

- In addition, Sweden’s island of Gotland in the middle of the Baltic Sea would give NATO a strategic advantage.

- Furthermore, when Sweden and Finland join NATO, the Baltic Sea — Russia’s gateway to the North Sea and the Atlantic Ocean — would be ringed entirely by NATO members.

Why Nordic countries are willing to join NATO?

- Although the debate over joining NATO was ongoing in both countries for nearly three decades, Russia’s annexation of Crimea pushed both towards NATO’s “open door” policy.

- Still, there was little political consensus in either country, especially in Sweden where the Social Democrats have long been against the idea.

- However, February 24 changed everything the date on which Russia invaded Ukraine.

A knee jerk reaction?

- If Putin’s invasion of Ukraine was meant to deter NATO’s eastward expansion, the war has had the opposite effect.

- If admitted, Sweden and Finland will become its 31st and 32nd members.

Russian response

- Back in March, Russia had evoked a threatening response to take retaliatory measures by stationing its nuclear and hypersonic weapons close to the Baltic Sea.

- Russia denounced the problems with Finland and Sweden but the NATO’s expansion at the expense of these countries does not pose a direct threat to us.

- But the expansion of military infrastructure into this territory will certainly provoke their response, warned Mr Putin.

- Sweden had already said it would not allow NATO bases or nuclear weapons on its territory.

Hurdles for Finland, Sweden

- At the moment the main obstacle to their applications in Turkey, a member since 1952 and which has NATO’s second-largest army after the US.

- Turkish president Erdogan has objected to their applications on the ground that the two countries had provided safe haven to the leaders of the Kurdish group PKK.

- Many Kurdish and other exiles have found refuge in Sweden over the past decades.

- PKK is an armed movement fighting for a separate Kurdistan, comprising Kurdish areas in Turkey, Iraq, Iran and Syria.

- Neither of these countries have a clear, open attitude towards terrorist organisation.

What could Turkey gain?

- Turkey is expected to seek to negotiate a compromise deal to seek action on Kurdish groups.

- Erdogan could also seek to use Sweden and Finland’s membership to wrest concessions from the United States and other allies.

- Turkey wants to return to the US-led F-35 fighter jet program — a project it was kicked out of following its purchase of Russian S-400 missile defense systems.

- Alternatively, Turkey is looking to purchase a new batch of F-16 fighter jets and upgrade its existing fleet.

How does this affect Turkey’s image in the West?

- Turkey is reinforcing an image that is blocking the alliance’s expansion for its own profit.

- It also risks damaging the credit it had earned by supplying Ukraine with the Bayraktar TB2 armed drones that became an effective weapon against Russian forces.

Is Turkey trying to appease Russia?

- Turkey has built close relations with both Russia and Ukraine and has been trying to balance its ties with both.

- It has refused to join sanctions against Russia — while supporting Ukraine with the drones that helped deny Russia air superiority.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: GST Council

Mains level: Read the attached story

The 47th meeting of the Goods and Services Tax Council began in Chandigarh, almost marking five years of the tax system coming into effect on July 1, 2017.

What is the GST Council?

- The GST regime came into force after the Constitutional (122nd Amendment) Bill was passed by both Houses of Parliament in 2016.

- More than 15 Indian states then ratified it in their state Assemblies, after which the President gave his assent.

- The GST Council – a joint forum of the Centre and the states — was set up by the President as per Article 279A (1) of the amended Constitution.

- The members of the Council include the Union Finance Minister (chairperson), the Union Minister of State (Finance) from the Centre.

- Each state can nominate a minister in-charge of finance or taxation or any other minister as a member.

Why was the Council set up?

- The Council, according to Article 279, is meant to “make recommendations to the Union and the states on important issues related to GST, like the goods and services that may be subjected or exempted from GST, model GST Laws”.

- It also decides on various rate slabs of GST.

- For instance, an interim report by a panel of ministers has suggested imposing 28 per cent GST on casinos, online gaming and horse racing.

- A decision on this will be taken at the Council meeting.

What has changed this time?

- The ongoing meeting is the first since a decision of the Supreme Court in May this year, which stated recommendations of the GST Council are not binding.

- The court said Article 246A of the Constitution gives both Parliament and state legislatures “simultaneous” power to legislate on GST .

- Recommendations of the Council are the product of a collaborative dialogue involving the Union and States.

- This was hailed by some states, such as Kerala and Tamil Nadu, who believe states can be more flexible in accepting the recommendations as suited to them.

Agenda in this meet

- The council’s meeting is also likely to focus on the issue of extension of the GST compensation regime beyond June 2022.

- This was a special mechanism by which states were assured that their revenues would not be affected by the new GST system.

- Some states are already demanding that the compensation be continued.

- Earlier, the Council had agreed to extend the levy of compensation cess till 2026, but only for repayment of the borrowings made in the aftermath of the pandemic to provide compensation to states.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Living Lands Charter

Mains level: Land degradation

All 54 Commonwealth members have agreed to voluntarily dedicate a ‘living land’ in their respective countries to future generations, in line with the strategy set for the UN Decade on Ecosystem Restoration.

Living Lands Charter

- The non-binding mandates that member countries will safeguard global land resources and arrest land degradation while acting against climate change, biodiversity loss and sustainable management.

- It helps to encapsulate the combined effort to hold the global average temperature increase to 1.5 degrees Celsius, said Commonwealth Secretary-General Patricia Scotland.

- The document came after nearly two years of intense consultation, engagement and negotiation with member countries at UN Rio Convention.

Key objectives

- Leaders and their representatives noted with concern in the charter the alarming decline in the health and productivity of global land resources.

- It aimed to support member countries to effectively deliver their commitments under the three Rio conventions:

- UN Convention on Biological Diversity

- UN Convention to Combat Desertification (UNCCD)

- UN Framework Convention on Climate Change

Major outcomes

- The attendees also underlined the principle of “critical guardianship” provided by indigenous peoples and local communities in protecting land and vital ecosystem services.

- The agreement was released along with a final wide-ranging communiqué by leaders, including on specific items on climate change.

- Country heads underscored in it that the “urgent threat of climate change” exacerbates existing vulnerabilities and presents a significant threat to COVID-19 recovery efforts.

Try this PYQ from CSP 2012:

Q.Consider the following statements:

- The Commonwealth has no charter, treaty or constitution

- All the territories/countries once under the British Empire (jurisdiction/rule/mandate) automatically joined the Commonwealth as its members

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Post your answers here.

Back2Basics: Commonwealth of Nations

- The Commonwealth of Nations is an intergovernmental organisation of 53 member states that are mostly former territories of the British Empire.

- It dates back to the first half of the 20th century with the decolonization of the British Empire through increased self-governance of its territories.

- It was originally created as the British Commonwealth of Nation through the Balfour Declaration at the 1926 Imperial Conference, and formalized by the UK through the Statute of Westminster in 1931.

- The current body was formally constituted by the London Declaration in 1949, which modernized the community, and established the member states as “free and equal”.

- The symbol of this free association is Queen Elizabeth II, who is the Head of the Commonwealth.

- The Queen is head of state of 16 member states, known as the Commonwealth realms, while 32 other members are republics and five others have different monarchs.

- Member has no legal obligations to one another. Instead, they are united by language, history, culture and their shared values of democracy, human rights and the rule of law.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 3- Challenges ahead for tech startups

Context

The startup ecosystem which has been in overdrive for the past few years — propelled by a combination of factors, but largely, by the era of cheap money — is now showing signs of weakness.

Factors that helped fuel the tech startups

- With the combination of accelerated financial inclusion (bank accounts), ease of identification (Aadhaar) and connectivity (mobile phones) it was said that it is ultimately a bet on the Indian consumer, and the economy, not on government regulations/policies.

- Low-interest rates: In the era of cheap money and negative real interest rates, uncomfortable questions over the true market size and profitability were swept under the rug.

- Growth fuelled by cash burn: High cash burn rates were the norm as both startups and investors sought growth by subsidising the customer.

What is going wrong?

- Lack of profitability: Among the startups that have gone public in recent times, Paytm’s losses stood at Rs 2,396 crore in 2021-22, while for Zomato and PB Fintech (PolicyBazaar) losses were Rs 1,222 crore and Rs 832 crore respectively.

- Drying-up of investment: Sure, investors will continue to pour money.

- Some early age start-ups will continue to be funded, as will some of the more mature ones.

- But investors are likely to be more circumspect in their dealings.

- Impact on valuation: There are also reports of startups in diverse markets, ranging from Ola to OYO, planning to raise funds at lower valuations.

- Among those who have gone public in recent times, most are trading much below their listing price.

- Tighter financial conditions, a re-rating of the market, will impact both fundraising efforts and valuations.

Lack of discretionary spending capacity

- Many numbers were given as indicators of the size of the market or TAM (the total addressable market).

- Smartphone users: One such number thrown around is the smartphone users in the country — some have pegged this at 500 million.

- UPI transactions: The transactions routed through the UPI platform — in May there were almost six billion transactions worth Rs 10 trillion.

- Bank account holders: We have the near universality of bank accounts.

- But in reality, for most of these startups, the market or even the potential market is just a fraction of this.

- There aren’t that many consumers with significant discretionary spending capacity, and those with the capacity aren’t increasing their spending as these companies would hope.

- No increase in spending: What is equally worrying is the complete absence of any increase in spending by even these consumers who would have the capacity to spend more.

- While more consumers are on-board digital payment platforms — Paytm has about 70 million monthly transacting users — these numbers suggest that when it comes to consumers with considerable discretionary spending, the size of the market shrivels considerably.

Conclusion

Tech startups are about to witness a tough time ahead. Some startups will survive this period. Many may not. And changes in the dynamics of private markets will also have a bearing on public markets.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 3- E-commerce regulation issue

Context

The proliferation of a wide range of e-commerce platforms has created convenience and increased consumer choice. However, these platforms also have given rise to several concerns as well.

What is e-commerce ?

- Electronic commerce or e-commerce is a business model that lets firms and individuals buy and sell things over the Internet.

- Propelled by rising smartphone penetration, the launch of 4G networks and increasing consumer wealth, the Indian e-commerce market is expected to grow to US$ 200 billion by 2026 from US$ 38.5 billion in 2017.

- India’s e-commerce revenue is expected to jump from US$ 39 billion in 2017 to US$ 120 billion in 2020, growing at an annual rate of 51%, the highest in the world.

- The Indian e-commerce industry has been on an upward growth trajectory and is expected to surpass the US to become the second-largest e-commerce market in the world by 2034.

Advantages of e-Commerce

- The process of e-commerce enables sellers to come closer to customers that lead to increased productivity and perfect competition. The customer can also choose between different sellers and buy the most relevant products as per requirements, preferences, and budget. Moreover, customers now have access to virtual stores 24/7.

- e-Commerce also leads to significant transaction cost reduction for consumers.

- e-commerce has emerged as one of the fast-growing trade channels available for the cross-border trade of goods and services.

- It provides a wider reach and reception across the global market,with minimum investments. It enables sellers to sell to a global audience and also customers to make a global choice. Geographical boundaries and challenges are eradicated/drastically reduced.

- Through direct interaction with final customers, this e-commerce process cuts the product distribution chain to a significant extent. A direct and transparent channel between the producer or service provider and the final customer is made. This way products and services that are created to cater to the individual preferences of the target audience.

- Customers can easily locate products since e-commerce can be one store set up for all the customers’ business needs

- Ease of doing business: It makes starting, managing business easy and simple.

- The growth in the e-commerce sector can boost employment, increase revenues from export, increase tax collection by ex-chequers, and provide better products and services to customers in the long-term.

Issues created by the e-commerce sites

- Predatory pricing: These companies resort to predatory pricing to acquire customers even as they suffer persistent financial losses.

- SEBI is rightly revisiting the valuation norms of such companies looking to list on the stock exchange.

- Exclusionary practice: They take away choice from suppliers and consumers.

- This, in the long run, can be viewed as an exclusionary practice that eliminates other players from the market.

- Lack of level playing field: While neutrality is the fundamental basis of a marketplace and a level playing field is in the fitness of things, claims of outfits such as Flipkart or Amazon to be a marketplace for a wide variety of sellers can be questioned.

- A few select sellers, who are generally affiliated with the platform, reap the benefits of greater visibility and better terms of trade — reduced commissions and platform-funded discounts.

- Undue advantage to associated companies: The associate companies are prominent sellers on their platform.

- It is alleged that undue advantage is given while recommending or listing these products.

- Cartelisation: Online travel aggregators are often accused of cartelisation.

- Information asymmetry: The aggregators gather shopping habits, consumer preferences, and other personal data.

- The platforms are accused of using this data to create and improve their own products and services, taking away business from other sellers on their platform.

- They capitalise on this data and information about other brands to launch competing products on their marketplace.

- This information asymmetry is exploited by the aggregators to devour organisations they promise to support.

- Problems in dispute resolution mechanism: Another issue often noticed is the lack of a fair and transparent dispute resolution mechanism for sellers on these platforms.

- Delayed payments, unreasonable charges, and hidden fees are common occurrences.

- Unreasonable and one-sided contracts allow travel aggregators to have a disparity clause (in the rates) which allows them to offer rooms at a much cheaper rate but bars the hotels from doing so.

Impact of the e-commerce

- The online aggregator platforms have also damaged large segments of small and medium businesses through their dominant position and the malpractices this position allows them to indulge in.

- The ultimate loss bearer is the consumer who will have a reduced bargaining position.

Way forward

- Comprehensive rules: It is time that a set of comprehensive rules and regulations is put together.

- These regulations need to be inclusive, should eliminate the conflicts of interest inherent in current market practices, and prevent any anti-competitive practices.

- Model agreement: A model agreement that is fair and allows a level playing field between the aggregators and their business partners should be implemented.

- Learning from EU act: There is a lot to learn from the Digital Markets Act of the EU that seeks to address unfair practices by these gatekeepers.

- Need for dispute resolution mechanism: Strong and quick grievance redressal and dispute resolution mechanisms should be established.

- Punitive penalties: The rules should allow for punitive penalties for unfair practices.

- Fair competition rules: Market dominance and subsequent invoking of fair competition rules should be triggered at the level of micro-markets and for product segments.

Conclusion

The nature of our success in dealing with this change will lie in the ways in which we deal with the concerns of all players.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Kihoto Collohan Case

Mains level: Political conundrum in states over defection

As the political battle in Maharashtra moves to the Supreme Court, the role and powers of the Deputy Speaker are in focus.

In the context of the crisis, references have been made to the landmark judgment in ‘Kihoto Hollohan vs Zachillhu And Others’ (1992).

What is the ‘Kihoto Hollohan’ case?

- A constitutional challenge to the Tenth Schedule was mounted, which was settled by the apex court in ‘Kihoto Hollohan’.

- The principal question before the Supreme Court in the case was whether the powerful role given to the Speaker violated the doctrine of basic structure.

- In this judgment, the Supreme Court upheld the sweeping discretion available to the Speaker in deciding cases of disqualification of MLAs.

- The Supreme Court laid down the doctrine of basic principle in its landmark judgment in ‘Kesavananda Bharati vs State Of Kerala’ (1973).

What does the Tenth Schedule of the Constitution say?

- The Tenth Schedule was inserted in the Constitution by the Constitution (Fifty-Second Amendment) Act, 1985.

- It provides for the disqualification of Members of Parliament and state legislatures who defect.

- It describes the Speaker’s sweeping discretionary powers to make decisions on case of defection.

What did the Supreme Court rule in ‘Kihoto Hollohan’?

- The petitioners in ‘Kihoto Hollohan’ argued whether it was fair that the Speaker should have such broad powers, given that there is always a reasonable likelihood of bias.

- The majority judgment authored by Justices M N Venkatachaliah and K Jayachandra Reddy answered this question in the affirmative. It read-

- The Speakers/Chairmen hold a pivotal position in the scheme of Parliamentary democracy and are guardians of the rights and privileges of the House.

- They are expected to and do take far reaching decisions in the Parliamentary democracy.

- Vestiture of power to adjudicate questions under the Tenth Schedule in them should not be considered exceptionable.

- The provisions were “salutory and intended to strengthen the fabric of Indian Parliamentary democracy by curbing unprincipled and unethical political defections.”

What was the dissenting opinion?

- Justices Lalit Mohan Sharma and J S Verma dissented and took a different view.

- The tenure of the Speaker, who is the authority in the Tenth Schedule to decide this dispute, is dependent on the continuous support of the majority in the House.

- Therefore, he does not satisfy the requirement of such an independent adjudicatory authority.

- They advocated for an independent adjudicatory machinery for resolving disputes relating to the competence of Members of the House,

- This is envisaged as an attribute of the democratic system which is a basic feature of our Constitution.

What about the role of the Deputy Speaker?

- Article 93 of the Constitution mentions the positions of the Speaker and Deputy Speaker of the House of the People (Lok Sabha), and Article 178 contains the corresponding position for Speaker and Deputy Speaker of the Legislative Assembly of a state.

- Maharashtra has been without a Speaker since February 2021, and Deputy has been carrying out the responsibilities of the position.

- Article 95(1) says: “While the office of Speaker is vacant, the duties of the office shall be performed by the Deputy Speaker”.

- In general, the Deputy Speaker has the same powers as the Speaker when presiding over a sitting of the House.

- All references to the Speaker in the Rules are deemed to be references to the Deputy Speaker when he presides.

Try this PYQ:

Q.Which one of the following Schedules of the Constitution of India contains provisions regarding anti-defection?

(a) Second Schedule

(b) Fifth Schedule

(c) Eighth Schedule

(d) Tenth Schedule

Post your answers here.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: Regulation of Gig Economy

A NITI Aayog report has identified that is expected to grow to 2.35 crore by 2029-30.

Do you know?

According to a study released by NITI Aayog, the number of gig workers in India is estimated to be 77 lakh in 2020-21. Isn’t it too low to imagine? Seems like there is huge under-reporting.

What is the Gig Economy?

- In a gig economy, temporary, flexible jobs are commonplace and companies tend toward hiring independent contractors and freelancers instead of full-time employees.

- A gig economy undermines the traditional economy of full-time workers who rarely change positions and instead focus on a lifetime career. e.g Employee models of Uber, Ola, Swiggy etc

- In this economy, tech-enabled platforms connect the consumer to the gig worker to hire services on a short-term basis.

- Gig workers include self-employed, freelancers, independent contributors and part-time workers.

Where does gig culture exist in Indian Economy?

- Sectors such as media, real estate, legal, hospitality, technology-help, management, medicine, allied and education are already operating in gig culture.

- The gig economy can benefit workers, businesses, and consumers by making work more adaptable to the needs of the moment and demand for flexible lifestyles.

Key Drivers for Gig Economy

- Unconventional work approach by millennials: Hectic lifestyles of employees in private sectors have created a negative perception of full-time employment among millennials.

- Emergence of a start-up culture: The start-up ecosystem in India has been developing rapidly. For start-ups, hiring full-time employees leads to high fixed costs and therefore, contractual freelancers are hired for non-core activities.

- MNCs are hiring contractual employees: MNCs are adopting flexi-hiring options, especially for niche projects, to reduce operational expenses after the pandemic.

- Rise in freelancing platforms: Rise in freelancing platforms has also aided in the development of the gig economy.

- Business Models: Gig employees work on various compensation models such as fixed-fee (decided during contract initiation), time & effort, actual unit of work delivered and quality of outcome.

- Impact of Covid-19: Many laid-off employees are focusing on developing skills to avail freelance job opportunities and become a part of this burgeoning economy.

Why is Gig Economy preferred by workers?

- Profit through multiple work: One can work on freelancing as well as work full-time somewhere else.

- Women empowerment: It is very beneficial for womenwho work on this concept when they cannot continue their work or take a break from career due to marriage or child birth.

- Leisure and dependency: Retired peoplecan stay active after retirement as this will keep them engaged away from loneliness and depression and can earn as well on their own.

- Flexibility and diversity to the workers: It offers flexibility when workers can work according to their convenience and schedule rather than routine like in full-time jobs.

- Work from home: The travel costs and energy to travel to the workplace is reduced.

Why is Gig Economy preferred by Employers?

- Efficiency, efficacy and productivity of workers in the gig economy are much more than that of a stable full-time job.

- More rconomical for employers-when employment givers can’t afford to hire full-time workers, they hire people for specific projects and pay them.

- Start-up companies and entrepreneurs – who do not have big financial space – can grow only if they can leverage the services of contract employees or freelancers.

- In a gig economy, businesses save resources in terms of benefits, office space and training.

- Competition and efficiency among workers is improved.

Challenges faced in Gig economy

- No perks and benefits: There are no labour welfare emoluments like pension, gratuity, etc. for the workers.

- Job insecurity: Gig workers may face unfair termination. They may also attain minimum wages and less paid leave.

- No legal protection: Workers do not have the bargaining power to negotiate a fair deal with their employers.

- Unionization of workers will be difficult.

- Confidentiality of documents etc. of the workplace is not guaranteed

- Urban nature: The gig economy is not accessible for people in many rural areas where internet connectivity and electricity is unavailable.

New classification by NITI Aayog: Platform vs. Non-platform Workers

- The NITI Aayog report broadly classifies gig workers into platform and non-platform-based workers.

- The consequent platformisation of work has given rise to a new classification of labour — platform labour — falling outside of the purview of the traditional dichotomy of formal and informal labour.

- While platform workers are those whose work is based on online software applications or digital platforms.

- Non-platform gig workers are generally casual wage workers and own-account workers in the conventional sectors, working part-time or full time.

Recommendations made by NITI Aayog

- The NITI Aayog has recommended steps to provide social security, including paid leave, occupational disease and accident insurance, support during irregularity of work and pension plans for the country’s gig workforce.

- It has also recommended introducing a ‘Platform India initiative’ on the lines of the ‘Startup India initiative’.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Di-ammonium fertilisers

Mains level: Paper 3- Reducing the cost of fertiliser imports

Context

The global prices of urea, DAP, MOP, phosphoric acid, ammonia and LNG have soared by two to two-and-a-half times in the last year

Resource richness of Indian agriculture

- No country has as much area under farming as India.

- Land under cultivation: At 169.3 million hectares (mh) in 2019, its land used for crop cultivation was higher than that of the US (160.4 mh), China (135.7 mh), Russia (123.4 mh) or Brazil (63.5 mh).

- Ample water: With its perennial Himalayan rivers and average annual rainfall of nearly 1,200 mm – against Russia’s 475 mm, China’s 650 mm and the US’s 750 mm – India has no dearth of land, water and sunshine to sustain vibrant agriculture.

- But there’s one resource in which the country is short and heavily import-dependent — mineral fertilisers.

India’s important dependence

- In 2021-22, India imported 10.16 million tonnes (mt) of urea, 5.86 mt of di-ammonium phosphate (DAP) and 2.91 mt of muriate of potash (MOP).

- Import value: In value terms, imports of all fertilisers touched an all-time high of $12.77 billion last fiscal.

- In 2021-22, India also produced 25.07 mt of urea, 4.22 mt of DAP, 8.33 mt of complex fertilisers (containing nitrogen-N, phosphorus-P, potassium-K and sulphur-S in different ratios) and 5.33 mt of single super phosphate (SSP).

- Import of raw material: The intermediates or raw materials for the manufacture of these fertilisers were substantially imported.

- Total value of fertiliser imports: The total value of fertiliser imports by India, inclusive of inputs used in domestic production, was a whopping $24.3 billion in 2021-22.

Two costs involved in import

- 1] Foreign exchange outgo for import: The first is foreign exchange outgo:

- Imports are mostly from the following countries:

- Urea: Imported from China, Oman, UAE and Egypt

- DAP: Imported from China, Saudi Arabia and Morocco.

- MOP: Imported from Belarus, Canada, Russia, Israel and Jordan.

- LNG: Imported from Qatar, US, UAE and Nigeria.

- Ammonia: Morocco, Jordan, Senegal and Tunisia (phosphoric acid); Saudi Arabia and Qatar.

- Rock phosphate: Jordan, Morocco, Egypt and Togo.

- 2] Fiscal cost: The second cost is fiscal.

- Fertilisers are not only imported but also sold at subsidised prices.

- The difference is paid as a subsidy by the government.

- That bill was Rs 1,53,658.11 crore or $20.6 billion in 2021-22 and projected at Rs 2,50,000 crore ($32 billion) this fiscal.

- Unsustainably high costs: Both costs are unsustainably high to bear for a mineral resource-poor country.

Suggestions

1] Reduce consumption of high-analysis fertilisers

- There is a need to cap or even reduce consumption of high-analysis fertilisers – particularly urea (46 per cent N content), DAP (18 per cent N and 46 per cent P) and MOP (60 per cent).

- Incorporate urease and inhibition compounds in urea: This can be done by incorporating urease and nitrification inhibition compounds in urea.

- These are basically chemicals that slow down the rate at which urea is hydrolysed and nitrified (which increases leaching).

- By reducing ammonia volatilisation and nitrate leaching, more nitrogen is made available to the crop, enabling farmers to harvest the same yields with a lesser number of urea bags.

- Liquid nano-urea: Together with products such as liquid “nano urea” –it is possible to achieve a 20 per cent or more drop in urea consumption from the present 34-35 mt levels.

- Liquid nano-urea with their ultra-small particle size is conducive to easier absorption by the plants than with bulk fertilisers, translating into higher nitrogen use efficiency.

2] Promote the sale of SSP and complex fertilisers